Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Glenorie reveals an overall ranking slightly below national averages considering recent, and medium term trends

As of Nov 2025, the Glenorie statistical area (Lv2) has an estimated population of around 3,962 people. This figure reflects a growth of 170 individuals since the 2021 Census, which reported a population of 3,792 people. The increase is inferred from AreaSearch's estimation of the resident population at 3,833 following examination of the ABS's latest ERP data release in June 2024 and validation of an additional 62 new addresses since the Census date. This population density translates to approximately 49 persons per square kilometer. Glenorie's growth rate of 4.5% since the census is within 0.8 percentage points of the SA3 area's growth rate of 5.3%, indicating competitive growth fundamentals. Overseas migration was the primary driver of population gains in recent periods for this area.

AreaSearch employs ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022, and NSW State Government's SA2-level projections where applicable, released in 2022 with a base year of 2021. These projections anticipate lower quartile growth trends for Australian statistical areas, forecasting an increase of 96 persons by 2041 for the Glenorie (SA2), reflecting a decrease of 0.1% over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Glenorie according to AreaSearch's national comparison of local real estate markets

AreaSearch analysis of ABS building approval numbers shows Glenorie recorded approximately 16 residential properties approved per year over the past five financial years, totalling an estimated 81 homes. In FY26 so far, 8 approvals have been recorded. The average population increase per dwelling built in Glenorie between FY21 and FY25 was 0.6 people per year. This indicates that new supply is meeting or exceeding demand, providing ample buyer choice and creating capacity for population growth beyond current forecasts.

The average construction cost value of new homes being built in Glenorie is $1,097,000, suggesting developers are targeting the premium market segment with higher-end properties. In FY26, $3.8 million in commercial approvals have been registered, reflecting the area's primarily residential nature. Compared to Greater Sydney, Glenorie has recorded 18.0% more construction activity per person over the past five years, balancing buyer choice while supporting current property values.

However, development activity has moderated in recent periods. Of new building activity, 91.0% are standalone homes and 9.0% are townhouses or apartments, maintaining Glenorie's traditional low density character with a focus on family homes appealing to those seeking space. The estimated population per dwelling approval is 350 people, reflecting its quiet, low activity development environment. With population expected to remain stable or decline, Glenorie should see reduced pressure on housing, potentially creating opportunities for buyers.

