Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Buxton has seen population growth performance typically on par with national averages when looking at short and medium term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch since the Census, Buxton's (NSW) statistical area (Lv2) population is estimated at around 2,567 as of Nov 2025. This reflects an increase of 496 people (23.9%) since the 2021 Census, which reported a population of 2,071 people. The change is inferred from the resident population of 2,454 estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024 and an additional 19 validated new addresses since the Census date. This level of population equates to a density ratio of 200 persons per square kilometer. Buxton's (NSW) growth rate exceeded the state's (7.6%) and metropolitan area, marking it as a growth leader in the region. Population growth was primarily driven by interstate migration contributing approximately 65.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area released in 2024 with 2022 as the base year, and NSW State Government's SA2 level projections for areas not covered by this data, released in 2022 with 2021 as the base year. Considering projected demographic shifts, an above median population growth is projected for the area analysed by AreaSearch, expecting to expand by 554 persons to 2041 based on aggregated SA2-level projections, reflecting a total increase of 13.1% over the 17 years.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Buxton when compared nationally

Buxton has seen approximately 29 dwelling approvals annually based on AreaSearch analysis of ABS data. From FY-21 to FY-25, around 148 homes were approved, with an additional 11 approved in FY-26 so far. Each new home constructed attracted an average of 2.4 people over the past five financial years, reflecting strong demand that supports property values.

The average construction cost value for new homes was $335,000. This year has seen $4.0 million in commercial development approvals, indicating the area's residential character. Compared to Greater Sydney, Buxton has 10% less new development per person but ranks at the 74th percentile nationally, suggesting strong developer confidence. Recent construction comprises 78% detached houses and 22% attached dwellings, maintaining the area's low-density character focused on family homes. This shift from the current housing mix (100% houses) reflects reduced development site availability and changing lifestyle demands.

The location has approximately 164 people per dwelling approval, indicating a growing market. By 2041, Buxton is projected to grow by 337 residents, with current development rates comfortably meeting demand and potentially supporting growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Buxton has moderate levels of nearby infrastructure activity, ranking in the top 50% nationally

