Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Iluka - Burns Beach lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Iluka - Burns Beach's population is 11,156 as of November 2025. This shows an increase of 1,419 people since the 2021 Census, which recorded a population of 9,737. The change is inferred from ABS estimates: 10,918 in June 2024 and an additional 274 validated new addresses since the Census date. This results in a density ratio of 1,913 persons per square kilometer, higher than national averages assessed by AreaSearch. Iluka - Burns Beach's growth of 14.6% since the 2021 census exceeds the SA3 area (8.9%) and the national average. Overseas migration contributed approximately 71.5% of overall population gains during recent periods, though all drivers were positive factors.

AreaSearch uses ABS/Geoscience Australia projections released in 2024 with a base year of 2022 for each SA2 area. For areas not covered by this data and post-2032 estimates, AreaSearch utilises growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections (released in 2023, based on 2022 data). Future demographic trends project above median population growth for Australian statistical areas. Iluka - Burns Beach is expected to expand by 2,231 persons to 2041, reflecting a total increase of 17.9% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Iluka - Burns Beach among the top 25% of areas assessed nationwide

Iluka - Burns Beach has granted around 62 residential approvals per year on average over the past five financial years, totalling 313 homes. As of FY-26, it has recorded 34 approvals. Each dwelling built attracts an average of 4 people per year to the area. This high demand exceeds new supply, leading to price growth and increased buyer competition.

New properties are constructed at an average expected cost value of $520,000, indicating a focus on premium market segments with higher-end properties. In FY-26, commercial approvals have reached $35.6 million, reflecting strong commercial development momentum. Compared to Greater Perth, Iluka - Burns Beach shows 93.0% higher new home approvals per person, offering greater choice for buyers. All recent developments in the area consist of detached dwellings, preserving its suburban nature and attracting space-seeking buyers.

Iluka - Burns Beach reflects a developing area with around 170 people moving in per approval. By 2041, it is forecasted to gain 1,993 residents (AreaSearch quarterly estimate). If current construction levels continue, housing supply should meet demand adequately, creating favourable conditions for buyers while potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Iluka - Burns Beach has emerging levels of nearby infrastructure activity, ranking in the 36thth percentile nationally

