Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Metung lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

As of November 2025, the estimated population for the Metung statistical area (Lv2) is around 2,139 people. This reflects an increase of 240 people since the 2021 Census, which reported a population of 1,899 people. The change is inferred from the resident population of 1,986 estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024 and an additional 60 validated new addresses since the Census date. This level of population equates to a density ratio of 77 persons per square kilometer. The Metung (SA2) experienced a growth rate of 12.6% since the 2021 census, exceeding the SA3 area's growth rate of 6.4%. Population growth was primarily driven by interstate migration contributing approximately 78.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered, AreaSearch utilises the VIC State Government's Regional/LGA projections released in 2023 with adjustments made employing a method of weighted aggregation of population growth from LGA to SA2 levels. Growth rates by age group are applied across all areas for years 2032 to 2041. Based on aggregated SA2-level projections, the Metung (SA2) is expected to grow by 600 persons to 2041, reflecting an increase of 17.6% in total over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is slightly higher than average within Metung when compared nationally

AreaSearch analysis of ABS building approval numbers in Metung shows around 18 residential properties granted approval annually. Over the past 5 financial years, from FY-21 to FY-25, approximately 94 homes were approved, with a further 7 approved so far in FY-26. On average, about 1.2 new residents per year arrived for each new home over these five years, indicating balanced supply and demand conditions. However, this has eased to 0.3 people per dwelling over the past two financial years, suggesting improved supply availability.

New properties are constructed at an average expected cost of $463,000, reflecting a focus on the premium market with high-end developments. In FY-26, $2.0 million in commercial approvals have been registered, highlighting Metung's residential nature. Compared to the Rest of Vic., Metung exhibits moderately higher construction activity, at 18.0% above the regional average per person over the past five years, offering good buyer choice while supporting existing property values.

All new constructions during this period comprised detached dwellings, maintaining Metung's traditional low-density character with a focus on family homes. With around 101 people per dwelling approval, Metung exhibits characteristics of a growth area. The latest AreaSearch quarterly estimate projects Metung to add 377 residents by 2041. Given current construction levels, housing supply is expected to adequately meet demand, creating favourable conditions for buyers and potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Metung has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

No changes can significantly affect a region's performance like alterations to local infrastructure, major projects, and planning initiatives. AreaSearch has identified zero projects that could potentially impact this area. Notable projects include Seadragon Offshore Wind Farm, Regional Housing Fund Gippsland, Gippsland Digital Infrastructure Upgrade, and Blue Mackerel North. The following list provides details on those projects most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

