Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Mount Baw Baw Region has seen population growth performance typically on par with national averages when looking at short and medium term trends

Mount Baw Baw Region's population was around 6,851 as of November 2025. This reflected an increase of 266 people since the 2021 Census which reported a population of 6,585. The change was inferred from the estimated resident population of 6,741 from the ABS as of June 2024 and an additional 42 validated new addresses since the Census date. This level of population resulted in a density ratio of 2.5 persons per square kilometer. Mount Baw Baw Region's growth rate of 4.0% since the census positioned it within 2.0 percentage points of the non-metro area's growth rate of 6.0%. Population growth was primarily driven by interstate migration, contributing approximately 59.3% of overall population gains during recent periods.

AreaSearch adopted ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilised the VIC State Government's Regional/LGA projections released in 2023, adjusting using weighted aggregation methods from LGA to SA2 levels. Growth rates by age group were applied across all areas for years 2032 to 2041. Future population trends indicated lower quartile growth nationally, with the area expected to increase by 204 persons to 2041 based on the latest annual ERP population numbers, reflecting an increase of 1.4% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Mount Baw Baw Region recording a relatively average level of approval activity when compared to local markets analysed countrywide

Mount Baw Baw Region has received around 28 dwelling approvals per year over the past five financial years, totalling 141 homes from FY-20 to FY-25. As of FY-26, 11 approvals have been recorded. Each dwelling built between FY-21 and FY-25 has attracted an average of 2.7 new residents per year, indicating strong demand that supports property values. The average expected construction cost value for these dwellings is $376,000.

In the current financial year, $6.8 million in commercial development approvals have been recorded, reflecting the region's predominantly residential nature. Compared to Rest of Vic., Mount Baw Baw Region has 60.0% lower building activity per person. The area's new construction consists solely of standalone homes, preserving its low-density character and attracting space-seeking buyers. As of FY-25, there are an estimated 392 people in the region per dwelling approval.

By 2041, Mount Baw Baw Region is projected to gain 94 residents, with current construction levels expected to meet demand adequately, creating favourable conditions for buyers and potentially enabling growth beyond current forecasts.

Frequently Asked Questions - Development

Infrastructure

Mount Baw Baw Region has emerging levels of nearby infrastructure activity, ranking in the 38thth percentile nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified 58 projects likely impacting the area. Notable projects include Warragul Sewer Main Upgrade - North East Growth Corridor, 147 Dollarburn Road Residential Development, Dollarburn Road Extension, and The Saleyards. Below is a list of projects most relevant to the area.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Alfred Street Mixed-Use Redevelopment

Transformative mixed-use redevelopment spanning 10,083m2 across three titles featuring a boutique hotel, vibrant retail and dining hub, and activated public spaces designed to enrich Warragul's cultural and economic landscape. The development aims to blend modern architecture with local heritage, creating a destination hub that fosters community engagement and supports economic growth.

Warragul and Drouin Precinct Structure Plan Implementation

Implementation of the Warragul and Drouin Precinct Structure Plan to guide future urban development and infrastructure delivery across both townships. Provides framework for sustainable growth and development coordination.

