Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Dalkeith reveals an overall ranking slightly below national averages considering recent, and medium term trends

Dalkeith's population, as of November 2025, is estimated at around 5,319 people. This reflects an increase of 921 people since the 2021 Census, which reported a population of 4,398 people. The change is inferred from AreaSearch's estimation of the resident population as 5,197 following examination of the latest ERP data release by the ABS in June 2024, along with an additional 25 validated new addresses since the Census date. This level of population equates to a density ratio of 1,767 persons per square kilometer, which is above the average seen across national locations assessed by AreaSearch. Dalkeith's growth of 20.9% since the 2021 census exceeded the national average of 9.7%. Population growth for the area was primarily driven by overseas migration.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and post-2032 estimations, AreaSearch utilises growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections, released in 2023 based on 2022 data. Moving forward with demographic trends, a population increase just below the median of national statistical areas is expected for Dalkeith (SA2), with an estimated expansion to around 5,962 persons by 2041, reflecting a gain of approximately 5.0% in total over the 17 years.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Dalkeith when compared nationally

AreaSearch analysis of ABS building approval numbers shows Dalkeith had approximately 43 dwelling approvals annually over the past five financial years, totalling an estimated 218 homes. As of FY-26, nine approvals have been recorded. Between FY-21 and FY-25, an average of 1.8 people moved to Dalkeith per dwelling built annually. However, this figure increased to 6.7 people per dwelling over the past two financial years, suggesting growing popularity and potential undersupply. The average construction value for development projects in Dalkeith is $906,000, indicating a focus on premium properties.

This year, $62.0 million in commercial development approvals have been recorded, reflecting high levels of local commercial activity. Compared to Greater Perth, Dalkeith has 76.0% more construction activity per person. Currently, new building activity comprises 27.0% detached dwellings and 73.0% townhouses or apartments, a notable shift from the area's existing housing composition of 96.0% houses. With around 183 people moving in annually for each dwelling approval, Dalkeith exhibits growth area characteristics. Population forecasts estimate Dalkeith will gain 264 residents by 2041. Given current construction levels, housing supply should meet demand adequately, creating favourable conditions for buyers while potentially supporting population growth that exceeds current forecasts.

Population forecasts indicate Dalkeith will gain 264 residents through to 2041 (from the latest AreaSearch quarterly estimate). With current construction levels, housing supply should adequately meet demand, creating favourable conditions for buyers while potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Dalkeith has emerging levels of nearby infrastructure activity, ranking in the 36thth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified three major projects likely affecting the region: Arbour Dalkeith, Tawarri Hot Springs, Dalkeith Townhomes, Point Walter Recreation and Conference Centre Redevelopment. The following details those considered most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

