Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Martin lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

As of November 2025, the estimated population of the Martin statistical area (Lv2) is around 2,095, reflecting a growth of 241 people since the 2021 Census. The 2021 Census reported a population of 1,854 in Martin (SA2). This increase was inferred from AreaSearch's estimate of 2,013 residents following examination of the latest ERP data release by the ABS in June 2024 and an additional two validated new addresses since the Census date. The population density is approximately 73 persons per square kilometer. Martin (SA2) experienced a growth rate of 13.0% between the 2021 Census and November 2025, exceeding the national average of 9.7%. Overseas migration contributed about 68.0% to this population gain.

AreaSearch's projections for Martin (SA2), based on ABS/Geoscience Australia data released in 2024 with a base year of 2022, forecast a significant population increase by 2041. The area is expected to expand by 531 persons by then, reflecting a total gain of 26.5% over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Martin recording a relatively average level of approval activity when compared to local markets analysed countrywide

Based on AreaSearch analysis of ABS building approval numbers from statistical area data, Martin has recorded approximately two residential properties granted approval per year over the past five financial years. This totals an estimated twelve homes. So far in Financial Year 26, one approval has been recorded.

Over these five years, there have been around twenty-two point one new residents arriving per dwelling constructed on average. This supply lags demand substantially, typically leading to heightened buyer competition and pricing pressures. New properties are constructed at an average value of $355,000, which is somewhat higher than regional norms due to quality-focused development. Compared to Greater Perth, Martin shows significantly reduced construction activity, 74.0% below the regional average per person. This limited new supply generally supports stronger demand and values for established homes.

However, development activity has picked up in recent periods, though it remains below national averages, reflecting the area's maturity and possible planning constraints. Recent building activity consists entirely of detached houses, maintaining Martin's traditional low density character with a focus on family homes appealing to those seeking space. The estimated count is 463 people per dwelling approval, indicating its quiet, low activity development environment. Future projections show Martin adding 556 residents by 2041 according to the latest AreaSearch quarterly estimate. If current development rates continue, housing supply may not keep pace with population growth, potentially increasing competition among buyers and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Martin has moderate levels of nearby infrastructure activity, ranking in the 45thth percentile nationally

The performance of an area can significantly be influenced by changes in local infrastructure, major projects, and planning initiatives. A total of thirteen projects have been identified by AreaSearch as potentially impacting the area. Notable projects include the Tonkin Highway Corridor Upgrade (Kelvin Road Interchange), Maddington Village Estate, Maddington Kenwick Strategic Employment Area (MKSEA), and Maddington Kenwick Strategic Employment Area Precincts 2 & 3B. The following list details those projects likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