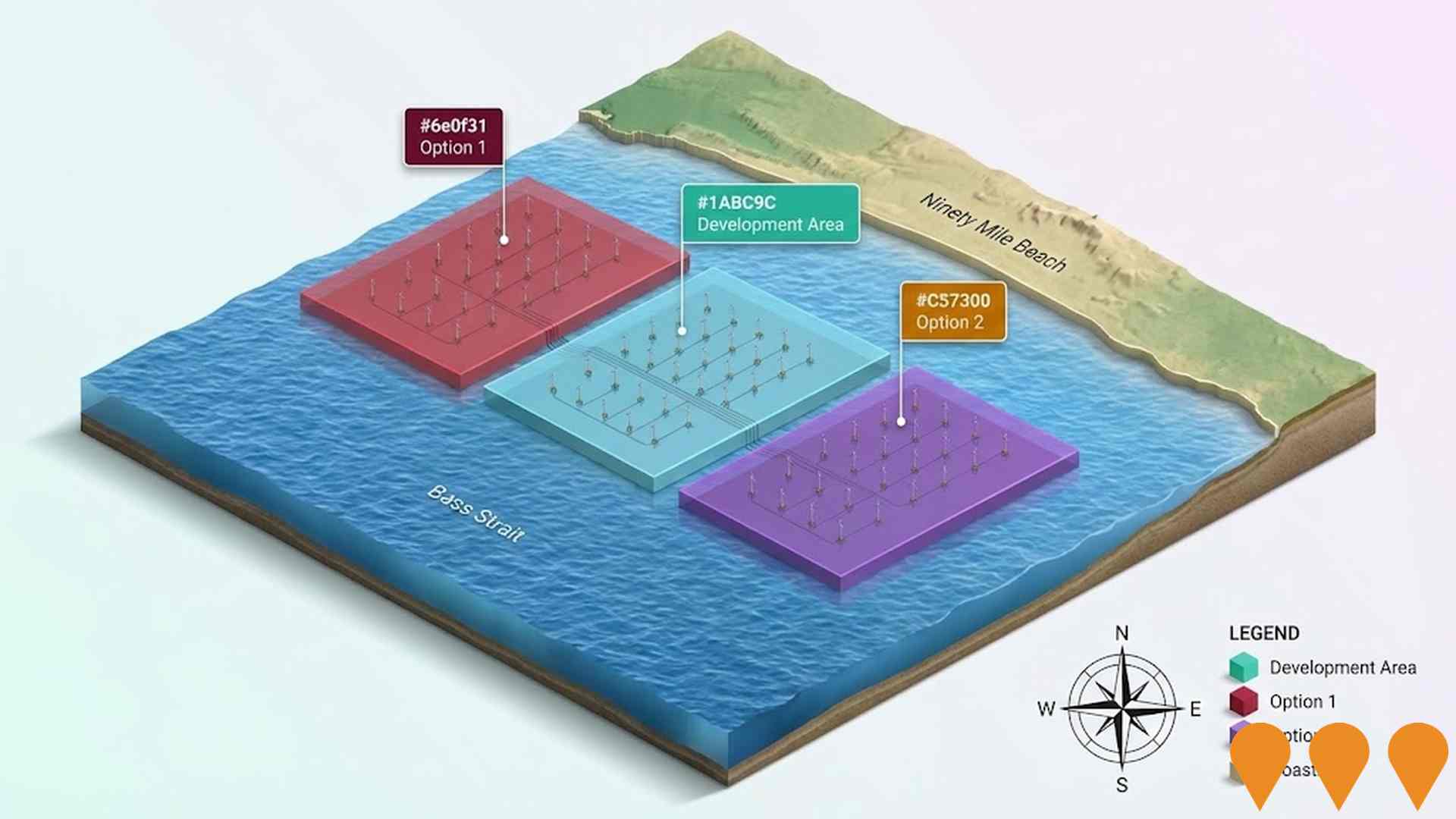

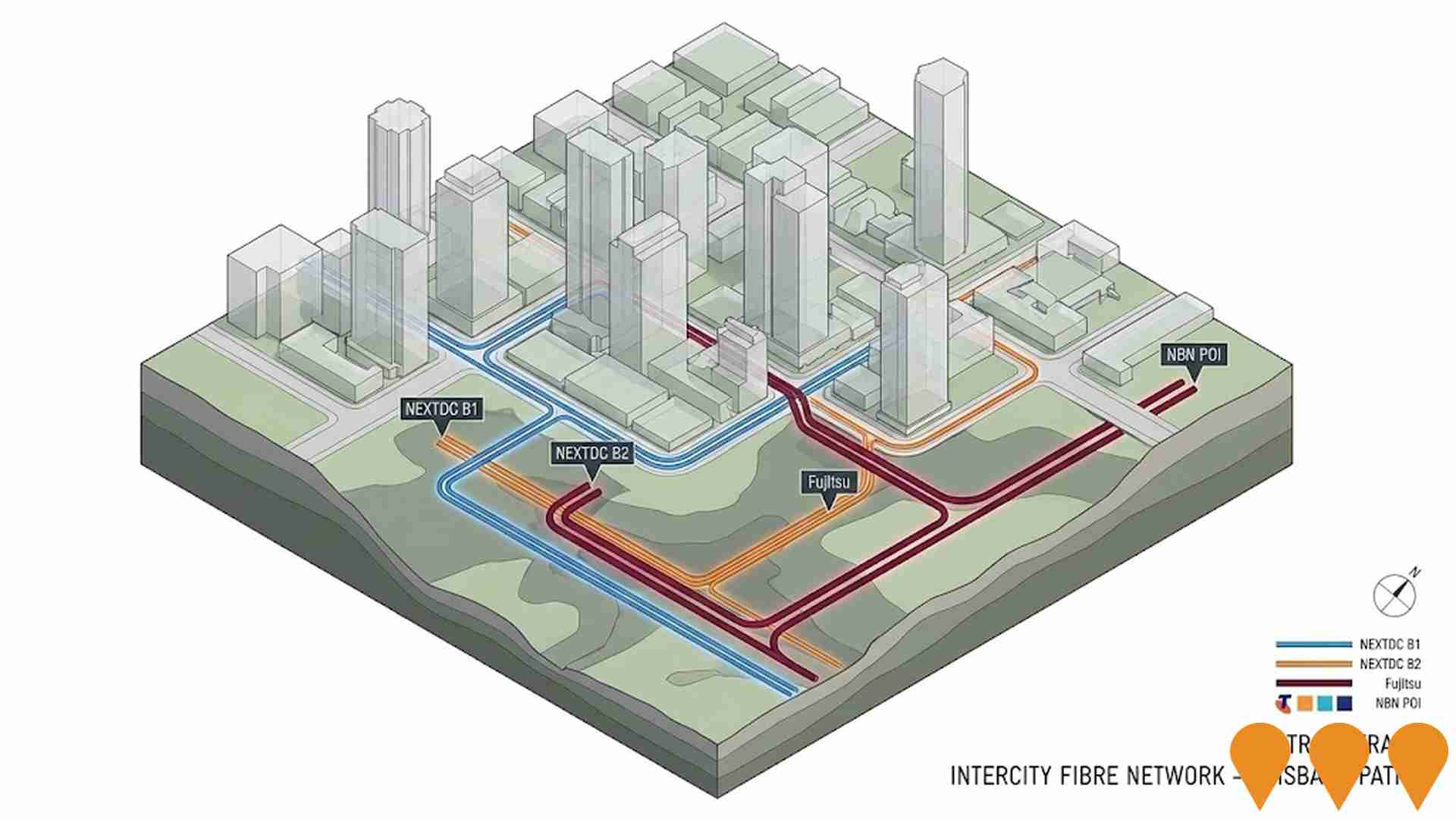

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms to enable diverse low and mid-rise housing, including dual occupancies, terraces, townhouses, and apartment buildings up to 6 storeys. The policy applies to residential zones within 800m of 171 nominated transport hubs and town centres. Stage 1 (dual occupancies) commenced 1 July 2024, and Stage 2 (mid-rise apartments and terraces) commenced 28 February 2025. In June 2025, further amendments adjusted aircraft noise thresholds and clarified storey definitions to expand the policy's reach. The initiative is expected to facilitate approximately 112,000 additional homes by 2030.

Marinus Link

Marinus Link is a 1,500 MW high-voltage direct current (HVDC) electricity and telecommunications interconnector. Stage 1 (750 MW) involves 255 km of subsea cable across Bass Strait and 90 km of underground cable in Gippsland. As of February 2026, the Australian Energy Regulator (AER) has approved $3.47 billion in capital expenditure for Stage 1. Major contracts are awarded to the TasVic Greenlink joint venture (DT Infrastructure and Samsung C&T) for converter stations at Heybridge (TAS) and Hazelwood (VIC), with full construction activities commencing in early 2026 and a target commissioning date of 2030.

