Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Richmond - Clarendon are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Richmond-Clarendon's population was 16,602 as of November 2025. This showed an increase of 1,363 people since the 2021 Census, which reported a population of 15,239. The growth was inferred from ABS estimates of 16,312 in June 2024 and validated new addresses since then. The density ratio was 222 persons per square kilometer. Richmond-Clarendon's growth rate exceeded the SA3 area and SA4 region at 8.9%. Interstate migration contributed approximately 68.6% of population gains.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered, NSW State Government's SA2 level projections are used, released in 2022 with a base year of 2021. Growth rates by age group are applied to all areas for years 2032 to 2041. By 2041, the area is projected to increase by 3,812 persons, reflecting a gain of 21.2% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Richmond - Clarendon among the top 25% of areas assessed nationwide

Richmond - Clarendon has received approximately 147 dwelling approvals annually over the past five financial years, totalling 735 homes. As of FY26, 52 approvals have been recorded. Each year, an average of 2.1 new residents are gained per dwelling built between FY21 and FY25, reflecting strong demand that supports property values. New homes are being constructed at an average cost of $330,000.

This financial year has seen $23.9 million in commercial approvals, indicating moderate levels of commercial development. Compared to Greater Sydney, Richmond - Clarendon records 113% more development activity per capita, offering buyers greater choice. However, construction activity has recently eased. New developments consist of 79% detached houses and 21% townhouses or apartments, maintaining the area's traditional low-density character focused on family homes.

With around 154 people per dwelling approval, Richmond - Clarendon exhibits growth area characteristics. By 2041, the area is projected to grow by 3,522 residents. At current development rates, new housing supply should comfortably meet demand, providing favourable conditions for buyers and potentially supporting population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Richmond - Clarendon has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

