Chart Color Schemes

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Woorim has shown very soft population growth performance across periods assessed by AreaSearch

As of Nov 2025, Woorim's population is estimated at around 1,934, reflecting a 4.9% increase since the 2021 Census which reported 1,843 people. This inference is based on AreaSearch validating new addresses and examining ABS ERP data released in June 2024, indicating a resident population of 1,931 with an additional 10 validated new addresses since the Census date. The population density ratio is approximately 70 persons per square kilometer. Over the past decade, Woorim has shown resilient growth patterns with a compound annual growth rate of 1.7%, outpacing national averages. Interstate migration contributed roughly 79% to overall population gains during recent periods. AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 using 2022 as the base year.

For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections are used, released in 2023 based on 2021 data. However, these state projections do not provide age category splits, so AreaSearch applies proportional growth weightings from ABS Greater Capital Region projections released in 2023 using 2022 data for each age cohort. Considering projected demographic shifts, lower quartile growth is anticipated with the suburb expected to expand by 104 persons to 2041 based on aggregated SA2-level projections, reflecting a total increase of 5.8% over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Woorim according to AreaSearch's national comparison of local real estate markets

AreaSearch analysis of ABS building approval numbers allocated from statistical area data shows Woorim has received approximately one dwelling development approval annually over the past five financial years. This totals an estimated nine homes. No approvals have been recorded so far in FY-26. On average, 19.1 people moved to the area per year for each dwelling built between FY-21 and FY-25.

Commercial approvals registered this financial year amount to $220,000, indicating a predominantly residential focus. Compared to Greater Brisbane, Woorim's building activity is 84.0% below the regional average per person. This limited new supply generally supports stronger demand and values for established homes, with population forecasts indicating Woorim will gain 112 residents by 2041.

At current development rates, housing supply may struggle to match population growth, potentially heightening buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

