Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Windsor - Bligh Park has shown very soft population growth performance across periods assessed by AreaSearch

Windsor - Bligh Park's population is approximately 15,443 as of November 2025. This figure represents an increase of 179 people since the 2021 Census, which reported a population of 15,264. The change is inferred from ABS estimated resident population of 15,433 in June 2024 and additional 33 validated new addresses since the Census date. This results in a density ratio of 679 persons per square kilometer. Natural growth contributed approximately 68.0% to overall population gains recently.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, NSW State Government's SA2 level projections are used, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. By 2041, the population is projected to decline by 31 persons overall, but specific age cohorts like the 75 to 84 group are expected to increase by 597 people.

Frequently Asked Questions - Population

Development

The level of residential development activity in Windsor - Bligh Park is very low in comparison to the average area assessed nationally by AreaSearch

Windsor - Bligh Park has seen approximately 16 dwellings receive development approval annually. Over the past five financial years, from FY21 to FY25, a total of 84 homes were approved, with another 6 receiving approval in FY26 so far. Despite recent population decline, housing supply has remained adequate relative to demand, resulting in a balanced market with good buyer choice.

The average construction cost value for new properties is $266,000, lower than regional norms, offering more affordable housing options. This financial year has seen $14.5 million in commercial approvals, indicating steady commercial investment activity. Compared to Greater Sydney, Windsor - Bligh Park records significantly lower building activity, 76.0% below the regional average per person, which generally supports stronger demand and values for established properties. This is also below national averages, suggesting maturity of the area and possible planning constraints. New development consists predominantly of detached houses (77.0%) with a smaller proportion of townhouses or apartments (23.0%), maintaining the area's traditional low density character focused on family homes.

The estimated population per dwelling approval is 1095 people, reflecting its quiet, low activity development environment. With population projections indicating stability or decline, Windsor - Bligh Park should experience reduced housing demand pressures in the future, benefiting potential buyers.

Frequently Asked Questions - Development

Infrastructure

Windsor - Bligh Park has moderate levels of nearby infrastructure activity, ranking in the top 50% nationally

