Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Glenhaven is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Glenhaven's population was approximately 6,401 as of November 2025. This figure represents an increase of 40 people from the 2021 Census count of 6,361. The change is inferred from the estimated resident population of 6,390 in June 2024 and an additional 7 validated new addresses since the Census date. The population density ratio was around 885 persons per square kilometer, comparable to averages across locations assessed by AreaSearch. Overseas migration primarily drove Glenhaven's population growth during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022. For areas not covered, NSW State Government's SA2 level projections from 2022 with a base year of 2021 are utilized. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Future demographic trends suggest lower quartile growth in Australian statistical areas, with Glenhaven expected to grow by 54 persons to 2041 based on the latest annual ERP population numbers, reflecting a total increase of approximately 0.7% over the 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Glenhaven is very low in comparison to the average area assessed nationally by AreaSearch

Glenhaven has recorded approximately 15 residential properties granted approval per year over the past five financial years, totalling 76 homes. As of FY-26, 15 approvals have been recorded. The population decline in recent years suggests that new supply has likely kept pace with demand, offering good choice to buyers. New homes are being built at an average value of $800,000, indicating that developers are targeting the premium market segment with higher-end properties.

In FY-26, $53,000 in commercial approvals have been registered, reflecting the area's residential nature. Compared to Greater Sydney, Glenhaven records significantly lower building activity (75.0% below regional average per person), which typically reinforces demand and pricing for existing dwellings. This is also below national average, suggesting the area's maturity and possible planning constraints. New building activity comprises 82.0% standalone homes and 18.0% townhouses or apartments, maintaining Glenhaven's traditional low density character focused on family homes appealing to those seeking space. The estimated population per dwelling approval in Glenhaven is 744 people, reflecting its quiet, low activity development environment.

Population forecasts indicate Glenhaven will gain 43 residents by 2041 (from the latest AreaSearch quarterly estimate). Based on current development patterns, new housing supply should readily meet demand, offering good conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Glenhaven has emerging levels of nearby infrastructure activity, ranking in the 31stth percentile nationally

Changes in local infrastructure significantly impact an area's performance. AreaSearch has identified ten projects potentially affecting this region. Notable ones are Castle Grange, Hills Shire Council Delivery Program and Operational Plan 2024-2025 Infrastructure Works, Dural Town Centre, and Castle Hill North Precinct Plan. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

