Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Glen Alpine reveals an overall ranking slightly below national averages considering recent, and medium term trends

As of Nov 2025, Glen Alpine's population is estimated at around 4,572, reflecting an increase of 143 people since the 2021 Census. This increase represents a growth rate of approximately 3.2%. The change is inferred from AreaSearch's estimation of the resident population as 4,456 in June 2024, based on examination of the latest ERP data release by the ABS, and an additional 6 validated new addresses since the Census date. This level of population results in a density ratio of 853 persons per square kilometer, which is relatively in line with averages seen across locations assessed by AreaSearch. Overseas migration contributed approximately 56% of overall population gains during recent periods, primarily driving growth for the area.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in Jun 2024 with 2022 as the base year. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections, released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Considering projected demographic shifts, exceptional growth is predicted for Glen Alpine (SA2), placing it in the top 10 percent of statistical areas analysed by AreaSearch. By 2041, the area is expected to grow by approximately 4,398 persons, reflecting a gain of around 97.1% over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Glen Alpine according to AreaSearch's national comparison of local real estate markets

Based on AreaSearch analysis of ABS building approval numbers, Glen Alpine has experienced around 5 dwellings receiving development approval each year. Between FY21 and FY25, approximately 29 homes were approved, with an additional 11 so far in FY26. On average, 4.7 new residents arrive per year per dwelling constructed during this period.

This indicates demand significantly exceeds supply, typically leading to price growth and increased buyer competition. The average construction cost of new dwellings is $417,000, slightly above the regional average. In FY26, commercial development approvals totaled $349,000, suggesting a predominantly residential focus. Compared to Greater Sydney, Glen Alpine has significantly less development activity, 80.0% below the regional average per person. This scarcity of new homes can strengthen demand and prices for existing properties. However, recent periods have seen an increase in development activity.

Nationally, this is also below average, reflecting the area's maturity and possible planning constraints. New development consists of 71.0% standalone homes and 29.0% medium to high-density housing, maintaining Glen Alpine's traditional low density character with a focus on family homes appealing to those seeking space. This shows a considerable change from the current housing mix, which is currently 98.0% houses, reflecting reduced availability of development sites and addressing shifting lifestyle demands and affordability requirements. The estimated count of 569 people in the area per dwelling approval reflects its quiet, low activity development environment. Looking ahead, Glen Alpine is expected to grow by 4,439 residents through to 2041, according to the latest AreaSearch quarterly estimate. If current development rates continue, housing supply may not keep pace with population growth, potentially increasing competition among buyers and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Glen Alpine has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified nine projects that could impact this region. Notable ones include Greater Macarthur Growth Area, Ambarvale Place Masterplan & Redevelopment, Spring Farm Riverside Estate, and Spring Farm Parkway Stage 1. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