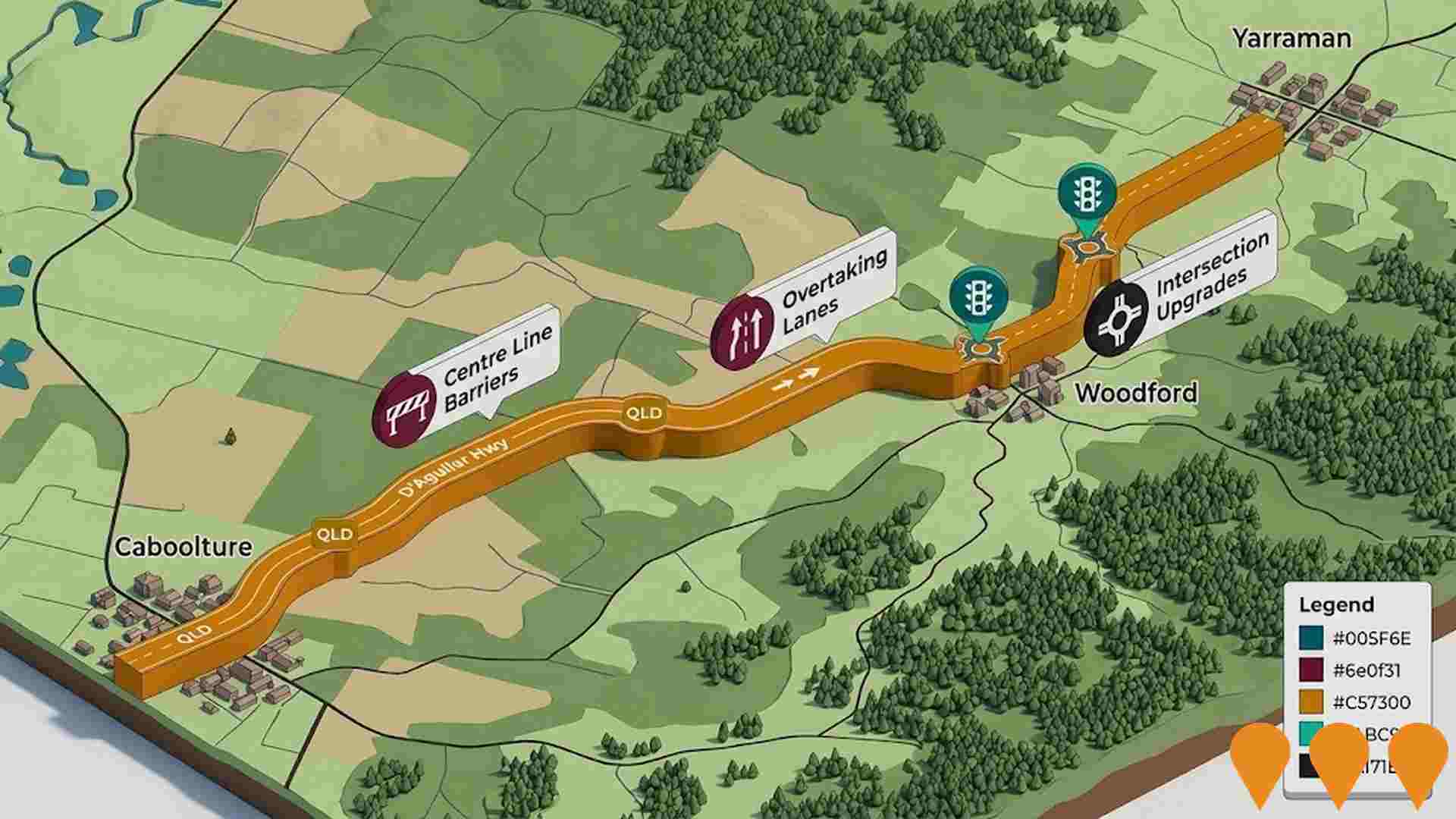

Woorim has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified nine projects likely affecting the region. Notable ones are Bribie Island Retiree Resort (Sundale), Bongaree Village Shopping Centre Expansion, Bribie Pines Island Village, and Solana Bribie Island Lifestyle Resort. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Queensland Energy Roadmap 2025

The Queensland Energy Roadmap 2025 is the successor to the Queensland Energy and Jobs Plan. It is a five-year plan for Queensland's energy system, focused on delivering affordable, reliable, and sustainable energy, with a greater emphasis on private sector investment. Key elements include the $1.6 billion Electricity Maintenance Guarantee to keep existing assets reliable, a $400 million investment to drive private-sector development in renewables (solar, hydro) and storage, and a new focus on gas generation (at least 2.6 GW by 2035) for system reliability. The plan formally repeals the previous renewable energy targets while maintaining a net-zero by 2050 commitment. It also continues major transmission projects like CopperString's Eastern Link. The associated Energy Roadmap Amendment Bill 2025 is currently before Parliament.

Queensland Energy and Jobs Plan - South East Queensland

The Queensland Energy and Jobs Plan (QEJP) is the state's 30-year roadmap to deliver a publicly-owned renewable energy future for Queensland. In South East Queensland the plan drives new renewable generation zones, large-scale long-duration storage (including the flagship 2,000 MW / 24 GWh Borumba Pumped Hydro Project), and the CopperString 2032 and SuperGrid transmission programs led by Powerlink. As of December 2025, the Borumba Pumped Hydro EIS is in public exhibition (closing early 2026), multiple Renewable Energy Zones are designated, and the first SuperGrid projects are in SEQ are in detailed planning and early procurement. The plan is legislated under the Energy (Renewable Transformation and Jobs) Act 2024.

Bribie Island Central Coles Precinct Redevelopment

Proposed expansion and refresh of the existing Bribie Island Central (formerly Bribie Island Shopping Centre) neighbourhood centre. The project, which is anchored by Coles, includes additional specialty retail, medical and a potential small-format supermarket. Development Application DA-2023-380/A was lodged with Moreton Bay Regional Council.

