Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Mount Tarcoola reveals an overall ranking slightly below national averages considering recent, and medium term trends

Based on AreaSearch's analysis of ABS population updates and new address validations, Mount Tarcoola's estimated population as of November 2025 is around 3,456 people. This reflects an increase of 199 individuals since the 2021 Census, which reported a population of 3,257 people. AreaSearch inferred this change from their resident population estimate of 3,426 as of June 2024, following examination of the latest ERP data release by the ABS and address validation since the Census date. This results in a population density ratio of 1,630 persons per square kilometer for Mount Tarcoola (SA2), which is higher than the average seen across national locations assessed by AreaSearch. Over the past decade, from 2015 to 2025, Mount Tarcoola has shown resilient growth patterns with a compound annual growth rate of 0.8%. This growth outpaced that of the broader SA3 area.

Natural growth contributed approximately 64.0% of overall population gains during recent periods for the Mount Tarcoola statistical area (Lv2). AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and to estimate growth post-2032, AreaSearch utilises the growth rates by age cohort provided by the ABS in their latest Greater Capital Region projections (released in 2023, based on 2022 data). Future population trends project an above median growth for regional areas across the nation. By 2041, the Mount Tarcoola (SA2) area is expected to grow by approximately 600 persons, reflecting a total increase of 18.2% over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Mount Tarcoola according to AreaSearch's national comparison of local real estate markets

Mount Tarcoola had 3 dwelling approvals annually between 2016 and 2020, totaling 16 dwellings. This low development activity reflects the rural nature of the area, with housing needs driving development rather than market demand. The small sample size means annual growth can be influenced by individual projects.

Mount Tarcoola had significantly less construction activity than Rest of WA and was below national averages during this period. Recent building activity consisted solely of detached houses, maintaining the rural character of the location. There were approximately 579 people per dwelling approval in Mount Tarcoola, indicating an established market. According to AreaSearch's latest quarterly estimate, Mount Tarcoola is expected to grow by 628 residents by 2041.

If current construction levels continue, housing supply may lag population growth, potentially intensifying buyer competition and supporting price growth.

Frequently Asked Questions - Development

Infrastructure

Mount Tarcoola has moderate levels of nearby infrastructure activity, ranking in the 44thth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified nine projects that may affect this region. Notable initiatives include the Revised Wandina Structure Plan, Geraldton Cycling Network Expansion Project, Geraldton Cycle Network Expansion Project, and Mount Tarcoola Brand Highway Residential Development Plan. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Double Beach Estate

Double Beach Estate is a massive 975-hectare coastal development located at Cape Burney. The project features 3.5km of Indian Ocean frontage and 3.5km of Greenough River frontage. It includes WAPC approval for a 900-lot subdivision (with 100 lots shovel-ready) and a conceptual master plan for up to 14,000 residential lots. The vision for this new townsite encompasses a marina, canal system, a major regional shopping centre, tourism facilities, and a caravan park. It currently operates as a sand mine and caravan park while awaiting full-scale development.

Geraldton Green Connect Project

The Geraldton Green Connect Project is a major urban renewal initiative transforming Maitland Park into a sustainable, multi-use precinct powered by renewable energy. The project integrates a sustainable transport hub featuring solar-powered covered busports and carparks to improve pedestrian safety for nearly 3,000 students in the surrounding school precinct. Key features include a multi-use community pavilion, youth plaza, nature playground, and culturally immersive landscape designs developed in collaboration with UDLA and various stakeholders.

Fortyn Court Commercial Retail Development

Convenience based highway service and fast food precinct comprising fuel station, quick service restaurants and retail tenancies on a prominent Brand Highway corner. Developed by M/Group from 2020 with national tenants including Chicken Treat, Hungry Jacks, Metro Petroleum, Dominos and Ultra Tune, the centre provides around 580 sqm of additional retail and showroom space across six tenancies on a site of about 6,200 sqm at the southern entry to Geraldton.