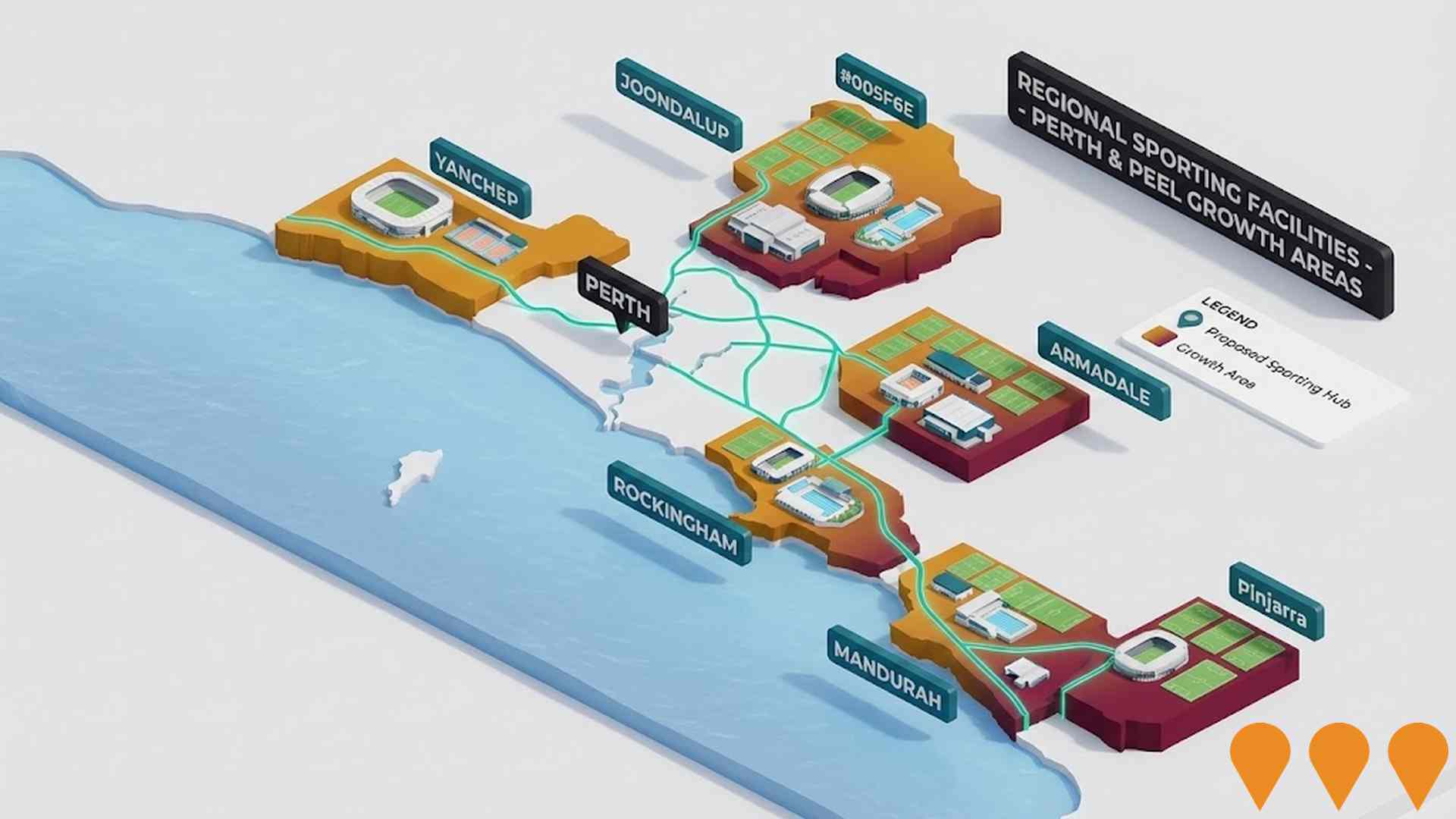

METRONET

METRONET is the largest public transport infrastructure program in Western Australia's history, expanding the Perth rail network by 72 kilometres and adding 23 new stations. As of February 2026, the program has reached substantial completion with the opening of the new Midland Station on February 22, 2026, marking the delivery of the final rail infrastructure project. Major milestones achieved include the Yanchep Rail Extension, Morley-Ellenbrook Line, Thornlie-Cockburn Link, and the Victoria Park-Canning Level Crossing Removal. The program also delivered 246 locally built C-series railcars and implemented high-capacity signalling across the network.

New Women and Babies Hospital

A $1.8 billion Western Australian Government project delivering a new 12-storey, 274-bed Women and Babies Hospital within the Fiona Stanley Hospital precinct. The facility will replace King Edward Memorial Hospital, providing inpatient maternity, gynaecology, and neonatology services. The scope includes state-of-the-art operating theatres, a family birth centre, and outpatient clinics, alongside two new multi-deck car parks. Managed by Webuild (under the WA Life banner), the project also encompasses major expansions at Osborne Park Hospital and Perth Children's Hospital.

Mandurah Line

70.8km suburban railway line connecting Perth CBD to Mandurah with 13 stations including Rockingham and Warnbro stations. Operates through Kwinana Freeway median with dedicated underground tunnels through Perth CBD. Serves as vital transport link for region. Recent extensions include integration with Thornlie-Cockburn Link in June 2025.

METRONET High Capacity Signalling Program

The High Capacity Signalling (HCS) project is a decade-long technology upgrade to Perth's rail network, replacing ageing fixed-block signalling with an advanced Communications-Based Train Control (CBTC) system. This 'moving block' technology uses real-time data to safely reduce the distance between trains, enabling a 40 percent increase in network capacity. The project includes the construction of a state-of-the-art Public Transport Operations Control Centre (PTOCC) in East Perth and the installation of a private Long-Term Evolution (LTE) radio network to support high-speed data transmission.

