Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Maudsland lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

The population of the Maudsland statistical area (Lv2) is estimated at around 8,622 as of Nov 2025. This reflects an increase of 549 people from the 2021 Census figure of 8,073. The change was inferred from AreaSearch's estimate of the resident population at 8,599 in June 2024, based on examination of the latest ERP data release by the ABS, and an additional 63 validated new addresses since the Census date. This results in a density ratio of 592 persons per square kilometer. Over the past decade, Maudsland has shown resilient growth patterns with a compound annual growth rate of 2.6%, outpacing its SA4 region. Natural growth contributed approximately 43.0% of overall population gains during recent periods, although all drivers including overseas migration and interstate migration were positive factors.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are adopted. These state projections do not provide age category splits; hence proportional growth weightings in line with the ABS Greater Capital Region projections released in 2023 based on 2022 data are applied for each age cohort. Future population dynamics anticipate above median growth for Australia's regional areas, with the Maudsland (SA2) expected to expand by 1,753 persons to 2041, reflecting a gain of 21.4% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Maudsland recording a relatively average level of approval activity when compared to local markets analysed countrywide

AreaSearch analysis of ABS building approval numbers indicates Maudsland has seen approximately 16 new homes approved each year over the past five financial years. This totals an estimated 80 homes from FY-21 to FY-25. As of FY-26, 12 approvals have been recorded. The average population increase per dwelling built in the area between FY-21 and FY-25 is around 10.2 people per year.

This suggests demand outpaces supply, potentially putting upward pressure on prices and increasing competition among buyers. New homes are being constructed at an average expected cost of $525,000, indicating developers target the premium market segment with higher-end properties.

In FY-26, commercial approvals valued at $3.4 million have been registered. All new constructions in Maudsland consist of detached dwellings, preserving its low-density nature and attracting space-seeking buyers. The estimated population per dwelling approval is 493 people. AreaSearch's latest quarterly estimate projects Maudsland to grow by 1,847 residents by 2041. If current development rates continue, housing supply may not keep pace with population growth, potentially increasing competition among buyers and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Maudsland has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified eight projects likely impacting the region. Notable ones are Stonewood Estate, Coomera Connector Stage 1, Movie World Hotel Development, and Riverstone Crossing Estate. The following details projects deemed most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Coomera Hospital

The new Coomera Hospital is a major health infrastructure project under the Queensland Hospital Rescue Plan, now expanded to deliver 600 beds. Stage 1 will provide 400 beds, an emergency department, maternity services, intensive care, and mental health units by 2031. Stage 2 will add a further 200 beds, day surgery, and specialist oncology/dialysis services. The facility is designed to support the rapid growth of the northern Gold Coast, featuring a multi-storey car park and direct integration with public transport networks. As of early 2026, foundation works and structural lift cores are visible, with main construction activities transitioning under the updated masterplan.

