Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Longford - Loch Sport lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Longford-Loch Sport's population, as of November 2025, is approximately 5640, representing a 14.8% increase from the 2021 Census figure of 4915 people. This growth is inferred from ABS estimates: June 2024's ERP of 5071 and 211 validated new addresses since the Census date. The population density is 3.5 persons per square kilometer. Longford-Loch Sport's growth exceeded the SA3 area (5.0%) and non-metro areas, indicating its status as a regional growth leader. Interstate migration contributed approximately 53.2% of overall population gains during recent periods. AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022; for uncovered areas, it employs VIC State Government's Regional/LGA projections from 2023 with adjustments using weighted aggregation methods.

Future population trends forecast significant increases in the top quartile of Australia's regional areas, with Longford-Loch Sport expected to gain 1942 persons by 2041, reflecting a total increase of 23.4% over the 17 years.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Longford - Loch Sport when compared nationally

Longford-Loch Sport has averaged approximately 56 new dwelling approvals annually. Over the past five financial years, from FY21 to FY25, a total of 282 homes were approved, with an additional 15 approved so far in FY26. Each year, on average, about 1.3 people have moved into the area for each dwelling built during these years.

This balance between supply and demand supports stable market conditions. The average expected construction cost value of new dwellings is around $273,000. In terms of commercial development, $3.2 million in approvals were recorded this financial year, reflecting the primarily residential nature of the area. Comparatively, Longford-Loch Sport records 94.0% more building activity per person than the Rest of Vic., indicating greater choice for buyers and robust developer interest. However, construction activity has recently eased.

The location maintains its traditional low-density character with recent development comprising entirely detached houses, focusing on family homes that appeal to those seeking space. With approximately 130 people per dwelling approval, Longford-Loch Sport indicates an expanding market. According to the latest AreaSearch quarterly estimate, the area is forecasted to gain 1,322 residents by 2041. Given current construction levels, housing supply should adequately meet demand, creating favourable conditions for buyers while potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Longford - Loch Sport has moderate levels of nearby infrastructure activity, ranking in the 47thth percentile nationally

