Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Parkwood reveals an overall ranking slightly below national averages considering recent, and medium term trends

Based on ABS population updates and AreaSearch validations, as of Nov 2025, Parkwood's estimated population is around 9,154. This reflects an increase of 317 people since the 2021 Census, which reported a population of 8,837. The change was inferred from AreaSearch's estimation of 9,145 residents following examination of ABS' latest ERP data release (June 2024), and five additional validated new addresses since the Census date. This results in a density ratio of 1,646 persons per square kilometer, above average national levels assessed by AreaSearch. Overseas migration contributed approximately 78% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered or years post-2032, Queensland State Government's SA2 area projections are used, released in 2023 and based on 2021 data. However, these state projections do not provide age category splits, so AreaSearch applies proportional growth weightings from ABS Greater Capital Region projections (released in 2023, based on 2022 data) for each age cohort. Considering projected demographic shifts, above median population growth is projected nationally for regional areas. Parkwood's SA2 area is expected to increase by 1,343 persons to 2041, reflecting a total increase of 14.6% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Parkwood, placing the area among the bottom 25% of areas assessed nationally

Parkwood averaged approximately 43 new dwelling approvals annually over the past five financial years ending FY25. This totals an estimated 216 homes. As of FY26, one new dwelling approval has been recorded. On average, 0.4 new residents arrived per new home built annually between FY21 and FY25, indicating supply meeting or exceeding demand.

The average construction value for these dwellings was $398,000. In FY26, $87,000 in commercial development approvals have been recorded, suggesting minimal commercial development activity. Parkwood's construction rates per person are similar to the rest of Queensland, supporting market stability aligned with regional patterns. Recent construction comprises 7% detached dwellings and 93% attached dwellings, marking a shift from the current 91% houses. This trend may indicate diminishing developable land availability and responds to evolving lifestyle preferences and housing affordability needs.

With approximately 1824 people per dwelling approval, Parkwood reflects a mature market. Population forecasts estimate Parkwood will gain 1334 residents by 2041. At current development rates, new housing supply should comfortably meet demand, providing good conditions for buyers and potentially supporting growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

Parkwood has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

AreaSearch has identified 31 projects likely to impact the area, significantly influencing its performance. Key projects include Griffith University Gold Coast Campus Expansion, New Coomera Hospital, Coomera Connector Stage 1 - Central Section, and Urbana (Coomera Urban Village) Stage 3. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

New Coomera Hospital

A state-of-the-art public hospital being delivered under the Queensland Government's Hospital Rescue Plan. The project was recently expanded to provide at least 600 overnight beds, up from the original 404. Stage 1 will deliver 400 beds, an emergency department, operating theatres, and maternity services by 2031. Stage 2 will add 200 beds, day surgery, and specialist clinics. The 12-storey facility includes intensive care, mental health services, and a multi-storey car park with direct connections to Coomera Train Station.

