Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Longford are slightly above average based on AreaSearch's ranking of recent, and medium term trends

As of Nov 2025, the population of the Longford (Vic.) statistical area (Lv2) is estimated at around 1,620 people. This reflects an increase of 131 people since the 2021 Census, which reported a population of 1,489 people. The change was inferred from AreaSearch's estimate of the resident population at 1,555 following examination of the latest ERP data release by the ABS in June 2024, and an additional 32 validated new addresses since the Census date. The population density ratio is approximately 5.2 persons per square kilometer. The area's growth rate of 8.8% since the 2021 census exceeded both the SA3 area (7.9%) and the non-metro area, marking it as a growth leader in the region. Interstate migration contributed around 53.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered by this data, AreaSearch utilises VIC State Government's Regional/LGA projections released in 2023, adjusted using a method of weighted aggregation of population growth from LGA to SA2 levels. Considering projected demographic shifts, significant population increases are forecast for the top quartile of non-metropolitan areas nationally. The Longford (Vic.) (SA2) is expected to expand by 599 persons to 2041 based on aggregated SA2-level projections, reflecting an increase of approximately 31.2% in total over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Longford according to AreaSearch's national comparison of local real estate markets

AreaSearch analysis of ABS building approval numbers indicates Longford recorded approximately 13 residential properties approved annually over the past five financial years, totalling around 68 homes. As of FY26, 4 approvals have been recorded. The average population growth per dwelling built in the area between FY21 and FY25 was 0.8 people per year. New construction has matched or outpaced demand, offering buyers more options and enabling population growth that could exceed current expectations.

The average expected construction cost value of new homes is $375,000, higher than regional norms, reflecting quality-focused development. In FY26, commercial approvals valued at $544,000 have been registered, indicating the area's residential nature. Compared to Rest of Vic., Longford shows 52.0% higher building activity per person. Building activity has slowed in recent years and consists entirely of detached houses, preserving the area's low density nature and attracting space-seeking buyers.

With around 252 people per approval, Longford reflects a transitioning market. According to AreaSearch's latest quarterly estimate, Longford is expected to grow by 506 residents through to 2041. Current construction levels should adequately meet demand, creating favourable conditions for buyers while potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Longford has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Area infrastructure changes significantly influence performance. AreaSearch identified 11 potential impact projects: Longford Development Plan, Fulham Solar Farm, Sale Integrated Centre for Children and Families, Gippsland Renewable Energy Park (GREP). Key projects are listed below.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

