Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Dallas reveals an overall ranking slightly below national averages considering recent, and medium term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch, Dallas's population is estimated at around 7,023 as of Nov 2025. This reflects an increase of 261 people (3.9%) since the 2021 Census, which reported a population of 6,762 people. The change is inferred from the resident population of 6,858 estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024 and an additional 38 validated new addresses since the Census date. This level of population equates to a density ratio of 2,890 persons per square kilometer, placing it in the upper quartile relative to national locations assessed by AreaSearch. Population growth for the Dallas statistical area was primarily driven by overseas migration that contributed approximately 77.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with a base year of 2022. For any SA2 areas not covered by this data, AreaSearch is utilising the VIC State Government's Regional/LGA projections released in 2023 with adjustments made employing a method of weighted aggregation of population growth from LGA to SA2 levels. Growth rates by age group from these aggregations are also applied across all areas for years 2032 to 2041. Moving forward, a significant population increase in the top quartile of national areas is forecast for Dallas (SA2), with an expected growth of 2,258 persons to 2041 based on aggregated SA2-level projections, reflecting an increase of 30.8% in total over the 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Dallas is very low in comparison to the average area assessed nationally by AreaSearch

Based on AreaSearch analysis of ABS building approval numbers, Dallas has averaged around 7 new dwelling approvals each year from FY-21 to FY-25, with an estimated total of 35 homes approved during this period. In FY-26 up to date, 7 homes have been approved. The average construction cost value for these new dwellings is $356,000.

This financial year, Dallas has registered $5.7 million in commercial approvals. Compared to Greater Melbourne, Dallas records significantly lower building activity, at 92.0% below the regional average per person. This constrained new construction typically reinforces demand and pricing for existing dwellings, which is also below national average, indicating the area's maturity and possible planning constraints. New building activity in Dallas consists of 60.0% standalone homes and 40.0% townhouses or apartments, showing a shift from the current housing mix of 84.0% houses. The location has approximately 1721 people per dwelling approval, reflecting an established market. According to AreaSearch's latest quarterly estimate, Dallas is forecasted to gain 2,161 residents by 2041.

At current development rates, housing supply may struggle to keep pace with population growth, potentially intensifying buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

Dallas has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified three projects expected to impact the area: Time & Place Campbellfield Industrial Development, Assembly Broadmeadows, Parkview Broadmeadows, and North Melbourne Logistics Hub. The following details these key projects in order of likely relevance.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

