Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Wyoming has shown very soft population growth performance across periods assessed by AreaSearch

Wyoming's population, as of November 2025, is approximately 11,338 people. This figure represents a decrease of 85 individuals since the 2021 Census, which recorded a population of 11,423 people. The estimated resident population was 11,340 as of June 2024, with an additional 5 validated new addresses since the Census date accounting for this change. This results in a population density ratio of 1,353 persons per square kilometer, exceeding the average across national locations assessed by AreaSearch. Overseas migration was the primary driver of population growth during recent periods.

AreaSearch employs ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, NSW State Government's SA2 level projections from 2022 with a base year of 2021 are utilized. Growth rates by age group from these aggregations are applied to all areas for the years 2032 to 2041. Projected demographic shifts indicate an overall population decline over this period, with Wyoming's population expected to decrease by 194 persons by 2041. However, specific age cohorts are anticipated to grow, notably the 85 and over age group, projected to expand by 345 people.

Frequently Asked Questions - Population

Development

The level of residential development activity in Wyoming is very low in comparison to the average area assessed nationally by AreaSearch

Wyoming has received approximately 7 dwelling approvals per year over the past five financial years, totaling 39 homes. As of FY-26, 2 dwellings have been approved so far. The population decline in recent years has maintained adequate housing supply relative to demand, resulting in a balanced market with good buyer choice. New homes are being constructed at an average cost of $216,000, which is below the regional average, indicating more affordable housing options for buyers.

This financial year, Wyoming has registered approximately $2.2 million in commercial approvals, suggesting minimal commercial development activity compared to Greater Sydney, where there is significantly higher development activity per person (82.0% above Wyoming's average). The scarcity of new dwellings typically strengthens demand and prices for existing properties in Wyoming, which also reflects below-average national levels, possibly due to planning constraints. Recent construction comprises 86.0% detached dwellings and 14.0% townhouses or apartments, preserving the area's suburban nature and attracting space-seeking buyers. With around 1752 people per dwelling approval, Wyoming indicates a highly mature market with stable or declining population forecasts, potentially creating favourable conditions for buyers in terms of housing pressure.

Given stable or declining population forecasts, Wyoming may experience less housing pressure, creating favourable conditions for buyers.

Frequently Asked Questions - Development

Infrastructure

Wyoming has moderate levels of nearby infrastructure activity, ranking in the 43rdth percentile nationally

The performance of an area can significantly be influenced by changes in local infrastructure, major projects, and planning initiatives. AreaSearch has identified a total of 26 projects that are expected to impact the area. Notable projects include Wyoming Shopping Village Upgrade, Narara District Master Plan, Telecommunications Mobile Base Station, and Henry Kendall Gardens Retaining Walls Replacement. The following list details those considered most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

