Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Palmyra are above average based on AreaSearch's ranking of recent, and medium to long-term trends

Population estimates for the Palmyra (WA) statistical area (Lv2), based on ABS updates and AreaSearch validation, indicate a population of approximately 8,482 as of November 2025. This figure represents an increase of 897 people since the 2021 Census, which reported a population of 7,585. The change is inferred from AreaSearch's estimated resident population of 8,445 in June 2024 and the addition of 11 validated new addresses since the Census date. This results in a population density ratio of 2,701 persons per square kilometer, placing Palmyra (WA) in the upper quartile relative to national locations assessed by AreaSearch. The area's growth rate of 11.8% since the 2021 census exceeds the national average of 9.7%. Overseas migration contributed approximately 68.0% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and post-2032 growth estimation, AreaSearch utilises growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections (released in 2023, based on 2022 data). Based on these projections, Palmyra (WA) is expected to grow by just below the median of statistical areas across the nation. By 2041, the area is projected to gain 887 persons, reflecting an overall increase of 8.2% over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Palmyra recording a relatively average level of approval activity when compared to local markets analysed countrywide

AreaSearch analysis indicates Palmyra has had approximately 14 dwelling approvals annually. Over the past five financial years, from FY-21 to FY-25, around 70 homes were approved, with a further 8 approved in FY-26. This results in an estimated average of 10.4 new residents arriving per year per dwelling constructed over these years.

Given this demand significantly exceeds supply, it typically leads to price growth and increased buyer competition. The average expected construction cost value for new dwellings is $731,000, indicating developers target the premium market segment with higher-end properties. In FY-26, $2.6 million in commercial approvals have been registered, demonstrating Palmyra's primarily residential nature. Compared to Greater Perth, Palmyra has significantly less development activity, at 72.0% below the regional average per person. This scarcity of new homes typically strengthens demand and prices for existing properties.

This level is also below national average, reflecting the area's maturity and possible planning constraints. New building activity shows 92.0% standalone homes and 8.0% attached dwellings, preserving Palmyra's suburban nature with an emphasis on detached housing attracting space-seeking buyers. However, new construction favours detached housing more than current patterns suggest (57.0% at Census), demonstrating ongoing robust demand for family homes despite increasing density pressures. Palmyra has a population density of around 630 people per approval, indicating a mature, established area. According to the latest AreaSearch quarterly estimate, Palmyra is projected to add 691 residents by 2041. If current construction levels persist, housing supply could lag population growth, likely intensifying buyer competition and underpinning price growth.

Frequently Asked Questions - Development

Infrastructure

Palmyra has emerging levels of nearby infrastructure activity, ranking in the 36thth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified six projects likely affecting the region. Notable initiatives include The Point Palmyra, The Point Attadale, the Palmyra Local Centre Structure Plan (Area 2), and Santa Clara Estate. The following list details those most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

