Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Rosemeadow - Glen Alpine has seen population growth performance typically on par with national averages when looking at short and medium term trends

Rosemeadow - Glen Alpine's population was around 24,533 as of November 2025. This figure reflects an increase of 3,378 people from the 2021 Census count of 21,155. The change is inferred from ABS' estimated resident population of 22,208 in June 2024 and validated new addresses since then. The population density was approximately 510 persons per square kilometer. Rosemeadow - Glen Alpine's growth rate of 16.0% between the 2021 Census and November 2025 exceeded both state (6.7%) and metropolitan averages, making it a regional growth leader. Overseas migration contributed about 56.1% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022. For areas not covered by this data, NSW State Government's SA2 level projections from 2022 with a base year of 2021 are used. Growth rates by age group are applied to all areas for years 2032 to 2041. Based on projected demographic shifts, Rosemeadow - Glen Alpine is expected to grow exceptionally, placing it in the top 10 percent nationally. By 2041, the area's population is predicted to increase by 21,591 persons, reflecting a total gain of 78.5% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Rosemeadow - Glen Alpine among the top 25% of areas assessed nationwide

Rosemeadow-Glen Alpine recorded approximately 263 residential properties granted approval annually. Over the past five financial years, from FY-21 to FY-25, 1,315 homes were approved, and as of FY-26274 have been approved. The average number of new residents arriving per new home over these years was around 0.6 annually.

This indicates that supply is meeting or exceeding demand, offering greater buyer choice while supporting potential population growth above projections. The average expected construction cost value for new dwellings during this period was $370,000. In FY-26, approximately $22.0 million in commercial approvals have been registered, indicating steady commercial investment activity in the area. Comparatively, Rosemeadow-Glen Alpine has 86.0% more new home approvals per person than Greater Sydney, suggesting greater choice for buyers and strong developer confidence in the location. The majority of new development consists of detached houses (75.0%), with townhouses or apartments making up the remaining 25.0%, preserving the area's low-density nature and attracting space-seeking buyers.

There are approximately 59 people per dwelling approval, indicating an expanding market. According to the latest AreaSearch quarterly estimate, Rosemeadow-Glen Alpine is projected to add around 19,265 residents by 2041. If current development rates continue, housing supply may not keep pace with population growth, potentially increasing competition among buyers and supporting stronger price growth in the future.

Frequently Asked Questions - Development

Infrastructure

Rosemeadow - Glen Alpine has moderate levels of nearby infrastructure activity, ranking in the top 50% nationally

