Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Windang has shown very soft population growth performance across periods assessed by AreaSearch

Based on ABS population updates for the broader area, and new addresses validated by AreaSearch, Windang's population is estimated at around 2,608 as of November 2025. This reflects a decrease of 2 people (0.1%) since the 2021 Census, which reported a population of 2,610 people. The change is inferred from the resident population of 2,605 estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024 and address validation since the Census date. This level of population equates to a density ratio of 1,100 persons per square kilometer, which is relatively in line with averages seen across locations assessed by AreaSearch. Population growth for Windang was primarily driven by overseas migration during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. According to these projections, Windang's population is expected to decline by 10 persons by 2041. However, growth across specific age cohorts is anticipated, led by the 25 to 34 age group, which is projected to grow by 50 people.

Frequently Asked Questions - Population

Development

The level of residential development activity in Windang is very low in comparison to the average area assessed nationally by AreaSearch

Windang has seen minimal development activity over the past five years, averaging less than one approval per year. This low level of development reflects Windang's rural nature, where housing needs rather than market demand primarily drive growth. The small sample size means individual projects can significantly impact annual statistics.

Compared to Rest of NSW and national averages, Windang shows notably lower construction activity.

Frequently Asked Questions - Development

Infrastructure

Windang has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified a single project likely to impact this area: Lake Illawarra Entrance Options Study, Warilla Beach Seawall Renewal, Southern Suburbs Community Centre and Library, Shellharbour Mobile Tiny Homes Pilot Program, with the following projects being most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

New Shellharbour Hospital and Integrated Services

A $782 million major health infrastructure project delivering a new seven-storey greenfield hospital at Dunmore. Key features include an expanded emergency department with a rooftop helipad, specialized elective surgery theatres, mental health inpatient units, and comprehensive outpatient services. The project also encompasses the new Warrawong Community Health Centre and upgrades to Wollongong and Bulli Hospitals to enhance the Illawarra Shoalhaven health network.