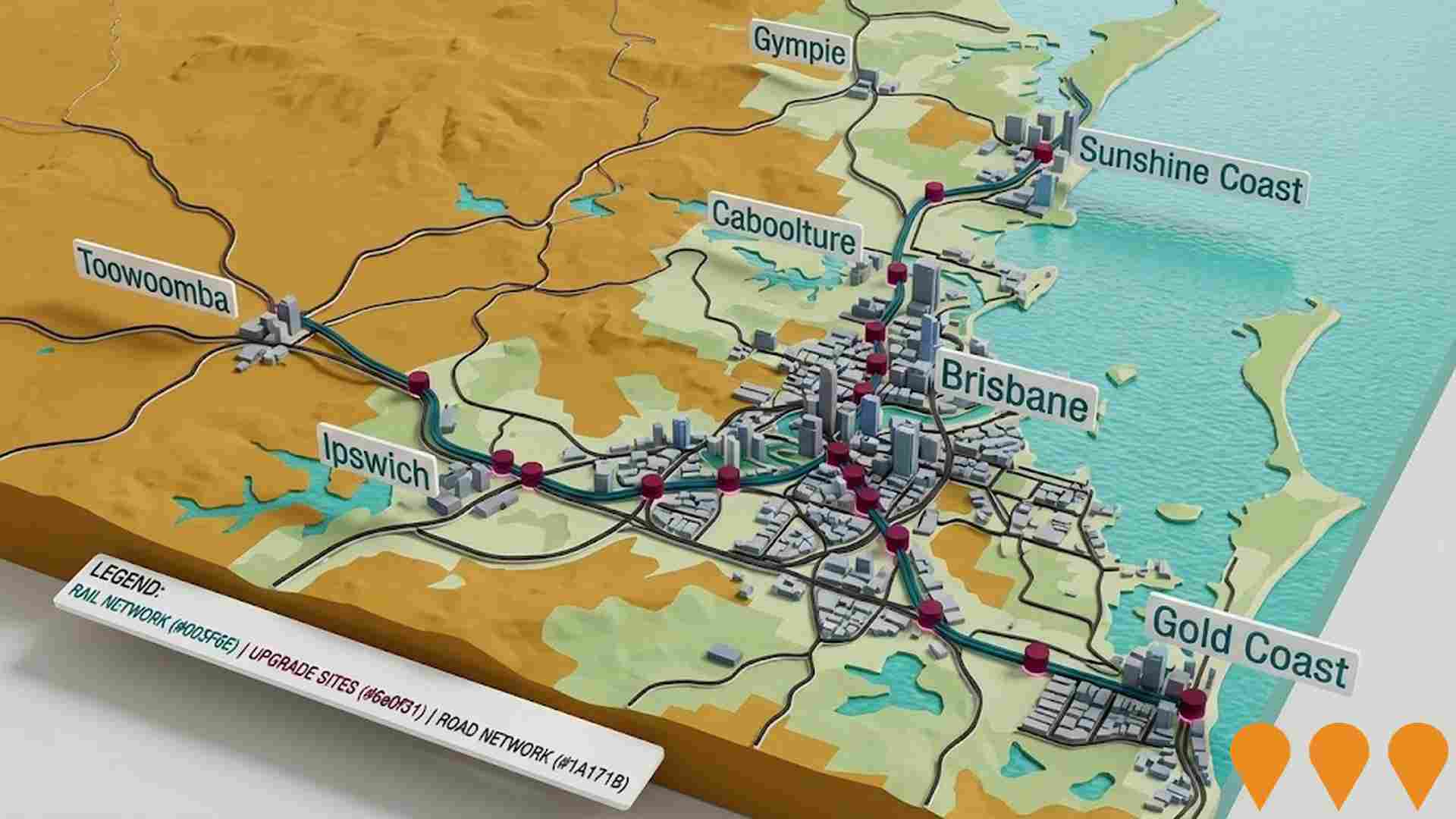

Moreton Bay Rail Link Stage 2

Proposed extension of the Redcliffe Peninsula Line (formerly Moreton Bay Rail Link) from Kippa-Ring to Bribie Island. While the first stage to Kippa-Ring was completed in 2016, this extension remains a long-term strategic proposal to connect Sandstone Point and Bribie Island to the SEQ rail network. Current Queensland Government priorities in the corridor focus on the $700 million duplication of the Bribie Island Road Bridge and upgrades to Caboolture-Bribie Island Road to improve immediate transport capacity.