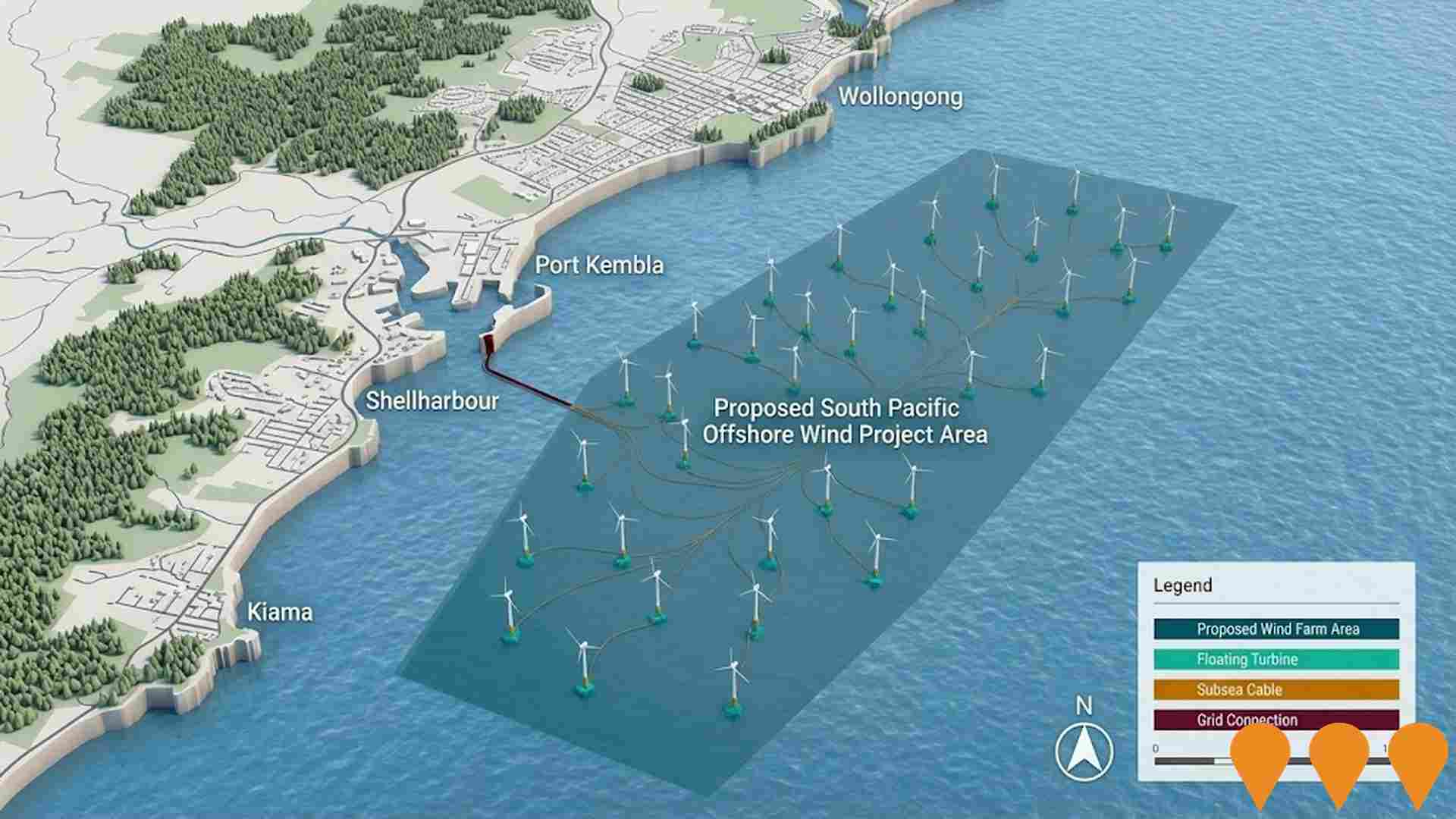

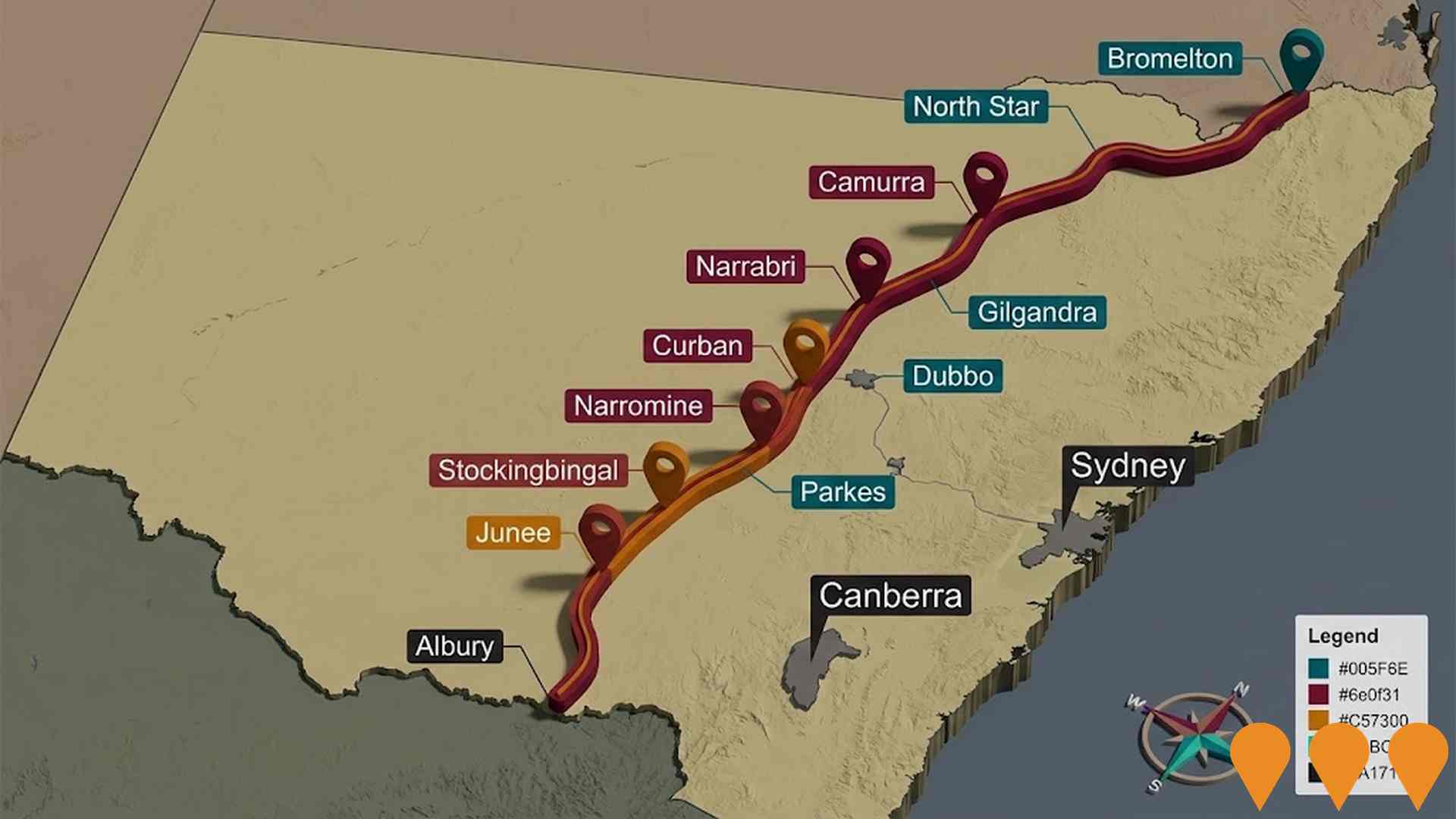

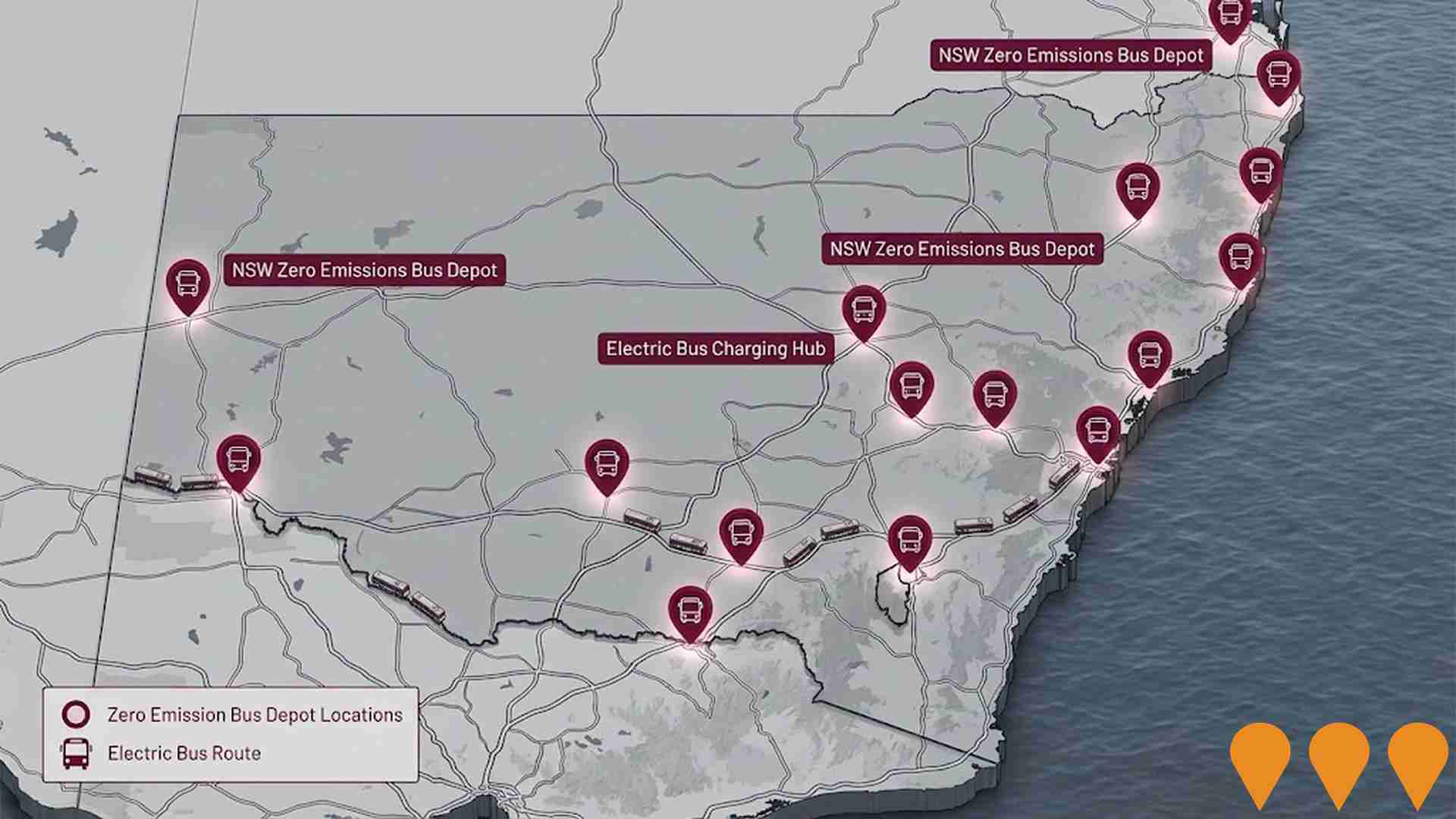

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified one major project that may impact this region. Key projects include Tahmoor South Coal Project, Maldon to Dombarton Freight Rail Line, Outer Sydney Metropolitan Correctional Precinct, and South Pacific Offshore Wind Project. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sydney Metro

Australia's largest public transport project, comprising four main lines. As of February 2026, the City & Southwest M1 line is operational to Sydenham, with the Sydenham-to-Bankstown conversion reaching 80% completion and intensive dynamic train testing underway for a late 2026 opening. Sydney Metro West has achieved major tunneling milestones at Westmead, with fit-out contracts worth $11.5 billion signed to target a 2032 opening. The Western Sydney Airport line remains under heavy construction with stations and viaducts progressing for an opening aligned with the airport in late 2026.