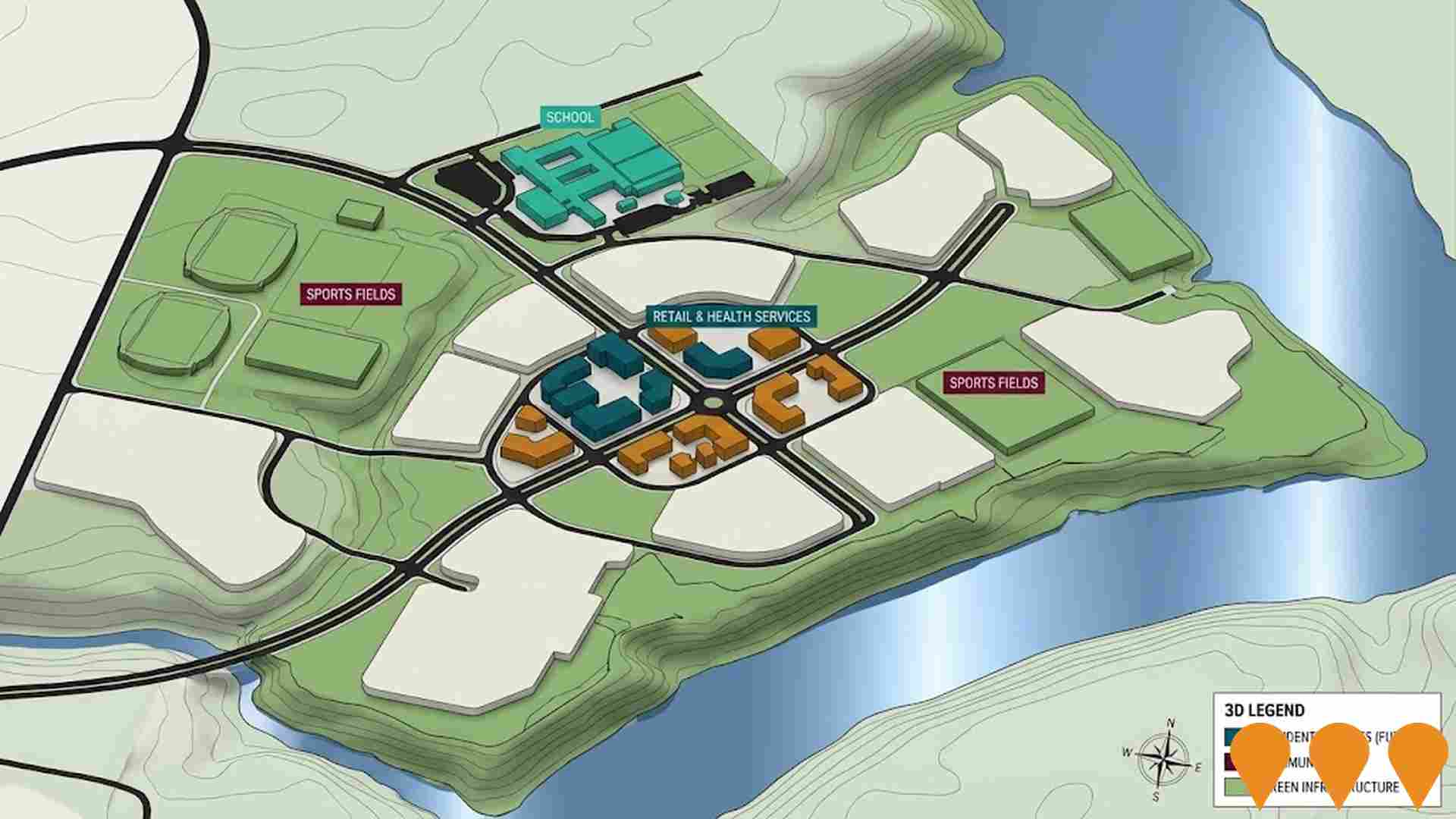

Infrastructure changes significantly impact an area's performance. AreaSearch has identified 21 projects likely affecting the region. Notable initiatives include New Richmond Bridge and Traffic Improvements, Redbank Estate - Stage 8 & Future Stages, Redbank North Richmond Master-Planned Community, and North Richmond Woolworths & Retail Expansion. The following list details projects most relevant to the area.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Redbank North Richmond Master-Planned Community

Redbank North Richmond is a 180 hectare master planned community in the Hawkesbury that will deliver about 1,399 detached homes plus an 80 bed aged care facility and a 192 home retirement village, alongside extensive parklands and open space. The $1.8 billion project includes a village centre with a cafe and restaurant, vet hospital and supermarket, with stage 2 of the Redbank Village centre and an IGA supermarket now under construction. The estate is well advanced, with planning reports noting that more than 900 lots have been sold, around 914 lots registered and about 700 lots already occupied, while new stages such as Cumberland Place and The Promenade continue to be released. Recent council planning proposals focus on minor zoning and control amendments across the existing estate and do not increase dwelling yield, while a separate planning proposal covers a Redbank expansion area at Kemsley Park. The community is supported by new childcare and community facilities, and future regional connectivity is to be improved through the proposed Grose River Bridge project being delivered in partnership with Transport for NSW and Hawkesbury City Council. :contentReference[oaicite:0]{index=0} :contentReference[oaicite:1]{index=1} :contentReference[oaicite:2]{index=2}

Redbank Estate - Stage 8 & Future Stages

Final residential stages of the 1,200-lot Redbank master-planned community by Landcom and Johnson Property Group, delivering a mix of detached homes, terraces, and apartments surrounding the existing village centre.

New Richmond Bridge and Traffic Improvements

Traffic and flood-resilience upgrade led by Transport for NSW delivering a new higher four-lane bridge over the Hawkesbury River downstream of the existing Richmond Bridge, a bypass of Richmond town centre, and upgrades to key intersections on The Driftway. Stage 1 (The Driftway intersections and enabling works) has a major construction contract awarded and is commencing in 2025, with completion targeted for 2027. Stage 2 will deliver the new bridge and associated works, with design and procurement progressing following community consultation.

North Richmond Woolworths & Retail Expansion

Expansion of the existing North Richmond shopping centre to include a full-line Woolworths supermarket, additional specialty retail, and medical/commercial tenancies.

Grose River Estate

Approved 450-lot residential subdivision on the western side of North Richmond, providing new housing and open space adjacent to the Grose River.

Redbank Village Centre Commercial Precinct

Multi-stage village centre development including veterinary hospital, regional playground, waterfront boardwalk, IGA supermarket, specialty shops, cafe/restaurant, and childcare centre. Stage one completed in 2022.

RSL LifeCare Aged Care Facility

Specialised high-dependency aged care facility with 80-bed capacity. Partnership between Redbank Communities and RSL LifeCare to provide comprehensive aged care services.

Hawkesbury Oasis Aquatic and Fitness Centre Improvements

Expansion of community facility to include new shallow-depth program pool for learn to swim and seniors programs with accessibility ramp, additional school-age amenities, new outdoor covered gym area for functional training and group fitness.

Employment

Employment performance in Richmond - Clarendon exceeds national averages across key labour market indicators

Richmond - Clarendon has an unemployment rate of 2.8% as of September 2025, which is 1.4% lower than Greater Sydney's rate of 4.2%. Workforce participation in the area is at 56.9%, compared to Greater Sydney's 60.0%.

The dominant employment sectors among residents are health care & social assistance, construction, and retail trade. Construction stands out with an employment share of 1.5 times the regional level. Professional & technical services have a limited presence, with only 4.9% employment compared to the regional average of 11.5%. Between September 2024 and September 2025, labour force decreased by 3.8%, while employment declined by 3.2%, resulting in a reduction of unemployment by 0.5 percentage points.