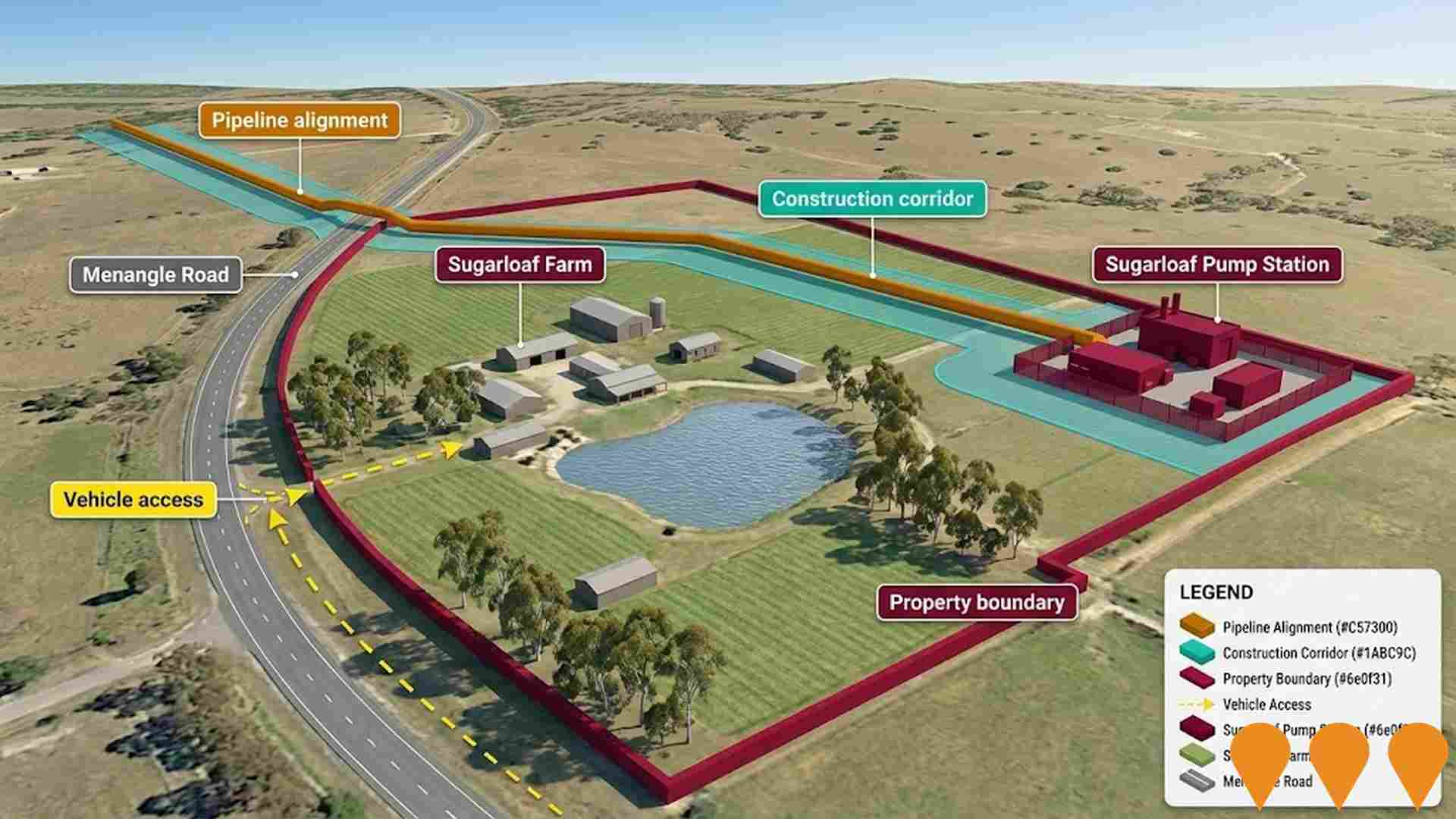

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

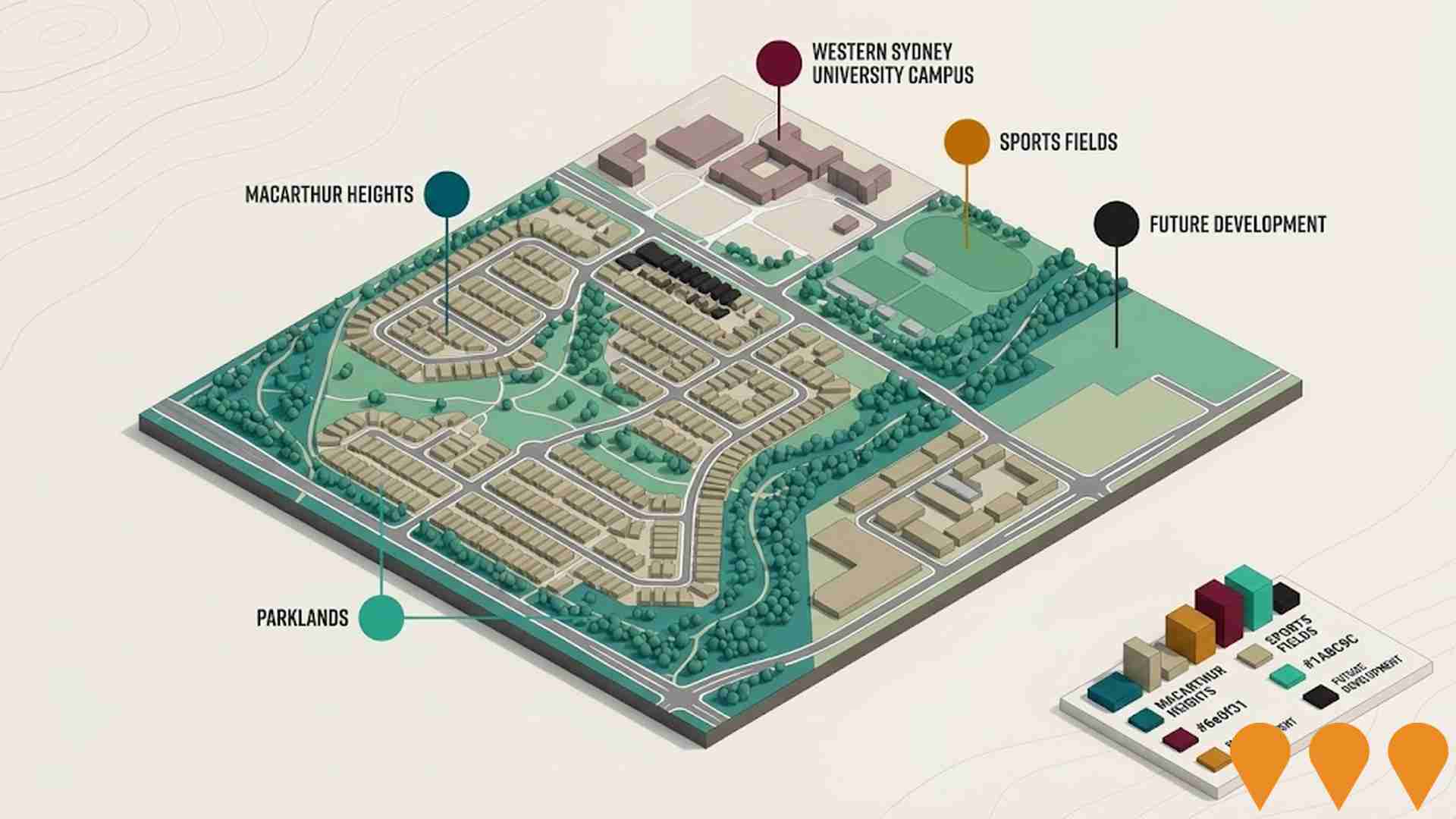

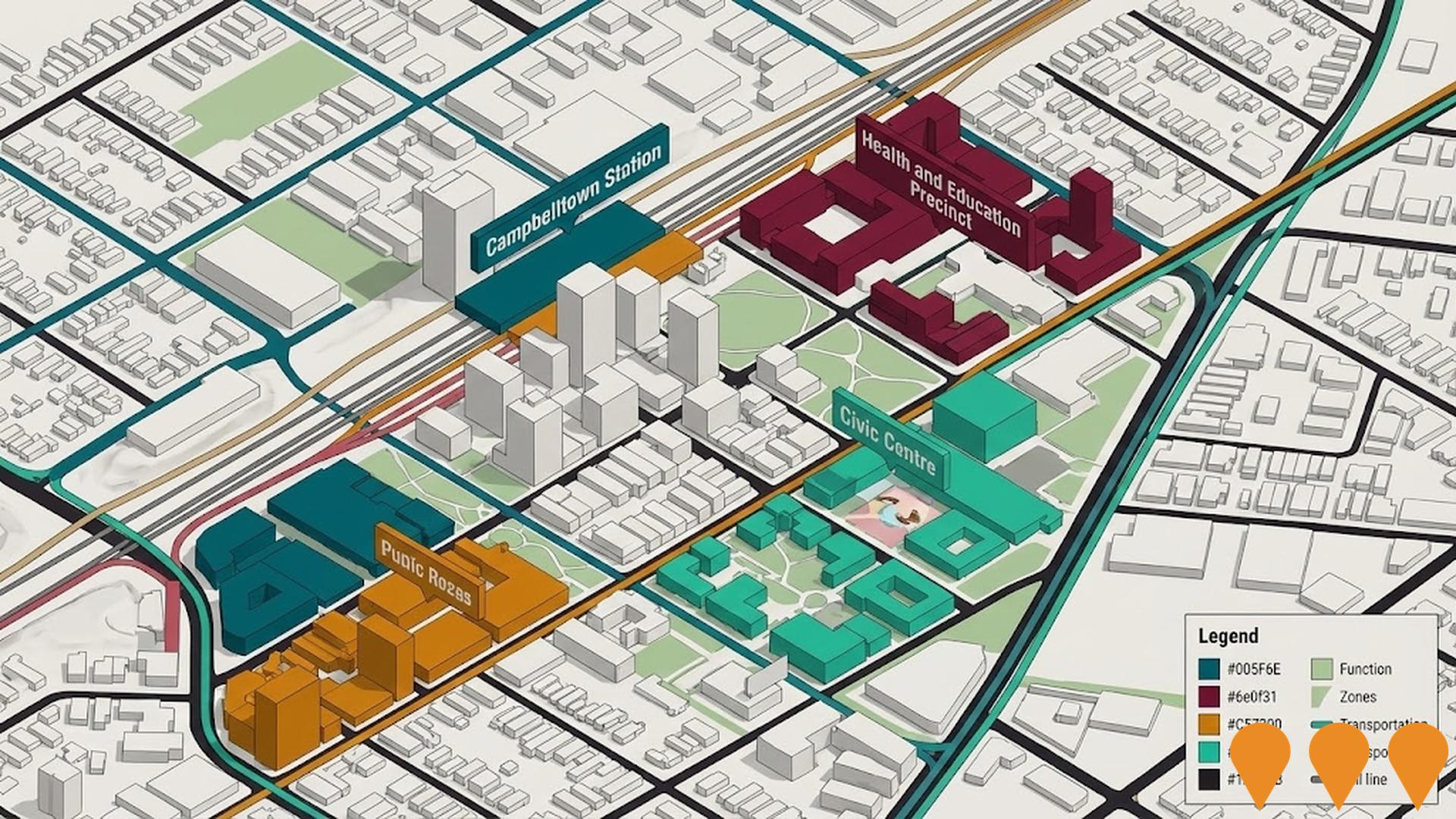

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Greater Macarthur Growth Area

The Greater Macarthur Growth Area is a state-led strategic initiative planned to deliver 58,000 new homes and 40,000 jobs over 30 years. It consists of the Glenfield to Macarthur urban renewal corridor and major land releases in Gilead and Appin. As of 2026, major earthworks are commencing at Glenfield, while development in the Appin (Part) Precinct is currently capped at 2,499 dwellings pending significant infrastructure upgrades for water, wastewater, and transport. The project includes the creation of the Warranmadhaa National Park to protect critical koala corridors.

Australian Botanic Garden Mount Annan Masterplan

A $204 million transformation of Australia's largest botanic garden. The masterplan, designed by McGregor Coxall, includes a new Coolamon Lake precinct, world-class biodome greenhouses for native flora, a First Nations Garden, and a native farm. It features over 10km of new walking and cycling trails, accommodation facilities, and a botanical research and innovation cluster expanding the Australian PlantBank and National Herbarium of NSW. The project aims to restore Dharawal Country and regenerate endangered Cumberland Plain vegetation while creating a globally significant destination.

Western Sydney University Campbelltown Campus Vertical Expansion

Major vertical expansion of WSU Campbelltown Campus centered on the Campbelltown Health and Education Precinct. The center-piece is the $55 million Lang Walker AO Medical Research Building, which officially opened in December 2025 as a hub for the Ingham Institute for Applied Medical Research. The broader expansion includes a 9-level Clinical Training and Simulation Tower, new student accommodation, and upgraded facilities to support the healthcare workforce in Western Sydney.