METRONET High Capacity Signalling Project

A decade-long, city-wide upgrade of Perth's urban rail signalling to a Communications-Based Train Control (CBTC) system across 500km of the Transperth network. The project implements 'moving block' technology to safely reduce the distance between trains, increasing network capacity by 40 percent. Key works include the installation of over 7,000 transponders, in-cab signalling for 125 trains, and 600+ new passenger information displays at 87 stations. The system is managed from the state-of-the-art Public Transport Operations Control Centre (PTOCC) in East Perth, which became operational in April 2025.

Point Walter Recreation and Conference Centre Redevelopment

Proposed upgrade and expansion of the existing Point Walter Recreation and Conference Centre, which includes new function spaces, improved public amenities, and enhanced riverfront activation. Recent completed works in the broader Point Walter Reserve include the Dyoondalup Bike Park (opened June 2024) and the Dyoondalup Point Walter playground upgrade (opened December 2025). The wider precinct is a site of deep cultural significance to the Whadjuk Noongar people, also known as Dyoondalup, meaning 'place of white sand'.

Arbour Dalkeith

A luxury development of ten apartments, including two penthouses with rooftop terraces. The design by Matthews & Scavalli Architects features limestone cladding and arched forms, paying homage to the heritage of the area and its proximity to the Swan River.

Tawarri Hot Springs

A $45-million wellness center in Dalkeith featuring over 5,500 sqm of space with over twenty thermal bathing experiences, saunas, hammams, a Vichy shower, cold plunge pools, a day spa, yoga and Pilates classes, and a caf'. The project uses geothermally heated water from the Yarragadee Aquifer and aims for a 6 Green Star rating, transforming the historic Dalkeith Hot Pool site into a sustainable destination.

Employment

Employment performance in Dalkeith ranks among the strongest 15% of areas evaluated nationally

Dalkeith has a highly educated workforce with professional services well represented. Its unemployment rate was 0.3% as of September 2025.

The area had 2,549 residents in work at this time, with an unemployment rate of 3.6%, which is 0.4 percentage points lower than Greater Perth's rate of 4.0%. Workforce participation in Dalkeith was 61.1%, compared to Greater Perth's 65.2%. The leading employment industries among residents were health care & social assistance, professional & technical services, and education & training. Health care & social assistance showed particularly strong representation with an employment share of 1.9 times the regional level.

Conversely, construction was under-represented at 4.6% compared to Greater Perth's 9.3%. The ratio of workers to residents in Dalkeith was 0.7 as at the Census, indicating a higher than average level of local employment opportunities. In the year ending September 2025, Dalkeith's labour force decreased by 3.0% and employment decreased by 2.9%, leading to a fall in unemployment rate of 0.1 percentage points. In contrast, Greater Perth experienced employment growth of 2.9% and labour force growth of 3.0%. State-level data for Western Australia up to 25-Nov-25 showed employment had contracted by 0.27%, with the state unemployment rate at 4.6%, slightly higher than the national rate of 4.3%. National employment forecasts from Jobs and Skills Australia, released in May-25, project that national employment will expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Dalkeith's employment mix suggests local employment should increase by 8.1% over five years and 16.5% over ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

AreaSearch's latest postcode level ATO data for financial year 2023 shows that Dalkeith has exceptionally high incomes nationally. The median income is $99,001 and the average income stands at $267,998. This contrasts with Greater Perth's figures of a median income of $60,748 and an average income of $80,248. Based on Wage Price Index growth of 9.62% since financial year 2023, current estimates for Dalkeith would be approximately $108,525 (median) and $293,779 (average) as of September 2025. Census data reveals that household, family and personal incomes in Dalkeith rank highly nationally, between the 96th and 99th percentiles. Income brackets indicate that the predominant cohort spans 57.2% of locals (3,042 people) in the $4000+ category, differing from patterns across the broader area where $1,500 - 2,999 dominates with 32.0%. The substantial proportion of high earners (64.4% above $3,000/week) indicates strong economic capacity throughout Dalkeith. After housing costs, residents retain 90.4% of income, reflecting strong purchasing power and the area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

