Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Palm Island is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Based on analysis of ABS population updates for the broader area, as of November 2025, Palm Island's estimated population is around 2,323. This reflects an increase of 185 people since the 2021 Census, which reported a population of 2,138. The change was inferred from AreaSearch's resident population estimate following examination of the latest ERP data release by the ABS in June 2024 and address validation since the Census date. This level of population equates to a density ratio of 26 persons per square kilometer. Palm Island's growth rate of 8.7% since the 2021 census exceeded that of its SA3 area (3.8%) and SA4 region, marking it as a growth leader in the region. Natural growth contributed approximately 99.0% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are adopted. However, these state projections do not provide age category splits; hence proportional growth weightings in line with the ABS Greater Capital Region projections released in 2023 based on 2022 data are applied where utilised. Future population trends project an above median growth for national non-metropolitan areas, with the Palm Island statistical area (Lv2) expected to expand by 403 persons to 2041, reflecting a total increase of 17.4% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Palm Island recording a relatively average level of approval activity when compared to local markets analysed countrywide

Palm Island has seen approximately 13 dwelling approvals per year based on AreaSearch's analysis of ABS building approval data over the past five financial years. This totals an estimated 69 homes from FY-20 to FY-24. As of FY-25, no approvals have been recorded yet.

On average, around 0.2 new residents arrive per new home annually between FY-21 and FY-25. New construction is meeting or exceeding demand, providing more options for buyers and potentially facilitating population growth beyond current expectations. The average expected construction cost of new properties is $351,000. Compared to the rest of Queensland, Palm Island has 191% more building activity per person.

Recent development consists solely of standalone homes, maintaining the area's low-density nature and attracting space-seeking buyers. There are approximately 79 people per dwelling approval in the location, indicating an expanding market. AreaSearch projects Palm Island to grow by 404 residents by 2041. Given current development patterns, new housing supply should readily meet demand, offering favourable conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Palm Island has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