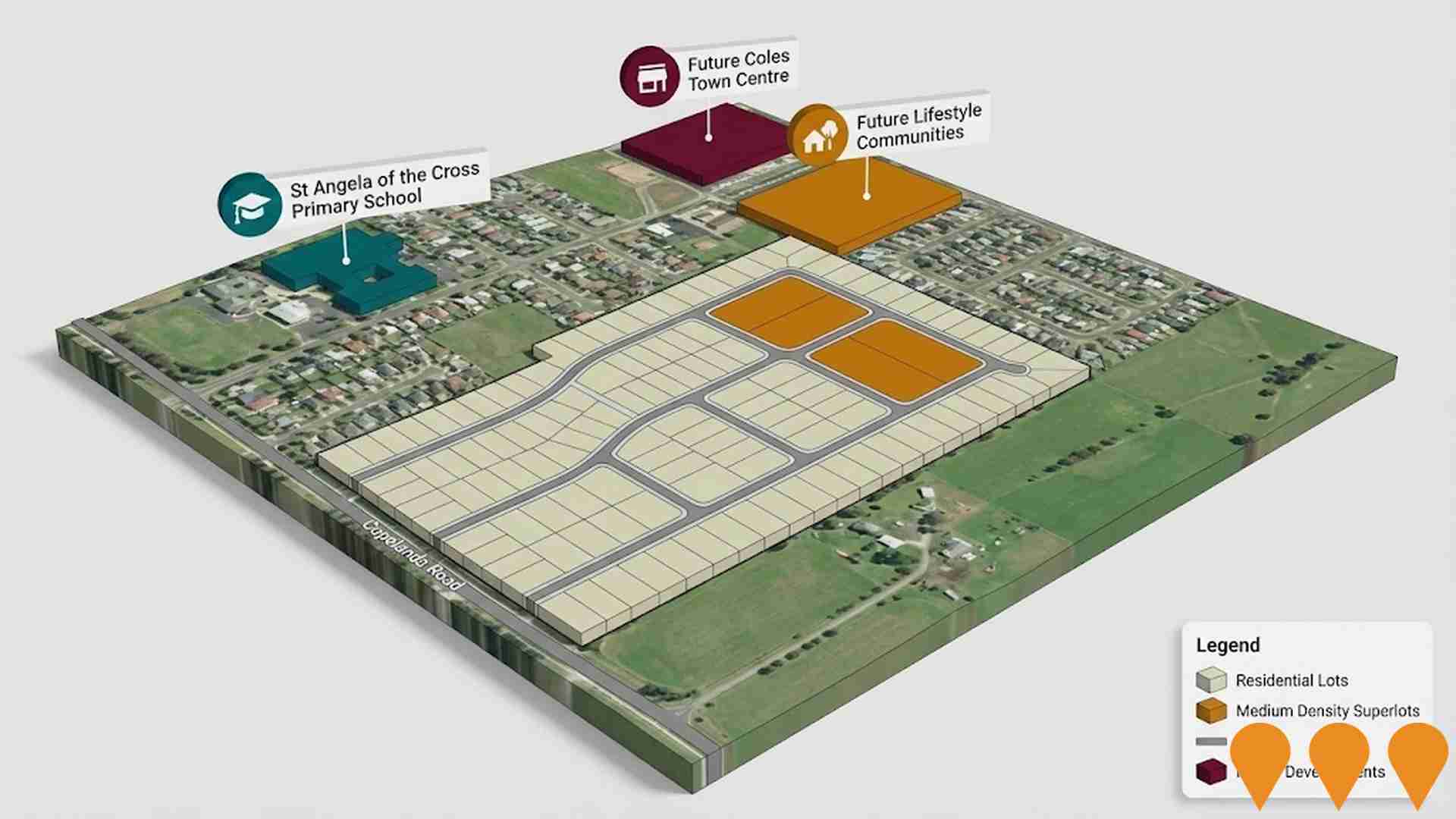

147 Dollarburn Road Residential Development

26.25 hectare approved residential subdivision within Warragul PSP featuring 114 residential lots, neighbourhood parks, sporting reserves, and farmland. Connected via proposed street through future government primary school to Waterford Rise Estate and Warragul township. Located within Urban Growth Boundary with proximity to future West Gippsland Hospital.

Mason Street Social Housing Development

$16.5 million, 51-unit social housing development featuring one, two and three-bedroom apartments across two four-storey buildings. Part of Victorian Government's $5.3 billion Big Housing Build. Architecturally designed by Freadman White with sustainable features including 7 Star NatHERS ratings, Green Star certification, and Livable Housing Australia Silver Level. Includes basement, office, multi-purpose space, 38 car parks and 56 bicycle parks. Currently under construction as of February 2025.

Princes Highway East Upgrade - Warragul Section

Upgrade of the Princes Highway east of Warragul to improve traffic flow, safety, and capacity for future growth. Part of broader regional infrastructure improvements.

Warragul Sewer Main Upgrade - North East Growth Corridor

Major sewer infrastructure upgrade to support residential growth in Warragul's north-east corridor. Includes new main sewer lines and pump stations to service new residential developments.

Loom Warragul

TW Projects is delivering Loom Warragul, a masterplanned community of around 200 residential lots on a circa 16 ha site in Warragul. Sales office open and early civil works/roadworks underway; lots marketed for staged release.

Warragul CBD Streetscape Project - Queen Street Final Stage

The ninth and final stage of the Warragul CBD Streetscape Project, featuring renewal of the Queen/Mason Street roundabout, replacement of five elm trees, improved footpath accessibility, kerb outstands and refuge islands at Queen Street and Gladstone Street intersection, new line-marking including bike lanes, new landscaping, and replacement of the old public toilet block with a modern facility. The project aims to improve pedestrian and traffic safety, accessibility, and traffic flow in Warragul's CBD.

Employment

Mount Baw Baw Region ranks among the top 25% of areas assessed nationally for overall employment performance

Mount Baw Baw Region has a skilled workforce with the construction sector being particularly prominent. The unemployment rate was 2.2% in September 2025, which is lower than Rest of Vic.'s rate of 3.8%.

Employment growth over the past year was estimated at 4.1%. There are currently 3,587 residents employed in the region. Workforce participation is similar to Rest of Vic.'s rate of 57.4%. Key employment sectors include agriculture, forestry & fishing, construction, and health care & social assistance.