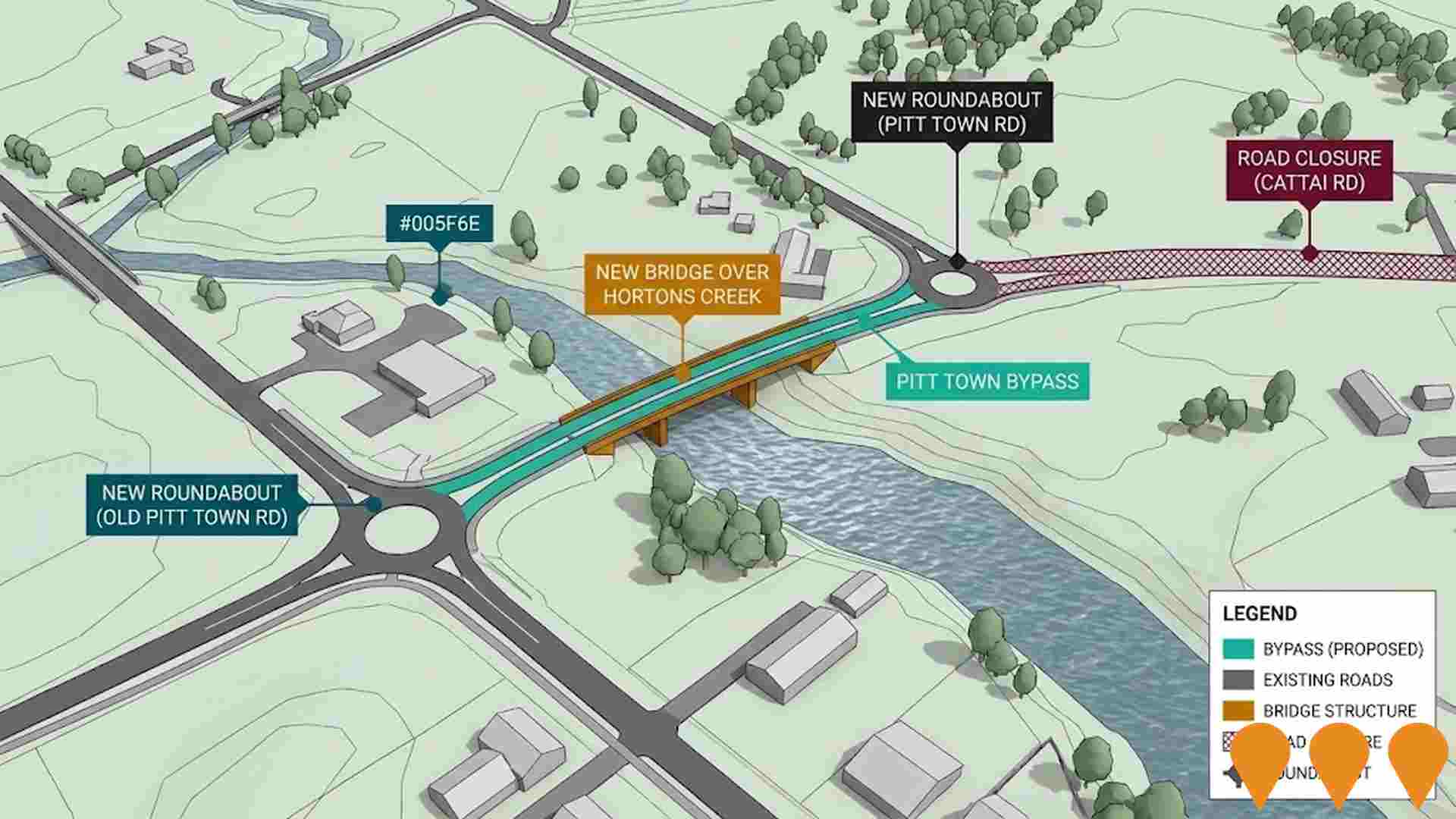

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified five projects expected to affect the region. Notable initiatives include Melonba Woolworths Neighbourhood Shopping Centre, Newpark Estate, Marsden Park North State Significant Rezoning, and Stockland The Gables Masterplanned Community.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