7-Eleven Service Station, Durlacher Street, Geraldton

Development of a 7-Eleven service station and convenience store, with associated pylon signage, access, car parking, and landscaping, approved by the Regional Development Assessment Panel (DAP/24/02803). The original proposal included six refuelling bays and 24/7 convenience services. The project is awaiting construction, as another 7-Eleven location in Geraldton (on Flores Road) was reportedly set to open first.

Revised Wandina Structure Plan

Approved residential structure plan guiding the development of 24 hectares in Wandina, Geraldton. The project includes 186 single residential lots ranging from 700-2527 square meters, one duplex site, public open spaces, and drainage infrastructure. The development features ocean views, integration with natural landform, limestone retaining walls, and connections to adjoining residential areas and schools. Individual lots are now being sold with development actively progressing.

Geraldton Cycling Network Expansion Project

A three stage State Government funded project adding about 8.3 km of high quality shared paths to connect the northern and southern suburbs of Geraldton. Stage one on Glenfield Beach Drive and stage two on Chapman Road are complete. Stage three will deliver a 4.8 km shared path along Brand Highway between Tarcoola Beach and Cape Burney to improve safe walking and riding options and links to local beaches, services and workplaces.

Fortyn Court Commercial Retail Development

Quick service retail and fuel center on Brand Highway in Mahomets Flats, delivered by M/Group in 2020 and now operating as a local convenience hub with national tenants including Hungry Jacks, Chicken Treat, Dominos, Metro Petroleum and Ultra Tune, plus around 580 sqm of additional retail space serving the surrounding residential community.

