Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Wyoming is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

As of November 2025, the estimated population of the Wyoming statistical area (Lv2) is around 10,065. This reflects a decrease from the 2021 Census figure of 10,111 people, representing a drop of 46 individuals or approximately 0.5%. The current resident population estimate of 10,045 by AreaSearch was derived from analysis of the latest ERP data release by the ABS in June 2024 and validation of five new addresses since the Census date. This results in a population density ratio of 1,409 persons per square kilometer, exceeding the average seen across national locations assessed by AreaSearch. Overseas migration was the primary driver of population growth in recent periods.

AreaSearch is utilising ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022. For areas not covered, NSW State Government's SA2 level projections released in 2022 with a base year of 2021 are applied. Growth rates by age group from these aggregations are used for all areas from 2032 to 2041. According to these projections, the Wyoming (SA2) population is expected to decline by 109 persons by 2041. However, specific age cohorts are anticipated to grow, notably the 85 and over age group which is projected to increase by 343 people during this period.

Frequently Asked Questions - Population

Development

The level of residential development activity in Wyoming is very low in comparison to the average area assessed nationally by AreaSearch

Wyoming has received around 7 residential building approvals annually over the past five financial years ending FY26. This totals an estimated 39 homes. As of FY26, 2 approvals have been recorded. The average expected construction cost value for new homes is $268,000, which is below regional levels, indicating more affordable housing options.

In FY26, there have been $2.2 million in commercial approvals, suggesting minimal commercial development activity. Compared to Greater Sydney, Wyoming has significantly less development activity, 80.0% below the regional average per person. This constrained new construction typically reinforces demand and pricing for existing properties, which is also under the national average, suggesting an established area with potential planning limitations. New building activity comprises 88.0% detached houses and 12.0% townhouses or apartments, maintaining Wyoming's suburban identity with a focus on family homes. The population density per dwelling approval is approximately 1542 people, indicating an established market.

With stable or declining population forecasts, Wyoming may experience less housing pressure, creating favourable conditions for buyers.

Frequently Asked Questions - Development

Infrastructure

Wyoming has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

Local infrastructure changes significantly influence an area's performance. AreaSearch identified 17 projects potentially impacting the region. Notable initiatives include Wyoming Shopping Village Upgrade, Narara District Master Plan, Telecommunications Mobile Base Station, and Henry Kendall Gardens Retaining Walls Replacement. The following list details those likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