Frequently Asked Questions - Development

Infrastructure

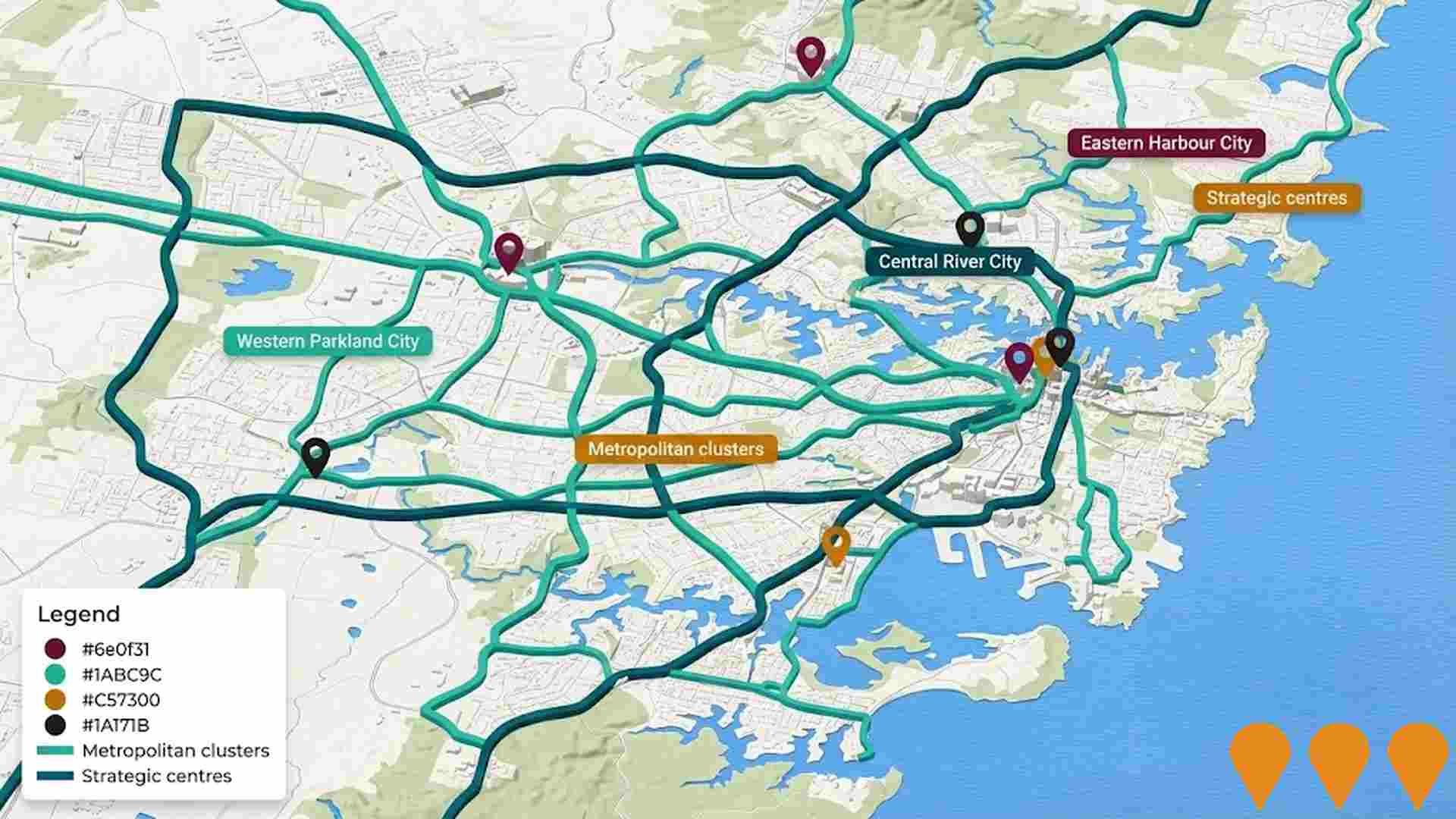

Glenorie has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

No changes can significantly affect a region's performance like alterations to local infrastructure, major projects, and planning initiatives. A total of zero projects have been identified by AreaSearch that are expected to influence the area. Notable projects include Rouse Hill Hospital, Box Hill Square, The Hills of Carmel, and Multiple Residential Subdivisions Box Hill, with the following list outlining those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sydney Metro - Western Sydney Airport

A 23-kilometre driverless metro railway line connecting St Marys to the new Western Sydney International (Nancy-Bird Walton) Airport and Bradfield City Centre. As of February 2026, the project is in advanced construction with station fit-outs, structural steel installation, and track welding ongoing. The line features six new stations: St Marys (interchange), Orchard Hills, Luddenham, Airport Business Park, Airport Terminal, and Bradfield City Centre. It is Australia's first carbon-neutral rail project from construction through operations, supporting over 14,000 jobs.

Rouse Hill Hospital

A new $910 million state-of-the-art public hospital designed to support Sydney's rapidly growing North West. The facility features a digital-first approach with 300+ beds, a comprehensive emergency department, and birthing services. Key architectural features include a 'care arcade' for retail and cafes, multi-storey parking, and integrated green spaces. The project is a joint venture between the NSW and Commonwealth Governments, serving as a vital health hub connected to the broader Western Sydney health network.

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms to enable diverse low and mid-rise housing, including dual occupancies, terraces, townhouses, and apartment buildings up to 6 storeys. The policy applies to residential zones within 800m of 171 nominated transport hubs and town centres. Stage 1 (dual occupancies) commenced 1 July 2024, and Stage 2 (mid-rise apartments and terraces) commenced 28 February 2025. In June 2025, further amendments adjusted aircraft noise thresholds and clarified storey definitions to expand the policy's reach. The initiative is expected to facilitate approximately 112,000 additional homes by 2030.

