Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Kurrajong reveals an overall ranking slightly below national averages considering recent, and medium term trends

Based on ABS population updates and AreaSearch validations, as of Nov 2025, Kurrajong's estimated population is around 3,201, reflecting an increase of 88 people since the 2021 Census. This growth rate exceeds that of the SA3 area (1.1%), marking Kurrajong as a growth leader in the region. The change is inferred from AreaSearch's estimate of 3,198 residents following examination of ABS ERP data released Jun 2024 and three additional validated addresses since the Census date. This level of population results in a density ratio of 70 persons per square kilometer. Natural growth contributed approximately 72.0% to overall population gains during recent periods. AreaSearch uses ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022, and NSW State Government's SA2-level projections released in 2022 with a base year of 2021 for areas not covered by the former data.

Growth rates by age group are applied to all areas for years 2032 to 2041. By 2041, Kurrajong is projected to grow by 478 persons, reflecting an increase of 14.7% in total over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Kurrajong, placing the area among the bottom 25% of areas assessed nationally

AreaSearch analysis of ABS building approval numbers shows Kurrajong recorded around 8 residential properties granted approval per year. Over the past 5 financial years (FY-21 to FY-25), approximately 42 homes were approved, with a further 5 approved in FY-26.

On average, 1.3 new residents per year per dwelling constructed were recorded over these years. This suggests supply and demand are well-balanced, maintaining stable market conditions. The average construction value of new properties was $787,000, indicating a focus on the premium market with high-end developments. Compared to Greater Sydney, Kurrajong's construction rate is 30.0% above the regional average per person over the past 5 years.

This maintains good buyer choice while supporting existing property values. However, building activity has slowed in recent years, reflecting the area's maturity and possible planning constraints. Recent construction comprises 86.0% detached dwellings and 14.0% medium to high-density housing, preserving Kurrajong's traditional low density character with a focus on family homes. The estimated population per dwelling approval is 489 people. Population forecasts indicate Kurrajong will gain approximately 470 residents by 2041, according to the latest AreaSearch quarterly estimate. Construction pace is maintaining reasonable growth, though buyers may face increasing competition as population increases.

Frequently Asked Questions - Development

Infrastructure

Kurrajong has moderate levels of nearby infrastructure activity, ranking in the top 50% nationally

