Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Burns Beach lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch, Burns Beach's population is estimated at around 4,886 as of Nov 2025. This reflects an increase of 815 people (20.0%) since the 2021 Census, which reported a population of 4,071 people. The change is inferred from the resident population of 4,801 estimated by AreaSearch following examination of the latest ERP data release by the ABS on Jun 2024 and an additional 245 validated new addresses since the Census date. This level of population equates to a density ratio of 1,476 persons per square kilometer, which is above the average seen across national locations assessed by AreaSearch. Burns Beach's 20.0% growth since the 2021 census exceeded the national average (9.7%), along with the SA3 area, marking it as a growth leader in the region. Population growth for the area was primarily driven by overseas migration that contributed approximately 72.0% of overall population gains during recent periods, although all drivers including natural growth and interstate migration were positive factors.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, and to estimate growth across all areas in the years post-2032, AreaSearch is utilising the growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections (released in 2023, based on 2022 data). As we examine future population trends, an above median population growth of statistical areas across the nation is projected. The Burns Beach statistical area (Lv2) is expected to grow by 719 persons to 2041 based on aggregated SA2-level projections, reflecting with an increase of 6.9% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential approval activity sees Burns Beach among the top 30% of areas assessed nationwide

AreaSearch analysis of ABS building approval numbers shows Burns Beach averaged around 54 new dwelling approvals per year. Between FY-21 and FY-25, an estimated 272 homes were approved, with a further 28 so far in FY-26. This translates to approximately 1.6 new residents per year arriving for each new home over the past five financial years.

The average construction value of these properties is $795,000, indicating a focus on the premium segment. In FY-26, commercial development approvals totalled $34.8 million, reflecting strong commercial development momentum in the area. Compared to Greater Perth, Burns Beach has 303.0% more development activity per person, offering greater choice for buyers and demonstrating strong developer confidence. All recent development consists of detached dwellings, maintaining the area's suburban character with a focus on family homes. With around 85 people per approval, Burns Beach reflects an actively developing area.

According to AreaSearch's latest quarterly estimate, the area is expected to grow by 338 residents through to 2041. Current construction levels should adequately meet demand, creating favourable conditions for buyers and potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Burns Beach has moderate levels of nearby infrastructure activity, ranking in the 47thth percentile nationally