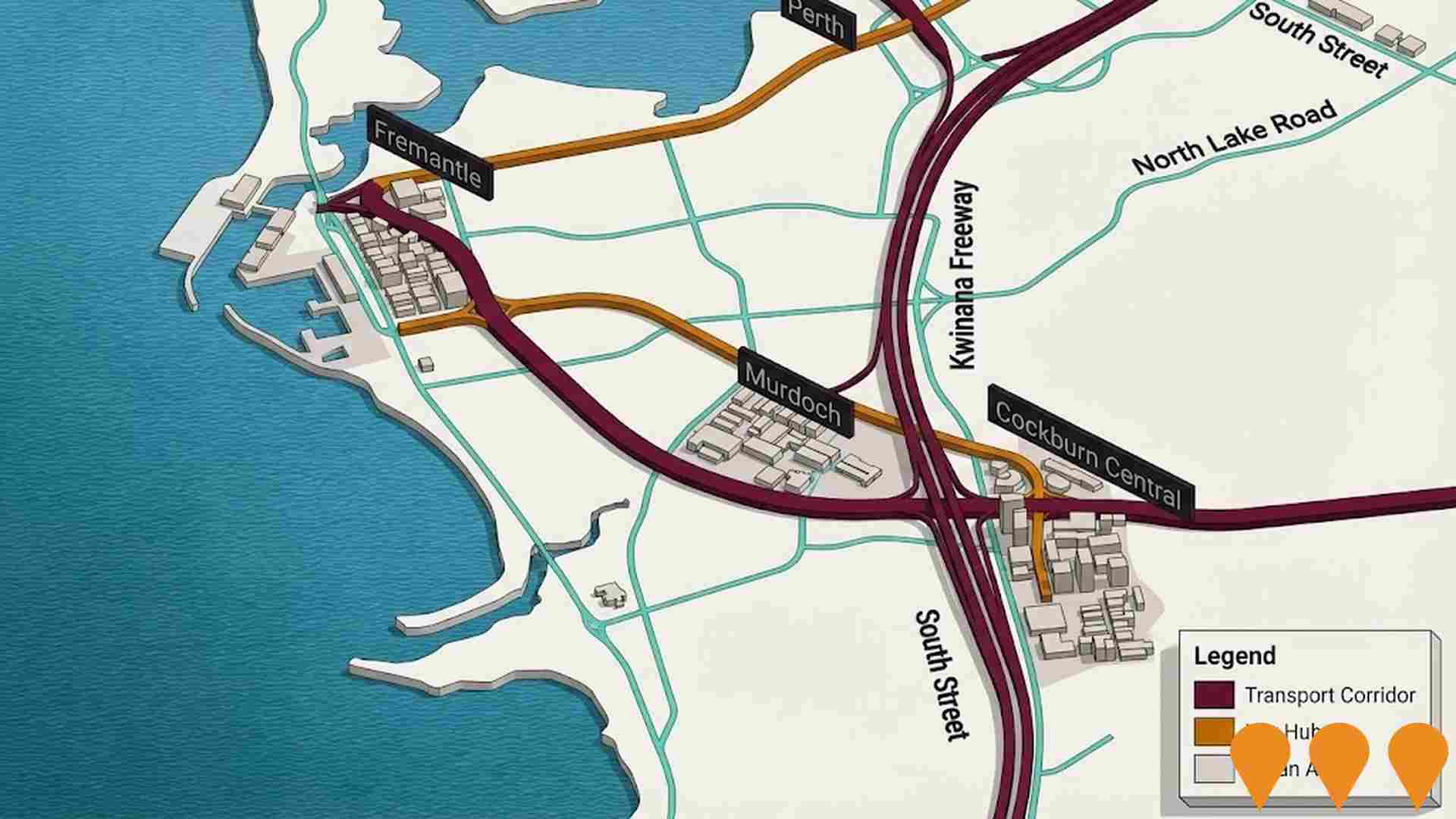

METRONET

METRONET is the largest public transport infrastructure program in Western Australia's history, expanding the Perth rail network by 72 kilometres and adding 23 new stations. As of February 2026, the program has reached substantial completion with the opening of the new Midland Station on February 22, 2026, marking the delivery of the final rail infrastructure project. Major milestones achieved include the Yanchep Rail Extension, Morley-Ellenbrook Line, Thornlie-Cockburn Link, and the Victoria Park-Canning Level Crossing Removal. The program also delivered 246 locally built C-series railcars and implemented high-capacity signalling across the network.

Future of Fremantle Waterfront

A long-term 50-year strategic transformation of 370 hectares of Fremantle Inner Harbour land and waterways. The project follows the Western Australian Government's endorsement of the Place and Economic Vision in late 2024, facilitating a transition once container shipping moves to Kwinana by the late 2030s. The precinct is planned to support 20,000 new dwellings, 55,000 residents, and 45,000 jobs, featuring 10km of activated waterfront, major parklands, and cultural facilities.

Bicton Central

A completed neighbourhood shopping centre redevelopment featuring Coles, Liquorland, and a mix of specialty retail and dining options serving the Bicton community.

Kardinya District Centre Precinct Structure Plan

The Kardinya District Centre Precinct Structure Plan (formerly ACP) was approved by the WAPC on November 4, 2025. It establishes a long-term framework for a mixed-use urban hub within a 400m walkable catchment. Key provisions include residential density increases from R25 to R60, maximum building heights up to 9 storeys for residential and 12 storeys at designated landmark sites, and public realm upgrades. This plan supports the ongoing $80 million redevelopment of the Kardinya Park Shopping Centre, which recently completed its second stage in December 2025, introducing an expanded Coles, a multi-deck car park, and a new medical wellness precinct.

