Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Ingham has shown very soft population growth performance across periods assessed by AreaSearch

Ingham's population is estimated at around 4,549 as of Nov 2025, reflecting an increase of 94 people since the 2021 Census. This growth, inferred from AreaSearch validations and latest ABS data, shows a resident population of 4,507 in Jun 2024, with additional validated new addresses contributing to the rise. The population density is approximately 109 persons per square kilometer. Between the 2021 Census and Nov 2025, Ingham's growth rate of 2.1% compares favorably with its SA3 area's 3.8%. Interstate migration accounted for around 77.0% of population gains during this period. AreaSearch uses ABS/Geoscience Australia projections for each SA2 area released in Jun 2024, based on 2022 data.

For areas not covered by these projections and years post-2032, Queensland State Government's SA2 area projections from 2023 are adopted. These state projections lack age category splits, so AreaSearch applies proportional growth weightings aligned with ABS Greater Capital Region projections released in 2023. Future population dynamics indicate a decline by 2041, with the total population projected to decrease by 321 persons. However, specific age cohorts are expected to grow; notably, the 65-74 age group is anticipated to increase by 51 people.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Ingham, placing the area among the bottom 25% of areas assessed nationally

AreaSearch analysis of ABS building approval numbers, allocated from statistical area data, indicates Ingham averaged around 6 new dwelling approvals annually. Over the past five financial years, between FY21 and FY25, an estimated 33 homes were approved, with a further 3 approved so far in FY26. On average, 1 new resident arrived per year for each new home over these five years, suggesting balanced supply and demand conditions. However, this ratio has recently eased to -0.3 people per dwelling over the past two financial years, reflecting improved supply availability.

New properties are constructed at an average value of $369,000. This year, $9.2 million in commercial approvals have been registered, highlighting the area's primarily residential nature. Compared to the rest of Queensland, Ingham records about three-quarters the building activity per person and ranks among the 33rd percentile nationally, resulting in relatively constrained buyer choice and supporting interest in existing dwellings. This lower-than-average national activity may reflect planning constraints and the area's maturity. New building activity shows 33.0% detached dwellings and 67.0% townhouses or apartments, indicating a trend towards denser development to provide accessible entry options for downsizers, investors, and entry-level buyers. This marks a significant change from the current housing mix of 86.0% houses, likely due to reduced availability of development sites and shifting lifestyle demands.

The area has an estimated 501 people per dwelling approval, reflecting its quiet, low activity development environment. With population expected to remain stable or decline, Ingham should see reduced pressure on housing, potentially creating opportunities for buyers.

Frequently Asked Questions - Development

Infrastructure

Ingham has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

Eight projects have been identified by AreaSearch as potentially impacting the area. These include the North Queensland Bio-Energy Facility in Ingham, Moduline's expansion in Ingham involving a factory and showroom, Atlantic North's project in Ingham, and the Residential Activation Fund for housing in Hinchinbrook.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