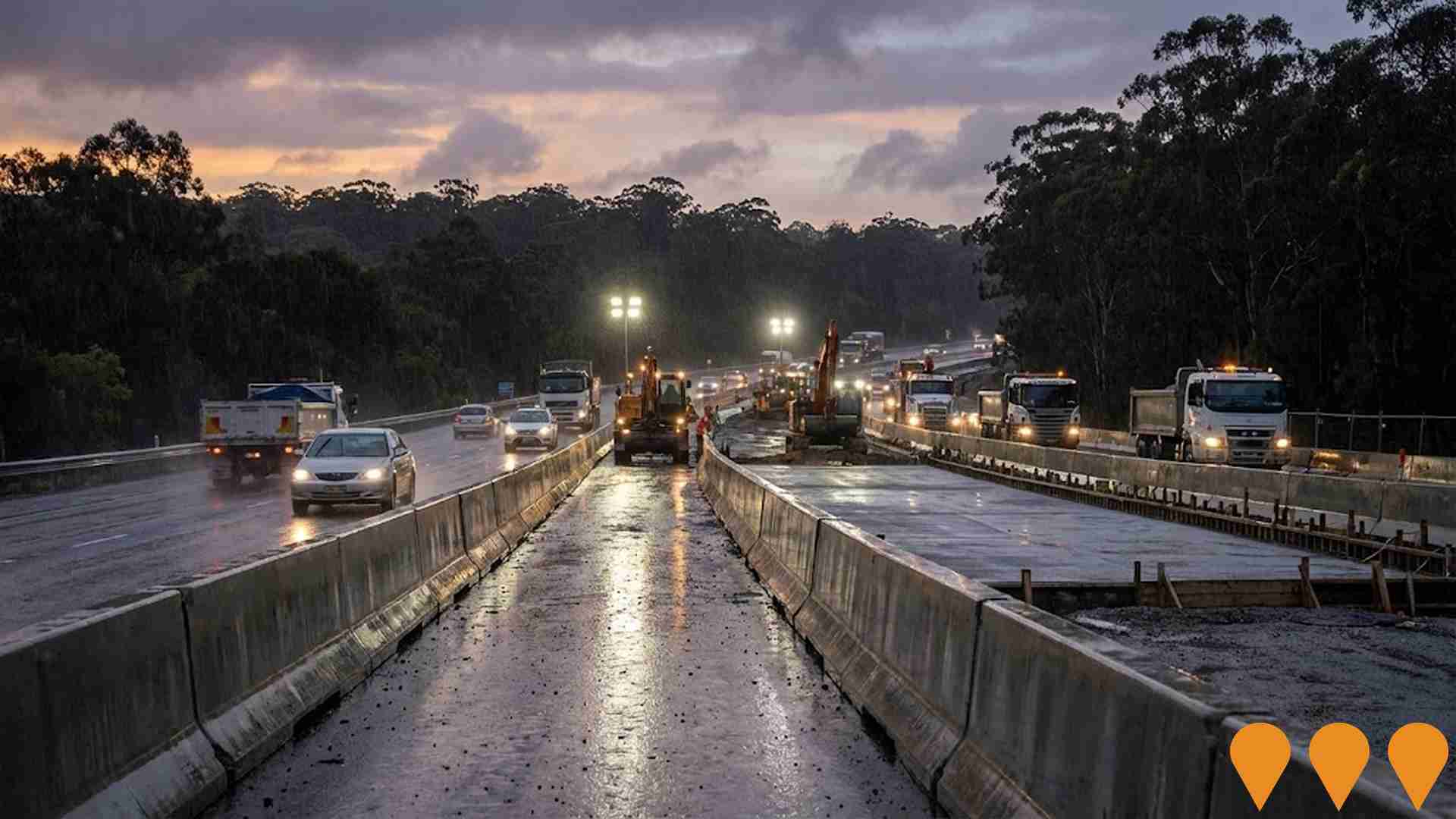

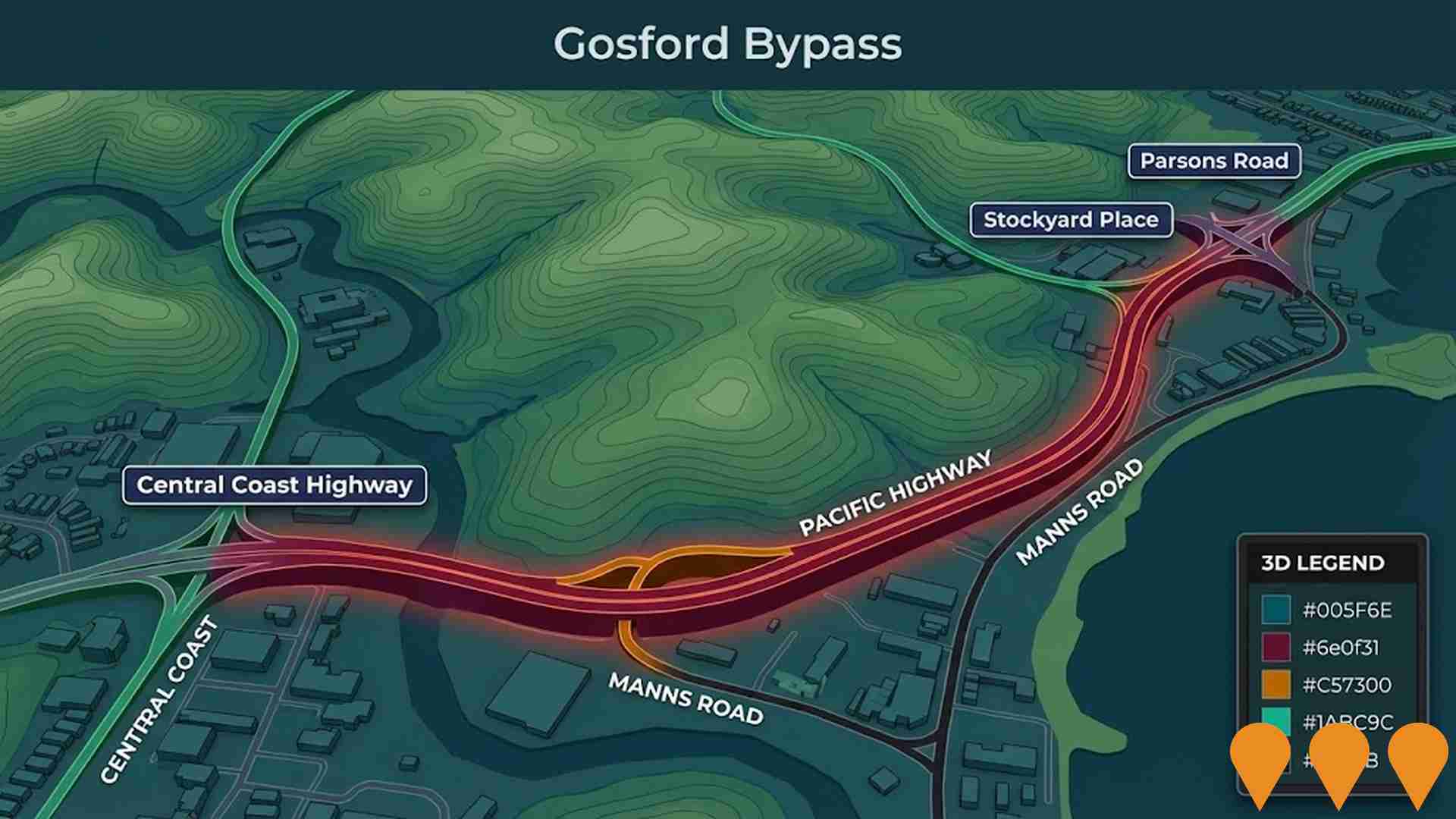

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Wyoming Shopping Village Upgrade

Upgrade and enhancement of the neighbourhood shopping centre, anchored by Coles, with a tailored tenancy mix focused on health, beauty, food, and beverage services. Planning is complete for the centre upgrade.

Narara District Master Plan

Development and delivery of master plans for the Narara District including Lisarow, Wyoming, and Niagara Park to support housing and urban development. The district is within the Central Coast Council local government area.

Gosford Waterfront project

NSW Government led public domain and connectivity upgrades along Brisbane Water between Polytec Stadium and Gosford Sailing Club. HCCDC is preparing a public domain plan with short term public space improvements and an active transport shared path between Gosford and Point Clare under design and costing. Community consultation ran in July and August 2025.

Gosford Cultural Precinct (Gosford Regional Library)

Central Coast Council's staged cultural precinct vision has progressed with the stand-alone Gosford Regional Library now nearing completion. The four-level facility will deliver library services, an innovation hub, flexible event spaces (including a multi-use hall), recording studios, meeting rooms, and Council customer service. The broader cultural precinct concept that once paired the library with a performing arts and conference centre was discontinued in 2019, with Council continuing to review options for a future RPACC.

