Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

West End has shown very soft population growth performance across periods assessed by AreaSearch

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch, the West End (Townsville - Qld) statistical area (Lv2)'s population is estimated at around 4,074 as of November 2025. This reflects an increase of 183 people (4.7%) since the 2021 Census, which reported a population of 3,891 people. The change is inferred from the resident population of 4,024 estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024 and an additional 16 validated new addresses since the Census date. This level of population equates to a density ratio of 1,318 persons per square kilometer, which is above the average seen across national locations assessed by AreaSearch. The West End (Townsville - Qld) (SA2)'s 4.7% growth since census positions it within 2.2 percentage points of the SA4 region (6.9%), demonstrating competitive growth fundamentals. Population growth for the area was primarily driven by overseas migration that contributed approximately 53.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, and for years post-2032, Queensland State Government's SA2 area projections, released in 2023 and based on 2021 data, are adopted. It should be noted that these state projections do not provide age category splits; hence where utilised, AreaSearch is applying proportional growth weightings in line with the ABS Greater Capital Region projections (released in 2023, based on 2022 data) for each age cohort. Anticipating future population dynamics, projections indicate a decline in overall population over this period, with the area's population expected to shrink by 325 persons by 2041 according to this methodology. However, growth across specific age cohorts is anticipated, led by the 85 and over age group, which is projected to expand by 73 people.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in West End according to AreaSearch's national comparison of local real estate markets

Based on AreaSearch analysis of ABS building approval numbers, allocated from statistical area data, West End recorded around 7 residential properties granted approval annually. Over the past 5 financial years, between FY-21 and FY-25, approximately 36 homes were approved, with an additional 3 so far in FY-26. On average, 3.1 new residents arrived per year per dwelling constructed during this period.

This demand significantly exceeded new supply, typically leading to price growth and increased buyer competition. New homes were being built at an average construction cost of $327,000, aligning with regional trends. In FY-26, West End recorded $8.7 million in commercial development approvals, suggesting the area's residential character. Compared to the Rest of Qld, West End had markedly lower building activity, 57.0% below the regional average per person, indicating scarcity of new dwellings and strengthening demand for existing properties. However, development activity has picked up in recent periods.

This level was also under the national average, suggesting the area's established nature and potential planning limitations. New building activity showed 89.0% detached houses and 11.0% townhouses or apartments, sustaining West End's suburban identity with a concentration of family homes suited to buyers seeking space. Interestingly, developers were building more traditional houses than the current mix suggested at Census (49.0%), indicating continued strong demand for family homes despite density pressures. With around 450 people per dwelling approval, West End showed a developed market. Given stable or declining population forecasts, West End may experience less housing pressure in the future, creating favourable conditions for buyers.

