Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Renwick lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

As of Nov 2025, the estimated population of the Renwick statistical area (Lv2) is around 1,513. This figure reflects an increase of 60 people since the 2021 Census, which reported a population of 1,453. The change was inferred from AreaSearch's estimate of the resident population at 1,493 in Jun 2024, based on the latest ERP data release by the ABS and an additional 9 validated new addresses since the Census date. This level of population results in a density ratio of 1,080 persons per square kilometer, which is comparable to averages seen across other locations assessed by AreaSearch. The Renwick (SA2) experienced a growth rate of 4.1% between the 2021 Census and Nov 2025, exceeding both the SA3 area's 3.1% growth and the SA4 region's growth rates. Overseas migration contributed approximately 62.0% to overall population gains during recent periods, with all drivers including natural growth and interstate migration being positive factors.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022, and NSW State Government's SA2 level projections where applicable, released in 2022 with a base year of 2021. Future population trends predict exceptional growth for the Renwick (SA2), placing it in the top 10 percent of regional areas nationally, with an expected increase of 749 persons to 2041 based on aggregated SA2-level projections, reflecting a gain of 49.6% over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Renwick recording a relatively average level of approval activity when compared to local markets analysed countrywide

Based on AreaSearch analysis of ABS building approval numbers, Renwick has received approximately 6 dwelling approvals annually over the past five financial years, totalling an estimated 33 homes. In FY26 so far, 1 approval has been recorded. On average, each home built between FY21 and FY25 accommodates around 4.6 new residents per year, indicating a significant demand outstripping supply, which typically exerts upward pressure on prices and intensifies competition among buyers. The average construction value of new properties is $503,000, reflecting a focus on the premium segment with upmarket properties.

This financial year has seen $1.8 million in commercial development approvals, suggesting a predominantly residential focus. Compared to the rest of NSW, Renwick records about three-quarters the building activity per person and ranks among the 49th percentile nationally, implying limited buyer options while bolstering demand for established properties. New developments consist of 86.0% detached houses and 14.0% attached dwellings, maintaining the area's suburban character with detached housing appealing to space-seeking buyers.

With around 333 people per dwelling approval, Renwick exhibits characteristics of a low-density area. According to AreaSearch's latest quarterly estimate, Renwick is projected to grow by 751 residents by 2041. If current construction levels persist, housing supply may lag population growth, potentially exacerbating buyer competition and supporting price growth.

