Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Spring Farm lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch, as of Nov 2025, Spring Farm's population is estimated at around 11,952. This reflects an increase of 2,084 people (21.1%) since the 2021 Census, which reported a population of 9,868 people. The change is inferred from the resident population of 11,734, estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024, and an additional 231 validated new addresses since the Census date. This level of population equates to a density ratio of 1,879 persons per square kilometer, which is above the average seen across national locations assessed by AreaSearch. Spring Farm's 21.1% growth since the 2021 census exceeded the SA3 area (6.9%), along with the state, marking it as a growth leader in the region. Population growth for the area was primarily driven by natural growth that contributed approximately 45.0% of overall population gains during recent periods, although all drivers including interstate migration and overseas migration were positive factors.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, AreaSearch is utilising the NSW State Government's SA2 level projections, as released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are also applied to all areas for years 2032 to 2041. As we examine future population trends, an above median population growth of national areas is projected, with the area expected to grow by 2,417 persons to 2041 based on aggregated SA2-level projections, reflecting a gain of 18.2% in total over the 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Spring Farm was found to be higher than 90% of real estate markets across the country

Based on AreaSearch analysis using ABS building approval numbers from statistical area data, Spring Farm has experienced around 117 dwellings receiving development approval each year. Over the past five financial years, between FY21 and FY25, approximately 587 homes were approved, with a further 14 approved so far in FY26. On average, 6.7 people have moved to the area for each dwelling built over these five years, indicating significant demand exceeding new supply.

New dwellings are developed at an average expected construction cost value of $354,000. In FY26, $511,000 in commercial development approvals have been recorded, suggesting a predominantly residential focus compared to other developments. Spring Farm shows 190.0% higher new home approvals per person than Greater Sydney, offering buyers greater choice but with recent construction activity easing. This high level of developer confidence is also significantly higher than the national average. Recent construction comprises 77.0% detached houses and 23.0% townhouses or apartments, maintaining Spring Farm's traditional suburban character focused on family homes appealing to those seeking space. This marks a significant departure from existing housing patterns, which are currently 94.0% houses, suggesting diminishing developable land availability and responding to evolving lifestyle preferences and housing affordability needs.

The location has approximately 175 people per dwelling approval, indicating an expanding market. Looking ahead, Spring Farm is expected to grow by 2,176 residents through to 2041, according to the latest AreaSearch quarterly estimate. With current construction levels, housing supply should adequately meet demand, creating favourable conditions for buyers while potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Spring Farm has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

