Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Picton are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Picton's population, as of November 2025, is estimated at around 6,273 people. This figure reflects an increase of 991 people since the 2021 Census, which reported a population of 5,282 people in Picton (NSW) statistical area (Lv2). The change was inferred from AreaSearch's estimation of the resident population at 5,656 following examination of the ABS's latest ERP data release in June 2024 and an additional 130 validated new addresses since the Census date. This level of population results in a density ratio of 148 persons per square kilometer. Picton's growth rate of 18.8% since the 2021 census exceeded both the state (7.6%) and metropolitan area, indicating it as a growth leader in the region. Interstate migration contributed approximately 65.0% of overall population gains during recent periods, with other factors such as natural growth and overseas migration also positive contributors.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year, for covered areas. For any SA2 areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections, released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Future population trends indicate a significant increase in Picton (NSW) (SA2), with an expected expansion of 1,621 persons by 2041 based on aggregated SA2-level projections, reflecting a gain of 21.4% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Picton among the top 25% of areas assessed nationwide

Picton averaged approximately 71 new dwelling approvals annually based on AreaSearch analysis of ABS building approval numbers. Between FY21 and FY25, around 357 homes were approved, with an additional 26 so far in FY26. Each year, about 2.5 people moved to the area per new home constructed over these five financial years.

The average construction cost value of new homes was approximately $335,000. This financial year, $3.9 million in commercial approvals were registered, indicating Picton's primarily residential nature. Compared to Greater Sydney, Picton has 17.0% less new development per person but ranks among the 91st percentile nationally, suggesting strong developer confidence. New building activity consists of 68.0% detached dwellings and 32.0% townhouses or apartments, expanding medium-density options and price brackets. This shift reflects reduced availability of development sites and changing lifestyle demands and affordability requirements, differing from the current housing mix of 90.0% houses.

With around 73 people per dwelling approval, Picton exhibits characteristics of a growth area. By 2041, Picton is projected to grow by approximately 1,345 residents. Given current development patterns, new housing supply should meet demand, providing favorable conditions for buyers and potentially facilitating further population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Picton has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified six projects likely to impact the region. Notable ones are Wollondilly Cultural Precinct, Picton Bypass, Picton Parklands Master Plan, and Picton High School Redevelopment. The following list details those deemed most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