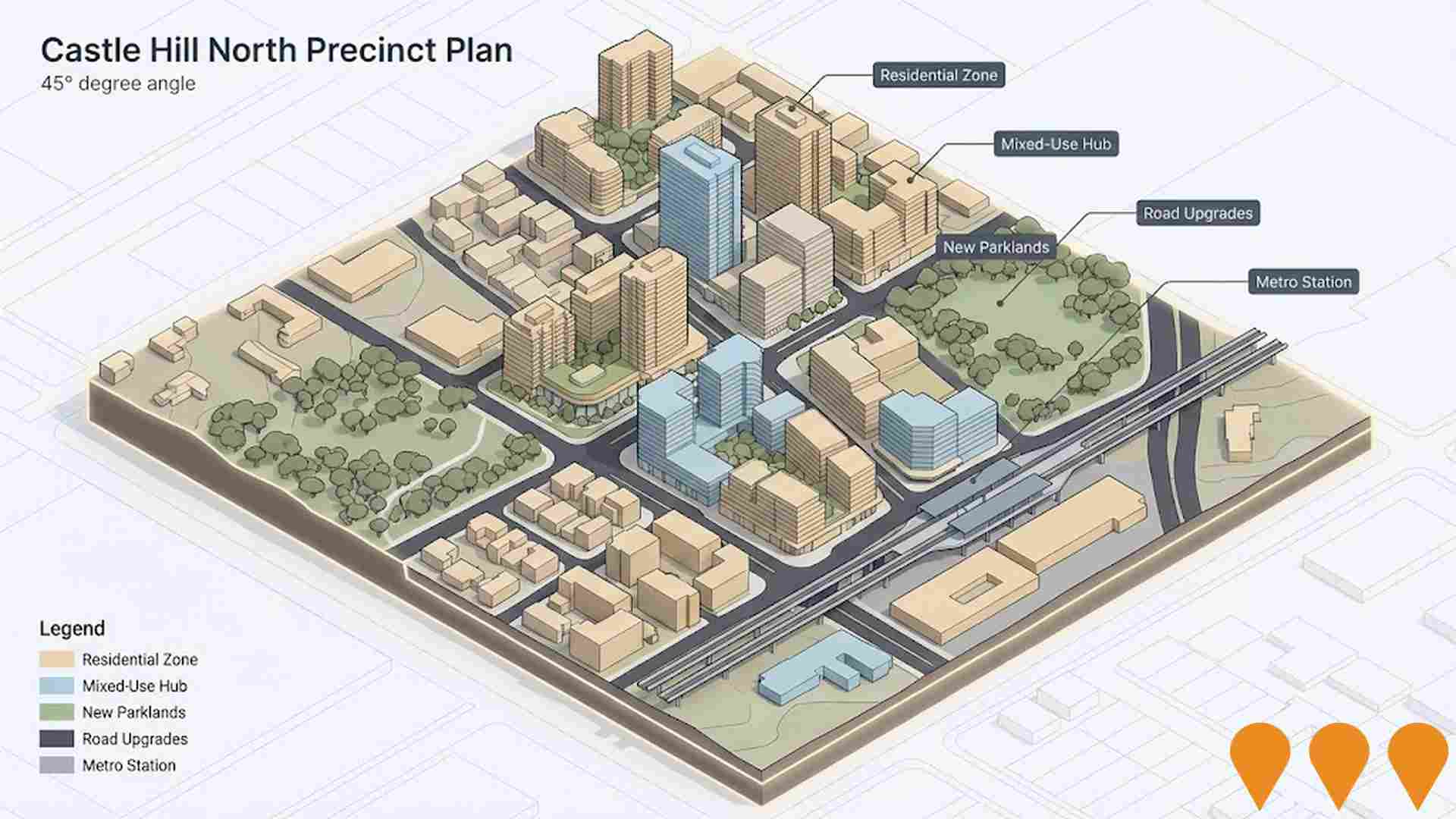

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sydney Metro Northwest

Australia's first fully automated metro rail system and the first stage of Sydney Metro. The 36 km line runs from Tallawong (Rouse Hill) to Chatswood with 13 stations (8 new stations plus the converted Epping to Chatswood rail link). Opened 26 May 2019 with turn-up-and-go services every 4 minutes in peak, platform screen doors and driverless trains. The line has carried over 150 million passenger journeys and now forms part of the extended Sydney Metro network.

Hills Showground Station Precinct

A major transit-oriented mixed-use development by Landcom and Sydney Metro, delivered in partnership with Deicorp. The precinct is divided into three main areas: the Doran Drive Precinct (marketed as 'Hills Showground Village', comprising ~430 homes and nearing completion), the Hills Showground Precinct East (marketed as 'Showground Pavilions', comprising 873 homes, currently under construction), and the future Precinct West. The project will deliver up to 1,620 new dwellings, 14,000sqm of retail, commercial, and community spaces, and extensive public domain works including a new village plaza and neighbourhood park adjacent to the Metro station.

Hills Shire Council Delivery Program and Operational Plan 2024-2025 Infrastructure Works

The Hills Shire Council's 2024-2025 infrastructure program is a significant component of the overall $308.5 million Delivery Program and Operational Plan. The total infrastructure expenditure for 2024-2025 is $162.8 million, focusing on maintaining, renewing, and building new assets like roads, parks, paths, and playgrounds across the Shire to accommodate rapid population growth. Key works include road upgrades (Annangrove Road, Withers Road, Boundary Road), new footpaths, cycleways, bridges, and new and refurbished parks and playgrounds, including Livvi's Place extension at Bernie Mullane Sports Complex. The Council is also actively campaigning for state and federal funding for critical infrastructure, particularly in high-growth areas like Box Hill and the Kellyville/Bella Vista precincts.