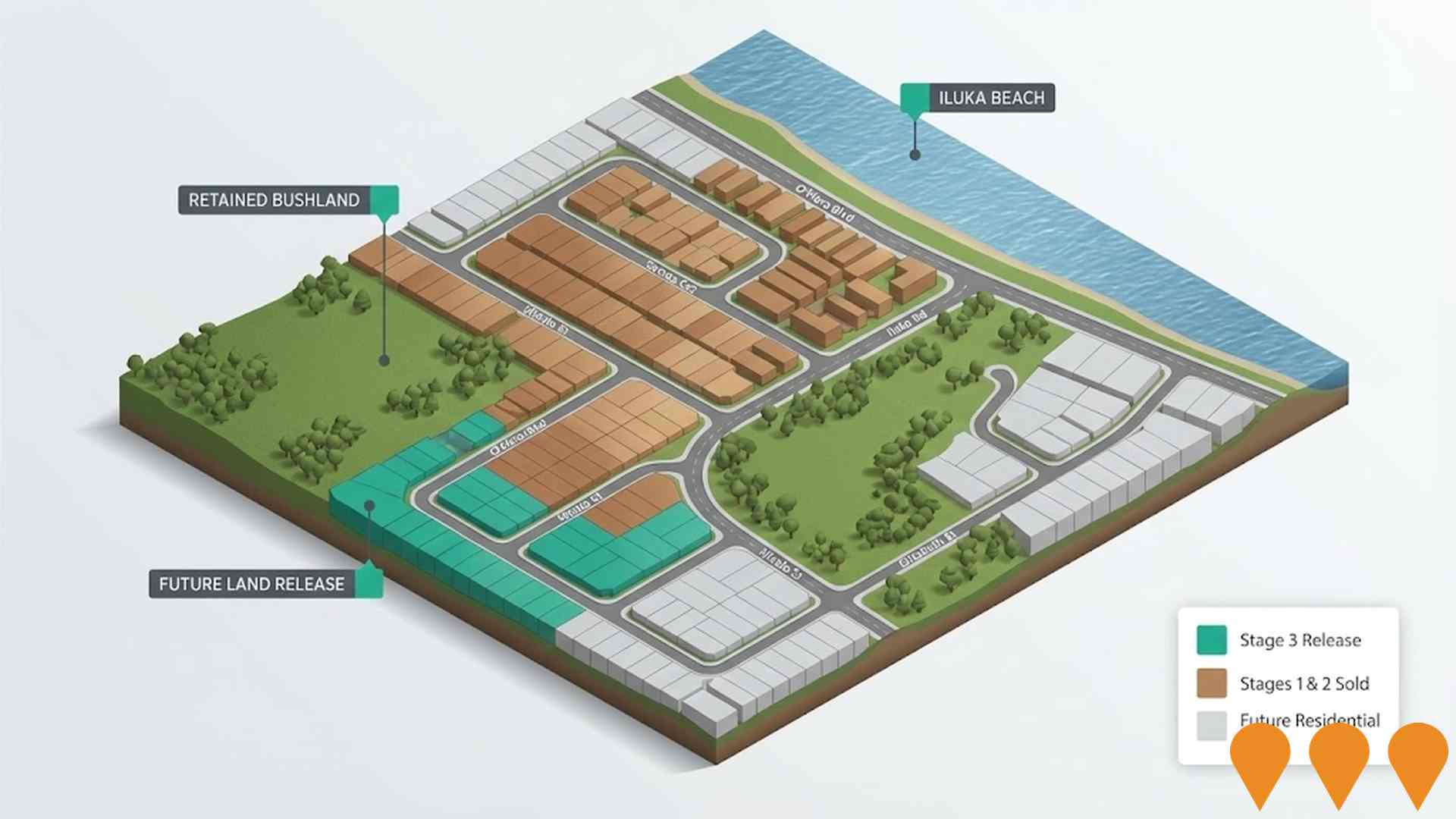

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified four projects likely impacting the area: Meridian Park Industrial Estate, Iluka Beach Residential Estate (Stages ongoing), Burns Beach Primary School, and Neerabup - Upgrade Roads and Drainage. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Joondalup Private Hospital Expansion

A $190 million expansion of Joondalup Private Hospital, fully funded by Ramsay Health Care. The project will increase bed capacity from 150 to 202, including 30 shelled beds for future demand. Key features include six new operating theatres (two shared with the public campus), two day procedure rooms, a day of surgery admissions unit, a 22-bed short stay surgical ward, a 30-bed surgical/medical ward, and six cardiac care beds. The development also incorporates rooftop solar panels and a new ground floor cafe. As of early 2025, structural concreting is complete with facade works underway.

Joondalup Health Campus Development Stage 2

A major $307.9 million expansion of Joondalup Health Campus co-funded by the State and Australian Governments. The project includes a new 102-bed Mental Health Unit (opened 2023), a new 106-bed public ward block, and a significant expansion of the theatre complex including new cath labs and operating theatres. As of early 2026, work continues on the final fit-out of 60 additional public beds across two shelled wards and a separate $190 million private hospital expansion scheduled for completion by mid-2026.

Ocean Reef Marina Redevelopment

A transformative world-class waterfront precinct featuring a 550-berth marina, Perth's first coastal pool, and a family-friendly beach. The development includes over 1,000 residential dwellings (mix of lots and apartments), 12,000sqm of retail and commercial space, a lobster-themed playground, and new facilities for the Ocean Reef Sea Sports Club and Marine Rescue Whitfords.

Iluka Plaza & Medical Precinct Expansion

Proposed expansion of the existing Iluka Plaza neighbourhood centre at 98 O'Mara Boulevard. The project aims to add new medical suites, a pharmacy, and additional food and beverage tenancies to serve the growing Kinross-Iluka catchment. The expansion builds upon the current two-level mixed-use precinct which already features an IGA, Nido Early School, GP West Medical Centre, and The Iluka Tavern. Recent 2026 planning applications include modifications to parking access to allow 24/7 use of the first-floor area.