Narara Community Centre and Library Redevelopment

Concept plan by Central Coast Council to upgrade and expand the existing Narara Community Centre, with the potential to integrate a small branch library and co-located community services. The intent is to modernise internal spaces, improve accessibility and flexibility for programs, and strengthen the role of the centre as a local hub for support services, activities and learning. As at late 2025 there is no publicly advertised development application or construction program specific to the building redevelopment, although the site has recently benefited from other investments such as a rooftop solar array and community battery delivered with Ausgrid.

Central Coast Film Studios

Proposed $230 million film and television production facility at Calga featuring 10 state-of-the-art sound stages, Australia's largest water tank, production offices, training and education precinct, film museum, and supporting infrastructure developed by Heath Bonnefin and Craig Giles.

Telecommunications Mobile Base Station

Development Application (DA/1244/2025) submitted to Central Coast Council by Amplitel Pty Ltd for the construction of a new telecommunications mobile base station at 172 Glennie St, Wyoming. The project aims to improve network coverage in the area. Written submissions on the application close on 20 October 2025.

Narara Ecovillage

Narara Ecovillage is a 64 hectare community title eco housing development on the former Gosford horticultural research station at Narara, planned for around 150 low impact homes plus shared community facilities, food growing spaces and integrated energy and water infrastructure. Stage 1 is largely complete and occupied, while Stage 2 civil works finished at the end of 2023 with most of the 40 plus new lots sold, owners preparing development applications and a growing number of homes under construction or already occupied; a planning proposal and amended planning agreement are progressing to support a future Stage 3 with more diverse housing types and small scale local services. :contentReference[oaicite:0]{index=0} :contentReference[oaicite:1]{index=1} :contentReference[oaicite:2]{index=2}

Employment

Wyoming has seen below average employment performance when compared to national benchmarks

Wyoming's workforce is skilled with well-represented essential services sectors. The unemployment rate was 4.5% in September 2025, with an estimated employment growth of 2.5% over the past year.

There were 5,339 residents employed while the unemployment rate was 0.4% higher than Greater Sydney's rate of 4.2%. Workforce participation lagged at 54.8%, compared to Greater Sydney's 60.0%. Leading employment industries among residents included health care & social assistance, retail trade, and construction. Health care & social assistance had a strong specialization with an employment share of 1.4 times the regional level.

Conversely, professional & technical services showed lower representation at 6.5% compared to the regional average of 11.5%. Over the 12 months to September 2025, employment increased by 2.5% while labour force increased by 3.2%, resulting in an unemployment rise of 0.6 percentage points. In comparison, Greater Sydney recorded employment growth of 2.1%, labour force growth of 2.4%, and an unemployment increase of 0.2 percentage points. State-level data to 25-Nov-25 showed NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. This compared favourably to the national unemployment rate of 4.3%. National employment forecasts from Jobs and Skills Australia for five and ten-year periods suggested Wyoming's employment should increase by 6.8% over five years and 14.1% over ten years, based on industry-specific projections applied to Wyoming's employment mix.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows Wyoming SA2 had a median income of $45,229 and an average income of $58,450 among taxpayers. This is lower than the national average. In comparison, Greater Sydney had a median income of $56,994 and an average income of $80,856 during the same period. Based on Wage Price Index growth of 12.61% from financial year 2022 to September 2025, estimated incomes would be approximately $50,932 (median) and $65,821 (average). According to 2021 Census figures, household, family and personal incomes in Wyoming rank modestly, between the 27th and 31st percentiles. The earnings profile shows that the largest segment comprises 31.8% of residents earning $1,500 - $2,999 weekly (3,605 residents), similar to the metropolitan region where this cohort also represents 30.9%. Housing affordability pressures are severe in Wyoming, with only 79.3% of income remaining after housing costs, ranking at the 24th percentile. The area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Wyoming is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Wyoming's dwelling structures, as per the latest Census data, consisted of 77.5% houses and 22.5% other dwellings such as semi-detached homes, apartments, and 'other' dwellings. In comparison, Sydney metro area had 74.2% houses and 25.9% other dwellings. Home ownership in Wyoming was at 31.2%, with mortgaged dwellings at 41.8% and rented ones at 27.0%. The median monthly mortgage repayment in Wyoming was $1,950, lower than Sydney metro's average of $2,150. Weekly rent median figure in Wyoming was recorded as $400, matching the Sydney metro figure of $400. Nationally, Wyoming's mortgage repayments were higher at $1,950 compared to the Australian average of $1,863, while rents were also higher at $400 against the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Wyoming has a typical household mix, with a fairly typical median household size