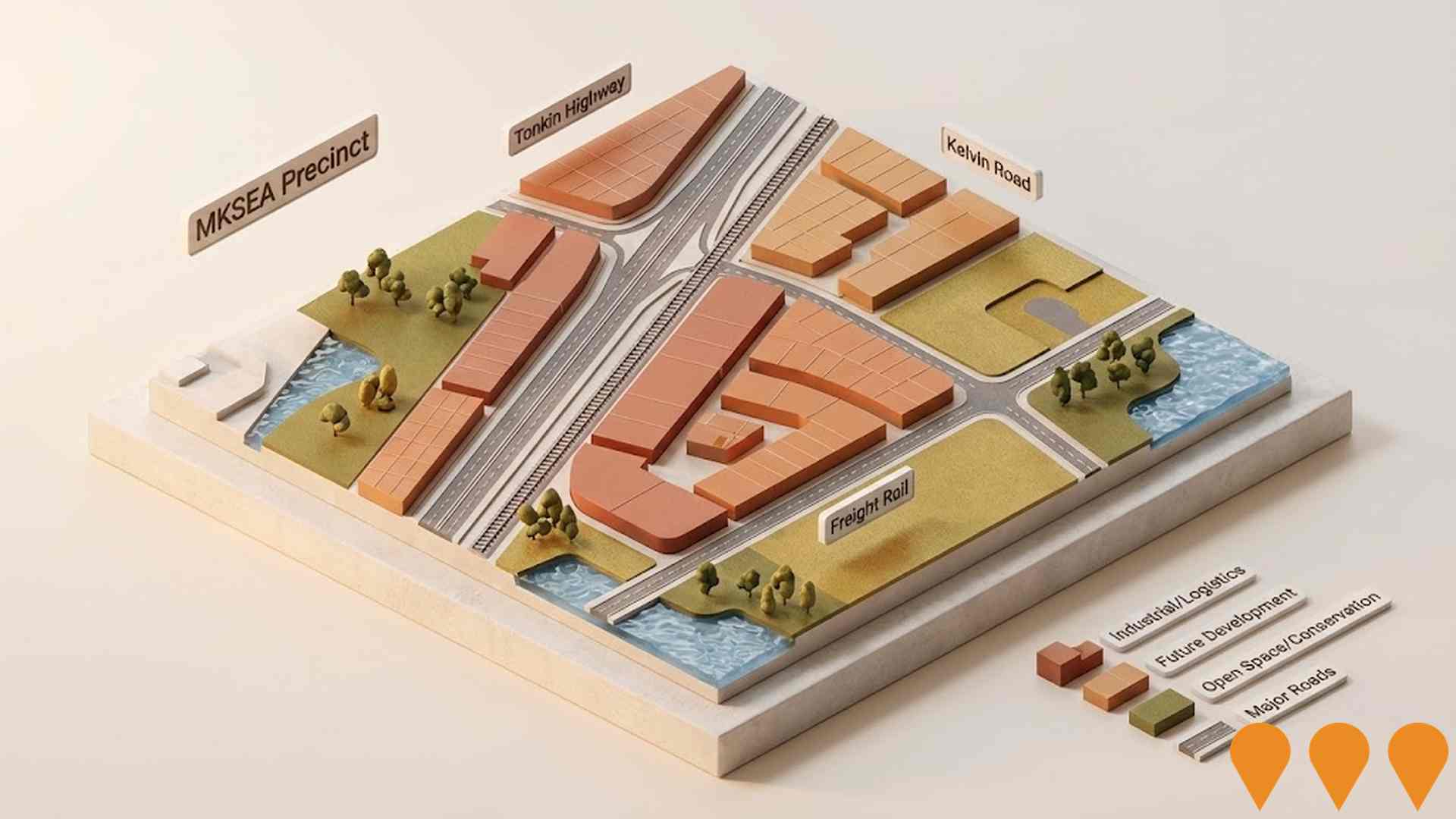

Maddington Kenwick Strategic Employment Area (MKSEA)

The Maddington Kenwick Strategic Employment Area (MKSEA) is a 480-hectare industrial precinct designed to serve as a major logistics and distribution hub for Perth. The project is divided into several precincts: Precinct 1 (Kelvin Road) and Precinct 3A (Logistics Boulevard) are the most advanced with construction and subdivision ongoing. Precincts 2 and 3B, covering approximately 244 hectares, were supported for rezoning to 'Business Development' by the City of Gosnells in February 2025, following a long-term environmental review process and ministerial support in December 2024. The area provides critical links to the freight road and rail network, supporting large-scale industrial expansion through 2032.

City of Gosnells Local Planning Scheme 24

Local Planning Scheme 24 (LPS 24) is the primary statutory planning framework for the City of Gosnells, replacing the former Scheme 17. Formally gazetted on 30 September 2025, it facilitates sustainable medium to high-density residential development specifically targeted around train stations and activity centres including Thornlie, Beckenham, Maddington, and Gosnells. The scheme modernises built-form controls, introduces transit-oriented development provisions, and establishes new regulations for short-term rental accommodation while strengthening environmental and bushfire protections.

