Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Merriwa reveals an overall ranking slightly below national averages considering recent, and medium term trends

Based on analysis of ABS population updates, the Merriwa (WA) statistical area (Lv2)'s population is estimated at around 6,117 as of Nov 2025. This reflects an increase of 530 people since the 2021 Census which reported a population of 5,587 people. The change is inferred from the resident population of 6,113 estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024 and an additional 1 validated new address since the Census date. This level of population equates to a density ratio of 2,671 persons per square kilometer, placing it in the upper quartile relative to national locations assessed by AreaSearch. The area's 9.5% growth since census positions it within 0.2 percentage points of the national average (9.7%), demonstrating competitive growth fundamentals. Population growth for the area was primarily driven by overseas migration contributing approximately 67.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and to estimate growth post-2032, AreaSearch utilises growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections, released in 2023 based on 2022 data. Future population trends project an above median growth for national areas, with the Merriwa (WA) (SA2) expected to increase by 1,402 persons to 2041, reflecting a total increase of 23.2% over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Merriwa according to AreaSearch's national comparison of local real estate markets

AreaSearch analysis of ABS building approval numbers allocated from statistical area data shows Merriwa averaging approximately 4 new dwelling approvals per year over the past five financial years, totalling an estimated 20 homes. As of FY-26, 5 approvals have been recorded. On average, 22.8 new residents are associated with each home built between FY-21 and FY-25, indicating significant demand exceeding supply. New properties are constructed at an average expected cost of $323,000.

This financial year has seen $1.0 million in commercial approvals, reflecting the area's residential nature. Compared to Greater Perth, Merriwa records notably lower building activity, 94.0% below the regional average per person. This scarcity typically strengthens demand and prices for existing properties, though recent periods have shown increased development activity. This is also below the national average, suggesting an established market with potential planning limitations. All new construction in Merriwa has consisted of standalone homes, maintaining its traditional suburban character focused on family homes.

Interestingly, developers are building more traditional houses than the current mix suggests, indicating strong demand for family homes despite density pressures. With approximately 1214 people per dwelling approval, Merriwa reflects a highly mature market. Future projections estimate Merriwa adding 1,417 residents by 2041. If current construction levels persist, housing supply may lag population growth, likely intensifying buyer competition and underpinning price growth.

Frequently Asked Questions - Development

Infrastructure

Merriwa has moderate levels of nearby infrastructure activity, ranking in the 46thth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified 11 projects likely affecting this region. Notable ones are Brighton Estate Master Planned Community, Claytons Mindarie Beachfront, Butler District Planning Scheme Amendment No. 212, and Quinns Rocks - Gumblossom Community Centre - Upgrade. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Butler Village Medical Centre

Butler Village Medical Centre is a modern, purpose-built family medicine practice providing comprehensive healthcare services to Butler, Alkimos, and Yanchep. The facility offers general practice, onsite pathology, dental services through Butler Village Family Dental, and chronic disease management. It operates as a private billing practice with modern diagnostic technology and is located opposite the Cornerstone Ale House.

Butler Boulevard Medical Centre

Butler Boulevard Medical Centre is a state-of-the-art multidisciplinary healthcare facility in Western Australia. It provides a wide range of services including general practice, minor surgery, chronic disease management, and onsite pathology. The centre features wheelchair-accessible facilities and is situated within the Butler Boulevard activity corridor to serve the growing northern corridor of Perth.

Wanneroo Road Corridor Improvements

Major road infrastructure improvements along Wanneroo Road corridor including capacity upgrades, intersection improvements, and safety enhancements. Critical for supporting northern corridor growth.

Dunes Beach Resort (Mindarie Ecotourism Resort)

Eco tourism resort on the former Quinns Rocks Caravan Park site in Mindarie, delivering 38 glamping tents with ensuite bathrooms, a single level hospitality building with restaurant, cafe, bar and function space for up to 240 patrons, a reception building and around 80 on site car parking bays. The privately funded resort focuses on sustainable design, coastal landscaping and public access, including lawn areas, picnic spaces, bike racks, improved beach access and community event space. Construction commenced in mid 2025 following Western Australian Planning Commission approvals in 2024 and 2025, with opening expected by mid April 2026.

