Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Kariong is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Kariong's population was around 6,487 as of November 2025. This figure reflects an increase of 2 people since the 2021 Census, which recorded a population of 6,485. The change is inferred from the estimated resident population of 6,490 in June 2024 and six validated new addresses added since the Census date. This results in a population density ratio of 780 persons per square kilometer, comparable to averages seen across locations assessed by AreaSearch. Kariong's 0% growth since the census places it within 2.3 percentage points of the SA3 area (2.3%), indicating competitive growth fundamentals. Natural growth primarily drove population growth in the area, contributing approximately 62.6% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022, and NSW State Government's SA2 level projections for areas not covered by this data, released in 2022 with a base year of 2021. Considering projected demographic shifts, lower quartile growth is anticipated, with the area expected to expand by 2 persons to 2041 based on latest annual ERP population numbers, reflecting an increase of 0.1% over the 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Kariong is very low in comparison to the average area assessed nationally by AreaSearch

Kariong has averaged approximately six new dwelling approvals per year over the past five financial years, totalling 34 homes. As of FY-26, seven approvals have been recorded. The area's population decline suggests that new supply has likely been meeting demand, providing good options for buyers. New properties are constructed at an average expected cost of $248,000, which is below regional norms, indicating more affordable housing options.

This financial year, $284,000 in commercial development approvals have been recorded, reflecting the area's residential nature. Compared to Greater Sydney, Kariong has significantly less development activity, 73.0% below the regional average per person. This scarcity typically strengthens demand and prices for existing properties. Nationally, development activity is also lower, suggesting market maturity and possible development constraints. New building activity comprises 80.0% detached dwellings and 20.0% townhouses or apartments, maintaining Kariong's traditional low density character with a focus on family homes.

The estimated population per dwelling approval is 1483 people, indicating a quiet, low activity development environment. According to the latest AreaSearch quarterly estimate, Kariong is expected to grow by five residents through to 2041. Based on current development patterns, new housing supply should readily meet demand, offering good conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Kariong has moderate levels of nearby infrastructure activity, ranking in the 47thth percentile nationally