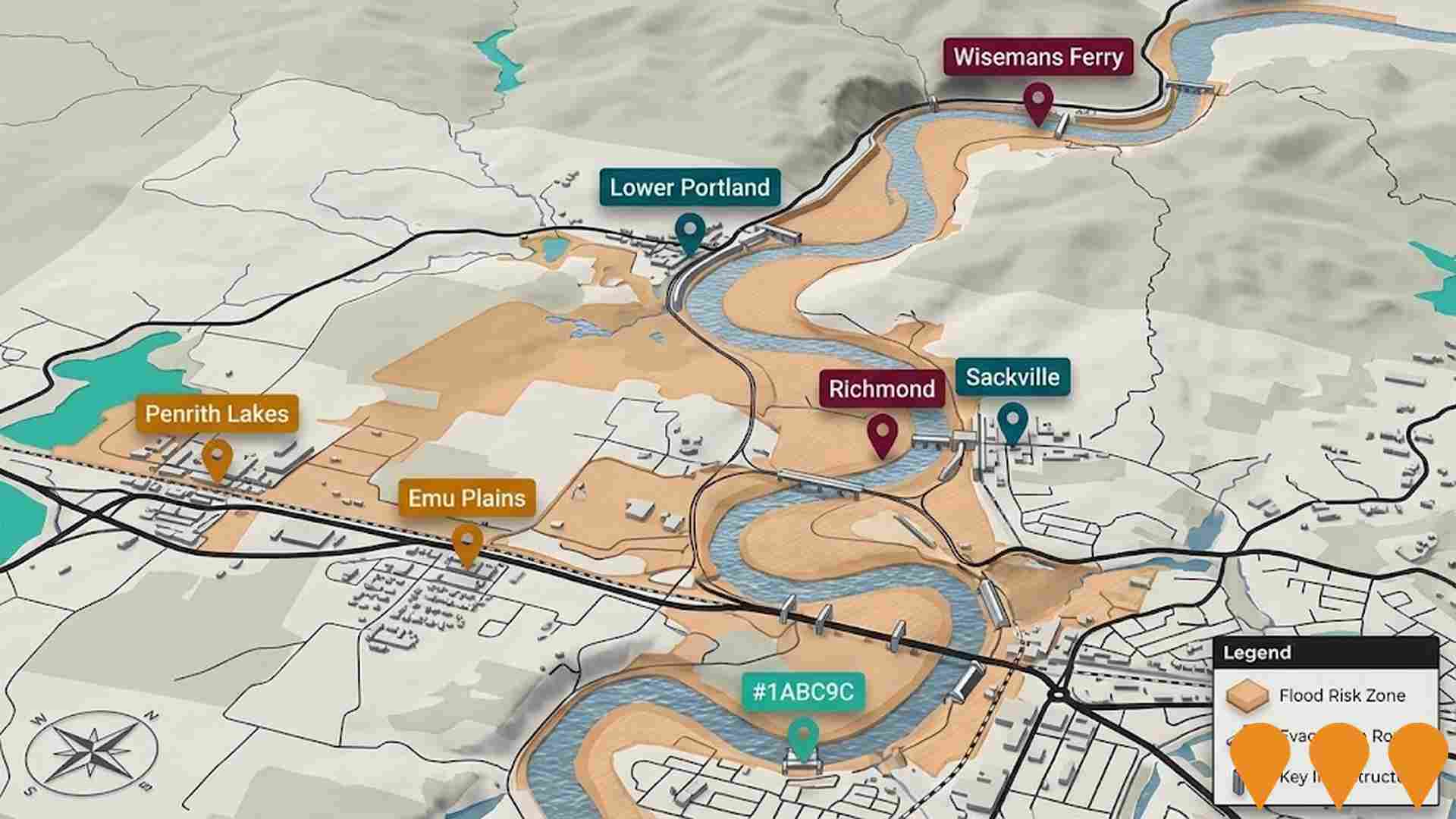

North West Treatment Hub

Sydney Water's $1.5 billion North West Treatment Hub is a 10-year program upgrading the Castle Hill, Rouse Hill, and Riverstone water resource recovery facilities. The project adds 45 ML/day of treatment capacity to support an additional 200,000 house connections. Key features include Australia's first large-scale wastewater biosolids carbonisation facility at Riverstone to produce biochar, a 90% reduction in biosolids volume, and improved recycled water reliability. Construction is being delivered in stages, with major milestones including a new 11kV high-voltage power network and membrane bioreactors to enhance water quality and protect the Hawkesbury-Nepean river system.