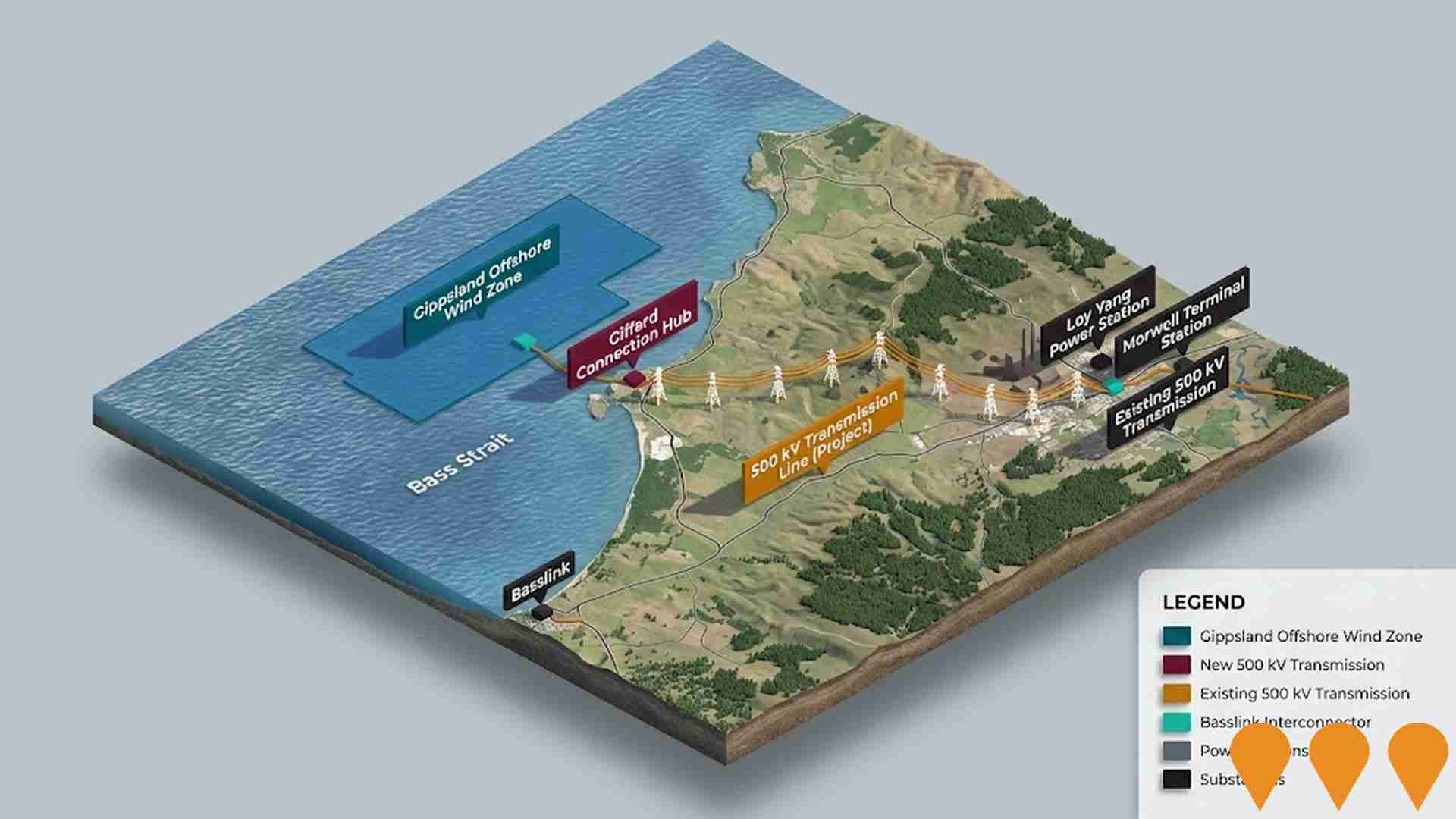

Orsted Offshore Australia 1 (Gippsland 1)

Orsted is developing the 2.82 GW Gippsland 1 offshore wind farm located 56-100 km off the coast of Victoria. In December 2025, the project reached a major milestone by lodging its federal environmental referral under the EPBC Act. The proposal includes up to 200 turbines with tips reaching heights of 350m, situated in water depths of approximately 60m. Feasibility studies, including wind measurement using Floating LiDAR and geotechnical investigations, are ongoing and expected to conclude by late 2027. The project aims to connect to the Victorian grid via a subsea cable landing at McGaurans Beach or Reeves Beach, eventually linking to the VicGrid connection hub at Giffard.

Gippsland Dawn Offshore Wind Project

The Gippsland Dawn Offshore Wind Project was a proposed 2.1 GW bottom-fixed wind farm located 10-33km off the coast between Paradise Beach and Ocean Grange. Managed by BlueFloat Energy and Energy Estate, the project aimed to power over 1 million homes with up to 140 turbines. Despite receiving a Commonwealth feasibility licence in 2024 and Federal Major Project Status, the project was officially cancelled in July 2025 after developer BlueFloat Energy surrendered its licence due to a strategic shift by its main shareholder away from offshore wind activities. The project is currently not proceeding but remains a reference for regional energy planning.