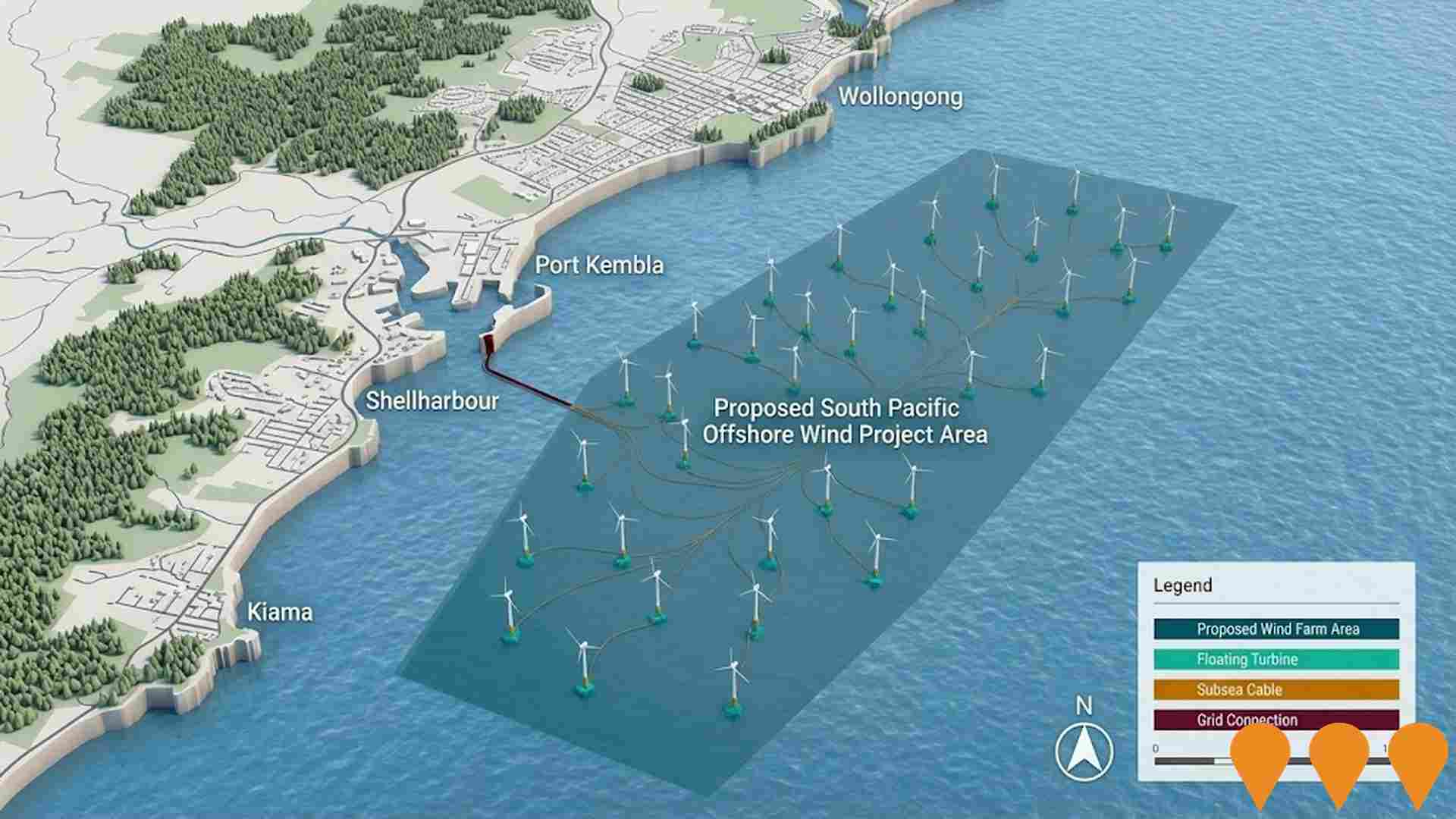

Illawarra Offshore Wind Zone

The Illawarra Offshore Wind Zone is a 1,022 square kilometre declared area in the Pacific Ocean located at least 20 km offshore between Wombarra and Kiama. Declared on June 15, 2024, the zone has a potential generation capacity of 2.9 GW, sufficient to power 1.8 million homes. As of January 2026, the project is in a transitional phase; the sole feasibility licence applicant, BlueFloat Energy, formally withdrew in early 2026 due to global supply chain and commercial pressures. While no feasibility licences are currently active for generation, the zone remains officially declared. The Federal Government has opened applications for Research and Demonstration (R&D) licences to test emerging technologies like floating foundations and wave energy within the zone.

Illawarra Offshore Wind Zone

The Illawarra Offshore Wind Zone is a Commonwealth-declared area covering 1,022 square kilometres in the Pacific Ocean, located 20km to 45km off the NSW coast between Wombarra and Kiama. Declared on 15 June 2024, the zone has a potential generation capacity of 2.9 GW, enough to power approximately 1.8 million homes. Following a competitive application process in late 2024, Corio Generation Australia was awarded the first feasibility licence in December 2025. This allows for seven years of detailed environmental assessments, geotechnical surveys, and community consultation to determine the technical and commercial viability of a large-scale floating offshore wind farm.

Illawarra Renewable Energy Zone (REZ)

NSW's first urban Renewable Energy Zone designed to integrate 1 GW of network capacity. The project focuses on leveraging existing industrial, port, and grid infrastructure to support green hydrogen, green steel, and offshore wind industries. It uniquely emphasizes consumer energy resources like rooftop solar and community batteries. As of early 2026, EnergyCo continues detailed infrastructure planning and community engagement following the 2025 Roundtable which identified over $43 billion in potential private investment interest.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet (D sets) replacing the aging V-set fleet across the NSW intercity network. Delivered by the RailConnect consortium, the trains feature 2x2 seating, charging ports, dedicated luggage/bicycle spaces, and enhanced accessibility with wheelchair spaces and accessible toilets. The fleet operates in 4, 6, 8, or 10-car formations. Passenger services commenced on the Central Coast & Newcastle Line on 3 December 2024 and the Blue Mountains Line on 13 October 2025. South Coast Line services are scheduled to begin in the first half of 2026. The project includes the Kangy Angy Maintenance Facility and extensive corridor upgrades such as platform extensions and signaling modifications.