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms to enable diverse low and mid-rise housing, including dual occupancies, terraces, townhouses, and apartment buildings up to 6 storeys. The policy applies to residential zones within 800m of 171 nominated transport hubs and town centres. Stage 1 (dual occupancies) commenced 1 July 2024, and Stage 2 (mid-rise apartments and terraces) commenced 28 February 2025. In June 2025, further amendments adjusted aircraft noise thresholds and clarified storey definitions to expand the policy's reach. The initiative is expected to facilitate approximately 112,000 additional homes by 2030.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet (D sets) replacing the aging V-set fleet across the NSW intercity network. Delivered by the RailConnect consortium, the trains feature 2x2 seating, charging ports, dedicated luggage/bicycle spaces, and enhanced accessibility with wheelchair spaces and accessible toilets. The fleet operates in 4, 6, 8, or 10-car formations. Passenger services commenced on the Central Coast & Newcastle Line on 3 December 2024 and the Blue Mountains Line on 13 October 2025. South Coast Line services are scheduled to begin in the first half of 2026. The project includes the Kangy Angy Maintenance Facility and extensive corridor upgrades such as platform extensions and signaling modifications.

Maldon to Dombarton Freight Rail Line

A proposed 35 km single-track freight rail link designed to connect the Main South Line at Maldon with the Moss Vale to Unanderra line at Dombarton. The project aims to improve freight access to Port Kembla and bypass the congested Sydney network. Revitalized advocacy under the SWIRL (South West Illawarra Rail Link) banner proposes upgrading the corridor to a dual-track electrified line for both freight and passengers, connecting Port Kembla to Western Sydney International Airport. While 25 km of earthworks were completed in the 1980s, the project is currently in an investigative stage with no formal construction funding in recent budgets.