Frequently Asked Questions - Development

Infrastructure

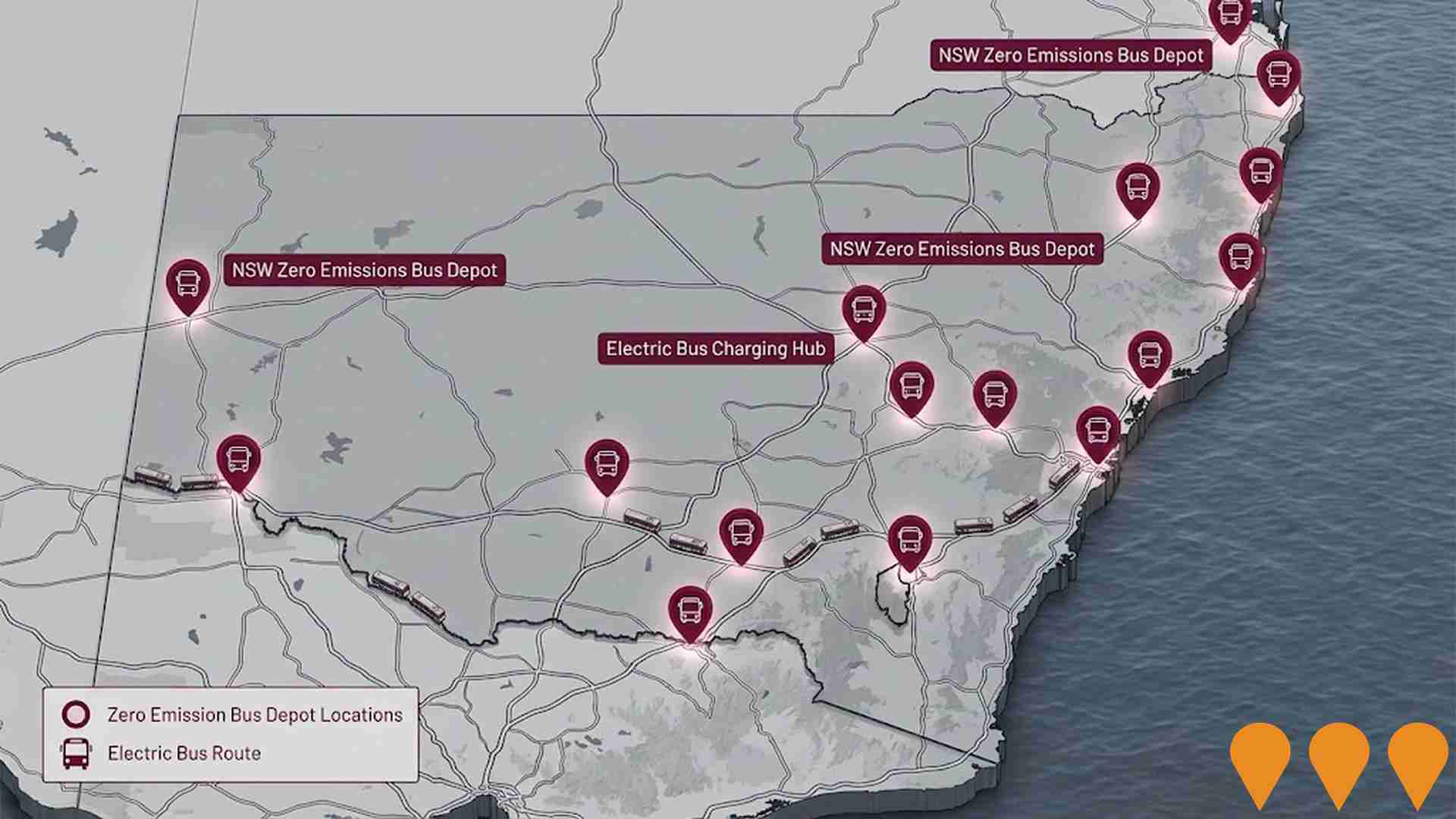

Renwick has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

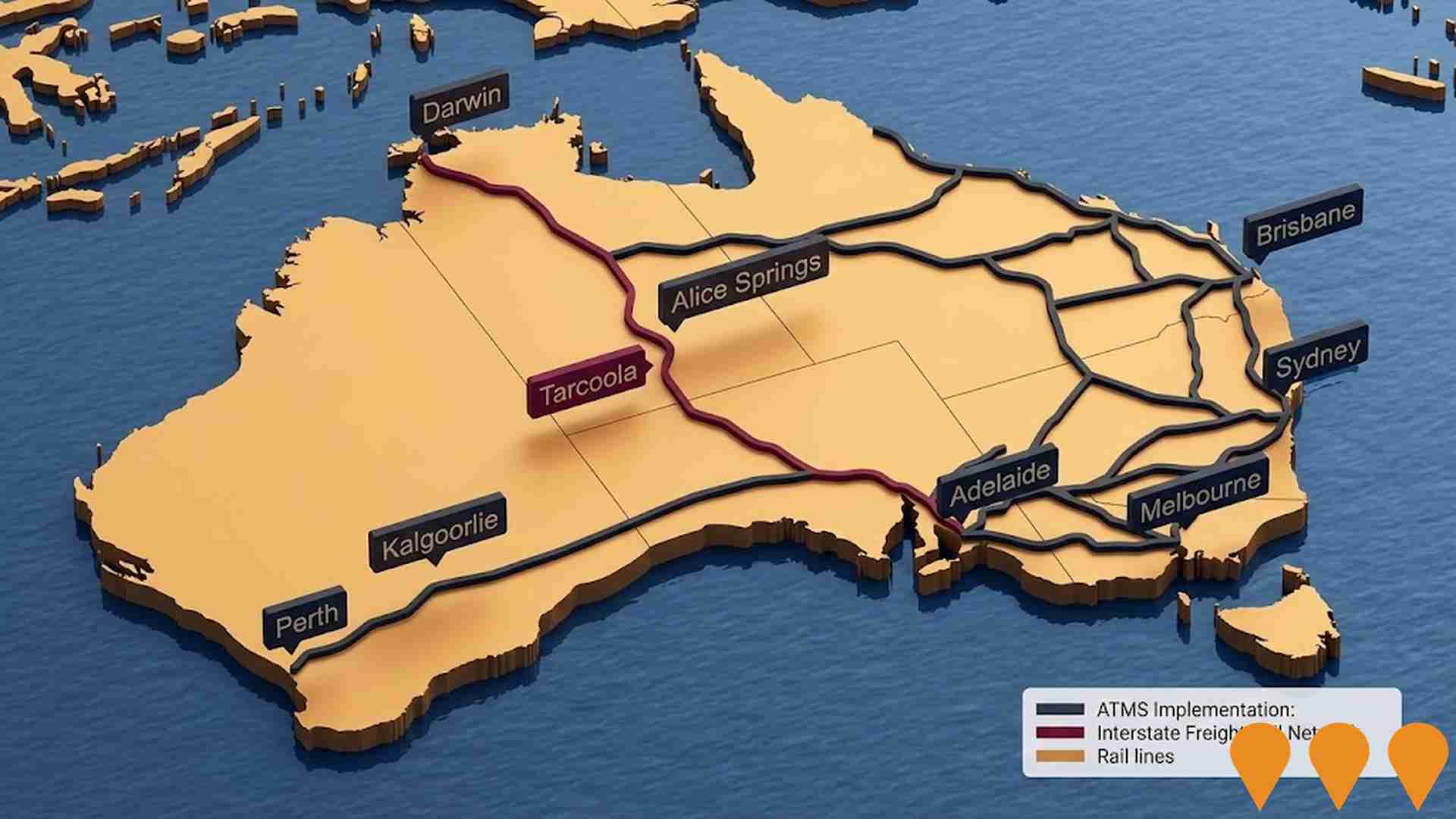

No factors influence a region's performance more than changes to local infrastructure, major projects, and planning initiatives. AreaSearch has identified zero projects that may impact this area. Notable ones include Sydney-Canberra Rail Connectivity And Capacity, Paling Yards Wind Farm, Mariyung Fleet (New Intercity Fleet), and Low and Mid-Rise Housing Policy. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