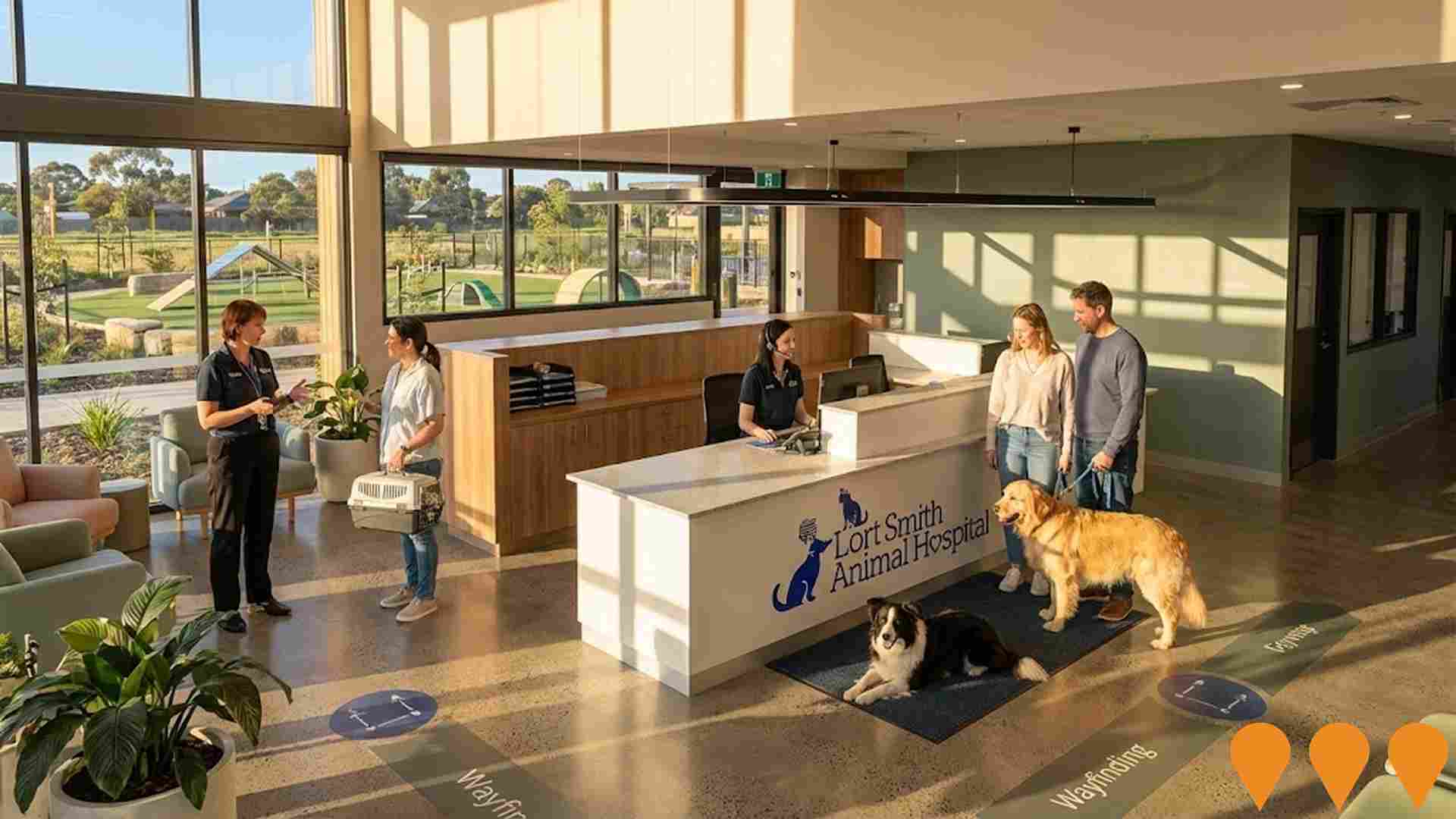

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Suburban Rail Loop North - Broadmeadows Station

A new underground transport super hub at Broadmeadows, part of the Suburban Rail Loop (SRL) North segment. The station will connect the Craigieburn line and regional V/Line services with the 90km orbital rail loop, transforming Broadmeadows into a major northern interchange. The precinct plan includes a 20-minute neighborhood strategy with increased housing density of up to 12 storeys in the activity centre core to support Melbourne's population growth toward 2050.

Hume Central - Broadmeadows Central Activities Area

A long-term urban renewal project transforming the land around the Broadmeadows Town Hall, Global Learning Centre, and Council Offices into a vibrant town centre. The master plan focuses on mixed-use development, including commercial opportunities, civic spaces, health services, and improved pedestrian connectivity. Key completed milestones include the $25 million Town Hall redevelopment and the Northern Study Hub. Future stages include a new multi-level car park and significant residential density increases of up to 12 storeys in the activity centre core to support the Victorian Government Housing Statement goals.

Assembly Broadmeadows

Redevelopment of the former 60-hectare Ford manufacturing plant into a next-generation industrial and logistics precinct. The project features 305,000 sqm of gross leasable area across advanced manufacturing, automated warehousing, and commercial office space. Key amenities planned include a 100-room hotel, retail convenience hub, supermarket, and childcare center. The site incorporates a 14-megawatt renewable energy system to reduce operator costs by up to 20 percent.