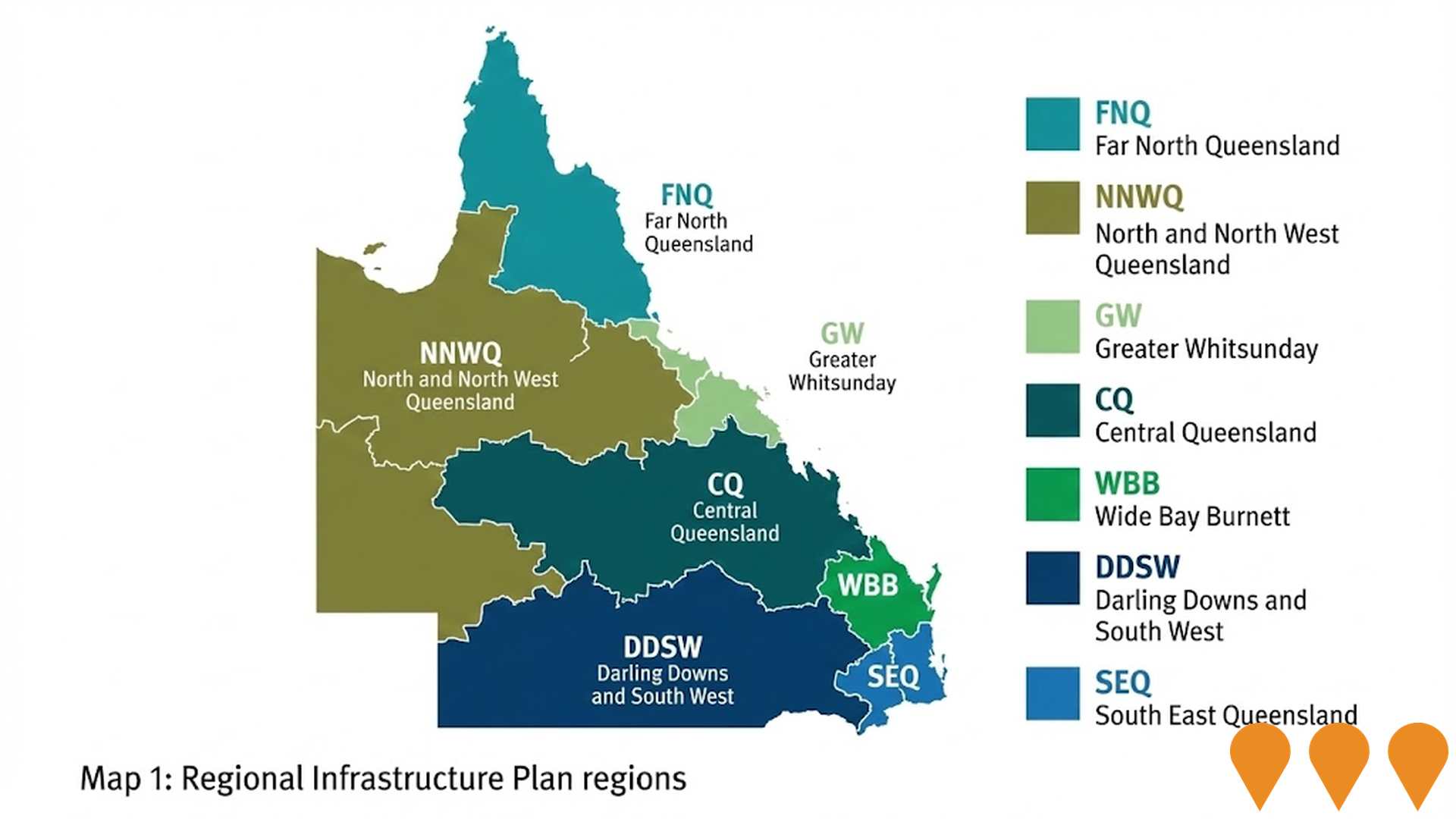

Queensland Energy Roadmap

A statewide energy transformation program following the 2025 pivot from the original Energy and Jobs Plan. The roadmap shifts focus toward a mix of existing coal asset retention until 2046, new gas-fired generation, and private sector-led renewable growth. Key active components include the CopperString transmission line, the Gladstone Grid Reinforcement, and various battery storage projects aimed at maintaining grid reliability and affordability.