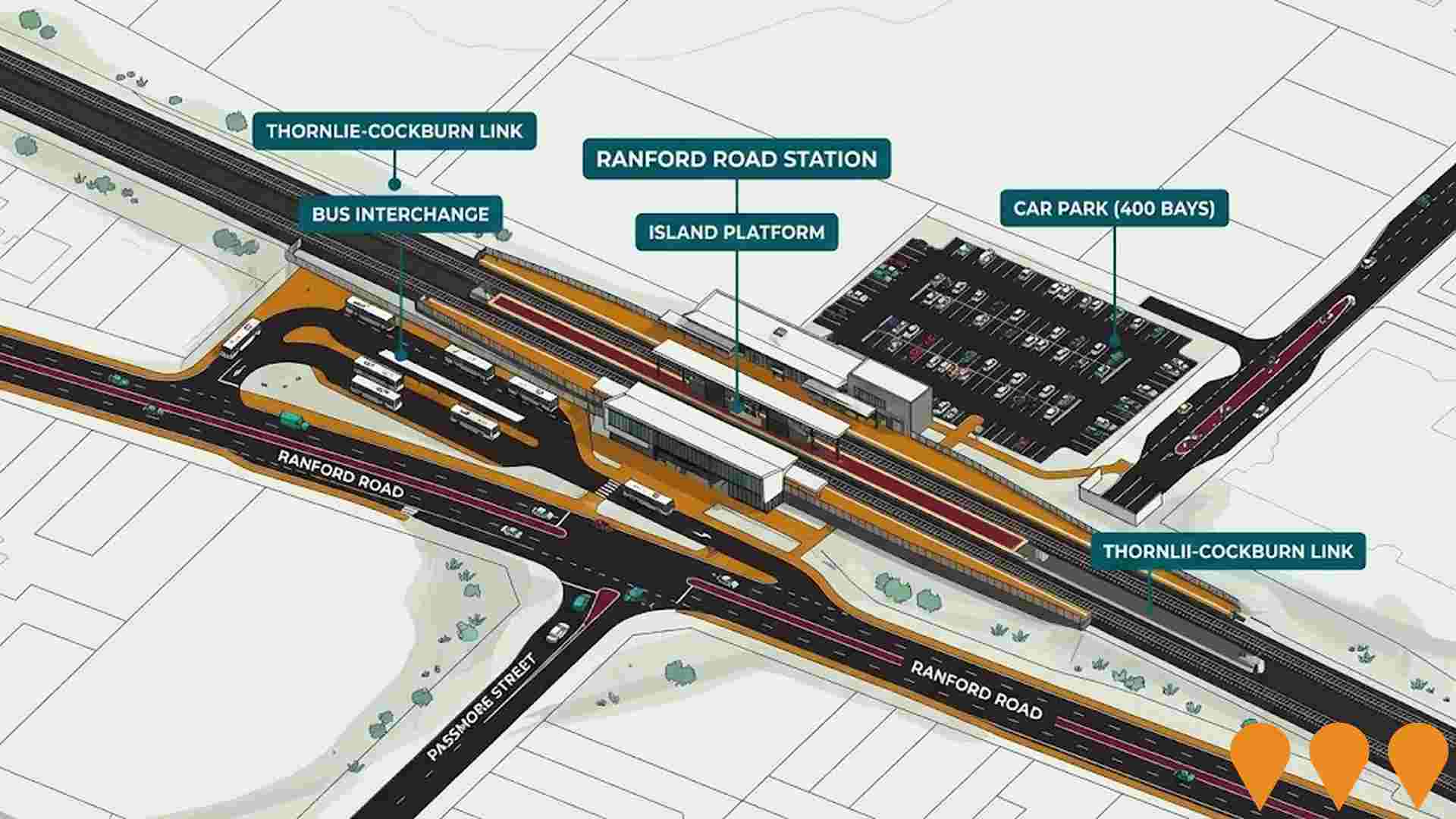

METRONET Armadale Line Transformation

A massive rail revitalisation project in Perth's south-east that combined the Victoria Park-Canning Level Crossing Removal, Thornlie-Cockburn Line, and Byford Rail Extension. The project delivered seven new or rebuilt stations, replaced 13 level crossings with elevated rail, and extended the line 8km to Byford. It also created Long Park, a 7km linear green corridor with 14 community spaces including playgrounds, skate parks, and public art beneath the viaducts. The full line and new extension officially reopened for passenger services on 13 October 2025.

