Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Liverpool - East lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

Liverpool - East's population was approximately 20,387 as of November 2025. This figure represents an increase of 2,851 people from the 2021 Census total of 17,536, indicating a growth rate of 16.3%. This change is inferred from ABS estimates: a resident population of 20,362 in June 2024 and an additional 437 validated new addresses since the Census date. The area's population density was around 9,020 persons per square kilometer, placing it within the top 10% nationally according to AreaSearch assessments. Liverpool - East's growth rate exceeded both state (6.7%) and metropolitan averages during this period. Overseas migration contributed approximately 58.0% of overall population gains, with other factors such as natural growth and interstate migration also being positive influences.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022, and NSW State Government's SA2 level projections for areas not covered by this data, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for the years 2032 to 2041. Based on projected demographic shifts, exceptional growth is predicted over this period, with an expected increase of 9,796 persons to 2041, reflecting a total increase of 47.9% over the seventeen-year span.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Liverpool - East when compared nationally

Liverpool - East has seen approximately 145 dwellings receive development approval annually. Over the past five financial years, from FY21 to FY25, a total of 726 homes were approved, with one more approved in FY26 so far. On average, each dwelling constructed over these years accommodates about five new residents per year.

This has led to demand significantly outstripping supply, typically resulting in price growth and increased buyer competition. The average construction value of these dwellings is $206,000, which is below the regional average, indicating more affordable housing options for buyers. This financial year, commercial development approvals have reached $157.8 million, suggesting strong local business investment.

Compared to Greater Sydney, Liverpool - East has slightly higher development activity, with 11.0% more approvals per person over the past five years. This maintains good buyer choice and supports existing property values, although recent periods have seen some moderation in development activity. The majority of new developments consist of townhouses or apartments (99.0%), with standalone homes making up only 1.0%. This trend towards denser development provides accessible entry options for downsizers, investors, and entry-level buyers. According to the latest AreaSearch quarterly estimate, Liverpool - East is projected to grow by 9,771 residents by 2041. If current development rates continue, housing supply may struggle to keep pace with population growth, potentially increasing buyer competition and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Liverpool - East has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified 26 projects likely affecting the area. Notable ones are Liverpool Civic Place, Liverpool Health and Academic Precinct, Liverpool Innovation Precinct, and Light Horse Park Redevelopment. The following list details projects expected to have the most relevance.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