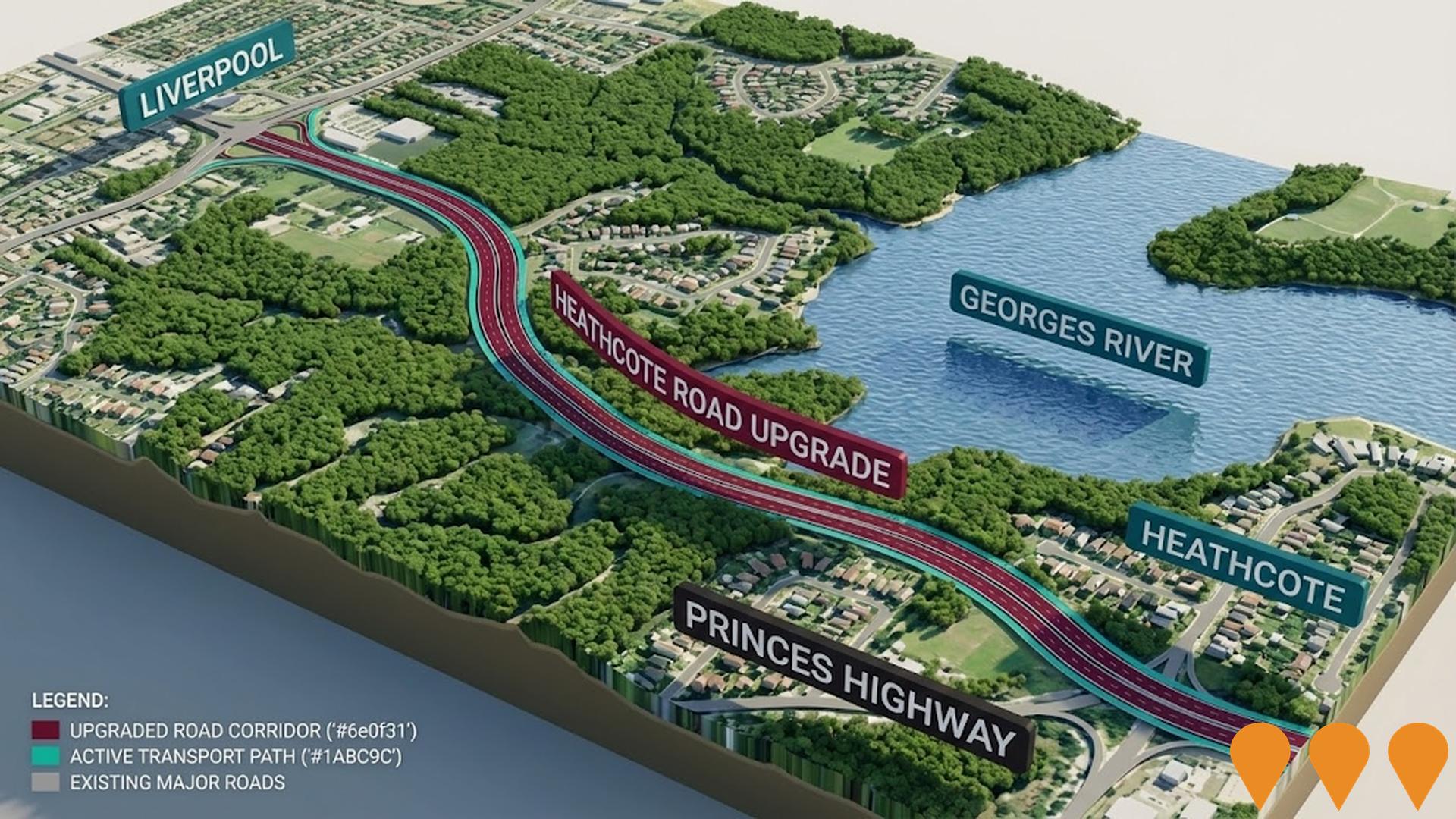

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Wilton Growth Area

A massive NSW Government Priority Growth Area transforming Wilton into a sustainable new town of approximately 19,000 homes. The project is divided into seven key precincts including North Wilton (Panorama), South East Wilton (Wilton Greens), and the Wilton Town Centre. It features integrated infrastructure such as the new Wilton High School (opening 2027), extensive retail cores, employment lands, and protected koala corridors. Development is actively progressing with residential construction underway in Wilton Greens and Panorama, while the Town Centre precinct is undergoing final neighbourhood planning as of early 2026.

Prospect South to Macarthur (ProMac)

A major Sydney Water infrastructure program expanding the drinking water network to support the Western Sydney Aerotropolis and South West Growth Area. The project includes 22km of large-diameter pipelines, the construction of three new pumping stations, five rechlorination plants, and significant reservoir upgrades. Key milestones include two new 24ML reservoirs at Oran Park and a rebuilt 6ML reservoir at Currans Hill, providing a total of 100ML in additional storage capacity to improve drought resilience and service over 84,000 future dwellings.

Maldon to Dombarton Freight Rail Line

A proposed 35 km single-track freight rail link designed to connect the Main South Line at Maldon with the Moss Vale to Unanderra line at Dombarton. The project aims to improve freight access to Port Kembla and bypass the congested Sydney network. Revitalized advocacy under the SWIRL (South West Illawarra Rail Link) banner proposes upgrading the corridor to a dual-track electrified line for both freight and passengers, connecting Port Kembla to Western Sydney International Airport. While 25 km of earthworks were completed in the 1980s, the project is currently in an investigative stage with no formal construction funding in recent budgets.