Frequently Asked Questions - Development

Infrastructure

West End has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

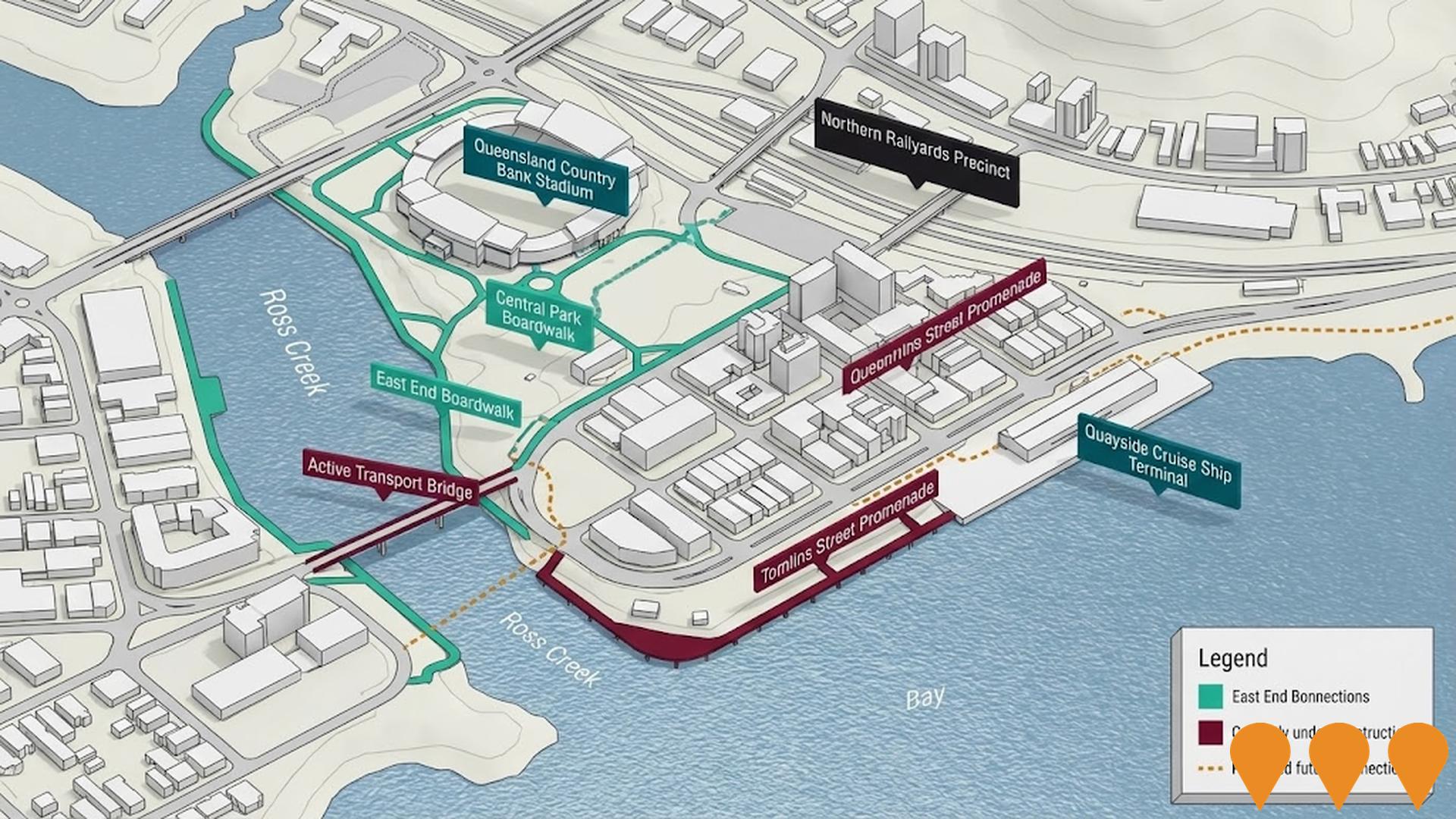

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified nine projects that could affect this region. Notable ones include Weststate Private Hospital, Army Aviation Program of Works at RAAF Base Townsville, Francis Street Roadworks in West End, and Mater Private Hospital Townsville Relocation. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Weststate Private Hospital

Development of a new five-storey short-stay private hospital and the adaptive reuse of the heritage-listed Townsville West State School. The facility will include four operating theatres, one procedure room, 19 day-surgery beds, and 26 overnight beds. Following legal disputes between Centuria Healthcare and the developer, a commercial settlement was reached in late 2025, allowing works to resume under a novated building contract. The project is currently progressing with structural framing and facade installation as of February 2026.

Army Aviation Program of Works - RAAF Base Townsville

A major AUD 700 million infrastructure transformation to support the arrival of 29 AH-64E Apache Guardian helicopters. As of early 2026, the first six aircraft have been delivered and flying operations are underway. The project involves the relocation of the 1st Aviation Regiment and 16th Aviation Brigade HQ to Townsville. Key works include new and renovated aircraft hangars, a dedicated simulation hall for pilot training, the Townsville Aviation Training Academy, and multi-storey car parks. CPB Contractors serves as the managing contractor, with Boeing Defence Australia providing sustainment and maintenance support.

Douglas Water Treatment Plant Clarifiers Upgrade

The project involved the installation of two new clarifiers at the Douglas Water Treatment Plant to double the number of clarifiers, enhancing water treatment capacity during tropical weather events and providing additional water security for Townsvilles growing population. The new infrastructure treats 950 litres per second through Module 3 and 1100 litres per second through Module 4.