The area has a notable concentration in agriculture, forestry & fishing with employment levels at twice the regional average. However, health care & social assistance is under-represented, with only 12.4% of Mount Baw Baw Region's workforce compared to Rest of Vic.'s 16.8%. The region appears to offer limited local employment opportunities based on Census data analysis. Between September 2024 and September 2025, employment increased by 4.1%, labour force increased by 3.8%, resulting in a decrease in unemployment rate by 0.3 percentage points. In contrast, Rest of Vic. saw employment fall by 0.7% during the same period. State-level data from November 25 shows VIC employment grew by 1.13% year-on-year, with an unemployment rate of 4.7%. National employment forecasts from May-25 project a growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Mount Baw Baw Region's employment mix suggests local employment should increase by 5.8% over five years and 12.4% over ten years.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

AreaSearch aggregated latest postcode level ATO data released for financial year 2022. Mount Baw Baw Region SA2 had a median income among taxpayers of $46,232 and an average of $60,358. These figures were lower than the national averages of $48,741 and $60,693 respectively for Rest of Vic. By September 2025, estimated incomes would be approximately $51,854 (median) and $67,698 (average), based on Wage Price Index growth of 12.16% since financial year 2022. According to 2021 Census figures, household, family, and personal incomes ranked modestly in Mount Baw Baw Region, between the 27th and 33rd percentiles. The earnings profile showed that the $1,500 - 2,999 band captured 30.6% of the community (2,096 individuals). Housing costs were manageable with 89.0% retained, but disposable income was below average at the 39th percentile. The area's SEIFA income ranking placed it in the 5th decile.

Frequently Asked Questions - Income

Housing

Mount Baw Baw Region is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The dwelling structure in Mount Baw Baw Region, as per the latest Census, comprised 97.9% houses and 2.1% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro Vic.'s 91.6% houses and 8.4% other dwellings. Home ownership in Mount Baw Baw Region was at 51.6%, with mortgaged dwellings at 38.8% and rented ones at 9.6%. The median monthly mortgage repayment was $1,517, lower than Non-Metro Vic.'s average of $1,600. The median weekly rent figure in Mount Baw Baw Region was $250, compared to Non-Metro Vic.'s $320. Nationally, mortgage repayments were significantly lower at $1,863 and rents substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Mount Baw Baw Region has a typical household mix, with a fairly typical median household size

Family households constitute 73.7% of all households, including 29.9% couples with children, 35.0% couples without children, and 8.1% single parent families. Non-family households comprise the remaining 26.3%, with lone person households at 24.7% and group households making up 1.5%. The median household size is 2.5 people, which matches the average for the Rest of Vic.

Frequently Asked Questions - Households

Local Schools & Education

Mount Baw Baw Region shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

The area's university qualification rate is 19.6%, significantly lower than Victoria's average of 33.4%. Bachelor degrees are the most prevalent at 12.9%, followed by postgraduate qualifications (3.5%) and graduate diplomas (3.2%). Vocational credentials are held by 42.9% of residents aged 15 and above, with advanced diplomas at 11.4% and certificates at 31.5%. Educational participation is high, with 28.0% of residents currently enrolled in formal education.

This includes 10.1% in primary education, 8.9% in secondary education, and 2.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis indicates that there are 13 active public transport stops operating within the Mount Baw Baw Region. These stops are serviced by one individual route, collectively providing 20 weekly passenger trips. Transport accessibility is rated as limited, with residents typically located 9504 meters from the nearest transport stop.

Service frequency averages two trips per day across all routes, equating to approximately one weekly trip per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Mount Baw Baw Region is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

The Mount Baw Baw Region faces significant health challenges with common health conditions being somewhat prevalent across both younger and older age cohorts. Approximately 50% (~3,425 people) of its total population has private health cover, which is relatively low compared to the national average of 55.3%.

The most common medical conditions in the area are arthritis and mental health issues, affecting 10.5 and 8.4% of residents respectively. Meanwhile, 65.0% of residents declare themselves completely clear of medical ailments, compared to 63.7% across Rest of Vic.. The region has 24.5% (1,677 people) of its residents aged 65 and over, higher than the 20.8% in Rest of Vic.. Despite this, health outcomes among seniors in Mount Baw Baw Region are particularly strong, performing even better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Mount Baw Baw Region is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Mount Baw Baw Region had low cultural diversity, with 89.7% citizens, 89.5% born in Australia, and 96.7% speaking English only at home. Christianity was the dominant religion, comprising 43.9%. Judaism was overrepresented at 0.1%, compared to 0.1% regionally.

The top three ancestry groups were Australian (32.9%), English (31.5%), and Scottish (9.3%). Dutch (2.9%) Maltese (0.6%) and Irish (9.2%) were overrepresented compared to regional averages of 2.7%, 0.4% and 8.5% respectively.

Frequently Asked Questions - Diversity

Age

Mount Baw Baw Region hosts an older demographic, ranking in the top quartile nationwide

Mount Baw Baw Region has a median age of 47 years, which is significantly higher than the Rest of Vic. average of 43 years and substantially exceeds the national average of 38 years. The region's age profile shows that those aged 55-64 are particularly prominent, making up 15.4% of the population, while those aged 25-34 comprise a smaller proportion at 9.5%, compared to the Rest of Vic. In the period from 2021 to present, the age group of 25-34 has grown from 8.7% to 9.5% of the population. Conversely, the age groups of 55-64 have declined from 17.2% to 15.4%, and those aged 45-54 have dropped from 13.3% to 11.7%. By the year 2041, Mount Baw Baw Region is expected to experience notable shifts in its age composition. The demographic shift will be led by the 25-34 age group, which is projected to grow by 36%, increasing from 648 people to 882. Meanwhile, the age groups of 5-14 and 15-24 are expected to experience population declines.