Market Overview

Australia at a Crossroads as Stubborn Inflation Forces RBA's Hand

The RBA’s decision to resume its tightening cycle, hiking the cash rate to 3.85%, has cast the economic outlook in a new light. This move, breaking a five-month pause, comes as December inflation re-accelerated to 3.8%, reversing its downward trend. While the economy shows surface-level resilience, underlying pressures are building as the labour market cools and households feel the pinch of rising essential costs, creating a complex and uncertain path forward for 2026.

Integrate seamlessly with your workflows and communicate the latest market drivers to clients.

Key Economic Indicators

Click to navigate| Indicator | As At | Units | Latest | -1yr | -2yr | -3yr | -4yr | -5yr |

|---|---|---|---|---|---|---|---|---|

| GDP | 2025-Sep | $m | 687,757 (+2.1%) | 673,927 (+0.8%) | 668,453 (+2.1%) | 654,444 (+6.1%) | 616,735 (+4.7%) | 589,183 |

| CPI | 2025-Dec | Index | 100.97 (+3.8%) | 97.31 (+2.7%) | 94.78 (+4.1%) | 91.09 (+7.8%) | 84.47 (+3.5%) | 81.62 |

| Population | 2025-Jun | Persons | 27,614,411 (+1.5%) | 27,194,286 (+2.0%) | 26,659,922 (+2.5%) | 26,018,721 (+1.3%) | 25,685,412 (+0.1%) | 25,649,248 |

| Employment | 2025-Nov | Persons ('000) | 14,656 (+1.3%) | 14,473 (+1.9%) | 14,207 (+3.0%) | 13,787 (+4.9%) | 13,148 (+3.2%) | 12,745 |

| Unemployment | 2025-Nov | % | 4.32 (+38bps) | 3.94 (+1bps) | 3.93 (+41bps) | 3.52 (-111bps) | 4.63 (-218bps) | 6.81 |

| Job Ads | 2025-Nov | No | 616,461 (-8.5%) | 673,554 (-14.7%) | 789,663 (-6.8%) | 847,229 (+13.2%) | 748,715 (+54.4%) | 485,019 |

| Household Spending | 2025-Sep | $m | 232,015 (+5.1%) | 220,838 (+2.8%) | 214,921 (+6.6%) | 201,614 (+28.4%) | 156,982 (-0.4%) | 157,628 |

| House Prices | 2025-Sep | $000s | 1,042 (+6.1%) | 982 (+5.6%) | 930 (+6.3%) | 875 (+2.1%) | 857 (+24.4%) | 689 |

| Attached Prices | 2025-Sep | $000s | 710.00 (+5.0%) | 676.00 (+5.0%) | 644.00 (+6.1%) | 607.00 (-2.9%) | 625.00 (+7.6%) | 581.00 |

| Dwelling Approvals | 2025-Oct | No | 191,311 (+11.6%) | 171,361 (+1.8%) | 168,347 (-12.8%) | 193,019 (-16.4%) | 230,989 (+27.1%) | 181,769 |

| Superannuation | 2025-Sep | $bn | 4,466 (+9.4%) | 4,082 (+13.4%) | 3,599 (+9.7%) | 3,281 (-4.4%) | 3,434 (+18.5%) | 2,897 |

| ASX All Ords | 2026-Jan | Index | 9,164 (+4.3%) | 8,790 (+11.1%) | 7,913 (+3.0%) | 7,686 (+5.8%) | 7,268 (+5.8%) | 6,871 |

Infrastructure & Major Projects

Transforming Australia's future

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

NSW

NSW

Sydney Metro West - Western Sydney Airport to Macarthur Corridor (South West Rail Link Extension)

The project involves the preservation of a 20km corridor for a future north-south extension of the Sydney Metro network. It will connect the future Bradfield station (part of the S

