Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Fremantle lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Fremantle's population was around 19,892 as of November 2025. This reflected an increase of 3,172 people since the 2021 Census, which reported a population of 16,720. The change was inferred from the estimated resident population of 19,584 in June 2024 and an additional 510 validated new addresses since the Census date. This level of population resulted in a density ratio of 673 persons per square kilometer. Fremantle's growth of 19.0% since the 2021 census exceeded the national average of 8.9%. Overseas migration contributed approximately 50.4% of overall population gains during recent periods, although all drivers were positive factors.

AreaSearch adopted ABS/Geoscience Australia projections for each SA2 area as released in 2024 with a base year of 2022. For areas not covered by this data and to estimate growth post-2032, AreaSearch utilised growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections released in 2023 based on 2022 data. Demographic trends projected an above median population growth for Australian statistical areas. The area was expected to expand by 4,502 persons to 2041, reflecting an increase of 21.1% over the 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Fremantle was found to be higher than 90% of real estate markets across the country

Fremantle has recorded approximately 160 residential properties granted approval each year over the past five financial years, totalling 803 homes. As of FY26, 49 approvals have been recorded. On average, 3.7 people move to the area annually for each dwelling built between FY21 and FY25, indicating significant demand exceeding new supply. New properties are constructed at an average expected cost of $489,000, targeting the premium market segment with higher-end properties.

This financial year has seen $65.2 million in commercial approvals, reflecting strong commercial development momentum. Compared to Greater Perth, Fremantle shows 66.0% higher new home approvals per person. New building activity consists of 13.0% detached houses and 87.0% townhouses or apartments, focusing on higher-density living to create more affordable entry points for downsizers, investors, and first-home buyers. This shift marks a significant departure from existing housing patterns (currently 46.0% houses), suggesting diminishing developable land availability and responding to evolving lifestyle preferences and housing affordability needs. The estimated population per dwelling approval is 433 people, reflecting Fremantle's quiet development environment. Population forecasts indicate Fremantle will gain 4,194 residents by 2041, with existing development levels aligned with future requirements, maintaining stable market conditions without significant price pressures.

Population forecasts indicate Fremantle will gain 4,194 residents through to 2041 (from the latest AreaSearch quarterly estimate). Existing development levels seem aligned with future requirements, maintaining stable market conditions without significant price pressures.

Frequently Asked Questions - Development

Infrastructure

Fremantle has emerging levels of nearby infrastructure activity, ranking in the 37thth percentile nationally

Infrastructure changes significantly influence an area's performance. AreaSearch identified 60 projects likely impacting the region. Notable initiatives include Swan River Crossings Project, Elder Place Fremantle (Elders Wool Stores Redevelopment), Monument East, and Serai North Fremantle. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Cockburn Coast Redevelopment

Long term coastal urban renewal of about 98 hectares between South Beach and Port Coogee, transforming former industrial land into a mixed residential and commercial community. The project is planned for around 12,000 residents in about 6,000 dwellings across the Shoreline, Hilltop and Power Station precincts, with new community spaces, foreshore upgrades and adaptive reuse of the heritage South Fremantle Power Station as a key activity center.

Future of Fremantle Waterfront

Long-term (50+ year) transformation of Fremantle's Inner Harbour and surrounding precincts after container shipping moves to Kwinana. The endorsed State Government vision will deliver a world-class waterfront city with up to 20,000 new dwellings, 55,000 residents, 10+ km of activated ocean and river frontage, major public parklands, tourism, cultural and education facilities, and an estimated 45,000 ongoing jobs.

Victoria Quay Revitalisation

Long-term revitalisation of Victoria Quay into a premier hospitality, entertainment, and tourism precinct. The first phase of short-term activation works is underway, including improving public spaces, enhancing access to Bathers Beach, and the redevelopment of heritage-listed B Shed into a new Rottnest ferry terminal, multi-use performance space, and common user ferry berth. This project is part of the broader Future of Fremantle Place and Economic Vision.