Wilton Growth Area - North Wilton Precinct

Large-scale residential release area delivering thousands of new homes as part of the broader Wilton Growth Area, with multiple developers active and first residents already moved in.

Wollondilly Cultural Precinct

Multi-stage civic and cultural precinct in Picton delivering a new Government Services Building (Stage 2, due mid 2026), refurbished Shire Hall, Performing Arts Centre (opened 2024), future new Library, Village Green and civic forecourt. The precinct will consolidate council and government services, expand cultural facilities and create new public space in the town centre.

Picton Parklands Master Plan

Council-adopted master plan and plan of management guiding staged upgrades across Picton Parklands (including Botanic Gardens, Hume Oval, Picton Sportsground, Monds Lane, RSL Park and creek corridors). Current works include the Picton Sportsground multi-use fields (earthworks, drainage, irrigation and lighting) progressing in 2025, alongside playspace and amenities upgrades at the Botanic Gardens. Implementation is staged as funding becomes available.

Picton High School Redevelopment

Completed $60 million complete rebuild accommodating up to 2,000 students. Features modern classrooms, specialist performance areas, creative arts spaces, hospitality kitchens, sports facilities, trade workshops, covered outdoor learning areas, library, administration spaces. Students moved into new buildings Term 2, 2021 with full completion 2022.

Tahmoor South Coal Project

Extension of the existing Tahmoor Coal Mine with new longwall mining areas to the south and west, approved in 2023 with operations expected until the early 2040s.

Employment

Employment conditions in Picton demonstrate strong performance, ranking among the top 35% of areas assessed nationally

Picton's workforce is skilled with well-represented essential services sectors. The unemployment rate was 3.5% in September 2024.

Employment growth over the past year was estimated at 5.4%. As of September 2025, 3,569 residents were employed, with an unemployment rate of 0.7% below Greater Sydney's rate of 4.2%. Workforce participation was 67.3%, compared to Greater Sydney's 60.0%. Leading employment industries included construction, health care & social assistance, and education & training.

Construction had notably high levels at 1.8 times the regional average. Professional & technical services had limited presence with 5.4% employment compared to 11.5% regionally. Employment opportunities locally appeared limited based on Census working population vs resident population comparison. Between September 2024 and September 2025, employment levels increased by 5.4%, labour force by 5.7%, resulting in a 0.3 percentage point unemployment rise. This contrasted with Greater Sydney where employment rose by 2.1% and unemployment rose by 0.2 percentage points. State-level data to 25-Nov-25 showed NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. National unemployment was 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 projected national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Picton's employment mix suggested local employment should increase by 6.3% over five years and 13.0% over ten years, though this was a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch released postcode level ATO data for financial year 2023. Picton's median income among taxpayers was $64,317, with an average of $76,449. Nationally, the median was $58,304 and the average was $82,193. Greater Sydney had a median of $60,817 and an average of $83,003. By September 2025, estimates suggest Picton's median income would be approximately $70,015 and the average $83,222, based on Wage Price Index growth of 8.86%. The 2021 Census showed household, family and personal incomes in Picton were at the 74th percentile nationally. The earnings profile indicated that 32.3% (2,026 people) fell into the $1,500 - 2,999 income category. In surrounding regions, this cohort represented 30.9%. High weekly earnings exceeding $3,000 were achieved by 33.9% of households, supporting elevated consumer spending. Despite high housing costs consuming 15.5% of income, disposable income remained at the 77th percentile nationally. The area's SEIFA income ranking placed it in the 7th decile.