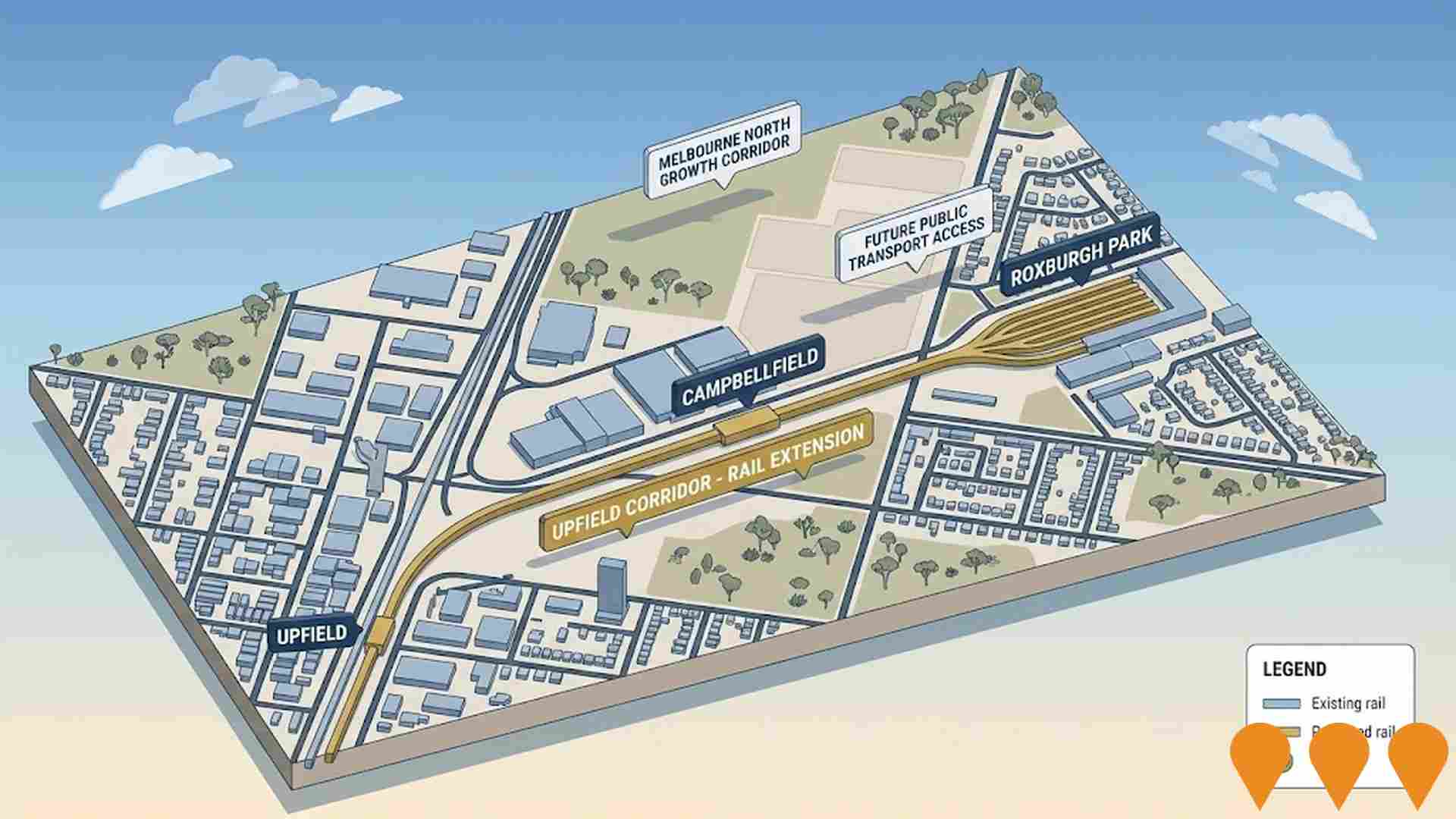

Upfield Corridor - Rail Extension to Roxburgh Park

Planning and investigation for the extension and electrification of the Upfield railway line from its current terminus to Roxburgh Park. The project involves duplicating the existing single track between Gowrie and Upfield to increase service frequency and connecting the line to the Craigieburn corridor. This work is a critical component of the Melbourne North Growth Corridor strategy to support rapid population growth in suburbs like Cloverton and Beveridge.