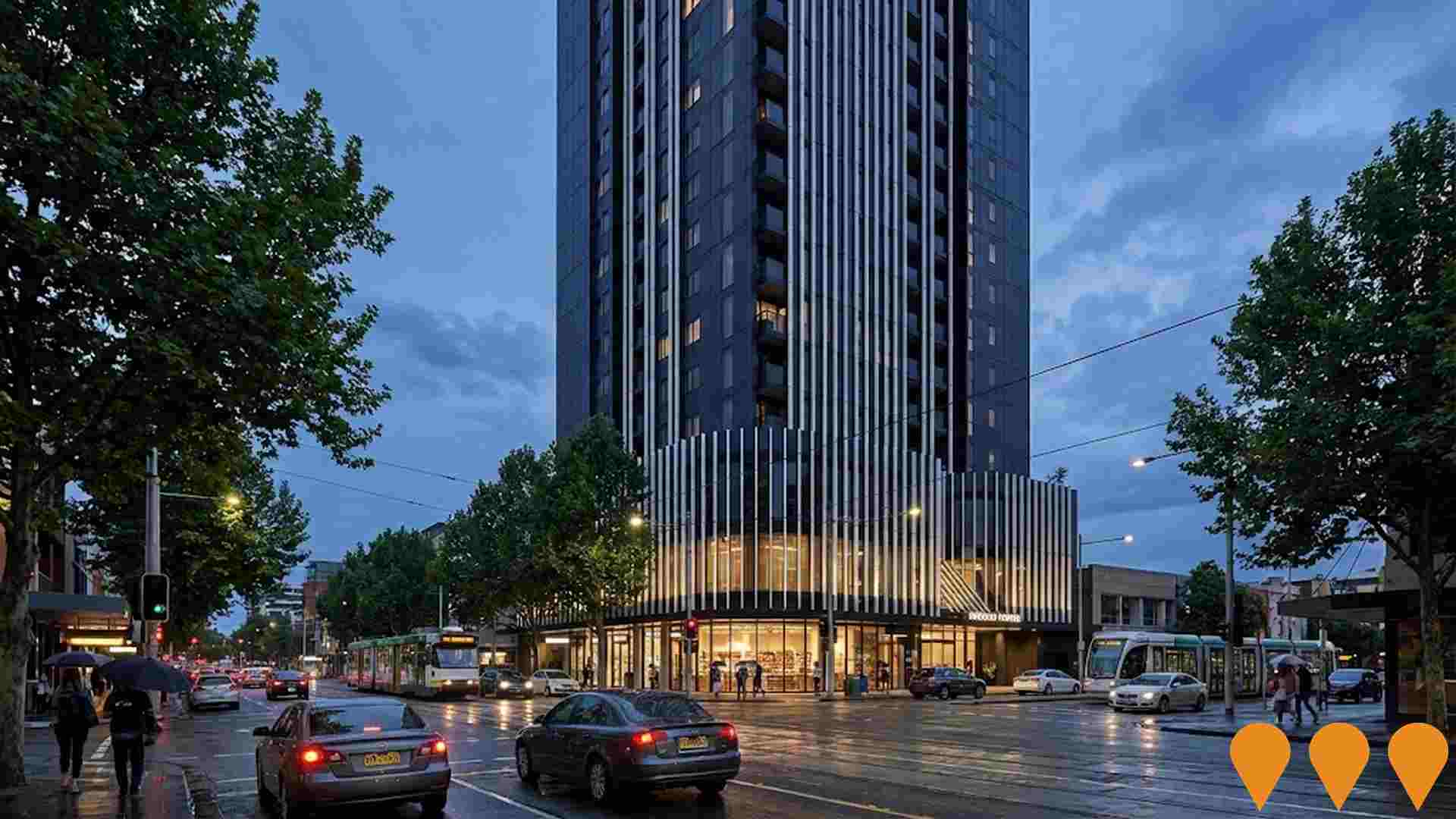

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

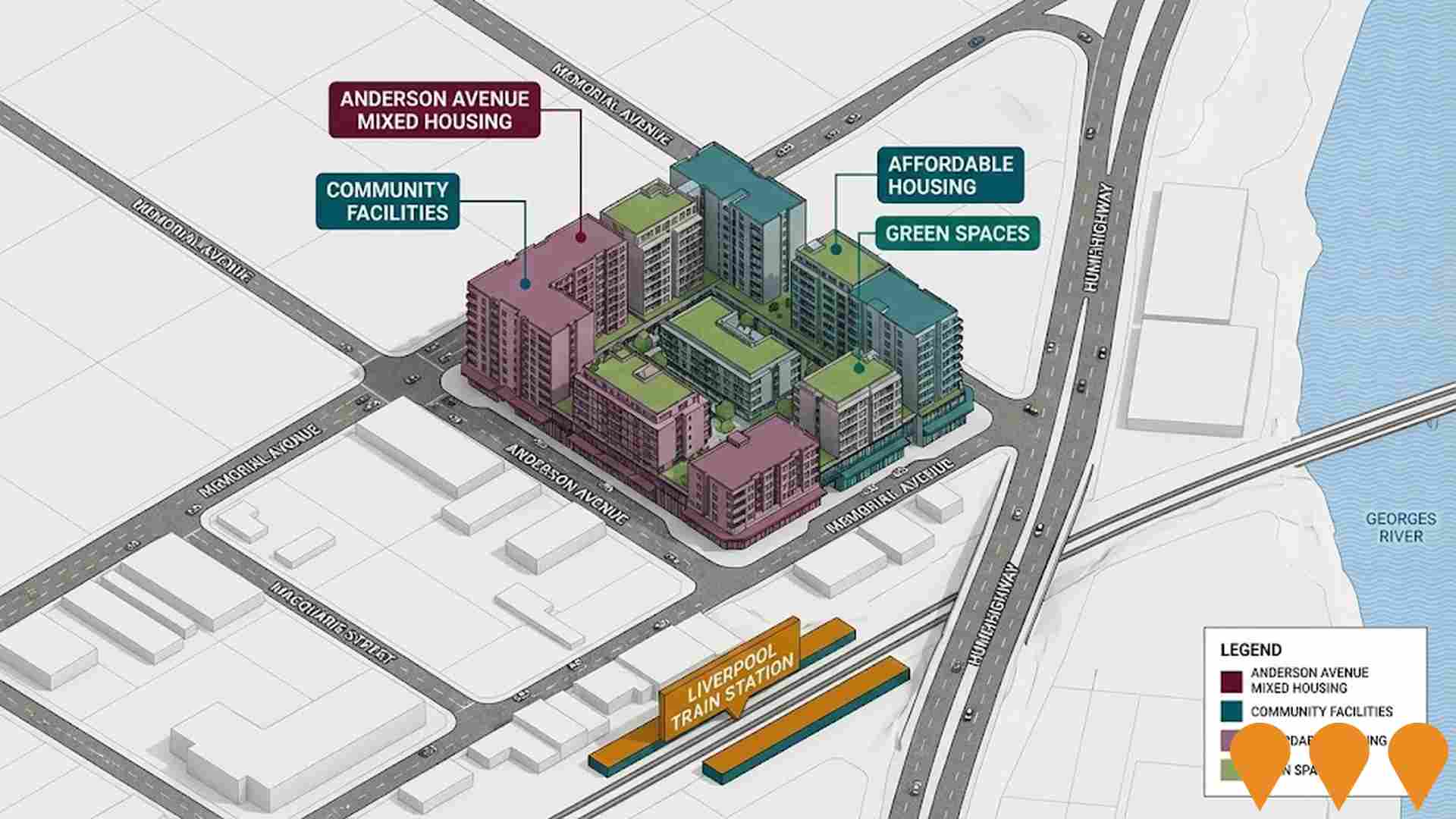

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Liverpool Civic Place

790 million mixed-use civic and commercial precinct in Liverpool CBD. Stage 1 (civic hub including new Council chambers, library, TAFE NSW, childcare, plaza and 450-space car park) completed and opened December 2023. Stage 2 (two towers: one civic/commercial/university building and one build-to-rent residential tower with 320 apartments) is under construction with practical completion expected mid-2027.

Liverpool Health and Academic Precinct

The $830 million Liverpool Health and Academic Precinct (LHAP) is a major redevelopment of Liverpool Hospital creating an international hub for clinical innovation, medical research, and education in South Western Sydney. Phase 1 delivered a new five-storey Integrated Services Building (completed October 2024) with expanded Emergency Department, neonatal intensive care unit, birthing suites, maternity and children's services, pathology, and ambulatory care. Phase 2 (underway, completion 2027) includes a new multi-storey Integrated Services Building with inpatient units, integrated cancer centre featuring the ACRF Oasis Wellness Centre, expanded women's and children's services, additional inpatient beds, research facilities, and supporting infrastructure. The precinct serves one of NSW's fastest-growing regions and includes prior multi-storey car park (2022).

Liverpool Innovation Precinct

A health, education, and research innovation precinct anchored by the ongoing $790 million Liverpool Hospital redevelopment. The precinct is a collaboration focused on health technologies, cancer care, translational research, and robotics, supported by a multi-university education hub (UNSW, Western Sydney University) and city centre public domain upgrades to create a vibrant economic hub.

Liverpool City Centre Renewal - Sydney's Third CBD

Ongoing strategic renewal of Liverpool City Centre as Sydney's Third CBD. The 2018 rezoning (LLEP Amendment 52) enables high-density mixed-use development across approximately 25 hectares. Multiple private and public projects are now in planning, development application or construction stages, guided by the Liverpool Collaboration Area Place Strategy (2023) and Liverpool Local Strategic Planning Statement. Focus on residential, commercial, retail, civic and public domain upgrades to support population and job growth to 2036 and beyond.