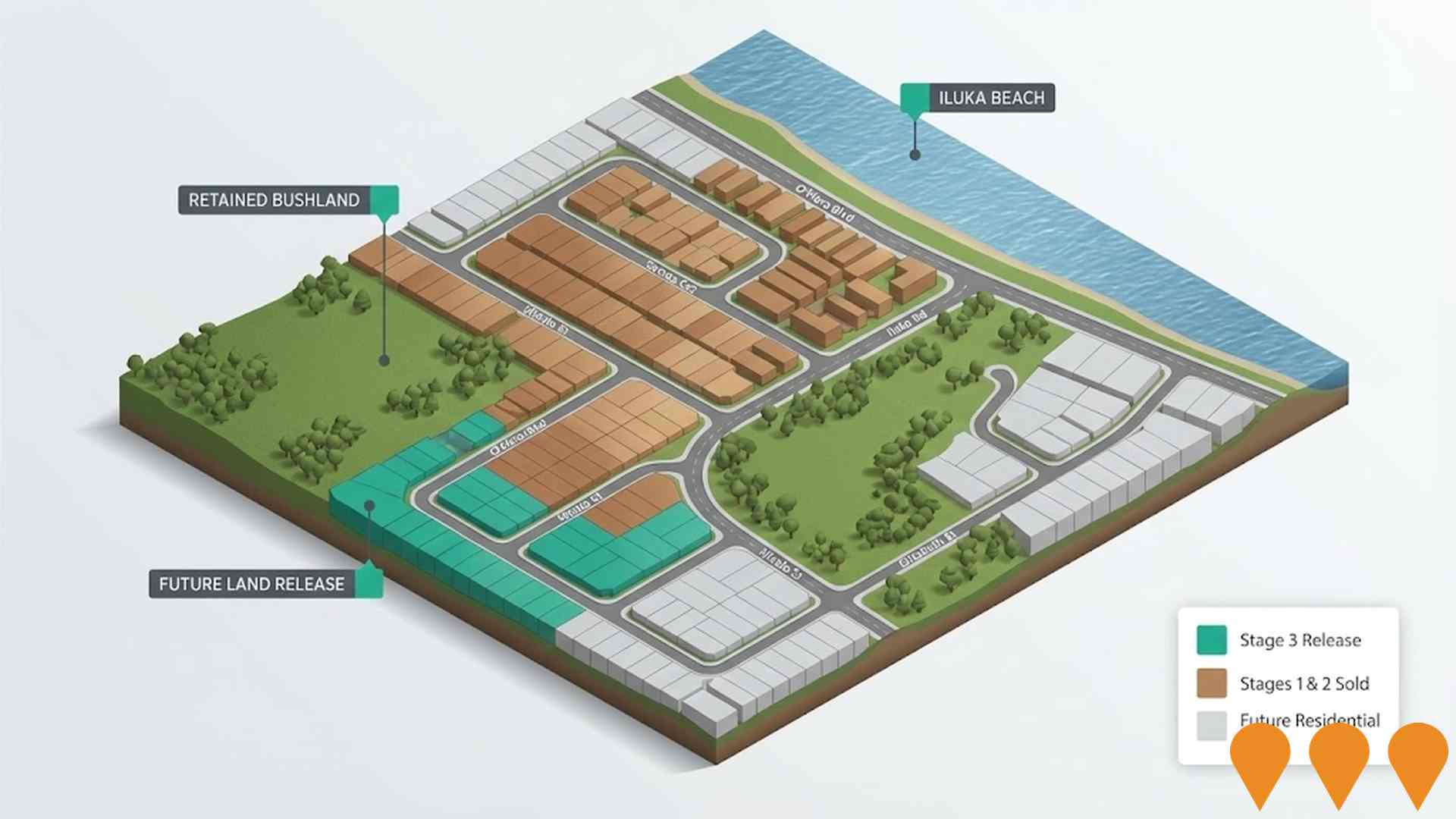

The performance of a region is significantly influenced by changes in local infrastructure, major projects, and planning initiatives. AreaSearch has identified nine projects that are anticipated to impact the area. Notable projects include Meridian Park Industrial Estate, Iluka Beach Residential Estate (Stages ongoing), Burns Beach Primary School, and Currambine Community Centre & Library Upgrade. The following list outlines those projects likely to be most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Joondalup Private Hospital Expansion

Major private hospital expansion at Joondalup Health Campus, fully funded by Ramsay Health Care with a value of $190 million. The project includes six new operating theatres (two shared with the public campus), two day procedure rooms, a day of surgery admissions unit, a 22-bed short stay surgical ward, a 30-bed surgical/medical ward, and six cardiac care beds. It will increase the private hospital bed capacity from 150 to 202, with a further 30 shelled beds for future use, and is expected to double admissions. The build also includes rooftop solar panels and a new ground floor cafe.

Joondalup Health Campus Development Stage 2

Major $307.9 million expansion of Joondalup Health Campus co-funded by the State and Australian Governments. The project is a six-year development due to end in mid-2026 when a further 60 public beds will be completed. As of July 2025, completed components include a new 102-bed Mental Health Unit (opened August 2023), a 106-bed public ward block including a new cardiac care unit, an expanded public theatre complex with one new public theatre and two new interventional catheterisation laboratories (cath labs), 12 Emergency Department beds, a Behavioural Assessment Urgent Care Clinic, additional parking, and a refurbished discharge lounge. Fit-out of two, 30-bed shelled wards in the new public ward block is in progress for completion by mid-2026. Two additional theatres for shared public and private use are also due to open in September 2025.

Iluka Plaza & Medical Precinct Expansion

Proposed expansion of the existing Iluka Plaza neighbourhood centre (at 98 O'Mara Boulevard) to include new medical suites, a pharmacy, and additional food & beverage tenancies to serve the growing Kinross-Iluka catchment. The current plaza already incorporates childcare, healthcare, and commercial tenancies including IGA, Nido Early School, GP West Medical Centre, and The Iluka Tavern.