Tahmoor South Coal Project

Extension of the existing Tahmoor Coal Mine with new longwall mining areas to the south and west, approved in 2023 with operations expected until the early 2040s.

Outer Sydney Metropolitan Correctional Precinct

NSW Government concept for a new correctional precinct to address metropolitan prison capacity. A previously examined option in Wollondilly (south-west Sydney) was ruled out by the government in 2018 following site investigations and community opposition. Subsequent government materials and media reporting indicate the state has continued assessing metropolitan capacity solutions and alternative precinct locations (including areas around Greater Parramatta/Camellia), but as of August 2025 no confirmed site, scope or delivery timeline has been announced. The project therefore remains an uncommitted concept under assessment rather than an approved build.

Newcastle-Sydney and Wollongong-Sydney Rail Line Upgrades

Program of upgrades to existing intercity rail corridors linking Newcastle-Central Coast-Sydney and Wollongong-Sydney to reduce travel times and improve reliability. Current scope includes timetable and service changes under the Rail Service Improvement Program, targeted network upgrades (signalling, power, station works) and the introduction of the Mariyung intercity fleet on the Central Coast & Newcastle Line, alongside Federal planning led by the High Speed Rail Authority for a dedicated Sydney-Newcastle high speed corridor.

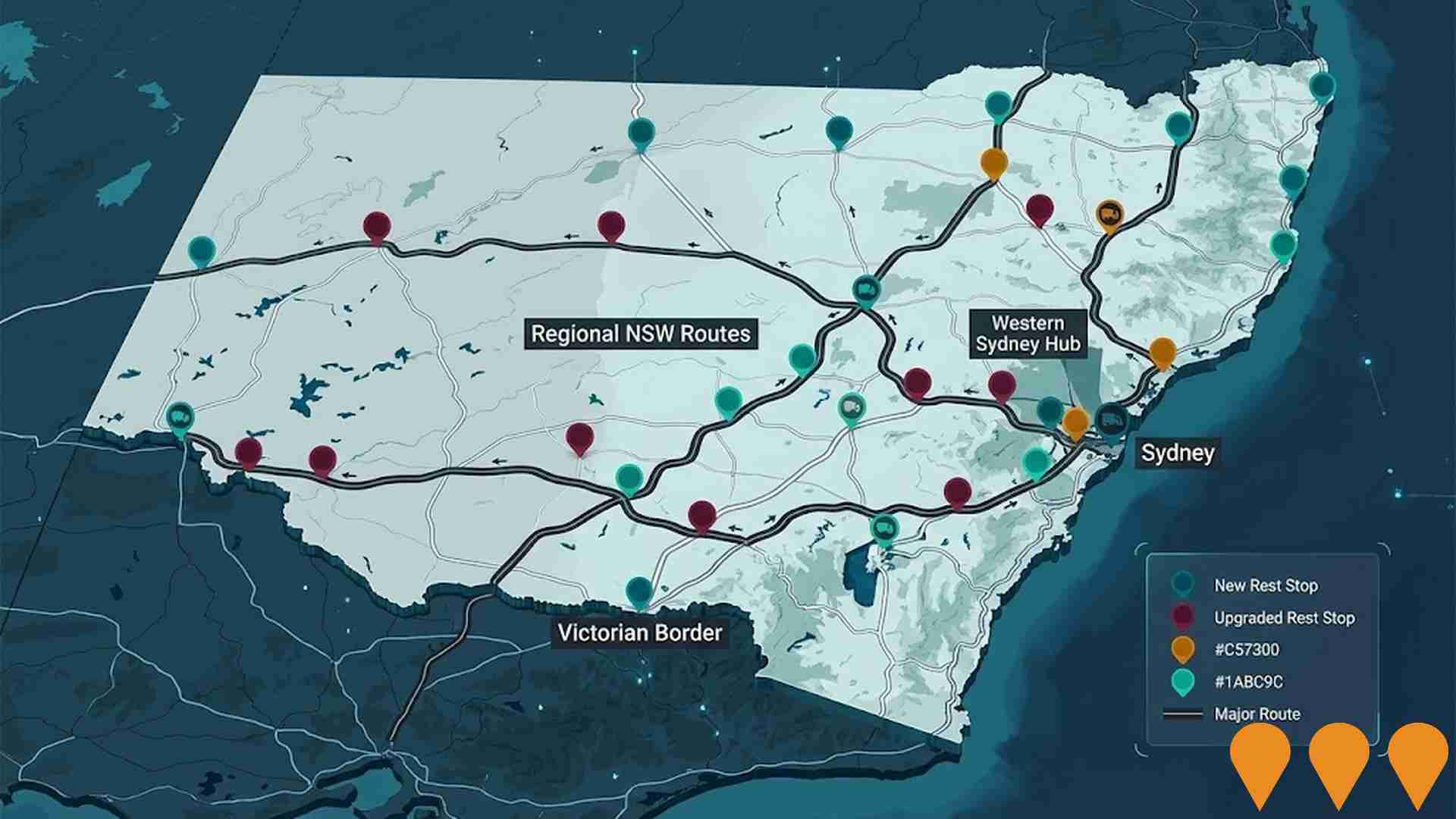

NSW Heavy Vehicle Rest Stops Program (TfNSW)

Statewide Transport for NSW program to increase and upgrade heavy vehicle rest stopping across NSW. Works include minor upgrades under the $11.9m Heavy Vehicle Rest Stop Minor Works Program (e.g. new green reflector sites and amenity/signage improvements), early works on new and upgraded formal rest areas in regional NSW, and planning and site confirmation for a major new dedicated rest area in Western Sydney. The program aims to reduce fatigue, improve safety and productivity on key freight routes, and respond to industry feedback collected since 2022.

Employment

Employment conditions in Buxton demonstrate exceptional strength compared to most Australian markets

Buxton has a balanced workforce with both white and blue collar jobs. The construction sector is prominent, with an unemployment rate of 3.0% and estimated employment growth of 5.9% in the past year, as per AreaSearch's statistical area data aggregation.

As of September 2025, 1,443 residents are employed, with an unemployment rate of 1.2% lower than Greater Sydney's rate of 4.2%. Workforce participation is high at 67.5%, compared to Greater Sydney's 60.0%. Key industries include construction, health care & social assistance, and manufacturing. Construction employment is particularly high, with a share 1.8 times the regional level.