Menangle Park Master Planned Community

A premier master-planned community in Sydneys South West Growth Area across 498 hectares. It is delivering upwards of 5,250 new homes, a major town centre, employment lands, schools, and over 140 hectares of open space, including the newly opened Hilltop Park and riparian corridors. The project features significant infrastructure works including the completed Stage 1 of the Spring Farm Parkway connection to the Hume Motorway.

Spring Farm Riverside Estate

Spring Farm Riverside comprises 1,100 residential lots carefully planned around the Nepean River and existing 10-hectare Springs Lake. The development includes boardwalks, parks, BBQ areas, playgrounds, 185 hectares of bike paths and walkways, picnic areas by the water's edge, and blocks ranging from 390m2 to 800m2 with premium lakeside and riverside positions.

Campbelltown City Centre Design Framework

McGregor Coxall-led transformative masterplan for Campbelltown-Macarthur CBD commissioned by Campbelltown City Council with $2.62 million in NSW Government funding. The framework envisions a vibrant, sustainable city centre with mixed-use development, enhanced public spaces, improved connectivity, and integration with surrounding communities to position Campbelltown as a major regional centre. The masterplan includes three major precincts: Campbelltown Station, Health and Education, and Civic Centre, with 3D Digital Twin capabilities for urban planning.

Spring Farm Parkway Stage 1

Four-lane divided road extending approximately one kilometre connecting Menangle Road to the Hume Motorway with city-facing on and off ramps. Stage 1 provides improved access to Spring Farm, Elderslie, and Menangle Park communities, reducing travel times by up to 15 minutes and diverting traffic from local roads. The project includes an interchange over the Hume Motorway connecting to the Menangle Park Urban Release Area.

Evergreen Estate Spring Farm

AVJennings' Evergreen Estate offers contemporary residential living with modern 3, 4 & 5 bedroom turnkey homes. Located 1km from Spring Farm Public School, 3km to Narellan Town Centre, 4km to Camden Town Centre, and 15 minutes to Macarthur Square Shopping Centre & Train Station. Features spacious layouts with stylish finishes perfect for modern living.

Employment

The employment environment in Glen Alpine shows above-average strength when compared nationally

Glen Alpine has a skilled workforce with essential services sectors well represented. Its unemployment rate was 3.7% in the past year, with an estimated employment growth of 6.0%.

As of September 2025, 2,628 residents are employed, with an unemployment rate of 0.5% below Greater Sydney's rate of 4.2%, and workforce participation at 62.2%. Key industries include health care & social assistance, education & training, and construction. Education & training is particularly specialized, with a share 1.3 times the regional level. However, professional & technical services are under-represented, at 7.0% compared to Greater Sydney's 11.5%.

Employment opportunities locally appear limited based on Census data. In the past year, employment increased by 6.0%, labour force by 5.8%, reducing unemployment by 0.1 percentage points. By comparison, Greater Sydney had employment growth of 2.1% and unemployment rose by 0.2 percentage points. State-level data to 25-Nov-25 shows NSW employment contracted by 0.03%, with an unemployment rate of 3.9%. National forecasts from May-25 project national employment growth at 6.6% over five years and 13.7% over ten years, but growth varies significantly between sectors. Applying these projections to Glen Alpine's employment mix suggests local employment should increase by 6.5% over five years and 13.5% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2023 shows that Glen Alpine has an above average income. The median income is $63,051 and the average is $72,364. This contrasts with Greater Sydney's figures of a median income of $60,817 and an average of $83,003. Based on Wage Price Index growth of 8.86% since financial year 2023, current estimates for Glen Alpine would be approximately $68,637 (median) and $78,775 (average) as of September 2025. From the 2021 Census, household incomes rank at the 93rd percentile ($2,669 weekly), while personal income ranks at the 64th percentile. The predominant income cohort spans 30.8% of locals (1,408 people) in the $1,500 - 2,999 category, consistent with broader trends across the metropolitan region showing 30.9% in the same category. Economic strength is evident through 44.0% of households achieving high weekly earnings exceeding $3,000, supporting elevated consumer spending. After housing costs, residents retain 88.8% of income, reflecting strong purchasing power and the area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Glen Alpine is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Dwelling structure in Glen Alpine, as evaluated at the latest Census, comprised 98.5% houses and 1.5% other dwellings. In comparison, Sydney metro had 78.5% houses and 21.5% other dwellings. Home ownership in Glen Alpine was 41.3%, with mortgaged dwellings at 50.5% and rented ones at 8.2%. The median monthly mortgage repayment was $2,167, higher than Sydney metro's $2,100. Median weekly rent in Glen Alpine was $570, compared to Sydney metro's $380. Nationally, Glen Alpine's mortgage repayments were significantly higher at $2,167 versus the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Glen Alpine features high concentrations of family households, with a higher-than-average median household size