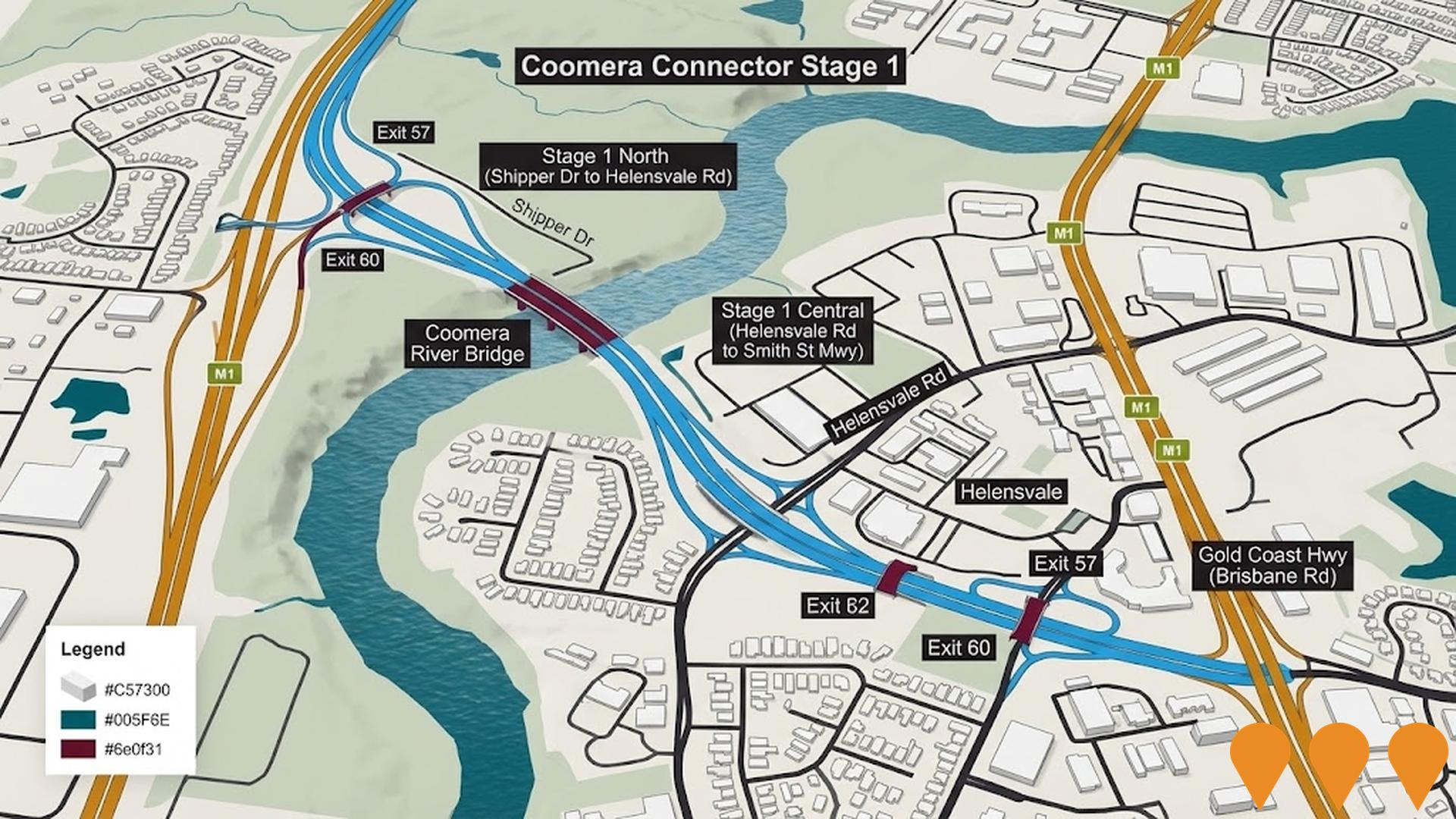

Coomera Connector (Second M1)

The Coomera Connector (M9) is a 45km north-south motorway being delivered to provide an alternative to the M1 Pacific Motorway. Stage 1 (16km) is a $3.02 billion project connecting Coomera to Nerang. Stage 1 North (Coomera to Helensvale) opened to traffic in December 2025. Construction is currently active on Stage 1 Central (Helensvale to Molendinar) and Stage 1 South (Molendinar to Nerang), featuring major bridge structures over the Coomera and Nerang Rivers and an 8km active transport path.