FOMO - Walyalup Koort (Kings Square)

FOMO (Fremantle On My Own) is the flagship retail component of the Walyalup Koort (formerly Kings Square) redevelopment, the largest public-private infrastructure project in Fremantle's history. The 5,500 sqm mixed-use precinct incorporates the adaptive reuse of the former Myer building and Queensgate carpark into a contemporary laneway retail and dining destination inspired by Asian hawker markets. The project seamlessly blends art, architecture, culture, retail, food and entertainment experiences, featuring a diverse mix of dining venues, FunLab entertainment complex (including Strike Bowling, Holey Moley, and B.Lucky & Sons), IGA Freo supermarket, and independent retailers. The development is part of the broader Walyalup Koort precinct which includes 20,800 sqm of WA State Government office space and the new Walyalup Civic Centre. FOMO has received multiple awards including PCA State Development of the Year 2023, Best Retail Under 75 Stores 2022, and Best Mixed-Use Development 2022, setting a new benchmark for urban regeneration and experiential retail in Western Australia.

Swan River Crossings Project

The Swan River Crossings Project is replacing the aging Fremantle Traffic Bridge with Australia's first extradosed bridge, featuring two lanes in each direction, wider active transport paths (up to 4m wide), higher clearance for watercraft (up to 9m), and enhanced connectivity between Fremantle and North Fremantle. The new bridge combines balanced cantilever precast segmental construction with cable supports and will serve as an iconic gateway to Fremantle. Construction is underway with completion expected in 2026, and the existing bridge will remain operational until early 2026 to minimize disruption.

Elder Place Fremantle (Elders Wool Stores Redevelopment)

A $110 million heritage redevelopment of the Elders Wool Stores (built 1927, extended 1950s), transforming the long-vacant buildings into Western Australia's largest heritage redevelopment. The seven-storey mixed-use development will comprise 213 residential units including 33 boutique apartments (1, 2 and 3-bedroom plus penthouses), 6 three-level townhouses, and 174 co-living rental units with shared facilities. The project will deliver over 6,600 square meters of commercial office space, ground floor hospitality venues including a tavern, cafes, restaurants and bars, plus small retail outlets along Cantonment Street. Designed by Fremantle architects Spaceagency, the development will retain 80% of the world-famous skate ledge and preserve the heritage facades while adding three levels to the original structure. Development application received Council support in April 2025, with ongoing community consultation regarding heritage elements and skate ledge access.

Fremantle Station Precinct Plan

Strategic planning for Fremantle Station precinct redevelopment including transit-oriented development, improved connectivity, and mixed-use opportunities. Integration with broader Fremantle transformation initiatives.