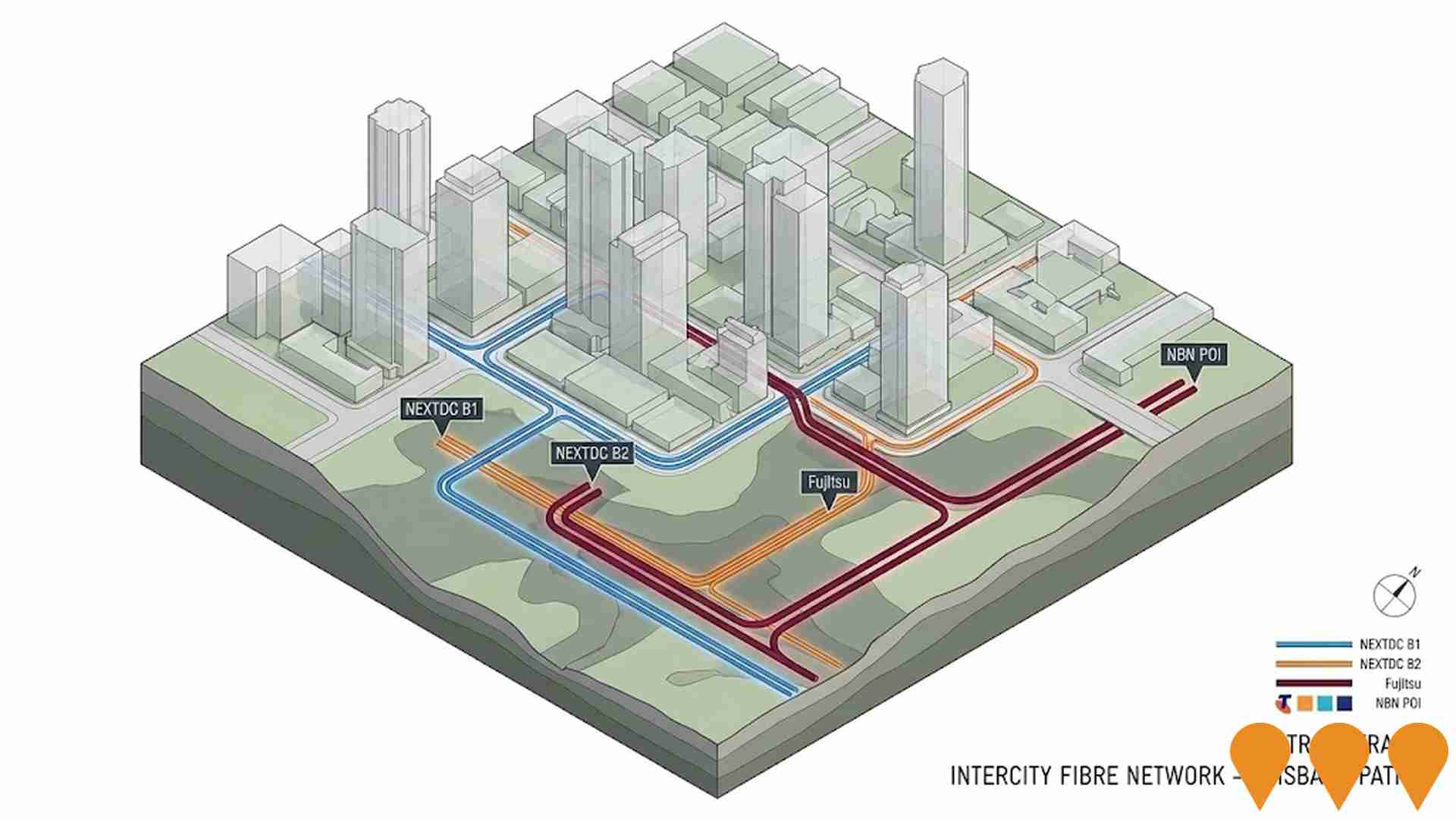

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms via amendments to the State Environmental Planning Policy to enable more diverse low and mid-rise housing (dual occupancies, terraces, townhouses, manor houses and residential flat buildings up to 6 storeys) in well-located areas within 800 m of selected train, metro and light-rail stations and town centres. Stage 1 (dual occupancies in R2 zones statewide) commenced 1 July 2024. Stage 2 (mid-rise apartments, terraces and dual occupancies near stations) commenced 28 February 2025. Expected to facilitate up to 112,000 additional homes over the next five years.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet being delivered by RailConnect NSW (UGL, Hyundai Rotem, Mitsubishi Electric Australia) for Transport for NSW. Named after the Darug word for emu, the fleet commenced passenger services on the Central Coast & Newcastle Line on 3 December 2024, followed by the Blue Mountains Line on 13 October 2025. Services on the South Coast Line are scheduled to commence in 2026. The fleet features modern amenities including spacious 2x2 seating, charging ports, improved accessibility with wheelchair spaces and accessible toilets, CCTV emergency help points, and dedicated spaces for luggage, prams and bicycles. The trains operate in flexible 4-car, 6-car, 8-car or 10-car formations. The fleet replaces aging V-set trains that entered service in the 1970s and serves approximately 26 million passenger journeys annually across the electrified intercity network. Supporting infrastructure includes the new Kangy Angy Maintenance Facility, platform extensions, and signaling upgrades at multiple stations.