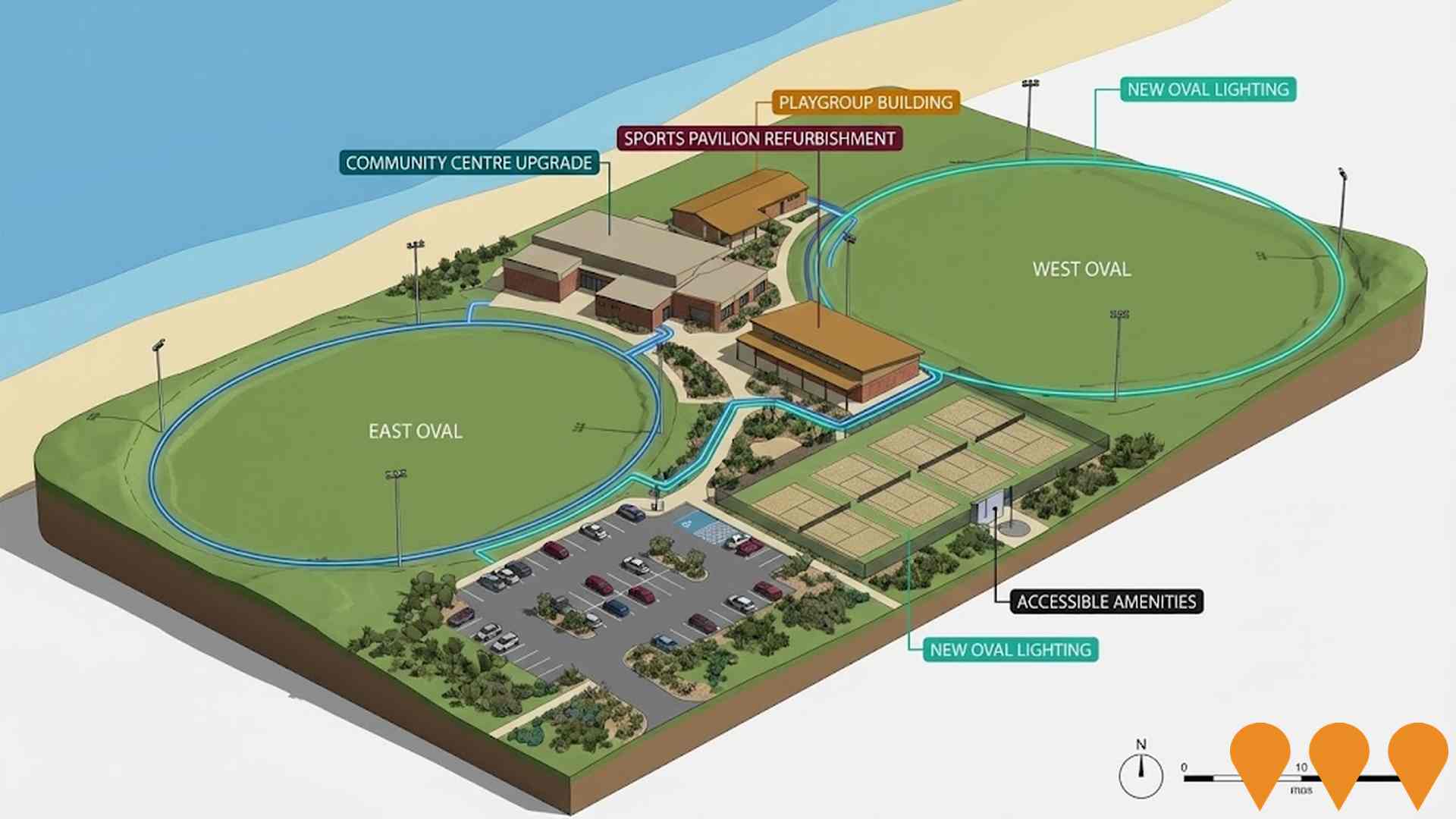

Gumblossom Community Centre Upgrade, Quinns Rocks

Multi stage upgrade of the Gumblossom Community Centre precinct in Quinns Rocks, including refurbishments to the community centre, sports pavilion and activity (playgroup) building. Works include new and upgraded kitchens, improved lighting and air conditioning, reconfigured meeting and office spaces, upgraded toilets and changerooms to improve accessibility, improved storage, outdoor barbecue and craft areas, and new internal and external CCTV. Stage 1 community centre works commenced in February 2025 and were completed mid 2025, with pavilion and activity building upgrades now proceeding under a separate construction contract, programmed through to 2027 to meet current and future community needs.

Claytons Mindarie Beachfront

Premium beachfront apartment development by Edge featuring 89 residences including 1, 2 and 3 bedroom apartments, penthouses and townhouses. First of its kind in Mindarie with direct beach access, resort-style amenities including pool, gymnasium, sauna and ocean views. Designed by Hillam Architects. Display suite at 4 Boston Quays, Mindarie.

Quinns Rocks - Gumblossom Community Centre - Upgrade

Upgrade of the existing Gumblossom Community Centre in Quinns Rocks, including refurbishment of the sports pavilion, community centre and playgroup building, with new kitchens, accessible toilets, storage, CCTV and other amenity upgrades to better serve local clubs and residents. Construction started in early 2025 under a City of Wanneroo capital works program with Lotterywest grant support, following a master plan and community consultation.

Mindarie Regional Centre Stage 2

Second stage expansion of Mindarie Regional Centre including additional retail, office space and residential components. Enhancing the established commercial hub.

Employment

AreaSearch assessment indicates Merriwa faces employment challenges relative to the majority of Australian markets

Merriwa's workforce is balanced across white and blue-collar jobs. The construction sector stands out with a significant representation.

