Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Capel are slightly above average based on AreaSearch's ranking of recent, and medium term trends

As of November 2025, the estimated population for the Capel statistical area (Lv2) is around 2,859. This figure represents an increase of 253 people since the 2021 Census, which reported a population of 2,606. The current estimate is based on AreaSearch's validation of new addresses and analysis of the latest ERP data release by the ABS (June 2024), along with an additional 13 validated new addresses since the Census date. This results in a density ratio of 43 persons per square kilometer. Over the past decade, Capel has shown resilient growth patterns with a compound annual growth rate of 1.3%, outperforming its SA3 area. Population growth was driven by balanced factors across natural increase and migration patterns.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and post-2032 estimates, AreaSearch utilises growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections (released in 2023, based on 2022 data). Nationally, regional areas are projected to have above median population growth. By 2041, the Capel (SA2) is expected to expand by 431 persons, reflecting a total increase of 13.7% over the 17 years.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Capel when compared nationally

AreaSearch analysis of ABS building approval numbers shows Capel averaged around 14 new dwelling approvals per year. Approximately 72 homes were approved between financial years FY-21 to FY-25, with an additional 17 approved in FY-26 so far.

On average, 3.3 people moved to the area for each dwelling built over the past five financial years. This indicates supply lagging demand, potentially leading to heightened buyer competition and pricing pressures. New dwellings are developed at an average expected construction cost of $333,000.

Compared to Rest of WA, Capel has 10.0% less new development per person but ranks among the 77th percentile nationally for development activity. Recent periods have seen increased development activity. All new constructions in Capel have been detached houses, preserving its low density nature and attracting space-seeking buyers. With around 151 people per dwelling approval, Capel exhibits characteristics of a growth area. Future projections estimate Capel will add 391 residents by 2041. Current development appears well-matched to future needs, suggesting steady market conditions without extreme price pressure.

Frequently Asked Questions - Development

Infrastructure

Capel has emerging levels of nearby infrastructure activity, ranking in the 38thth percentile nationally

No factor impacts an area's performance more than local infrastructure changes, major projects, and planning initiatives. AreaSearch has identified zero projects expected to affect this area. Key projects are Busselton Margaret River Airport Expansion, City of Busselton Local Planning Scheme No. 22, Bunbury Regional Hospital Redevelopment, and Bunbury Offshore Wind Project (North). The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