Amaroo Village Buckley Caring Centre Expansion

Major expansion of Buckley Caring Centre featuring new two-storey Tuart and Wandoo buildings with 74 residential aged care places over two levels. The expansion includes private ensuite rooms organized in six-room pods, new main reception, commercial kitchen, laundry facilities, and workshop. The project was designed by Gary Batt & Associates and constructed by PACT Construction, integrating seamlessly with the existing facility while maintaining operational continuity.

Stockland Harrisdale Shopping Centre

Stockland Harrisdale is a vibrant retail town centre located 20km south-east of Perth CBD in the Newhaven masterplanned community. It features 10,602 sqm of GLA, anchored by Woolworths and ALDI supermarkets, with over 30 specialty stores emphasizing retail services and food. The centre includes an alfresco dining precinct, an Early Learning Centre, and sustainable features achieving a 4 Star Green Star Design rating. Opened in 2016, it generated over 700 construction jobs and 300 permanent retail positions, serving the local community with essential amenities.

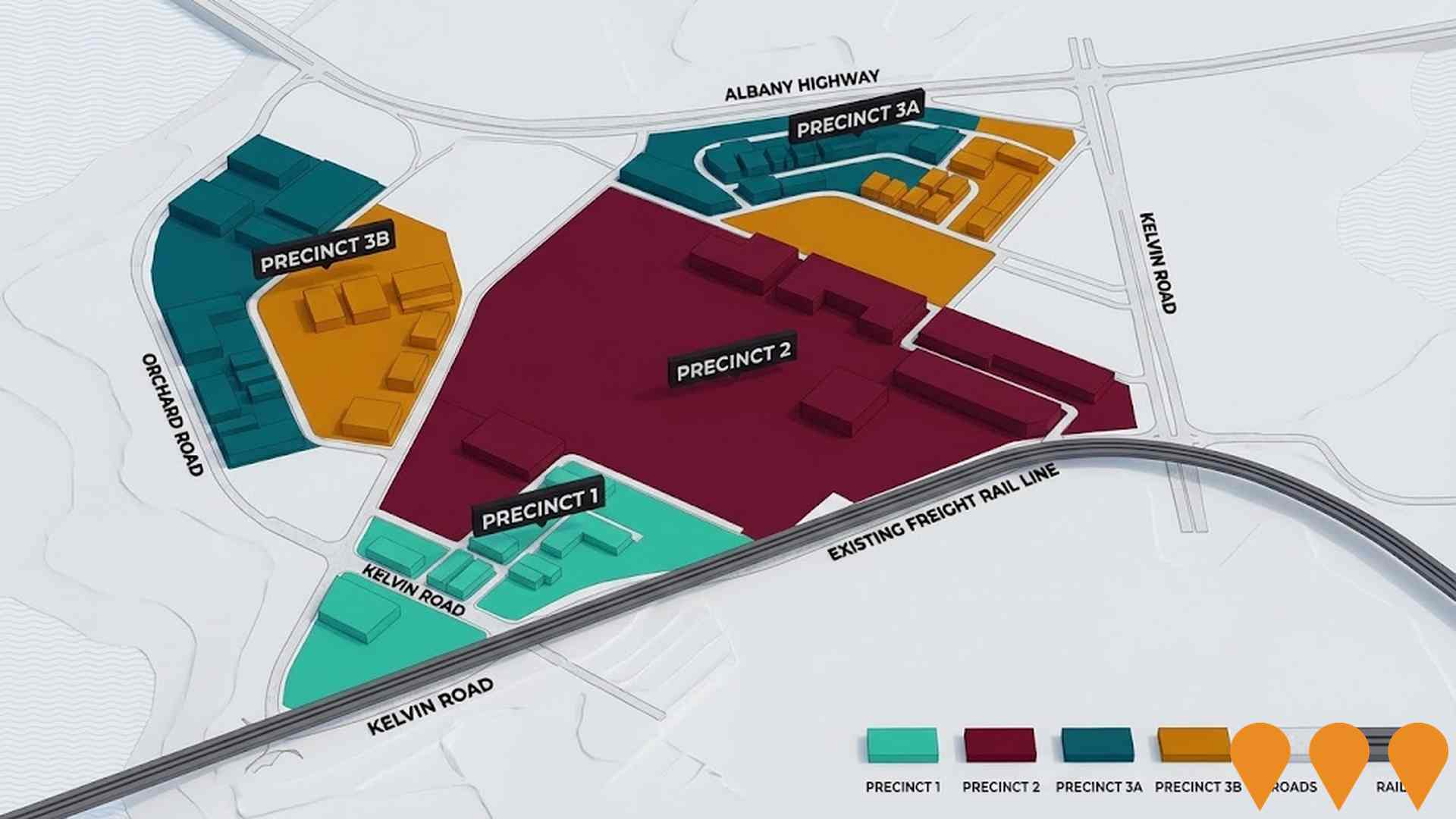

Maddington Kenwick Strategic Employment Area Precincts 2 & 3B

Rezoning of approximately 244.5 hectares from General Rural to Business Development to facilitate future industrial and commercial development. The project involves two scheme amendments (No. 166 for Precinct 3B and No. 169 for Precinct 2) to enable strategic employment area development near Perth Airport. The EPA released Report 1757 in April 2024 recommending against the amendments, but the City has appealed this decision.

CDC Maddington Data Centre Campus

CDC Data Centres plans a 200MW high-density data centre campus in Maddington within the MKSEA area. The first stage is valued at about AUD 415 million, with initial operations targeted for 2026. The project has secured Development Assessment Panel approval and will support AI, cloud and secure government workloads, using advanced liquid cooling and closed-loop water systems.

Tonkin Highway Corridor Upgrade (Kelvin Road Interchange)

Part of the Tonkin Highway Corridor program, this project involves the construction of a new grade-separated interchange at Kelvin Road and the widening of Tonkin Highway to six lanes. While substantive construction on the Hale and Welshpool Road interchanges is slated for mid-2026, the Kelvin Road interchange is being delivered as a separate 'Package Two' contract. It is currently in the development and environmental approval phase to alleviate chronic congestion and improve freight efficiency in the Maddington and Orange Grove areas.