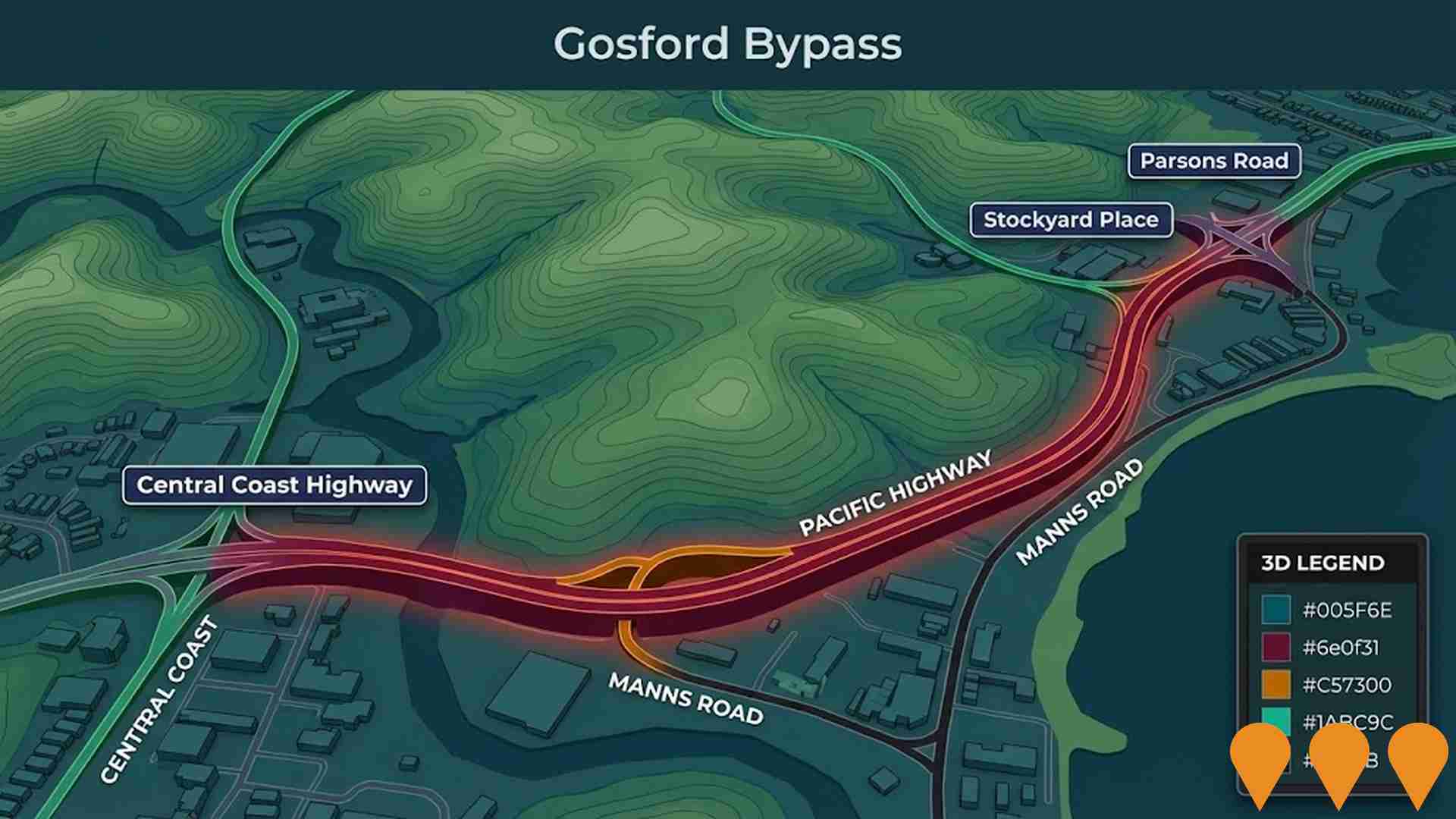

No changes can significantly affect a region's performance as much as alterations to local infrastructure, major projects, and planning initiatives. As of AreaSearch's identification, zero projects have been pinpointed that are expected to impact this area. Notable projects include Northside Private Hospital, Gosford Private Hospital redevelopment, Pacific Highway And Manns Road Upgrade, and Gosford Bypass, with the following list providing details on those deemed most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms via amendments to the State Environmental Planning Policy to enable more diverse low and mid-rise housing (dual occupancies, terraces, townhouses, manor houses and residential flat buildings up to 6 storeys) in well-located areas within 800 m of selected train, metro and light-rail stations and town centres. Stage 1 (dual occupancies in R2 zones statewide) commenced 1 July 2024. Stage 2 (mid-rise apartments, terraces and dual occupancies near stations) commenced 28 February 2025. Expected to facilitate up to 112,000 additional homes over the next five years.

Sydney Metro

Australia's biggest public transport infrastructure program, delivering four new metro railway lines (City & Southwest, West, Western Sydney Airport, and extensions). As of December 2025, the City & Southwest line (M1) is fully operational from Chatswood to Sy1 Sydenham-Bankstown conversion is under construction with target opening 2026-2027. Sydney Metro West tunnelling is over 70% complete with all TBMs now at or past Parramatta, targeted for 2032 opening. Western Sydney Airport line civil works and station construction are progressing with services planned for airport opening in late 2026.

High Speed Rail - Newcastle to Sydney (Stage 1)

The first stage of the proposed National High Speed Rail network aims to connect Newcastle to Sydney via the Central Coast, reducing travel time to approximately one hour with trains reaching speeds up to 320 km/h. The project is focused on the development phase, which includes design refinement, securing planning approvals, and corridor preservation. It is being advanced by the Australian Government's High Speed Rail Authority (HSRA). Stations are planned for Broadmeadow, Lake Macquarie, Central Coast, and Central Sydney. The long-term vision is a national network connecting Brisbane, Sydney, Canberra, and Melbourne.