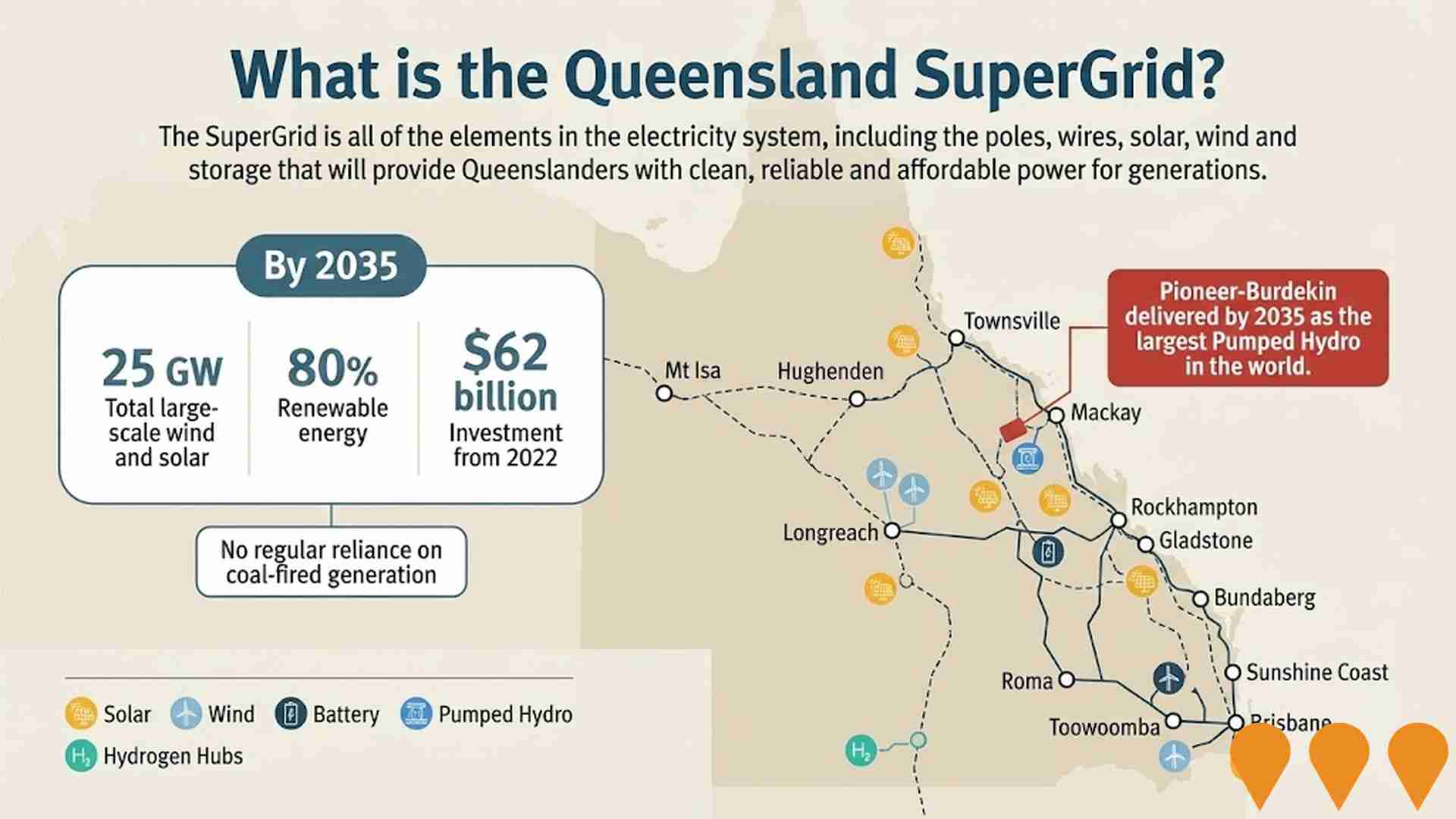

Queensland Energy and Jobs Plan SuperGrid

The Queensland SuperGrid is a high-capacity statewide electricity network connecting renewable energy zones, storage, and demand centers. As of 2026, the program is transitioning under the new Queensland Energy Roadmap, moving from rigid percentage targets to an emission-reduction focus while maintaining critical infrastructure delivery. Major works include the CopperString 2032 link, the Gladstone Grid Reinforcement (Stage 1), and the Borumba Pumped Hydro transmission connections. The plan integrates 22 GW of new renewables through Regional Energy Hubs and state-owned clean energy hubs at repurposed coal-fired power station sites.