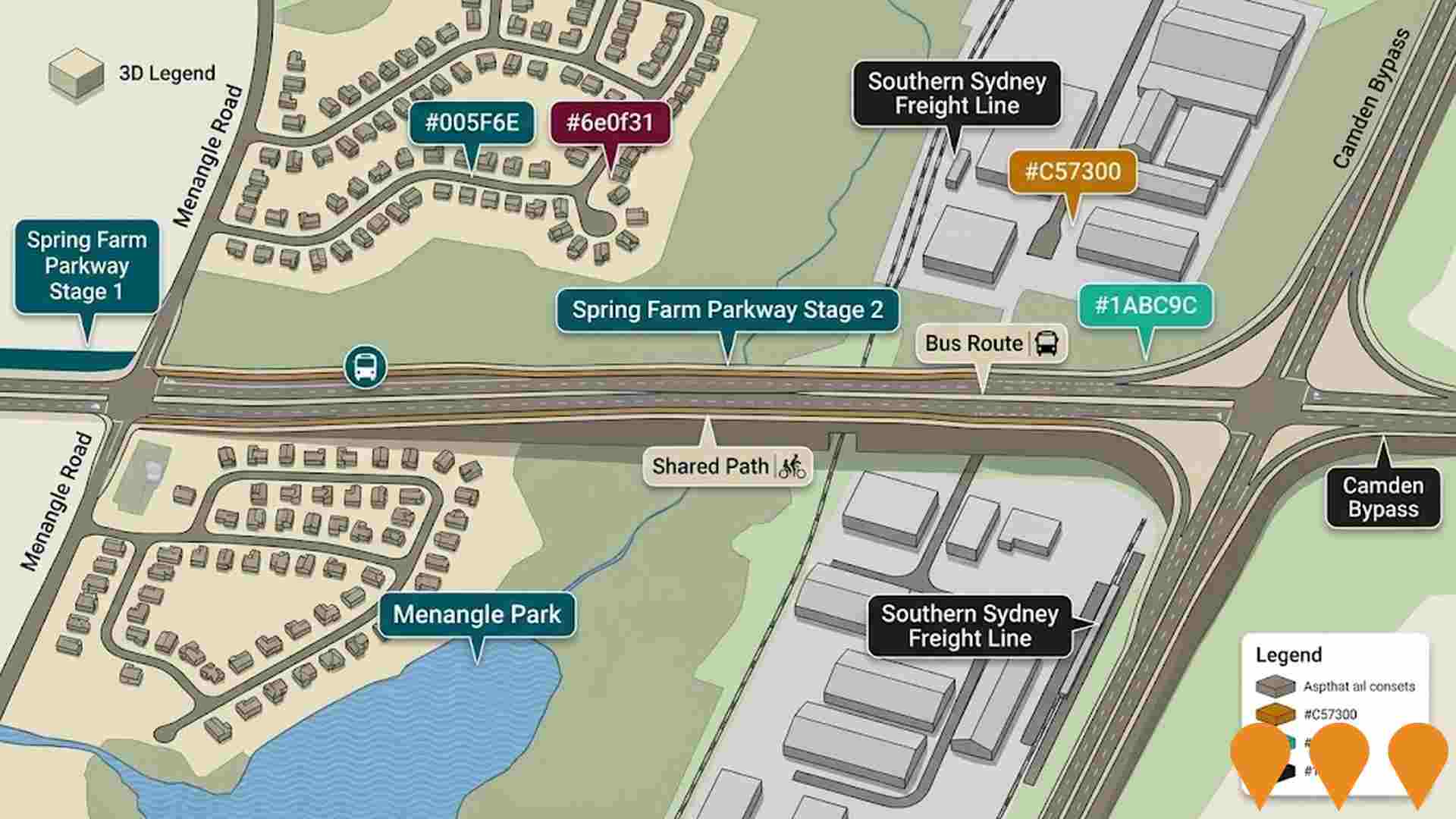

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified 10 projects likely to impact the area. Key projects include Evergreen Spring Farm, Springs Road/Macarthur Roundabout Upgrade, Elderslie Estate by Mirvac, and Spring Farm Riverside. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Australian Botanic Garden Mount Annan Masterplan

A $204 million transformation of Australia's largest botanic garden. The masterplan, designed by McGregor Coxall, includes a new Coolamon Lake precinct, world-class biodome greenhouses for native flora, a First Nations Garden, and a native farm. It features over 10km of new walking and cycling trails, accommodation facilities, and a botanical research and innovation cluster expanding the Australian PlantBank and National Herbarium of NSW. The project aims to restore Dharawal Country and regenerate endangered Cumberland Plain vegetation while creating a globally significant destination.

Elderslie Village Centre

The Elderslie Village Centre is a proposed neighbourhood retail hub located at the corner of Lodges Road and Hilder Street. The project is designed to serve the Elderslie Urban Release Area with a maximum gross floor area of 2,500m2 for business and retail premises, including a supermarket, specialty shops, and medical facilities. As of late 2025, the project remains in the planning phase as Camden Council requires a separate masterplan for the E1 Local Centre to be approved before any specific Development Applications (DA) for the buildings can be considered. The centre is intended to be a vibrant focal point with a civic square or plaza, potentially incorporating shop-top housing and community facilities.

Spring Farm Riverside

A flagship masterplanned community comprising 1,100 residential lots alongside the Nepean River, featuring elevated positions with views over Springs Lake and Razorback Mountain. The precinct includes 185 hectares of parklands with boardwalks, BBQ areas, playgrounds, and 24km of bike paths and walkways. Located 5 minutes from Camden and 60 minutes from Sydney CBD, the development offers modern living surrounded by nature with access to local amenities including Woolworths supermarket, Spring Farm Public Primary School, and recreational facilities.