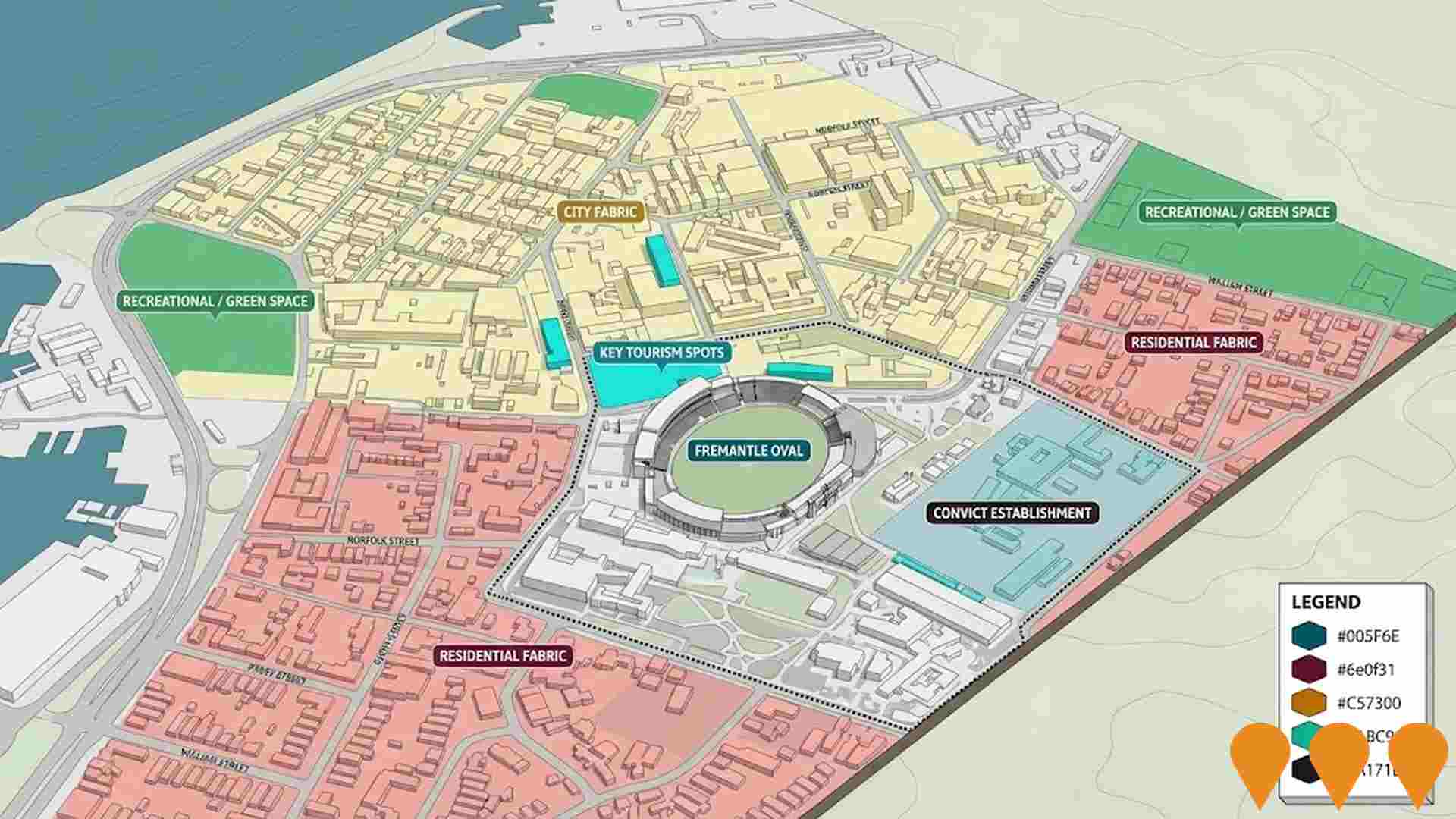

Fremantle Oval Precinct Masterplan

Council-endorsed masterplan to redevelop the Fremantle Oval precinct with upgraded football facilities, improved spectator experience, better community access, event capability, and refurbishment of Victoria Pavilion. The City is preparing a business case and seeking State and Federal funding to progress detailed design and delivery.

Employment

Fremantle has seen below average employment performance when compared to national benchmarks

Fremantle has a highly educated workforce with professional services well represented. The unemployment rate was 5.3% in the past year, with an estimated employment growth of 4.1%.

As of September 2025, there were 11,512 residents employed while the unemployment rate was 1.3% higher than Greater Perth's rate of 4.0%. Workforce participation was similar to Greater Perth at 65.2%. Key industries employing residents include health care & social assistance, professional & technical services, and education & training. Fremantle specializes in professional & technical jobs, with an employment share 1.6 times the regional level.

Retail trade employed only 6.1% of local workers, lower than Greater Perth's 9.3%. The Census showed 1.1 workers per resident, indicating Fremantle functions as an employment hub attracting workers from nearby areas. Between September 2024 and September 2025, employment levels increased by 4.1%, labour force grew by 4.4%, raising the unemployment rate by 0.3 percentage points. In contrast, Greater Perth saw employment rise by 2.9% and unemployment increase marginally. State-level data from 25-Nov-25 shows WA employment contracted by 0.27%, with a state unemployment rate of 4.6%, compared to the national rate of 4.3%. National employment forecasts from May-25 project overall growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Fremantle's employment mix suggests local employment should increase by 6.9% over five years and 14.3% over ten years, though this is a simplified extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

The area exhibits notably strong income performance, ranking higher than 70% of areas assessed nationally through AreaSearch analysis

Fremantle SA2 has one of the highest income levels nationally, according to AreaSearch's aggregation of ATO data for financial year 2022. The median income among taxpayers in Fremantle SA2 is $60,926, with an average income of $94,686. These figures compare to Greater Perth's median and average incomes of $58,380 and $78,020 respectively. By September 2025, estimates suggest the median income will be approximately $69,577 and the average income will reach around $108,131, based on Wage Price Index growth of 14.2% since financial year 2022. Census data shows individual earnings in Fremantle SA2 stand at the 83rd percentile nationally ($1,059 weekly). A significant portion of the population (27.2%, or 5,410 individuals) falls within the $1,500 - 2,999 income range, reflecting a regional trend where 32.0% occupy this bracket. Notably, 32.3% earn above $3,000 per week, indicating strong economic capacity in Fremantle SA2. Despite high housing costs consuming 15.3% of income, disposable income remains at the 63rd percentile nationally. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Fremantle displays a diverse mix of dwelling types, with a higher proportion of rental properties than the broader region