However, professional & technical jobs are under-represented, at 4.0% of Buxton's workforce compared to Greater Sydney's 11.5%. Local employment opportunities appear limited based on Census working population vs resident population data. In the 12 months prior, employment increased by 5.9%, labour force by 6.1%, leading to a slight unemployment rise of 0.1 percentage points. By comparison, Greater Sydney recorded employment growth of 2.1% and unemployment rose by 0.2 percentage points. State-level data from NSW as of 25-Nov shows employment contracted by 0.03%, with an unemployment rate of 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Buxton's employment mix suggests local employment should grow by 5.8% in five years and 12.4% in ten years, though this is a simple extrapolation for illustrative purposes and does not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income levels align closely with national averages, indicating typical economic conditions for Australian communities according to AreaSearch analysis

The median taxpayer income in Buxton is $54,317, with an average of $64,563 according to postcode level ATO data aggregated by AreaSearch for the financial year 2023. This is lower than the national average, which stands at a median of $60,817 and an average of $83,003 in Greater Sydney. Based on Wage Price Index growth of 8.86% from financial year 2023 to September 2025, estimated incomes would be approximately $59,129 (median) and $70,283 (average). The 2021 Census shows household, family, and personal incomes in Buxton are at the 55th percentile nationally. Incomes predominantly cluster between $1,500 - 2,999, with 41.3% of locals (1,060 people) falling into this category. This is similar to the metropolitan region where 30.9% occupy this income range. High housing costs consume 18.4% of income, but strong earnings place disposable income at the 58th percentile nationally. The area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Buxton is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Buxton's dwelling structures, as assessed in the latest Census, consisted of 99.6% houses and 0.4% other dwellings (semi-detached, apartments, 'other' dwellings), contrasting with Sydney metro's 94.1% houses and 5.9% other dwellings. Home ownership in Buxton stood at 24.3%, with mortgaged dwellings at 62.0% and rented ones at 13.7%. The median monthly mortgage repayment was $2,102, lower than Sydney metro's average of $2,318. The median weekly rent in Buxton was $410, slightly higher than the national average of $375 but lower than Sydney metro's figure of $415. Nationally, Buxton's mortgage repayments were significantly higher than the Australian average of $1,863.