Enabling Infrastructure for Hydrogen Production

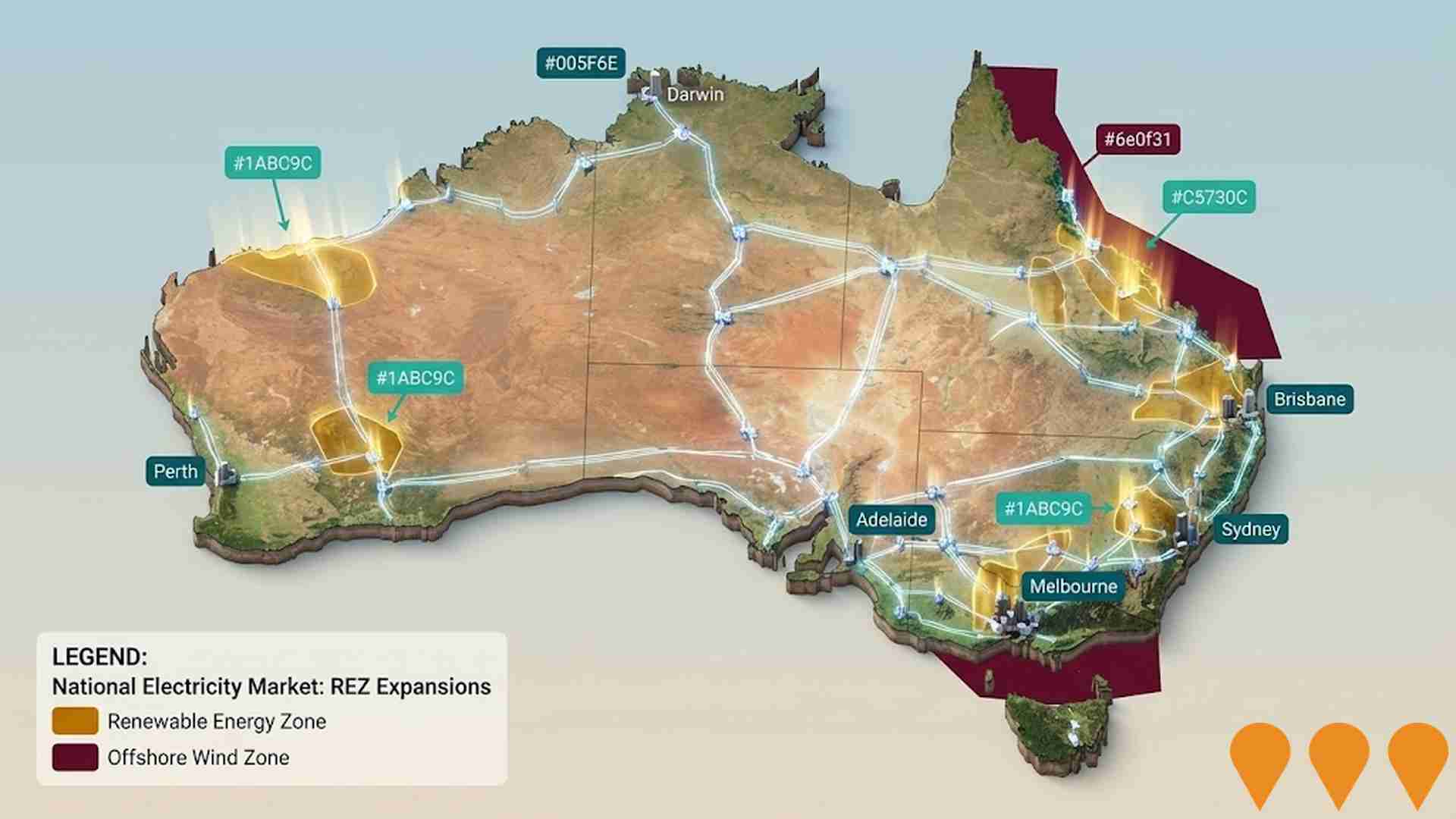

A national initiative to coordinate and deploy infrastructure supporting large-scale renewable hydrogen production. Following the 2024 National Hydrogen Strategy refresh and the National Hydrogen Infrastructure Assessment (NHIA) to 2050, the program focuses on aligning transport, storage, water, and electricity inputs with Renewable Energy Zones and hydrogen hubs. Key financial drivers include the $4 billion Hydrogen Headstart program (with Round 2 EOI launched in October 2025) and the Hydrogen Production Tax Incentive (HPTI) legislated to provide a $2 per kg credit from July 2027 to 2040.