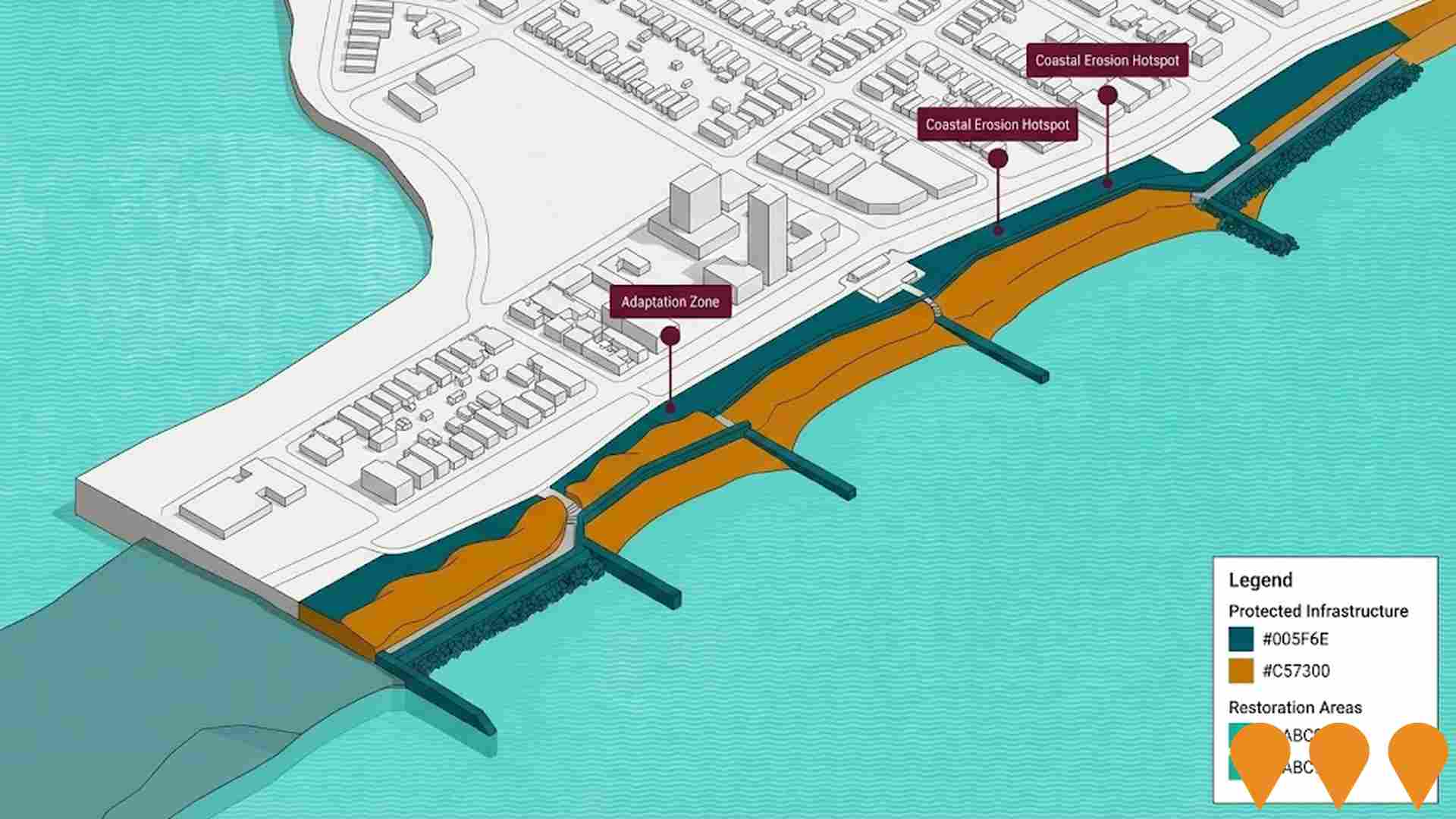

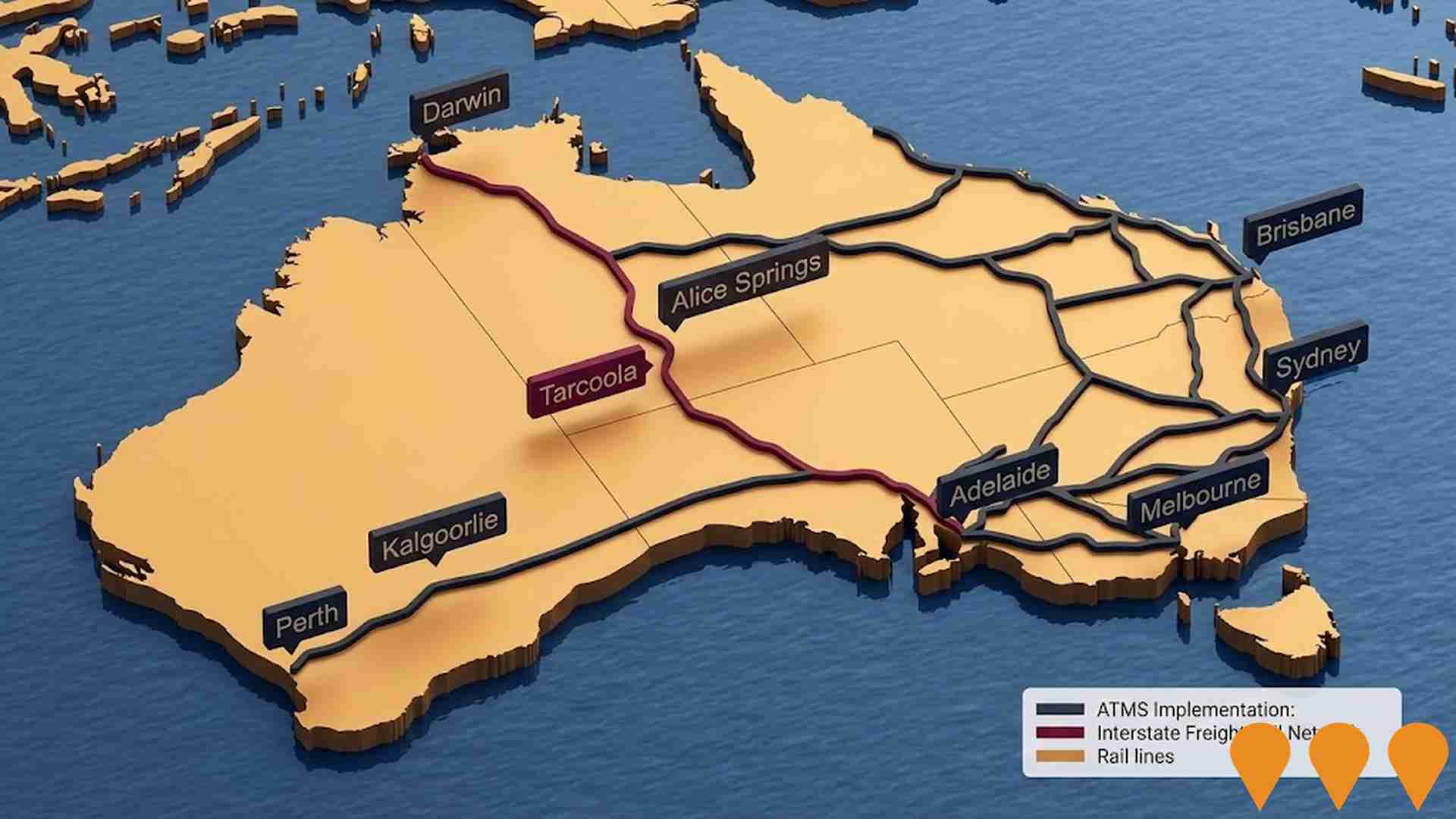

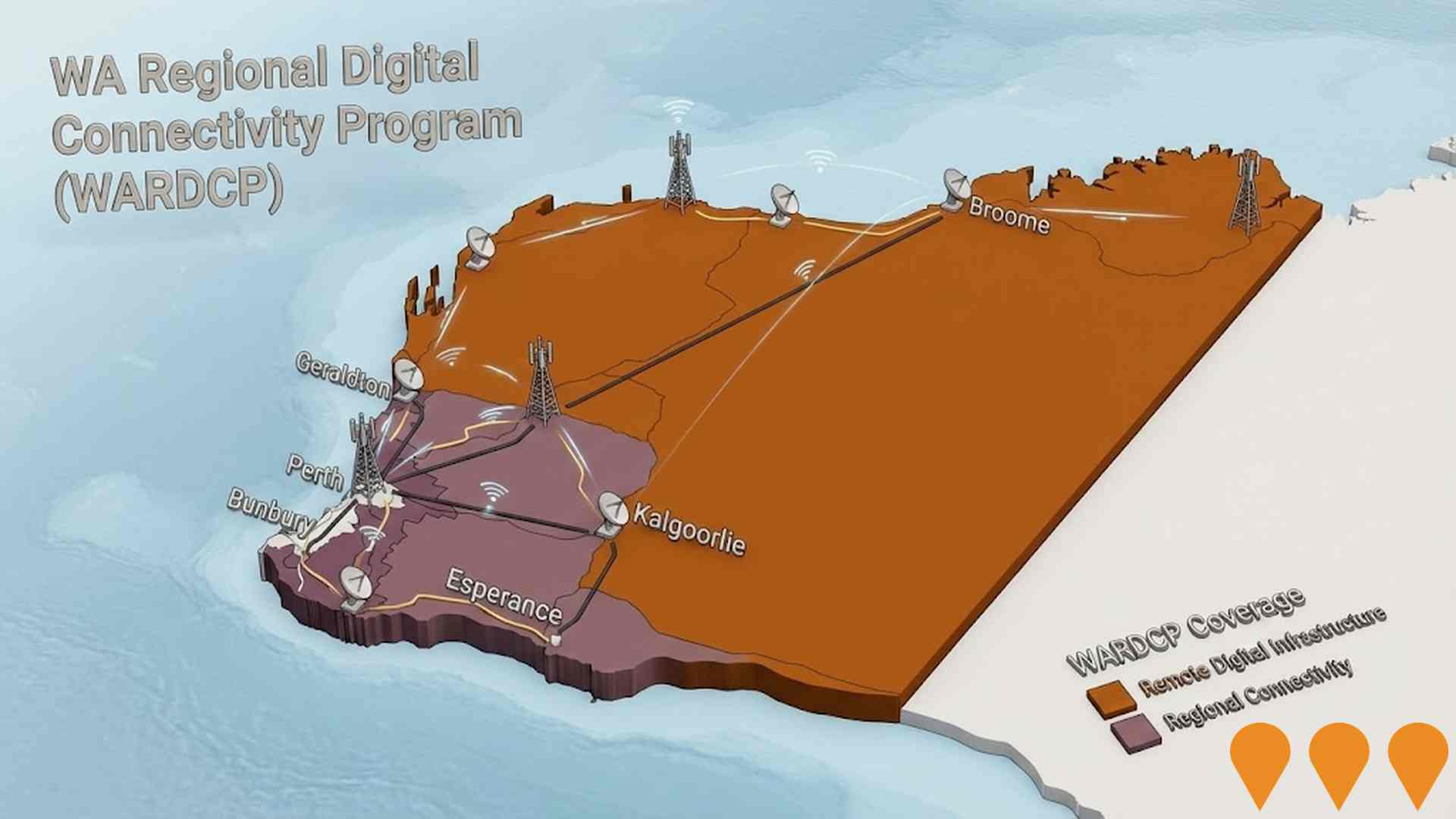

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Resources Community Investment Initiative

A $750 million partnership between the WA Government and major resource companies (Rio Tinto, BHP, Woodside Energy, Chevron, Mineral Resources, Fortescue, Roy Hill) to fund community, social, and regional infrastructure. Key allocated projects include the $150.3 million Perth Concert Hall redevelopment and the $20 million Paraburdoo Hospital upgrade.

Bunbury Regional Hospital Redevelopment

A $471.5 million redevelopment transforming Bunbury Regional Hospital into Western Australia's largest and most modern regional healthcare facility. Key features include a new seven-storey clinical tower with a rooftop helideck, an expanded emergency department, increased operating theatre and intensive care capacity, and dedicated mental health observation and inpatient units. The project also introduces the state's first regional training, education, and research centre, alongside expanded maternity and neonatal services to support the growing South West community.

Busselton Margaret River Airport Expansion