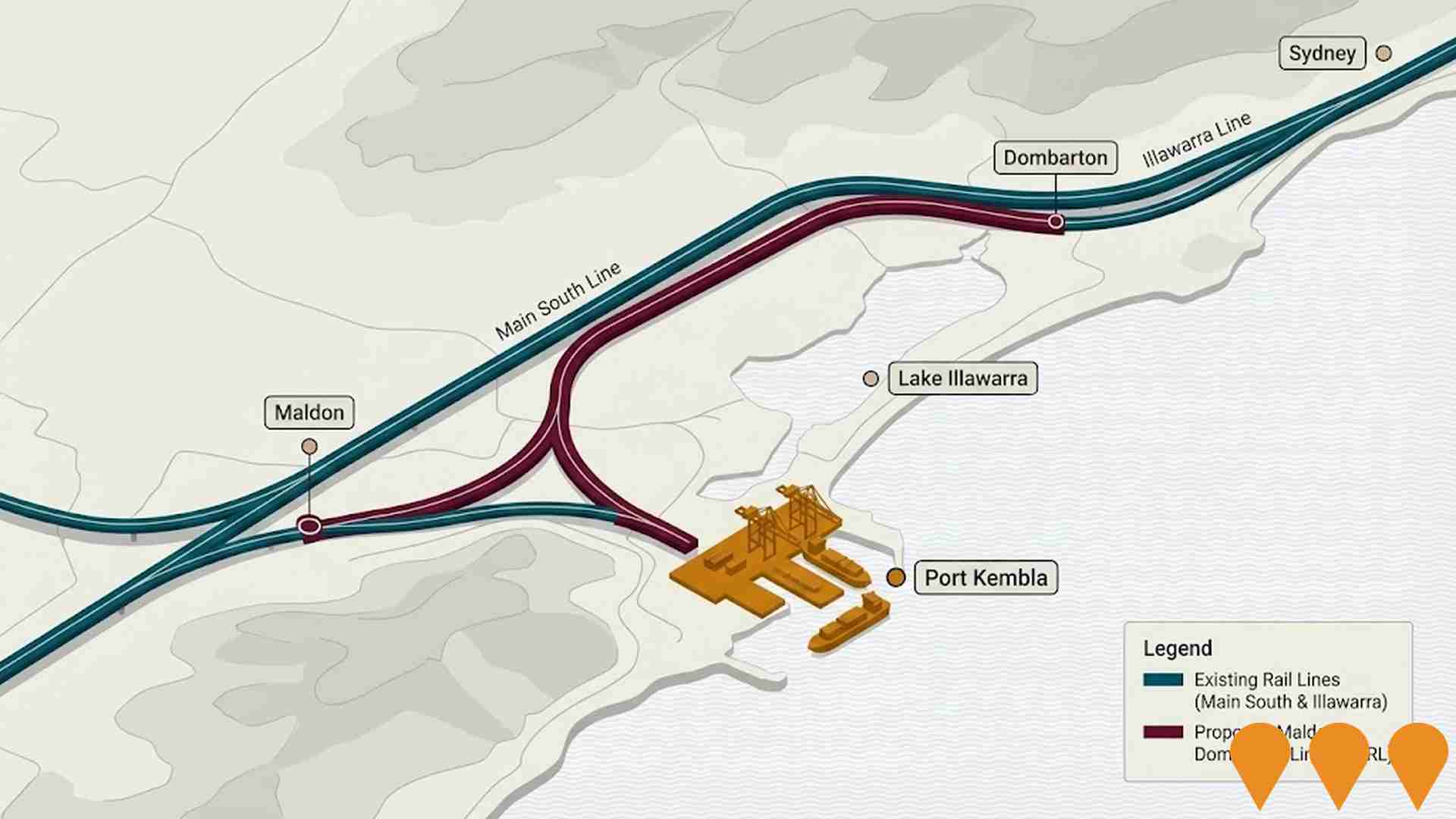

Rail Service Improvement Program (Mortdale-Kiama)