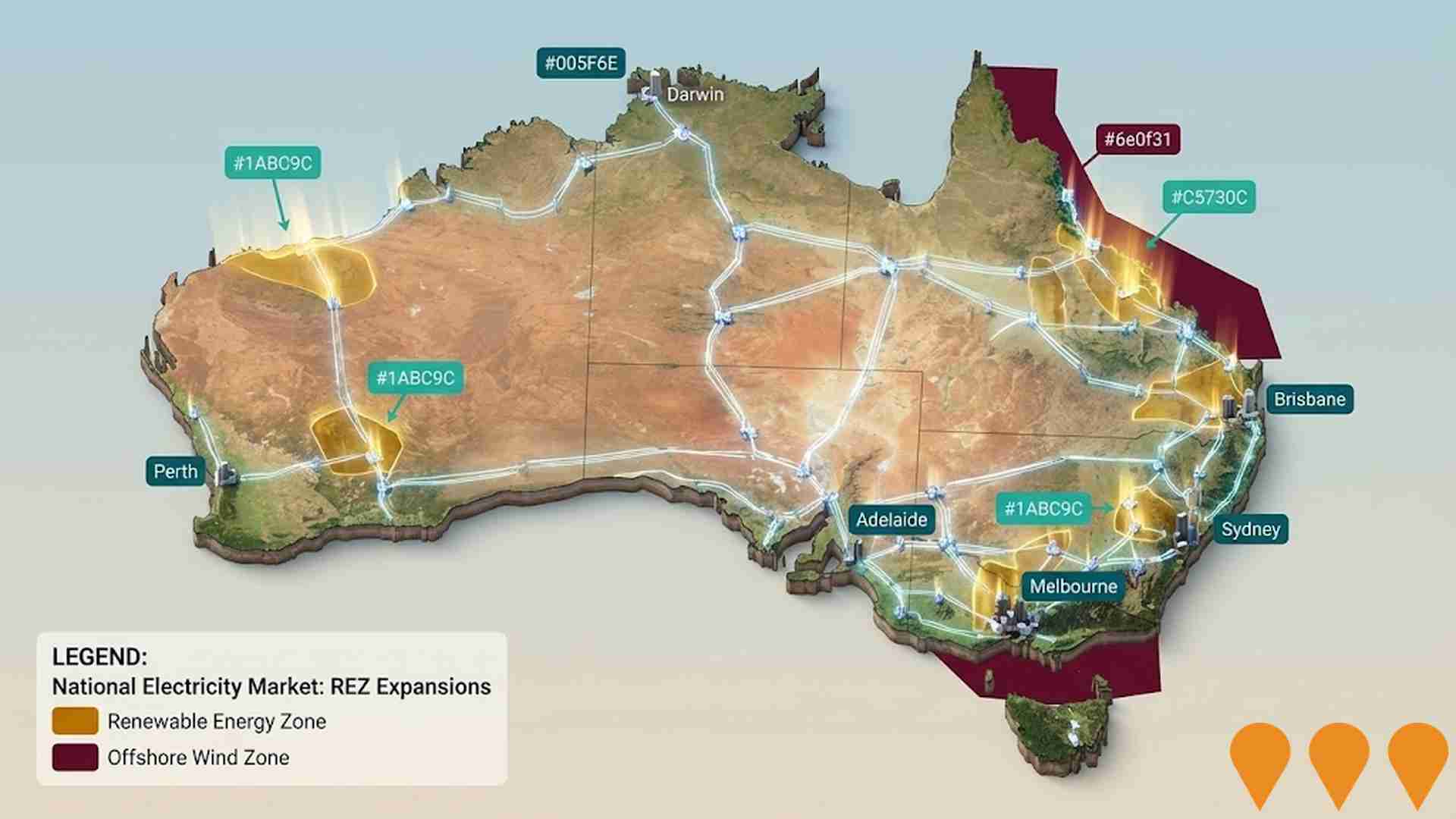

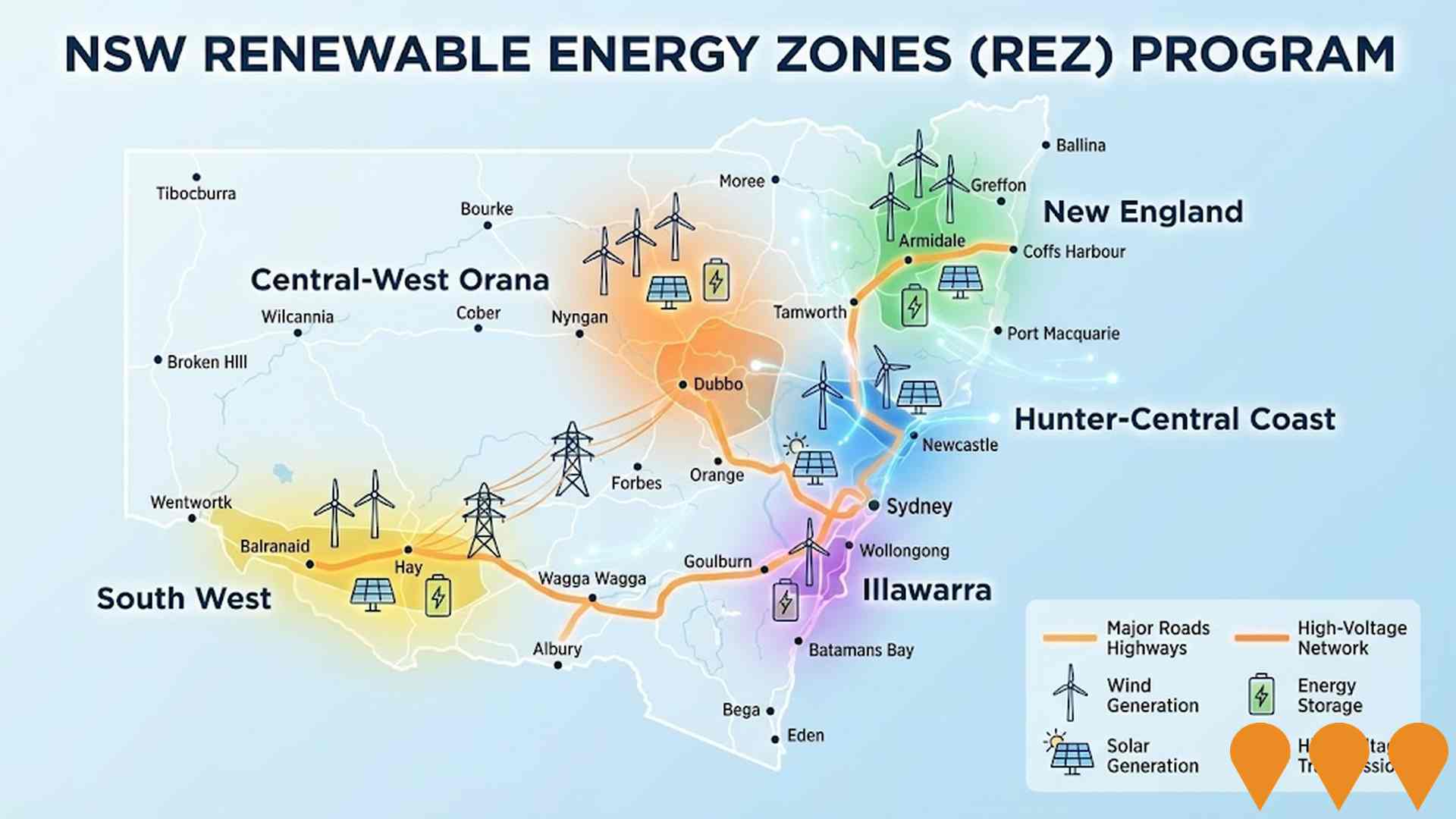

NSW Renewable Energy Zones (REZ) Program

NSW is delivering five Renewable Energy Zones (Central-West Orana, New England, South West, Hunter-Central Coast and Illawarra) to coordinate new wind and solar generation, storage and high-voltage transmission. The program is led by EnergyCo NSW under the Electricity Infrastructure Roadmap. Construction of the first REZ (Central-West Orana) transmission project commenced in June 2025, with staged energisation from 2028. Across the program, NSW targets at least 12 GW of new renewable generation and 2 GW of long-duration storage by 2030.