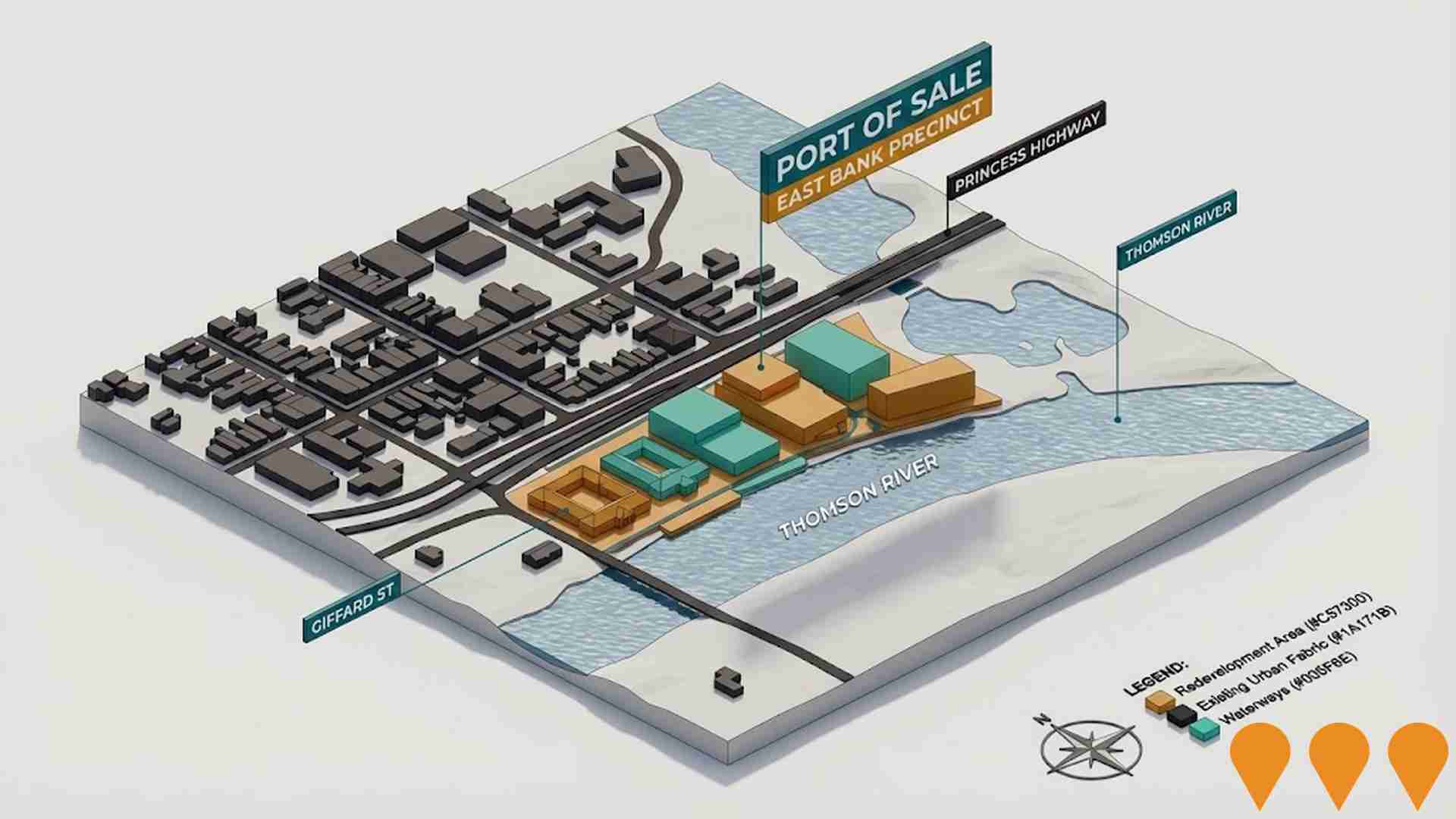

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified 40 projects potentially impacting the region. Notable initiatives include Gippsland Renewable Energy Park (GREP), Fulham Solar Farm, Longford Development Plan, and Port of Sale East Bank Redevelopment Study. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Gippsland Renewable Energy Park (GREP)

Development of a large-scale renewable energy hub, primarily featuring the Giffard Wind Farm and Battery. The project proposal includes up to 417MW of wind generation capacity and a 400MW/800MWh battery energy storage system (BESS). Located on an 8,000-hectare site in Giffard West, the project is a joint venture between Octopus Australia and the Clean Energy Finance Corporation (CEFC). Originally proposed with a significant solar component, the current focus is on wind and storage to support the Gippsland Renewable Energy Zone.

North Sale Growth Area Development Plan

Comprehensive development plan for the North Sale Growth Area providing framework for coordinated urban development. Includes residential subdivisions, infrastructure planning, and community facilities to accommodate Sale's growth.

Wurruk Development Plan - Sale Western Growth Area

The Sale Western Growth Area - Wurruk Development Plan provides for approximately 1,255 residential lots across six estates as part of the Sale, Wurruk and Longford Structure Plan. The development plan was approved in June 2022 and establishes preferred development outcomes and key infrastructure requirements for coordinated residential growth. Multiple stages are currently being released including Stage 3A and 3B developments.

Fulham Solar Farm

80 megawatt solar farm with 128MWh battery storage near Sale generating enough clean energy to power approximately 39,000 homes. One of Australia's first DC-coupled hybrid solar and battery projects developed by Octopus Australia with Clean Energy Finance Corporation investment.

Regional Housing Fund Gippsland

Part of Victorian Government's $1 billion Regional Housing Fund delivering over 1,300 new homes across regional Victoria including Gippsland. Mix of social and affordable housing developed through collaboration with councils and communities.

Perry Bridge Solar Farm

44 megawatt solar farm with 50MWh battery storage near Sale generating enough electricity to power over 15,000 homes. Developed by Octopus Australia in joint venture with Clean Energy Finance Corporation as part of Gippsland's renewable energy transition.

Longford Development Plan

The Longford Development Plan facilitates rural residential development across 11 precincts. Precincts 9 and 10 were rezoned in June 2023 to Rural Living Zone Schedule 5 (RLZ5), enabling the creation of approximately 180 rural lifestyle blocks with minimum 6,000m2 and average 7,000m2 lot sizes. The Development Plan guides coordinated infrastructure delivery and development outcomes for rural lifestyle opportunities in the Longford Growth Area.

Port of Sale East Bank Redevelopment Study

A comprehensive redevelopment study for the East Bank site within the Port of Sale Cultural and Civic Precinct. The study aims to prepare new planning controls for the future use and redevelopment of the site containing former Sale Specialist School and Sale High School buildings, plus heritage-listed George Gray Centre. The project seeks to create high architectural standards that complement the existing Port Precinct character.

Employment

Longford - Loch Sport has seen below average employment performance when compared to national benchmarks

Longford - Loch Sport has a skilled workforce with well-represented essential services sectors. Its unemployment rate was 4.5% in the past year, with an estimated employment growth of 4.3%.

As of September 2025, 2,337 residents are employed while the unemployment rate is 0.8% higher than Rest of Vic.'s rate of 3.8%. Workforce participation lags at 51.8%, compared to Rest of Vic.'s 57.4%. Dominant employment sectors include public administration & safety, health care & social assistance, and construction. Public administration & safety is particularly strong, with an employment share 2.4 times the regional level.

