Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Calista reveals an overall ranking slightly below national averages considering recent, and medium term trends

As of November 2025, the estimated population for the Calista statistical area (Lv2) is around 2,060 people. This figure reflects an increase of 85 individuals since the 2021 Census, which recorded a population of 1,975 people. The latest estimate is based on AreaSearch's validation of new addresses and examination of the ABS' ERP data release from June 2024, indicating a resident population of 2,053. This results in a population density ratio of approximately 891 persons per square kilometer, comparable to averages seen across other locations assessed by AreaSearch. The primary driver for this growth was overseas migration, contributing around 97.0% of overall population gains.

AreaSearch employs ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and to estimate post-2032 growth, AreaSearch uses growth rates by age cohort provided by the ABS in its Greater Capital Region projections from 2023, based on 2022 data. Looking ahead, significant population growth is forecast for Calista (SA2), with an expected increase of 666 persons to reach a total of 2,726 people by 2041. This reflects a projected increase of approximately 34.2% over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Calista, placing the area among the bottom 25% of areas assessed nationally

Calista has received approximately six dwelling approvals annually since FY-21. Over the past five financial years, from FY-21 to FY-25, around 31 homes were approved, with two more approved in FY-26 so far. Each new home constructed attracted an average of 2.5 people per year over this period.

The average construction value for these homes was $353,000. This financial year has seen $894,000 in commercial approvals registered, reflecting Calista's residential nature. Compared to Greater Perth, Calista shows significantly reduced construction activity, with 79.0% below the regional average per person. Recent development has been entirely detached houses, maintaining the area's low-density character and appealing to families seeking space. This is despite a current mix of housing that suggests otherwise (69.0% at Census).

The estimated population per dwelling approval in Calista is 828 people. By 2041, the area is forecasted to gain 705 residents. If current development rates continue, housing supply may not meet population growth, potentially increasing competition among buyers and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Calista has moderate levels of nearby infrastructure activity, ranking in the 47thth percentile nationally

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified one major project that may impact this region. Notable projects include Parmelia Primary School Modernisation Stage 2, Westport - Kwinana Container Port, Kwinana Education Precinct, and Mandurah Line. The following details those most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Rockingham General Hospital Redevelopment

Comprehensive redevelopment of Rockingham General Hospital that expanded capacity from 47 to 229 beds. Completed in phases between 2007 and 2010, the project added a new emergency department, intensive care unit, operating theatres, and maternity services. Recent capacity enhancements include the 30-bed 'Moordibirdup' modular ward opened in August 2022 to manage low-to-medium acuity patients. Further upgrades through 2025-2026 involve a new Mental Health Emergency Centre and Behavioural Assessment Urgent Care Centre to address growing regional demand.