In the past year, Merriwa had an unemployment rate of 8.3% and employment growth of 5%. As of September 2025, there were 2,677 employed residents, with an unemployment rate of 4.3%, higher than Greater Perth's 4.0%. Workforce participation was lower at 50.7% compared to Greater Perth's 65.2%. Major employment sectors included construction, health care & social assistance, and retail trade.

Construction had a particularly high share of jobs, 1.5 times the regional level. Professional & technical services employed only 4.2% of local workers, lower than Greater Perth's 8.2%. Between August 2024 and September 2025, employment increased by 5.0%, while labor force grew by 3.7%, reducing unemployment by 1.2 percentage points. In contrast, Greater Perth had employment growth of 2.9% with a slight rise in unemployment. Statewide, WA's employment contracted by 0.27% between November 2024 and November 2025, with an unemployment rate of 4.6%. Nationally, employment grew by 0.14%, with an unemployment rate of 4.3%. Jobs and Skills Australia forecasts national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Merriwa's employment mix suggests local employment should increase by 6.0% over five years and 12.7% over ten years, though this is a simplified extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

AreaSearch's aggregation of latest postcode level ATO data released for financial year 2023 shows Merriwa had a median taxpayer income of $48,955 and an average income of $61,471. These figures are lower than national averages of $60,748 and $80,248 in Greater Perth respectively. Based on Wage Price Index growth of 9.62% since financial year 2023, estimated median and average incomes for Merriwa as of September 2025 would be approximately $53,664 and $67,385 respectively. According to the 2021 Census, household, family, and personal incomes in Merriwa fall between the 16th and 17th percentiles nationally. The data indicates that 29.8% of Merriwa's population (1,822 individuals) earn within the $1,500 - $2,999 income range, similar to the surrounding region where 32.0% fall into this bracket. Housing affordability pressures are severe in Merriwa, with only 78.1% of income remaining, ranking at the 12th percentile nationally.