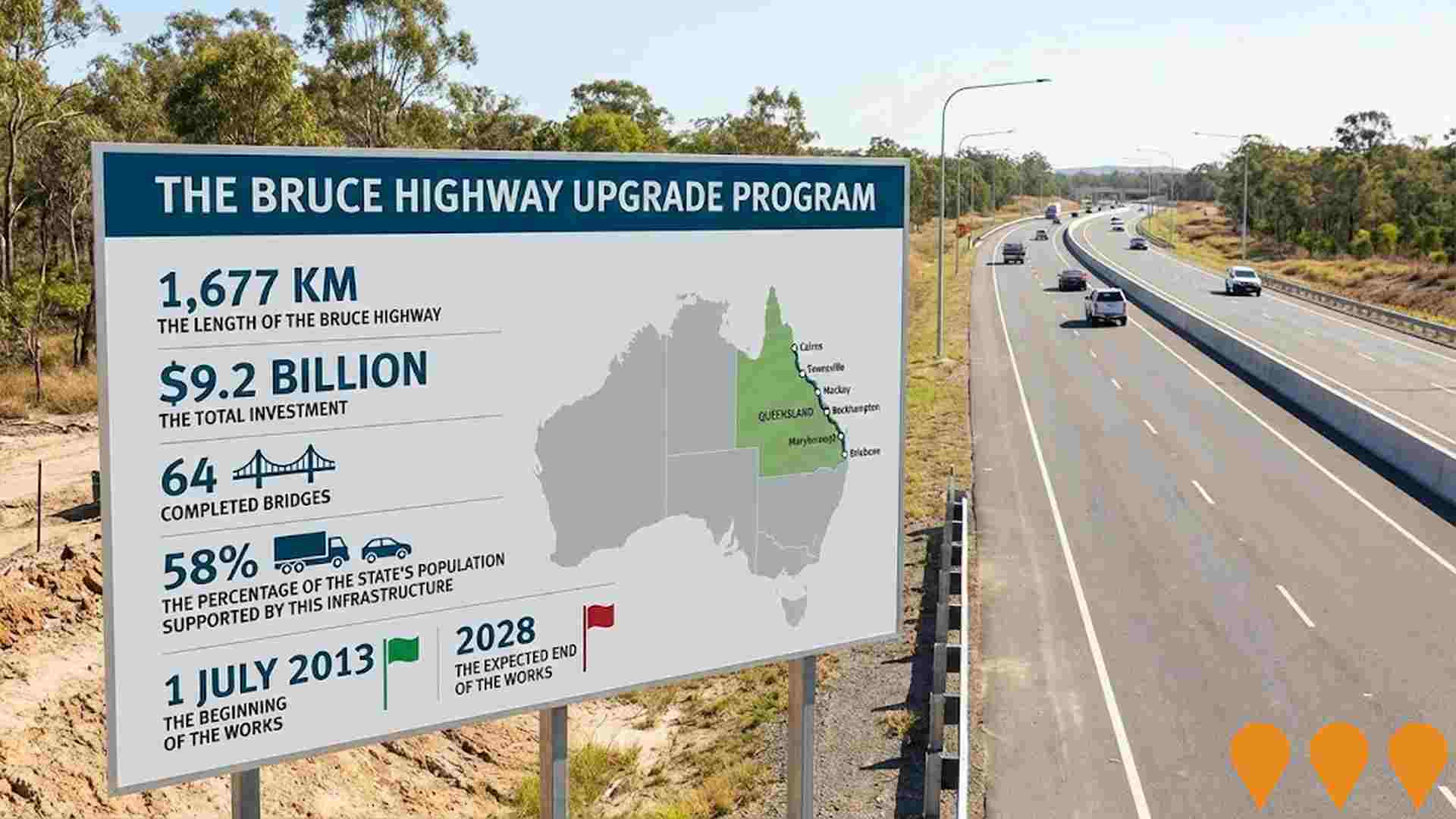

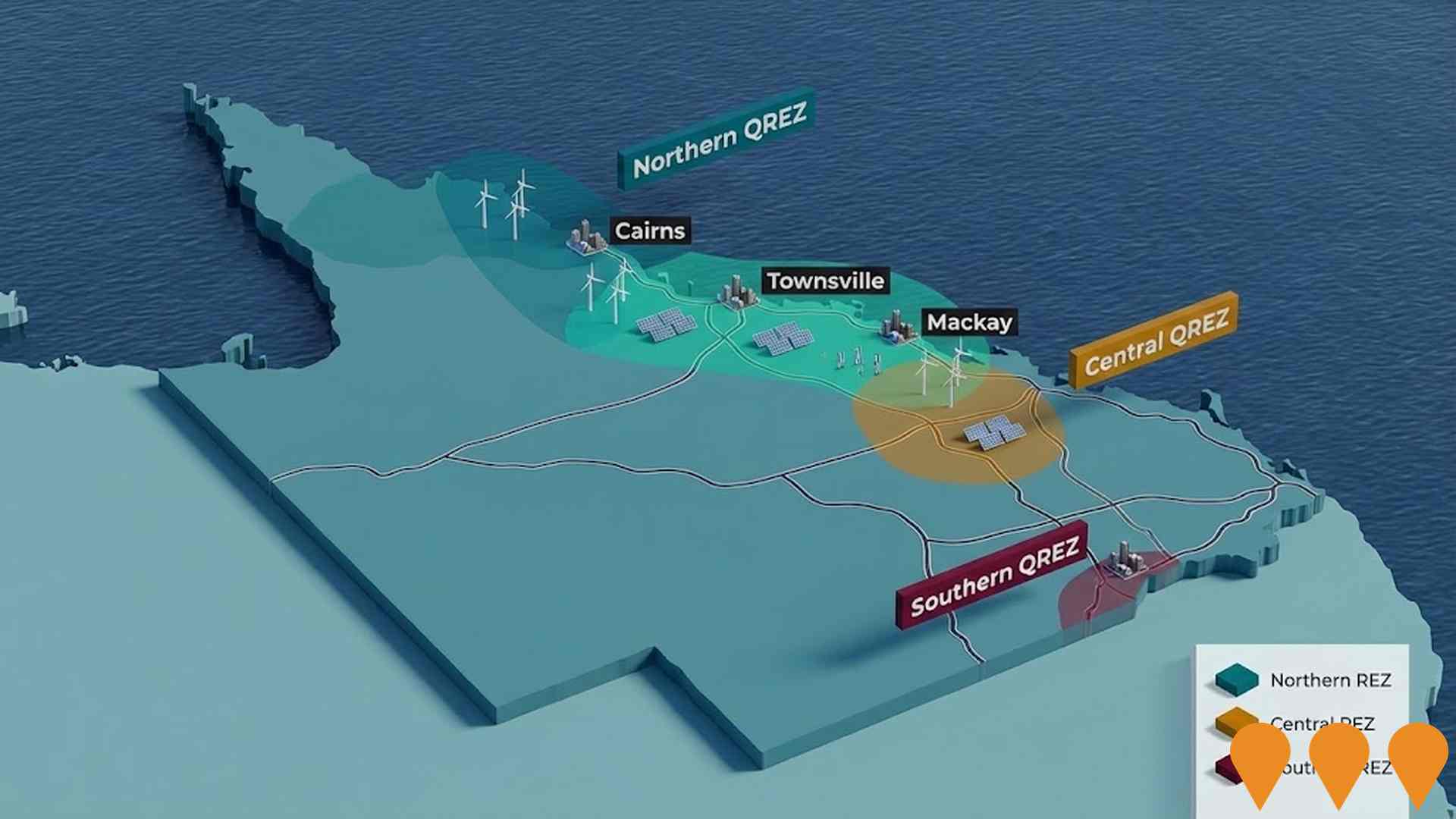

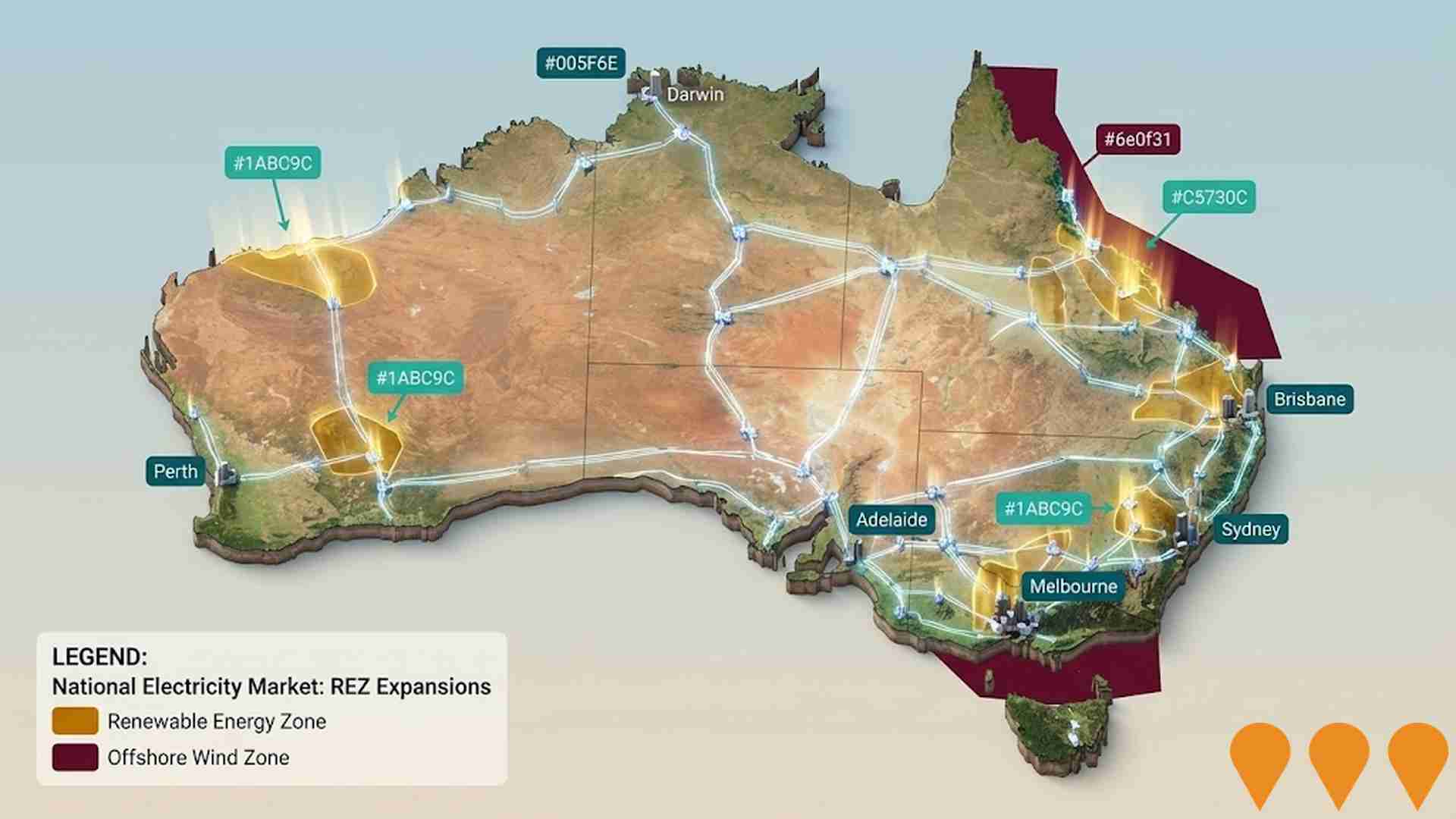

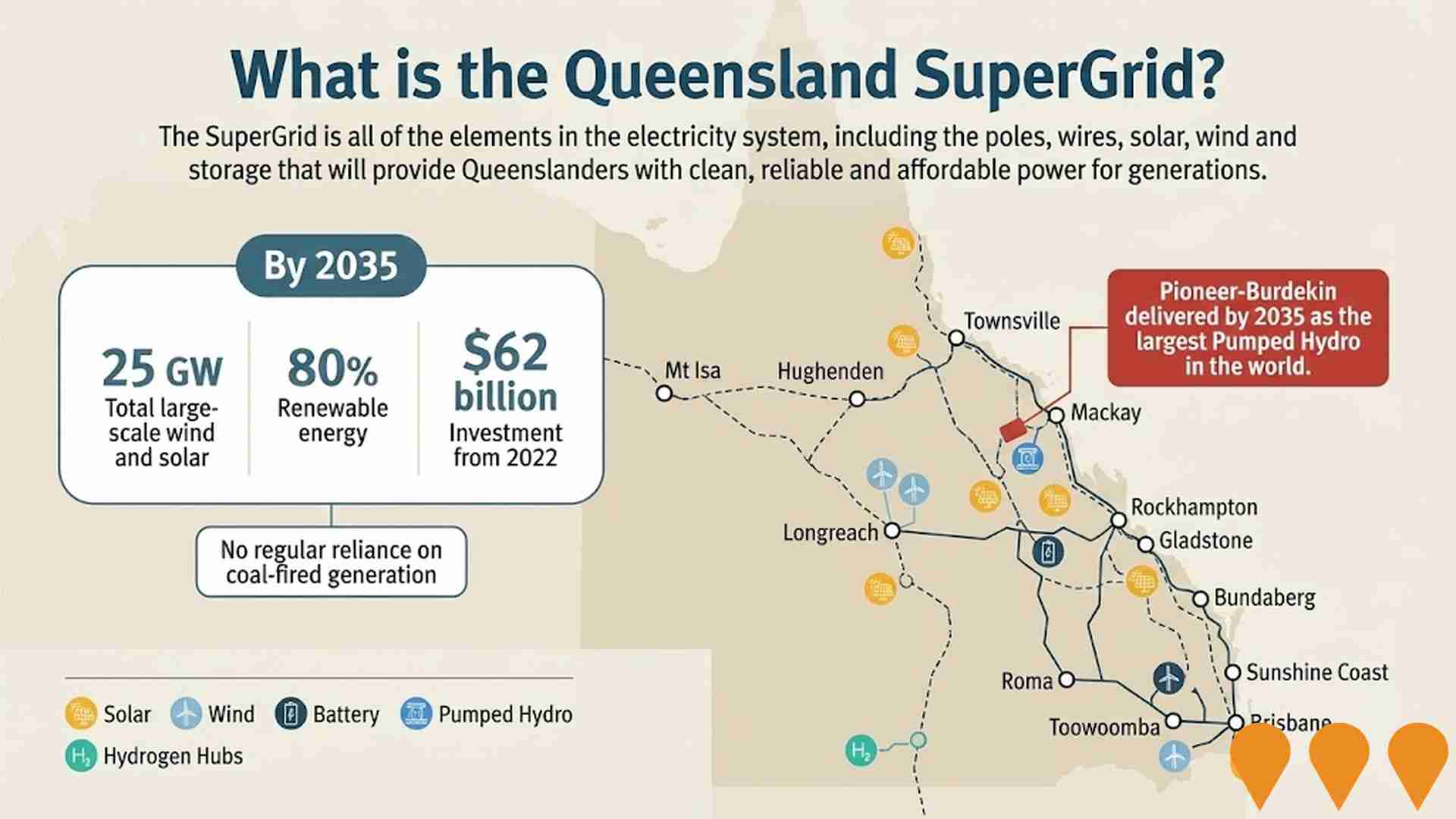

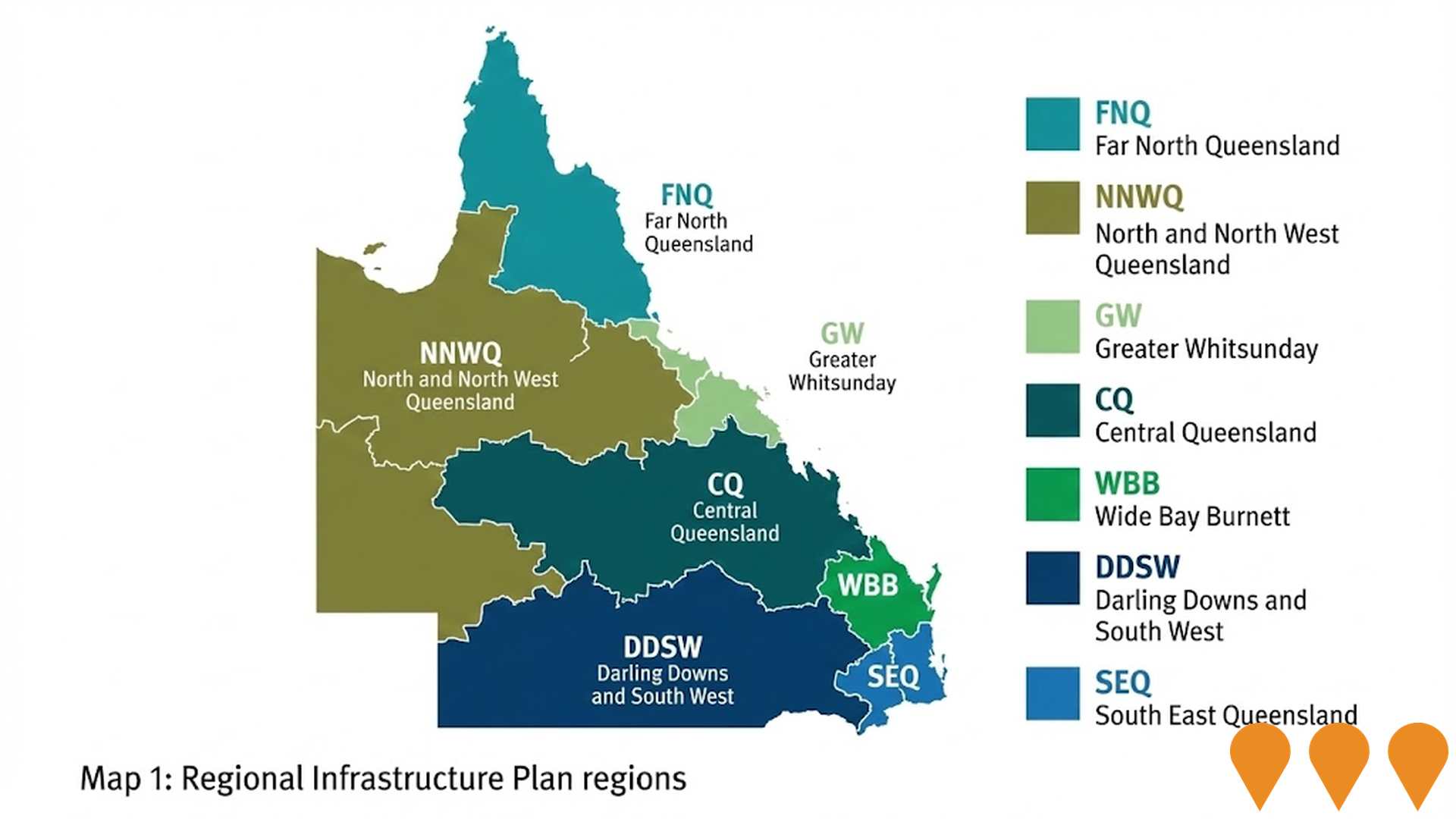

AreaSearch has identified zero projects that could potentially impact the area's performance due to changes in local infrastructure or planning initiatives. Notable projects include the Bruce Highway upgrade program between Townsville and Ingham, the North and Far North Queensland Renewable Energy Zones (REZs), maintenance of the Queensland National Land Transport Network, and the Queensland Energy and Jobs Plan SuperGrid. The following list provides details on those projects most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Queensland Energy Roadmap

A statewide energy transformation program following the 2025 pivot from the original Energy and Jobs Plan. The roadmap shifts focus toward a mix of existing coal asset retention until 2046, new gas-fired generation, and private sector-led renewable growth. Key active components include the CopperString transmission line, the Gladstone Grid Reinforcement, and various battery storage projects aimed at maintaining grid reliability and affordability.