In contrast, Greater Sydney saw employment grow by 2.1% over the same period. As of 25-November-25, NSW employment contracted by 0.03% (losing 2,260 jobs), with an unemployment rate of 3.9%, compared to the national average of 4.3%. National employment forecasts suggest a growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Richmond - Clarendon's employment mix indicates local employment should increase by 6.2% over five years and 13.0% over ten years, based on simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income levels align closely with national averages, indicating typical economic conditions for Australian communities according to AreaSearch analysis

The Richmond-Clarendon SA2 had a median taxpayer income of $53,617 and an average of $66,206 in the financial year 2022, according to postcode level ATO data aggregated by AreaSearch. This was slightly above the national average for that year. In comparison, Greater Sydney had a median income of $56,994 and an average income of $80,856 during the same period. Based on Wage Price Index growth figures from financial year 2022 to September 2025, estimated incomes would be approximately $60,378 (median) and $74,555 (average). Census 2021 data shows that household, family, and personal incomes in Richmond-Clarendon all ranked modestly, between the 40th and 47th percentiles. The income bracket of $1,500 - $2,999 dominated with 33.0% of residents (5,478 people). Housing affordability pressures were severe, with only 80.9% of income remaining after housing costs, ranking at the 38th percentile. The area's SEIFA income ranking placed it in the 5th decile.

Frequently Asked Questions - Income

Housing

Richmond - Clarendon is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Richmond-Clarendon's dwelling structure, as per the latest Census, was 74.7% houses and 25.4% other dwellings. In comparison, Sydney metro had 79.7% houses and 20.3% other dwellings. Home ownership in Richmond-Clarendon was 32.2%, with mortgaged dwellings at 31.8% and rented ones at 36.0%. The median monthly mortgage repayment was $2,167, aligning with Sydney metro's average. The median weekly rent was $400, also matching Sydney metro's figure. Nationally, Richmond-Clarendon's mortgage repayments were higher at $2,167 compared to the Australian average of $1,863. Rents in the area exceeded the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Richmond - Clarendon features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 66.8% of all households, including 26.9% couples with children, 25.2% couples without children, and 13.8% single parent families. Non-family households comprise the remaining 33.2%, with lone person households at 30.5% and group households making up 2.7% of the total. The median household size is 2.4 people, which is smaller than the Greater Sydney average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Richmond - Clarendon aligns closely with national averages, showing typical qualification patterns and performance metrics

The area's university qualification rate is 19.9%, significantly lower than Greater Sydney's average of 38.0%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 12.7%, followed by postgraduate qualifications (5.2%) and graduate diplomas (2.0%). Trade and technical skills are prominent, with 40.3% of residents aged 15+ holding vocational credentials – advanced diplomas (11.9%) and certificates (28.4%).

Educational participation is high, with 27.6% of residents currently enrolled in formal education. This includes 8.9% in primary education, 6.9% in secondary education, and 4.6% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Richmond-Clarendon has 104 operational public transport stops offering a combination of train and bus services. These stops are served by 90 unique routes that facilitate a total of 3,322 weekly passenger trips. The area's transport accessibility is deemed good, with residents on average residing just 231 meters from their nearest transport stop.

Across all routes, service frequency stands at an average of 474 daily trips, translating to approximately 31 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Richmond - Clarendon is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Richmond-Clarendon faces significant health challenges, as indicated by its health data.

Both younger and older age groups have a notable prevalence of common health conditions. The area has approximately 52% private health cover, which is slightly higher than the average SA2 area. Mental health issues and arthritis are the most prevalent medical conditions, affecting around 10.3% and 9.5% of residents respectively. Approximately 63.1% of residents claim to be free from medical ailments, compared to 65.9% across Greater Sydney. The area has a higher proportion of seniors aged 65 and over, at 22.2%, compared to the 17.8% in Greater Sydney. Health outcomes among seniors are generally aligned with those of the wider population.

Frequently Asked Questions - Health

Cultural Diversity

Richmond - Clarendon ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Richmond-Clarendon was found to have a low level of cultural diversity, with 87.2% of its population being Australian citizens, born in Australia (83.2%), and speaking English only at home (90.3%). The dominant religion in Richmond-Clarendon is Christianity, practiced by 59.7% of the population, slightly lower than the Greater Sydney average of 60.7%. The top three ancestry groups are English (29.1%), Australian (28.7%), and Irish (7.9%).

Notably, Maltese (2.7%) and Macedonian (1.1%) populations are higher in Richmond-Clarendon compared to the regional averages of 4.6% and 0.5%, respectively, while Dutch representation is slightly higher at 1.7%.

Frequently Asked Questions - Diversity

Age

Richmond - Clarendon's population aligns closely with national norms in age terms

The median age in Richmond-Clarendon is 39 years, which is higher than Greater Sydney's average of 37 years and close to the national average of 38 years. Compared to Greater Sydney, the 75-84 age cohort is notably over-represented at 9.2% locally, while the 35-44 age group is under-represented at 12.0%. Post-2021 Census data shows that the 75-84 age group has grown from 8.0% to 9.2%, and the 65-74 cohort has declined from 10.2% to 9.4%. Population forecasts for 2041 indicate significant demographic changes in Richmond-Clarendon, with the 75-84 group set to grow by 65% (adding 985 people), reaching 2,508 from 1,522. The 65 and older age group is expected to represent 59% of the total population growth, while the 0-4 age group will experience more modest growth of 3%, adding only 33 residents.