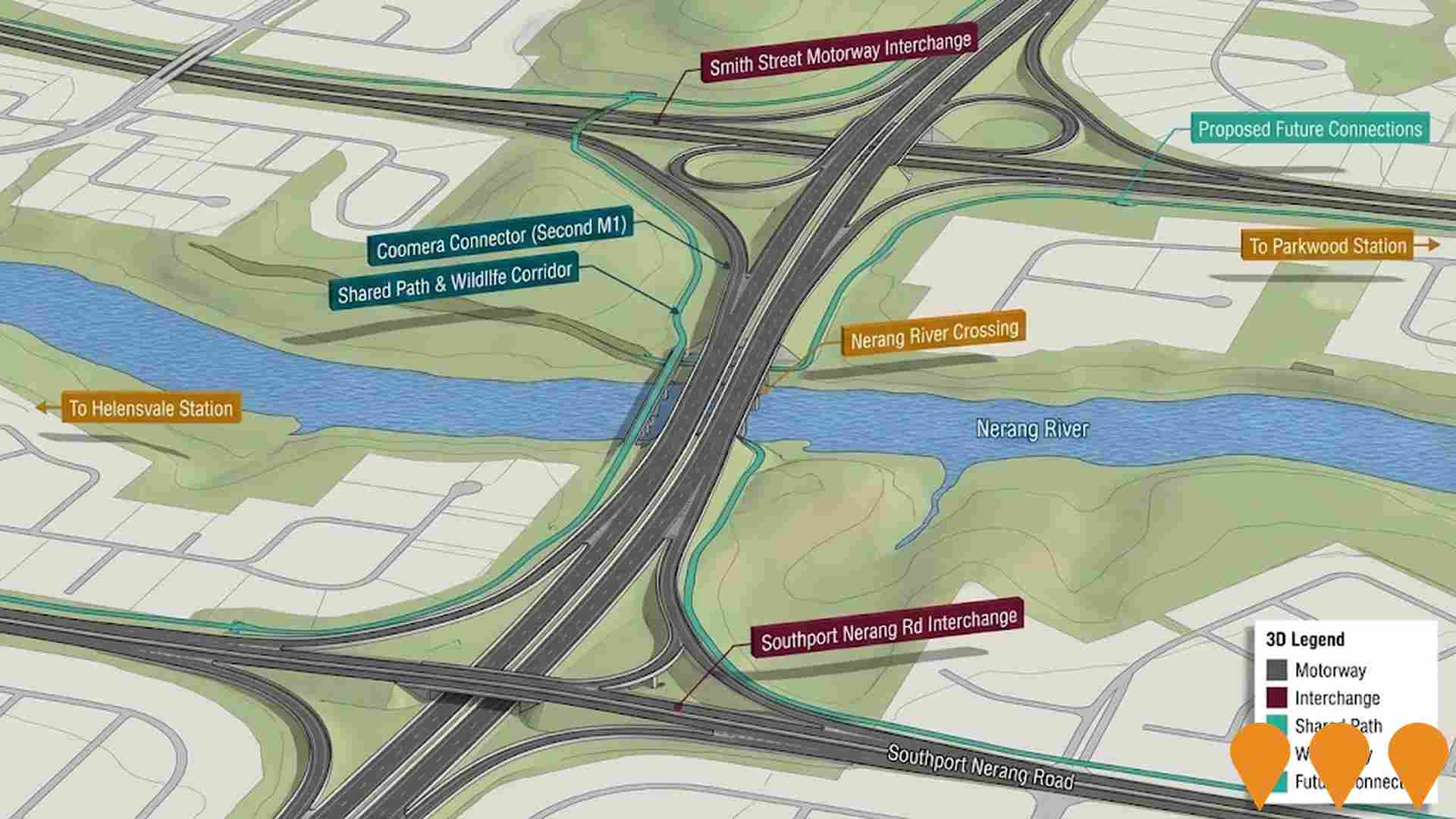

Coomera Connector Stage 1 - Central Section

Construction of 8km section of the Coomera Connector (Second M1) between Helensvale Road and Smith Street Motorway in Parkwood. Features grade separated interchanges, more than 8km of shared bike and pedestrian paths connecting to Helensvale and Parkwood light rail stations, and wildlife corridors.

130-Bed Aged Care Facility

8,906 sqm site with development approval for a 130 bed residential aged care facility. The site was marketed by Knight Frank under instructions from Cor Cordis as receivers, with DA current until April 2026. The property has since sold (May 2025). No construction works identified; project remains at approved stage pending new owner plans.

Arundel Hills Residential Development

Approved redevelopment of the 67-hectare former Arundel Hills Country Club into an environmentally focused residential community. The Queensland Government-approved project will deliver a minimum of 650 homes (including 20% affordable housing) for approximately 1200 residents, with over 60% of the site dedicated to recreation, open space, conservation, wetlands and koala habitat. Features include low-rise and medium-density dwellings, a destination recreation park, sporting facilities for AB Paterson College, and comprehensive environmental protections.