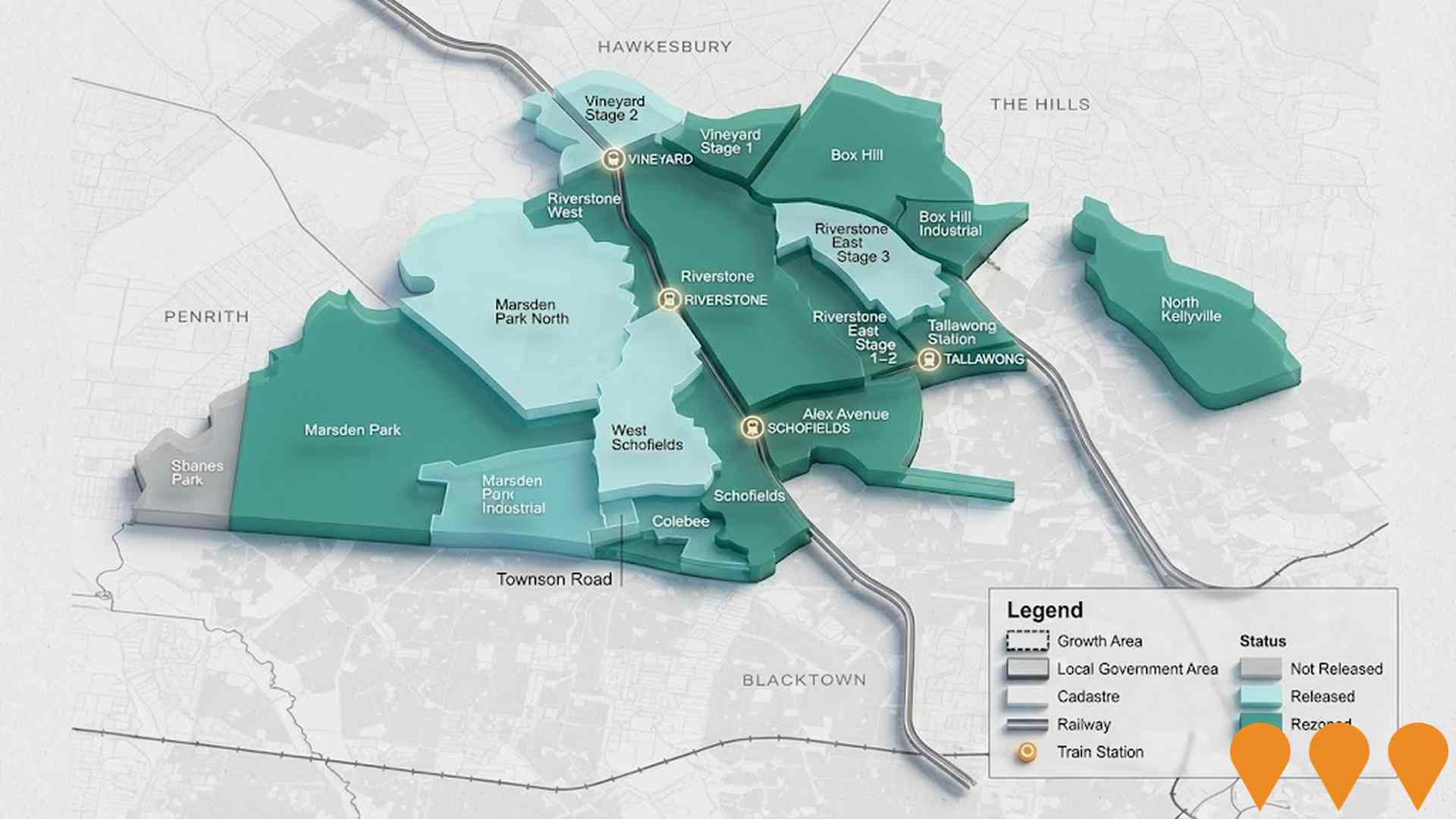

Sydney Metro Northwest

First stage of Sydney Metro featuring a 36km automated rail line from Chatswood to Tallawong with 13 stations including Tallawong and Rouse Hill. The system includes 15.5km twin tunnels (longest in Sydney), 4km elevated skytrain, and 4,000 car parking spaces across stations. Automated trains run every 4 minutes during peak hours. This $8.3 billion investment opened in May 2019 and serves as a crucial transport backbone for northwest Sydney development.