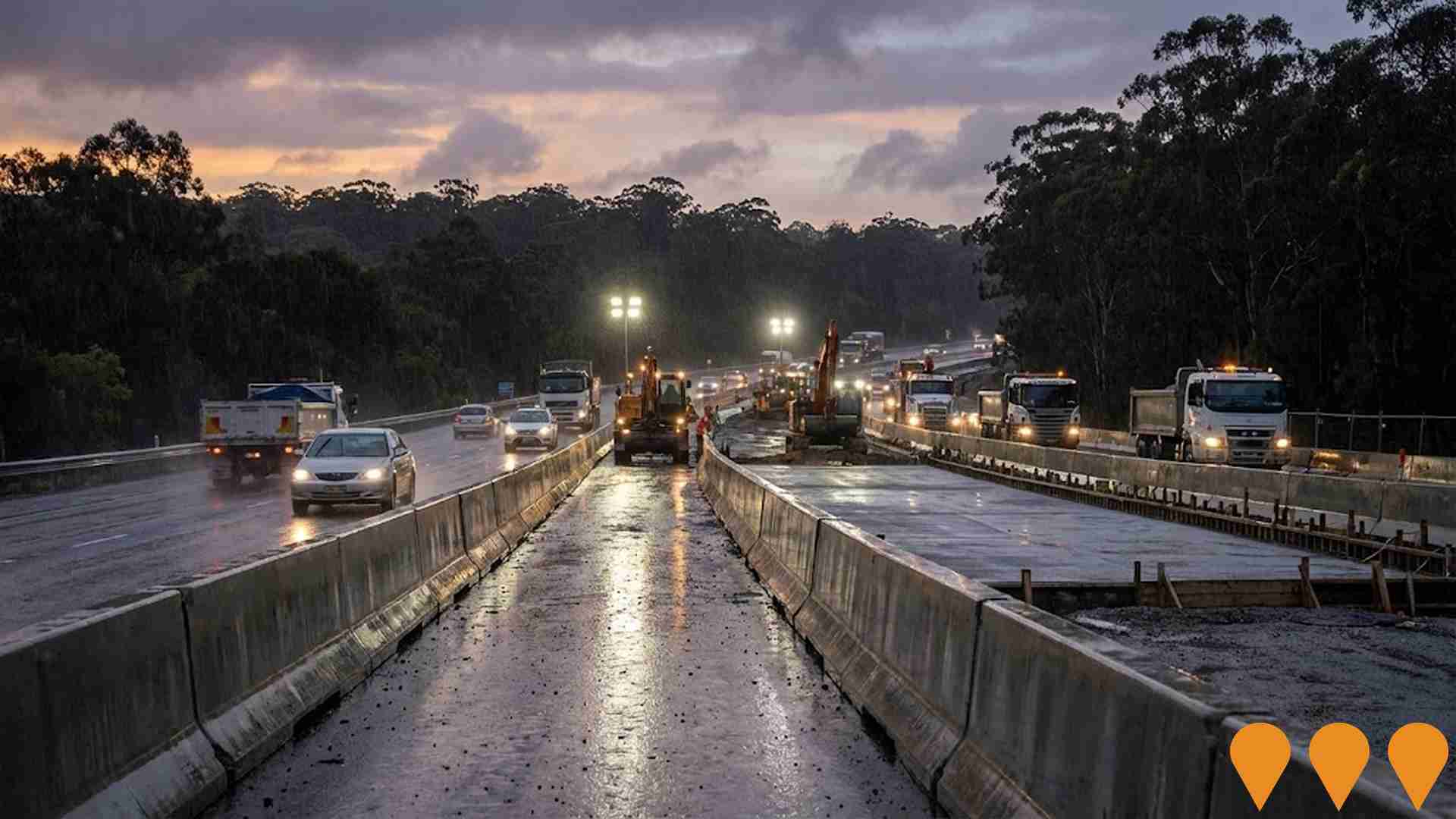

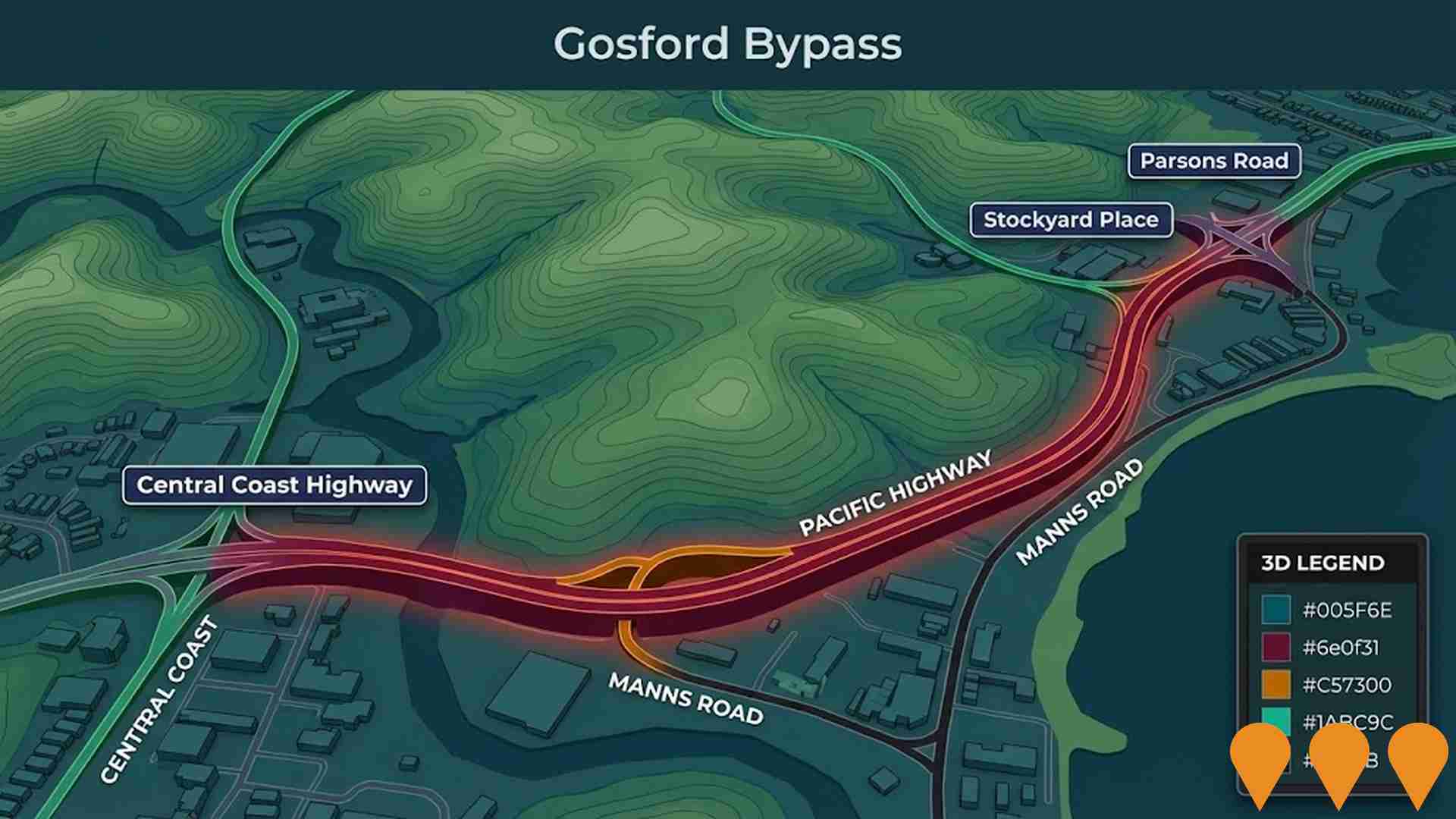

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Wyoming Shopping Village Upgrade

The Wyoming Shopping Village Upgrade involves the extension and refurbishment of the existing neighbourhood shopping centre. Anchored by a full-line Coles supermarket, the project focuses on enhancing the tenancy mix with a focus on health, beauty, food, and beverage services to better serve the local catchment. Recent updates indicate the project remains in the planning and pre-construction phase with GWPC as the project managers for the extension works.

Narara District Master Plan

Development and delivery of master plans for the Narara District including Lisarow, Wyoming, and Niagara Park to support housing and urban development. The district is within the Central Coast Council local government area.

Gosford Waterfront project

NSW Government led public domain and connectivity upgrades along Brisbane Water between Polytec Stadium and Gosford Sailing Club. HCCDC is preparing a public domain plan with short term public space improvements and an active transport shared path between Gosford and Point Clare under design and costing. Community consultation ran in July and August 2025.

Narara Community Centre and Library Redevelopment

Concept plan by Central Coast Council to upgrade and expand the existing Narara Community Centre, with the potential to integrate a small branch library and co-located community services. The intent is to modernise internal spaces, improve accessibility and flexibility for programs, and strengthen the role of the centre as a local hub for support services, activities and learning. As at late 2025 there is no publicly advertised development application or construction program specific to the building redevelopment, although the site has recently benefited from other investments such as a rooftop solar array and community battery delivered with Ausgrid.

Central Coast Film Studios

Proposed $230 million film and television production facility at Calga featuring 10 state-of-the-art sound stages, Australia's largest water tank, production offices, training and education precinct, film museum, and supporting infrastructure developed by Heath Bonnefin and Craig Giles.

