Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Beaconsfield are above average based on AreaSearch's ranking of recent, and medium to long-term trends

The population of the Beaconsfield (WA) statistical area (Lv2), as estimated by AreaSearch, was around 5,965 as of Nov 2025. This figure reflects a growth of 650 people since the 2021 Census, which reported a population of 5,315 people in Beaconsfield (WA) (SA2). The increase is inferred from AreaSearch's estimate of 5,932 residents following examination of ABS's latest ERP data release (June 2024), along with an additional 26 validated new addresses since the Census date. This results in a population density ratio of 2,185 persons per square kilometer, higher than the national average assessed by AreaSearch. The area's growth rate of 12.2% since the 2021 census surpassed the national average of 9.7%. Overseas migration contributed approximately 75.0% to overall population gains in recent periods, although all drivers were positive factors.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and post-2032 growth estimation, AreaSearch uses ABS's latest Greater Capital Region projections (released in 2023, based on 2022 data). Projecting forward with these trends, an above-median population growth is expected for the area, with a projected increase of 902 persons to 2041, reflecting a total gain of 13.6% over the 17 years.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Beaconsfield when compared nationally

Based on AreaSearch analysis, Beaconsfield has experienced around 30 dwelling approvals annually over the past five financial years from FY21 to FY25. This totals an estimated 153 homes. So far in FY26, seven approvals have been recorded. On average, 3.5 people moved to the area each year for every dwelling built during this period.

Commercial development approvals totalled $13.1 million in FY26. Beaconsfield maintains similar construction rates per person compared to Greater Perth but has seen a slowdown in recent years. New building activity comprises 68% detached dwellings and 32% townhouses or apartments, providing options across different price points.

With around 306 people per dwelling approval, Beaconsfield shows a developing market. Population forecasts indicate the area will gain 812 residents by 2041. Existing development levels appear aligned with future requirements, maintaining stable market conditions without significant price pressures.

Frequently Asked Questions - Development

Infrastructure

Beaconsfield has moderate levels of nearby infrastructure activity, ranking in the 47thth percentile nationally

