Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

East Kurrajong is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Based on analysis of ABS population updates for the broader area, as of November 2025, East Kurrajong's estimated population is around 2,209. This reflects an increase of 6 people since the 2021 Census, which reported a population of 2,203. The change is inferred from AreaSearch's resident population estimate of 2,208, following examination of the latest ERP data release by ABS in June 2024 and address validation since the Census date. This level of population equates to a density ratio of 62 persons per square kilometer. East Kurrajong's 0.3% growth since census positions it within 0.8 percentage points of the SA3 area (1.1%), demonstrating competitive growth fundamentals. Population growth for the area was primarily driven by natural growth, contributing approximately 72.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. By 2041, the East Kurrajong statistical area is expected to grow by 151 persons based on aggregated SA2-level projections, reflecting a total increase of 7.7% over the 17-year period.

Frequently Asked Questions - Population

Development

The level of residential development activity in East Kurrajong is very low in comparison to the average area assessed nationally by AreaSearch

East Kurrajong has had no residential development approvals in the past five years. This lack of new developments suggests a mature area with limited housing opportunities. While this may support property values due to restricted supply, it also indicates a stable market with less frequent turnover compared to Greater Sydney.

The scarcity of new properties typically enhances demand and prices for existing dwellings in East Kurrajong, which is below the national average, possibly due to its maturity or planning constraints.