Ocean Reef Marina

DevelopmentWA is delivering a new waterfront precinct with more than 1,000 dwellings, around 12,000 sqm of retail and commercial space, a 50-metre coastal pool, protected family beach, public open space and upgraded marine facilities. Stage 1 bulk earthworks and civil works are underway with initial community facilities opening from 2025 and broader staging through 2026, with full civil completion targeted around 2030.

Currambine North Masterplan (Currambine District Centre Precinct)

A long-term masterplanned mixed-use precinct for the Currambine North area, envisioned to deliver a vibrant district centre with higher-density residential, commercial offices, retail, entertainment and community facilities around the future Currambine Train Station northern extension.

Ocean Reef Marina Redevelopment

A $180 million coastal marina and residential precinct delivering a 550-berth marina, up to 550 dwellings, waterfront retail and dining, public open space and coastal protection works, located approximately 6 km north of City Beach.

Meridian Park Industrial Estate

95 hectare industrial estate in the Neerabup Industrial Area, serving Perth's growing north-west corridor. Features sustainable design, support for Restricted Access Vehicles (RAV4), easy access to Mitchell Freeway, and focus on logistics, manufacturing, robotics, and mining services. Expected to generate up to 20,000 employment opportunities. Includes the Australian Automation and Robotics Precinct.

Alkimos to Wanneroo Desalination Pipeline

Below-ground trunk main of about 33.5km connecting the future Alkimos Seawater Desalination Plant to Wanneroo Reservoir, with offtakes to Carabooda Tank and the future Nowergup Tank. Largest drinking water pipeline built by Water Corporation at up to 1600mm diameter. Status: in construction with staged works commencing late July 2025 and delivery by 2027.

Employment

Employment conditions in Iluka - Burns Beach rank among the top 10% of areas assessed nationally

Iluka - Burns Beach has a highly educated workforce with significant representation in professional services. Its unemployment rate is 1.1% and it experienced an estimated employment growth of 3.9% over the past year up to September 2025.

As of this date, 6,940 residents are employed while the unemployment rate is 2.8 percentage points lower than Greater Perth's rate of 4.0%. The workforce participation rate in Iluka - Burns Beach is 73.2%, compared to Greater Perth's 65.2%. Employment among residents is concentrated in health care & social assistance, construction, and education & training. Notably, construction employment is particularly strong at 1.3 times the regional level.

Conversely, transport, postal & warehousing shows lower representation at 2.8% compared to the regional average of 4.7%. Over the 12 months to September 2025, employment increased by 3.9% while labour force increased by 3.8%, resulting in a slight decrease in unemployment rate of 0.1 percentage points. In contrast, Greater Perth recorded employment growth of 2.9% and unemployment rose marginally. State-level data up to 25-Nov-25 shows WA employment contracted by 0.27% (losing 5,520 jobs), with the state unemployment rate at 4.6%, compared to the national rate of 4.3%. National employment forecasts from May-25 suggest a growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Iluka - Burns Beach's employment mix, local employment is expected to increase by 6.6% over five years and 13.6% over ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

The Iluka - Burns Beach SA2 had an extremely high national income level according to latest ATO data aggregated by AreaSearch for financial year ended June 30, 2022. The median income among taxpayers was $67,050 and the average income stood at $90,627, compared to Greater Perth's figures of $58,380 and $78,020 respectively. Based on Wage Price Index growth of 14.2% from July 1, 2022 to September 2025, current estimates would be approximately $76,571 (median) and $103,496 (average). From the Census conducted on August 10, 2021, household, family and personal incomes all ranked highly in Iluka - Burns Beach, between the 83rd and 98th percentiles nationally. Income analysis revealed that 37.6% of the population, equating to 4,194 individuals, fell within the $40,000+ income range, differing from patterns across the region where $25,000 - $49,999 dominated with 32.0%. Economic strength was evident through 54.9% of households achieving high weekly earnings exceeding $3,000, supporting elevated consumer spending. After housing costs, residents retained 87.0% of income, reflecting strong purchasing power and the area's SEIFA income ranking placed it in the 10th decile.