Broadmeadows Activity Centre Plan

The Broadmeadows Activity Centre Plan is a finalized strategic framework by the Department of Transport and Planning designed to guide urban renewal and development over the next 30 years. Part of the Victorian Government's Housing Statement, the plan aims to unlock between 3,000 and 4,500 new homes by 2051 through increased density in the commercial core and surrounding walkable catchments. Key features include building heights up to 12 storeys in the core and streamlined planning processes to accelerate housing supply while improving public spaces and connectivity.

Hume Central Redevelopment

Council-led renewal to transform the Broadmeadows town centre into a mixed-use precinct with a new town square, improved civic spaces, a study hub, car park, potential hotel and mixed-use building, and upgrades to public realm and infrastructure to support jobs, learning and community life.

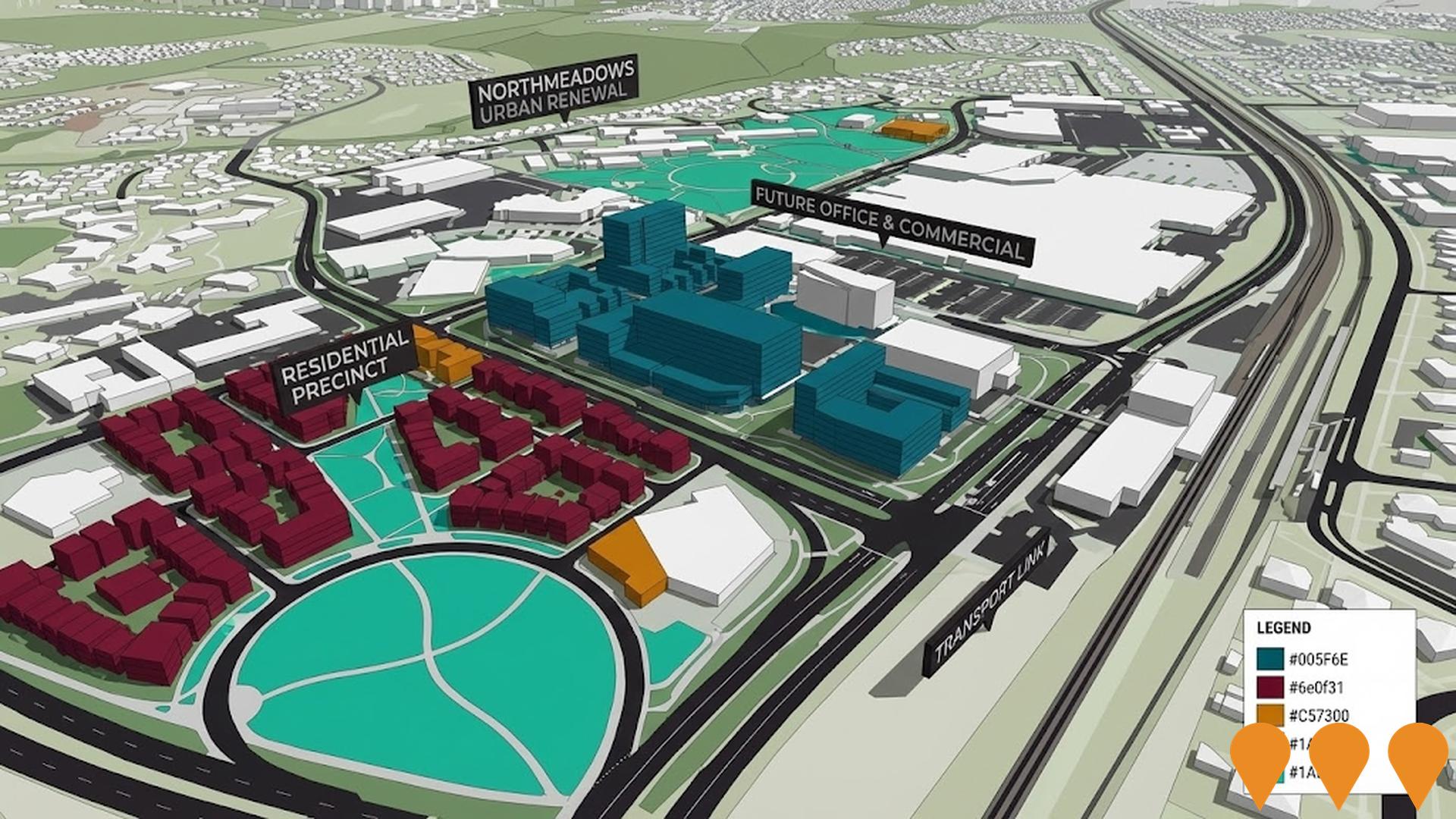

Northmeadows Strategic Site

The Northmeadows Strategic Site (formerly Meadowlink Strategic Priority Area) is a 60-hectare brownfield urban renewal precinct in Broadmeadows. It is transitioning from industrial/manufacturing uses into a mixed-use 20-minute neighbourhood with diverse housing (potential for ~3,750 dwellings), protected and intensified employment land, new community facilities, open spaces, improved transport links, and local jobs. Originally led by the Victorian Planning Authority (VPA), the project has transitioned to Hume City Council for ongoing strategic planning and implementation.

Time & Place Campbellfield Industrial Development

Redevelopment of the historic Ford site into a modern industrial hub providing warehousing, logistics, and advanced manufacturing facilities. Supports domestic manufacturing and e-commerce logistics growth in Melbourne's northern industrial corridor, with an estimated end value of $250 million.

Employment

Employment conditions in Dallas face significant challenges, ranking among the bottom 10% of areas assessed nationally

Dallas has a skilled workforce with notable representation in the construction sector. Its unemployment rate was 18.7% in the past year, with an estimated employment growth of 2.0%.