Mater Private Hospital Townsville Relocation

Relocation and modernization of private healthcare facilities to better serve the community with state-of-the-art medical technology and infrastructure.

Eden Park Estate

Premium acreage estate in Townsville's Northern Beaches with large blocks ranging from 2005m2 to 2953m2. Located at foothills of Mount Kulburn with elevated settings and sandstone retaining walls.

Harris Crossing Estate

Harris Crossing is a premier masterplanned community in Townsville's western growth corridor, featuring approximately 800 residential lots ranging from 300m2 to 1280m2. The estate is set along the Bohle River and includes over 70 hectares of parkland, North Queensland's first 18-hole Disc Golf Course, and a major display village. A significant recent addition is the $210 million Living Gems Harris Crossing, a 295-home gated over-50s lifestyle resort currently under construction at 99 Hogarth Drive, featuring $16 million in resort-style amenities including a country club, cinema, and bowling alley.

Sanctum Estate

Sanctum is a premier 700-hectare masterplanned community in Townsville's Northern Beaches growth corridor, ultimately delivering over 4,000 lots. The project features 28 hectares of landscaped parkland, a 3km meandering waterway, and extensive walking trails. Current activity includes the 'Hydrangea Release' and construction within the 'Plumwood' and 'Satinwood' precincts, offering various lot sizes up to 1200m2. The estate has expanded to include specialized precincts like the $200 million Lincoln Lifestyle over-50s community.

Defence Housing Australia - Townsville New Builds Volume Leasing Program (400+ Homes)

Large-scale residential development by Defence Housing Australia (DHA) to deliver more than 400 new, high-quality homes for Australian Defence Force personnel and their families in Townsville. The homes are being built across approximately seven suburbs within 30km of Lavarack Barracks as part of the New Builds Volume Leasing Program, in partnership with local builders and developers. The first homes are expected to be delivered in the 2025-26 financial year.

Employment

AreaSearch assessment indicates West End faces employment challenges relative to the majority of Australian markets

West End has an educated workforce with significant representation in essential services sectors. Its unemployment rate was 8.8% as per AreaSearch's statistical area data aggregation.

As of September 2025, West End had 2,091 residents employed, with an unemployment rate 4.7% higher than Rest of Qld's 4.1%. Workforce participation was 64.0%, slightly higher than Rest of Qld's 59.1%. Major employment sectors were health care & social assistance, public administration & safety, and education & training. Public administration & safety showed strong specialization with an employment share twice the regional level.

Agriculture, forestry & fishing had limited presence at 0.3% compared to region's 4.5%. From September 2021 to September 2022, West End's labour force increased by 0.2%, but employment declined by 2.2%, causing unemployment to rise by 2.3 percentage points. In contrast, Rest of Qld saw employment growth of 1.7% and labour force growth of 2.1%, with unemployment rising by 0.3 percentage points. State-level data as of 25-Nov-25 showed Queensland's employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%, closely aligned with the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 indicate overall employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to West End's employment mix suggests local employment could increase by 6.7% over five years and 13.9% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates above-average performance, with income metrics exceeding national benchmarks based on AreaSearch comparative assessment

The suburb of West End's income level is extremely high nationally according to the latest ATO data aggregated by AreaSearch for financial year 2023. The median income among taxpayers in West End is $66,732 and the average income stands at $86,587. This compares to figures for Rest of Qld's median income of $53,146 and average income of $66,593 respectively. Based on Wage Price Index growth of 9.91% since financial year 2023, current estimates would be approximately $73,345 (median) and $95,168 (average) as of September 2025. According to Census 2021 income data, personal income ranks at the 70th percentile ($921 weekly), while household income sits at the 29th percentile. The earnings profile shows that the $1,500 - 2,999 bracket dominates with 30.6% of residents (1,246 people). Housing affordability pressures are severe, with only 84.1% of income remaining after housing costs, ranking at the 28th percentile.