Frequently Asked Questions - Development

Infrastructure

East Kurrajong has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

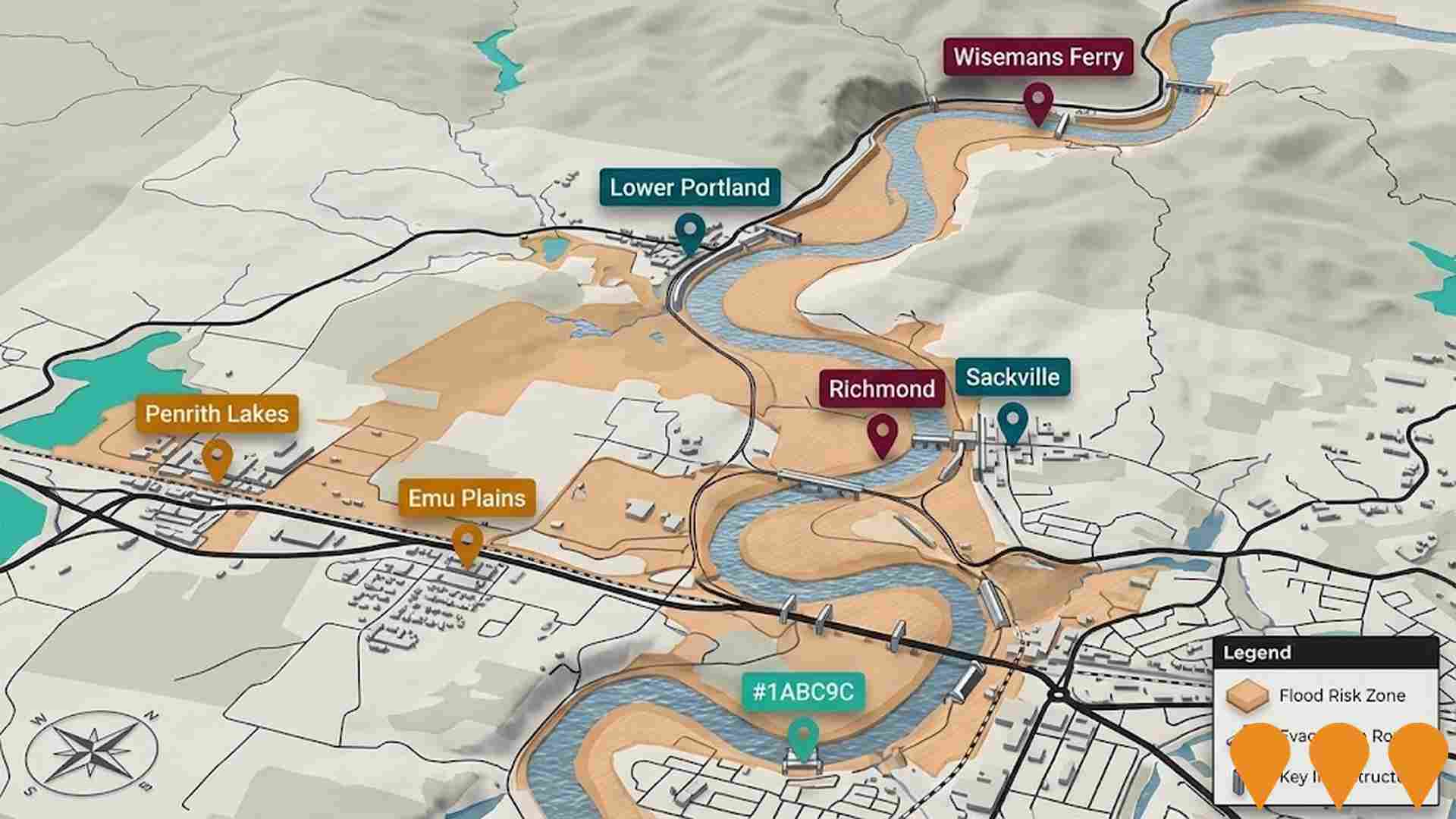

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified two projects expected to impact the area. Notable projects include Jacaranda Ponds, Hawkesbury-Nepean Valley Flood Management, Western Sydney Infrastructure Plan, and Regional NSW Road Network Safety Improvements. The following details those likely most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Central-West Orana Renewable Energy Zone (REZ) Transmission Project

Australia's first coordinated Renewable Energy Zone transmission project. It involves the delivery of 90km of 500kV and 150km of 330kV transmission lines, along with energy hubs at Merotherie and Elong Elong. The project will initially unlock 4.5 GW of network capacity, increasing to 6 GW by 2038. ACEREZ (Acciona, Cobra, Endeavour Energy) is the Network Operator responsible for design, construction, and 35 years of maintenance. Major construction is currently ramping up with a 1,200-bed workforce camp at Merotherie and a 600-bed site at Cassilis supporting thousands of local jobs.

Sydney Metro

Australia's largest public transport project, comprising four main lines. As of February 2026, the City & Southwest M1 line is operational to Sydenham, with the Sydenham-to-Bankstown conversion reaching 80% completion and intensive dynamic train testing underway for a late 2026 opening. Sydney Metro West has achieved major tunneling milestones at Westmead, with fit-out contracts worth $11.5 billion signed to target a 2032 opening. The Western Sydney Airport line remains under heavy construction with stations and viaducts progressing for an opening aligned with the airport in late 2026.

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms to enable diverse low and mid-rise housing, including dual occupancies, terraces, townhouses, and apartment buildings up to 6 storeys. The policy applies to residential zones within 800m of 171 nominated transport hubs and town centres. Stage 1 (dual occupancies) commenced 1 July 2024, and Stage 2 (mid-rise apartments and terraces) commenced 28 February 2025. In June 2025, further amendments adjusted aircraft noise thresholds and clarified storey definitions to expand the policy's reach. The initiative is expected to facilitate approximately 112,000 additional homes by 2030.

High Speed Rail - Newcastle to Sydney (Stage 1)

The first stage of Australia's High Speed Rail network involves a 194km dedicated rail line connecting Newcastle to Sydney. The project features trains reaching speeds of 320 km/h on surface sections and 200 km/h in tunnels, aiming to reduce travel time to approximately one hour. Following the 2025 business case evaluation, the project has moved into a two-year Development Phase focusing on design refinement (to 40% maturity), securing planning approvals, and corridor preservation. The route includes approximately 115km of tunneling and six planned stations: Broadmeadow, Lake Macquarie, Gosford, Sydney Central, Parramatta, and Western Sydney International Airport.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet (D sets) replacing the aging V-set fleet across the NSW intercity network. Delivered by the RailConnect consortium, the trains feature 2x2 seating, charging ports, dedicated luggage/bicycle spaces, and enhanced accessibility with wheelchair spaces and accessible toilets. The fleet operates in 4, 6, 8, or 10-car formations. Passenger services commenced on the Central Coast & Newcastle Line on 3 December 2024 and the Blue Mountains Line on 13 October 2025. South Coast Line services are scheduled to begin in the first half of 2026. The project includes the Kangy Angy Maintenance Facility and extensive corridor upgrades such as platform extensions and signaling modifications.