Orsted Offshore Australia 1 (Gippsland 1)

Orsted is developing the 2.82 GW Gippsland 1 offshore wind farm located 56-100 km off the coast of Victoria. In December 2025, the project reached a major milestone by lodging its federal environmental referral under the EPBC Act. The proposal includes up to 200 turbines with tips reaching heights of 350m, situated in water depths of approximately 60m. Feasibility studies, including wind measurement using Floating LiDAR and geotechnical investigations, are ongoing and expected to conclude by late 2027. The project aims to connect to the Victorian grid via a subsea cable landing at McGaurans Beach or Reeves Beach, eventually linking to the VicGrid connection hub at Giffard.

Victorian Renewable Energy Zones

VicGrid is coordinating the staged development of six onshore Renewable Energy Zones (REZs) and a Gippsland Shoreline zone. The 2025 Victorian Transmission Plan identifies indicative REZ locations and the nearly 800km of transmission upgrades required to connect 25GW of new wind, solar, and storage by 2035. The plan balances infrastructure needs with impacts on agriculture, Traditional Owners, and the environment. Formal declaration of the first five zones is anticipated in early 2026, followed by a competitive access regime for developers.

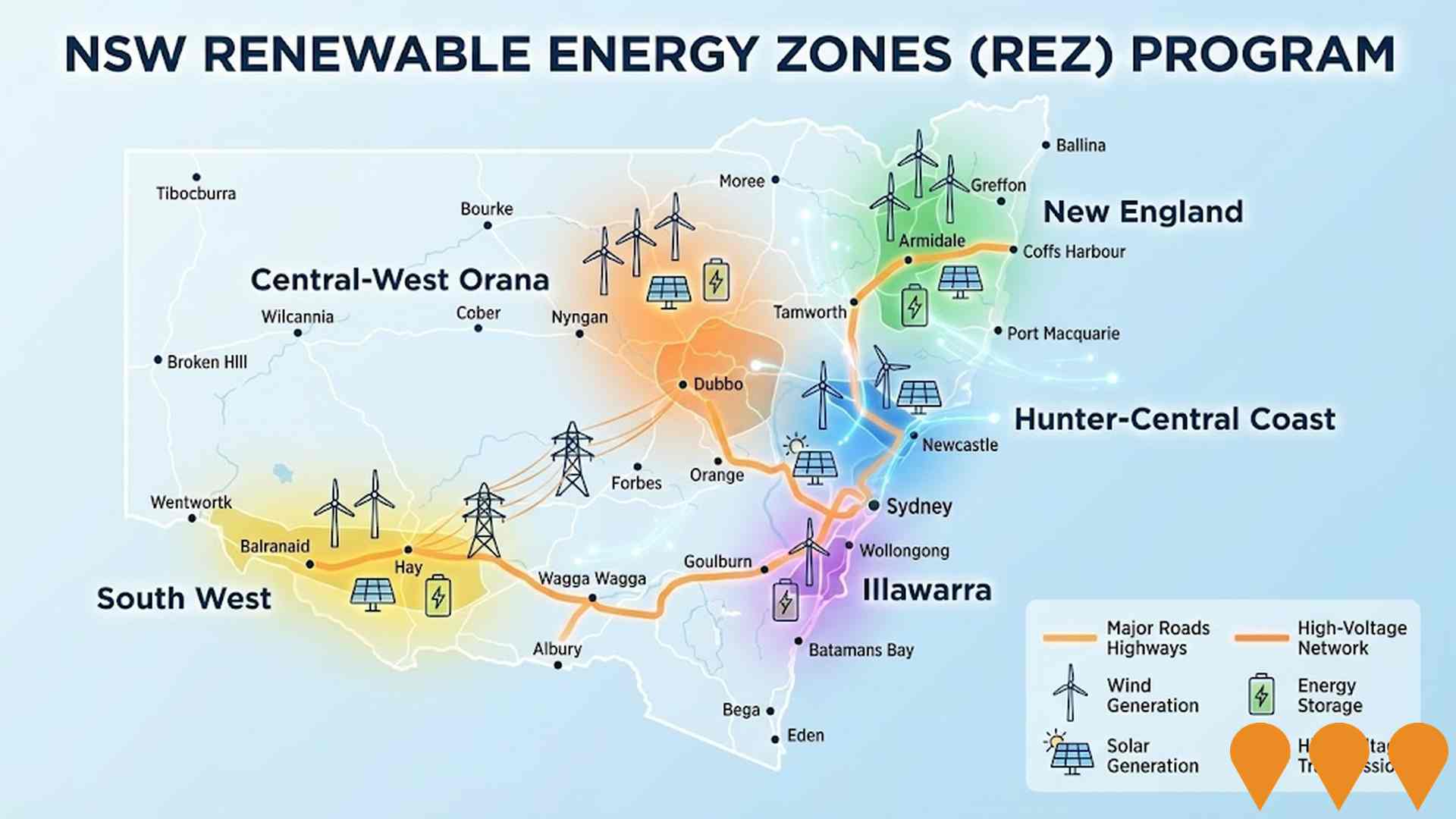

NSW Renewable Energy Zones (REZ) Program

NSW is delivering five Renewable Energy Zones (Central-West Orana, New England, South West, Hunter-Central Coast, and Illawarra) to coordinate wind and solar generation, storage, and high-voltage transmission. Led by EnergyCo NSW under the Electricity Infrastructure Roadmap, the program targets at least 12 GW of new renewable generation and 2 GW of long-duration storage by 2030. Major construction of the first REZ (Central-West Orana) transmission project began in June 2025, involving 90km of 500kV and 150km of 330kV lines. As of February 2026, the project reached a milestone with the Australian Energy Regulator's final decision on network revenue determinations, and significant progress has been made on temporary worker accommodation and road upgrades between the Port of Newcastle and the Central-West Orana region.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