QLD

QLD

Greater Springfield Master Planned Community

Australia's largest privately funded master-planned city, covering 2,860 hectares in the Western Growth Corridor. As of 2026, the project has exceeded $30 billion in investment wit

QLD

QLD

Brisbane Metro Northern Extension (Northern Metro)

Expansion of the Brisbane Metro rapid transit system from the CBD to Carseldine. The project will deliver high-capacity, fully electric metro vehicles operating on a high-frequency

NSW

NSW

Sydney Metro Eastern Suburbs Extension

A strategic long-term extension of the Sydney Metro network, specifically envisioned as a continuation of Metro West from Hunter Street. The corridor is identified in the South Eas

WA

WA

Aboriginal Cultural Centre

A landmark cultural infrastructure project on Whadjuk Noongar Country, situated between the Perth Concert Hall and the Derbarl Yerrigan (Swan River). The centre is designed as an i

SA

SA

Riverlea Estate (Buckland Park Township)

South Australia's largest master-planned community, covering 1,340ha and planned to deliver 12,000 homes for over 40,000 residents. Key features include the $100M Palms Shopping Vi

VIC

VIC

Kew Library Upgrade

City of Boroondara is undertaking an extensive upgrade of the Kew Library building starting in April 2026. Following a decision to preserve the existing modernist structure rather

VIC

VIC

Sunshine Priority Precinct Vision 2050

The Sunshine Priority Precinct Vision 2050 is a major urban renewal strategy to establish Sunshine as the capital of Melbournes west. It leverages over $20 billion in total infrast

SA

SA

Whyalla GREENSTEEL Transformation

A nationally significant industrial program to transition the Whyalla Steelworks into a world-leading low-carbon facility. The project focuses on substituting coal-based blast furn