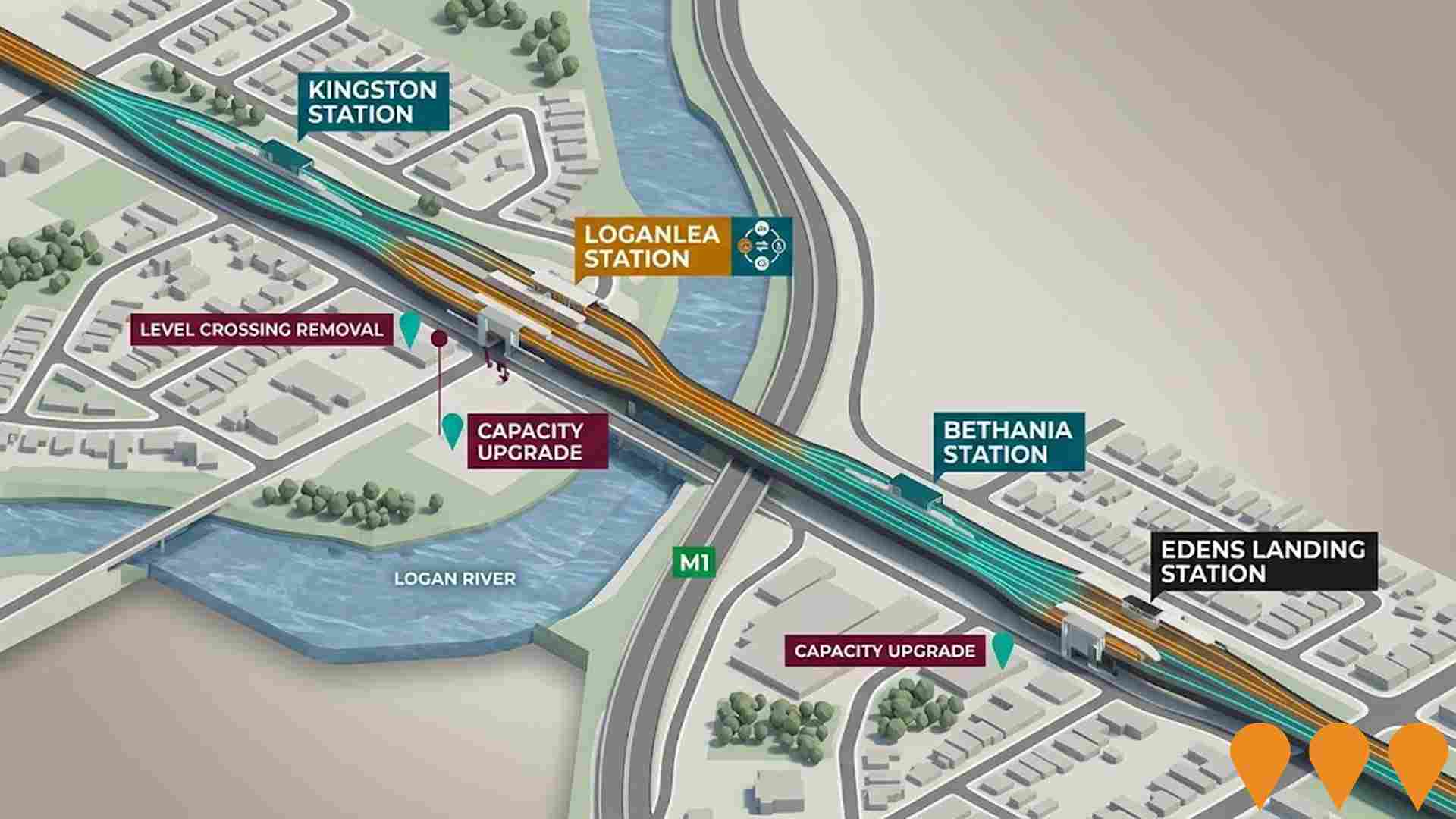

Logan and Gold Coast Faster Rail

Major rail infrastructure project to deliver more frequent and reliable train services between Brisbane, Logan, and Gold Coast. The $5.75 billion project will double tracks from two to four between Kuraby and Beenleigh over 20km, remove 5 level crossings, upgrade 9 stations (Kuraby, Trinder Park, Woodridge, Kingston, Loganlea, Bethania, Edens Landing, Holmview, Beenleigh), and improve accessibility and connectivity. Part of South East Queensland rail network improvements supporting Brisbane 2032 Olympic and Paralympic Games. Jointly funded 50:50 by Australian and Queensland Governments.

Foxwell Day Hospital & Health Precinct

400-bed private hospital and comprehensive health precinct by Keylin and Kinstone Group. Features ambulatory care, surgical facilities, and medical services. Part of $1.5 billion Foxwell Coomera masterplan development.

Griffith University Gold Coast Campus Expansion

New academic buildings, student accommodation, research facilities and sports complex at Griffith University Gold Coast campus.

Parkwood Investigation Area Study

Long-term strategic planning for the Parkwood area along Napper Road to meet the needs of current and future residents while protecting the city's lifestyle. The Preferred Concept Plan was endorsed by Council in December 2024, and the next step is to incorporate it into the new Planning Scheme with further community consultation under the Queensland Planning Act 2016.

Employment

Employment performance in Parkwood has been broadly consistent with national averages

Parkwood has a skilled workforce with essential services sectors well represented. The unemployment rate was 4.2% in the past year, with an estimated employment growth of 1.2%.

As of September 2025, 5,189 residents are employed, aligning with Rest of Qld's 4.1% unemployment rate and a workforce participation rate of 64.8%, higher than Rest of Qld's 59.1%. Key employment sectors include health care & social assistance, retail trade, and construction, while agriculture, forestry & fishing employs only 0.3% of local workers, lower than Rest of Qld's 4.5%. The area offers limited local employment opportunities, as indicated by the Census working population vs resident population count.