Light Horse Park Redevelopment

Council-led multi-stage redevelopment of Light Horse Park into a vibrant, inclusive riverfront destination. Stage 1 (accessible kayak launch) complete. Current works (Stage 2) include carpark upgrades, lighting, CCTV, landscaping and EV infrastructure (expected completion April 2026). Future stages include enhanced play spaces, fitness stations, riverbank restoration, viewing platforms, pavilions, picnic areas, oval upgrades and a new community hub. Total project value approximately $36.7 million, funded by NSW Government (WestInvest/WSIG) in association with Liverpool City Council. Expected overall completion early 2027.

Liverpool CBD Mixed-Use Development (34 Storey)

Concept development application for a 34-storey mixed-use tower featuring ground floor commercial and educational facilities, a child care centre, 118 hotel suites, 190 residential apartments, retention of a heritage item, and four levels of basement parking. The project aims to contribute to the transformation of Liverpool CBD.

Woodward Park Masterplan

Comprehensive masterplan for Woodward Park redevelopment including community facilities, sports grounds, playgrounds and open space improvements

Anderson Avenue Mixed Housing Development

Mixed housing development on Anderson Avenue featuring affordable housing options, community facilities and green spaces

Employment

Employment performance in Liverpool - East has been below expectations when compared to most other areas nationally

Liverpool - East has a well-educated workforce with essential services sectors well represented. The unemployment rate in the area was 6.8% as of September 2025.

There was an estimated employment growth of 6.6% over the past year. As of September 2025, 10,595 residents were in work while the unemployment rate was 2.6% higher than Greater Sydney's rate of 4.2%. Workforce participation lagged significantly at 49.9%, compared to Greater Sydney's 60.0%. Leading employment industries among residents comprised health care & social assistance, retail trade, and transport, postal & warehousing.

The area showed particularly strong specialization in health care & social assistance, with an employment share of 1.5 times the regional level. In contrast, professional & technical employed just 5.5% of local workers, below Greater Sydney's 11.5%. The ratio of 0.9 workers for each resident indicated substantial local employment opportunities based on Census data. During the year to September 2025, employment levels increased by 6.6% and labour force increased by 4.7%, causing the unemployment rate to fall by 1.6 percentage points. This contrasted with Greater Sydney where employment grew by 2.1%, labour force expanded by 2.4%, and unemployment rose by 0.2 percentage points. State-level data to 25-Nov showed NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. This compared favourably to the national unemployment rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 offered further insight into potential future demand within Liverpool - East. These projections suggested that national employment should expand by 6.6% over five years and 13.7% over ten years, with growth rates differing significantly between industry sectors. Applying these industry-specific projections to Liverpool - East's employment mix suggested local employment should increase by 6.7% over five years and 14.0% over ten years.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

Liverpool - East SA2's median income among taxpayers was $50,316 in financial year 2022, according to the latest ATO data aggregated by AreaSearch. This figure is lower than the national average of $56,994 for Greater Sydney. The area's average income stood at $59,158 compared to Greater Sydney's $80,856 in the same year. Based on Wage Price Index growth of 12.61% since financial year 2022, estimated median and average incomes as of September 2025 would be approximately $56,661 and $66,618 respectively. Census 2021 income data shows household, family, and personal incomes in Liverpool - East rank modestly, between the 23rd and 28th percentiles. The largest segment comprises 34.3% earning $1,500 - $2,999 weekly (6,992 residents), consistent with broader trends across the metropolitan region showing 30.9% in the same category. Housing affordability pressures are severe, with only 74.2% of income remaining after housing costs, ranking at the 13th percentile.