Frequently Asked Questions - Income

Housing

West End displays a diverse mix of dwelling types, with a higher proportion of rental properties than the broader region

In West End, as per the latest Census evaluation, 49.0% of dwellings were houses while 51.0% consisted of other types such as semi-detached homes, apartments, and 'other' dwellings. This contrasts with Non-Metro Qld's figures of 81.3% houses and 18.7% other dwellings. Home ownership in West End stood at 19.7%, with mortgaged dwellings at 28.2% and rented ones at 52.1%. The median monthly mortgage repayment was $1,430, lower than Non-Metro Qld's average of $1,517. The median weekly rent in West End was recorded at $250, compared to Non-Metro Qld's $305. Nationally, West End's mortgage repayments were significantly lower than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

West End features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households account for 50.4% of all households, including 15.9% couples with children, 22.7% couples without children, and 10.7% single parent families. Non-family households constitute the remaining 49.6%, with lone person households at 44.4% and group households making up 5.1%. The median household size is 1.9 people, which is smaller than the Rest of Qld average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

West End faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's educational profile is notable regionally, with university qualification rates of 29.1% among residents aged 15+, surpassing the SA4 region average of 20.1% and the Rest of Qld figure of 20.6%. Bachelor degrees are most common at 19.4%, followed by postgraduate qualifications (7.1%) and graduate diplomas (2.6%). Vocational credentials are prominent, with 36.4% of residents aged 15+ holding such qualifications - advanced diplomas account for 9.6% while certificates make up 26.8%.

Educational participation is high at 27.8%, including 8.4% in primary education, 7.2% in tertiary education, and 5.9% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis indicates 20 active stops operating within West End, serving a mix of bus routes. These stops are serviced by 4 individual routes, collectively providing 370 weekly passenger trips. Transport accessibility is rated as good, with residents typically located 238 meters from the nearest stop.

Service frequency averages 52 trips per day across all routes, equating to approximately 18 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in West End is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

West End faces significant health challenges with common health conditions prevalent across both younger and older age cohorts. The rate of private health cover is exceptionally high at approximately 62% of the total population (2,505 people), compared to 53.9% across Rest of Qld and a national average of 55.7%. Mental health issues impact 10.7% of residents, while arthritis affects 7.5%.

Sixty-six point seven percent declare themselves completely clear of medical ailments, compared to 67.8% across Rest of Qld. Seventeen point one percent of residents are aged 65 and over (696 people), higher than the 14.9% in Rest of Qld. Health outcomes among seniors present challenges broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

West End ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

West End's cultural diversity was found to be below average, with 85.1% of its population being citizens born in Australia who speak English only at home. Christianity was the predominant religion, making up 48.2% of West End's population. The most notable overrepresentation was seen in the 'Other' category, comprising 0.9% compared to Rest of Qld's 0.7%.

In terms of ancestry, the top three groups were English (27.6%), Australian (24.2%), and Irish (9.4%). Notably, Spanish (0.6%) and French (0.6%) groups were overrepresented in West End compared to regional averages of 0.4% each. Additionally, German ancestry was slightly higher at 4.5% versus the region's 4.0%.

Frequently Asked Questions - Diversity

Age

West End's population is slightly older than the national pattern

The median age in West End is 39 years, which is lower than Rest of Qld's average of 41 but close to the national average of 38 years. The age profile shows that individuals aged 25-34 years are prominent at 17.7%, while those aged 5-14 years are comparatively smaller at 7.7% compared to Rest of Qld. From 2021 to present, the 25-34 age group has grown from 15.9% to 17.7%, and the 15-24 cohort has increased from 12.0% to 13.3%. Conversely, the 45-54 age group has declined from 15.2% to 11.7%, and the 5-14 age group has dropped from 9.2% to 7.7%. Looking ahead to 2041, demographic projections reveal significant shifts in West End's age structure. The 85+ age cohort is projected to rise substantially, expanding by 67 people (an increase of 87%) from 77 to 145. Notably, the combined 65+ age groups are expected to account for 77% of total population growth, reflecting the area's aging demographic profile. Conversely, the 0-4 and 65-74 cohorts are expected to experience population declines.