Employment

Employment conditions in Martin remain below the national average according to AreaSearch analysis

Martin has a skilled workforce with manufacturing and industrial sectors well-represented. The unemployment rate was 4.2% in the past year, with an estimated employment growth of 2.1%.

As of September 2025, there are 1,170 residents employed, with an unemployment rate of 4.2%, 0.2% higher than Greater Perth's rate of 4.0%. Workforce participation is lower at 62.9% compared to Greater Perth's 65.2%. The dominant employment sectors include health care & social assistance, construction, and retail trade. Transport, postal & warehousing has a particularly high representation with an employment share of 1.7 times the regional level.

Conversely, professional & technical services have lower representation at 5.3% compared to the regional average of 8.2%. There are 2.4 workers for every resident, indicating that the area functions as an employment hub attracting workers from surrounding areas. Over the past year, employment increased by 2.1%, labour force grew by 2.5%, and unemployment rose by 0.3 percentage points. By comparison, Greater Perth recorded higher employment growth of 2.9%. State-level data to November 25 shows WA employment contracted by 0.27% with an unemployment rate of 4.6%, compared to the national rate of 4.3%. National employment forecasts from May-25 suggest a projected expansion of 6.6% over five years and 13.7% over ten years, but growth rates differ significantly between industry sectors. Applying these projections to Martin's employment mix suggests local employment should increase by 6.3% over five years and 13.2% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2023 shows that median income in Martin suburb is $65,009 and average income is $75,193. This contrasts with Greater Perth's median income of $60,748 and average income of $80,248. Based on Wage Price Index growth of 9.62% since financial year 2023, estimated current incomes in Martin are approximately $71,263 (median) and $82,427 (average) as of September 2025. Census 2021 income data shows that incomes in Martin cluster around the 62nd percentile nationally. Income distribution in Martin is dominated by the $1,500 - $2,999 bracket with 32.2% of residents (674 people). High housing costs consume 16.4% of income, but strong earnings place disposable income at the 64th percentile nationally. The area's SEIFA income ranking places it in the 6th decile.