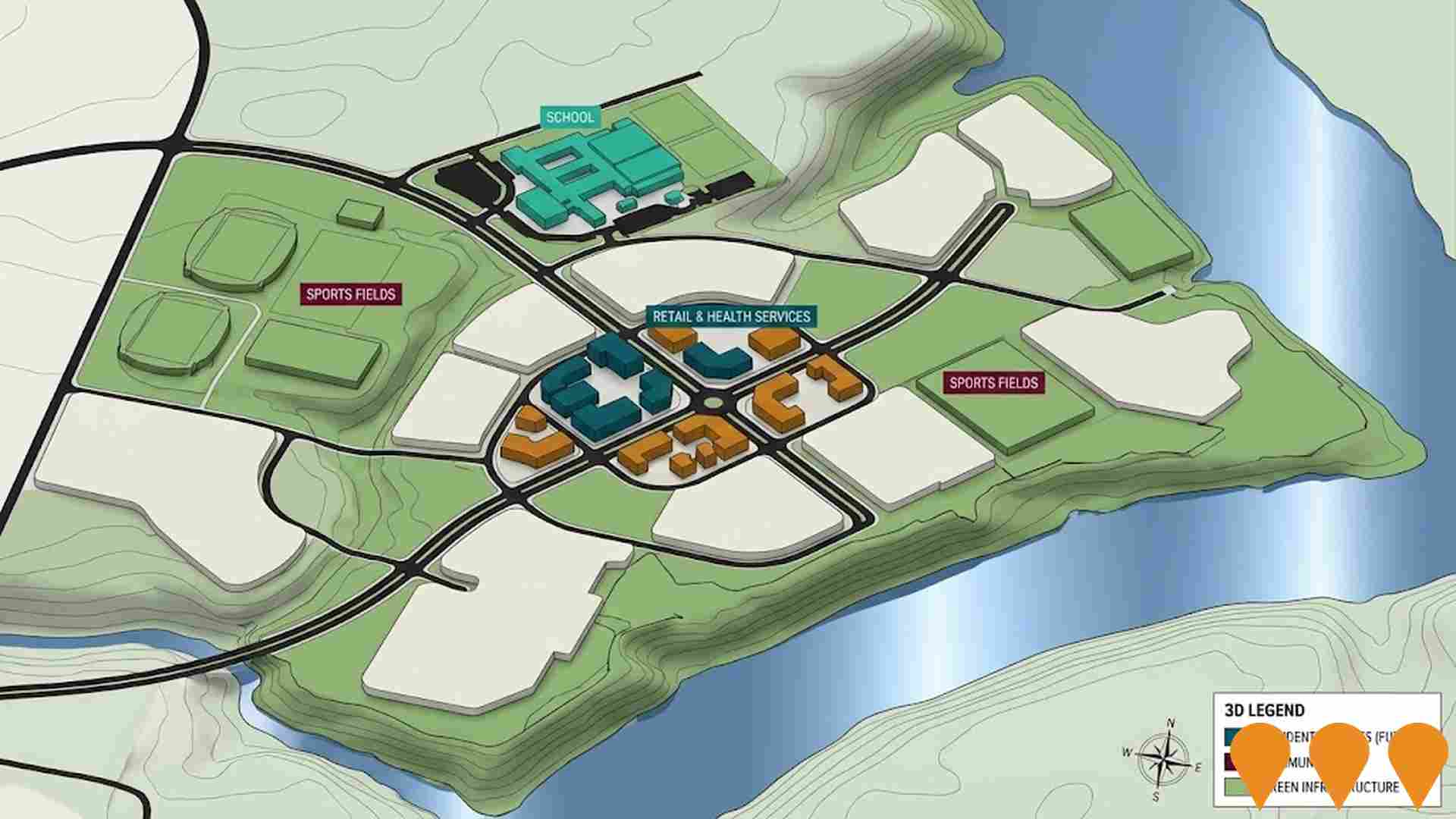

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified seven projects that may impact this region. Notable ones are The Sanctuary North Richmond, Redbank Estate - Stage 8 & Future Stages, New Richmond Bridge and Traffic Improvements, and Hambledon Park. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Rouse Hill Hospital

A new $910 million state-of-the-art public hospital designed to support Sydney's rapidly growing North West. The facility features a digital-first approach with 300+ beds, a comprehensive emergency department, and birthing services. Key architectural features include a 'care arcade' for retail and cafes, multi-storey parking, and integrated green spaces. The project is a joint venture between the NSW and Commonwealth Governments, serving as a vital health hub connected to the broader Western Sydney health network.

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms to enable diverse low and mid-rise housing, including dual occupancies, terraces, townhouses, and apartment buildings up to 6 storeys. The policy applies to residential zones within 800m of 171 nominated transport hubs and town centres. Stage 1 (dual occupancies) commenced 1 July 2024, and Stage 2 (mid-rise apartments and terraces) commenced 28 February 2025. In June 2025, further amendments adjusted aircraft noise thresholds and clarified storey definitions to expand the policy's reach. The initiative is expected to facilitate approximately 112,000 additional homes by 2030.

Sydney Metro

Australia's largest public transport project, comprising four main lines. As of February 2026, the City & Southwest M1 line is operational to Sydenham, with the Sydenham-to-Bankstown conversion reaching 80% completion and intensive dynamic train testing underway for a late 2026 opening. Sydney Metro West has achieved major tunneling milestones at Westmead, with fit-out contracts worth $11.5 billion signed to target a 2032 opening. The Western Sydney Airport line remains under heavy construction with stations and viaducts progressing for an opening aligned with the airport in late 2026.