Dural Town Centre

Neighbourhood shopping centre on a greenfield site at Round Corner, with formal Development Approval (late June 2025) and staged approvals for road upgrades. The scheme is retail-led (no residential), introducing ~10,000 m2 of floorspace anchored by a full-line Woolworths, ALDI and Dan Murphy's, plus a medical and allied health precinct, gym, food and dining, and 30+ specialty retailers. Works include a new signalised all-ways intersection and upgrades along Old Northern Road. Target completion is Q4 2026.

Castle Hill North Precinct Plan

The Castle Hill North Precinct Plan aims to deliver higher density residential development to support population growth in the Castle Hill area. The plan includes rezoning for residential and mixed-use developments, infrastructure upgrades such as road improvements, and enhanced public transport connectivity, including potential links to the Sydney Metro Northwest. The project seeks to create a vibrant, sustainable urban precinct with improved community facilities.

Bella Vista Gardens

Award winning aged care and seniors living community in Norwest/Kellyville featuring a 142 bed residential aged care home and 55 independent living units, with wellness facilities, hydrotherapy pool, hair and beauty salon, landscaped village green and views over Castle Hill Country Club golf course. :contentReference[oaicite:0]{index=0} :contentReference[oaicite:1]{index=1} :contentReference[oaicite:2]{index=2} :contentReference[oaicite:3]{index=3} :contentReference[oaicite:4]{index=4}

Castle Hill Station Precinct

Development opportunities around Castle Hill Metro Station situated beneath Arthur Whitling Park opposite Castle Towers Shopping Centre. Underground station 25 metres below ground level with integrated park reconstruction above. Part of Landcom's urban renewal program.

William Clarke College Bryson Building

Construction of the four-story Bryson Building at William Clarke College, named after founding Headmaster Philip Bryson. The building will provide classrooms, staff rooms, library and ancillary teaching spaces located in the center of the site. Part of State Significant Development SSD-35715221, the project includes site preparation, bulk earthworks, structural works including concrete footings, lift pits, electrical and hydraulic installations, and landscaping works.

Employment

AreaSearch analysis reveals Glenhaven significantly outperforming the majority of regions assessed nationwide

Glenhaven has a well-educated workforce with professional services strongly represented. The unemployment rate was 1.7% as of September 2025.

Employment stability was relatively high over the past year. There were 3,256 residents employed in September 2025, with an unemployment rate of 1.7%, which is 2.5% lower than Greater Sydney's rate of 4.2%. Workforce participation was somewhat below standard at 58.0% compared to Greater Sydney's 60.0%. Key industries of employment among residents were health care & social assistance, professional & technical services, and education & training.

Employment in construction was notable with levels at 1.3 times the regional average. Conversely, transport, postal & warehousing showed lower representation at 2.1% compared to the regional average of 5.3%. Limited local employment opportunities were indicated by Census data on working population versus resident population. Between September 2024 and September 2025, employment levels increased by 0.1%, labour force increased by 0.5%, resulting in an unemployment rise of 0.4 percentage points. In comparison, Greater Sydney recorded employment growth of 2.1% and labour force growth of 2.4%. State-level data to 25-Nov-25 shows NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%, which compares favourably to the national unemployment rate of 4.3%. National employment forecasts from Jobs and Skills Australia project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Glenhaven's employment mix suggests local employment should increase by 6.8% over five years and 13.8% over ten years, based on simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

Glenhaven SA2 had exceptionally high national income levels according to latest ATO data aggregated by AreaSearch for financial year 2022. Its median income among taxpayers was $60,453 and average income stood at $113,536, compared to Greater Sydney's figures of $56,994 and $80,856 respectively. Based on Wage Price Index growth of 12.61% since financial year 2022, current estimates would be approximately $68,076 (median) and $127,853 (average) as of September 2025. According to 2021 Census figures, household incomes ranked exceptionally at the 90th percentile ($2,491 weekly). Distribution data showed the $4000+ bracket dominated with 31.8% of residents (2,035 people), contrasting with regional levels where the $1,500 - 2,999 bracket led at 30.9%. Glenhaven demonstrated considerable affluence with 43.7% earning over $3,000 per week, supporting premium retail and service offerings. Housing accounted for 14.1% of income while strong earnings ranked residents within the 90th percentile for disposable income. The area's SEIFA income ranking placed it in the 9th decile.