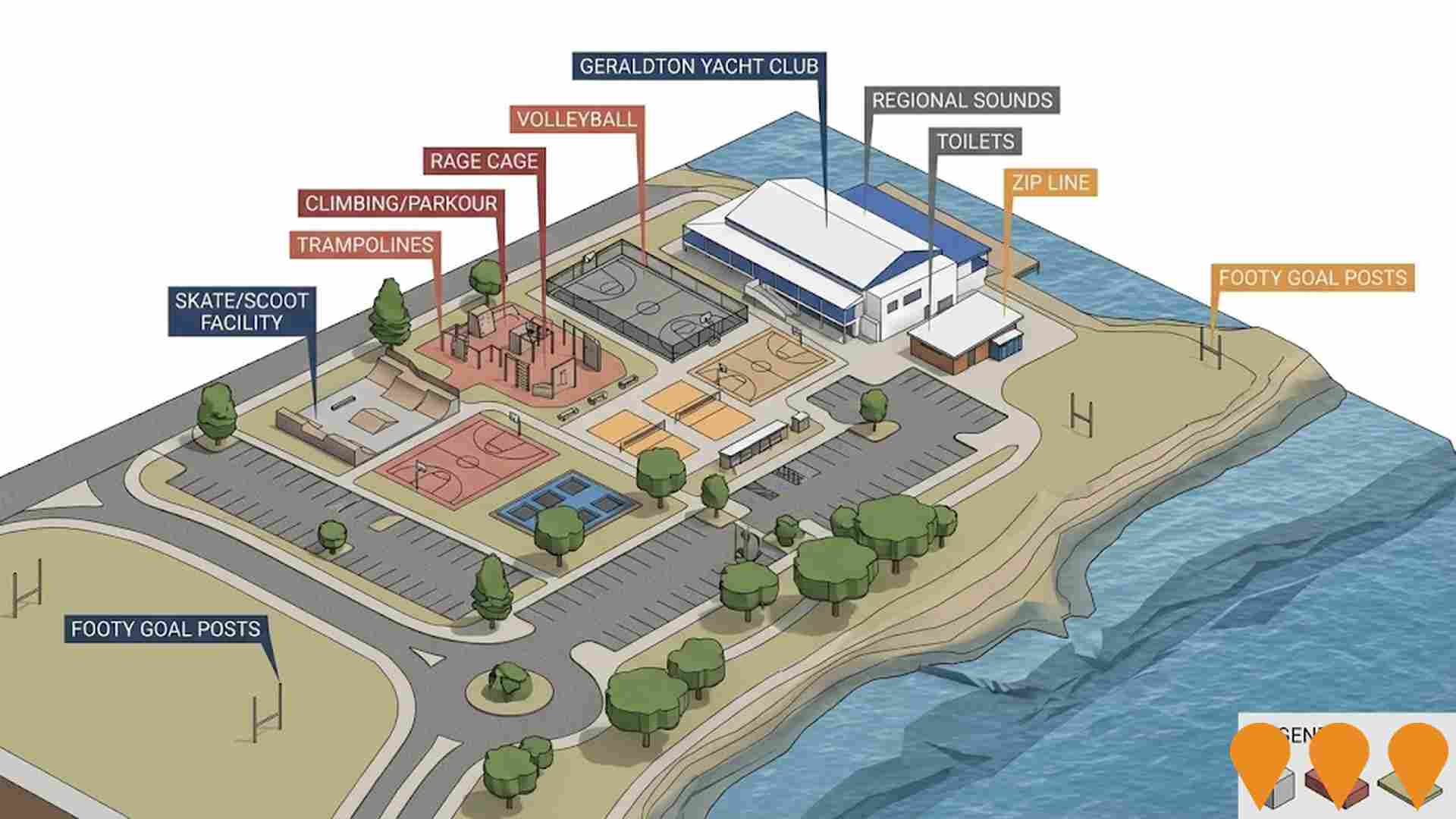

Geraldton Youth Precinct Masterplan Development

Upgrade of the Youth Precinct on the Geraldton foreshore to provide inclusive facilities and amenities for young people aged 12-25, including a new skatepark. The Updated Masterplan was endorsed by the City of Greater Geraldton Council in July 2025. Detailed design will now begin, followed by construction estimated to commence in early 2026.

Employment

Mount Tarcoola ranks among the top 25% of areas assessed nationally for overall employment performance

Mount Tarcoola has a diverse workforce with both white and blue collar jobs, with essential services well represented. As of September 2025, its unemployment rate is 2.3%.

Over the past year, employment stability has been relatively consistent. The area's unemployment rate is 1.0% lower than Rest of WA's rate of 3.3%, and workforce participation is higher at 66.4% compared to Rest of WA's 59.4%. Leading industries for residents include health care & social assistance, retail trade, and education & training. The area specializes in health care & social assistance with an employment share 1.4 times the regional level, while agriculture, forestry & fishing has limited presence at 2.8% compared to the regional 9.3%.

Local employment opportunities appear limited as indicated by Census data comparing working population and resident population. Over a 12-month period ending September 2025, employment increased by 0.2%, labour force grew by 0.5%, leading to an unemployment rate rise of 0.3 percentage points. In contrast, Rest of WA saw employment growth of 1.4% and unemployment fall by 0.2 percentage points. Jobs and Skills Australia's national employment forecasts from May-25 project overall employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Mount Tarcoola's employment mix suggests local employment should increase by 6.4% over five years and 13.3% over ten years, though these are illustrative extrapolations not accounting for localized population projections.

Frequently Asked Questions - Employment

Income

The area's income profile falls below national averages based on AreaSearch analysis