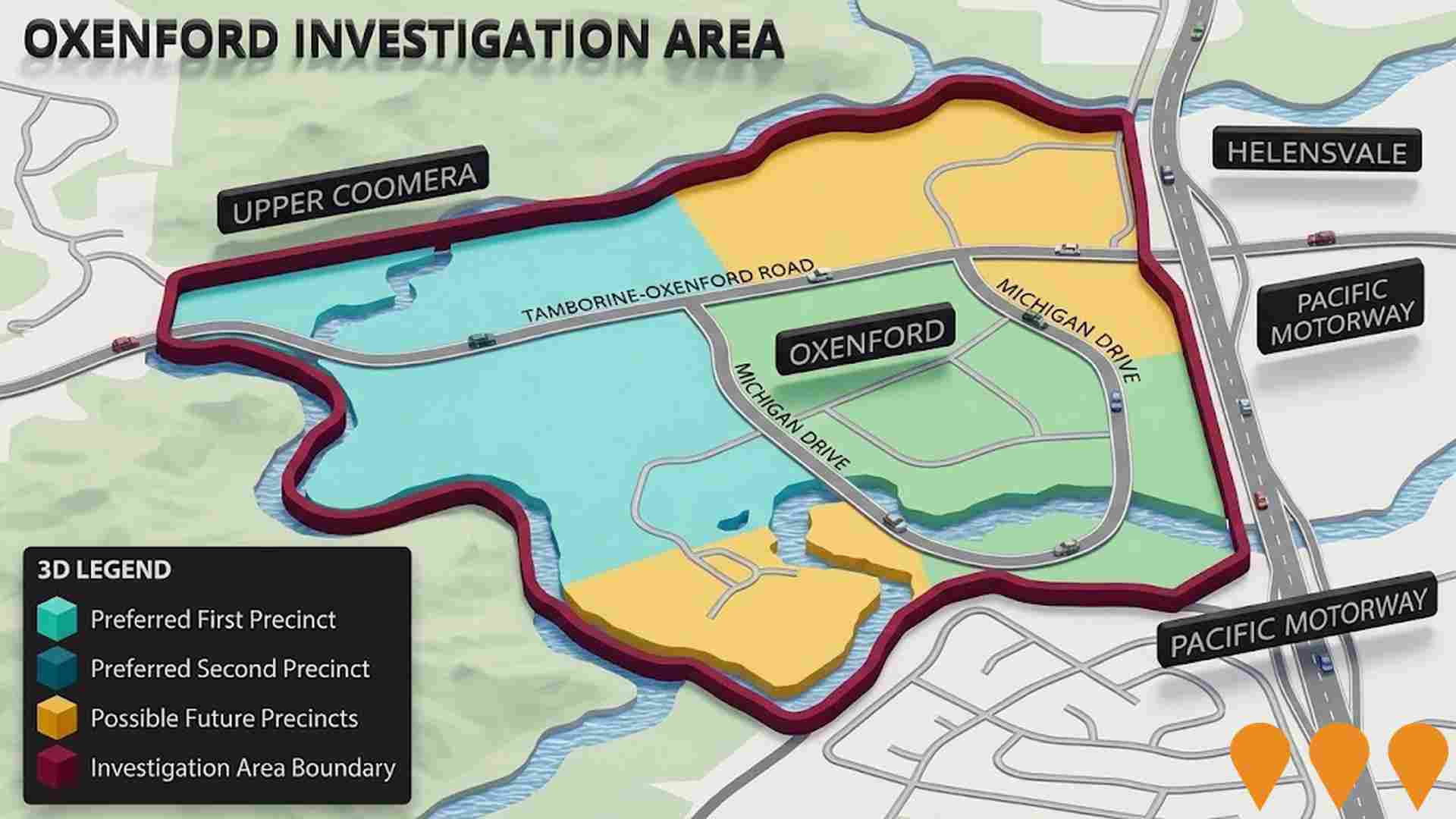

Oxenford Investigation Area (Riversdale A Precinct)

Long-term strategic urban planning initiative focused on the Riversdale A Precinct in Oxenford. Originally planned for approximately 1,700-2,000 new dwellings, parks, stormwater management, and transport infrastructure to address housing supply and population growth. The Preferred Concept Plan was endorsed in 2023 and updated in 2024, but in July 2025 the City of Gold Coast resolved to place the project on hold pending State Government commitment to fund essential transport infrastructure upgrades.

Harbour Shores Biggera Waters

$1.5b masterplanned waterfront community on 16 hectares with 1.2km canal frontage. Circa 2,000 dwellings across 30 mid-rise buildings and villas, with resort-style amenities, waterfront boardwalk and private marina berths. Certified 6 Star Green Star Communities v1.1. Stage 1 (The Waterline, Palm House and The Residences) is under construction and tracking ahead of schedule: Waterline fitouts underway with first kitchens installed 2 July 2025; Palm House sheet piling and basement excavation complete with the first basement pour scheduled mid-August 2025. First residents expected mid 2026; full build out over the next decade.