WA

WA

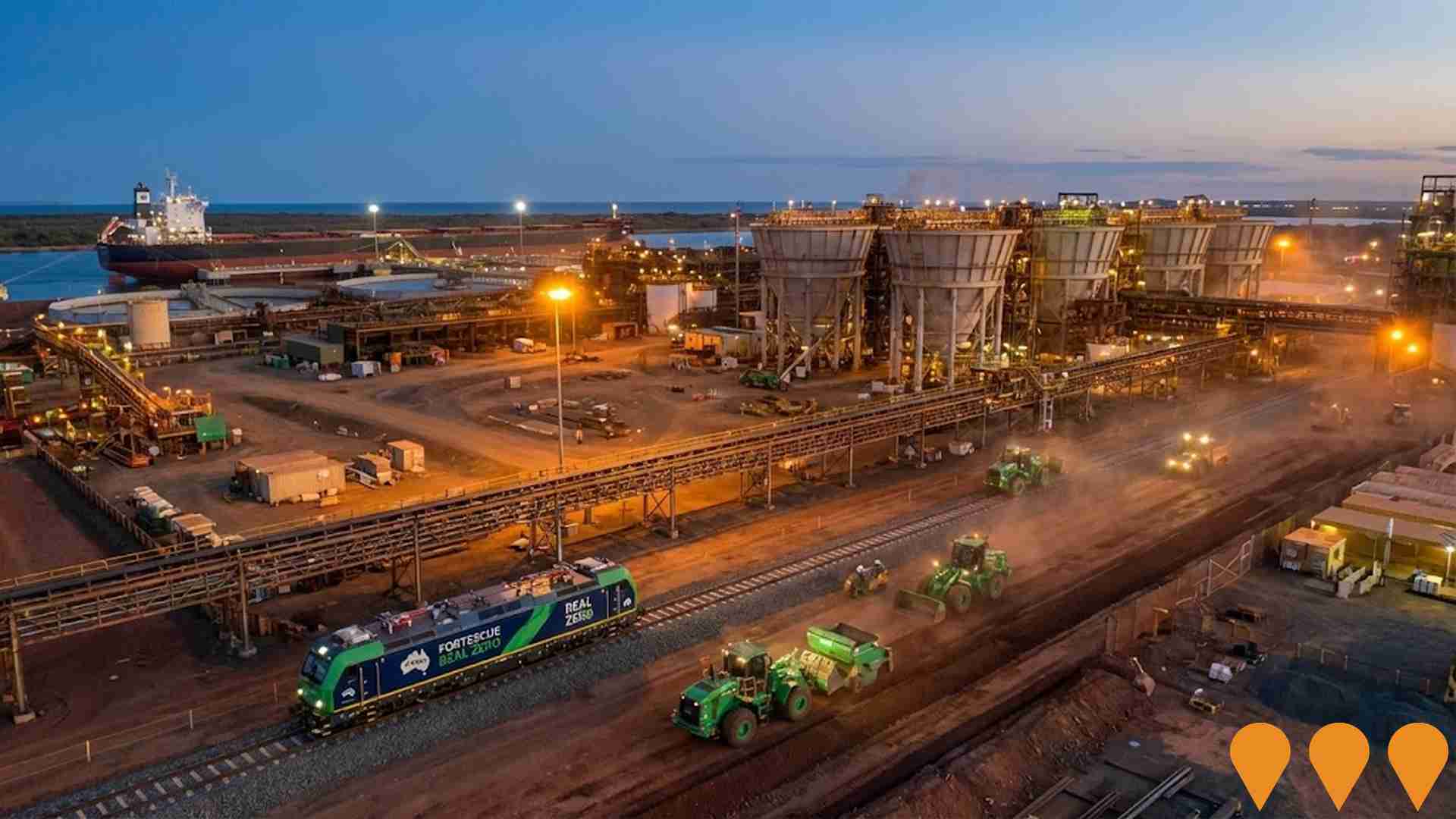

Fortescue Port Hedland Operations Decarbonisation and Modernisation

Comprehensive modernisation of Fortescue's Port Hedland facilities to achieve 'Real Zero' terrestrial emissions by 2030. Key work includes upgrading the Herb Elliott Port to a 210M

NT

NT

Middle Arm Sustainable Development Precinct

A 1,500-hectare sustainable industrial hub in Darwin Harbour focused on low-carbon industries including renewable hydrogen, carbon capture and storage (CCS), critical minerals proc

ACT

ACT

Molonglo Town Centre

Molonglo Town Centre is the future sixth town centre for Canberra, serving as the primary commercial, civic, and community hub for the Molonglo Valley. The 97-hectare precinct will

QLD

QLD

Waraba Priority Development Area

Waraba is a significant greenfield city development spanning 2,900 hectares in the Moreton Bay Region. Declared a Priority Development Area in August 2024, the project will deliver

QLD

QLD

Woree Social and Affordable Housing Precinct

Queensland's largest social and affordable housing precinct, delivering 490 modern, energy-efficient apartments specifically for seniors over 55 and people living with disability.

NSW

NSW

Central-West Orana Renewable Energy Zone (REZ) Transmission Project

Australia's first coordinated Renewable Energy Zone transmission project. It involves the delivery of 90km of 500kV and 150km of 330kV transmission lines, along with energy hubs at

QLD

QLD

Queensland Energy Roadmap 2025

The Queensland Energy Roadmap 2025 is a strategic framework focused on delivering affordable, reliable, and sustainable energy through 2035. Key initiatives include a $1.6 billion

GDP & Economic Output

Scroll to load chart

Population & Migration

Scroll to load chart

Development Activity

Scroll to load chart

Housing Market

Scroll to load chart

Housing Finance

Scroll to load chart

Monetary & Financial Conditions

Scroll to load chart

FX Rates & Commodities

Scroll to load chart

Employment

Scroll to load chart

Job Advertisements

Scroll to load chart

Wages & Earnings

Scroll to load chart

Household Consumption

Scroll to load chart

Household Spending

Scroll to load chart

Inflation & Cost of Living

Scroll to load chart

Equities & Superannuation

Scroll to load chart