The Outlook Narara

The Outlook Narara is a completed master planned over 55s lifestyle resort on the NSW Central Coast, comprising 178 independent living units delivered in stages between 2020 and 2023. The gated community provides resort style communal facilities and a residents clubhouse, offering low maintenance living for retirees close to Gosford services, shops and public transport. The village is now operating as an established over 55s community with ongoing lifestyle and management services in place.

Telecommunications Mobile Base Station

Development Application (DA/1244/2025) submitted to Central Coast Council by Amplitel Pty Ltd for the construction of a new telecommunications mobile base station at 172 Glennie St, Wyoming. The project aims to improve network coverage in the area. Written submissions on the application close on 20 October 2025.

Narara Ecovillage

Narara Ecovillage is a 64 hectare community title eco housing development on the former Gosford horticultural research station at Narara, planned for around 150 low impact homes plus shared community facilities, food growing spaces and integrated energy and water infrastructure. Stage 1 is largely complete and occupied, while Stage 2 civil works finished at the end of 2023 with most of the 40 plus new lots sold, owners preparing development applications and a growing number of homes under construction or already occupied; a planning proposal and amended planning agreement are progressing to support a future Stage 3 with more diverse housing types and small scale local services. :contentReference[oaicite:0]{index=0} :contentReference[oaicite:1]{index=1} :contentReference[oaicite:2]{index=2}

Employment

The employment landscape in Wyoming shows performance that lags behind national averages across key labour market indicators

Wyoming has a skilled workforce with essential services sectors well-represented. The unemployment rate is 4.5%, with an estimated employment growth of 2.5% over the past year (AreaSearch aggregation of statistical area data).

As of September 2025, 4,681 residents are employed, with an unemployment rate at 4.5%, 0.3% higher than Greater Sydney's rate of 4.2%. Workforce participation stands at 54.1%, lower than Greater Sydney's 60.0%. Key employment industries include health care & social assistance, retail trade, and construction. Wyoming has a significant employment specialization in health care & social assistance (1.4 times the regional level), while professional & technical services employ only 6.6% of local workers, below Greater Sydney's 11.5%.

The area appears to offer limited local employment opportunities, indicated by the Census working population count compared to resident population. Between September 2024 and September 2025, employment levels increased by 2.5%, labour force grew by 3.2%, causing unemployment to rise by 0.6 percentage points (AreaSearch analysis of SALM and ABS data). In comparison, Greater Sydney saw employment grow by 2.1%, labour force expand by 2.4%, with unemployment rising by 0.2 percentage points. State-level data from NSW up to 25-Nov-25 shows employment contracted by 0.03% (-2,260 jobs), with the state unemployment rate at 3.9%. Nationally, the unemployment rate stands at 4.3%. Jobs and Skills Australia's national employment forecasts (May-25) project overall growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Wyoming's employment mix suggests local employment should increase by approximately 6.8% over five years and 14.2% over ten years, though these are simple extrapolations for illustrative purposes and do not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

According to AreaSearch's aggregation of latest postcode level ATO data released for financial year 2023, Wyoming had a median income among taxpayers of $44,515 and an average income of $57,527. These figures are lower than the national averages of $60,817 and $83,003 respectively for Greater Sydney. Based on Wage Price Index growth of 8.86% since financial year 2023, estimated median and average incomes as of September 2025 would be approximately $48,459 and $62,624 respectively. Census data indicates that household, family, and personal incomes in Wyoming rank modestly between the 25th and 29th percentiles. The largest income segment comprises 31.5% earning $1,500 - $2,999 weekly, with 3,170 residents falling into this category, similar to the broader area where 30.9% occupy this range. Housing affordability pressures are severe in Wyoming, with only 79.3% of income remaining after housing costs, ranking at the 22nd percentile. The area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Wyoming is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Wyoming's dwelling structure, as per the latest Census, was 76.8% houses and 23.1% other dwellings. In comparison, Sydney metro had 74.2% houses and 25.9% other dwellings. Home ownership in Wyoming was 31.7%, with mortgaged dwellings at 40.8% and rented ones at 27.6%. The median monthly mortgage repayment was $1,950, below Sydney metro's $2,150. Median weekly rent in Wyoming was $390, compared to Sydney metro's $400. Nationally, Wyoming's mortgage repayments were higher than the Australian average of $1,863, and rents exceeded the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Wyoming has a typical household mix, with a lower-than-average median household size