From September 2024 to September 2025, Parkwood's employment levels increased by 1.2% and labour force by 2.0%, raising the unemployment rate by 0.7 percentage points. In contrast, Rest of Qld had employment growth of 1.7% and labour force growth of 2.1%, with a 0.3 percentage point rise in unemployment. State-level data to 25-Nov-25 shows Queensland's employment contracted by 0.01%, losing 1,210 jobs, with an unemployment rate of 4.2%, close to the national rate of 4.3%. National employment forecasts from May-25 indicate a 6.6% growth over five years and 13.7% over ten years. Applying these projections to Parkwood's employment mix suggests local employment should increase by 6.7% over five years and 13.9% over ten years, though this is a simple extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income levels align closely with national averages, indicating typical economic conditions for Australian communities according to AreaSearch analysis

Parkwood's median income among taxpayers was $48,663 during financial year 2023. The average income was $63,270. This was lower than the national average. In Queensland excluding Parkwood (Rest of Qld), the median income was $53,146 and the average was $66,593. By September 2025, adjusted for Wage Price Index growth of 9.91%, Parkwood's estimated median income would be approximately $53,486 and the average would be around $69,540. According to Census 2021 data, Parkwood's household income ranked at the 69th percentile ($2,064 weekly) and personal income was at the 35th percentile. Income distribution showed that 37.5% of individuals earned between $1,500 and $2,999. High housing costs consumed 16.8% of income, but disposable income ranked at the 68th percentile. The area's SEIFA income ranking placed it in the 6th decile.