METRONET High Capacity Signalling Program

The High Capacity Signalling (HCS) project is a decade-long technology upgrade to Perth's rail network, replacing ageing fixed-block signalling with an advanced Communications-Based Train Control (CBTC) system. This 'moving block' technology uses real-time data to safely reduce the distance between trains, enabling a 40 percent increase in network capacity. The project includes the construction of a state-of-the-art Public Transport Operations Control Centre (PTOCC) in East Perth and the installation of a private Long-Term Evolution (LTE) radio network to support high-speed data transmission.

Kwinana Freeway Upgrade (Roe Highway to Safety Bay Road)

A $700 million project to widen and upgrade the Kwinana Freeway between Roe Highway and Safety Bay Road to improve safety and freight efficiency for over 100,000 daily vehicles. Key features include an additional lane in each direction between Russell Road and Mortimer Road, a new southbound lane between Roe Highway and Berrigan Drive, and a new northbound lane from Russell Road to Beeliar Drive. The project also introduces coordinated ramp signals on northbound on-ramps and upgrades to the Principal Shared Path (PSP) network. Environmental assessments are currently underway following its designation as a 'controlled action' under the EPBC Act, with preliminary documentation expected in early 2026. Procurement is active with a construction contract award scheduled for mid-2026.

Palmyra Local Centre Structure Plan (Area 2)

Approved structure plan for the Palmyra local centre (Area 2), providing zoning, height and land use controls to support higher density mixed use redevelopment around the Canning Highway and Carrington Street precinct. The area now forms part of the broader Melville District Activity Centre, with the Melville District Activity Centre Plan (approved by the Western Australian Planning Commission in 2017) acting as the key planning framework guiding future residential, commercial and public realm upgrades across the centre. The structure plan is being implemented progressively as individual development and local development plan proposals are lodged and assessed under Local Planning Scheme No. 6.

Attadale Reserve Masterplan & Sports Facilities Upgrade

Major upgrade of Attadale Reserve including new sports pavilion, changerooms, floodlighting and landscape improvements as part of the City of Melville's long-term masterplan.

Employment

Palmyra ranks among the top 25% of areas assessed nationally for overall employment performance

Palmyra has an educated workforce with key services sectors well-represented. Its unemployment rate was 2.3% in the past year, with estimated employment growth of 3.7%.

As of September 2025, 4,929 residents are employed, and the unemployment rate is 1.7% lower than Greater Perth's rate of 4.0%. Workforce participation is similar to Greater Perth at 68.3%. Dominant employment sectors include health care & social assistance, education & training, and professional & technical services. Education & training has a notable concentration with levels at 1.5 times the regional average.

Retail trade has limited presence at 7.6% compared to the regional average of 9.3%. The area appears to offer limited local employment opportunities based on Census data. In the past year, employment increased by 3.7%, labour force by 4.0%, raising the unemployment rate by 0.2 percentage points. Greater Perth saw employment growth of 2.9% and a marginal rise in unemployment. State-level data to 25-Nov-25 shows WA employment contracted by 0.27%, with an unemployment rate of 4.6%. National employment forecasts suggest growth of 6.6% over five years and 13.7% over ten years, but local projections vary significantly between industry sectors. Applying these projections to Palmyra's employment mix indicates potential local employment increases of 6.7% over five years and 14.0% over ten years.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

The suburb of Palmyra had a median taxpayer income of $62,749 and an average income of $87,815 in the financial year 2023, according to postcode level ATO data aggregated by AreaSearch. These figures are significantly higher than Greater Perth's median income of $60,748 and average income of $80,248 during the same period. By September 2025, estimated incomes would be approximately $68,785 (median) and $96,263 (average), based on a 9.62% growth in wages since financial year 2023. As of the 2021 Census, personal income ranked at the 77th percentile ($991 weekly), while household income was at the 48th percentile. The earnings profile showed that 29.9% of individuals (2,536 people) fell into the $1,500 - $2,999 earnings band, similar to the surrounding region where 32.0% occupied this range. Housing affordability pressures were severe, with only 83.3% of income remaining after housing costs, ranking at the 48th percentile. The suburb's SEIFA income ranking placed it in the 7th decile.