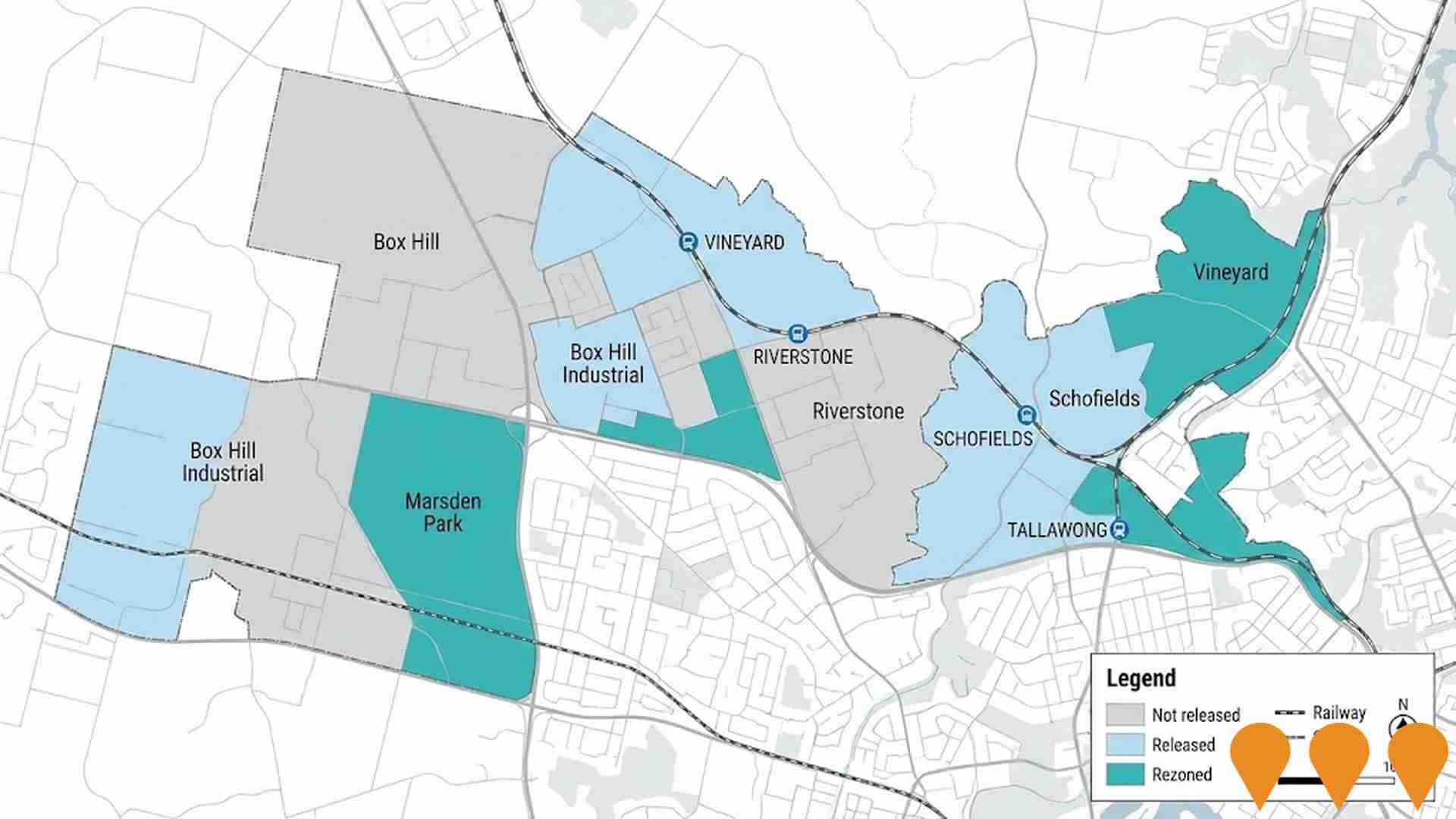

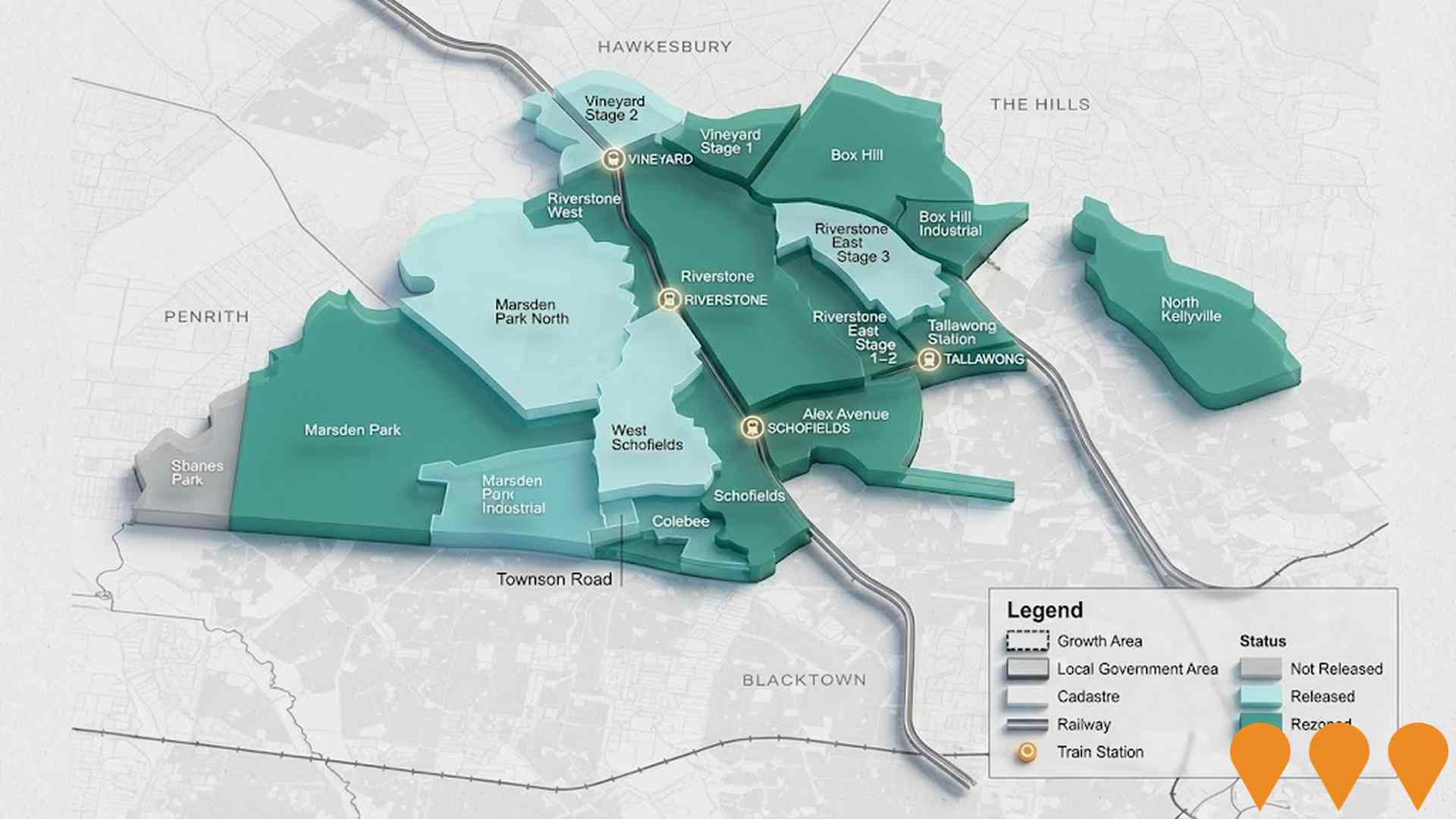

Box Hill and Box Hill Industrial Precinct

Large-scale masterplanned residential and employment precinct in Sydney's North West Growth Area. Will deliver up to 16,030 new homes, 115 ha of employment land including the Box Hill Industrial Precinct, a new town centre, three village centres, new primary and secondary schools, sports facilities and major road upgrades. As of mid-2025, approximately 12,500 lots have development approval, over 8,000 dwellings are completed or under construction, and multiple residential estates are actively building. Construction of the new Box Hill Sports Complex and several parks/reserves is underway.

North West Treatment Hub

Sydney Water's North West Treatment Hub is a $1.5+ billion program upgrading the Castle Hill, Rouse Hill and Riverstone water resource recovery facilities to support population growth in Sydney's North West Growth Area (expected to double by 2056). Delivered by the North West Hub Alliance (Sydney Water, John Holland, Stantec, KBR), the upgrades will add 45 ML/day of wastewater treatment capacity, enable ~200,000 additional house connections, and incorporate Australia's first large-scale wastewater biosolids carbonisation facility at Riverstone to produce biochar. Works also enhance recycled water reliability and protect the Hawkesbury-Nepean river system.

Marsden Park Precinct

Large-scale masterplanned precinct in Sydney's North West Growth Area delivering approximately 10,300 new dwellings, a new strategic town centre, two village centres, over 108 ha of open space, multiple new schools (including Marsden Park Public School and St Luke's Catholic College Stage 2 already open), and an estimated 3,000+ jobs. Development is progressing with ongoing residential subdivisions, road upgrades, and town centre planning.

Box Hill Release Area Development

Major greenfield release area in north west Sydney planned under the NSW Government North West Priority Growth Area program. The Box Hill and Box Hill Industrial precincts are intended to deliver around 9600 new homes, a town centre, schools, employment land and supporting open space, transport and utility infrastructure. Development is being delivered progressively by private developers under planning controls set by the NSW Government and The Hills Shire Council, with ongoing subdivision, road upgrades and community facilities expected through the 2030s.