Frequently Asked Questions - Income

Housing

Parkwood is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Parkwood's dwelling structure, as per the latest Census, consisted of 90.7% houses and 9.3% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Non-Metro Qld had 44.5% houses and 55.5% other dwellings. Home ownership in Parkwood was at 27.7%, with mortgaged dwellings at 41.9% and rented dwellings at 30.4%. The median monthly mortgage repayment in the area was $1,894, higher than Non-Metro Qld's average of $1,750. The median weekly rent figure was recorded at $538, compared to Non-Metro Qld's $420. Nationally, Parkwood's mortgage repayments were higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Parkwood features high concentrations of group households and family households, with a higher-than-average median household size

Family households constitute 80.6% of all households, including 38.1% couples with children, 27.5% couples without children, and 13.3% single parent families. Non-family households comprise the remaining 19.4%, with lone person households at 12.8% and group households at 6.8%. The median household size is 3.0 people, larger than the Rest of Qld average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Parkwood demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

The area's educational profile is notable regionally with university qualification rates at 26.8%, exceeding the Rest of Qld average of 20.6%. Bachelor degrees are most prevalent at 18.1%, followed by postgraduate qualifications (6.7%) and graduate diplomas (2.0%). Vocational credentials are prominent, with 36.4% of residents aged 15+ holding such qualifications, including advanced diplomas (11.9%) and certificates (24.5%).

Educational participation is high at 32.7%, comprising tertiary education (9.6%), primary education (9.0%), and secondary education (7.8%).

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Parkwood has 41 operational public transport stops, serving a mix of lightrail and bus services. These stops are covered by five separate routes, collectively facilitating 1,628 weekly passenger trips. Residential accessibility to these stops is rated as good, with residents typically situated 209 meters from the nearest stop.

Service frequency averages 232 trips per day across all routes, translating to approximately 39 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Parkwood is notably higher than the national average with prevalence of common health conditions quite low across both younger and older age cohorts

Parkwood shows better-than-average health outcomes, with low prevalence rates for common conditions across both younger and older age groups. The area has approximately 52% private health cover (about 4,784 people), slightly higher than the Rest of Queensland's average of 49.3%.

The most prevalent medical conditions are asthma and arthritis, affecting 7.4% and 7.3% of residents respectively. Around 71.5% of residents report no medical ailments, compared to 69.4% in the Rest of Queensland. As of 2021, Parkwood has 14.2% of its population aged 65 and over (1,299 people), lower than the Rest of Queensland's 17.1%. Health outcomes among seniors are above average, aligning with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Parkwood was found to be above average when compared nationally for a number of language and cultural background related metrics

Parkwood's population exhibited greater linguistic diversity than most local markets, with 17.9% speaking a language other than English at home. Born overseas, 33.3% of Parkwood residents were recorded. Christianity was the predominant religion in Parkwood, accounting for 47.2%.

Islam showed an overrepresentation in Parkwood compared to the Rest of Qld, with 2.6% versus 1.8%. In terms of ancestry, English (29.0%), Australian (21.9%), and Other (9.9%) were the top represented groups. Notable differences existed for New Zealand (1.7% vs regional 1.4%), Maori (2.0% vs 1.6%), and Russian (0.5% vs 0.5%).

Frequently Asked Questions - Diversity

Age

Parkwood's population is slightly younger than the national pattern

Parkwood's median age in 2021 was 36 years, which is lower than the Rest of Qld figure of 41 years and marginally lower than Australia's median age of 38 years. The 15-24 cohort was notably over-represented in Parkwood at 18.7%, compared to the Rest of Qld average, while the 75-84 year-olds were under-represented at 4.3%. This concentration of the 15-24 age group is well above the national average of 12.5%. Between 2021 and the present day, the 25 to 34 age group has grown from 13.3% to 15.2%, while the 15 to 24 cohort increased from 17.2% to 18.7%. Conversely, the 5 to 14 cohort declined from 11.8% to 10.0%, and the 45 to 54 age group dropped from 13.6% to 12.1%. Demographic modeling suggests that Parkwood's age profile will evolve significantly by 2041. The 25 to 34 age cohort is projected to expand notably, increasing by 579 people (42%) from 1,391 to 1,971. Conversely, both the 55 to 64 and 15 to 24 age groups are projected to see reduced numbers.