Frequently Asked Questions - Income

Housing

Merriwa is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Merriwa's dwellings, as per the latest Census, consisted of 76.0% houses and 24.0% other dwellings. In contrast, Perth metro had 92.2% houses and 7.8% other dwellings. Home ownership in Merriwa was at 19.1%, with mortgaged dwellings at 51.2% and rented ones at 29.7%. The median monthly mortgage repayment in Merriwa was $1,500, lower than Perth metro's $1,898. Median weekly rent in Merriwa was $330, compared to Perth metro's $350. Nationally, Merriwa's mortgage repayments were significantly lower at $1,500 versus the Australian average of $1,863, and rents were substantially below the national figure of $375 at $330.

Frequently Asked Questions - Housing

Household Composition

Merriwa has a typical household mix, with a lower-than-average median household size

Family households are present in 68.7% of all households, including 24.8% couples with children, 25.8% couples without children, and 16.9% single parent families. Non-family households constitute the remaining 31.3%, with lone person households at 28.6% and group households comprising 2.4%. The median household size is 2.5 people, which is smaller than the Greater Perth average of 2.8.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Merriwa fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 10.8%, significantly lower than the Australian average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are most prevalent at 7.9%, followed by postgraduate qualifications (1.5%) and graduate diplomas (1.4%). Vocational credentials are prominent, with 43.8% of residents aged 15+ holding them - advanced diplomas account for 10.9% and certificates for 32.9%.

Educational participation is high at 29.3%, including 11.5% in primary education, 8.6% in secondary education, and 3.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Merriwa has 23 active public transport stops, all of which are bus stops. These stops are served by three different routes that together facilitate 863 weekly passenger trips. The average distance from residents to the nearest transport stop is 182 meters, indicating excellent accessibility.

On average, there are 123 trips per day across all routes, which equates to approximately 37 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Merriwa is well below average with a range of health conditions having marked impacts on both younger and older age cohorts

Merriwa faces significant health challenges, as indicated by health data. Multiple conditions affect both younger and older age groups notably arthritis (impacting 10.0%) and mental health issues (9.6%).

Private health cover is relatively low at approximately 52% (~3,156 people), compared to Greater Perth's 54.8%. Only 60.3% of residents report no medical ailments, lower than Greater Perth's 73.0%. The area has a higher proportion of seniors aged 65 and over at 25.2% (1,541 people), compared to Greater Perth's 13.6%. Senior health outcomes present challenges broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Merriwa was found to be above average when compared nationally for a number of language and cultural background related metrics

Merriwa's cultural diversity was higher than most local markets, with 13.3% speaking a language other than English at home and 36.5% born overseas. Christianity dominated Merriwa's religion, comprising 45.4%. Judaism had similar representation in both Merriwa (0.1%) and Greater Perth (0.1%).

The top three ancestral groups were English (33.8%), Australian (23.9%), and Other (8.6%). Notably, Maori (2.0% vs regional 1.3%), South African (1.4% vs 1.8%), and New Zealand (1.3% vs 1.1%) groups had different representations compared to the broader region.

Frequently Asked Questions - Diversity

Age

Merriwa's population is slightly older than the national pattern

Merriwa has a median age of 40, which is higher than Greater Perth's figure of 37 years and marginally higher than Australia's median age of 38 years. Compared to Greater Perth, Merriwa has an over-representation of the 85+ cohort at 7.3%, while the 25-34 year-olds are under-represented at 11.2%. The 85+ concentration in Merriwa is well above the national figure of 2.2%. Between 2021 and present, the population aged 55 to 64 has grown from 8.4% to 9.8%, while the 5 to 14 cohort has declined from 13.8% to 12.3% and the 45 to 54 group has dropped from 11.4% to 10.2%. By 2041, demographic modeling suggests significant changes in Merriwa's age profile. The 75 to 84 age cohort is projected to grow by 451 people (78%), from 581 to 1,033. Notably, the combined 65+ age groups will account for 76% of total population growth, reflecting Merriwa's aging demographic profile. Meanwhile, the 0 to 4 and 5 to 14 cohorts are expected to experience population declines.