Mardi Water Treatment Plant Upgrade

Central Coast Council's $82.5 million upgrade of the Mardi Water Treatment Plant will increase capacity to meet growing demand and improve drinking water quality and reliability for over 210,000 residents and businesses across the Central Coast. Works include a new Dissolved Air Flotation clarifier, additional flocculation tanks, upgraded chemical dosing systems, and enhanced sludge handling facilities.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet being delivered by RailConnect NSW (UGL, Hyundai Rotem, Mitsubishi Electric Australia) for Transport for NSW. Named after the Darug word for emu, the fleet commenced passenger services on the Central Coast & Newcastle Line on 3 December 2024, followed by the Blue Mountains Line on 13 October 2025. Services on the South Coast Line are scheduled to commence in 2026. The fleet features modern amenities including spacious 2x2 seating, charging ports, improved accessibility with wheelchair spaces and accessible toilets, CCTV emergency help points, and dedicated spaces for luggage, prams and bicycles. The trains operate in flexible 4-car, 6-car, 8-car or 10-car formations. The fleet replaces aging V-set trains that entered service in the 1970s and serves approximately 26 million passenger journeys annually across the electrified intercity network. Supporting infrastructure includes the new Kangy Angy Maintenance Facility, platform extensions, and signaling upgrades at multiple stations.

Newcastle-Sydney and Wollongong-Sydney Rail Line Upgrades

Program of upgrades to existing intercity rail corridors linking Newcastle-Central Coast-Sydney and Wollongong-Sydney to reduce travel times and improve reliability. Current scope includes timetable and service changes under the Rail Service Improvement Program, targeted network upgrades (signalling, power, station works) and the introduction of the Mariyung intercity fleet on the Central Coast & Newcastle Line, alongside Federal planning led by the High Speed Rail Authority for a dedicated Sydney-Newcastle high speed corridor.

Newcastle Offshore Wind Project

The Newcastle Offshore Wind project proposes a floating wind farm off Newcastle, NSW, with an expected capacity of up to 10 gigawatts, pending a Scoping Study's results.

Gosford Private Hospital redevelopment

The development will house additional Theatres, a new Day Surgery and Recovery area, purpose-built Maternity Ward, and car parking.

Employment

AreaSearch analysis of employment trends sees Kariong performing better than 85% of local markets assessed across Australia

Kariong has a skilled workforce with essential services sectors well represented. Its unemployment rate was 2.4% in the past year, with an estimated employment growth of 2.5%.

As of September 2025, 3701 residents are employed, and the unemployment rate is 1.8% lower than Greater Sydney's rate of 4.2%. Workforce participation is higher at 69.1%, compared to Greater Sydney's 60.0%. Leading employment industries include health care & social assistance, construction, and retail trade. Health care & social assistance is particularly strong, with an employment share 1.2 times the regional level.

However, professional & technical services are under-represented at 6.7%, compared to Greater Sydney's 11.5%. Employment opportunities locally appear limited based on Census data analysis. Between September 2024 and September 2025, employment levels increased by 2.5% while the labour force grew by 3.2%, causing unemployment to rise by 0.6 percentage points. In contrast, Greater Sydney saw employment growth of 2.1% and a 0.2 percentage point rise in unemployment. State-wide, NSW employment contracted by 0.03% between November 2024 and November 2025, losing 2260 jobs, with an unemployment rate of 3.9%. Nationally, the unemployment rate was 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Kariong's employment mix suggests local employment should increase by 6.6% over five years and 13.8% over ten years, though this is a simplified extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

The area exhibits notably strong income performance, ranking higher than 70% of areas assessed nationally through AreaSearch analysis

AreaSearch's latest postcode level ATO data for financial year 2022 shows Kariong SA2 had a median income among taxpayers of $55,157 and an average of $71,280. This is higher than the national average. Compared to Greater Sydney, which has a median income of $56,994 and an average of $80,856, Kariong's incomes are lower but still above the national averages. Based on Wage Price Index growth since financial year 2022, current estimates for September 2025 would be approximately $62,112 (median) and $80,268 (average). Census data reveals household income ranks at the 78th percentile with a weekly income of $2,200, while personal income sits at the 59th percentile. Distribution data shows that 39.9% of individuals in Kariong earn between $1,500 and $2,999 per week (2,588 individuals), which aligns with the broader area where this cohort also represents 30.9%. High housing costs consume 16.0% of income, but strong earnings place disposable income at the 77th percentile. The area's SEIFA income ranking places it in the 6th decile.