Gippsland Renewable Energy Park (GREP)

Development of a large-scale renewable energy hub, primarily featuring the Giffard Wind Farm and Battery. The project proposal includes up to 417MW of wind generation capacity and a 400MW/800MWh battery energy storage system (BESS). Located on an 8,000-hectare site in Giffard West, the project is a joint venture between Octopus Australia and the Clean Energy Finance Corporation (CEFC). Originally proposed with a significant solar component, the current focus is on wind and storage to support the Gippsland Renewable Energy Zone.

North Sale Growth Area Development Plan

Comprehensive development plan for the North Sale Growth Area providing framework for coordinated urban development. Includes residential subdivisions, infrastructure planning, and community facilities to accommodate Sale's growth.

Fulham Solar Farm

80 megawatt solar farm with 128MWh battery storage near Sale generating enough clean energy to power approximately 39,000 homes. One of Australia's first DC-coupled hybrid solar and battery projects developed by Octopus Australia with Clean Energy Finance Corporation investment.

Regional Housing Fund Gippsland

Part of Victorian Government's $1 billion Regional Housing Fund delivering over 1,300 new homes across regional Victoria including Gippsland. Mix of social and affordable housing developed through collaboration with councils and communities.

Perry Bridge Solar Farm

44 megawatt solar farm with 50MWh battery storage near Sale generating enough electricity to power over 15,000 homes. Developed by Octopus Australia in joint venture with Clean Energy Finance Corporation as part of Gippsland's renewable energy transition.

Longford Development Plan

The Longford Development Plan facilitates rural residential development across 11 precincts. Precincts 9 and 10 were rezoned in June 2023 to Rural Living Zone Schedule 5 (RLZ5), enabling the creation of approximately 180 rural lifestyle blocks with minimum 6,000m2 and average 7,000m2 lot sizes. The Development Plan guides coordinated infrastructure delivery and development outcomes for rural lifestyle opportunities in the Longford Growth Area.

Employment

AreaSearch analysis places Longford well above average for employment performance across multiple indicators

Longford has a skilled workforce with essential services sectors well represented. The unemployment rate is 3.0% and there was an estimated employment growth of 4.4% in the past year based on AreaSearch aggregation of statistical area data.

As of September 2025787 residents are employed while the unemployment rate is 0.8% lower than Rest of Vic.'s rate of 3.8%. Workforce participation is high at 67.0%, compared to Rest of Vic.'s 57.4%. The dominant employment sectors among residents include health care & social assistance, construction, and education & training. Notably, mining employs 8.7 times the regional average.

However, manufacturing employs only 4.3% of local workers, below Rest of Vic.'s 7.7%. Employment opportunities locally may be limited, as indicated by the count of Census working population versus resident population. Over the 12 months to September 2025, employment increased by 4.4% while labour force increased by 4.1%, resulting in a decrease in unemployment by 0.2 percentage points. This contrasts with Rest of Vic., where employment contracted by 0.7% and unemployment rose marginally. State-level data to 25-Nov shows VIC employment grew by 1.13% year-on-year, with the state unemployment rate at 4.7%, compared to the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggest that while national employment is forecast to expand by 6.6% over five years and 13.7% over ten years, local employment should increase by 6.2% over five years and 13.2% over ten years based on a simple weighting extrapolation of industry-specific projections.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

According to AreaSearch's aggregation of ATO data released for financial year 2023, Longford had a median taxpayer income of $57,752 and an average income of $76,191. Nationally, these figures are high compared to the Rest of Vic., which has median and average incomes of $50,954 and $62,728 respectively. Based on Wage Price Index growth of 8.25% since financial year 2023, estimated current incomes as of September 2025 are approximately $62,517 (median) and $82,477 (average). Census 2021 data shows household income ranks at the 66th percentile ($2,024 weekly), with personal income at the 47th percentile. Income distribution indicates that 33.3% of Longford's population falls within the $1,500 - $2,999 range, similar to the regional average of 30.3%. After housing costs, residents retain 89.3% of their income, reflecting strong purchasing power and the area's SEIFA income ranking in the 6th decile.