Westport - Kwinana Container Port

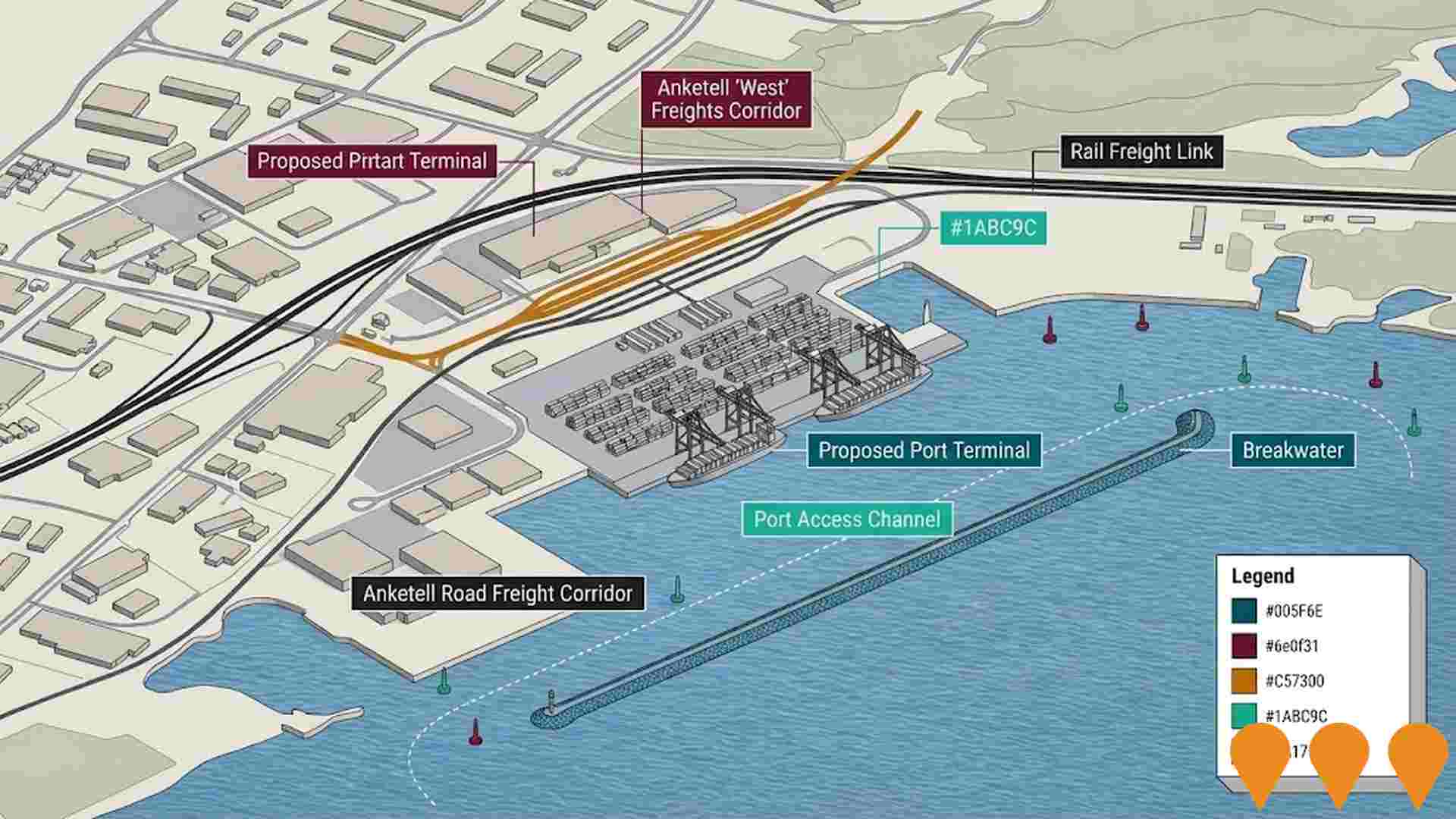

Westport is a multi-billion dollar program to relocate container trade from Fremantle Port to a new facility in Kwinana by the late 2030s. The project includes a new port terminal, an 18-meter deep shipping channel, and integrated road and rail upgrades, including the Anketell-Thomas Road Freight Corridor and rail duplication between Kwinana and Cockburn. In late 2025, the WA Government committed an additional $30 million for early works and $22.5 million for landside infrastructure planning for the Kwinana Bulk Terminal relocation. Tenders for freight rail planning were released in October 2025, with contract awards expected in early 2026. The project aims to increase rail container share to 30% and reach net zero emissions by 2050.

Mandurah Line

70.8km suburban railway line connecting Perth CBD to Mandurah with 13 stations including Rockingham and Warnbro stations. Operates through Kwinana Freeway median with dedicated underground tunnels through Perth CBD. Serves as vital transport link for region. Recent extensions include integration with Thornlie-Cockburn Link in June 2025.

Kwinana Freeway Upgrade (Roe Highway to Safety Bay Road)

A major upgrade to the Kwinana Freeway to alleviate congestion and support the future Westport facility. Key works include widening the freeway to three lanes in each direction between Russell Road and Mortimer Road, a new southbound lane between Roe Highway and Berrigan Drive, and a new northbound lane from Russell Road to Beeliar Drive. The project also introduces coordinated ramp signals on northbound on-ramps between Safety Bay Road and Roe Highway to improve traffic flow and safety for approximately 100,000 daily vehicles.