Frequently Asked Questions - Income

Housing

Kariong is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Kariong's dwellings, as per the latest Census, consisted of 92.2% houses and 7.8% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Sydney metro's 74.2% houses and 25.9% other dwellings. Home ownership in Kariong stood at 25.1%, with the rest being mortgaged (52.3%) or rented (22.6%). The median monthly mortgage repayment was $2,080, below Sydney metro's average of $2,150. Median weekly rent was $450, higher than Sydney metro's $400. Nationally, Kariong's mortgage repayments were higher at $2,080 compared to the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Kariong features high concentrations of family households, with a higher-than-average median household size

Family households constitute 82.9% of all households, consisting of 44.5% couples with children, 24.4% couples without children, and 13.3% single parent families. Non-family households comprise the remaining 17.1%, with lone person households at 15.1% and group households making up 2.0%. The median household size is 3.0 people, larger than the Greater Sydney average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Kariong fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 20.7%, significantly lower than Greater Sydney's average of 38.0%. Bachelor degrees are the most common at 15.0%, followed by postgraduate qualifications (3.9%) and graduate diplomas (1.8%). Vocational credentials are prevalent, with 41.9% of residents aged 15+ holding such qualifications, including advanced diplomas (12.7%) and certificates (29.2%). Educational participation is high, with 32.2% of residents currently enrolled in formal education, comprising 11.4% in primary, 9.7% in secondary, and 3.9% in tertiary education.

Educational participation is notably high, with 32.2% of residents currently enrolled in formal education. This includes 11.4% in primary education, 9.7% in secondary education, and 3.9% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Kariong shows that there are currently 34 operational transport stops. These stops offer a variety of bus services, with a total of 27 different routes running through the area. Together, these routes facilitate 467 weekly passenger trips.

The report rates the accessibility of transport in Kariong as excellent, with residents typically located just 199 meters away from their nearest transport stop. On average, there are 66 trips per day across all routes, which equates to approximately 13 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Kariong's residents are healthier than average in comparison to broader Australia with prevalence of common health conditions quite low among the general population though higher than the nation's average across older, at risk cohorts

Health data shows that Kariong residents have relatively positive health outcomes.

The prevalence of common health conditions among them is quite low compared to the general population, but higher than the national average for older and at-risk cohorts. Approximately 55% (~3,567 people) of the total population has private health cover, which is very high. Mental health issues and asthma are the most common medical conditions in the area, affecting 9.3% and 8.9% of residents respectively. About 69.2% of residents declare themselves completely clear of medical ailments, compared to 64.8% across Greater Sydney. The area has 12.7% (826 people) of residents aged 65 and over, which is lower than the 24.5% in Greater Sydney. Health outcomes among seniors require more attention than those of the broader population.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Kariong records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Kariong's population shows cultural diversity similar to the wider region, with 81.0% born in Australia, 91.2% being citizens, and 88.9% speaking English only at home. Christianity is the predominant religion, practiced by 51.4%. Judaism, however, has a slightly higher representation in Kariong than Greater Sydney (0.2% vs 0.2%).

The top three ancestry groups are Australian (30.4%), English (28.4%), and Irish (7.2%). Some ethnic groups have notable differences: Russian is overrepresented at 0.5%, Lebanese at 0.9%, and Welsh at 0.7%.

Frequently Asked Questions - Diversity

Age

Kariong's population is slightly younger than the national pattern

Kariong's median age at 36 years is nearly matching Greater Sydney's average of 37, both being modestly under Australia's median age of 38. Compared to Greater Sydney, Kariong has a higher proportion of residents aged 5-14 (14.6%) but fewer residents aged 25-34 (12.0%). Between the 2021 Census and now, the population share of those aged 65-74 has grown from 6.4% to 7.8%, while the share of those aged 45-54 has declined from 14.9% to 14.0%. By 2041, demographic modeling suggests Kariong's age profile will significantly evolve. The 75-84 cohort is projected to grow by 120%, adding 272 residents to reach 500. Residents aged 65 and above will drive all population growth, highlighting trends of demographic aging. Conversely, the cohorts aged 25-34 and 0-4 are expected to experience population declines.