Redbank North Richmond Master-Planned Community

Redbank North Richmond is a 180-hectare master-planned community in the Hawkesbury region, designed for approximately 1,400 homes and 3,900 residents. The $1.8 billion development features a diverse range of housing, including traditional family lots, grand homestead plots, and the Kingsford-Smith over-55s lifestyle village. Key community infrastructure includes the Redbank Village Centre, which opened its first stage in 2023 with a vet hospital and cafe, with the second stage featuring an IGA supermarket and specialty retail scheduled for 2025. The project preserves 85 acres of heritage-protected parklands and is supported by the major Grose River Bridge project, which received development approval in late 2024 to improve regional connectivity.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet (D sets) replacing the aging V-set fleet across the NSW intercity network. Delivered by the RailConnect consortium, the trains feature 2x2 seating, charging ports, dedicated luggage/bicycle spaces, and enhanced accessibility with wheelchair spaces and accessible toilets. The fleet operates in 4, 6, 8, or 10-car formations. Passenger services commenced on the Central Coast & Newcastle Line on 3 December 2024 and the Blue Mountains Line on 13 October 2025. South Coast Line services are scheduled to begin in the first half of 2026. The project includes the Kangy Angy Maintenance Facility and extensive corridor upgrades such as platform extensions and signaling modifications.

Redbank Estate - Stage 8 & Future Stages

Final residential stages of the 1,200-lot Redbank master-planned community by Landcom and Johnson Property Group, delivering a mix of detached homes, terraces, and apartments surrounding the existing village centre.