Bongaree Village Shopping Centre Expansion

Council led upgrade and expansion of the Bongaree Village Shopping Precinct on Bribie Island, delivering additional small format retail tenancies, upgraded streetscape and public realm, improved pedestrian links and foreshore connections, and reconfigured parking as part of the Bongaree Village master plan and wider investment in the City of Moreton Bay coastal villages.

Solana Bribie Island Lifestyle Resort

Large-scale over-50s land lease community with 320 independent living units, a Livewell Centre featuring a clubhouse, indoor and outdoor pools, bowling green, and other resort facilities. The resort is fully tenanted and homes are sold out, with resales only.

Bribie Pines Island Village

Bribie Pines Island Village is an over 50s manufactured home estate on Bribie Island, offering around 200 low maintenance homes in a land lease community. Set on roughly 15 acres close to Pumicestone Passage, the village includes a community centre, library, gym, indoor bowls, pool, spa and other shared facilities with on site management and nightly security patrols. Residents own their home and lease the site, targeting downsizers seeking a secure, resort style coastal lifestyle.

Pacific Harbour Bribie Island

Masterplanned waterfront residential community on Bribie Island delivering around 2000 house and land lots across canal, golf and lakeside precincts, anchored by the Pacific Harbour Golf and Country Club. More than 1200 homes have already been completed, with remaining titled waterfront lots and house and land packages now selling ahead of an expected community build out around 2026.

Employment

The employment environment in Woorim shows above-average strength when compared nationally

Woorim has a skilled workforce with significant representation in essential services sectors. Its unemployment rate is 3.4%.

Over the past year, estimated employment growth was 11.7%, as per AreaSearch's aggregation of statistical area data. As of June 2025774 residents are employed while the unemployment rate is 0.7% lower than Greater Brisbane's rate of 4.1%. Workforce participation in Woorim lags behind Greater Brisbane at 39.1%, compared to its regional counterpart's 64.5%. Leading employment industries among residents include health care & social assistance, construction, and education & training.

The area specializes in accommodation & food services with an employment share of 1.6 times the regional level. However, professional & technical occupations employ only 6.1% of local workers, lower than Greater Brisbane's 8.9%. An analysis of Census working population vs resident population suggests limited local employment opportunities. In the 12-month period ending Sep-22, employment increased by 11.7%, while labour force grew by 8.8%, leading to a 2.5 percentage point drop in unemployment rate. This contrasts with Greater Brisbane where employment rose by 4.4% and unemployment fell by 0.4%. National employment forecasts from Jobs and Skills Australia project growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Woorim's employment mix suggests local employment should increase by 6.4% over five years and 13.3% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

Woorim's median income among taxpayers was $44,180 in financial year 2022. The average income stood at $60,381 during the same period. In comparison, Greater Brisbane had a median income of $55,645 and an average income of $70,520. By September 2025, based on Wage Price Index growth of 13.99%, Woorim's estimated median income would be approximately $50,361 and the average would be around $68,828. According to Census 2021 data, incomes in Woorim fall between the 1st and 9th percentiles nationally for households, families, and individuals. Income distribution shows that 34.3% of residents earn between $400 and $799 weekly, with a total of 663 people in this bracket. This contrasts with the broader area where the highest earning segment is those making between $1,500 and $2,999 weekly at 33.3%. In Woorim, 43.4% earn under $800 per week, indicating significant income constraints that impact local spending patterns. Housing affordability pressures are severe in the suburb, with only 81.4% of income remaining after housing costs, ranking it at the 3rd percentile nationally.