Frequently Asked Questions - Income

Housing

Martin is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Martin's dwelling structure, as per the latest Census, consisted of 94.1% houses and 5.9% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Perth metro had 88.9% houses and 11.1% other dwellings. Home ownership in Martin was at 31.7%, with the rest being mortgaged (57.9%) or rented (10.4%). The median monthly mortgage repayment in Martin was $2,167, higher than Perth metro's average of $1,733. The median weekly rent figure in Martin was recorded at $360, compared to Perth metro's $330. Nationally, Martin's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were lower than the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Martin features high concentrations of family households, with a fairly typical median household size

Family households constitute 78.1% of all households, consisting of 36.8% couples with children, 29.3% couples without children, and 10.5% single parent families. Non-family households comprise the remaining 21.9%, with lone person households at 19.9% and group households making up 2.0%. The median household size is 2.8 people, which aligns with the Greater Perth average.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Martin aligns closely with national averages, showing typical qualification patterns and performance metrics

Martin Trail's educational qualifications trail Australian benchmarks, with 21.0% of residents aged 15+ holding university degrees compared to the national average of 30.4%. This gap suggests potential for educational development and skills enhancement in the region. Bachelor degrees are most prevalent at 15.6%, followed by postgraduate qualifications (3.6%) and graduate diplomas (1.8%). Trade and technical skills are prominent, with 42.6% of residents aged 15+ holding vocational credentials – advanced diplomas account for 12.4% and certificates for 30.2%.

Educational participation is notably high in Martin Trail, with 32.0% of residents currently enrolled in formal education. This includes 11.3% in primary education, 9.0% in secondary education, and 5.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Martin has seven active public transport stops, all offering bus services. These stops are served by five different routes, collectively facilitating 158 weekly passenger trips. Transport accessibility is rated as limited, with residents on average located 787 meters from the nearest stop.

Service frequency across all routes averages 22 trips per day, equating to approximately 22 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Martin is notably higher than the national average with prevalence of common health conditions low among the general population though higher than the nation's average across older, at risk cohorts

Martin demonstrates above-average health outcomes with prevalence of common health conditions low among the general population, though higher than the national average across older, at-risk cohorts. The rate of private health cover is very high, approximately 57% of the total population (around 1,195 people), compared to 51.8% across Greater Perth.

The most common medical conditions in the area are arthritis and asthma, impacting 6.7% and 6.7% of residents respectively, while 72.5% declare themselves completely clear of medical ailments, compared to 73.3% across Greater Perth. The area has 21.2% of residents aged 65 and over (444 people), which is higher than the 14.7% in Greater Perth.

Frequently Asked Questions - Health

Cultural Diversity

Martin was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Martin's population was found to be more linguistically diverse than most local markets, with 20.9% speaking a language other than English at home as of the latest data. Overseas-born residents comprised 34.7%. Christianity was the predominant religion in Martin, accounting for 49.5% of its population.

However, Islam's presence was notably lower at 5.1%, compared to Greater Perth's average of 11.8%. In terms of ancestry, English heritage made up 28.5% of Martin's population, significantly higher than the regional average of 22.7%. Australian ancestry also stood out at 25.4%, surpassing the regional average of 18.2%. Conversely, 'Other' ancestry was notably lower at 12.6%, below the regional average of 20.2%. Some ethnic groups showed significant differences: Dutch heritage was overrepresented at 3.2% in Martin versus 1.4% regionally; Welsh heritage stood at 0.9% (vs 0.5%) and South African heritage at 1.1% (vs 0.8%).

Frequently Asked Questions - Diversity

Age

Martin's population is slightly older than the national pattern

Martin has a median age of 40, which is slightly higher than Greater Perth's figure of 37 and Australia's national average of 38 years. Compared to Greater Perth, Martin has an over-representation of the 85+ cohort (4.6% locally) and an under-representation of the 35-44 age group (12.9%). Between 2021 and present, the 15-24 age group increased from 10.2% to 11.2%, while the 25-34 cohort decreased from 13.7% to 12.9%. By 2041, demographic projections suggest significant changes in Martin's age profile. The 85+ age cohort is expected to surge dramatically, increasing by 118 people (123%) from 96 to 215. Notably, the combined 65+ age groups will account for 57% of total population growth, reflecting the area's aging demographic trend. Meanwhile, the 35-44 cohort is projected to decline by 5 people.