Enabling Infrastructure for Hydrogen Production

Australia has completed the National Hydrogen Infrastructure Assessment (NHIA) to 2050 and refreshed its National Hydrogen Strategy (2024). The programmatic focus has shifted to planning and enabling infrastructure through measures such as ARENA's Hydrogen Headstart and the Hydrogen Production Tax Incentive (from April 2025). Round 2 of Hydrogen Headstart consultation occurred in 2025. Collectively these actions aim to coordinate investment in transport, storage, water and electricity inputs linked to Renewable Energy Zones and priority hubs, supporting large-scale renewable hydrogen production and future export supply chains.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

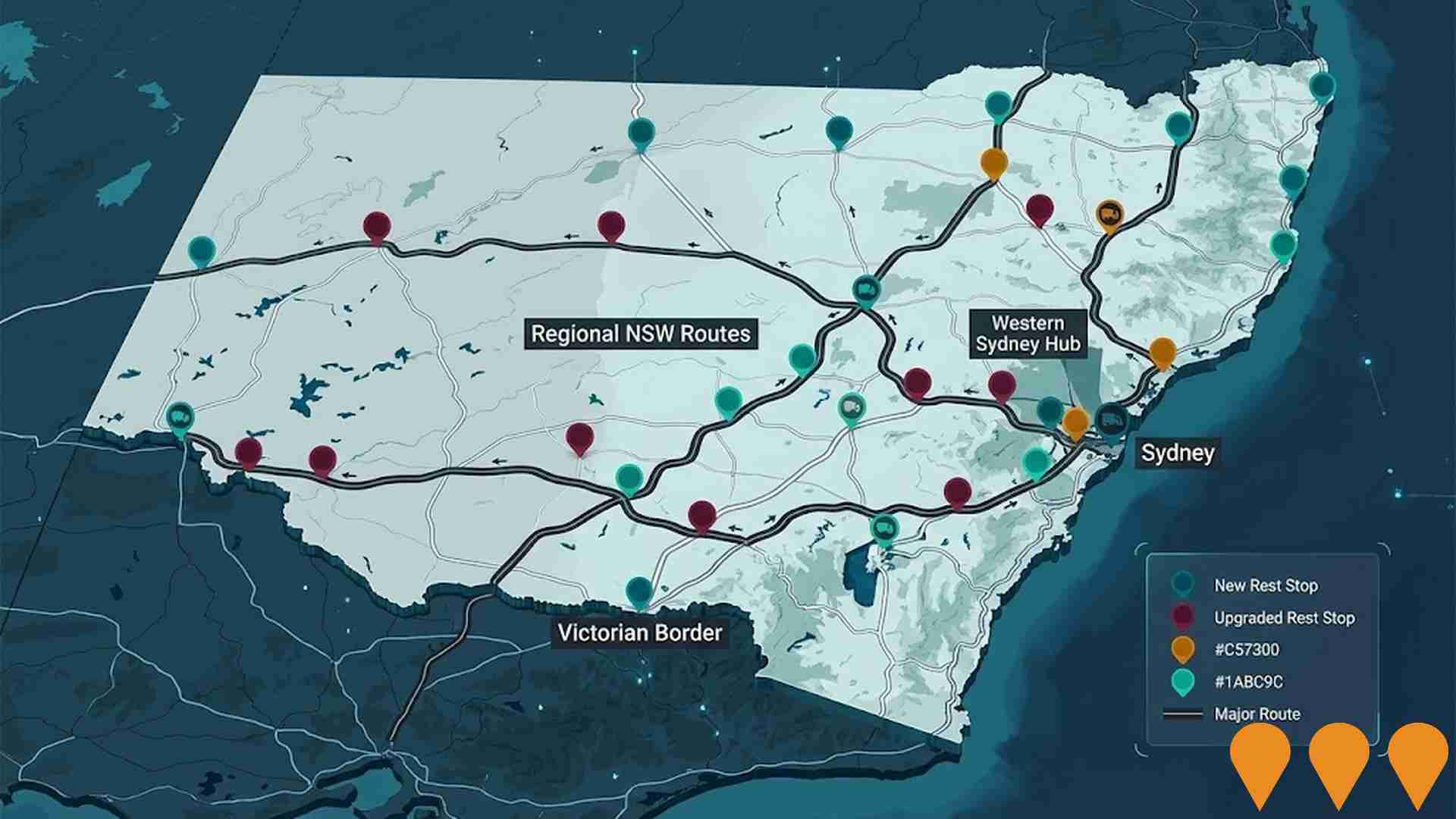

NSW Heavy Vehicle Rest Stops Program (TfNSW)

Statewide Transport for NSW program to increase and upgrade heavy vehicle rest stopping across NSW. Works include minor upgrades under the $11.9m Heavy Vehicle Rest Stop Minor Works Program (e.g. new green reflector sites and amenity/signage improvements), early works on new and upgraded formal rest areas in regional NSW, and planning and site confirmation for a major new dedicated rest area in Western Sydney. The program aims to reduce fatigue, improve safety and productivity on key freight routes, and respond to industry feedback collected since 2022.