Frequently Asked Questions - Income

Housing

Longford is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Longford's dwelling structures, as per the latest Census, consisted entirely of houses with no other dwellings recorded. This differs from Non-Metro Vic., which had 91.9% houses and 8.1% other dwellings. Home ownership in Longford stood at 40.9%, with mortgaged dwellings at 54.3% and rented ones at 4.8%. The median monthly mortgage repayment was $1,625, higher than Non-Metro Vic.'s average of $1,300. The median weekly rent in Longford was $274, compared to Non-Metro Vic.'s $260. Nationally, Longford's mortgage repayments were lower at $1,625 versus the Australian average of $1,863, and rents were also lower at $274 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Longford features high concentrations of family households, with a higher-than-average median household size

Family households constitute 86.1% of all households, including 41.2% couples with children, 35.8% couples without children, and 6.9% single parent families. Non-family households comprise the remaining 13.9%, with lone person households at 12.9% and group households making up 1.4%. The median household size is 2.9 people, which is larger than the Rest of Vic. average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Longford performs slightly above the national average for education, showing competitive qualification levels and steady academic outcomes

The area's university qualification rate is 18.4%, significantly lower than Victoria's average of 33.4%. Bachelor degrees are the most common at 12.2%, followed by postgraduate qualifications (3.1%) and graduate diplomas (3.1%). Vocational credentials are prevalent, with 45.9% of residents aged 15+ holding such qualifications, including advanced diplomas (10.9%) and certificates (35.0%). Educational participation is high, with 30.6% of residents currently enrolled in formal education.

This includes 10.6% in primary education, 10.3% in secondary education, and 2.9% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Longford has seven active public transport stops operating, all of which are bus stops. These stops are served by two different routes that together offer ten weekly passenger trips. The accessibility of these transport services is limited, with residents typically located 1423 meters away from the nearest stop.

On average, there is one trip per day across all routes, equating to approximately one weekly trip per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Longford is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

Longford demonstrates above-average health outcomes with both young and old age cohorts seeing low prevalence of common health conditions. The rate of private health cover is very high at approximately 57% of the total population (~921 people), compared to 49.5% across Rest of Vic..

The most common medical conditions in the area are arthritis and asthma, impacting 8.2 and 7.4% of residents respectively, while 71.0% declare themselves completely clear of medical ailments, compared to 62.7% across Rest of Vic.. The area has 18.0% of residents aged 65 and over (291 people), which is lower than the 23.5% in Rest of Vic.. Health outcomes among seniors are particularly strong, performing even better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Longford placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Longford was found to have below average cultural diversity, with 91.0% of its population born in Australia, 94.3% being citizens, and 97.6% speaking English only at home. The predominant religion in Longford is Christianity, making up 47.3% of the population, compared to 46.9% across Rest of Vic.. In terms of ancestry, the top three represented groups are Australian (34.8%), English (32.2%), and Irish (8.8%).

Notably, Dutch ethnicity is overrepresented in Longford at 2.5%, compared to 2.1% regionally, Maltese at 0.8% versus 0.4%, and Scottish at 8.7% versus 8.6%.

Frequently Asked Questions - Diversity

Age

Longford's population is slightly older than the national pattern

The median age in Longford is 40 years, which is slightly below Rest of Vic.'s average of 43 but above Australia's median of 38. In comparison with Rest of Vic., the 5-14 age group is notably higher at 14.2% locally, while the 25-34 cohort is lower at 8.3%. Between the 2021 Census and the present, the 75 to 84 age group has grown from 3.1% to 5.2%, and the 55 to 64 cohort has increased from 13.6% to 15.0%. Conversely, the 45 to 54 age group has decreased from 15.4% to 13.7%. By 2041, population forecasts indicate significant demographic changes for Longford. The 25 to 34 age cohort is projected to grow by 124 people (93%), from 134 to 259. Meanwhile, the 85+ cohort is projected to remain unchanged.