Dwelling structure in Fremantle, as evaluated at the latest Census held on 28 August 2016, comprised 45.6% houses and 54.4% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Perth metropolitan area had 61.2% houses and 38.8% other dwellings. Home ownership in Fremantle stood at 31.5%, with the remainder of dwellings either mortgaged (30.4%) or rented (38.0%). The median monthly mortgage repayment in Fremantle was $2,167, aligning with Perth metro's average. The median weekly rent figure was recorded at $385, compared to Perth metro's $379. Nationally, Fremantle's mortgage repayments were significantly higher than the Australian average of $1,863 as reported in the 2017 Housing Industry Association-Commonwealth Bank Housing Affordability Report. Meanwhile, rents in Fremantle exceeded the national figure of $375 according to the same report.

Frequently Asked Questions - Housing

Household Composition

Fremantle features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households constitute 57.0% of all households, including 19.9% couples with children, 28.2% couples without children, and 8.2% single parent families. Non-family households make up the remaining 43.0%, with lone person households at 36.9% and group households comprising 6.1%. The median household size is 2.1 people, which is smaller than the Greater Perth average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Fremantle shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Fremantle's educational attainment notably exceeds broader benchmarks. Among residents aged 15 and above, 48.9% possess university qualifications, compared to 27.9% in Western Australia (WA) and 28.6% in the SA4 region. This significant educational advantage positions Fremantle favourably for knowledge-based opportunities. Bachelor degrees are most prevalent at 30.5%, followed by postgraduate qualifications (13.7%) and graduate diplomas (4.7%).

Trade and technical skills are also prominent, with 25.8% of residents aged 15 and above holding vocational credentials – advanced diplomas (10.9%) and certificates (14.9%). Educational participation is notably high in Fremantle, with 26.9% of residents currently enrolled in formal education. This includes 9.1% in tertiary education, 6.5% in primary education, and 6.1% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Fremantle's public transport analysis shows 121 active stops operating within the city, offering a mix of train and bus services. These stops are served by 37 individual routes, collectively facilitating 7,986 weekly passenger trips. Transport accessibility is rated as good, with residents typically located 268 meters from their nearest transport stop.

Service frequency averages 1,140 trips per day across all routes, equating to approximately 66 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Fremantle's residents are healthier than average in comparison to broader Australia with a fairly standard level of common health conditions seen across both young and old age cohorts

Fremantle's health data shows positive outcomes with common conditions seen equally in younger and older residents. Private health cover is high at approximately 69% of Fremantle's total population (13,785 people), compared to Greater Perth's 67.0%, and the national average of 55.3%. Mental health issues and arthritis are the most common conditions, affecting 10.1% and 7.2% respectively.

69.1% of residents report no medical ailments, slightly lower than Greater Perth's 69.6%. Fremantle has 20.4% seniors (aged 65 and over), totaling 4,050 people. Health outcomes among seniors are strong, outperforming the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Fremantle was found to be slightly above average when compared nationally for a number of language and cultural background related metrics

Fremantle's population, as of June 30, 2016, showed high cultural diversity with 12.9% speaking a language other than English at home and 31.5% born overseas. Christianity was the predominant religion, accounting for 36.2%. Judaism was slightly overrepresented compared to Greater Perth, comprising 0.4% versus 0.3%.

The top three ancestry groups were English (30.9%), Australian (19.9%), and Irish (10.6%). Notable divergences included Welsh at 1.1%, French at 1.2%, and Croatian at 1.2%.

Frequently Asked Questions - Diversity

Age

Fremantle's median age exceeds the national pattern

The median age in Fremantle is 43 years, which is higher than Greater Perth's average of 37 years and exceeds the national average of 38 years. The age profile shows that those aged 55-64 are particularly prominent at 13.6%, while those aged 5-14 are comparatively smaller at 9.7%. Between 2021 and present, the 5-14 age group has grown from 7.8% to 9.7% of the population, while the 75-84 cohort increased from 5.9% to 6.9%. Conversely, the 45-54 cohort has declined from 13.8% to 12.2%. By 2041, demographic projections reveal significant shifts in Fremantle's age structure. The 75-84 age cohort is projected to rise substantially, increasing by 1,046 people (76%) from 1,376 to 2,423. Notably, the combined 65+ age groups will account for 57% of total population growth. Conversely, the 0-4 and 35-44 cohorts are expected to experience population declines.