Frequently Asked Questions - Housing

Household Composition

Buxton features high concentrations of family households, with a fairly typical median household size

Family households account for 82.8% of all households, including 41.6% couples with children, 27.1% couples without children, and 13.2% single parent families. Non-family households constitute the remaining 17.2%, with lone person households at 15.2% and group households making up 1.5%. The median household size is 2.9 people, which aligns with Greater Sydney's average.

Frequently Asked Questions - Households

Local Schools & Education

Buxton faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

In the region, university qualification rates are lower than the Greater Sydney average, with only 10.8% of residents holding such qualifications compared to 38.0%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are most prevalent at 7.4%, followed by postgraduate qualifications (2.2%) and graduate diplomas (1.2%). Vocational credentials are also common, with 48.1% of residents aged 15+ holding these skills, including advanced diplomas (9.4%) and certificates (38.7%).

Educational participation is high, with 30.8% of residents currently enrolled in formal education. This includes 10.4% in primary education, 9.0% in secondary education, and 2.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis indicates 36 active stops operating in Buxton, offering mixed bus services. These stops are covered by 17 routes, facilitating 142 weekly passenger trips collectively. Transport accessibility is rated excellent, with residents positioned on average 194 meters from the nearest stop.

Service frequency averages 20 trips daily across all routes, equating to approximately three weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Buxton's residents are healthier than average in comparison to broader Australia with prevalence of common health conditions quite low among the general population though higher than the nation's average across older, at risk cohorts

Buxton's health data shows a relatively positive picture with low prevalence of common health conditions among its general population compared to national averages. However, certain older, at-risk cohorts have higher rates.

Private health cover stands at approximately 52% of Buxton's total population (~1,347 people), slightly leading the average SA2 area but trailing Greater Sydney's 55.3%. The most prevalent medical conditions are mental health issues (9.0%) and asthma (8.6%). A significant portion, 68.7%, report no medical ailments, similar to Greater Sydney's figure. Buxton has a lower proportion of seniors aged 65 and over at 9.8% (251 people), compared to Greater Sydney's 16.5%. Despite this, health outcomes among seniors require more attention than the broader population.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Buxton placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Buxton's cultural diversity was found to be below average, with 91.6% of its population being citizens, 90.6% born in Australia, and 97.7% speaking English only at home. The dominant religion in Buxton is Christianity, comprising 54.5% of the population, compared to 63.0% across Greater Sydney. In terms of ancestry, the top three groups are Australian (34.3%), English (29.9%), and Irish (6.6%).

Notably, Maltese (1.6%) and Dutch (1.6%) populations are overrepresented in Buxton compared to regional averages of 2.3% and 1.0%, respectively. Similarly, South African ancestry is also slightly higher at 0.6%.

Frequently Asked Questions - Diversity

Age

Buxton's young demographic places it in the bottom 15% of areas nationwide

Buxton's median age is 32, which is younger than Greater Sydney's average of 37 and the national average of 38. Compared to Greater Sydney, Buxton has a higher percentage of residents aged 5-14 (14.6%) but fewer residents aged 75-84 (3%). According to post-2021 Census data, the age group 35-44 has increased from 12.4% to 13.8%, while the age group 45-54 has decreased from 14.1% to 12.6%. By 2041, demographic modeling suggests Buxton's age profile will change significantly. The 15-24 cohort is projected to grow by 17%, adding 65 residents to reach 445. The 0-4 group is expected to grow by 1%, adding only 1 resident.