Stockland The Gables Masterplanned Community

The Gables is a 293-hectare masterplanned community in Sydney's Hills District, formerly known as Box Hill, which Stockland acquired for $415 million in 2020 to develop 1,900 additional homes. The total development, which began in 2015, is expected to include a total of about 4,100 to 4,500 homes and a population of around 13,000 residents upon completion. The community features 75 hectares of green space, a future 4-hectare lake, a K-12 school, a public primary school and preschool set to open in 2027, and a new town centre. The Stockland Gables Town Centre opened in October 2025 and is anchored by a Woolworths supermarket, with other tenants including a childcare centre, medical facility, and various specialty shops and dining options. Construction is also underway on Stockland Halcyon Gables, a land lease community for over-60s within the estate.

Stockland Gables Town Centre

A fully leased, $95 million neighbourhood shopping centre with a gross lettable area of 9,400 square metres, anchored by a full-line Woolworths. It features 30 retailers, including a childcare centre (Nido Early School), medical centre, pharmacy, gym, specialty shops, and dining options. The centre is targeting a 5-star Green Star rating and includes a 500 kWp solar installation with battery storage. It is located in the heart of The Gables masterplanned community.

Melonba Woolworths Neighbourhood Shopping Centre

Neighbourhood shopping centre in the new suburb of Melonba, anchored by a full line Woolworths supermarket with a BWS liquor store, specialty retail and food and drink tenancies, kiosk, amenities, outdoor dining areas and at grade parking for about 191 cars. The project is being delivered for Woolworths Group by Mainbrace Constructions to serve the growing Marsden Park and Melonba community with convenient local shopping.

Richards Sydney 2765

A masterplanned precinct in Sydney's north west transforming former industrial land into a mixed use suburb with housing, jobs precincts, town centre and green space. Led by Sakkara, the 285ha site aims to deliver new homes, employment land, community facilities and open space in line with NSW planning for Riverstone and Riverstone East precincts.

Employment

The employment landscape in Windsor - Bligh Park presents a mixed picture: unemployment remains low at 3.5%, yet recent job losses have affected its comparative national standing

Windsor Bligh Park has a diverse workforce with both white and blue collar jobs. The construction sector is prominent, with an unemployment rate of 3.5%.

As of September 2025, there are 8,380 employed residents, with an unemployment rate of 0.7% lower than Greater Sydney's 4.2%. Workforce participation is 63.5%, slightly higher than Greater Sydney's 60.0%. Key employment sectors include construction, health care & social assistance, and retail trade. Construction stands out with employment levels at 1.8 times the regional average, while professional & technical services have a limited presence at 4.4% compared to the regional 11.5%.

Many residents commute elsewhere for work based on Census data. Between September 2024 and 2025, labour force decreased by 4.1%, employment by 3.0%, leading to a 1.1 percentage point drop in unemployment rate. In contrast, Greater Sydney saw employment growth of 2.1% and labour force growth of 2.4%. Statewide, NSW employment contracted by 0.03% (losing 2,260 jobs) as of 25-November-25, with an unemployment rate of 3.9%, lower than the national rate of 4.3%. Jobs and Skills Australia forecasts national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Windsor Bligh Park's current employment mix suggests local employment could increase by 6.1% over five years and 12.7% over ten years, though this is a simplified extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates above-average performance, with income metrics exceeding national benchmarks based on AreaSearch comparative assessment

According to AreaSearch's aggregation of the latest postcode level ATO data released for financial year ending June 2022, Windsor - Bligh Park SA2 had a median income among taxpayers of $55,194 and an average level of $68,724. This is higher than the national averages of $51,372 (median) and $71,890 (average). Compared to Greater Sydney's levels of $56,994 (median) and $80,856 (average), Windsor - Bligh Park's incomes are lower. Based on Wage Price Index growth of 12.61% from June 2022 to September 2025, estimated current incomes would be approximately $62,154 (median) and $77,390 (average). According to the 2021 Census, household, family, and personal incomes in Windsor - Bligh Park cluster around the 55th percentile nationally. Income distribution shows that 36.6% of locals (5,652 people) fall within the $1,500 - 2,999 category, similar to the surrounding region where 30.9% occupy this range. High housing costs consume 18.9% of income, leaving disposable income at the 50th percentile.