Newcastle-Sydney and Wollongong-Sydney Rail Line Upgrades

Program of upgrades to existing intercity rail corridors linking Newcastle-Central Coast-Sydney and Wollongong-Sydney to reduce travel times and improve reliability. Current scope includes timetable and service changes under the Rail Service Improvement Program, targeted network upgrades (signalling, power, station works) and the introduction of the Mariyung intercity fleet on the Central Coast & Newcastle Line, alongside Federal planning led by the High Speed Rail Authority for a dedicated Sydney-Newcastle high speed corridor.

Western Sydney Infrastructure Plan

The Western Sydney Infrastructure Plan (WSIP) is a joint Australian and NSW Government 10-year, $4.4 billion road investment program delivering major upgrades across Western Sydney to support population growth and the opening of Western Sydney International Airport in 2026. Key projects include the M12 Motorway (under construction), M4 Smart Motorway, upgrades to The Northern Road and Bringelly Road (largely completed), Werrington Arterial Road (completed 2017), Glenbrook intersection upgrade (completed 2018), and a $200 million Local Roads Package supporting seven Western Sydney councils.

Newcastle Offshore Wind Project

The Newcastle Offshore Wind project proposes a floating wind farm off Newcastle, NSW, with an expected capacity of up to 10 gigawatts, pending a Scoping Study's results.

Employment

East Kurrajong has seen below average employment performance when compared to national benchmarks

East Kurrajong has a balanced workforce with both white and blue collar employment. The construction sector is particularly prominent.

As of September 2025, the unemployment rate is 5.3%. This is based on AreaSearch aggregation of statistical area data. There are 1,268 residents in work, while the unemployment rate is 1.1% higher than Greater Sydney's rate of 4.2%. Workforce participation is high at 70.2%, compared to Greater Sydney's 60.0%.

The dominant employment sectors among residents include construction, education & training, and health care & social assistance. Construction is notably specialized, with an employment share of 2.5 times the regional level. However, professional & technical services are under-represented, at 4.3% compared to Greater Sydney's 11.5%. Local employment opportunities appear limited, as indicated by Census data comparing working population to resident population. Over the 12 months to September 2025, labour force levels remained stable (0.0%), while employment declined by 0.7%, causing unemployment to rise by 0.7 percentage points. This contrasts with Greater Sydney's employment growth of 2.1% and labour force expansion of 2.4%. State-level data from NSW as of 25-Nov shows employment contracted by 0.03%, losing 2,260 jobs, with an unemployment rate of 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to East Kurrajong's employment mix suggests local employment should increase by 6.0% over five years and 12.4% over ten years, though this is a simple weighting extrapolation for illustrative purposes and does not account for localised population projections.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch released postcode level ATO data for financial year 2023. East Kurrajong's median income among taxpayers was $56,793, with an average of $72,511. This is higher than the national average and compares to Greater Sydney's median of $60,817 and average of $83,003. Based on Wage Price Index growth since financial year 2023, current estimates as of September 2025 would be approximately $61,825 (median) and $78,935 (average). According to the 2021 Census, household incomes rank at the 94th percentile ($2,757 weekly). Income analysis shows that 31.4% of residents earn between $1,500 - 2,999 weekly (693 residents), similar to the region where 30.9% occupy this bracket. Economic strength is evident with 45.0% of households achieving high weekly earnings exceeding $3,000, supporting elevated consumer spending. Housing accounts for 13.9% of income, while strong earnings rank residents within the 94th percentile for disposable income. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

East Kurrajong is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

East Kurrajong's dwelling structures, as per the latest Census, consisted of 99.2% houses and 0.8% other dwellings (semi-detached, apartments, 'other' dwellings), contrasting with Sydney metro's 98.7% houses and 1.2% other dwellings. Home ownership in East Kurrajong stood at 34.9%, with mortgaged dwellings at 58.2% and rented ones at 6.9%. The median monthly mortgage repayment was $2,600, higher than Sydney metro's average of $2,308, while the median weekly rent figure was $500 compared to Sydney metro's $430. Nationally, East Kurrajong's mortgage repayments were significantly higher at $2,600 versus Australia's average of $1,863, and rents were substantially above the national figure of $375 at $500.