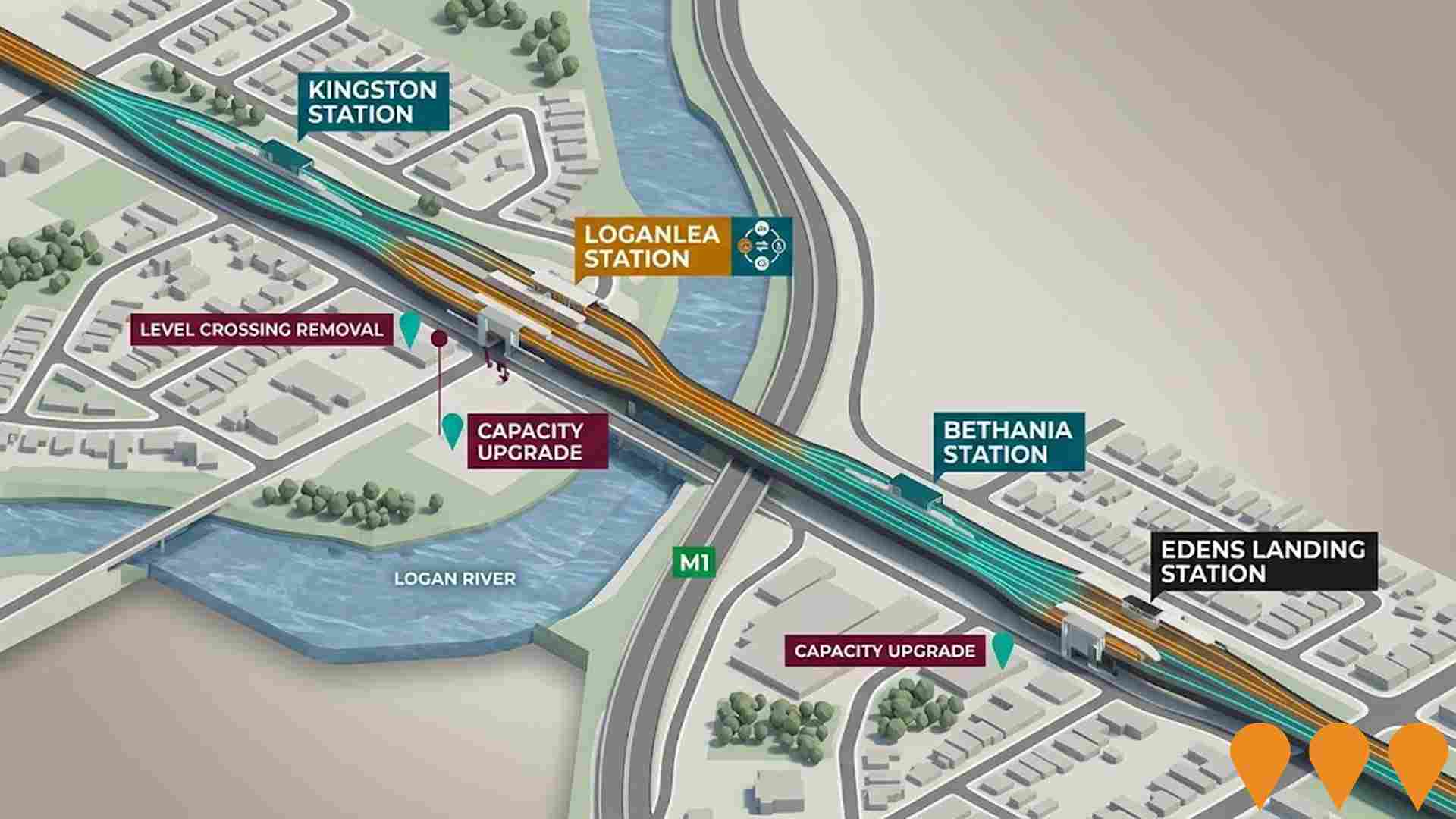

Logan and Gold Coast Faster Rail

Major rail infrastructure project to deliver more frequent and reliable train services between Brisbane, Logan, and Gold Coast. The $5.75 billion project will double tracks from two to four between Kuraby and Beenleigh over 20km, remove 5 level crossings, upgrade 9 stations (Kuraby, Trinder Park, Woodridge, Kingston, Loganlea, Bethania, Edens Landing, Holmview, Beenleigh), and improve accessibility and connectivity. Part of South East Queensland rail network improvements supporting Brisbane 2032 Olympic and Paralympic Games. Jointly funded 50:50 by Australian and Queensland Governments.

Coomera Connector Stage 1

Queensland's second M1 - a $3.026 billion, 16km motorway connection between Coomera and Nerang, delivered in three packages (North, Central, South). Will provide alternative to M1, removing up to 60,000 local trips per day. Features 4 lanes with provision for future widening to 6 lanes, bridges over Coomera and Nerang rivers, grade-separated interchanges at Shipper Drive and Helensvale Road, shared pedestrian/cycle paths, and open graded asphalt road surface. Expected to progressively open to traffic from late 2025.

Gold Coast Rail Stations (Pimpana, Hope Island, Merrimac)

Three new rail stations on the existing Gold Coast Line delivered as part of Cross River Rail project. Stations designed to serve growing population in South East Queensland with modern accessibility features and transport connections.

Coomera Connector Stage 1

A 16km motorway spanning Coomera to Nerang, functioning as a high-speed alternative to the Pacific Motorway (M1). The project is delivered in three packages: North (Shipper Drive to Helensvale Road), Central (Helensvale Road to Smith Street Motorway), and South (Smith Street Motorway to Nerang-Broadbeach Road). Stage 1 North opened to traffic on 2 December 2025. Construction is currently intensive on the Central and South sections, featuring an 8km 6-lane stretch in the Central package, smart motorway technology, and significant active transport paths.

Employment

Employment conditions in Maudsland rank among the top 10% of areas assessed nationally