Frequently Asked Questions - Income

Housing

Windsor - Bligh Park is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Windsor - Bligh Park's dwelling structures, as per the latest Census, consisted of 79.2% houses and 20.8% other dwellings (semi-detached, apartments, 'other' dwellings). This is similar to Sydney metro's structure of 79.7% houses and 20.3% other dwellings. Home ownership in Windsor - Bligh Park was at 22.3%, with the rest being mortgaged (39.5%) or rented (38.2%). The median monthly mortgage repayment was $2,100, below Sydney metro's average of $2,167. The median weekly rent was $390, compared to Sydney metro's $400. Nationally, Windsor - Bligh Park's mortgage repayments were higher at $2,100 versus the Australian average of $1,863, and rents were also higher at $390 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Windsor - Bligh Park has a typical household mix, with a fairly typical median household size

Family households constitute 72.6% of all households, composed of 32.0% couples with children, 23.2% couples without children, and 16.2% single parent families. Non-family households account for the remaining 27.4%, with lone person households at 24.7% and group households comprising 2.8%. The median household size is 2.6 people, which aligns with the Greater Sydney average.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Windsor - Bligh Park fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 16.0%, significantly lower than Greater Sydney's average of 38.0%. This indicates a need for targeted educational initiatives. Bachelor degrees are the most common at 10.6%, followed by postgraduate qualifications (3.6%) and graduate diplomas (1.8%). Vocational credentials are prominent, with 41.6% of residents aged 15+ holding them, including advanced diplomas (10.6%) and certificates (31.0%).

Educational participation is high at 29.3%, comprising primary education (10.5%), secondary education (7.6%), and tertiary education (3.7%).

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Windsor - Bligh Park has 114 active public transport stops. These include train and bus services. There are 70 individual routes operating in total.

Each week, these routes provide 4,146 passenger trips. The accessibility of transport is rated as excellent, with residents typically living just 182 meters from the nearest stop. On average, there are 592 trips per day across all routes, which equates to approximately 36 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Windsor - Bligh Park is lower than average with prevalence of common health conditions notable across both younger and older age cohorts

Windsor - Bligh Park faces significant health challenges, with common health conditions prevalent across both younger and older age cohorts.

Approximately 54% of its total population (~8,292 people) have private health cover. Mental health issues affect 9.9% of residents, while asthma impacts 9.1%. About 66.5% declare themselves completely clear of medical ailments, compared to 65.9% across Greater Sydney. The area has 14.7% of residents aged 65 and over (2,267 people), lower than the 17.8% in Greater Sydney. Health outcomes among seniors present some challenges, broadly aligning with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Windsor - Bligh Park ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Windsor-Bligh Park was found to have low cultural diversity, with 89.4% of its population being citizens, 85.8% born in Australia, and 92.1% speaking English only at home. The predominant religion in Windsor-Bligh Park is Christianity, accounting for 58.2% of the population, compared to 60.7% across Greater Sydney. In terms of ancestry, the top three groups are Australian (30.2%), English (28.0%), and Irish (7.3%).

Notably, Maltese representation in Windsor-Bligh Park is higher than regional averages at 3.0%, while Australian Aboriginal is at 5.0% compared to 4.0%, and Lebanese is at 0.7% versus 0.5%.

Frequently Asked Questions - Diversity

Age

Windsor - Bligh Park's population is younger than the national pattern

Windsor - Bligh Park has a median age of 35 years, which is slightly younger than Greater Sydney's 37 years and the national average of 38 years. The 55-64 age group comprises 12.3% of the population compared to Greater Sydney, while the 35-44 cohort makes up 13.2%. Between 2021 and present, the 35-44 age group has increased from 12.3% to 13.2%, whereas the 45-54 cohort has decreased from 12.2% to 11.0%. By 2041, population forecasts indicate significant demographic changes for Windsor - Bligh Park. The 75-84 age group is projected to rise substantially by 555 people (79%), from 702 to 1,258. Notably, the combined 65+ age groups will account for 94% of total population growth, reflecting the area's aging demographic profile. In contrast, both the 15-24 and 0-4 age groups are expected to decrease in number.