Currambine North Masterplan (Currambine District Centre Precinct)

A long-term masterplanned mixed-use precinct for the Currambine North area, envisioned to deliver a vibrant district centre with higher-density residential, commercial offices, retail, entertainment and community facilities around the future Currambine Train Station northern extension.

Meridian Park Industrial Estate

95 hectare industrial estate in the Neerabup Industrial Area, serving Perth's growing north-west corridor. Features sustainable design, support for Restricted Access Vehicles (RAV4), easy access to Mitchell Freeway, and focus on logistics, manufacturing, robotics, and mining services. Expected to generate up to 20,000 employment opportunities. Includes the Australian Automation and Robotics Precinct.

Alkimos to Wanneroo Desalination Pipeline

Below-ground trunk main of about 33.5km connecting the future Alkimos Seawater Desalination Plant to Wanneroo Reservoir, with offtakes to Carabooda Tank and the future Nowergup Tank. Largest drinking water pipeline built by Water Corporation at up to 1600mm diameter. Status: in construction with staged works commencing late July 2025 and delivery by 2027.

Wanneroo Road and Joondalup Drive Interchange

Grade separation intersection with Joondalup Drive built over Wanneroo Road featuring two lanes in each direction. Includes three local intersection upgrades: new roundabout at Joondalup Drive and Cheriton Drive, signalised intersection at Wanneroo Road and Clarkson Avenue, and modifications to Burns Beach Road and Joondalup Drive Roundabout. Enhanced path network connectivity and improved traffic flow for Perth's northern suburbs.

Employment

AreaSearch analysis of employment trends sees Burns Beach performing better than 90% of local markets assessed across Australia

Burns Beach has a highly educated workforce. In the construction sector specifically, it has significant representation with an unemployment rate of 1.0% as of September 2025.

This is lower than Greater Perth's rate of 4.0%. The employment growth in Burns Beach over the past year was estimated at 3.9%, based on AreaSearch aggregation of statistical area data. As of September 2025, there are 2,892 residents employed with an unemployment rate of 2.9% below Greater Perth's rate. Workforce participation is high at 75.8%, compared to Greater Perth's 65.2%.

The dominant employment sectors include health care & social assistance, construction, and retail trade. Construction stands out with an employment share 1.4 times the regional level. Conversely, accommodation & food services are under-represented at 4.6% of Burns Beach's workforce compared to Greater Perth's 6.8%. Employment opportunities locally appear limited as indicated by Census working population vs resident population count. In the year to September 2025, employment levels increased by 3.9% and labour force grew by 3.8%, leading to a fall in unemployment by 0.1 percentage points. This contrasts with Greater Perth where employment rose by 2.9%, labour force grew by 3.0%, and unemployment marginally increased. State-level data to 25-Nov-25 shows WA employment contracted by 0.27% (losing 5,520 jobs), with the state unemployment rate at 4.6%. National employment forecasts from May-25 suggest national employment will expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Burns Beach's employment mix suggests local employment should increase by 6.6% over five years and 13.5% over ten years, assuming no change in population projections.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

Burns Beach suburb has a median taxpayer income of $73,001 and an average income of $98,671, according to the latest postcode level ATO data aggregated by AreaSearch for financial year 2023. Nationally, these figures are exceptionally high, contrasting with Greater Perth's median income of $60,748 and average income of $80,248. Based on Wage Price Index growth of 9.62% since financial year 2023, current estimates would be approximately $80,024 (median) and $108,163 (average) as of September 2025. Census data shows household, family and personal incomes all rank highly in Burns Beach, between the 88th and 99th percentiles nationally. Income analysis reveals that 39.8% of the community (1,944 individuals) falls into the $4000+ earnings band, differing from the surrounding region where the $1,500 - 2,999 category predominates at 32.0%. This indicates a substantial proportion of high earners (58.8% above $3,000/week) in Burns Beach, suggesting strong economic capacity throughout the suburb. Housing accounts for 14.3% of income, and residents rank within the 98th percentile for disposable income. The area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