Mount Tarcoola suburb has a median taxpayer income of $52,501 and an average income of $65,527 based on the latest postcode level ATO data aggregated by AreaSearch for financial year 2023. This is slightly lower than the national average, contrasting with Rest of WA's median income of $59,973 and average income of $74,392. As of September 2025, current estimates suggest a median income of approximately $57,552 and an average income of $71,831, accounting for Wage Price Index growth of 9.62% since financial year 2023. According to the 2021 Census, incomes in Mount Tarcoola cluster around the 59th percentile nationally. Income brackets indicate that 36.9% of the population (1,275 individuals) fall within the $1,500 - $2,999 income range, reflecting patterns seen in the surrounding region where 31.1% similarly occupy this range. After housing costs, residents retain 87.4% of their income, indicating strong purchasing power and the area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Mount Tarcoola is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Mount Tarcoola's dwelling structure, as per the latest Census, consisted of 95.2% houses and 4.8% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Non-Metro WA's 87.5% houses and 12.5% other dwellings. Home ownership in Mount Tarcoola stood at 31.8%, with mortgaged dwellings at 42.4% and rented ones at 25.8%. The median monthly mortgage repayment was $1,517, aligning with Non-Metro WA's average, while the median weekly rent was $300, compared to Non-Metro WA's $250. Nationally, Mount Tarcoola's mortgage repayments were lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Mount Tarcoola has a typical household mix, with a higher-than-average median household size

Family households account for 74.5% of all households, including 28.9% couples with children, 31.0% couples without children, and 12.8% single parent families. Non-family households constitute the remaining 25.5%, with lone person households at 23.1% and group households comprising 2.7%. The median household size is 2.5 people, which is larger than the Rest of WA average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Mount Tarcoola fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 16.5%, significantly lower than the Australian average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 12.6%, followed by graduate diplomas (2.2%) and postgraduate qualifications (1.7%). Vocational credentials are prevalent, with 43.5% of residents aged 15+ holding them, including advanced diplomas (10.4%) and certificates (33.1%).

Educational participation is high, with 30.5% of residents currently enrolled in formal education, comprising 10.4% in primary, 10.3% in secondary, and 2.5% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 19 active stops operating within Mount Tarcoola, serving a mix of bus routes. These stops are serviced by 4 individual routes, collectively providing 75 weekly passenger trips. Transport accessibility is rated excellent, with residents typically located 181 meters from the nearest stop.

Service frequency averages 10 trips per day across all routes, equating to approximately 3 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Mount Tarcoola's residents are healthier than average in comparison to broader Australia with a fairly standard level of common health conditions seen across both young and old age cohorts

Mount Tarcoola's health data shows positive outcomes with common health conditions seen equally across young and old residents.

Private health cover stands at approximately 53%, slightly higher than the SA2 area average. Asthma (8.7%) and mental health issues (7.8%) are the most prevalent conditions, while 68.7% of residents report no medical ailments, compared to 66.8% in Rest of WA. The area has 16.3% of residents aged 65 and over (563 people), lower than Rest of WA's 18.3%. Health outcomes among seniors are above average, outperforming the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Mount Tarcoola ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Mount Tarcoola's cultural diversity was below average, with 88.9% of its population being citizens, 84.3% born in Australia, and 91.4% speaking English only at home. Christianity was the predominant religion, making up 51.3%. Islam, however, was overrepresented at 2.4%, compared to 1.3% regionally.

The top three ancestry groups were Australian (30.2%), English (29.9%), and Irish (8.1%). Notably, Filipino (2.0%) and Australian Aboriginal (4.2%) populations were higher than regional averages of 1.0% and 6.9%, respectively. Macedonian population was also slightly higher at 0.2%.

Frequently Asked Questions - Diversity

Age

Mount Tarcoola's population aligns closely with national norms in age terms

The median age in Mount Tarcoola is 39 years, similar to Rest of WA's average of 40 and aligned with Australia's 38 years. The 15-24 age group constitutes 13.0% of the population, higher than Rest of WA's percentage. Conversely, the 55-64 cohort makes up 10.6%. Post-2021 Census data shows the 25 to 34 age group grew from 12.0% to 13.2%, while the 55 to 64 cohort declined from 12.3% to 10.6% and the 5 to 14 group dropped from 14.6% to 13.3%. Population forecasts for 2041 indicate substantial demographic changes in Mount Tarcoola, with the 25 to 34 age group projected to grow by 51%, reaching 688 people from 456. Conversely, the 85+ and 75 to 84 cohorts are expected to experience population declines.