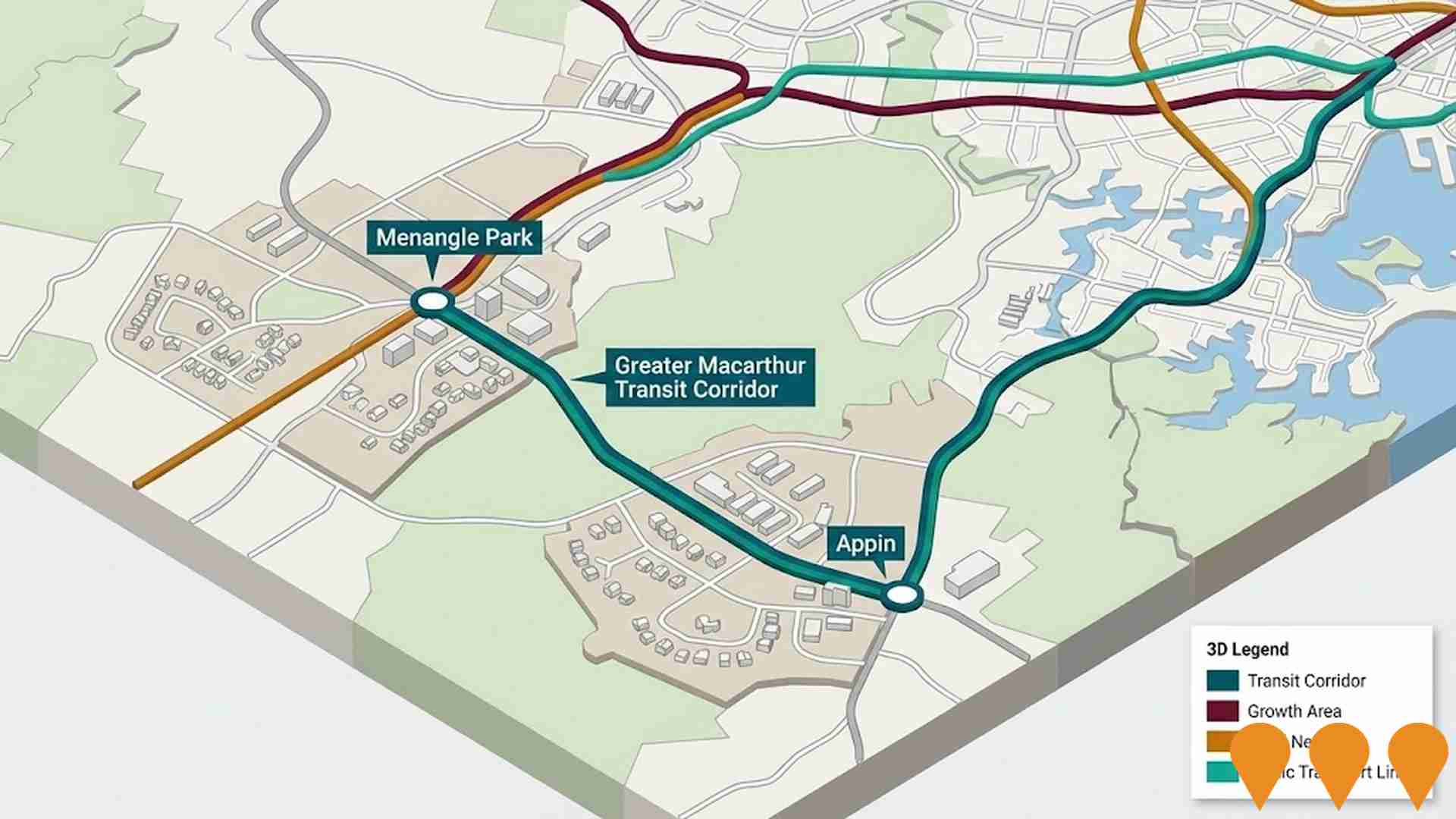

AreaSearch has identified 38 projects that could impact the area significantly. Key among these are Greater Macarthur Growth Area, Ambarvale Place Masterplan & Redevelopment, Kerridge Release Area (Ambarvale South), and Spring Farm Parkway Stage 1. The following list details those likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