Box Hill Square

Box Hill Square is a significant mixed-use town centre development featuring 660 apartments across multiple towers. The precinct includes a 22,843 sqm retail core anchored by a full-line Coles supermarket, an Eat Street dining precinct, over 50 specialty retailers, and a medical precinct. It also provides essential community infrastructure including a 100-place childcare facility and integrated pocket parks. Following the acquisition by Polyhedric Developments in late 2024, construction preparation began with main works commencing in 2026 to support the rapidly growing North West growth corridor.

Hills Shire Council Delivery Program and Operational Plan 2024-2025 Infrastructure Works

A 162.8 million AUD infrastructure program central to the Hills Shire Council's 2024-2025 budget, focusing on critical growth areas like Box Hill and North Kellyville. Major works include the 24.4 million AUD upgrade of Annangrove Road to four lanes, the 20.2 million AUD Withers Road upgrade, and the 28.5 million AUD Boundary Road transformation. The plan also encompasses new cycleways along Cattai Creek, the expansion of Livvi's Place at Bernie Mullane Sports Complex, and a 7 million AUD investment in footpaths and bridges to support the region's rapid population growth.

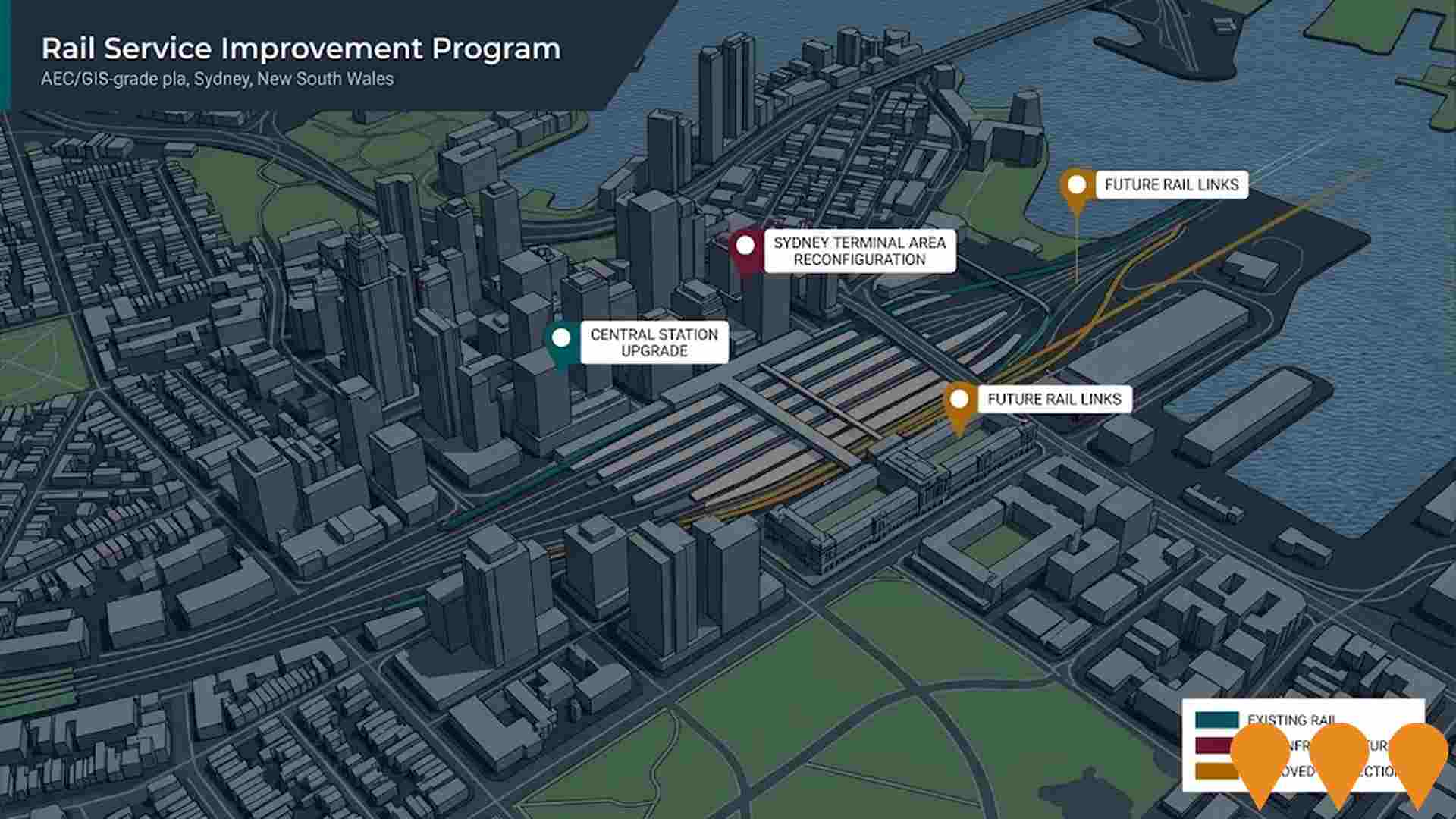

Newcastle-Sydney and Wollongong-Sydney Rail Line Upgrades

Program of upgrades to existing intercity rail corridors linking Newcastle-Central Coast-Sydney and Wollongong-Sydney to reduce travel times and improve reliability. Current scope includes timetable and service changes under the Rail Service Improvement Program, targeted network upgrades (signalling, power, station works) and the introduction of the Mariyung intercity fleet on the Central Coast & Newcastle Line, alongside Federal planning led by the High Speed Rail Authority for a dedicated Sydney-Newcastle high speed corridor.

Employment

AreaSearch analysis places Glenorie well above average for employment performance across multiple indicators

Glenorie has a skilled workforce with notable representation in the construction sector. The unemployment rate was 2.8% in Glenorie as of September 2025, compared to Greater Sydney's 4.2%.