Family households account for 68.3% of all households, including 27.9% couples with children, 25.6% couples without children, and 13.7% single parent families. Non-family households constitute the remaining 31.7%, with lone person households at 28.9% and group households comprising 2.7%. The median household size is 2.4 people, which is smaller than the Greater Sydney average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Wyoming aligns closely with national averages, showing typical qualification patterns and performance metrics

The area's university qualification rate is 21.5%, significantly lower than Greater Sydney's average of 38.0%. Bachelor degrees are the most common at 15.3%, followed by postgraduate qualifications (4.1%) and graduate diplomas (2.1%). Vocational credentials are prevalent, with 39.8% of residents aged 15+ holding them, including advanced diplomas (11.5%) and certificates (28.3%). Educational participation is high, with 28.6% of residents currently enrolled in formal education, including 9.9% in primary, 7.9% in secondary, and 3.9% in tertiary education.

Educational participation is notably high, with 28.6% of residents currently enrolled in formal education. This includes 9.9% in primary education, 7.9% in secondary education, and 3.9% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis indicates 87 active transport stops operating within Wyoming. These stops are serviced by 43 individual routes, collectively providing 894 weekly passenger trips. Transport accessibility is rated excellent, with residents typically located 180 meters from the nearest stop.

Service frequency averages 127 trips per day across all routes, equating to approximately 10 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Wyoming is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Wyoming faces significant health challenges, as indicated by data showing high prevalence of common health conditions across both younger and older age groups. Private health cover is relatively low at approximately 50% of the total population (~5,004 people), compared to 55.3% in Greater Sydney and a national average of 55.7%. The most prevalent medical conditions are arthritis (10.3%) and mental health issues (9.9%).

Conversely, 60.1% of residents report having no medical ailments, compared to 64.8% in Greater Sydney. Wyoming has 24.4% of residents aged 65 and over (2,455 people), with senior health outcomes presenting challenges largely consistent with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Wyoming records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Wyoming's cultural diversity aligns with the wider region's average, with 79.7% born in Australia, 89.5% being citizens, and 90.1% speaking English only at home. Christianity is the predominant religion, accounting for 52.7%. Judaism, however, is overrepresented at 0.1%, compared to 0.2% regionally.

The top three ancestry groups are English (30.3%), Australian (28.0%), and Irish (8.8%). Notably, Russian (0.5%) and New Zealand (1.0%) ethnicities are overrepresented in Wyoming compared to regional averages of 0.4% and 0.7%, respectively. Korean ethnicity is also slightly higher at 0.6%.

Frequently Asked Questions - Diversity

Age

Wyoming's median age exceeds the national pattern

The median age in Wyoming is 42 years, significantly higher than Greater Sydney's average of 37 years. This is also considerably older than Australia's median age of 38 years. The 75-84 age group comprises 9.9% of Wyoming's population, compared to Greater Sydney's percentage. Conversely, the 25-34 cohort makes up 10.7% of Wyoming's population, which is less prevalent than in Greater Sydney. Post-2021 Census data shows that the 75 to 84 age group has grown from 8.4% to 9.9%, while the 25 to 34 cohort has declined from 12.0% to 10.7%. Population forecasts for 2041 indicate substantial demographic changes in Wyoming. The 85+ age group is expected to grow by 80%, reaching 761 people from 422, leading the demographic shift. Notably, the combined 65+ age groups will account for 96% of total population growth, reflecting the area's aging demographic profile. In contrast, the 65 to 74 and 15 to 24 cohorts are expected to experience population declines.