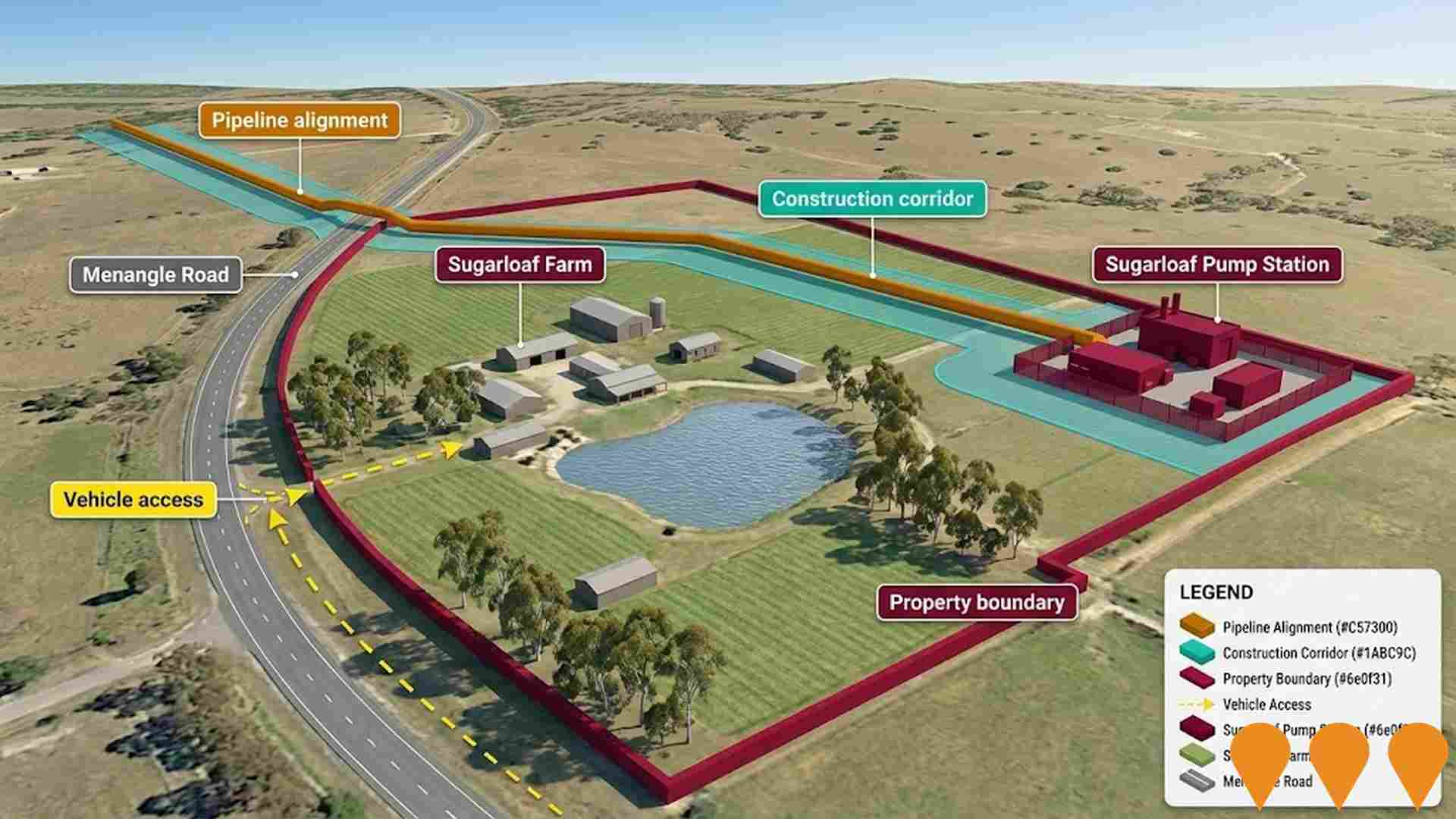

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Greater Macarthur Growth Area

The Greater Macarthur Growth Area is one of NSW's priority growth areas, encompassing the Glenfield to Macarthur urban renewal corridor and new land release precincts at Gilead, Appin and West Appin. It is planned to deliver approximately 58,000 new homes and support around 40,000 new jobs over the next 20-30 years, with planning and infrastructure coordination and environmental conservation ongoing.

Western Sydney University Campbelltown Campus Vertical Expansion

Major vertical expansion of WSU Campbelltown Campus including the new Lang Walker AO Medical Research Building (medical school and advanced research facilities), a 9-level Clinical Training and Simulation Tower, new student accommodation, and associated health/education precinct upgrades to support Western Sydney's growing healthcare workforce training and research.

Menangle Park Master Planned Community

Large-scale master-planned community in Sydney's South West Growth Area delivering approximately 5,500 new homes, a future town centre, neighbourhood centres, schools, over 100 hectares of open space including sports fields and riparian corridors, employment lands and integrated transport networks.

Australian Botanic Garden Mount Annan Masterplan

A $203.7 million transformation of Australia's largest botanic garden featuring a new Coolamon Lake precinct shaped like a traditional coolamon vessel, world-class biodome greenhouses showcasing Australian native flora, First Nations Garden with cultural awareness programs, native farm, accommodation facilities, over 10 kilometers of new walking and cycling trails, entertainment and event spaces, research and science facilities including expansion of the Australian PlantBank and National Herbarium, and ecotourism facilities. The masterplan designed by McGregor Coxall aims to restore Dharawal Country, regenerate endangered Cumberland Plain vegetation, and establish one of the world's leading sustainable scientific gardens while providing essential green space for Western Sydney's growing population.