Family households account for 91.1% of all households, including 49.4% couples with children, 31.3% couples without children, and 9.0% single parent families. Non-family households make up the remaining 8.9%, with lone person households at 8.1% and group households comprising 1.0%. The median household size is 3.2 people, larger than the Greater Sydney average of 2.9.

Frequently Asked Questions - Households

Local Schools & Education

Glen Alpine shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

The area's university qualification rate is 25.9%, significantly lower than Greater Sydney's average of 38.0%. Bachelor degrees are the most common at 17.1%, followed by postgraduate qualifications (6.5%) and graduate diplomas (2.3%). Vocational credentials are prevalent, with 34.7% of residents aged 15+ holding them, including advanced diplomas (11.9%) and certificates (22.8%). Educational participation is high, with 27.2% currently enrolled in formal education: 8.4% in secondary, 8.2% in primary, and 6.0% in tertiary education.

Educational participation is notably high, with 27.2% of residents currently enrolled in formal education. This includes 8.4% in secondary education, 8.2% in primary education, and 6.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 34 active public transport stops in Glen Alpine. These stops are served by buses only. There are 15 different routes operating, offering a total of 339 weekly passenger trips.

The average distance from residents to the nearest stop is 154 meters, indicating excellent accessibility. On average, there are 48 trips per day across all routes, which equates to approximately 9 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Glen Alpine is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

Glen Alpine demonstrates superior health outcomes for both younger and older age cohorts, with low prevalence of common health conditions. Approximately 56% (~2,538 people) have private health cover, higher than Greater Sydney's 50.5%.

The most prevalent medical conditions are arthritis (affecting 8.4%) and asthma (7.5%), while 70.0% report being completely free of medical ailments, similar to Greater Sydney's 70.3%. Glen Alpine has a higher proportion of seniors aged 65 and over at 18.5% (845 people), compared to Greater Sydney's 14.4%. Health outcomes among seniors are above average, mirroring the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Glen Alpine was found to be above average when compared nationally for a number of language and cultural background related metrics

Glen Alpine, surveyed in June 2016, had a higher overseas-born population at 28.3%, compared to most local markets. 23.5% spoke languages other than English at home. Christianity was the predominant religion, at 67.9%, slightly higher than Greater Sydney's 51.8%.

Ancestry showed Australian at 23.2%, English at 23.1%, and Other at 13.0%. Polish (1.4%), Serbian (0.9%), and Croatian (1.2%) groups were notably overrepresented compared to regional averages of 0.6%, 0.5%, and 0.7% respectively.

Frequently Asked Questions - Diversity

Age

Glen Alpine hosts a notably older demographic compared to the national average

The median age in Glen Alpine is 43 years, which is higher than Greater Sydney's average of 37 and the national average of 38. The age profile shows that those aged 55-64 are particularly prominent, making up 16.4% of the population, compared to 9.9% for the 25-34 group. This concentration of 55-64 year-olds is higher than the national average of 11.2%. Between 2021 and present, the 75-84 age group has grown from 3.6% to 4.9%, while the 15-24 cohort increased from 14.3% to 15.4%. Conversely, the 55-64 cohort has declined from 17.6% to 16.4%. Looking ahead to 2041, demographic projections show significant shifts in Glen Alpine's age structure, with the 45-54 age group projected to grow exceptionally, expanding by 755 people (128%) from 589 to 1,345.