Latitude 32 Industry Zone

Latitude 32 is a massive 1,400-hectare industrial redevelopment within the Western Trade Coast, designed to support Perth's freight, logistics, and manufacturing sectors over a 30-year period. The zone is divided into six development areas; the Flinders Precinct is fully operational, while Orion Industrial Park is currently in active development with Stage 3 lots released in late 2024 and titles expected in Q2 2025. In 2025-2026, the project received significant momentum from the Western Trade Coast Infrastructure Strategy, including a $125 million state allocation to unlock new land and coordinate with the upcoming Westport container terminal and major road upgrades like the Anketell Road expansion.

The Village at Wellard

320-hectare master planned community by DevelopmentWA and Peet Limited delivering 3,075 homes. Transit-oriented development around Wellard Train Station with shopping precinct, schools, and community facilities. Development completed in 2024 after 21-year journey.

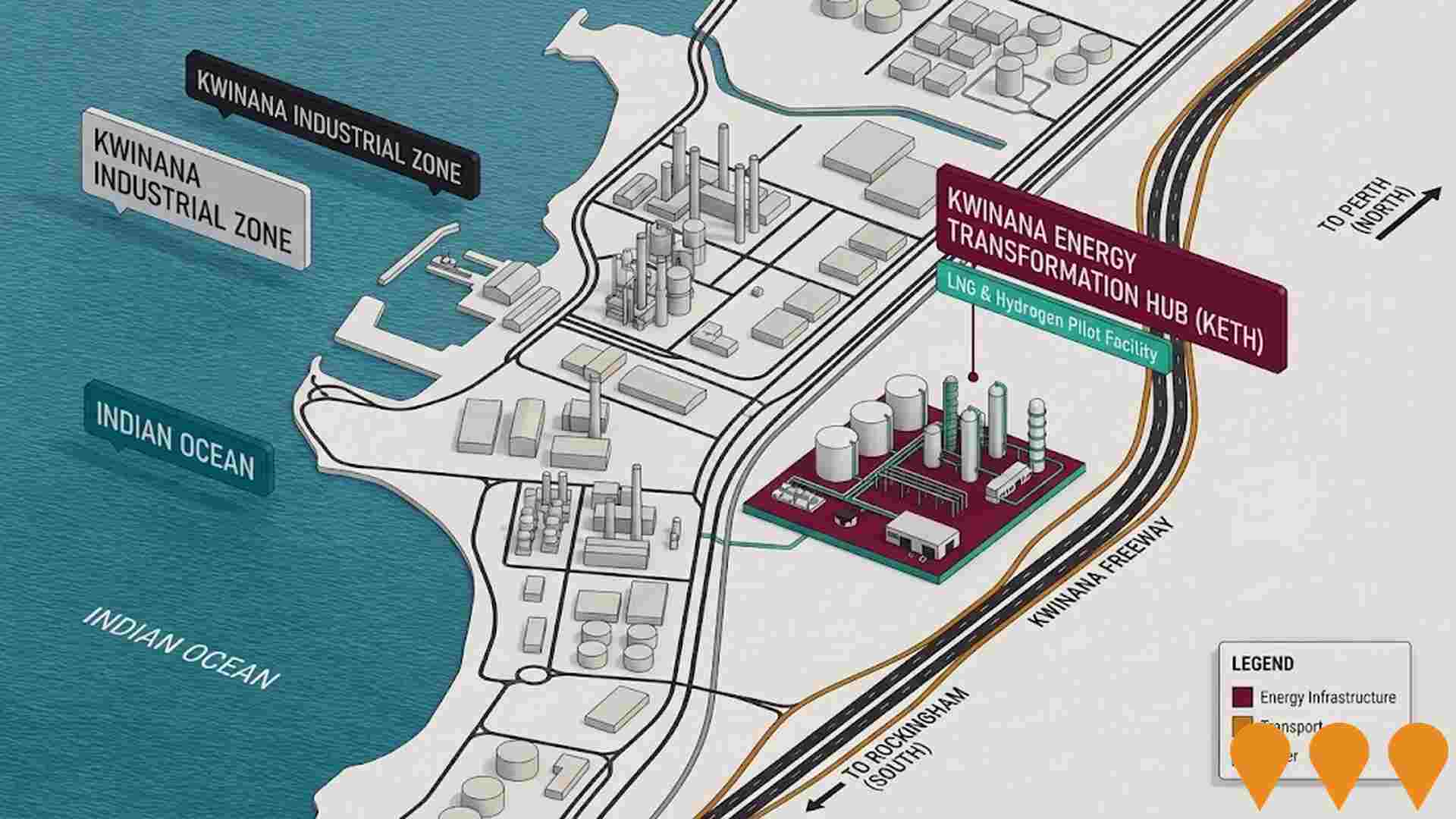

Kwinana Energy Transformation Hub (KETH)

Flagship open-access LNG and hydrogen research, testing and training facility being developed in the Kwinana industrial zone. Led by Future Energy Exports CRC through its subsidiary Luth Eolas, KETH will host pilot-scale assets including a 10 t/day LNG unit, 100 kg/day hydrogen electrolyser and liquefier, storage and emissions rigs to de-risk decarbonisation technologies for export energy industries. Development Application approved with construction targeted to commence in 2025 and initial operations in 2026.

Karnup Residential Land Release

Major residential land release as part of WA Government's $3.2 billion housing measures. The Karnup site comprises over 480 hectares strategically located adjacent to Kwinana Freeway and close to future Karnup train station. Expected to deliver over 3,300 new residential lots with potential for up to 450 social homes and house approximately 4,000 families. Part of larger 600+ hectare state-wide release including Eglinton site. Expression of Interest process opened October 2024, with development partnerships available under partnered or direct purchase models.

Employment

Employment conditions in Calista face significant challenges, ranking among the bottom 10% of areas assessed nationally