Frequently Asked Questions - Income

Housing

Iluka - Burns Beach is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

In Iluka-Burns Beach, evaluated in the latest Census, 98.1% of dwellings were houses, with the remaining 1.9% being semi-detached, apartments, or other types. This contrasts with Perth metro's figures of 88.7% houses and 11.3% other dwellings. Home ownership in Iluka-Burns Beach stood at 33.6%, with mortgaged properties at 58.6% and rented ones at 7.9%. The median monthly mortgage repayment was $2,763, higher than Perth metro's average of $2,080. Median weekly rent in the area was $650, compared to Perth metro's $400. Nationally, Iluka-Burns Beach's mortgage repayments were significantly higher than the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Iluka - Burns Beach features high concentrations of family households, with a higher-than-average median household size

Family households account for 91.9% of all households, including 53.5% couples with children, 31.9% couples without children, and 6.0% single parent families. Non-family households make up the remaining 8.1%, consisting of 7.8% lone person households and 0.4% group households. The median household size is 3.1 people, which is larger than the Greater Perth average of 2.7.

Frequently Asked Questions - Households

Local Schools & Education

Iluka - Burns Beach shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

University qualifications in Iluka - Burns Beach are higher than the WA average, with 31.9% of residents aged 15 and above holding such qualifications compared to the state's 27.9%. Bachelor degrees are most common at 22.4%, followed by postgraduate qualifications (6.5%) and graduate diplomas (3.0%). Vocational credentials are also prevalent, with 35.7% of residents aged 15 and above holding them.

This includes advanced diplomas (13.9%) and certificates (21.8%). Educational participation is high, with 30.8% of residents currently enrolled in formal education. This includes secondary education (10.7%), primary education (9.8%), and tertiary education (6.3%).

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Iluka - Burns Beach shows that there are 33 active transport stops operating. These stops serve a mix of bus routes. There are 3 individual routes servicing these stops, which collectively provide 617 weekly passenger trips.

The accessibility of transport is rated as good, with residents typically located 221 meters from the nearest transport stop. On average, there are 88 trips per day across all routes, equating to approximately 18 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Iluka - Burns Beach's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Health outcomes data shows excellent results across Iluka - Burns Beach, with very low prevalence of common health conditions across all age groups. The rate of private health cover is exceptionally high at approximately 67% of the total population (7,441 people), compared to 59.3% across Greater Perth and a national average of 55.3%. The most common medical conditions in the area are arthritis and asthma, impacting 5.9 and 5.8% of residents respectively, while 77.7% of residents declare themselves completely clear of medical ailments, compared to 71.5% across Greater Perth.

The area has 15.7% of residents aged 65 and over (1,748 people), which is lower than the 20.1% in Greater Perth. Health outcomes among seniors are particularly strong, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Iluka - Burns Beach was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Iluka-Burns Beach has a higher cultural diversity than most local areas, with 13.2% of residents speaking a language other than English at home and 53.2% born overseas. The predominant religion is Christianity, practiced by 57.0% of the population, compared to 49.6% in Greater Perth. The top three ancestry groups are English (36.9%), Australian (16.2%), and Irish (8.6%).

Notably, South African ancestry is higher at 3.7%, Welsh at 1.3%, and Dutch at 2.1%, compared to regional averages of 1.8%, 1.1%, and 1.7% respectively.

Frequently Asked Questions - Diversity

Age

Iluka - Burns Beach's median age exceeds the national pattern

The median age in Iluka - Burns Beach is 43 years, which is considerably higher than Greater Perth's average of 37 years and substantially exceeds the national average of 38 years. The age profile shows that individuals aged 55-64 years make up a particularly prominent group at 17.6%, while those aged 25-34 years are comparatively smaller at 6.1% compared to Greater Perth's population. This concentration of the 55-64 age group is well above the national average of 11.2%. Between 2021 and present, the 65 to 74 age group has grown from 8.4% to 10.7%, while the 75 to 84 age group increased from 2.4% to 4.0%. Conversely, the 45 to 54 age group has declined from 19.4% to 16.8%. Looking ahead to 2041, demographic projections reveal significant shifts in Iluka - Burns Beach's age structure. The 65 to 74 age cohort is projected to rise substantially, with an increase of 788 people (66%) from 1,197 to 1,986. Notably, the combined age groups of 65 and above will account for 74% of total population growth, reflecting the area's aging demographic profile. Conversely, the 0 to 4 and 5 to 14 age cohorts are expected to experience population declines.