Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Pitt Town lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

Based on AreaSearch's analysis of ABS population updates and new addresses validated since the Census, Pitt Town's estimated population was around 3,977 as of Nov 2025. This reflected an increase of 106 people (2.7%) from the 2021 Census figure of 3,871. The change was inferred from a resident population estimate of 3,665 by AreaSearch following examination of the latest ERP data release by the ABS in June 2024, along with an additional 12 validated new addresses since the Census date. This resulted in a population density ratio of 315 persons per square kilometer. Over the past decade, Pitt Town demonstrated resilient growth patterns with a compound annual growth rate of 1.6%, outpacing metropolitan areas. Natural growth contributed approximately 48.0% of overall population gains during recent periods, while overseas and interstate migration also positively impacted growth.

AreaSearch adopted ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, NSW State Government's SA2 level projections released in 2022 with a base year of 2021 were utilised. Growth rates by age group from these aggregations were applied to all areas for years 2032 to 2041. Considering projected demographic shifts, exceptional growth is predicted over the period, placing Pitt Town in the top 10 percent of statistical areas across the nation. By 2041, the area is expected to increase by 3,100 persons, reflecting a gain of 80.3% in total population over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is slightly higher than average within Pitt Town when compared nationally

AreaSearch analysis of ABS building approval numbers shows Pitt Town has received approximately 5 dwelling approvals per year over the past five financial years. This totals an estimated 28 homes from FY-21 to FY-25. As of FY-26, 9 approvals have been recorded. On average, each new home built in Pitt Town attracts around 9 new residents annually between FY-21 and FY-25.

This high demand-to-supply ratio typically leads to price growth and increased buyer competition. Developers focus on the premium market segment, with new dwellings valued at an average of $522,000 for construction costs. In FY-26, commercial approvals totalled $76,000, indicating minimal commercial development activity compared to Greater Sydney. Pitt Town's lower development activity may reinforce demand and pricing for existing properties but has picked up recently. Nationally, development activity is also relatively low, suggesting market maturity or potential constraints.

Recent developments have been exclusively detached dwellings, maintaining the area's low-density character and attracting space-seeking buyers. The estimated population per dwelling approval is 350 people. By 2041, AreaSearch projects Pitt Town to add 3,192 residents. If current development rates continue, housing supply may not keep pace with population growth, potentially increasing buyer competition and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Pitt Town has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