Calista has a balanced workforce with both white and blue collar jobs, prominent manufacturing and industrial sectors, an unemployment rate of 15.1%, and estimated employment growth of 0.8% over the past year (AreaSearch). As of September 2025, there are 762 employed residents, with an unemployment rate at 11.2%, significantly higher than Greater Perth's 4%.

Workforce participation is lower in Calista at 45.3%, compared to Greater Perth's 65.2%. Dominant sectors include health care & social assistance, construction, and retail trade. Manufacturing stands out with an employment share of 2.1 times the regional level. Conversely, education & training has a lower representation at 3.6% versus Greater Perth's 9.2%.

Employment opportunities locally appear limited based on Census data comparisons. Over the past year, employment increased by 0.8%, while labour force grew by 3.6%, leading to a 2.3 percentage point rise in unemployment rate (AreaSearch). State-level data from 25-Nov-25 shows WA's employment contracted by 0.27% with an unemployment rate of 4.6%. National employment forecasts project growth of 6.6% over five years and 13.7% over ten years, but local projections vary significantly based on industry-specific growth rates. Applying these projections to Calista's employment mix suggests potential increases of 5.9% over five years and 12.7% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

As per AreaSearch's latest postcode level ATO data released for financial year ending June 2023, the suburb of Calista's median income among taxpayers is $48,312, with an average of $55,805. This is lower than average nationally, and compares to Greater Perth's median of $60,748 and average of $80,248. Based on Wage Price Index growth of 9.62% from financial year ending June 2023 to September 2025, current estimates for Calista would be approximately $52,960 (median) and $61,173 (average). Census data reveals household, family and personal incomes in Calista all fall between the 2nd and 3rd percentiles nationally. The data shows the $400 - 799 income bracket dominates with 32.4% of residents (667 people), unlike trends at regional levels where 32.0% fall within the $1,500 - 2,999 range. Lower income households are notably prevalent, with 43.5% earning below $800 weekly, indicating affordability pressures for many residents. Housing affordability pressures are severe, with only 79.4% of income remaining after housing costs, ranking at the 3rd percentile nationally.