Frequently Asked Questions - Income

Housing

Glenhaven is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Glenhaven's dwelling structure, as per the latest Census, consisted of 74.1% houses and 25.8% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Sydney metro's 74.1% houses and 25.9% other dwellings. Home ownership in Glenhaven stood at 49.3%, with mortgaged dwellings at 43.6% and rented ones at 7.2%. The median monthly mortgage repayment was $3,033, higher than Sydney metro's average of $3,000. Median weekly rent in Glenhaven was $650, compared to Sydney metro's $580. Nationally, Glenhaven's mortgage repayments were significantly higher than the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Glenhaven features high concentrations of family households, with a lower-than-average median household size

Family households account for 80.9% of all households, including 42.4% couples with children, 31.7% couples without children, and 6.0% single parent families. Non-family households constitute the remaining 19.1%, with lone person households at 18.3% and group households comprising 0.8%. The median household size is 2.8 people, which is smaller than the Greater Sydney average of 3.0.

Frequently Asked Questions - Households

Local Schools & Education

Glenhaven shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

The area's university qualification rate is 36.0%, significantly lower than the SA3 area average of 46.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 25.1%, followed by postgraduate qualifications (7.8%) and graduate diplomas (3.1%). Trade and technical skills are prevalent, with 31.0% of residents aged 15+ holding vocational credentials – advanced diplomas (13.1%) and certificates (17.9%).

Educational participation is notably high, with 29.2% of residents currently enrolled in formal education, including 9.9% in secondary education, 9.4% in primary education, and 5.9% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Glenhaven has 74 active public transport stops, all of which are bus stops. These stops are served by 62 different routes that together facilitate 680 weekly passenger trips. The average distance from a resident's location to the nearest transport stop is 167 meters, indicating excellent accessibility.

On average, there are 97 trips per day across all routes, equating to about 9 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Glenhaven's residents are relatively healthy in comparison to broader Australia with a fairly standard level of common health conditions seen across both young and old age cohorts

Glenhaven's health metrics align closely with national benchmarks. Common health conditions are seen across both young and old age cohorts at a standard level. Private health cover is exceptionally high, with approximately 78% of Glenhaven's total population (4960 people) having it, compared to Greater Sydney's 63.7%, and the national average of 55.3%.

The most prevalent medical conditions are arthritis and asthma, affecting 10.2% and 6.1% of residents respectively. 68.4% of Glenhaven residents declare themselves completely clear of medical ailments, compared to Greater Sydney's 75.9%. As of 2021, 27.0% of Glenhaven residents are aged 65 and over (1730 people), higher than Greater Sydney's 18.9%. Health outcomes among seniors in Glenhaven are above average, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Glenhaven was found to be slightly above average when compared nationally for a number of language and cultural background related metrics

Glenhaven's cultural diversity was found to be above average, with 14.7% of its population speaking a language other than English at home and 25.8% born overseas. Christianity was the main religion in Glenhaven, comprising 69.6%, compared to Greater Sydney's 51.9%. The top three ancestry groups were English (28.2%), Australian (22.6%), and Irish (7.8%), all higher than regional averages of 17.3%, 15.9%, and 4.0% respectively.

Notably, Lebanese (2.1%) and Maltese (1.4%) groups were overrepresented compared to their respective regional averages of 1.6% and 0.9%.

Frequently Asked Questions - Diversity

Age

Glenhaven hosts an older demographic, ranking in the top quartile nationwide

Glenhaven's median age is 48 years, which is significantly higher than Greater Sydney's average of 37 years and Australia's average of 38 years. The age profile shows that those aged 75-84 years are particularly prominent, making up 11.7% of the population, compared to 6.0% nationally. Conversely, the 25-34 year-old group is smaller at 4.8%, compared to Greater Sydney's figure. Between 2021 and present, the 15-24 age group has grown from 13.2% to 15.1%, while the 65-74 age group has declined from 11.7% to 9.9%. By 2041, population forecasts indicate substantial demographic changes in Glenhaven. The 85+ cohort is projected to grow by 96%, adding 333 residents to reach 680. Residents aged 65 and above will drive 89% of population growth, highlighting trends towards an aging population. Conversely, population declines are projected for the 25-34 and 0-4 age groups.