Frequently Asked Questions - Income

Housing

Woorim displays a diverse mix of dwelling types, with a higher proportion of rental properties than the broader region

Woorim's dwelling structures, as per the latest Census, consisted of 58.8% houses and 41.2% other dwellings (semi-detached, apartments, 'other' dwellings). In contrast, Brisbane metro had 78.8% houses and 21.2% other dwellings. Home ownership in Woorim stood at 50.0%, similar to Brisbane metro, with mortgaged dwellings at 19.4% and rented dwellings at 30.6%. The median monthly mortgage repayment in the area was $1,517, lower than Brisbane metro's $1,647. Median weekly rent in Woorim was $340, compared to Brisbane metro's $350. Nationally, Woorim's mortgage repayments were lower at $1,517 versus the Australian average of $1,863, and rents were less at $340 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Woorim features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 57.0% of all households, including 9.7% composed of couples with children, 38.1% consisting of couples without children, and 8.2% being single parent families. Non-family households account for the remaining 43.0%, with lone person households making up 40.2% and group households comprising 2.7%. The median household size is 1.9 people, which is smaller than the Greater Brisbane average of 2.1.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Woorim exceeds national averages, with above-average qualification levels and academic performance metrics

Educational qualifications in Woorim trail region show 21.8% of residents aged 15+ have university degrees, compared to Greater Brisbane's 30.5%. Bachelor degrees are most common at 13.8%, followed by postgraduate qualifications (4.8%) and graduate diplomas (3.2%). Vocational credentials are held by 36.8% of residents aged 15+, with advanced diplomas at 10.6% and certificates at 26.2%. School attendance covers 19.8%, including secondary education (7.2%), primary education (6.5%), and tertiary education (2.6%).

Educational facilities seem outside immediate catchment boundaries, requiring families to access schools in neighboring areas.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis indicates 20 operational transport stops in Woorim, serving a mix of bus routes. These stops are covered by one route, facilitating 197 weekly passenger trips collectively. Transport accessibility is rated excellent, with residents typically situated 123 meters from the nearest stop.

Service frequency averages 28 trips daily across all routes, equating to approximately nine weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Woorim is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Woorim faces significant health challenges, with various conditions affecting both younger and older age groups. Private health cover is held by approximately 51% of Woorim's total population (~988 people), slightly lower than the average SA2 area's rate of 57%.

This compares to a rate of 47.3% across Greater Brisbane. The most prevalent medical conditions in Woorim are arthritis and mental health issues, affecting 14.8% and 8.4% of residents respectively. Conversely, 56.5% of residents report no medical ailments, compared to 52.7% across Greater Brisbane. Woorim has a higher proportion of seniors aged 65 and over at 45.7% (883 people), compared to Greater Brisbane's rate of 44.7%. Notably, health outcomes among seniors in Woorim are stronger than those of the general population, as indicated by health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Woorim ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Woorim's population is predominantly culturally homogeneous, with 87.3% being citizens born in Australia who speak English exclusively at home. Christianity is the primary religion, practiced by 49.1%. Compared to Greater Brisbane, this figure is slightly lower than the regional average of 56.3%.

In terms of ancestry, English (34.2%) and Australian (26.7%) are the most prevalent, followed by Irish at 10.9%. Notable differences exist in Welsh (1.0% vs 0.7%), Scottish (9.8% vs 9.0%), and Samoan (0.3% vs 0.1%) representation.

Frequently Asked Questions - Diversity

Age

Woorim ranks among the oldest 10% of areas nationwide

The median age in Woorim is 61 years, significantly higher than Greater Brisbane's average of 36 and the national norm of 38. Compared to Greater Brisbane, the 65-74 cohort is notably over-represented at 25.0% locally, while the 25-34 age group is under-represented at 2.8%. This concentration of the 65-74 cohort is well above the national average of 9.4%. Between the 2016 and 2021 Census periods, Woorim's median age increased by one year to 61 years from 60 years. During this time, the 75-84 age group grew from 12.6% to 16.7%, and the 65-74 cohort increased from 23.9% to 25.0%. Conversely, the 25-34 age group declined from 4.4% to 2.8%, and the 5-14 age group decreased from 7.8% to 6.7%. Looking ahead to 2041, demographic projections show significant shifts in Woorim's age structure. The 75-84 cohort is projected to grow by 49%, adding 159 residents to reach 482. Residents aged 65 and older represent 100% of the anticipated population growth. Conversely, population declines are projected for the 0-4 and 55-64 age cohorts.