Employment growth over the past year was estimated at 0.8%. As of September 2025, 2,132 residents were employed, with a workforce participation rate of 64.8%, slightly higher than Greater Sydney's 60.0%. Key industries for employment among Glenorie residents are construction, retail trade, and professional & technical services. Construction employment levels were particularly high at 2.0 times the regional average.

Conversely, health care & social assistance showed lower representation at 9.9% compared to the regional average of 14.1%. Many residents commute elsewhere for work based on Census data. Between September 2024 and September 2025, employment levels increased by 0.8%, labour force grew by 1.0%, resulting in an unemployment rate rise of 0.2 percentage points. In comparison, Greater Sydney recorded employment growth of 2.1% over the same period. State-level data from NSW to 25-Nov-25 shows employment contracted by 0.03%, with a state unemployment rate of 3.9%. National projections indicate total employment should increase by 6.6% over five years and 13.7% over ten years. Applying these projections to Glenorie's employment mix suggests local employment could grow by 6.4% over five years and 13.0% over ten years, though this is a simplified extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

The area exhibits notably strong income performance, ranking higher than 70% of areas assessed nationally through AreaSearch analysis

Glenorie's median income among taxpayers was $56,337 in financial year 2023. The average income stood at $115,005 during the same period. Comparing these figures with Greater Sydney's median income of $60,817 and average income of $83,003 shows Glenorie's incomes were higher. By September 2025, estimated median income would be approximately $61,328 and average income around $125,194, based on an 8.86% Wage Price Index growth since financial year 2023. According to the 2021 Census, household incomes ranked at the 91st percentile ($2,524 weekly), while personal incomes ranked lower at the 64th percentile. Distribution data indicated that 28.8% of Glenorie residents (1,141 people) earned between $1,500 and $2,999 weekly, mirroring regional levels where 30.9% occupied this bracket. The suburb demonstrated affluence with 42.3% earning over $3,000 per week. High housing costs consumed 15.3% of income, but strong earnings placed disposable income at the 90th percentile. Glenorie's SEIFA income ranking placed it in the 9th decile.