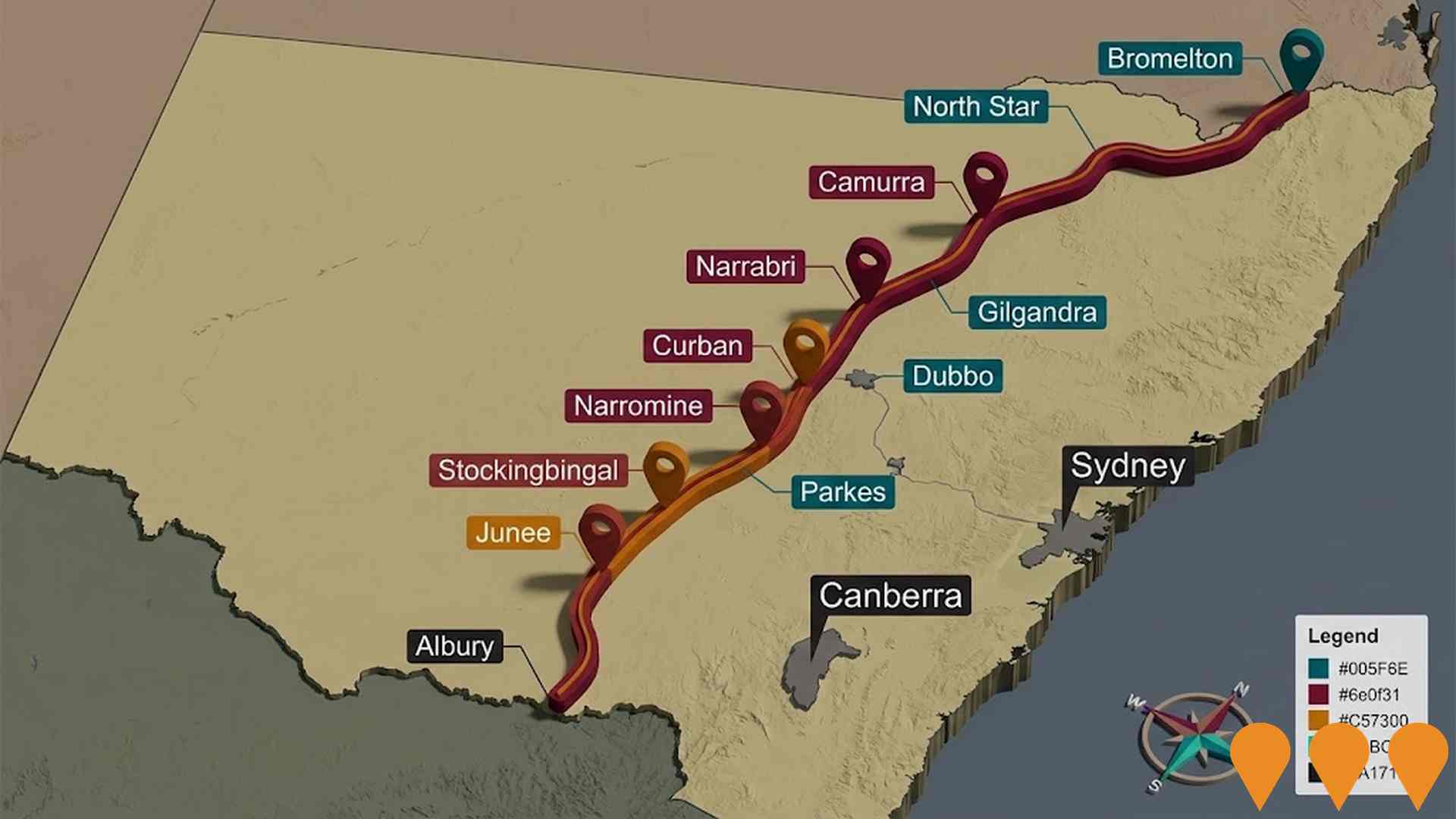

Sydney-Canberra Rail Connectivity And Capacity

The project involves potential upgrades to enable faster rail services between Sydney and Canberra to improve the customer experience, increase productivity, and provide a competitive alternative to driving or flying. Potential upgrades include track straightening and duplication, track formation renewal, electrification and signalling upgrades, and new rolling stock.

Paling Yards Wind Farm

The Paling Yards Wind Farm is a proposed 290-megawatt wind farm consisting of 47 turbines with a maximum tip height of 240 metres. It will connect to the Mount Piper to Bannaby 500-kilovolt transmission line via a new terminal station located approximately eight kilometres north-east of the project site. Construction is expected to commence in Q2 2026 and be operational in Q2 2028.