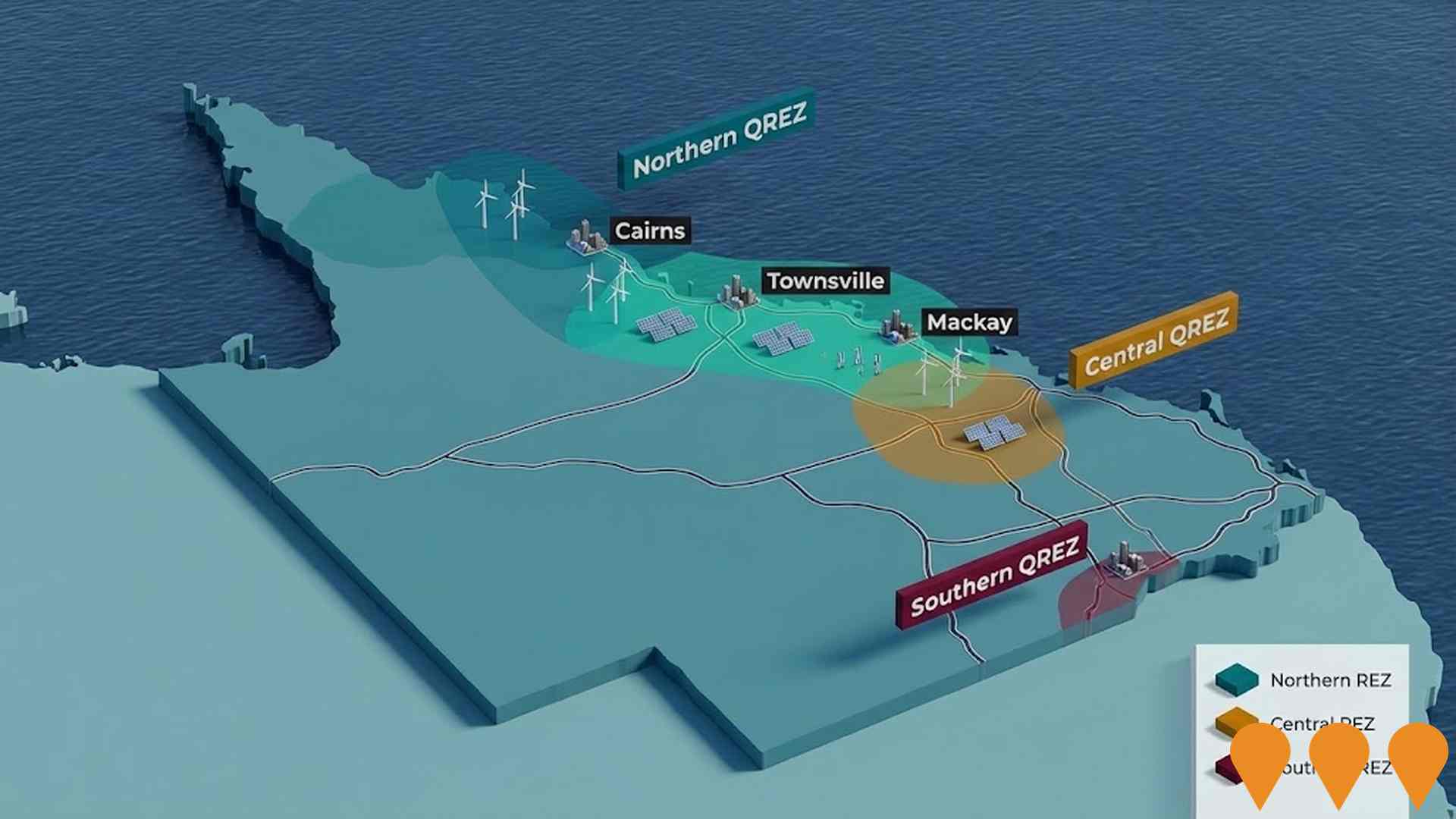

Queensland Energy and Jobs Plan - Northern Queensland SuperGrid (CopperString 2032 & Northern REZ)

A flagship 1,100 km high-voltage transmission project connecting the North West Minerals Province to the National Electricity Market. The project includes a 500kV line from Townsville to Hughenden, a 330kV line to Cloncurry, and a 220kV line to Mount Isa. It establishes the Northern Renewable Energy Zone to unlock large-scale wind and solar potential and supports critical minerals processing. Construction commenced in 2024 with workforce accommodation facilities, while major transmission line works are slated for 2025-2026.