The Busselton Margaret River Airport is advancing Phase 1 of its 2024 Master Plan, featuring a proposed $65 million terminal expansion to accommodate surging passenger demand from interstate and FIFO services. Key works for the 2025-2028 period include a new permanent passenger terminal, security screening upgrades, a new public car park, septic system improvements, and a ground service equipment storage facility. The project aims to cement the airport as a regional hub for international tourism and freight, supported by ongoing business case development and strategic government funding commitments.

Bunbury Offshore Wind Project (North)

The Bunbury Offshore Wind Project (North) is a proposed 1.5 GW offshore wind farm located at least 30km off the coast of Western Australia. Developed by a consortium led by EDF Renewables Australia and Ocean Winds, the project was officially granted a feasibility licence by the Federal Government in January 2026. This licence allows for seven years of detailed technical studies, environmental surveys, and community consultation. The project is a critical component of WA's energy transition, aiming to supply clean power to the South West Interconnected System as coal-fired plants retire.

City of Busselton Local Planning Scheme No. 22

Comprehensive new local planning scheme for Busselton City including Dunsborough areas, supporting sustainable growth while retaining character and identity. Currently under EPA and WAPC review.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

National EV Charging Network (Highway Fast Charging)

Partnership between the Australian Government and NRMA to deliver a backbone EV fast charging network on national highways. Program funds and co-funds 117 DC fast charging sites at roughly 150 km intervals to connect all capital cities and regional routes, reducing range anxiety and supporting EV uptake.

WA Regional Digital Connectivity Program (WARDCP)

Statewide co-investment program delivering new and upgraded mobile, fixed wireless and broadband infrastructure to improve reliability, coverage and performance for regional and remote Western Australia. Current workstreams include the Regional Telecommunications Project, State Agriculture Telecommunications Infrastructure Fund, and the WA Regional Digital Connectivity Program (WARDCP).

Employment

Employment conditions in Capel demonstrate strong performance, ranking among the top 35% of areas assessed nationally

Capel has a diverse workforce comprising white and blue-collar jobs. The construction sector is notably prominent with an unemployment rate of 2.7%.

Over the past year, ending September 2025, employment grew by 6.3%. As of that date, 1,528 residents are employed, with an unemployment rate of 0.6% lower than Rest of WA's 3.3%. Workforce participation is similar to Rest of WA at 59.4%. Key industries include health care & social assistance, construction, and retail trade.