Narellan Road Upgrade

A $152 million, 6.8km upgrade of Narellan Road between Camden Valley Way, Narellan and Blaxland Road, Campbelltown. The project upgraded the road to six lanes divided with three lanes in each direction, improved intersections, installed traffic management systems, and added shared pedestrian/cyclist paths. Jointly funded by the Australian and NSW governments to reduce congestion, improve safety and travel times in this key transport corridor servicing south-western Sydney.

Camden Community Nursery

A community nursery and gardening facility focused on environmental sustainability, offering native plant propagation, educational programs, and community workshops to promote local biodiversity and engagement.

Studley Park House Redevelopment

Adaptive reuse of the state-heritage Studley Park House as a 5-room boutique hotel and function spaces, plus a new connected 44-key hotel building and four residential flat buildings (148 apartments). Works include remediation, demolition of dilapidated defence structures, new road access, landscaping, civil infrastructure and Community Title subdivision.

Outer Sydney Metropolitan Correctional Precinct

NSW Government concept for a new correctional precinct to address metropolitan prison capacity. A previously examined option in Wollondilly (south-west Sydney) was ruled out by the government in 2018 following site investigations and community opposition. Subsequent government materials and media reporting indicate the state has continued assessing metropolitan capacity solutions and alternative precinct locations (including areas around Greater Parramatta/Camellia), but as of August 2025 no confirmed site, scope or delivery timeline has been announced. The project therefore remains an uncommitted concept under assessment rather than an approved build.

Mount Annan Christian College Expansion

Multi-phase campus expansion including demolition of existing buildings, tree removal, and staged construction of new single and multi-storey general learning areas. The masterplan aims to increase student capacity from 850 to 1,410 students. Block B (Kindergarten to Year 2 facilities) was completed in September 2023, with additional learning areas under construction. The development includes new classrooms, learning streets, car park reconfiguration, and associated site works across the 37-acre semi-rural campus.

Employment

The exceptional employment performance in Spring Farm places it among Australia's strongest labour markets

Spring Farm has a skilled workforce with an unemployment rate of 1.8% as of September 2025. Employment growth over the past year was estimated at 5.9%.

The unemployment rate is below Greater Sydney's rate of 4.2%, and workforce participation is higher at 77.7%. Dominant employment sectors include health care & social assistance, construction, and retail trade. Construction has notably high representation with levels at 1.5 times the regional average. Conversely, professional & technical services show lower representation at 4.2% compared to the regional average of 11.5%.

Employment opportunities locally may be limited as indicated by Census data comparing working population to resident population. Over the 12 months to September 2025, employment increased by 5.9%, while labour force increased by 6.1%, causing unemployment to rise by 0.1 percentage points. Greater Sydney recorded employment growth of 2.1% during this period. State-level data from NSW to 25-Nov shows employment contracted by 0.03%, with the state unemployment rate at 3.9%. National employment forecasts from May-25 suggest national employment will expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Spring Farm's employment mix, local employment is estimated to increase by 6.3% over five years and 13.1% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data released for financial year 2023 shows Spring Farm's median income among taxpayers is $66,710. The average income in Spring Farm is $81,711. This places it among the highest incomes in Australia. Comparing to Greater Sydney's median of $60,817 and average of $83,003 shows Spring Farm has higher incomes. Based on Wage Price Index growth of 8.86% since financial year 2023, current estimates for September 2025 would be approximately $72,621 (median) and $88,951 (average). Census data reveals household, family and personal incomes rank highly in Spring Farm, between the 86th and 87th percentiles nationally. The largest segment comprises 46.0% earning $1,500 - $2,999 weekly, with 5,497 residents falling into this category. This aligns with the surrounding region where this cohort represents 30.9%. Economic strength is evident through 31.1% of households achieving high weekly earnings exceeding $3,000. High housing costs consume 20.7% of income. Despite this, strong earnings place disposable income at the 80th percentile. The area's SEIFA income ranking places it in the 7th decile.