North Queensland Bio-Energy Facility (Ingham)

Proposed integrated sugar, ethanol and renewable power facility on a greenfield site near Ingham. The project has previously been described as an 80 ha site south of Ingham with sugar milling, ethanol production and export of renewable electricity to the grid. Corporate updates since 2017 indicate efforts to finalise EPC and financing; local reports in later years note the project stalled pending market and policy settings. Contact details and site information remain active on the developer website.

Atlantic North Ingham

Proposed mixed-use retail precinct at 70 Townsville Road, Ingham, featuring large-format retail/showrooms, motel rooms and dormitory accommodation, and associated parking, intended to expand and complement Ingham's commercial centre.

Bruce Highway (Townsville-Ingham) upgrade program

Concurrent upgrades to improve safety and efficiency on the Bruce Highway between Townsville and Ingham. Current scope includes a new northbound overtaking lane between Leichhardt Creek and Lilypond Creek, wide centre line treatments, pavement strengthening near Hencamp Creek, and upgrades to the Christmas Creek rest area (ablutions, turn lanes, heavy vehicle improvements).

North and Far North Queensland REZs

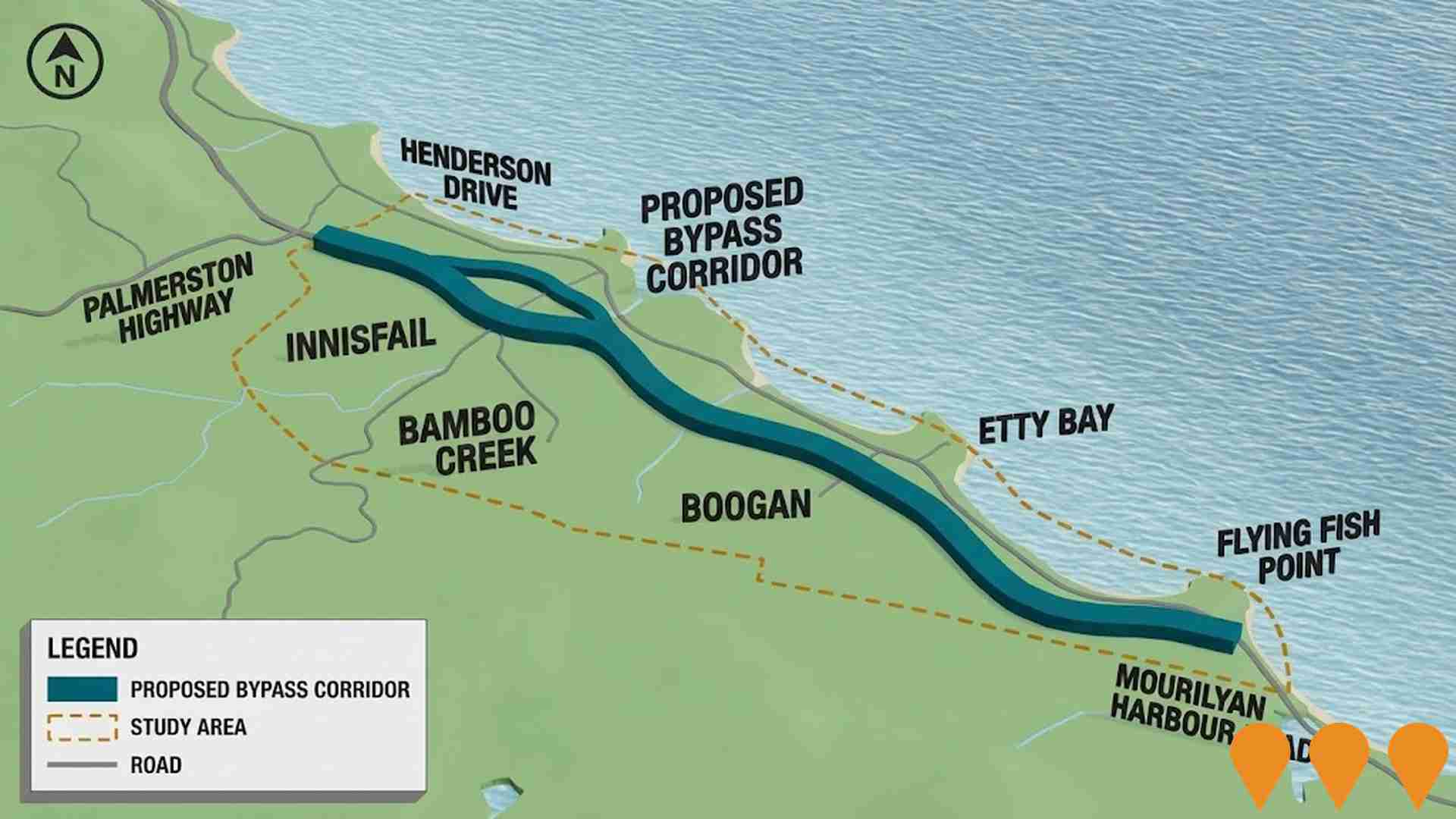

Queensland is progressing three potential Renewable Energy Zones (REZs) in the North and Far North region: Far North Queensland, Collinsville and Flinders. As at August 2025 these REZs have not been formally declared under the Energy (Renewable Transformation and Jobs) Act 2024. Powerlink Queensland has been appointed as the REZ Delivery Body to develop REZ management plans and lead planning and consultation ahead of any declaration. Government materials indicate early network upgrades south of Cairns to unlock up to 500 MW in the Far North as an initial step, with broader REZ design, access and community engagement to follow.

Moduline Ingham Expansion - Factory and Showroom

Proposed ~4,400 sqm manufacturing facility with ~550 sqm office and retail showroom for Moduline in Ingham CBD. Development Application lodged 24 Feb 2025 for Medium Impact Industry (furniture manufacturing, display and sales) across multiple lots fronting Herbert St and Lynn St. State assessment (SARA) advice issued 17 Mar 2025. Project aims to modernize production, expand local jobs and renew the town centre retail presence.

Employment