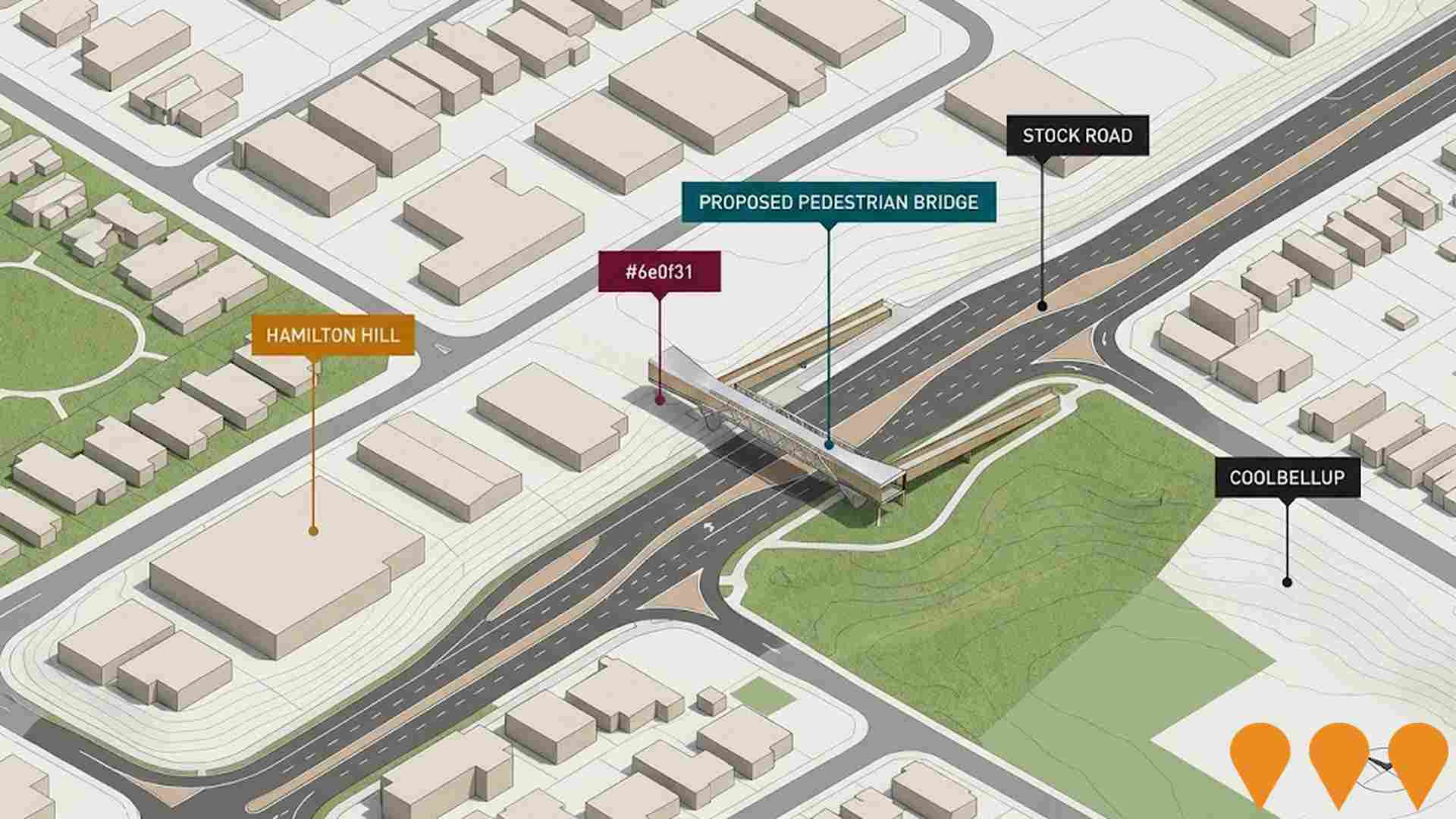

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified two projects likely impacting this region. Major initiatives include Stockland Nara, Cockburn Coast Redevelopment, OneOneFive Hamilton Hill, and Stock Road Pedestrian Bridge. The following details projects expected to have the most relevance.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