As of September 2025, 2,086 residents were employed while the unemployment rate was 14.0% higher than Greater Melbourne's rate of 4.7%. Workforce participation lagged significantly at 40.4%, compared to Greater Melbourne's 64.1%. Key industries of employment among residents were construction, health care & social assistance, and manufacturing. Dallas had a particularly notable concentration in transport, postal & warehousing, with employment levels at 2.0 times the regional average.

Conversely, professional & technical services showed lower representation at 3.2% versus the regional average of 10.1%. The area appeared to offer limited local employment opportunities, as indicated by the count of Census working population vs resident population. During the year to September 2025, employment levels increased by 2.0% and labour force increased by 1.8%, causing the unemployment rate to fall by 0.1 percentage points. By comparison, Greater Melbourne recorded employment growth of 3.0%, labour force growth of 3.3%, with unemployment rising 0.3 percentage points. State-level data to 25-Nov showed VIC employment grew by 1.13% year-on-year (adding 41,950 jobs), with the state unemployment rate at 4.7%, compared to the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggested that national employment should expand by 6.6% over five years and 13.7% over ten years, but growth rates differed significantly between industry sectors. Applying these projections to Dallas's employment mix indicated local employment should increase by 5.8% over five years and 12.3% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

According to AreaSearch's aggregation of the latest postcode level ATO data released for financial year ended June 2023, the suburb of Dallas had a median income among taxpayers of $38,433 and an average level of $46,534. Both figures are below the national averages of $57,688 and $75,164 for Greater Melbourne respectively. Based on Wage Price Index growth of 8.25% from financial year ended June 2023 to September 2025, estimated median income in Dallas would be approximately $41,604 and average income $50,373 during this period. According to the Census conducted on August 2021, incomes in Dallas fall between the 1st and 6th percentiles nationally for households, families, and individuals. Income distribution data shows that 30.6% of Dallas' population (2,149 individuals) earn within the $800 - $1,499 income range, differing from regional levels where the $1,500 - $2,999 category is predominant at 32.8%. Housing affordability pressures are severe in Dallas, with only 80.0% of income remaining after housing costs, ranking at the 6th percentile nationally.