Frequently Asked Questions - Income

Housing

Palmyra displays a diverse mix of dwelling types, with a higher proportion of rental properties than the broader region

In Palmyra, as per the latest Census evaluation, 57.1% of dwellings were houses while 42.9% consisted of other types such as semi-detached homes, apartments, and 'other' dwellings. This contrasts with Perth metro's figures which stood at 76.5% for houses and 23.6% for other dwellings. Home ownership in Palmyra was recorded at 29.7%, with mortgaged dwellings making up 43.2% and rented ones comprising 27.1%. The median monthly mortgage repayment in the area was $1,950, lower than Perth metro's average of $2,200. Meanwhile, the median weekly rent figure for Palmyra was $350, compared to Perth metro's $400. Nationally, Palmyra's median monthly mortgage repayments were higher at $1,950 against Australia's average of $1,863, while rents were lower at $350 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Palmyra features high concentrations of lone person households, with a lower-than-average median household size

Family households comprise 60.1% of all households, including 25.1% couples with children, 22.7% couples without children, and 11.2% single parent families. Non-family households make up the remaining 39.9%, with lone person households accounting for 36.3% and group households comprising 3.6%. The median household size is 2.2 people, which is smaller than the Greater Perth average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Palmyra shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Palmyra's educational attainment exceeds broader benchmarks. Among residents aged 15+, 39.2% have university qualifications, compared to 27.9% in WA and 28.6% in the SA4 region. Bachelor degrees are most common at 27.5%, followed by postgraduate qualifications (7.1%) and graduate diplomas (4.6%). Vocational credentials are also prevalent, with 31.7% of residents aged 15+ holding them, including advanced diplomas (11.5%) and certificates (20.2%).

Educational participation is high, with 27.5% currently enrolled in formal education, comprising 9.1% in primary, 7.0% in secondary, and 6.2% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Palmyra shows that there are currently 21 active transport stops operating within the city. These stops serve a mix of bus routes, with a total of 6 individual routes providing service. Together, these routes facilitate 1,752 weekly passenger trips.

The accessibility of transport in Palmyra is rated as good, with residents typically located an average of 274 meters from their nearest transport stop. Service frequency across all routes averages 250 trips per day, which equates to approximately 83 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Palmyra is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

Palmyra shows better-than-average health results, with both younger and older residents having low rates of common health conditions. Approximately 62% of its total population (5,263 people) has private health cover, compared to 66.5% in Greater Perth and a national average of 55.7%. The most prevalent medical issues are mental health problems (8.9%) and arthritis (7.2%), with 71.3% reporting no medical ailments, similar to the 72.5% across Greater Perth.

Palmyra has 18.7% of residents aged 65 and over (1,586 people), lower than Greater Perth's 22.4%. Despite this, health outcomes among seniors are strong, mirroring those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Palmyra records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Palmyra's cultural diversity was found to be above average, with 10.0% of its population speaking a language other than English at home and 25.8% born overseas. Christianity was the main religion in Palmyra, comprising 42.7% of people. Judaism was overrepresented, making up 0.1% of Palmyra's population compared to 0.1% across Greater Perth.

The top three ancestry groups were English (31.4%), Australian (24.3%), and Irish (9.4%). Notably, French (0.8%) was overrepresented in Palmyra compared to the regional figure of 0.6%. Croatian representation was equal at 1.1%, while Italian was slightly higher at 5.4% versus the regional figure of 4.9%.

Frequently Asked Questions - Diversity

Age

Palmyra's population aligns closely with national norms in age terms

The median age in Palmyra is 39 years, which is higher than Greater Perth's average of 37 years and close to Australia's national average of 38 years. Compared to Greater Perth, the 75-84 age group is over-represented in Palmyra at 6.5%, while the 15-24 age group is under-represented at 10.5%. According to data from the 2021 Census, the 75-84 age group has grown from 5.1% to 6.5% of Palmyra's population. Meanwhile, the 45-54 age group has declined from 13.4% to 12.6%. Population forecasts for 2041 indicate significant demographic changes in Palmyra. Notably, the 75-84 age group is expected to grow by 69%, reaching 929 people from 551. This growth is led by residents aged 65 and older, who will represent 74% of the anticipated population increase. Conversely, the 0-4 and 5-14 age groups are projected to experience population declines.