Family households constitute 69.1% of all households, including 28.3% couples with children, 25.6% couples without children, and 14.2% single parent families. Non-family households account for the remaining 30.9%, with lone person households at 28.1% and group households comprising 2.8%. The median household size is 2.5 people, which aligns with the Greater Sydney average.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Wyoming aligns closely with national averages, showing typical qualification patterns and performance metrics

The area has university qualification rates of 21.8%, significantly lower than the Greater Sydney average of 38.0%. Bachelor degrees are the most common at 15.5%, followed by postgraduate qualifications (4.1%) and graduate diplomas (2.2%). Vocational credentials are held by 40.1% of residents aged 15+, with advanced diplomas at 11.4% and certificates at 28.7%. Educational participation is high, with 28.8% of residents currently enrolled in formal education.

This includes 10.1% in primary education, 7.9% in secondary education, and 4.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Public transport analysis reveals 90 active transport stops operating within Wyoming. These stops are serviced by 51 individual routes, collectively providing 937 weekly passenger trips. Transport accessibility is rated as excellent, with residents typically located 176 meters from the nearest transport stop.

Service frequency averages 133 trips per day across all routes, equating to approximately 10 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Wyoming is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Wyoming faces significant health challenges, as indicated by data showing high prevalence of common health conditions across both younger and older age groups. The rate of private health cover is relatively low at approximately 49% of the total population, which amounts to around 5,544 people. This compares to a rate of 54.7% in Greater Sydney, with a national average of 55.3%.

Mental health issues and arthritis are the most common medical conditions in the area, affecting 10.1 and 10.0% of residents respectively. Meanwhile, 60.7% of residents report being completely free from medical ailments, compared to 64.8% in Greater Sydney. The area has a lower proportion of residents aged 65 and over at 23.3%, or approximately 2,640 people, than Greater Sydney's 24.5%. Health outcomes among seniors present some challenges, broadly aligning with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Wyoming records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Wyoming's cultural diversity aligns with the broader regional average, with approximately 80% of its residents born in Australia, around 90% being citizens, and nearly 90% speaking English exclusively at home. Christianity is the predominant religion in Wyoming, comprising roughly 52% of the population, compared to about 53% across Greater Sydney. The top three ancestry groups are English (30%), Australian (28%), and Irish (9%).

Notably, Korean, New Zealand, and Russian ethnicities have higher representation in Wyoming than regionally: Korean at 0.6% vs 0.3%, New Zealand at 0.9% vs 0.7%, and Russian at 0.4%.

Frequently Asked Questions - Diversity

Age

Wyoming's population is slightly older than the national pattern

Wyoming's median age is 41 years, which is higher than Greater Sydney's average of 37 years and slightly older than Australia's median of 38 years. Compared to Greater Sydney, Wyoming has a notably higher proportion of the 75-84 age group (9.4%) and a lower proportion of 25-34 year-olds (11.1%). According to the 2021 Census, the 75-84 age group increased from 7.9% to 9.4%, while the 25-34 cohort decreased from 12.4% to 11.1%. By 2041, Wyoming's age profile is projected to change significantly. The 85+ cohort is expected to grow by 81%, adding 342 residents to reach 763. The population growth will mainly be driven by those aged 65 and older, who represent 94% of the anticipated growth. Conversely, population declines are projected for the 65-74 and 15-24 age groups.