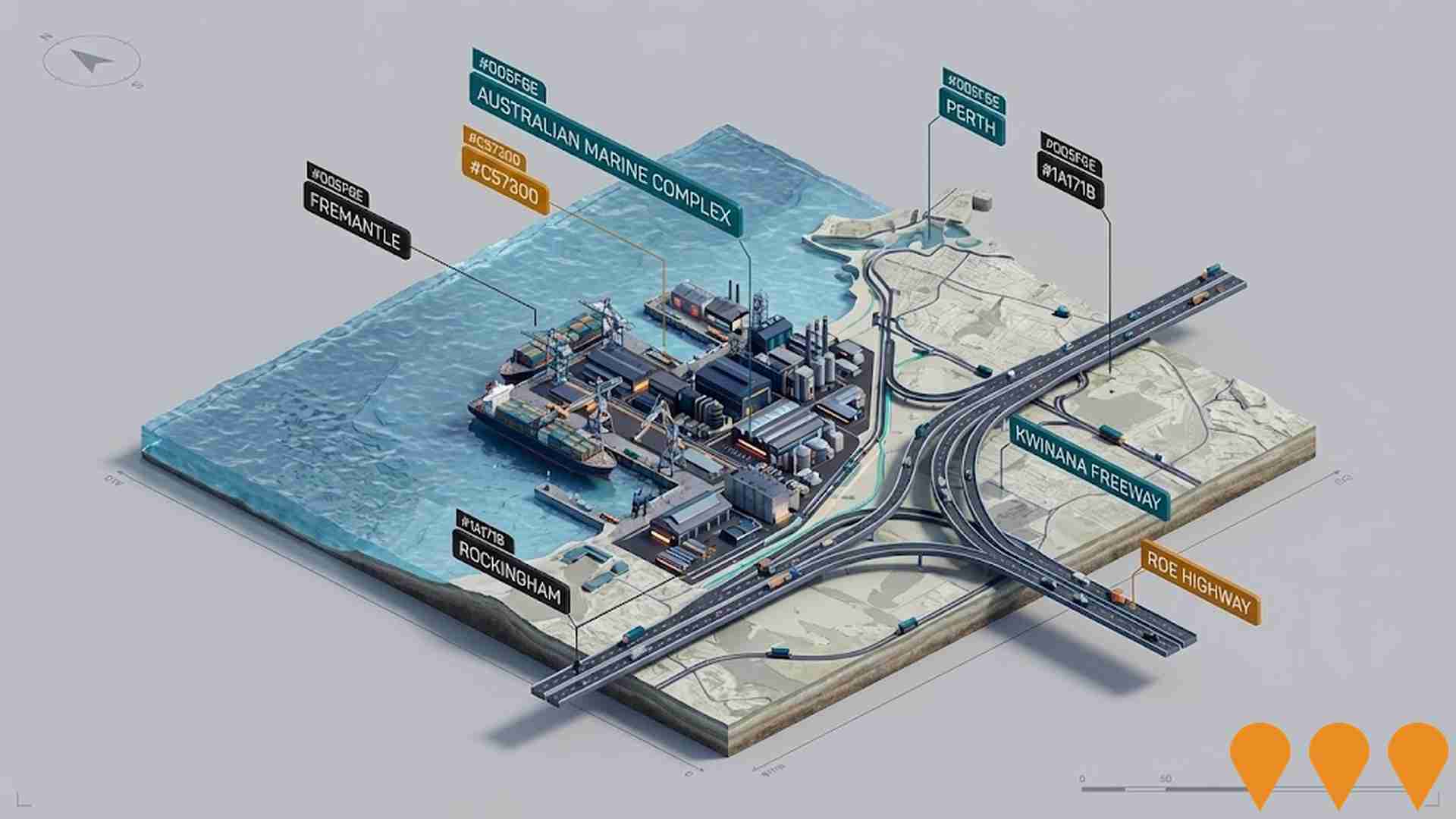

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

METRONET

METRONET is the largest public transport infrastructure program in Western Australia's history, expanding the Perth rail network by 72 kilometres and adding 23 new stations. As of February 2026, the program has reached substantial completion with the opening of the new Midland Station on February 22, 2026, marking the delivery of the final rail infrastructure project. Major milestones achieved include the Yanchep Rail Extension, Morley-Ellenbrook Line, Thornlie-Cockburn Link, and the Victoria Park-Canning Level Crossing Removal. The program also delivered 246 locally built C-series railcars and implemented high-capacity signalling across the network.

Cockburn Coast Redevelopment

A long-term 98-106 hectare coastal urban renewal project transforming former industrial land into a community for 12,000 residents. The development is divided into three main precincts: Shoreline (active construction/residential), Hilltop, and the Power Station precinct. A central feature is the adaptive reuse of the heritage-listed South Fremantle Power Station into a regional activity center for retail, tourism, and hospitality.

Future of Fremantle Waterfront

A long-term 50-year strategic transformation of 370 hectares of Fremantle Inner Harbour land and waterways. The project follows the Western Australian Government's endorsement of the Place and Economic Vision in late 2024, facilitating a transition once container shipping moves to Kwinana by the late 2030s. The precinct is planned to support 20,000 new dwellings, 55,000 residents, and 45,000 jobs, featuring 10km of activated waterfront, major parklands, and cultural facilities.

METRONET High Capacity Signalling Program

The High Capacity Signalling (HCS) project is a decade-long technology upgrade to Perth's rail network, replacing ageing fixed-block signalling with an advanced Communications-Based Train Control (CBTC) system. This 'moving block' technology uses real-time data to safely reduce the distance between trains, enabling a 40 percent increase in network capacity. The project includes the construction of a state-of-the-art Public Transport Operations Control Centre (PTOCC) in East Perth and the installation of a private Long-Term Evolution (LTE) radio network to support high-speed data transmission.