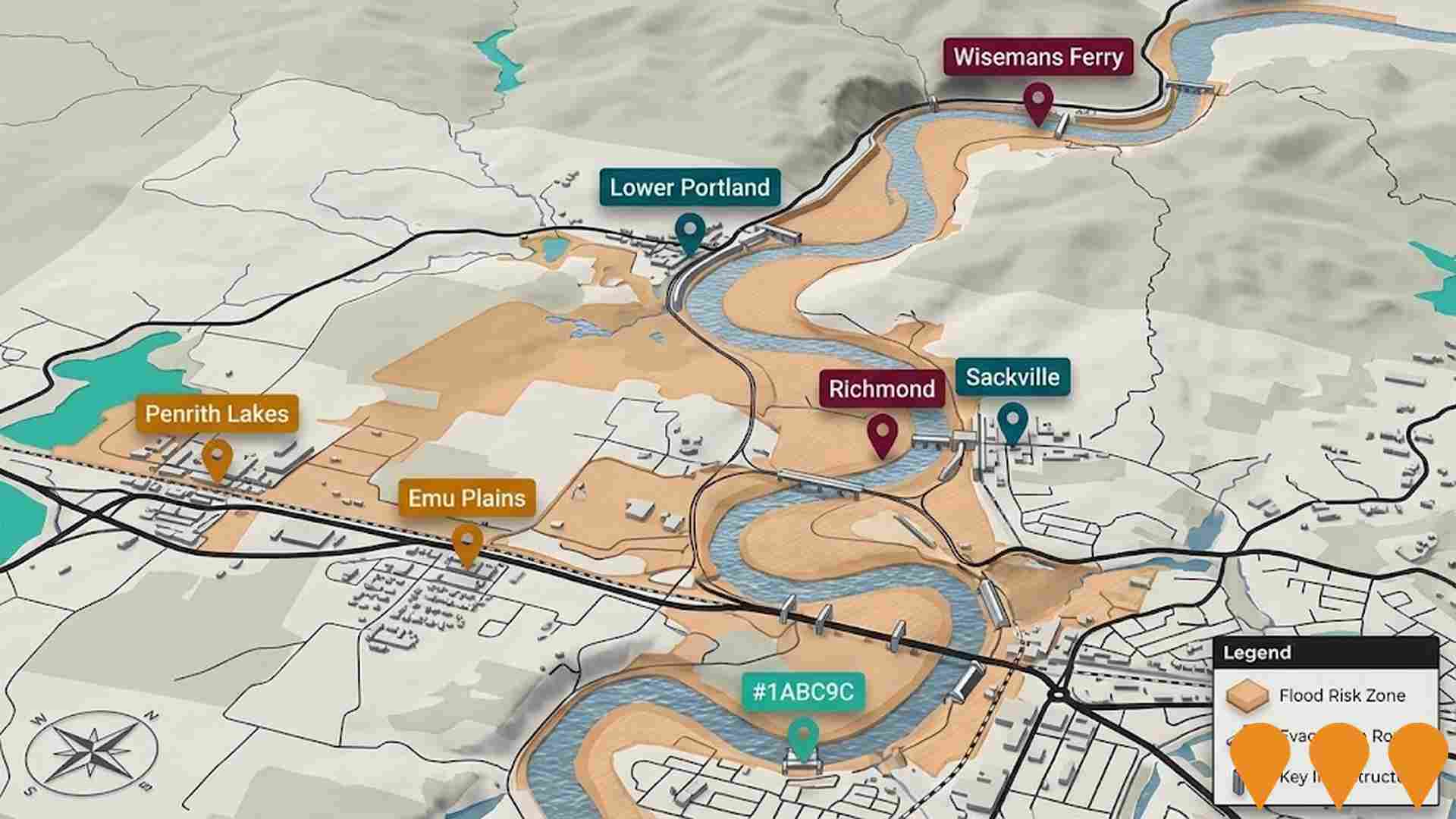

New Richmond Bridge and Traffic Improvements

Traffic and flood-resilience upgrade led by Transport for NSW delivering a new higher four-lane bridge over the Hawkesbury River downstream of the existing Richmond Bridge, a bypass of Richmond town centre, and upgrades to key intersections on The Driftway. Stage 1 (The Driftway intersections and enabling works) has a major construction contract awarded and is commencing in 2025, with completion targeted for 2027. Stage 2 will deliver the new bridge and associated works, with design and procurement progressing following community consultation.

Newcastle-Sydney and Wollongong-Sydney Rail Line Upgrades

Program of upgrades to existing intercity rail corridors linking Newcastle-Central Coast-Sydney and Wollongong-Sydney to reduce travel times and improve reliability. Current scope includes timetable and service changes under the Rail Service Improvement Program, targeted network upgrades (signalling, power, station works) and the introduction of the Mariyung intercity fleet on the Central Coast & Newcastle Line, alongside Federal planning led by the High Speed Rail Authority for a dedicated Sydney-Newcastle high speed corridor.

Employment

The employment landscape in Kurrajong shows performance that lags behind national averages across key labour market indicators

Kurrajong's workforce comprises skilled individuals with notable representation in essential services sectors. The unemployment rate stood at 4.7% as of September 2025, reflecting relative employment stability over the preceding year, according to AreaSearch's statistical area data aggregation.

As of this date, 1,755 residents were employed, with an unemployment rate of 4.7%, 0.5 percentage points higher than Greater Sydney's rate of 4.2%. Workforce participation in Kurrajong was 64.0%, comparable to Greater Sydney's 60.0%. Dominant employment sectors among residents included construction, education & training, and health care & social assistance. Kurrajong exhibited particular specialization in construction, with an employment share 2.1 times the regional level.

Conversely, finance & insurance was under-represented, accounting for only 2.1% of Kurrajong's workforce compared to Greater Sydney's 7.3%. Employment opportunities locally appeared limited, as indicated by the Census working population count versus resident population. Over the 12 months to September 2025, employment increased by 0.1%, while labour force grew by 0.7%, leading to a rise in unemployment rate of 0.5 percentage points, compared to Greater Sydney's respective growths of 2.1% and 2.4%. State-level data up to 25-Nov showed NSW employment contracted by 0.03%, with an unemployment rate of 3.9%, favourably comparing to the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 projected overall growth of 6.6% over five years and 13.7% over ten years, but growth varied significantly between sectors. Applying these projections to Kurrajong's employment mix suggested local employment should increase by 6.3% over five years and 13.0% over ten years, though these are simple extrapolations for illustrative purposes and do not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

The suburb of Kurrajong had median taxpayer income of $53,502 and average income of $68,308 in financial year 2023. These figures compared to Greater Sydney's $60,817 and $83,003 respectively. By September 2025, estimates based on Wage Price Index growth suggest median income would be approximately $58,242 and average income $74,360. Kurrajong's households ranked at the 83rd percentile for weekly incomes of $2,304. The largest segment comprised 30.9% earning $1,500 - 2,999 weekly (989 residents). Economic strength was evident with 36.6% of households earning over $3,000 weekly. Housing accounted for 13.6% of income. Residents ranked in the 85th percentile for disposable income and the suburb's SEIFA income ranking placed it in the 8th decile.