Gilead Stage Two

Lendlease's 495ha State Assessed Planning Proposal to transform a site within the Greater Macarthur Growth Area to deliver up to 3,300 new homes, a new school, town centre, and public open space over 10-15 years. The rezoning has been finalised, with 50% of the site (247.8ha) zoned as protected environmental land, including 230ha of mapped koala corridors. The potential development of 3,300 dwellings is approved, with 600 dwelling lots unlocked now, pending adoption of a Precinct Structure Plan and Development Control Plan, and a further 2,700 lots conditional on delivery of necessary infrastructure such as wastewater servicing. Upgrades to Appin Road including koala underpasses are also committed by the proponent.

Spring Farm Riverside Estate

Spring Farm Riverside comprises 1,100 residential lots carefully planned around the Nepean River and existing 10-hectare Springs Lake. The development includes boardwalks, parks, BBQ areas, playgrounds, 185 hectares of bike paths and walkways, picnic areas by the water's edge, and blocks ranging from 390m2 to 800m2 with premium lakeside and riverside positions.

Spring Farm Parkway Stage 1

Four-lane divided road extending approximately one kilometre connecting Menangle Road to the Hume Motorway with city-facing on and off ramps. Stage 1 provides improved access to Spring Farm, Elderslie, and Menangle Park communities, reducing travel times by up to 15 minutes and diverting traffic from local roads. The project includes an interchange over the Hume Motorway connecting to the Menangle Park Urban Release Area.

Evergreen Estate Spring Farm

AVJennings' Evergreen Estate offers contemporary residential living with modern 3, 4 & 5 bedroom turnkey homes. Located 1km from Spring Farm Public School, 3km to Narellan Town Centre, 4km to Camden Town Centre, and 15 minutes to Macarthur Square Shopping Centre & Train Station. Features spacious layouts with stylish finishes perfect for modern living.

Employment

Rosemeadow - Glen Alpine shows employment indicators that trail behind approximately 70% of regions assessed across Australia

Rosemeadow-Glen Alpine has a skilled workforce with diverse sector representation. The unemployment rate in the area was 6.2% as of September 2025.

This represents an estimated employment growth of 5.9% over the past year. As of that date, there were 10,771 residents employed while the unemployment rate was 2.1% higher than Greater Sydney's rate of 4.2%. Workforce participation in Rosemeadow-Glen Alpine lagged significantly at 53.4%, compared to Greater Sydney's 60.0%. The leading employment industries among Rosemeadow-Glen Alpine residents are health care & social assistance, retail trade, and manufacturing.

The area shows strong specialization in manufacturing, with an employment share of 1.7 times the regional level. However, professional & technical services have limited presence, with only 4.9% employment compared to the regional average of 11.5%. Employment opportunities locally appear limited, as indicated by the comparison between Census working population and resident population. Between September 2024 and September 2025, employment increased by 5.9%, while labour force increased by 5.5%. This resulted in a decrease of unemployment by 0.3 percentage points. In contrast, Greater Sydney recorded employment growth of 2.1% over the same period, with labour force growth of 2.4% and an increase in unemployment by 0.2 percentage points. Providing broader context, state-level data from NSW to November 25 shows employment contracted by 0.03%, losing 2,260 jobs. The state unemployment rate was at 3.9%, which compares favourably with the national unemployment rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 offer insight into potential future demand within Rosemeadow-Glen Alpine. National employment is forecast to expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Rosemeadow-Glen Alpine's employment mix suggests local employment should increase by 6.2% over five years and 13.0% over ten years, though this is a simple weighting extrapolation for illustrative purposes and does not take into account localised population projections.

Frequently Asked Questions - Employment

Income

The area's income profile falls below national averages based on AreaSearch analysis

Rosemeadow - Glen Alpine SA2 had a lower than average income level nationally according to ATO data aggregated by AreaSearch for financial year 2022. Its median income among taxpayers was $49,770 and the average income stood at $57,121. In comparison, Greater Sydney's figures were $56,994 and $80,856 respectively. Based on Wage Price Index growth of 12.61% since financial year 2022, current estimates would be approximately $56,046 (median) and $64,324 (average) as of September 2025. Census data reveals household income ranks at the 45th percentile ($1,663 weekly), while personal income sits at the 27th percentile. Distribution data shows that 33.9% of the community (8,316 individuals) fall within the $1,500 - 2,999 earnings band, mirroring the region where 30.9% occupy this bracket. Housing affordability pressures are severe, with only 82.2% of income remaining, ranking at the 44th percentile. The area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Rosemeadow - Glen Alpine is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Rosemeadow-Glen Alpine's dwelling structure, as per the latest Census, comprised 83.1% houses and 16.9% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Sydney metro's 78.5% houses and 21.5% other dwellings. Home ownership in Rosemeadow-Glen Alpine was at 28.6%, with the rest either mortgaged (39.1%) or rented (32.3%). The median monthly mortgage repayment was $1,950, below Sydney metro's $2,100. Median weekly rent was $370, compared to Sydney metro's $380. Nationally, Rosemeadow-Glen Alpine's mortgage repayments were higher at $1,950 than the Australian average of $1,863, while rents were lower at $370 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Rosemeadow - Glen Alpine features high concentrations of family households, with a fairly typical median household size