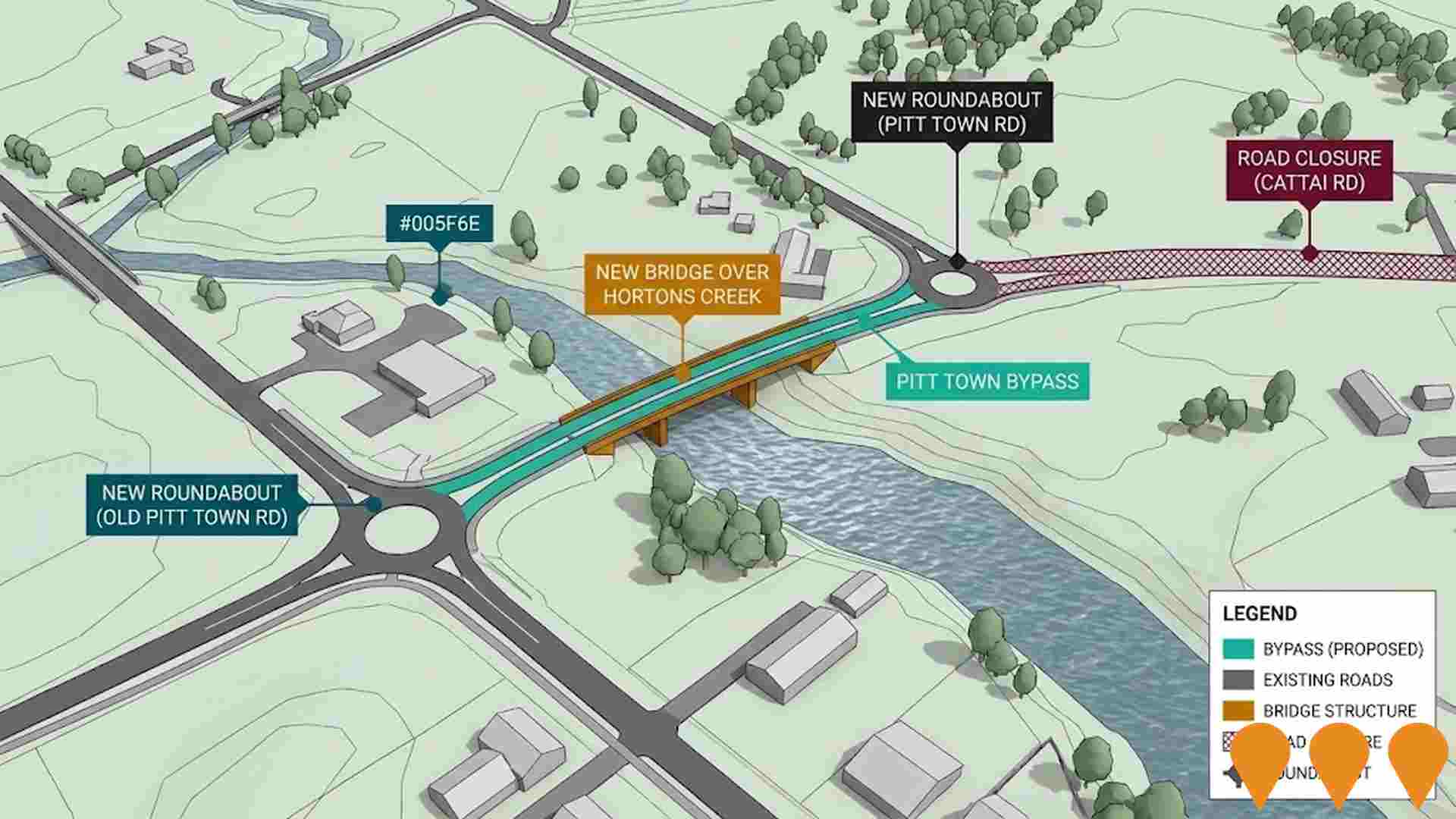

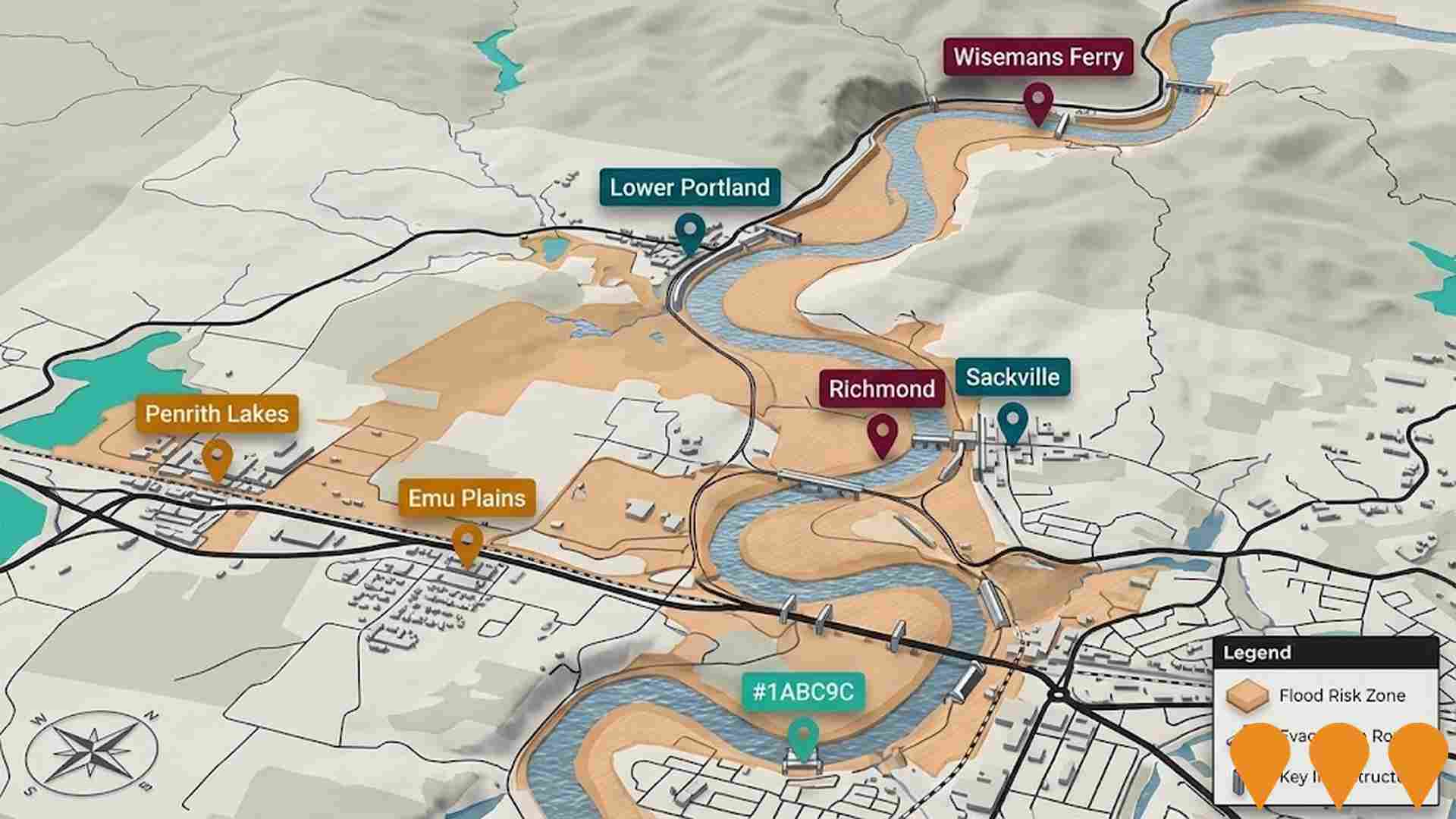

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified one major project likely to impact this region: Pitt Town Bypass, Ridgehaven Estate Box Hill, Multiple Residential Subdivisions Box Hill, and Box Hill Industrial Precinct are key projects, with the following list detailing those of most relevance.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sydney Metro - Western Sydney Airport

A 23-kilometre driverless metro railway line connecting St Marys to the new Western Sydney International (Nancy-Bird Walton) Airport and Bradfield City Centre. As of February 2026, the project is in advanced construction with station fit-outs, structural steel installation, and track welding ongoing. The line features six new stations: St Marys (interchange), Orchard Hills, Luddenham, Airport Business Park, Airport Terminal, and Bradfield City Centre. It is Australia's first carbon-neutral rail project from construction through operations, supporting over 14,000 jobs.

Rouse Hill Hospital

A new $910 million state-of-the-art public hospital designed to support Sydney's rapidly growing North West. The facility features a digital-first approach with 300+ beds, a comprehensive emergency department, and birthing services. Key architectural features include a 'care arcade' for retail and cafes, multi-storey parking, and integrated green spaces. The project is a joint venture between the NSW and Commonwealth Governments, serving as a vital health hub connected to the broader Western Sydney health network.