Employment conditions in Ingham face significant challenges, ranking among the bottom 10% of areas assessed nationally

Ingham's workforce comprises both white and blue-collar jobs with significant representation in essential services sectors. The unemployment rate was 9.8% as per AreaSearch's statistical area data aggregation.

As of September 2025, 1,785 residents were employed, with an unemployment rate of 5.7%, which is 1.6 percentage points higher than Rest of Qld's 4.1%. Workforce participation in Ingham was 49.5%, compared to Rest of Qld's 59.1%. The dominant employment sectors among residents included health care & social assistance, manufacturing, and retail trade. Manufacturing stood out with an employment share of 2.2 times the regional level, while construction had a limited presence at 5.2% compared to the regional 10.1%.

The worker-to-resident ratio was 0.7 as per the Census, indicating above-normal local employment opportunities. Between September 2024 and September 2025, labour force levels decreased by 0.3%, while employment declined by 2.2%, causing the unemployment rate to rise by 1.8 percentage points in Ingham. Conversely, Rest of Qld saw employment rise by 1.7% and the labour force grow by 2.1%. State-level data from November 25, 2025, showed Queensland's employment had contracted by 0.01%, with an unemployment rate of 4.2%, closely aligned with the national rate of 4.3%. Jobs and Skills Australia's May 2025 projections forecast national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Ingham's employment mix suggests local employment should increase by 5.4% over five years and 12.2% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

The median taxpayer income in Ingham is $47,011 and the average is $55,615 according to postcode level ATO data aggregated by AreaSearch for financial year 2023. This is lower than the national averages of $53,146 (median) and $66,593 (average). By September 2025, estimates based on a 9.91% Wage Price Index growth suggest median income will be approximately $51,670 and average income will be around $61,126. Ingham's incomes fall between the 4th and 12th percentiles nationally according to Census 2021 data. The $400 - 799 earnings band includes 29.2% of Ingham's population (1,328 individuals), unlike metropolitan regions where the $1,500 - 2,999 category is predominant at 31.7%. Despite modest housing costs allowing for 88.1% income retention, total disposable income ranks at just the 7th percentile nationally.