Family households constitute 80.5% of all households, including 36.5% that are couples with children, 24.5% that are couples without children, and 18.0% that are single parent families. Non-family households comprise the remaining 19.5%, with lone person households at 17.7% and group households comprising 1.9% of the total. The median household size is 2.9 people, which aligns with the Greater Sydney average.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Rosemeadow - Glen Alpine fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 17.6%, significantly lower than Greater Sydney's average of 38.0%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 12.4%, followed by postgraduate qualifications (3.7%) and graduate diplomas (1.5%). Trade and technical skills are prominent, with 36.5% of residents aged 15+ holding vocational credentials - advanced diplomas (10.5%) and certificates (26.0%).

Educational participation is high, with 31.3% of residents currently enrolled in formal education. This includes 11.3% in primary education, 9.4% in secondary education, and 4.4% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Rosemeadow-Glen Alpine has 136 active public transport stops. These include a mix of train and bus services. There are 61 individual routes operating in total, providing 4,092 weekly passenger trips collectively.

The area's transport accessibility is rated excellent, with residents typically located 183 meters from the nearest stop. On average, there are 584 trips per day across all routes, which equates to approximately 30 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Rosemeadow - Glen Alpine is lower than average with common health conditions somewhat prevalent across the board, though to a slightly higher degree among older age cohorts

Rosemeadow - Glen Alpine faces significant health challenges with common health conditions somewhat prevalent across all age groups but slightly more so among older cohorts. Approximately 48% of the total population (~11,849 people) have private health cover, lower than the national average of 55.3%.

The most common medical conditions are arthritis and asthma, affecting 9.2% and 9.0% of residents respectively. However, 65.4% of residents report having no medical ailments, compared to 70.3% across Greater Sydney. As of the 2016 Census, 18.0% of residents are aged 65 and over (4,423 people), higher than the 14.4% in Greater Sydney. Health outcomes among seniors require more attention due to these challenges.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Rosemeadow - Glen Alpine was found to be above average when compared nationally for a number of language and cultural background related metrics

Rosemeadow-Glen Alpine, surveyed in 2016, had a higher cultural diversity than most local areas: 27.7% of its population was born overseas and 24.8% spoke languages other than English at home. Christianity dominated Rosemeadow-Glen Alpine's religious landscape with 60.0%, compared to Greater Sydney's 51.8%. In terms of ancestry, Australians made up 24.1%, English 22.1%, and Other groups 15.2% - lower than the regional average of 21.6%.

Notably, Samoan (1.9%), Spanish (0.8%) and Lebanese (1.4%) populations were also different from regional averages of 2.4%, 0.7% and 1.9% respectively.

Frequently Asked Questions - Diversity

Age

Rosemeadow - Glen Alpine's population is slightly younger than the national pattern

Rosemeadow-Glen Alpine has a median age of 37, matching Greater Sydney's figure and remaining comparable to Australia's median age of 38 years. The 65-74 age group is strongly represented at 10.8%, higher than Greater Sydney's percentage, while the 25-34 cohort is less prevalent at 12.0%. Between 2021 and the present day, the 75 to 84 age group has grown from 4.6% to 6.0% of the population, and the 15 to 24 cohort has increased from 13.3% to 14.3%. Conversely, the 55 to 64 cohort has declined from 13.1% to 11.5%. By 2041, demographic projections indicate significant shifts in Rosemeadow-Glen Alpine's age structure, with the 45 to 54 group expected to grow by 106%, reaching 5,598 people from its current total of 2,718.