Maudsland's workforce is skilled with notable representation in the construction sector. Its unemployment rate was 2.0% in the past year, with an estimated employment growth of 2.6%.

As of September 2025, 5,191 residents are employed, with an unemployment rate of 2.1%, compared to Rest of Qld's 4.1%. Workforce participation is high at 76.9% versus Rest of Qld's 59.1%. Key employment sectors include health care & social assistance, construction, and retail trade. Construction employment is particularly high, with a share 1.4 times the regional level, while agriculture, forestry & fishing has limited presence at 0.5%.

Over the past year, employment increased by 2.6% alongside labour force growth of 2.6%, with unemployment remaining largely unchanged. In comparison, Rest of Qld saw employment grow by 1.7%, labour force expand by 2.1%, and unemployment rise by 0.3 percentage points. State-level data to 25-Nov-25 shows Queensland's employment contracted by 0.01% with an unemployment rate of 4.2%. National employment forecasts from May-25 suggest a 6.6% increase over five years and 13.7% over ten years, though growth varies significantly between sectors. Applying these projections to Maudsland's employment mix indicates local employment should rise by 6.6% in five years and 13.6% in ten years.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

The suburb of Maudsland had a median taxpayer income of $60,297 and an average income of $73,094 in the latest postcode level ATO data aggregated by AreaSearch for financial year 2023. This is higher than the national averages of $53,146 (median) and $66,593 (average). Based on Wage Price Index growth of 9.91% since financial year 2023, estimated median income would be approximately $66,272 and average income would be around $80,338 as of September 2025. Census data shows household incomes rank at the 92nd percentile with a weekly income of $2,576. Income analysis indicates that 39.6% of locals (3,414 people) fall into the $1,500 - 2,999 weekly income category. A significant 38.9% earn above $3,000 weekly. High housing costs consume 16.8% of income, but strong earnings place disposable income at the 90th percentile. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Maudsland is characterized by a predominantly suburban housing profile