Regional Housing Fund Gippsland

Part of Victorian Government's $1 billion Regional Housing Fund delivering over 1,300 new homes across regional Victoria including Gippsland. Mix of social and affordable housing developed through collaboration with councils and communities.

Employment

AreaSearch analysis indicates Metung maintains employment conditions that align with national benchmarks

Metung has a skilled workforce with well-represented essential services sectors. Its unemployment rate is 3.4%, lower than the Rest of Vic.'s 3.8%.

Employment growth over the past year was estimated at 4.8%. As of September 2025836 residents are employed while the unemployment rate is 0.4% below the Rest of Vic.'s rate. Workforce participation in Metung is 46.1%, significantly lower than Rest of Vic.'s 57.4%. Dominant employment sectors include health care & social assistance, construction, and accommodation & food.

The latter sector has particularly notable concentration, with employment levels at 1.6 times the regional average. Agriculture, forestry & fishing is under-represented, with only 3.9% of Metung's workforce compared to Rest of Vic.'s 7.5%. Employment opportunities locally may be limited, as indicated by the count of Census working population vs resident population. Between September 2024 and September 2025, employment increased by 4.8% while labour force increased by 5.0%, causing the unemployment rate to rise by 0.2 percentage points. In contrast, Rest of Vic. experienced an employment decline of 0.7% and a labour force decline of 0.6%. State-level data from 25-Nov shows VIC employment grew by 1.13% year-on-year, with the state unemployment rate at 4.7%, compared to the national rate of 4.3%. National employment forecasts suggest growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Metung's employment mix suggests local employment should increase by 6.6% over five years and 13.7% over ten years, assuming constant population projections.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