Frequently Asked Questions - Housing

Household Composition

East Kurrajong features high concentrations of family households, with a higher-than-average median household size

Family households comprise 90.0% of all households, including 55.6% couples with children, 27.3% couples without children, and 6.5% single parent families. Non-family households account for the remaining 10.0%, with lone person households at 9.0% and group households at 0.8%. The median household size is 3.4 people, larger than the Greater Sydney average of 2.9.

Frequently Asked Questions - Households

Local Schools & Education

East Kurrajong shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

The area's university qualification rate is 15.6%, significantly lower than the SA4 region average of 40.4%. Bachelor degrees are most common at 9.9%, followed by postgraduate qualifications (3.7%) and graduate diplomas (2.0%). Vocational credentials are prevalent, with 46.9% of residents aged 15+ holding them, including advanced diplomas (12.0%) and certificates (34.9%). Educational participation is high, with 28.4% currently enrolled in formal education: 9.8% in primary, 8.9% in secondary, and 2.7% in tertiary education.

Educational participation is notably high, with 28.4% of residents currently enrolled in formal education. This includes 9.8% in primary education, 8.9% in secondary education, and 2.7% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 26 active stops operating in East Kurrajong. These stops offer a mix of bus services, with 15 individual routes providing a total of 95 weekly passenger trips.

The average service frequency is 13 trips per day across all routes, resulting in approximately 3 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

East Kurrajong's residents are extremely healthy with prevalence of common health conditions low among the general population though slightly higher across older, at risk cohorts

Analysis of health metrics shows strong performance throughout East Kurrajong.

Prevalence of common health conditions is low among the general population but slightly higher among older, at-risk cohorts. The rate of private health cover is very high, approximately 56% of the total population (around 1,227 people). The most common medical conditions in the area are asthma and mental health issues, impacting 7.7% and 7.3% of residents respectively. Approximately 70.8% of residents declare themselves completely clear of medical ailments, compared to 70.4% across Greater Sydney. East Kurrajong has 15.5% of residents aged 65 and over (342 people), which is lower than the 18.9% in Greater Sydney. Health outcomes among seniors are above average but require more attention than the broader population.

Frequently Asked Questions - Health

Cultural Diversity

East Kurrajong is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

East Kurrajong, surveyed in 2016, had a population with 90.4% born in Australia, 96.1% being citizens, and 96.4% speaking English only at home. Christianity was the predominant religion, practiced by 63.3%, compared to Greater Sydney's 60.4%. The top three ancestral groups were Australian (30.9%), English (28.6%), and Irish (6.9%).

Notably, Maltese (5.5% vs regional 4.8%), Polish (0.9% vs 0.6%), and Dutch (1.6% vs 1.5%) were overrepresented.

Frequently Asked Questions - Diversity

Age

East Kurrajong's population aligns closely with national norms in age terms

The median age in East Kurrajong as of 2021 was 38 years, closely matching Greater Sydney's average of 37 years and Australia's median of 38 years. Compared to Greater Sydney, East Kurrajong had a higher proportion of residents aged 55-64 (13.5%) but fewer residents aged 25-34 (9.9%). Between the 2016 and 2021 censuses, the percentage of the population aged 75 to 84 increased from 3.7% to 5.5%, while the proportion of those aged 45 to 54 decreased from 16.0% to 14.6%. The percentage of residents aged 25 to 34 also declined, from 11.2% in 2016 to 9.9% in 2021. By the year 2041, East Kurrajong's age composition is projected to change significantly. Notably, the number of residents aged 75 to 84 is expected to grow by 65%, from 121 to 201 people. The population aged 65 and above is projected to account for 86% of the total growth in population. Conversely, declines are projected for the age groups 5-14 and 55-64.