Frequently Asked Questions - Income

Housing

Glenorie is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Glenorie's dwelling structure, as per the latest Census, consisted of 98.6% houses and 1.4% other dwellings (semi-detached, apartments, 'other' dwellings). In contrast, Sydney metro had 91.0% houses and 9.0% other dwellings. Home ownership in Glenorie stood at 40.9%, with mortgaged dwellings at 44.5% and rented ones at 14.6%. The median monthly mortgage repayment was $3,000, aligning with Sydney metro's average. The median weekly rent was $543, compared to Sydney metro's $3,000 and $520 respectively. Nationally, Glenorie's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Glenorie features high concentrations of family households, with a higher-than-average median household size

Family households account for 84.7% of all households, including 47.0% couples with children, 27.2% couples without children, and 10.4% single parent families. Non-family households constitute the remaining 15.3%, with lone person households at 13.1% and group households comprising 2.0%. The median household size is 3.2 people, larger than the Greater Sydney average of 3.1.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Glenorie exceeds national averages, with above-average qualification levels and academic performance metrics

The area's university qualification rate is 26.4%, significantly lower than the SA4 region average of 40.4%. Bachelor degrees are the most common at 18.9%, followed by postgraduate qualifications (5.1%) and graduate diplomas (2.4%). Vocational credentials are held by 36.2% of residents aged 15 and above, with advanced diplomas at 11.6% and certificates at 24.6%. Educational participation is high, with 30.7% of residents currently enrolled in formal education.

This includes 10.6% in primary education, 9.2% in secondary education, and 5.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Glenorie has 52 active public transport stops, all of which are bus stops. These stops are served by 24 different routes that collectively facilitate 253 weekly passenger trips. The accessibility of these services is rated as good, with residents typically residing 343 meters from their nearest transport stop.

On average, across all routes, there are 36 trips per day, which equates to approximately 4 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Glenorie's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Glenorie shows excellent health outcomes across all age groups, with a very low prevalence of common health conditions. Private health cover rate is exceptionally high at approximately 72% (2,860 people), compared to the national average of 55.7%.

The most prevalent medical conditions are arthritis and mental health issues, affecting 7.3% and 5.9% of residents respectively. Overall, 75.1% of Glenorie residents report no medical ailments, higher than Greater Sydney's 72.3%. As of 2021, 19.8% (784 people) are aged 65 and over, lower than Greater Sydney's 22.4%. Despite this, health outcomes among seniors align with the general population's profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Glenorie was found to be slightly above average when compared nationally for a number of language and cultural background related metrics

Glenorie's cultural diversity is above average, with 21.9% of its population born overseas and 18.7% speaking a language other than English at home. Christianity is the predominant religion in Glenorie, accounting for 67.6%, compared to 65.5% across Greater Sydney. The top three ancestry groups are English (26.1%), Australian (22.2%), and Italian (8.2%).

Notably, Lebanese (6.8%) and Korean (0.7%) populations are higher in Glenorie than the regional averages of 3.6% and 0.5%, respectively. Maltese representation is slightly lower at 1.6%.

Frequently Asked Questions - Diversity

Age

Glenorie's median age exceeds the national pattern

The median age in Glenorie is 42 years, which is significantly higher than Greater Sydney's average of 37 years and older than Australia's median age of 38 years. The 55-64 age group comprises 13.6% of the population in Glenorie, compared to a lower percentage for the 25-34 cohort at 8.0%. Post-2021 Census data shows that the 75-84 age group has increased from 5.5% to 6.9%, while the 45-54 cohort has decreased from 15.3% to 14.2%. By 2041, population forecasts indicate substantial demographic changes for Glenorie. The 85+ age group is expected to grow by 100%, reaching 182 people from an initial 91. Notably, the combined 65+ age groups will account for 97% of total population growth, reflecting Glenorie's aging demographic profile. In contrast, the 55-64 and 0-4 age cohorts are expected to experience population declines.