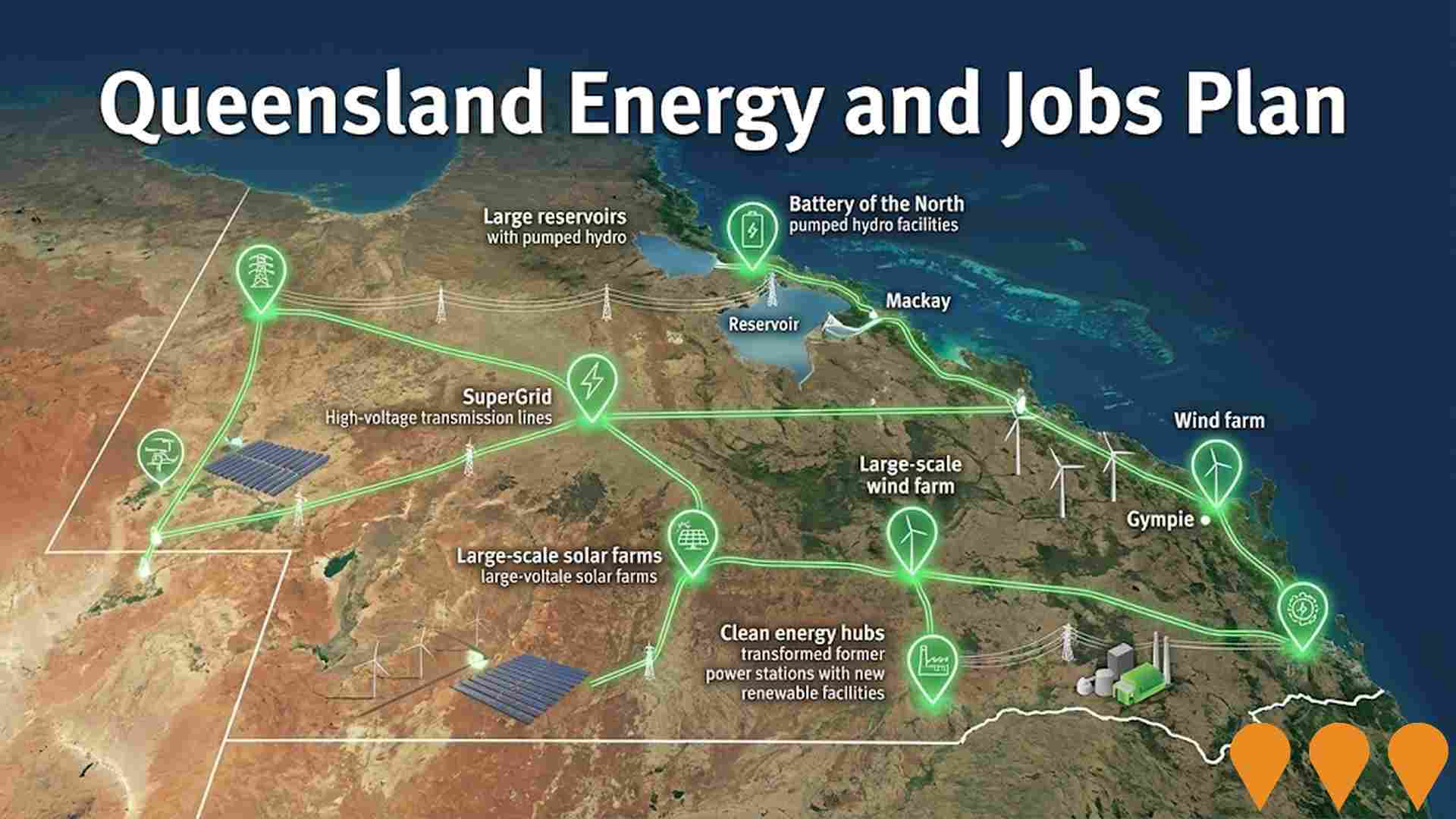

Queensland Energy and Jobs Plan SuperGrid

The Queensland SuperGrid is a high-capacity statewide electricity network connecting renewable energy zones, storage, and demand centers. As of 2026, the program is transitioning under the new Queensland Energy Roadmap, moving from rigid percentage targets to an emission-reduction focus while maintaining critical infrastructure delivery. Major works include the CopperString 2032 link, the Gladstone Grid Reinforcement (Stage 1), and the Borumba Pumped Hydro transmission connections. The plan integrates 22 GW of new renewables through Regional Energy Hubs and state-owned clean energy hubs at repurposed coal-fired power station sites.

Queensland Energy Roadmap

The Queensland Energy Roadmap is the state's revised energy strategy as of 2025-2026, replacing the previous Energy and Jobs Plan. It focuses on a market-based transition to net-zero by 2050 while extending the life of state-owned coal assets until at least 2046. Key components include the delivery of CopperString 2032 (a 1,000km transmission line), the Borumba Pumped Hydro Project, and the conversion of Renewable Energy Zones into Regional Energy Hubs. The plan prioritizes targeted transmission upgrades and gas-fired generation for grid firming.