Frequently Asked Questions - Income

Housing

Ingham is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Ingham's dwelling structure, as per the latest Census, consisted of 86.5% houses and 13.6% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Non-Metro Qld had 89.5% houses and 10.5% other dwellings. Home ownership in Ingham was at 45.5%, with mortgaged dwellings at 19.8% and rented ones at 34.6%. The median monthly mortgage repayment in the area was $1,083, compared to Non-Metro Qld's average of $1,213. The median weekly rent figure for Ingham was $210, while nationally it stood at $375.

Frequently Asked Questions - Housing

Household Composition

Ingham features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 60.9% of all households, including 18.5% couples with children, 30.0% couples without children, and 11.5% single parent families. Non-family households account for the remaining 39.1%, with lone person households at 36.7% and group households comprising 2.4%. The median household size is 2.1 people, smaller than the Rest of Qld average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Ingham faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 9.7%, significantly lower than Australia's average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives in the region. Bachelor degrees are most prevalent at 7.7%, followed by postgraduate qualifications (1.2%) and graduate diplomas (0.8%). Vocational credentials are prominent, with 40.1% of residents aged 15+ holding such qualifications - advanced diplomas comprise 6.9% and certificates account for 33.2%.

Educational participation is high, with 26.3% of residents currently enrolled in formal education. This includes 9.8% in primary education, 9.3% in secondary education, and 2.1% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Ingham is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Ingham faces significant health challenges, as indicated by health data. Both younger and older age groups have a notable prevalence of common health conditions.

Private health cover is relatively low in Ingham, with approximately 49% of the total population (~2,239 people) having it, compared to the national average of 55.7%. The most prevalent medical conditions are arthritis (11.3%) and mental health issues (8.3%), while 60.9% of residents report being completely clear of medical ailments, compared to 66.2% in the rest of Queensland. Ingham has a higher proportion of seniors aged 65 and over at 27.3% (1,241 people), compared to 24.3% in the rest of Queensland. Health outcomes among seniors present some challenges but perform better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Ingham is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Ingham's population was found to be below average in cultural diversity, with 89.6% being citizens, 89.6% born in Australia, and 92.5% speaking English only at home. Christianity was the main religion, accounting for 74.6%, compared to 70.7% across Rest of Qld. The top three ancestry groups were Australian (24.2%), English (23.8%), and Italian (21.1%), the latter being substantially higher than the regional average of 11.3%.

Notably, Spanish was overrepresented at 0.9%, Australian Aboriginal at 6.2%, and Maltese at 0.4% compared to regional averages of 0.6%, 8.1%, and 0.2% respectively.

Frequently Asked Questions - Diversity

Age

Ingham hosts an older demographic, ranking in the top quartile nationwide

Ingham's median age is 48, significantly higher than Rest of Qld's figure of 41 and the national norm of 38. The 75-84 age group comprises 10.0% of Ingham's population compared to Rest of Qld, while the 35-44 cohort is less prevalent at 9.0%. Post-2021 Census data shows that the 25 to 34 age group has grown from 10.1% to 11.7%. Conversely, the 45 to 54 cohort has declined from 11.7% to 10.3%. By 2041, Ingham's age composition is expected to shift notably. The 65 to 74 group will grow by 6%, reaching 609 from 573, with those aged 65 and above comprising 75% of projected growth. Conversely, population declines are projected for the 5 to 14 and 45 to 54 cohorts.