Construction stands out with a share of employment 1.4 times the regional level. Mining's presence is limited at 8.3%, compared to 11.7% regionally. Local employment opportunities appear limited based on Census data comparison. Between September 2024 and September 2025, employment increased by 6.3% while labour force grew by 5.9%, reducing unemployment by 0.4 percentage points. In contrast, Rest of WA saw employment rise by 1.4%, labour force grow by 1.2%, and unemployment fall by 0.2 percentage points. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Capel's employment mix suggests local employment should grow by 5.8% over five years and 12.4% over ten years, though this is a simple extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

Capel's income level is below the national average according to latest ATO data aggregated by AreaSearch for financial year 2023. Capel's median income among taxpayers is $50,033 and average income stands at $62,712, compared to Rest of WA's figures of $59,973 and $74,392 respectively. Based on Wage Price Index growth of 9.62% since financial year 2023, estimated incomes as of September 2025 would be approximately $54,846 (median) and $68,745 (average). Census 2021 income data shows household, family and personal incomes in Capel rank modestly, between the 29th and 30th percentiles. Income distribution data indicates 34.0% of population (972 individuals) fall within the $1,500 - 2,999 range, consistent with surrounding region's 31.1%. Housing affordability pressures are severe, with only 83.7% of income remaining, ranking at the 30th percentile.

Frequently Asked Questions - Income

Housing

Capel is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Capel's dwelling structure, as per the latest Census, consisted of 93.7% houses and 6.3% other dwellings (including semi-detached properties, apartments, and 'other' dwellings). This compares to Non-Metro WA's figures of 88.1% houses and 11.8% other dwellings. Home ownership in Capel stood at 31.5%, with mortgaged dwellings accounting for 48.9% and rented dwellings making up 19.6%. The median monthly mortgage repayment was $1,498, lower than Non-Metro WA's average of $1,616. The median weekly rent in Capel was recorded at $320, compared to Non-Metro WA's figure of $300. Nationally, Capel's mortgage repayments were significantly lower than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Capel has a typical household mix, with a fairly typical median household size

Family households account for 73.9 percent of all households, including 28.2 percent that are couples with children, 30.9 percent that are couples without children, and 13.6 percent that are single parent families. Non-family households make up the remaining 26.1 percent, with lone person households at 23.6 percent and group households comprising 3.4 percent of the total. The median household size is 2.5 people, which matches the average for the Rest of WA.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Capel fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 12.4%, significantly lower than Australia's average of 30.4%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 8.9%, followed by graduate diplomas (2.2%) and postgraduate qualifications (1.3%). Trade and technical skills are prominent, with 41.7% of residents aged 15+ holding vocational credentials - advanced diplomas (8.2%) and certificates (33.5%).

Educational participation is high, with 29.6% of residents currently enrolled in formal education. This includes 12.1% in primary education, 10.5% in secondary education, and 2.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Capel has two active public transport stops operating within its boundaries. These stops are serviced by a mix of bus routes, with one route providing all the services. This results in a total of eleven weekly passenger trips across both stops.

The accessibility to these transport options is rated as limited, with residents typically located 944 meters from the nearest stop. On average, there is one trip per day across all routes, which equates to approximately five weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Capel is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Capel faces significant health challenges, with common conditions affecting both younger and older age groups. Private health cover stands at approximately 52% (1,489 people), slightly higher than the average SA2 area but lower than Rest of WA's 55.4%.

Arthritis and mental health issues are prevalent, impacting 11.6% and 9.7% respectively. However, 62.5% report no medical ailments, compared to 66.4% in Rest of WA. Capel has a higher proportion of seniors aged 65 and over at 19.4% (554 people), compared to 17.6% in Rest of WA. Health outcomes among seniors present some challenges but perform better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Capel is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Capel's population showed low cultural diversity, with 88.9% being citizens born in Australia speaking English only at home. Christianity was the dominant religion at 38.8%. There was no representation of Judaism, mirroring the region's 0.0%.

The top ancestry groups were English (35.8%), Australian (32.6%), and Scottish (7.4%). Notably, Welsh (0.9% vs regional 0.6%), Dutch (2.5% vs 1.6%), and French (0.8% vs 0.4%) were overrepresented.

Frequently Asked Questions - Diversity

Age

Capel's median age exceeds the national pattern

Capel's median age is 41, closely matching Rest of WA's figure of 40 and slightly exceeding the national norm of 38. The 15-24 age group comprises 12.4%, higher than Rest of WA, while the 55-64 cohort stands at 11.4%. Post-2021 Census, the 15-24 group grew from 10.6% to 12.4%, and the 25-34 cohort rose from 9.8% to 11.0%. Conversely, the 55-64 group fell from 13.0% to 11.4%, and the 5-14 group decreased from 15.1% to 13.7%. By 2041, Capel's age profile is projected to change significantly. The 25-34 cohort is expected to grow by 61%, reaching 507 from 314. Declines are forecast for the 85+ and 75-84 cohorts.