Dalkeith is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Dalkeith's dwelling structures, as per the latest Census, consisted of 96.3% houses and 3.7% other dwellings. In contrast, Perth metro had 68.6% houses and 31.3% other dwellings. Home ownership in Dalkeith stood at 56.1%, with mortgaged dwellings at 27.8% and rented ones at 16.1%. The median monthly mortgage repayment was $5,000, higher than Perth metro's average of $3,293. Median weekly rent in Dalkeith was $802, compared to Perth metro's $450. Nationally, Dalkeith's mortgage repayments were significantly higher at $1,863 and rents substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Dalkeith features high concentrations of family households, with a higher-than-average median household size

Family households constitute 85.7% of all households, including 48.1% couples with children, 30.4% couples without children, and 6.3% single parent families. Non-family households account for the remaining 14.3%, with lone person households at 13.4% and group households comprising 1.1%. The median household size is 3.0 people, larger than the Greater Perth average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Educational achievement in Dalkeith places it within the top 10% nationally, reflecting strong academic performance and high qualification levels across the community

Dalkeith has a notably high level of educational attainment among its residents aged 15 and above, with 62.7% holding university qualifications compared to the broader benchmarks of 27.9% in Western Australia and 30.1% in Greater Perth. The area's educational advantage is reflected in its distribution of qualifications: Bachelor degrees lead at 39.6%, followed by postgraduate qualifications (18.2%) and graduate diplomas (4.9%). Technical qualifications make up 12.2% of the residents' educational achievements, with advanced diplomas accounting for 7.6% and certificates for 4.6%. The area's educational participation is also notably high, with 33.9% of residents currently enrolled in formal education.

This includes 11.5% in secondary education, 10.1% in primary education, and 9.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 47 active stops in Dalkeith offering mixed bus services. These are covered by three routes, totalling 307 weekly passenger trips. Residential accessibility is rated excellent, with residents typically 179 metres from nearest stop.

Average service frequency is 43 trips daily across all routes, equating to about six weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Dalkeith's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Health outcomes data shows excellent results across Dalkeith, with very low prevalence of common health conditions across all age groups. The rate of private health cover is exceptionally high at approximately 134% of the total population (7,104 people), compared to 86.3% across Greater Perth and a national average of 55.7%. The most common medical conditions in the area are arthritis and asthma, affecting 6.1 and 6.0% of residents respectively, while 75.0% declare themselves completely clear of medical ailments compared to 74.2% across Greater Perth.

As of August 2021, 21.8% of residents are aged 65 and over (1,159 people). Health outcomes among seniors in Dalkeith are particularly strong, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Dalkeith was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Dalkeith, as of the 2016 Census, had a higher proportion of residents speaking a language other than English at home, with 19.2%, compared to most local markets. Additionally, 38.9% of Dalkeith's population was born overseas. Christianity was the predominant religion in Dalkeith, comprising 54.6% of its population.

Notably, Judaism had an overrepresentation in Dalkeith, with 0.7% of residents identifying as Jewish, compared to 0.5% across Greater Perth. In terms of ancestry, the top three groups in Dalkeith were English (24.4%), Australian (18.3%), and Chinese (13.9%), which was substantially higher than the regional average of 5.6%. There were also notable differences in the representation of certain ethnic groups: South African residents made up 1.1% of Dalkeith's population, Dutch residents comprised 1.7%, and Sri Lankan residents accounted for 0.5%, each slightly overrepresented compared to their regional averages.

Frequently Asked Questions - Diversity

Age

Dalkeith hosts a notably older demographic compared to the national average

Dalkeith has a median age of 44, which is higher than Greater Perth's figure of 37 and the national norm of 38. The 15-24 age group makes up 20.5% of Dalkeith's population, compared to Greater Perth's percentage, while the 25-34 cohort comprises 7.6%. This concentration of young residents is higher than the national average of 12.5%. According to the 2021 Census, younger residents have reduced the median age by 1.2 years to 44. Specifically, the 15-24 age group has grown from 14.9% to 20.5%, and the 25-34 cohort has increased from 5.9% to 7.6%. Conversely, the 65-74 age group has declined from 12.8% to 11.3%. By 2041, Dalkeith's age composition is expected to shift notably. The 75-84 cohort is projected to grow by 42%, adding 181 residents to reach 618. The aging population trend is evident, with those aged 65 and above comprising 69% of the projected growth. Meanwhile, both the 0-4 and 35-44 age groups are expected to decrease in number.