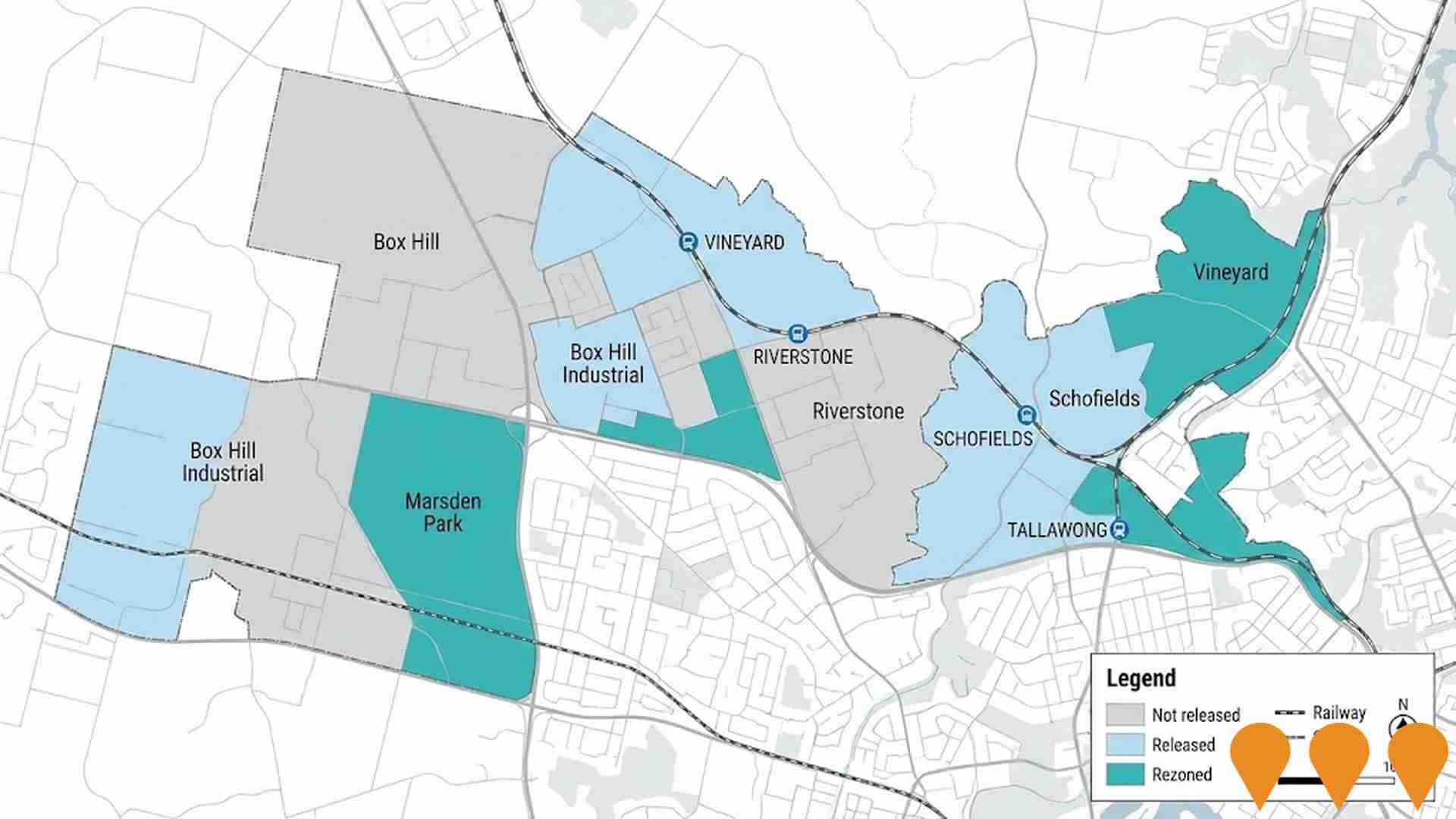

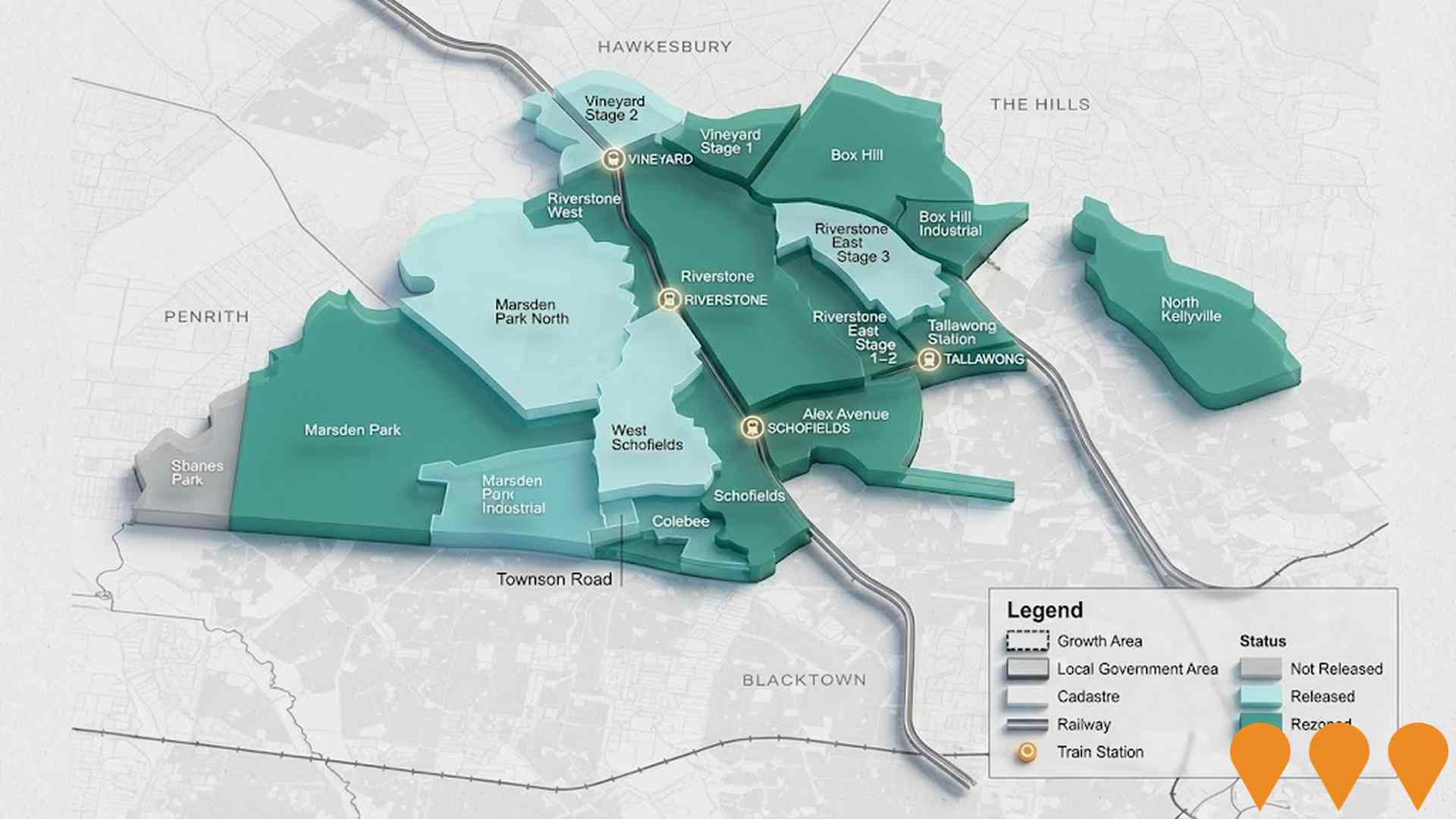

Box Hill and Box Hill Industrial Precinct

A massive masterplanned residential and employment precinct within Sydney's North West Growth Area, spanning 974 hectares. The project is transforming rural land into a vibrant urban hub that will ultimately provide approximately 16,030 homes and 115 hectares of employment land. As of 2026, over 11,300 lots have been approved and approximately 6,500 dwellings are completed. Major infrastructure works currently underway include the $32 million Water Lane Reserve sports complex (scheduled for completion in late 2026) and significant upgrades to Terry Road and Mason Road to support the growing population. The precinct also includes a new town centre, primary and secondary schools, and extensive parklands.

North West Treatment Hub

Sydney Water's $1.5 billion North West Treatment Hub is a 10-year program upgrading the Castle Hill, Rouse Hill, and Riverstone water resource recovery facilities. The project adds 45 ML/day of treatment capacity to support an additional 200,000 house connections. Key features include Australia's first large-scale wastewater biosolids carbonisation facility at Riverstone to produce biochar, a 90% reduction in biosolids volume, and improved recycled water reliability. Construction is being delivered in stages, with major milestones including a new 11kV high-voltage power network and membrane bioreactors to enhance water quality and protect the Hawkesbury-Nepean river system.

Sydney Metro Northwest

First stage of Sydney Metro featuring a 36km automated rail line from Chatswood to Tallawong with 13 stations including Tallawong and Rouse Hill. The system includes 15.5km twin tunnels (longest in Sydney), 4km elevated skytrain, and 4,000 car parking spaces across stations. Automated trains run every 4 minutes during peak hours. This $8.3 billion investment opened in May 2019 and serves as a crucial transport backbone for northwest Sydney development.

Newcastle-Sydney and Wollongong-Sydney Rail Line Upgrades

Program of upgrades to existing intercity rail corridors linking Newcastle-Central Coast-Sydney and Wollongong-Sydney to reduce travel times and improve reliability. Current scope includes timetable and service changes under the Rail Service Improvement Program, targeted network upgrades (signalling, power, station works) and the introduction of the Mariyung intercity fleet on the Central Coast & Newcastle Line, alongside Federal planning led by the High Speed Rail Authority for a dedicated Sydney-Newcastle high speed corridor.