Hamilton Hill Revitalisation Strategy

Council adopted the strategy in 2012 to guide residential rezoning and public realm upgrades across Hamilton Hill. Residential codings were changed in 2014 and the City continues to deliver streetscape, park and traffic improvements. As at October 2025 the City is awaiting WAPC approval of its Local Planning Strategy, after which the Hamilton Hill Strategy is intended to be reviewed and updated into a Local Area Plan while ongoing actions continue.

Kwinana Freeway Upgrade (Roe Highway to Safety Bay Road)

A $700 million project to widen and upgrade the Kwinana Freeway between Roe Highway and Safety Bay Road to improve safety and freight efficiency for over 100,000 daily vehicles. Key features include an additional lane in each direction between Russell Road and Mortimer Road, a new southbound lane between Roe Highway and Berrigan Drive, and a new northbound lane from Russell Road to Beeliar Drive. The project also introduces coordinated ramp signals on northbound on-ramps and upgrades to the Principal Shared Path (PSP) network. Environmental assessments are currently underway following its designation as a 'controlled action' under the EPBC Act, with preliminary documentation expected in early 2026. Procurement is active with a construction contract award scheduled for mid-2026.

OneOneFive Hamilton Hill

Award-winning sustainable residential development on former Hamilton Senior High School site. Features 232 lots delivering around 310 diverse, climate-responsive homes with nature play areas, parks and retained mature trees. Stage 2 lots (150-344sqm) releasing mid-2025.

Stockland Nara

A $250 million all-electric medium-density community featuring 206 architecturally designed two to three-storey townhouses with one to four bedrooms. Designed in collaboration with Plus Architecture and built by Northerly Group, the development includes 26% open green spaces, smart home automation, 8.8kW solar systems with 10.1kWh battery storage, and no strata fees with green title ownership. Located 900 metres from South Beach and 2 kilometres from Fremantle's cultural precinct, the community offers a sustainable coastal lifestyle with 7-star energy ratings as standard.

Employment

The employment environment in Beaconsfield shows above-average strength when compared nationally

Beaconsfield has an educated workforce with prominent representation in essential services sectors. Its unemployment rate is 3.5%, lower than the Greater Perth average of 4%.

Employment growth over the past year was estimated at 4.2%. As of September 2025, 3,355 residents are employed while the unemployment rate is 0.5% below Greater Perth's rate. Workforce participation in Beaconsfield is similar to Greater Perth's 65.2%. Leading employment industries include health care & social assistance, education & training, and professional & technical services.

Education & training has a particularly strong share of employment, at 1.5 times the regional level. Retail trade, however, is under-represented with only 6.8% of Beaconsfield's workforce compared to Greater Perth's 9.3%. Limited local employment opportunities are indicated by Census data comparing working population and resident population. Over the 12 months to September 2025, employment in Beaconsfield increased by 4.2%, while labour force increased by 4.5%, resulting in a rise of 0.3 percentage points in unemployment rate. In contrast, Greater Perth experienced employment growth of 2.9% and labour force growth of 3.0%. State-level data to 25-Nov-25 shows WA employment contracted by 0.27%, with the state unemployment rate at 4.6%, compared to the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggest potential future demand within Beaconsfield. National employment is forecast to expand by 6.6% over five years and 13.7% over ten years, with varying growth rates between industry sectors. Applying these projections to Beaconsfield's employment mix suggests local employment should increase by 6.7% over five years and 14.0% over ten years.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

AreaSearch's data for financial year 2023 shows Beaconsfield's median income at $58,616 and average income at $81,617. Greater Perth has a median income of $60,748 and an average of $80,248. By September 2025, estimated incomes would be approximately $64,255 (median) and $89,469 (average), based on Wage Price Index growth of 9.62%. Census data indicates Beaconsfield's household, family, and personal incomes are around the 60th percentile nationally. Income brackets show 26.0% of locals earn between $1,500 - 2,999 weekly, with 30.1% earning above $3,000 weekly. High housing costs consume 15.6% of income, but strong earnings place disposable income at the 56th percentile nationally. Beaconsfield's SEIFA income ranking is in the 7th decile.