Frequently Asked Questions - Income

Housing

Dallas is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The latest Census evaluation in Dallas found that dwelling structures comprised 83.9% houses and 16.1% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Melbourne metro's figures of 87.6% houses and 12.4% other dwellings. Home ownership in Dallas stood at 32.8%, with mortgaged dwellings at 33.5% and rented ones at 33.7%. The median monthly mortgage repayment in the area was $1,408, lower than Melbourne metro's average of $1,834. The median weekly rent figure in Dallas was recorded at $323, compared to Melbourne metro's $369. Nationally, Dallas's mortgage repayments were significantly lower than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Dallas has a typical household mix, with a lower-than-average median household size

Family households constitute 75.4% of all households, including 40.1% couples with children, 15.0% couples without children, and 18.3% single parent families. Non-family households account for the remaining 24.6%, with lone person households at 21.0% and group households comprising 3.5%. The median household size is 3.1 people, which is smaller than the Greater Melbourne average of 3.2.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Dallas fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 18.6%, significantly lower than Greater Melbourne's average of 37.0%. Bachelor degrees are the most common at 12.2%, followed by postgraduate qualifications (5.0%) and graduate diplomas (1.4%). Vocational credentials are prevalent, with 26.2% of residents aged 15+ holding them, including advanced diplomas (9.8%) and certificates (16.4%). Educational participation is high, with 38.5% currently enrolled in formal education: 13.9% in primary, 9.9% in secondary, and 5.5% in tertiary education.

Educational participation is notably high, with 38.5% of residents currently enrolled in formal education. This includes 13.9% in primary education, 9.9% in secondary education, and 5.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transportation in Dallas indicates that there are currently 20 active transport stops operating within the city. These stops serve a mix of bus routes, with two individual routes providing a total of 738 weekly passenger trips. The accessibility of transport is rated as good, with residents typically located approximately 323 meters from the nearest transport stop.

On average, there are 105 trips per day across all routes, which equates to roughly 36 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health outcomes in Dallas are marginally below the national average with the level of common health conditions among the general population somewhat typical, though higher than the nation's average among older cohorts

Health indicators suggest below-average health outcomes in Dallas compared to national averages. Common health conditions are somewhat typical but higher among older cohorts. Approximately 45% of residents have private health cover, which is lower than the 49.5% found across Greater Melbourne and the national average of 55.7%.

The most common medical conditions are asthma (7.6%) and arthritis (7.4%), with 71.9% of residents reporting no medical ailments, compared to 76.3% in Greater Melbourne. Dallas has a higher proportion of seniors aged 65 and over at 13.7%, compared to Greater Melbourne's 10.8%. Health outcomes among seniors require more attention than the broader population due to presenting challenges.

Frequently Asked Questions - Health

Cultural Diversity

Dallas is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Dallas has a population where 49.8% were born overseas, with 74.6% speaking a language other than English at home. The predominant religion in Dallas is Islam, accounting for 61.5%. This figure is higher compared to Greater Melbourne's 24.1%.

In terms of ancestry, the top groups are Other (48.6%), Australian (12.9%), and English (9.6%). Notably, Lebanese representation is higher at 9.4% in Dallas compared to the regional average of 4.2%. Samoan and Vietnamese populations also show slight increases with 1.5% and 2.1%, respectively, compared to the region's 1.3% and 0.9%.

Frequently Asked Questions - Diversity

Age

Dallas hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Dallas's median age is 32 years, which is younger than Greater Melbourne's average of 37 and significantly lower than Australia's national average of 38 years. Compared to Greater Melbourne, Dallas has a higher percentage of residents aged 5-14 (16.4%) but fewer residents aged 35-44 (12.7%). Post-2021 Census data reveals that the age group 15-24 has increased from 14.4% to 15.4% of Dallas's population, while the age group 25-34 has decreased from 15.2% to 13.7%. By 2041, demographic modeling suggests that Dallas's age profile will change significantly. The strongest projected growth is in the 45-54 age cohort, which is expected to grow by 45%, adding 355 residents to reach a total of 1,142.