Frequently Asked Questions - Income

Housing

Calista displays a diverse mix of dwelling types, with above-average rates of outright home ownership

Calista's dwelling structure, as per the latest Census, consisted of 69.3% houses and 30.7% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Perth metro had 93.0% houses and 7.0% other dwellings. Home ownership in Calista stood at 28.1%, with mortgaged dwellings at 32.6% and rented dwellings at 39.3%. The median monthly mortgage repayment was $1,300, lower than Perth metro's average of $1,724. The median weekly rent in Calista was $250, compared to Perth metro's $315. Nationally, Calista's mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Calista features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households constitute 52.8 percent of all households, including 16.7 percent that are couples with children, 20.6 percent consisting of couples without children, and 13.9 percent being single parent families. Non-family households account for the remaining 47.2 percent, with lone person households making up 42.9 percent and group households comprising 3.9 percent of the total. The median household size is 2.1 people, smaller than the Greater Perth average of 2.7.

Frequently Asked Questions - Households

Local Schools & Education

Calista faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 10.6%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common at 8.0%, followed by postgraduate qualifications (1.6%) and graduate diplomas (1.0%). Vocational credentials are prevalent, with 37.8% of residents aged 15+ holding them, including advanced diplomas (7.9%) and certificates (29.9%). A total of 22.6% of the population is currently engaged in formal education, comprising 8.7% in primary, 5.1% in secondary, and 2.8% in tertiary education.

A substantial 22.6% of the population actively pursues formal education. This includes 8.7% in primary education, 5.1% in secondary education, and 2.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 17 active stops operating in Calista, with a mix of bus services. These stops are covered by 4 routes, offering 734 weekly passenger trips combined. Transport access is rated excellent, with residents usually within 178 meters of the nearest stop.

Service frequency averages 104 trips daily across all routes, equating to about 43 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Calista is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Calista faces significant health challenges, with various conditions affecting both younger and older age groups. Approximately 49% (~1,016 people) have private health cover, compared to Greater Perth's 53.9% and the national average of 55.7%. Mental health issues and arthritis are the most prevalent conditions, impacting 12.7% and 12.0% of residents respectively.

However, 50.6% report having no medical ailments, compared to Greater Perth's 71.4%. Calista has a higher proportion of seniors aged 65 and over at 31.7% (653 people), compared to Greater Perth's 10.4%. Health outcomes among seniors are challenging but generally align with the overall population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Calista was found to be slightly above average when compared nationally for a number of language and cultural background related metrics

Calista's population was found to be more culturally diverse than most local markets, with 9.0% speaking a language other than English at home and 35.2% born overseas. Christianity was the predominant religion in Calista, comprising 43.6% of its population. Buddhism, however, showed an overrepresentation compared to Greater Perth, making up 1.4% of Calista's population versus 1.5%.

In terms of ancestry, the top three groups were English at 37.2%, Australian at 25.7%, and Scottish at 7.7%. Notably, Welsh (1.3%) was overrepresented compared to the regional average of 0.7%, while South African (0.8% vs 1.1%) and Maori (1.0% vs 2.1%) showed lower representation than regionally.

Frequently Asked Questions - Diversity

Age

Calista hosts an older demographic, ranking in the top quartile nationwide

Calista's median age is 48 years, which is significantly higher than Greater Perth's average of 37 years and Australia's national average of 38 years. The age profile shows that the 75-84 year-old group is particularly prominent at 13.2%, while the 35-44 year-old group is comparatively smaller at 9.7%. This concentration of 75-84 year-olds is well above the national average of 6.0%. Between 2021 and the present, the 5 to 14 year-old cohort has declined from 10.1% to 7.5%. Population forecasts for the year 2041 indicate substantial demographic changes in Calista. The 85+ year-old cohort is projected to grow by 165%, adding 271 residents to reach a total of 436. Senior residents aged 65 and above will drive 86% of population growth, emphasizing the trend towards an aging population. Conversely, population declines are projected for the 0 to 4 year-old and 35 to 44 year-old cohorts.