Frequently Asked Questions - Income

Housing

Kurrajong is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The dwelling structure in Kurrajong, as evaluated at the latest Census, consisted of 97.7% houses and 2.4% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Sydney metro's 98.7% houses and 1.2% other dwellings. The level of home ownership in Kurrajong was higher than that of Sydney metro, at 44.5%, with the remaining dwellings either mortgaged (44.5%) or rented (10.9%). The median monthly mortgage repayment in the area was $2,600, exceeding the Sydney metro average of $2,308. Meanwhile, the median weekly rent figure in Kurrajong was recorded at $430, aligning with the Sydney metro figure of $430. Nationally, Kurrajong's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Kurrajong features high concentrations of family households, with a fairly typical median household size

Family households constitute 82.4% of all households, including 39.9% couples with children, 33.4% couples without children, and 8.8% single parent families. Non-family households comprise the remaining 17.6%, with lone person households at 16.3% and group households making up 1.1%. The median household size is 2.9 people, which aligns with the Greater Sydney average.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Kurrajong exceeds national averages, with above-average qualification levels and academic performance metrics

The area's university qualification rate is 24.7%, significantly lower than the SA4 region average of 40.4%. Bachelor degrees are most common at 16.1%, followed by postgraduate qualifications (5.7%) and graduate diplomas (2.9%). Vocational credentials are held by 42.2% of residents aged 15 and above, with advanced diplomas at 12.4% and certificates at 29.8%. Educational participation is high, with 25.0% of residents currently enrolled in formal education.

This includes 8.8% in primary education, 7.0% in secondary education, and 3.6% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Kurrajong indicates there are currently 40 active transport stops operating. These stops offer a mix of bus services. There are 29 individual routes serving these stops, which together provide 262 weekly passenger trips.

The accessibility of transport is rated as good, with residents typically located approximately 318 meters from the nearest transport stop. On average, service frequency across all routes is around 37 trips per day, equating to roughly 6 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Kurrajong is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Kurrajong faces significant health challenges with common health conditions prevalent across both younger and older age cohorts.

Approximately 54%, or about 1,726 people, have private health cover. The most common medical conditions are arthritis and mental health issues, affecting 9.0% and 7.2% of residents respectively. However, 67.5% of residents report being completely clear of medical ailments, compared to 70.4% across Greater Sydney. Kurrajong has 23.5%, or 752 people, aged 65 and over, which is higher than the 18.9% in Greater Sydney. Health outcomes among seniors are above average, performing better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Kurrajong ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Kurrajong's population showed low cultural diversity, with 85.4% born in Australia and 94.2% being citizens. English was spoken exclusively at home by 94.1%. Christianity was the dominant religion, practiced by 62.2%, slightly higher than Greater Sydney's 60.4%.

The top three ancestry groups were English (31.6%), Australian (28.1%), and Irish (7.8%). Notably, Maltese residents comprised 4.0% compared to the regional average of 4.8%. Polish residents made up 1.4%, higher than the regional 0.6%. Lebanese residents constituted 0.6%, slightly above Greater Sydney's 0.4%.

Frequently Asked Questions - Diversity

Age

Kurrajong hosts an older demographic, ranking in the top quartile nationwide

The median age in Kurrajong is 46 years, which is higher than Greater Sydney's average of 37 years and also exceeds the Australian median of 38 years. Compared to Greater Sydney, Kurrajong has a notably higher proportion of individuals aged 65-74 (13.0% locally) but a lower proportion of those aged 25-34 (9.2%). Between the 2021 Census and the present, the proportion of individuals aged 75 to 84 has increased from 6.4% to 8.0%, while the proportion of those aged 45 to 54 has decreased from 15.0% to 13.0%. By 2041, Kurrajong's population forecasts indicate significant demographic changes. The number of individuals aged 85 and above is projected to increase by 169 people (212%), rising from 80 to 250. The aging population trend is evident, with those aged 65 and above accounting for 95% of the projected growth. Conversely, the populations of individuals aged 15-24 and 55-64 are expected to decline.