Employment

Error processing employment analysis

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 indicates Renwick's median income among taxpayers is $63,454. The average income in the suburb is $142,414. Nationally, this places Renwick in the top percentile. Comparing to Rest of NSW, Renwick's median is higher at $63,454 compared to $49,459, and its average is also higher at $142,414 versus $62,998. Based on Wage Price Index growth of 12.61% since financial year 2022, current estimates for Renwick's median income would be approximately $71,456 and average $160,372 as of September 2025. According to the 2021 Census, household, family, and personal incomes in Renwick rank highly nationally, between the 75th and 87th percentiles. In terms of income distribution, 31.4% of individuals (475 people) earn between $1,500 - $2,999, reflecting regional patterns where 29.9% also fall within this range. Economic strength is evident with 34.7% of households earning high weekly incomes exceeding $3,000, supporting elevated consumer spending. High housing costs consume 16.1% of income, yet strong earnings place disposable income at the 85th percentile nationally. The area's SEIFA income ranking places it in the 9th decile.

Frequently Asked Questions - Income

Housing

Renwick is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Renwick's dwelling structures, as per the latest Census, consisted entirely of houses with 0.0% other dwellings. This contrasted with Non-Metro NSW which had 90.6% houses and 9.4% other dwellings. Home ownership in Renwick stood at 35.4%, with mortgaged dwellings at 47.3% and rented ones at 17.3%. The median monthly mortgage repayment was $2,522, higher than Non-Metro NSW's average of $2,167. The median weekly rent in Renwick was $620, compared to Non-Metro NSW's $430. Nationally, Renwick's mortgage repayments were significantly higher at $2,522 versus the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Renwick features high concentrations of family households, with a higher-than-average median household size

Family households constitute 85.8% of all households, including 46.0% couples with children, 32.3% couples without children, and 6.0% single parent families. Non-family households account for the remaining 14.2%, with lone person households at 13.5% and group households comprising 1.0%. The median household size is 2.9 people, which is larger than the Rest of NSW average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Renwick fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 28.1%, exceeding the Rest of NSW average of 21.3%. This reflects the community's emphasis on higher education. Bachelor degrees are the most common at 19.4%, followed by postgraduate qualifications (6.5%) and graduate diplomas (2.2%).

Trade and technical skills are prominent, with 42.0% of residents aged 15+ holding vocational credentials – advanced diplomas (14.8%) and certificates (27.2%). Educational participation is high, with 27.9% of residents currently enrolled in formal education. This includes 11.9% in primary education, 6.1% in secondary education, and 2.7% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Renwick has nine active public transport stops, all of which are bus stops. These stops are served by nine different routes that together offer 55 weekly passenger trips. The accessibility of these services is rated as good, with residents living an average of 304 meters from the nearest stop.

On average, there are seven trips per day across all routes, which equates to roughly six weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Renwick's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Renwick demonstrates excellent health outcomes across all age groups, with a very low prevalence of common health conditions. The rate of private health cover stands at approximately 83%, comprising 1,254 people, which is notably higher than Rest of NSW's 66.3% and the national average of 55.3%. Arthritis and mental health issues are the most prevalent medical conditions in the area, affecting 7.4% and 6.3% of residents respectively.

A significant majority, 73.1%, report being completely free from medical ailments, compared to Rest of NSW's 64.8%. The proportion of residents aged 65 and over is 17.0%, with a total of 257 people in this age group, which is lower than the Rest of NSW figure of 27.7%. Despite this, health outcomes among seniors are robust and largely align with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Renwick records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Renwick's population showed above-average cultural diversity, with 20.5% born overseas and 11.6% speaking a language other than English at home. Christianity was the predominant religion in Renwick, accounting for 57.1%. Judaism was slightly overrepresented compared to Rest of NSW, comprising 0.4% versus 0.3%.

The top three ancestry groups were English (29.3%), Australian (26.2%), and Irish (10.0%). Notably, French (0.9%) Welsh (0.7%), and Russian (0.4%) ethnicities were overrepresented compared to regional averages of 0.6%, 0.6%, and 0.2% respectively.

Frequently Asked Questions - Diversity

Age

Renwick's population is slightly younger than the national pattern

The median age in Renwick is 37 years, which is lower than the Rest of NSW average of 43 and close to the national average of 38. The age profile shows that those aged 35-44 are prominent at 17.3%, while those aged 55-64 are smaller at 8.6%. Between 2021 and present, the 35-44 age group has grown from 16.2% to 17.3%, while the 45-54 cohort has declined from 11.3% to 10.2%. By 2041, projections show significant shifts in Renwick's age structure, with the 35-44 age group projected to increase by 151 people (58%) from 261 to 413.