Frequently Asked Questions - Income

Housing

Spring Farm is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

The dwelling structure in Spring Farm, as per the latest Census, consisted of 93.9% houses and 6.1% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Sydney metro had 92.7% houses and 7.3% other dwellings. The home ownership level in Spring Farm was at 10.7%, with the rest being mortgaged (63.1%) or rented (26.2%). The median monthly mortgage repayment in Spring Farm was $2,500, higher than Sydney metro's average of $2,383. The median weekly rent figure for Spring Farm was $510, compared to Sydney metro's $480. Nationally, Spring Farm's mortgage repayments were significantly higher than the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Spring Farm features high concentrations of family households, with a fairly typical median household size

Family households make up 86.3% of all households, including 48.5% couples with children, 24.3% couples without children, and 12.8% single parent families. Non-family households constitute the remaining 13.7%, with lone person households at 11.8% and group households comprising 1.7%. The median household size is 3.0 people, which aligns with the Greater Sydney average.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Spring Farm aligns closely with national averages, showing typical qualification patterns and performance metrics

The area's university qualification rate is 23.0%, significantly lower than Greater Sydney's average of 38.0%. Bachelor degrees are the most common at 15.8%, followed by postgraduate qualifications (5.2%) and graduate diplomas (2.0%). Vocational credentials are prevalent, with 42.5% of residents aged 15+ holding them, including advanced diplomas (12.9%) and certificates (29.6%). Educational participation is high, with 31.1% currently enrolled in formal education: 12.3% in primary, 6.3% in secondary, and 3.8% in tertiary education.

Educational participation is notably high, with 31.1% of residents currently enrolled in formal education. This includes 12.3% in primary education, 6.3% in secondary education, and 3.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 34 active transport stops in Spring Farm, consisting of bus services. These stops are served by 10 different routes, offering a total of 462 weekly passenger trips. Transport accessibility is rated good, with residents typically located 258 meters from the nearest stop.

Service frequency averages 66 trips per day across all routes, equating to approximately 13 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Spring Farm's residents boast exceedingly positive health performance metrics with both young and old age cohorts seeing low prevalence of common health conditions

Spring Farm's health outcomes data shows excellent results with both younger and older age groups experiencing low prevalence of common health conditions. The area has a notably high private health cover rate at approximately 59% of its total population (7,074 people), compared to Greater Sydney's 56.7%.

The most prevalent medical conditions are asthma and mental health issues, affecting 8.3 and 7.9% of residents respectively. Notably, 76.4% of residents report being completely free from medical ailments, higher than the 71.6% reported across Greater Sydney. As of Spring Farm's population data dated 2021-03-31, 6.8% of residents are aged 65 and over (812 people), which is lower than Greater Sydney's 12.9%. However, health outcomes among seniors in the area require more attention than those of the broader population.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Spring Farm records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Spring Farm's cultural diversity was above average, with 17.4% of its population born overseas and 15.9% speaking a language other than English at home. Christianity was the predominant religion in Spring Farm, making up 56.2% of people, compared to 64.3% across Greater Sydney. The top three ancestry groups were Australian (28.3%), English (23.6%), and Other (11.3%).

Notably, Spanish (0.9%) and Maltese (1.8%) were proportionally equal or higher in Spring Farm compared to the regional averages of 0.6% and 1.8%, respectively. Hungarian representation was also slightly higher at 0.4%.

Frequently Asked Questions - Diversity

Age

Spring Farm hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Spring Farm's median age in 2021 was 31 years, which is lower than Greater Sydney's average of 37 years and Australia's median of 38 years. Compared to Greater Sydney, Spring Farm had a higher percentage of residents aged 0-4 (11.2%) but fewer residents aged 55-64 (6.5%). This figure for the 0-4 age group was significantly higher than the national average of 5.7%. Between 2021 and present, the population aged 35-44 grew from 17.1% to 19.1%, while the 25-34 cohort decreased from 23.0% to 19.8% and the 0-4 group dropped from 12.9% to 11.2%. By 2041, demographic projections suggest significant changes in Spring Farm's age profile. The 55-64 age cohort is expected to increase substantially, growing by 904 people (116%) from 776 to 1,681. Conversely, the 5-14 and 0-4 age groups are projected to experience population declines.