Frequently Asked Questions - Income

Housing

Beaconsfield is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Beaconsfield's dwelling structures, as per the latest Census, consisted of 79.4% houses and 20.6% other dwellings (semi-detached, apartments, 'other' dwellings). This contrasts with Perth metro's structure of 61.2% houses and 38.8% other dwellings. Home ownership in Beaconsfield stood at 37.1%, with mortgaged dwellings at 36.6% and rented dwellings at 26.3%. The median monthly mortgage repayment was $2,300, higher than Perth metro's average of $2,167. Median weekly rent in Beaconsfield was $350, compared to Perth metro's $379. Nationally, Beaconsfield's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were lower than the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Beaconsfield features high concentrations of group households, with a higher-than-average median household size

Family households account for 68.2% of all households, including 28.9% couples with children, 25.5% couples without children, and 12.4% single parent families. Non-family households constitute the remaining 31.8%, with lone person households at 27.4% and group households making up 4.6%. The median household size is 2.4 people, larger than the Greater Perth average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Beaconsfield exceeds national averages, with above-average qualification levels and academic performance metrics

Beaconsfield's educational attainment is notably higher than broader benchmarks. Among residents aged 15 and above, 39.6% hold university qualifications, compared to 27.9% in Western Australia (WA) and 28.6% in the SA4 region. This educational advantage positions Beaconsfield favourably for knowledge-based opportunities. Bachelor degrees are most prevalent at 25.1%, followed by postgraduate qualifications at 9.9% and graduate diplomas at 4.6%.

Vocational credentials are also prominent, with 28.6% of residents aged 15 and above holding such qualifications – advanced diplomas at 10.8% and certificates at 17.8%. Educational participation is high in Beaconsfield, with 28.0% of residents currently enrolled in formal education. This includes 8.8% in primary education, 7.3% in secondary education, and 6.7% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 34 active transport stops in Beaconsfield, served by buses via 15 routes. These offer 2,828 weekly passenger trips. Average distance to nearest stop is 173 meters.

Daily service averages 404 trips across all routes, equating to about 83 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Beaconsfield's residents are healthier than average in comparison to broader Australia with prevalence of common health conditions quite low across both younger and older age cohorts

Health data shows relatively positive outcomes for Beaconsfield residents. Prevalence of common health conditions is quite low across both younger and older age cohorts.

Approximately 60% of the total population (3,555 people) have private health cover, compared to 67.1% across Greater Perth. The most common medical conditions are mental health issues and arthritis, affecting 8.1% and 7.8% of residents respectively. 70.5% of residents declare themselves completely clear of medical ailments, compared to 69.6% across Greater Perth. There are 19.8% of residents aged 65 and over (1,181 people). Health outcomes among seniors in Beaconsfield are particularly strong, performing even better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Beaconsfield was found to be above average when compared nationally for a number of language and cultural background related metrics

Beaconsfield, surveyed in June 2016, had a higher linguistic diversity than most local areas, with 16.9% of residents speaking languages other than English at home and 29.7% born overseas. Christianity was the dominant religion, accounting for 42.5%. Notably, Judaism was proportionally similar to Greater Perth's 0.3%.

The top three ancestry groups were English (28.4%), Australian (19.9%), and Irish (9.6%). Some ethnic groups showed significant differences: Croatian at 2.4% (regional average 1.4%), Welsh at 0.9% (1.0%), and Italian at 9.6% (6.5%).

Frequently Asked Questions - Diversity

Age

Beaconsfield's median age exceeds the national pattern

The median age in Beaconsfield is 42 years, significantly higher than Greater Perth's average of 37 years and Australia's national average of 38 years. The 45-54 age group constitutes 14.2% of the population, compared to Greater Perth, while the 25-34 cohort makes up 11.3%. According to post-2021 Census data, the 15-24 age group has increased from 10.1% to 10.9%, whereas the 0-4 cohort has decreased from 6.3% to 5.6%. By 2041, population forecasts indicate substantial demographic changes in Beaconsfield. Notably, the 75-84 age group is projected to grow by 59% (249 people), reaching 673 from 423. The combined 65+ age groups are expected to account for 58% of total population growth, reflecting the area's aging demographic profile. Conversely, the 5-14 and 0-4 cohorts are anticipated to experience population declines.