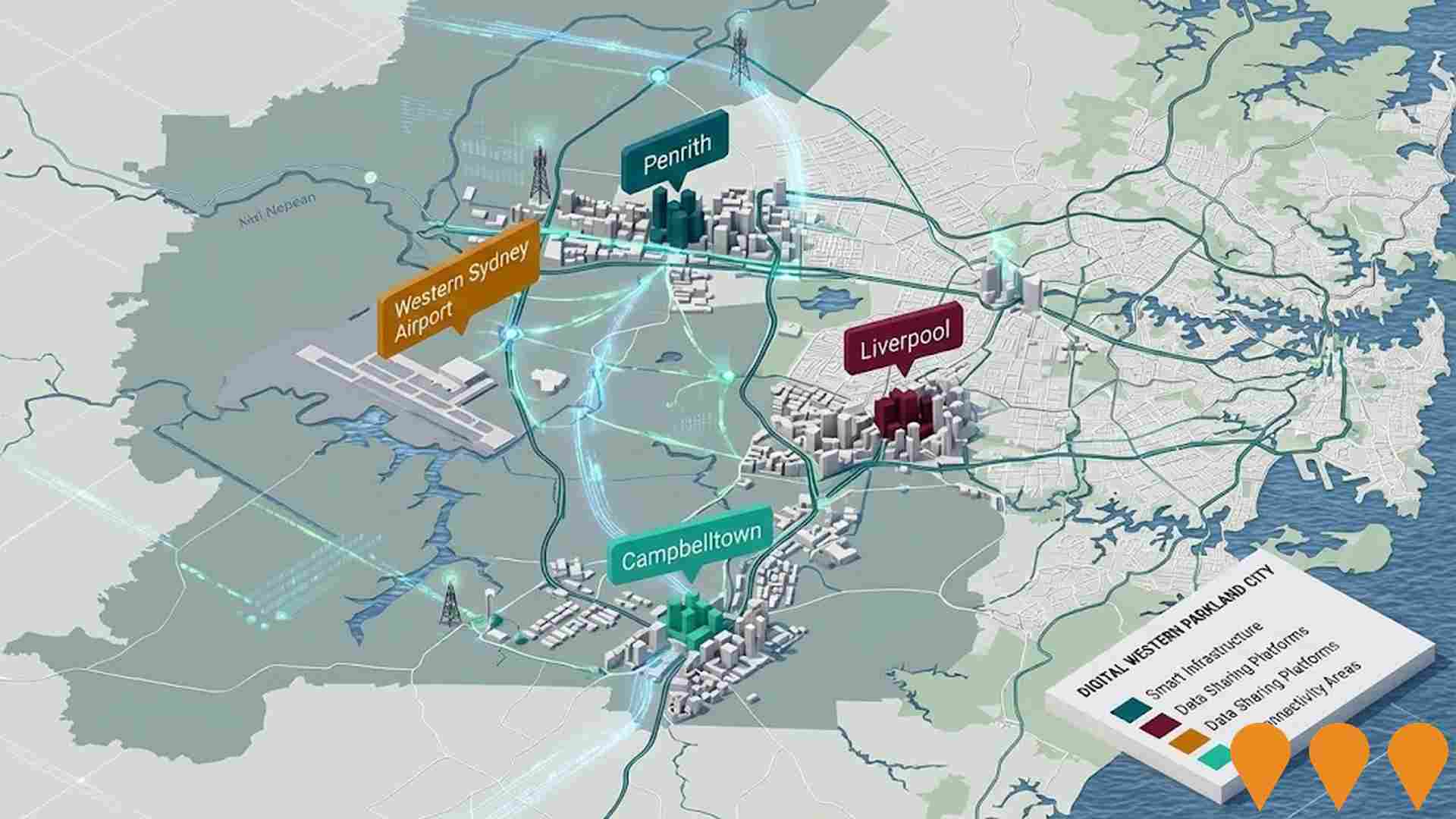

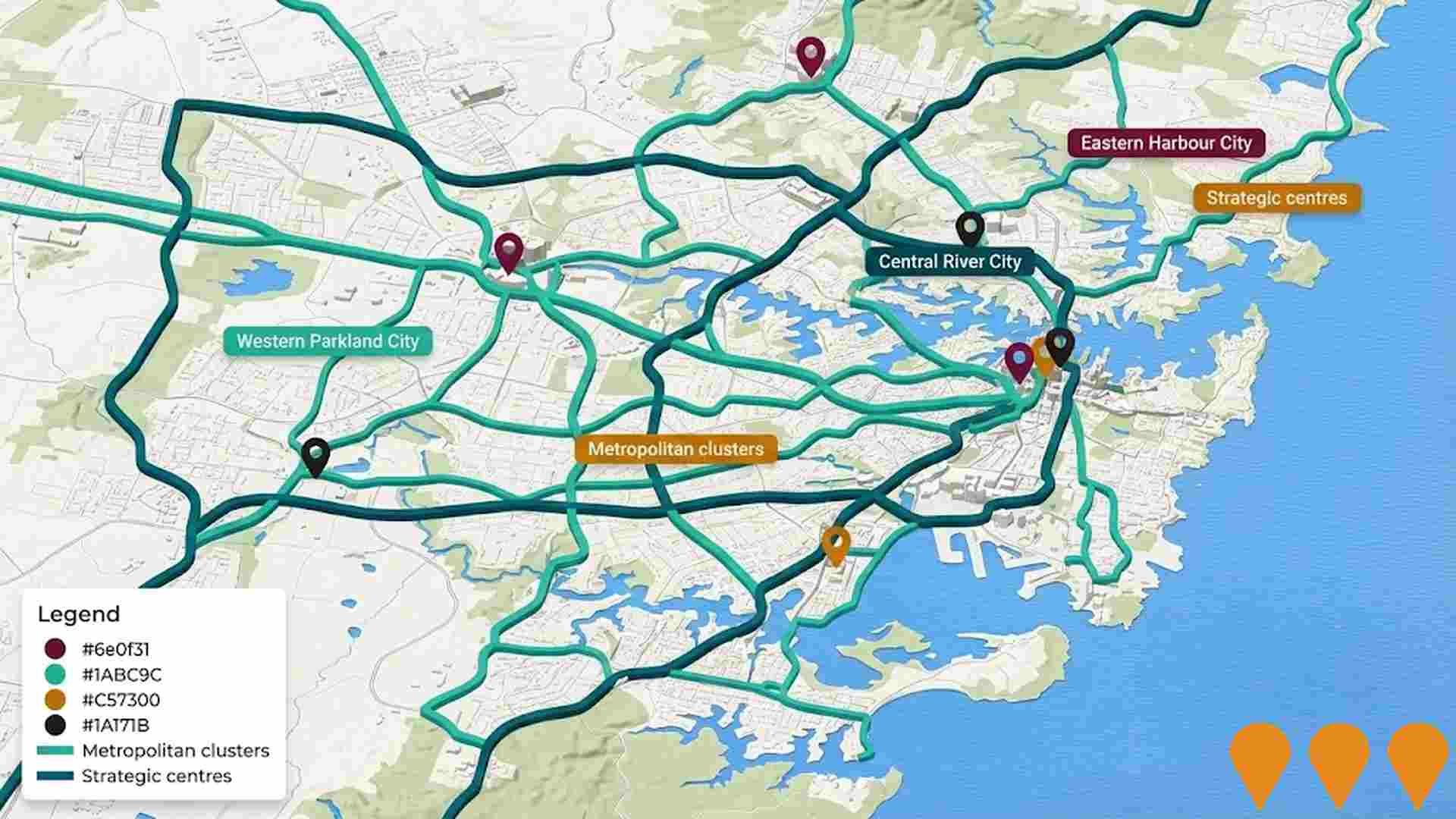

Digital Western Parkland City

Program to deliver digital infrastructure, data sharing and smart technology foundations across the Western Parkland City under the Western Sydney City Deal. Focus areas include shared data platforms, connectivity (including preparation for 5G trials), cybersecurity uplift, and city-scale smart solutions to improve services, sustainability and liveability.

Greater Sydney Cycling Network Improvements

NSW Government (Transport for NSW) is progressing a program of strategic cycleway corridors and local network upgrades across Greater Sydney to make riding safer and more convenient. The program aims to connect centres and public transport, fill missing links such as the Sydney Harbour Bridge northern ramp, and deliver over 100 km of new strategic cycleways supported by council projects under Get NSW Active by around 2028.

Employment

Employment conditions in Pitt Town remain below the national average according to AreaSearch analysis

Pitt Town has a balanced workforce with both white and blue collar employment. The construction sector is prominent, with an unemployment rate of 4.2% and stable employment over the past year, according to AreaSearch's statistical area data aggregation.

As of September 2025, 2,250 residents are employed, aligning with Greater Sydney's 4.2% unemployment rate, but with higher workforce participation at 69.8%. Dominant sectors include construction, health care & social assistance, and retail trade, with construction being particularly notable at 2.6 times the regional average. Professional & technical employment is lower at 6.0%, compared to the regional 11.5%. The area may offer limited local employment opportunities, indicated by Census working population vs resident population counts.

Between September 2024 and September 2025, employment levels increased by 0.2% and labour force by 0.8%, raising unemployment by 0.6 percentage points. In comparison, Greater Sydney had employment growth of 2.1%. State-level data to 25-Nov-25 shows NSW employment contracted by 0.03%, with an unemployment rate of 3.9%, favourably comparing to the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project overall growth of 6.6% over five years and 13.7% over ten years, but sector-specific projections suggest Pitt Town's employment could increase by 6.1% in five years and 12.5% in ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