AreaSearch's latest postcode level ATO data for financial year 2023 shows income in Metung is lower than average nationally. The median income is $42,639 and the average is $54,985. This contrasts with Rest of Vic.'s figures, where the median is $50,954 and the average is $62,728. Based on Wage Price Index growth of 8.25% since financial year 2023, current estimates for Metung would be approximately $46,157 (median) and $59,521 (average) as of September 2025. The 2021 Census reveals household, family, and personal incomes in Metung fall between the 13th and 14th percentiles nationally. Income distribution shows 33.0% of residents earn between $800 - $1,499, differing from the regional predominance of the $1,500 - $2,999 category at 30.3%. Housing costs are modest, with 89.1% of income retained. However, total disposable income ranks at just the 20th percentile nationally, and the area's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Metung is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Metung's dwelling structures, as per the latest Census, consisted of 97.9% houses and 2.1% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro Vic.'s 90.9% houses and 9.2% other dwellings. Home ownership in Metung stood at 57.9%, with mortgaged dwellings at 26.8% and rented ones at 15.3%. The median monthly mortgage repayment was $1,300, aligning with Non-Metro Vic.'s average. Median weekly rent was $346, compared to Non-Metro Vic.'s $268. Nationally, Metung's mortgage repayments were lower at $1,300 versus Australia's average of $1,863, and rents were less at $346 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Metung has a typical household mix, with a lower-than-average median household size

Family households account for 72.0% of all households, including 15.9% couples with children, 49.5% couples without children, and 6.8% single parent families. Non-family households make up the remaining 28.0%, with lone person households at 26.2% and group households comprising 1.1% of the total. The median household size is 2.1 people, which is smaller than the Rest of Vic. average of 2.2.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Metung exceeds national averages, with above-average qualification levels and academic performance metrics

Metung trail has educational qualifications that lag behind regional benchmarks. Specifically, 25.0% of residents aged 15 and above hold university degrees, compared to the Victorian average of 33.4%. This indicates potential for educational development and skills enhancement in the area. Bachelor degrees are the most common at 16.6%, followed by postgraduate qualifications (5.1%) and graduate diplomas (3.3%).

Vocational credentials are also prominent, with 42.2% of residents aged 15 and above holding such qualifications – advanced diplomas account for 15.4% while certificates make up 26.8%. A significant portion of the population is actively pursuing formal education, with 20.9% engaged in studies. This includes 7.9% in primary education, 5.7% in secondary education, and 2.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Metung is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Metung faces significant health challenges, with common conditions prevalent across both younger and older age groups. Private health cover is low at approximately 49% (around 1,040 people), compared to the national average of 55.7%.

The most frequent medical conditions are arthritis (affecting 12.5%) and mental health issues (8.1%). Notably, 60.1% report no medical ailments, similar to Rest of Vic.. Metung has a higher proportion of seniors aged 65 and over at 38.0% (812 people), compared to 30.5% in Rest of Vic.. Despite this, health outcomes among seniors are strong, outperforming general population metrics.

Frequently Asked Questions - Health

Cultural Diversity

Metung is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Metung's population showed lower cultural diversity, with 81.2% born in Australia and 89.9% being citizens. English was spoken at home by 96.9%. Christianity was the dominant religion, comprising 44.2%.

Judaism, however, was overrepresented at 0.4%, compared to 0.1% regionally. Top ancestry groups were English (36.4%), Australian (26.6%), and Scottish (10.6%). Dutch (2.2%) Welsh (0.8%) and Hungarian (0.4%) were notably overrepresented among other ethnicities.

Frequently Asked Questions - Diversity

Age

Metung ranks among the oldest 10% of areas nationwide

Metung has a median age of 59, which is significantly higher than the Rest of Vic figure of 43 and the Australian median of 38. Compared to Rest of Vic., Metung has a higher concentration of 65-74 residents at 23.9%, but fewer 25-34 year-olds at 5.9%. This 65-74 concentration is well above the national figure of 9.4%. Post-2021 Census data shows that the 35 to 44 age group grew from 8.2% to 9.9%, while the 75 to 84 cohort increased from 10.9% to 12.4%. Conversely, the 65 to 74 cohort declined from 25.9% to 23.9%, and the 55 to 64 group dropped from 20.8% to 19.7%. Looking ahead to 2041, demographic projections reveal significant shifts in Metung's age structure. The 25 to 34 cohort is projected to grow by 56%, adding 70 residents to reach a total of 197. The 15 to 24 group shows more modest growth at 8%, with an increase of only 9 residents.