Manufacturing has limited presence, at 4.1% compared to the regional 7.7%. Many residents commute elsewhere for work based on Census data. Between September 2024 and September 2025, employment levels increased by 4.3%, labour force by 3.7%, reducing the unemployment rate by 0.5 percentage points. In contrast, Rest of Vic. saw employment decline by 0.7% and a marginal rise in unemployment. State-level data to 25-Nov-25 shows VIC employment grew by 1.13% year-on-year, with an unemployment rate of 4.7%. National forecasts project employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Longford - Loch Sport's employment mix suggests local employment should increase by 5.9% over five years and 12.6% over ten years, based on simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

The area's income levels rank in the lower 15% nationally based on AreaSearch comparative data

The Longford-Loch Sport SA2 had median and average incomes below national averages in financial year 2022. Median income was $43,807, while the average stood at $57,794. These figures compared to Rest of Vic.'s $48,741 and $60,693 respectively. By September 2025, estimates suggest median income would be approximately $49,134 and average $64,822, assuming a 12.16% Wage Price Index growth since 2022. Census data shows Longford-Loch Sport's incomes rank between the 6th and 11th percentiles nationally. The $400-$799 income band captured 28.1% of the community, differing from metropolitan regions where the $1500-$2999 bracket dominates at 30.3%. Housing costs are modest, with 89.0% of income retained. However, total disposable income ranks at just the 11th percentile nationally.

Frequently Asked Questions - Income

Housing

Longford - Loch Sport is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Longford-Loch Sport, as per the latest Census evaluation, 96.4% of dwellings were houses, with the remaining 3.6% comprising semi-detached homes, apartments, and other dwelling types. This compares to Non-Metro Vic.'s 91.9% houses and 8.1% other dwellings. Home ownership in Longford-Loch Sport stood at 57.8%, with mortgaged dwellings at 34.3% and rented ones at 8.0%. The median monthly mortgage repayment was $1,300, aligning with Non-Metro Vic.'s average, while the median weekly rent was $200, compared to Non-Metro Vic.'s $1,300 and $260 respectively. Nationally, Longford-Loch Sport's mortgage repayments were significantly lower than the Australian average of $1,863, with rents substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Longford - Loch Sport features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 66.1% of all households, including 22.1% couples with children, 36.7% couples without children, and 6.3% single parent families. Non-family households comprise the remaining 33.9%, with lone person households at 31.3% and group households making up 2.6%. The median household size is 2.2 people, which is smaller than the Rest of Vic. average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Longford - Loch Sport faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 18.1%, significantly lower than Victoria's average of 33.4%. Bachelor degrees are the most common at 13.2%, followed by postgraduate qualifications (2.6%) and graduate diplomas (2.3%). Vocational credentials are prevalent, with 41.3% of residents aged 15+ holding them, including advanced diplomas (9.6%) and certificates (31.7%). A total of 24.4% of the population is currently engaged in formal education, comprising 8.7% in primary, 7.2% in secondary, and 2.6% in tertiary education.

A substantial 24.4% of the population actively pursues formal education. This includes 8.7% in primary education, 7.2% in secondary education, and 2.6% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 26 active transport stops operating in Longford - Loch Sport. These are mixed bus services. There are two routes serving these stops, offering a total of 28 weekly passenger trips.

Transport accessibility is limited, with residents on average located 1987 meters from the nearest stop. Service frequency averages four trips per day across all routes, equating to approximately one weekly trip per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Longford - Loch Sport is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Longford - Loch Sport faces significant health challenges, with common conditions prevalent across both younger and older age groups. Private health cover is relatively low at approximately 49% (around 2,757 people), compared to the national average of 55.3%.

The most common medical conditions are arthritis (11.9%) and mental health issues (8.0%). About 61.3% report no medical ailments, slightly lower than the Rest of Vic's 62.7%. Residents aged 65 and over comprise 26.7% (around 1,504 people), higher than Rest of Vic's 23.5%.

Frequently Asked Questions - Health

Cultural Diversity

Longford - Loch Sport is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Longford-Loch Sport has a cultural diversity below average, with 85.4% of its population born in Australia, 89.6% being citizens, and 96.5% speaking English only at home. Christianity is the main religion in Longford-Loch Sport, comprising 49.1% of the population there. Judaism, however, is overrepresented at 0.1%, compared to 0.0% across Rest of Vic..

The top three ancestry groups are English (33.6%), Australian (29.9%), and Irish (9.5%). Notably, Dutch (2.4%) and Scottish (9.1%) are overrepresented, while Maltese (1.0%) is also higher than the regional average (0.4%).

Frequently Asked Questions - Diversity

Age

Longford - Loch Sport ranks among the oldest 10% of areas nationwide

The median age in Longford-Loch Sport is 52, which is significantly higher than Victoria's average of 43 and Australia's average of 38. Compared to Victoria's average, the 55-64 age cohort is notably over-represented at 19.7% locally, while the 25-34 age group is under-represented at 7.8%. The 55-64 concentration in Longford-Loch Sport is well above the national average of 11.2%. Between 2021 and the present, the 75 to 84 age group has increased from 6.6% to 8.1%, while the 35 to 44 cohort has risen from 9.2% to 10.6%. Conversely, the 45 to 54 cohort has declined from 14.1% to 12.5%, and the 65 to 74 age group has dropped from 18.6% to 17.4%. Population forecasts for 2041 indicate substantial demographic changes, with the 25-34 age cohort projected to grow by 82%, adding 359 residents to reach a total of 798.