The Rail Service Improvement Program (formerly More Trains, More Services) is a multi-billion-dollar NSW Government initiative to modernize the rail network for the Mariyung fleet. The Mortdale to Kiama package involves infrastructure upgrades including the Mortdale Maintenance Centre (active maintenance and shunting works in February 2026), platform extensions at Kiama (completed), and ongoing signaling, power supply, and station improvements at Thirroul and Shellharbour Junction to enable increased service frequency on the T4 Illawarra and South Coast lines.

Shellharbour Mobile Tiny Homes Pilot Program

State-first two-year pilot program allowing mobile tiny homes on existing residential properties without development applications. Council approved September 23, 2025. Planning Proposal to amend Shellharbour LEP 2013 requires NSW Government approval and 28-day public consultation (up to 6 months process). Program provides affordable rental housing through moveable dwellings on trailers registered under Road Transport Act 2013, subject to strict conditions including minimum setbacks, connection to essential services, and fire safety compliance. Addresses housing crisis where median house price is $1 million.

Illawarra Offshore Wind Farm

Initial Oceanex proposal for a floating offshore wind project of up to 2,000 MW located roughly 20-30 km off the Illawarra coast (Wollongong/Port Kembla, NSW). The Commonwealth declared the Illawarra offshore wind area on 15 June 2024 and opened feasibility licence applications from 17 June to 15 August 2024. Reporting in late 2024 indicated Oceanex and Equinor did not proceed with a feasibility application in Illawarra; in early 2025 other proponents signaled requests to delay licence decisions. As at early 2025, no Illawarra project by Oceanex has an awarded feasibility licence; the area remains declared and subject to ongoing assessment and consultation.

Employment

Employment conditions in Windang face significant challenges, ranking among the bottom 10% of areas assessed nationally

Windang has a balanced workforce with both white and blue collar jobs. The unemployment rate is 9.6%.

As of September 2025, there are 989 residents employed, but the unemployment rate is higher than Rest of NSW's by 5.8%, indicating room for improvement. Workforce participation is lower at 41.1% compared to Rest of NSW's 56.4%. The leading employment industries in Windang are health care & social assistance, construction, and education & training. Construction stands out with an employment share 1.4 times the regional level.

However, agriculture, forestry & fishing is under-represented with only 0.0% of Windang's workforce compared to Rest of NSW's 5.3%. Over the year to September 2025, labour force levels increased by 0.2%, while employment decreased by 1.3%, causing unemployment to rise by 1.4 percentage points. In comparison, Rest of NSW saw employment fall by 0.5% and unemployment rise by 0.4%. State-level data from November 25 shows NSW employment contracted by 0.03%, with an unemployment rate of 3.9%. National forecasts suggest employment will expand by 6.6% over five years and 13.7% over ten years, but local growth rates may differ based on Windang's employment mix.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

AreaSearch's latest postcode level ATO data for financial year 2023 reports Windang's median taxpayer income as $45,416 and average income at $55,076. These figures are lower than national averages. Rest of NSW has a median income of $52,390 and an average of $65,215. Based on Wage Price Index growth of 8.86% since financial year 2023, estimated incomes for September 2025 are approximately $49,440 (median) and $59,956 (average). Windang's household, family, and personal incomes, as per Census 2021 data, fall between the 1st and 10th percentiles nationally. The earnings profile shows that 35.5% of locals (925 people) earn between $400 - $799 weekly, unlike regional trends where 29.9% fall within the $1,500 - $2,999 range. A significant portion, 44.9%, falls into sub-$800 weekly brackets, indicating economic challenges. Housing affordability pressures are severe, with only 80.6% of income remaining after expenses, ranking at the 3rd percentile nationally.