Queensland Energy and Jobs Plan - Northern Queensland SuperGrid (CopperString 2032 & Northern REZ)

A flagship 1,100 km high-voltage transmission project connecting the North West Minerals Province to the National Electricity Market. The project includes a 500kV line from Townsville to Hughenden, a 330kV line to Cloncurry, and a 220kV line to Mount Isa. It establishes the Northern Renewable Energy Zone to unlock large-scale wind and solar potential and supports critical minerals processing. Construction commenced in 2024 with workforce accommodation facilities, while major transmission line works are slated for 2025-2026.

Queensland Energy Roadmap 2025

The Queensland Energy Roadmap 2025 is a strategic framework focused on delivering affordable, reliable, and sustainable energy through 2035. Key initiatives include a $1.6 billion Electricity Maintenance Guarantee for existing assets, a $400 million Energy Investment Fund to catalyze private sector renewables (solar, hydro) and storage, and a mandate for at least 2.6 GW of new gas generation by 2035. The plan formally repealed previous state renewable energy targets via the Energy Roadmap Amendment Act 2025 while maintaining a net-zero by 2050 commitment. It prioritizes the CopperString transmission project and renames Renewable Energy Zones to 'Regional Energy Hubs' to facilitate market-led development.

Queensland Energy Roadmap 2025

The Queensland Energy Roadmap 2025 is a strategic framework focused on energy affordability, reliability, and sustainability, replacing the previous 2022 Energy and Jobs Plan. Key initiatives include a $400 million Energy Investment Fund, a $1.6 billion Electricity Maintenance Guarantee for existing assets, and a new Regional Energy Hubs framework. The plan targets 6.8 GW of new wind/solar and 3.8 GW of storage by 2030 through private sector investment. It also prioritizes the CopperString Eastern Link (330kV) to be delivered by 2032 and a 400MW gas-fired generation tender in Central Queensland. The Energy Roadmap Amendment Act 2025, passed in December 2025, formally repealed previous renewable energy targets while maintaining a net zero by 2050 commitment.

Queensland Energy Roadmap 2025

The Queensland Energy Roadmap 2025 is a strategic framework focused on energy affordability and reliability. Key initiatives include a $1.6 billion Electricity Maintenance Guarantee to extend the life of state-owned coal assets until at least 2046 and a $400 million Queensland Energy Investment Fund to catalyze private sector investment. Major infrastructure priorities include the delivery of the CopperString Eastern Link (330kV) by 2032 and a 400MW Central Queensland Gas Power Tender to be operational by 2032. The plan replaces the former Energy and Jobs Plan and shifts from renewable targets to Regional Energy Hubs and emission reduction goals.

Building Future Hospitals Program

Queensland's Hospital Rescue Plan is a landmark $18.5 billion infrastructure initiative delivering over 2,600 new and refurbished public hospital beds by 2032. The program includes the construction of three new hospitals in Coomera, Bundaberg, and Toowoomba, alongside major expansions at Ipswich (Stage 2), Logan, Princess Alexandra, and Townsville University hospitals. It also encompasses satellite hospitals and a statewide cancer network to address the needs of a growing and aging population.

Employment

Employment conditions in Palm Island face significant challenges, ranking among the bottom 10% of areas assessed nationally

Palm Island has a mixed workforce comprising white and blue-collar jobs, with essential services well represented. Its unemployment rate is 70.2%, according to AreaSearch's statistical area data aggregation.

As of September 2025136 residents are employed while the unemployment rate is 66.1% higher than Rest of Qld's rate of 4.1%. Workforce participation on Palm Island lags significantly at 27.3%, compared to Rest of Qld's 59.1%. Employment is concentrated in health care & social assistance, education & training, and public administration & safety. Notably, health care & social assistance employment is at 2.0 times the regional average.