Burns Beach is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Burns Beach's dwelling structures, as per the latest Census data, consisted of 98.7% houses and 1.3% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Perth metro's 88.7% houses and 11.3% other dwellings. Home ownership in Burns Beach stood at 26.0%, with mortgaged dwellings at 65.6% and rented ones at 8.4%. The median monthly mortgage repayment was $2,890, above Perth metro's average of $2,080. Median weekly rent in Burns Beach was $650, higher than Perth metro's $400. Nationally, Burns Beach's mortgage repayments were significantly higher at $1,863 and rents substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Burns Beach features high concentrations of family households, with a higher-than-average median household size

Family households comprise 93.4% of all households, including 57.7% couples with children, 29.9% couples without children, and 4.9% single parent families. Non-family households account for the remaining 6.6%, with lone person households at 6.4% and group households comprising 0.5%. The median household size is 3.2 people, larger than the Greater Perth average of 2.7.

Frequently Asked Questions - Households

Local Schools & Education

Burns Beach shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Burns Beach has a higher proportion of residents with university qualifications aged 15 and above (32.6%) compared to the Western Australian average (27.9%). Bachelor degrees are the most common at 23.4%, followed by postgraduate qualifications (6.4%) and graduate diplomas (2.8%). Vocational credentials are also prevalent, with 36.5% of residents aged 15 and above holding such qualifications.

This includes advanced diplomas (14.5%) and certificates (22.0%). Educational participation is high in Burns Beach, with 31.5% of residents currently enrolled in formal education. This includes 11.3% in primary education, 10.4% in secondary education, and 5.7% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis indicates 17 active transport stops in Burns Beach, operated by buses along two routes. These stops facilitate 447 weekly passenger trips. Residential accessibility to transport is excellent, with residents typically situated 185 meters from the nearest stop.

Service frequency averages 63 trips daily across all routes, resulting in approximately 26 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Burns Beach's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Burns Beach demonstrates excellent health outcomes with very low prevalence of common health conditions across all age groups. The rate of private health cover is exceptionally high at approximately 66%, comprising 3,242 people, compared to Greater Perth's 60.2% and the national average of 55.7%. Asthma and arthritis are the most common medical conditions in the area, affecting 5.8% and 4.5% of residents respectively.

80.5% of residents report being completely clear of medical ailments, compared to Greater Perth's 71.5%. Burns Beach has a lower proportion of seniors aged 65 and over at 13.7%, with 669 people, compared to Greater Perth's 20.1%. Health outcomes among seniors in Burns Beach are particularly strong, broadly aligning with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Burns Beach was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Burns Beach's population showed higher linguistic diversity, with 13.6% speaking a language other than English at home as of the latest data from 2016. In terms of birthplace, 53.1% were born overseas by 2016. Christianity was the predominant religion in Burns Beach, accounting for 54.4% of its population, compared to 49.6% across Greater Perth as of the same year.

The top three ancestral groups in Burns Beach were English (36.5%), Australian (16.0%), and Irish (8.7%). Notably, South African ancestry was overrepresented at 3.6%, higher than the regional average of 1.8%. Welsh ancestry remained consistent with the regional average at 1.1%, while Polish ancestry was slightly higher at 1.1% compared to the regional average of 0.9%.

Frequently Asked Questions - Diversity

Age

Burns Beach's population is slightly older than the national pattern

Burns Beach has a median age of 40, which is slightly higher than Greater Perth's figure of 37 and Australia's median age of 38. The 55-64 age group is notably over-represented in Burns Beach at 15.2%, compared to the Greater Perth average, while the 25-34 age group is under-represented at 7.7%. Between 2021 and present, the 65-74 age group has grown from 7.2% to 9.6%, and the 75-84 cohort has increased from 1.6% to 3.4%. Conversely, the 45-54 age group has declined from 18.8% to 16.4%. By 2041, demographic modeling suggests Burns Beach's age profile will significantly evolve. The 65-74 age cohort is projected to grow by 269 people (58%), increasing from 469 to 739. Notably, the combined 65+ age groups are expected to account for 85% of total population growth. Meanwhile, the 0-4 and 5-14 cohorts are anticipated to experience population declines.