AreaSearch's latest postcode level ATO data for financial year ending June 2023 indicates that Pitt Town suburb has one of Australia's highest incomes. The median income is $65,799 and the average income stands at $79,875. This contrasts with Greater Sydney's median income of $60,817 and average income of $83,003 for the same period. Based on Wage Price Index growth of 8.86% from financial year ending June 2023 to September 2025, current estimates would be approximately $71,629 (median) and $86,952 (average). According to the 2021 Census, household, family, and personal incomes in Pitt Town rank highly nationally, between the 80th and 93rd percentiles. Income brackets show that the $1,500 - $2,999 bracket dominates with 31.5% of residents (1,252 people), similar to metropolitan regions where 30.9% occupy this range. Economic strength is evident as 44.0% of households earn high weekly incomes exceeding $3,000, supporting elevated consumer spending. High housing costs consume 15.9% of income, yet strong earnings place disposable income at the 93rd percentile nationally. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Pitt Town is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The dwelling structure in Pitt Town, as per the latest Census, consisted of 95.9% houses and 4.1% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Sydney metro's 87.7% houses and 12.3% other dwellings. Home ownership in Pitt Town stood at 35.6%, with mortgaged dwellings at 55.1% and rented dwellings at 9.3%. The median monthly mortgage repayment was $2,969, lower than Sydney metro's average of $3,000. The median weekly rent in Pitt Town was $570, compared to Sydney metro's $600. Nationally, Pitt Town's mortgage repayments were higher at $2,969 against the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Pitt Town features high concentrations of family households, with a lower-than-average median household size

Family households account for 88.9% of all households, including 53.4% couples with children, 26.1% couples without children, and 8.6% single parent families. Non-family households constitute the remaining 11.1%, with lone person households at 10.1% and group households at 0.8%. The median household size is 3.2 people, which is smaller than the Greater Sydney average of 3.3.

Frequently Asked Questions - Households

Local Schools & Education

Pitt Town shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

The area's university qualification rate is 16.5%, significantly lower than the SA4 region average of 40.4%. Bachelor degrees are most common at 11.7%, followed by postgraduate qualifications (3.0%) and graduate diplomas (1.8%). Vocational credentials are prevalent, with 45.1% of residents aged 15+ holding them, including advanced diplomas (11.6%) and certificates (33.5%). Educational participation is high at 30.8%, with 12.3% in primary education, 9.2% in secondary education, and 3.0% pursuing tertiary education.

Educational participation is notably high, with 30.8% of residents currently enrolled in formal education. This includes 12.3% in primary education, 9.2% in secondary education, and 3.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Pitt Town has 38 active public transport stops, all of which are bus stops. These stops are served by 15 different routes that together offer 236 weekly passenger trips. The accessibility of these services is deemed good, with residents located an average of 362 meters from the nearest stop.

On average, there are 33 trips per day across all routes, which equates to approximately 6 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Pitt Town's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Health outcomes data shows excellent results across Pitt Town, with very low prevalence of common health conditions across all age groups. The rate of private health cover is exceptionally high at approximately 58% of the total population (2,325 people), compared to 61.5% across Greater Sydney.

The most common medical conditions in the area are arthritis and asthma, impacting 7.3 and 6.3% of residents respectively, while 74.5% declare themselves completely clear of medical ailments, compared to 79.5% across Greater Sydney. As of 2016 data, the area has 14.1% of residents aged 65 and over (560 people), which is higher than the 9.5% in Greater Sydney. Health outcomes among seniors are particularly strong, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Pitt Town is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Pitt Town, as per the Australian Bureau of Statistics Census 2016 data, showed low cultural diversity with 89.8% of its population born in Australia, 94.5% being citizens, and 94.4% speaking English only at home. Christianity was the predominant religion, accounting for 70.8% of Pitt Town's population, compared to 55.0% across Greater Sydney. The top three ancestry groups were Australian (30.9%), English (29.5%), and Irish (7.5%).

Notably, Maltese (4.2%) was overrepresented compared to the regional average (2.9%), as were Russian (0.4%) and Croatian (0.7%) groups.

Frequently Asked Questions - Diversity

Age

Pitt Town's population aligns closely with national norms in age terms

The median age in Pitt Town is 38 years, close to Greater Sydney's average of 37 and equivalent to Australia's median of 38. Compared to Greater Sydney, Pitt Town has a higher percentage of residents aged 5-14 (16.4%) but fewer residents aged 25-34 (8.6%). In the 2021 Census, the 15 to 24 age group increased from 13.3% to 14.6%. Conversely, the 65 to 74 age group decreased from 8.4% to 7.5%. By 2041, Pitt Town's age composition is expected to shift notably. The 15 to 24 age group is projected to grow by 77%, adding 448 people and reaching a total of 1,029 from the current 580.