Frequently Asked Questions - Income

Housing

Liverpool - East features a more urban dwelling mix with significant apartment living, with a higher proportion of rental properties than the broader region

Liverpool - East's dwelling structure, as per the latest Census, consisted of 5.2% houses and 94.8% other dwellings (semi-detached, apartments, 'other' dwellings). This contrasts with Sydney metro's composition of 63.3% houses and 36.8% other dwellings. Home ownership in Liverpool - East stood at 9.7%, with mortgaged dwellings at 18.7% and rented dwellings at 71.6%. The median monthly mortgage repayment was $1,733, lower than Sydney metro's average of $2,167. The median weekly rent figure in Liverpool - East was $380, compared to Sydney metro's $400. Nationally, Liverpool - East's mortgage repayments were below the Australian average of $1,863, while rents exceeded the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Liverpool - East features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households account for 63.7% of all households, including 27.3% couples with children, 20.2% couples without children, and 14.2% single parent families. Non-family households make up the remaining 36.3%, with lone person households at 32.0% and group households comprising 4.3% of the total. The median household size is 2.3 people, which is smaller than the Greater Sydney average of 3.0.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Liverpool - East aligns closely with national averages, showing typical qualification patterns and performance metrics

In Liverpool - East, 32.0% of residents aged 15+ have university qualifications, exceeding the SA4 region's 21.4%. Bachelor degrees are most common at 21.1%, followed by postgraduate qualifications (9.4%) and graduate diplomas (1.5%). Vocational credentials are held by 30.1% of residents aged 15+, with advanced diplomas at 12.7% and certificates at 17.4%. Educational participation is high, with 34.8% currently enrolled in formal education: primary (10.0%), tertiary (7.5%), and secondary (6.7%).

Educational participation is notably high, with 34.8% of residents currently enrolled in formal education. This includes 10.0% in primary education, 7.5% in tertiary education, and 6.7% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Liverpool - East has 53 active public transport stops offering a mix of train and bus services. These stops are served by 89 routes that together facilitate 9,641 weekly passenger trips. The average distance from residents to the nearest stop is 159 meters, indicating excellent transport accessibility.

On average, there are 1,377 trips daily across all routes, which amounts to around 181 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Liverpool - East's residents boast exceedingly positive health performance metrics with younger cohorts in particular seeing very low prevalence of common health conditions

Liverpool - East's health outcomes data shows excellent results, with younger cohorts experiencing low prevalence of common health conditions. Approximately 49% of its total population (~10,010 people) has private health cover, lower than the national average of 55.3%.

Mental health issues and asthma are the most prevalent medical conditions in the area, affecting 5.7 and 5.2% of residents respectively. A higher proportion of residents, 79.4%, report being completely clear of medical ailments compared to Greater Sydney's 76.4%. The area has a lower percentage of seniors aged 65 and over at 11.1% (2,267 people) than Greater Sydney's 12.8%. However, health outcomes among seniors require more attention despite being above average.

Frequently Asked Questions - Health

Cultural Diversity

Liverpool - East is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Liverpool-East has a high level of cultural diversity, with 73.6% of its population speaking a language other than English at home and 65.3% born overseas. Christianity is the predominant religion in Liverpool-East, accounting for 42.5%. However, Islam is significantly overrepresented, comprising 20.5% compared to the Greater Sydney average of 17.4%.

In terms of ancestry, the top three groups are Other at 41.4%, Indian at 8.5%, and Australian at 7.8%, which is lower than the regional average of 14.1%. Notably, Serbian (6.8% vs 2.4%), Croatian (1.4% vs 0.9%), and Spanish (0.9% vs 0.8%) ethnic groups are overrepresented in Liverpool-East compared to the region.

Frequently Asked Questions - Diversity

Age

Liverpool - East hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Liverpool-East has a median age of 33, which is younger than Greater Sydney's figure of 37 and Australia's national average of 38 years. Compared to Greater Sydney, Liverpool-East has a higher proportion of residents aged 25-34 (22.5%) but fewer residents aged 55-64 (8.3%). This concentration of 25-34 year-olds is significantly higher than the national average of 14.5%. Between the 2021 Census and now, the proportion of residents aged 65 to 74 has increased from 5.8% to 7.0%, while the proportion of those aged 25 to 34 has decreased from 24.1% to 22.5%. By 2041, population forecasts indicate substantial demographic changes for Liverpool-East. The 25-34 age group is projected to grow by 37%, adding 1,680 residents to reach a total of 6,268.