Frequently Asked Questions - Income

Housing

Windang is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Windang's dwelling structures, as per the latest Census, consisted of 80.4% houses and 19.6% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro NSW's 85.5% houses and 14.5% other dwellings. Home ownership in Windang stood at 54.6%, with mortgaged dwellings at 22.6% and rented ones at 22.8%. The median monthly mortgage repayment was $1,950, lower than Non-Metro NSW's average of $2,000. Median weekly rent in Windang was $335, compared to Non-Metro NSW's $365. Nationally, Windang's mortgage repayments were higher at $1,950 versus the Australian average of $1,863, while rents were lower at $335 against the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Windang features high concentrations of lone person households, with a lower-than-average median household size

Family households account for 56.2% of all households, including 19.7% couples with children, 25.8% couples without children, and 7.9% single parent families. Non-family households constitute the remaining 43.8%, with lone person households at 42.0% and group households comprising 2.2% of the total. The median household size is 2.1 people, smaller than the Rest of NSW average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Windang faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 12.5%, significantly lower than the NSW average of 32.2%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are most common at 8.6%, followed by postgraduate qualifications (2.3%) and graduate diplomas (1.6%). Trade and technical skills are prominent, with 41.6% of residents aged 15+ holding vocational credentials – advanced diplomas (8.8%) and certificates (32.8%).

A substantial 22.8% of the population is actively pursuing formal education, including 8.0% in primary education, 7.1% in secondary education, and 2.6% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Windang has 30 active public transport stops operating within its boundaries. These stops serve a mix of bus routes, totaling 20 individual routes. The combined weekly passenger trips across these routes amount to 568.

Residents enjoy excellent transport accessibility, with an average distance of 127 meters to the nearest stop. Service frequency is high, averaging 81 trips per day across all routes, which translates to approximately 18 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Windang is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Windang faces significant health challenges, with various conditions affecting both younger and older age groups. The rate of private health cover in Windang is low at approximately 49%, covering around 1,271 people, compared to 52% across the rest of NSW and a national average of 55.7%. The most prevalent medical conditions are arthritis (affecting 14.4% of residents) and mental health issues (8.8%).

Conversely, 54.6% of residents report no medical ailments, compared to 63.9% in the rest of NSW. Windang has a higher proportion of seniors aged 65 and over at 38%, with around 991 people falling into this category, compared to 19% in the rest of NSW. Health outcomes among seniors present challenges broadly reflective of the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Windang ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Windang's cultural diversity was found to be below average, with 85.8% of its population born in Australia, 89.7% being citizens, and 94.4% speaking English only at home. The predominant religion in Windang is Christianity, comprising 58.3% of the population, compared to 58.1% across Rest of NSW. In terms of ancestry, the top three represented groups are English (30.8%), Australian (30.2%), and Irish (9.0%).

Notably, Spanish (1.2%) is overrepresented in Windang compared to the regional average of 0.9%, as are Welsh (0.9% vs 0.6%) and Hungarian (0.6% vs 0.3%).

Frequently Asked Questions - Diversity

Age

Windang ranks among the oldest 10% of areas nationwide

The median age in Windang is 56 years, which is notably higher than Rest of NSW's average of 43 years and significantly higher than Australia's national average of 38 years. The 75-84 age group comprises 15.0% of the population, compared to Rest of NSW, while the 5-14 cohort makes up 8.5%. This concentration in the 75-84 age group is well above the national average of 6.0%. According to the 2021 Census, the 25 to 34 age group has increased from 7.2% to 8.1%, while the 55 to 64 cohort has decreased from 14.0% to 12.5%. By 2041, demographic projections indicate significant shifts in Windang's age structure. The 85+ cohort is projected to grow by 38%, adding 49 residents to reach a total of 180. Conversely, population declines are projected for the 45 to 54 and 5 to 14 cohorts.