Frequently Asked Questions - Income

Housing

Picton is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Picton's dwelling structure, as per the latest Census, consisted of 90.0% houses and 10.0% other dwellings (semi-detached, apartments, 'other' dwellings). In contrast, Sydney metro had 94.1% houses and 5.9% other dwellings. Home ownership in Picton was 32.3%, similar to Sydney metro's level, with mortgaged dwellings at 48.2% and rented ones at 19.5%. The median monthly mortgage repayment in Picton was $2,383, higher than Sydney metro's average of $2,318. The median weekly rent figure in Picton was $375, compared to Sydney metro's $415. Nationally, Picton's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were comparable at $375.

Frequently Asked Questions - Housing

Household Composition

Picton features high concentrations of family households, with a lower-than-average median household size

Family households constitute 78.3% of all households, including 39.3% couples with children, 27.7% couples without children, and 10.4% single parent families. Non-family households account for the remaining 21.7%, with lone person households at 20.5% and group households comprising 1.5%. The median household size is 2.8 people, which is smaller than the Greater Sydney average of 2.9.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Picton aligns closely with national averages, showing typical qualification patterns and performance metrics

The area's university qualification rate is 20.3%, significantly lower than Greater Sydney's average of 38.0%. Bachelor degrees are the most common at 13.7%, followed by postgraduate qualifications (4.3%) and graduate diplomas (2.3%). Vocational credentials are prevalent, with 44.2% of residents aged 15+ holding them, including advanced diplomas (12.1%) and certificates (32.1%). Educational participation is high at 28.7%, with 10.1% in primary education, 7.8% in secondary education, and 4.2% pursuing tertiary education.

Educational participation is notably high, with 28.7% of residents currently enrolled in formal education. This includes 10.1% in primary education, 7.8% in secondary education, and 4.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Picton has 130 active public transport stops. These include train and bus services. There are 58 routes in total, offering 2,368 weekly passenger trips combined.

The average distance from residents to the nearest stop is 162 meters. On average, there are 338 trips per day across all routes, which equals about 18 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health outcomes in Picton are marginally below the national average with the level of common health conditions among the general population somewhat typical, though higher than the nation's average among older cohorts

Picton's health indicators show below-average results.

Common health conditions are somewhat typical for the general population but higher than the national average among older cohorts. Private health cover is very high at approximately 57% of the total population, which totals around 3,583 people. Mental health issues and asthma are the most common medical conditions in Picton, affecting 8.8 and 8.5% of residents respectively. About 67.7% of residents report being completely clear of medical ailments, compared to 68.7% across Greater Sydney. The area has 15.4% of residents aged 65 and over, numbering around 966 people, which is lower than the 16.5% in Greater Sydney. Health outcomes among seniors require more attention due to presenting some challenges compared to the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Picton is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Picton's cultural diversity was found to be below average, with 87.6% of its population born in Australia, 93.3% being citizens, and 95.5% speaking English only at home. The predominant religion in Picton is Christianity, accounting for 61.1% of the population, compared to 63.0% across Greater Sydney. In terms of ancestry, the top three groups in Picton are English (31.5%), Australian (29.4%), and Irish (9.7%).

Certain ethnic groups show notable differences: Serbian is overrepresented at 0.5% in Picton compared to 0.3% regionally, Maltese at 1.0% versus 2.3%, and Croatian at 0.7%.

Frequently Asked Questions - Diversity

Age

Picton's population aligns closely with national norms in age terms

The median age in Picton is close to Greater Sydney's average of 37 years and equivalent to Australia's median age of 38 years. Compared to Greater Sydney, Picton has a higher percentage of residents aged 55-64 (12.3%) but fewer residents aged 25-34 (12.8%). Between the 2021 Census and present day, the proportion of residents aged 75-84 has increased from 4.1% to 4.8%. Conversely, the proportion of residents aged 45-54 has decreased from 14.6% to 13.7%. By the year 2041, Picton's age composition is expected to change significantly. The 75-84 age group is projected to grow by 84%, adding 252 people and reaching a total of 554 from its previous count of 301. The 0-4 age group is expected to grow at a more modest rate of 3%, with an increase of just 13 residents.