In Maudsland, as per the latest Census evaluation, 97.5% of dwellings were houses with the remaining 2.5% consisting of semi-detached properties, apartments, and other dwelling types. Home ownership stood at 15.0%, with 66.6% of dwellings being mortgaged and 18.4% rented out. The median monthly mortgage repayment in Maudsland was $2,167, significantly higher than the Australian average of $1,863. Meanwhile, the median weekly rent figure was $540, substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Maudsland features high concentrations of family households, with a median household size of 3.4 people

Family households account for 91.5% of all households, including 58.3% that are couples with children, 21.5% that are couples without children, and 10.8% that are single parent families. Non-family households make up the remaining 8.5%, with lone person households at 7.2% and group households comprising 1.5%. The median household size is 3.4 people.

Frequently Asked Questions - Households

Local Schools & Education

Maudsland demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

Maudsland Trail residents aged 15+ have 22.9% university degrees, compared to Australia's 30.4%. Bachelor degrees are most common (16.7%), followed by postgraduate qualifications (4.1%) and graduate diplomas (2.1%). Vocational credentials are held by 42.2%, with advanced diplomas at 14.6% and certificates at 27.6%. Educational participation is high, with 35.0% currently enrolled in formal education: 13.9% in primary, 10.3% in secondary, and 4.1% in tertiary education.

Educational participation is notably high, with 35.0% of residents currently enrolled in formal education. This includes 13.9% in primary education, 10.3% in secondary education, and 4.1% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Maudsland has two operational public transport stops, both serving buses. One route services these stops, offering 73 weekly passenger trips in total. Residents have limited access to transport, with an average distance of 1135 meters to the nearest stop.

The service runs approximately 10 trips daily across all routes, equating to about 36 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Maudsland's residents boast exceedingly positive health performance metrics with younger cohorts in particular seeing very low prevalence of common health conditions

Maudsland's health outcomes show exceptional results, with younger age groups having particularly low prevalence rates for common health conditions.

Approximately 4,842 individuals, or about 56% of the total population, have private health cover. The most prevalent medical conditions in the area are asthma and mental health issues, affecting 7.7% and 6.8% of residents respectively. Notably, 76.2% of Maudsland residents report having no medical ailments, compared to 0% across the rest of Queensland. As of 19th June 2021, 7.8% of Maudsland's population is aged 65 and over, comprising 672 individuals. While health outcomes among seniors in Maudsland are above average, they still require more attention than those of the broader population.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Maudsland was found to be slightly above average when compared nationally for a number of language and cultural background related metrics

Maudsland had cultural diversity above average, with 11.1% speaking a language other than English at home and 30.5% born overseas. Christianity was the main religion, comprising 46.8%. The 'Other' religious group was overrepresented at 1.2%, compared to None% in Rest of Qld.

In ancestry, the top groups were English (30.5%), Australian (25.1%), and Scottish (8.2%). Notably, New Zealanders were overrepresented at 1.8%, Maori at 2.4%, and Welsh at 0.8%.

Frequently Asked Questions - Diversity

Age

Maudsland hosts a young demographic, positioning it in the bottom quartile nationwide

The median age in Maudsland is 34 years, which is lower than the Rest of Queensland's average of 41 and also significantly below the Australian median of 38. Compared to Rest of Qld, Maudsland has a higher percentage of residents aged 35-44 (18.3%) but fewer individuals aged 65-74 (4.8%). According to the 2021 Census, the population aged 25 to 34 grew from 11.1% to 12.2%, while the 5 to 14 age group decreased from 19.0% to 17.8%. By 2041, Maudsland's demographic is projected to change significantly. The 25 to 34 age group is expected to increase by 46%, adding 481 people and reaching a total of 1,533 from the current figure of 1,051. The 15 to 24 age group is anticipated to grow at a more modest rate of 4%, with an addition of only 44 residents.