Conversely, construction is under-represented with only 2.4% of Palm Island's workforce compared to Rest of Qld's 10.1%. Limited local employment opportunities are suggested by the difference between Census working population and resident population. Over the 12 months to September 2025, labour force levels increased by 1.6%, while employment declined by 10.5%, causing unemployment to rise by 4.0 percentage points. In contrast, Rest of Qld experienced employment growth of 1.7% and labour force growth of 2.1%, with a 0.3 percentage point rise in unemployment. State-level data to 25-Nov shows QLD employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%, closely aligned with the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 indicate a projected expansion of national employment by 6.6% over five years and 13.7% over ten years, though growth rates vary significantly between industry sectors. Applying these projections to Palm Island's employment mix suggests local employment should increase by 7.7% over five years and 16.0% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2023 shows that income in Palm Island is below the national average. The median income is $52,258 and the average is $63,468. This contrasts with Rest of Qld's figures where the median income is $53,146 and the average is $66,593. Based on Wage Price Index growth of 9.91% since financial year 2023, current estimates for Palm Island would be approximately $57,437 (median) and $69,758 (average) as of September 2025. According to the 2021 Census figures, household, family, and personal incomes in Palm Island all fall between the 1st and 2nd percentiles nationally. Income analysis reveals that the largest segment comprises 27.3% earning $400 - $799 weekly (634 residents), contrasting with the surrounding region where the $1,500 - $2,999 bracket leads at 31.7%. The prevalence of lower-income residents (40.4% under $800/week) indicates constrained household budgets across much of the area. While housing costs are modest with 87.4% of income retained, the total disposable income ranks at just the 5th percentile nationally.

Frequently Asked Questions - Income

Housing

Palm Island is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Palm Island's dwelling structure, as per the latest Census, had 87.9% houses and 12.1% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro Qld's 89.5% houses and 10.5% other dwellings. Home ownership on Palm Island was at 2.2%, with mortgaged dwellings at 0.0% and rented at 97.8%. The median monthly mortgage repayment was $2,167, higher than Non-Metro Qld's average of $1,213. Median weekly rent on Palm Island was $125, lower than Non-Metro Qld's $202 and the national average of $375. Nationally, Palm Island's mortgage repayments were significantly higher at $2,167 compared to the Australian average of $1,863.

Frequently Asked Questions - Housing

Household Composition

Palm Island has a typical household mix, with a higher-than-average median household size

Family households compose 75.9% of all households, including 27.6% couples with children, 11.2% couples without children, and 30.0% single parent families. Non-family households account for the remaining 24.1%, with lone person households at 21.1% and group households comprising 3.7%. The median household size is 3.7 people, which is larger than the Rest of Qld average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Palm Island faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

In the area, university qualification rates are low at 7.3%, significantly below Australia's average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common among those with university qualifications (4.9%), followed by postgraduate qualifications (1.4%) and graduate diplomas (1.0%). Vocational pathways account for 22.6% of qualifications among residents aged 15 and above, with advanced diplomas at 4.5% and certificates at 18.1%.

Educational participation is high, with 30.3% of residents currently enrolled in formal education. This includes 21.0% in primary education, 6.4% in secondary education, and 0.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Palm Island's residents boast exceedingly positive health performance metrics with both young and old age cohorts seeing low prevalence of common health conditions

Palm Island shows excellent health outcomes with both young and elderly cohorts having low prevalence of common health conditions. Its private health cover rate stands at approximately 52%, higher than the average SA2 area's 50.3%.

The most prevalent medical conditions are diabetes (7.2%) and heart disease (4.3%). A total of 83.9% of residents report no medical ailments, compared to Rest of Qld's 66.2%. Only 7.2% of Palm Island's population is aged 65 and over (167 people), lower than Rest of Qld's 24.3%. Despite this, health outcomes among seniors require more attention than the broader population.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Palm Island records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Palm Island's cultural diversity aligns with its region's average. Its population comprises 93.2% citizens, 97.8% born in Australia, and 56.7% speaking English only at home. Christianity is the predominant religion on Palm Island, with 81.7%, compared to 70.7% across Rest of Qld.

In terms of ancestry, Australian Aboriginal comprises 72.6%, Other 16.4%, and Australian 4.6%. These figures contrast with regional averages: Australian Aboriginal at 8.1%, Other at 4.6%, and Australian at 27.4%.

Frequently Asked Questions - Diversity

Age

Palm Island hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Palm Island's median age is 27 years, which is lower than the Rest of Qld average of 41 and the Australian median of 38. Compared to Rest of Qld, Palm Island has a higher percentage of residents aged 5-14 (19.4%) but fewer residents aged 65-74 (5.2%). This 5-14 concentration is higher than the national average of 12.2%. Between 2021 and present, the population aged 35 to 44 has increased from 11.1% to 12.5%, while the 25 to 34 cohort has risen from 15.4% to 16.6%. Conversely, the 45 to 54 cohort has decreased from 11.6% to 10.1%, and the 5 to 14 group has dropped from 20.8% to 19.4%. By 2041, demographic modeling projects significant changes in Palm Island's age profile. The 25 to 34 age cohort is expected to grow steadily, increasing by 116 people (30%) from 385 to 502. Meanwhile, the 15 to 24 and 5 to 14 cohorts are projected to experience population declines.