Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Glebe is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Based on analysis of ABS population updates for the broader area, as of Nov 2025, Glebe's estimated population is around 12,531. This reflects an increase of 851 people since the 2021 Census, which reported a population of 11,680. The change was inferred from AreaSearch's resident population estimate of 12,520 following examination of ABS' latest ERP data release (June 2024) and an additional 79 validated new addresses since the Census date. This level of population equates to a density ratio of 7,414 persons per square kilometer, placing Glebe in the top 10% of national locations assessed by AreaSearch. Over the past decade, Glebe has demonstrated resilient growth patterns with a compound annual growth rate of 1.5%, outpacing metropolitan area trends. Population growth was primarily driven by overseas migration contributing approximately 87.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered, AreaSearch utilises NSW State Government's SA2 level projections released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Moving forward, demographic trends suggest a population increase just below the median of national statistical areas. By 2041, Glebe's population is expected to expand by 709 persons, reflecting a gain of 6.3% in total over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Glebe according to AreaSearch's national comparison of local real estate markets

AreaSearch analysis of ABS building approval numbers shows Glebe had approximately 8 dwelling approvals annually over the past 5 financial years, totalling about 43 homes. As of FY-26, there have been 23 recorded approvals. Between FY-21 and FY-25, an average of 5.4 people moved to Glebe for each dwelling built. The average construction cost value of new dwellings is around $1,105,000, indicating a focus on the premium segment.

In FY-26, there have been $90.7 million in commercial development approvals, reflecting significant local commercial activity. Compared to Greater Sydney, Glebe has 88.0% lower building activity per person. The dwelling types approved are mainly townhouses or apartments (83.0%) and detached dwellings (17.0%). Glebe's population is projected to increase by 4171 people by 2041, potentially outpacing housing supply at current development rates.

Future projections show Glebe adding 794 residents by 2041 (from the latest AreaSearch quarterly estimate). At current development rates, housing supply may struggle to match population growth, potentially heightening buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

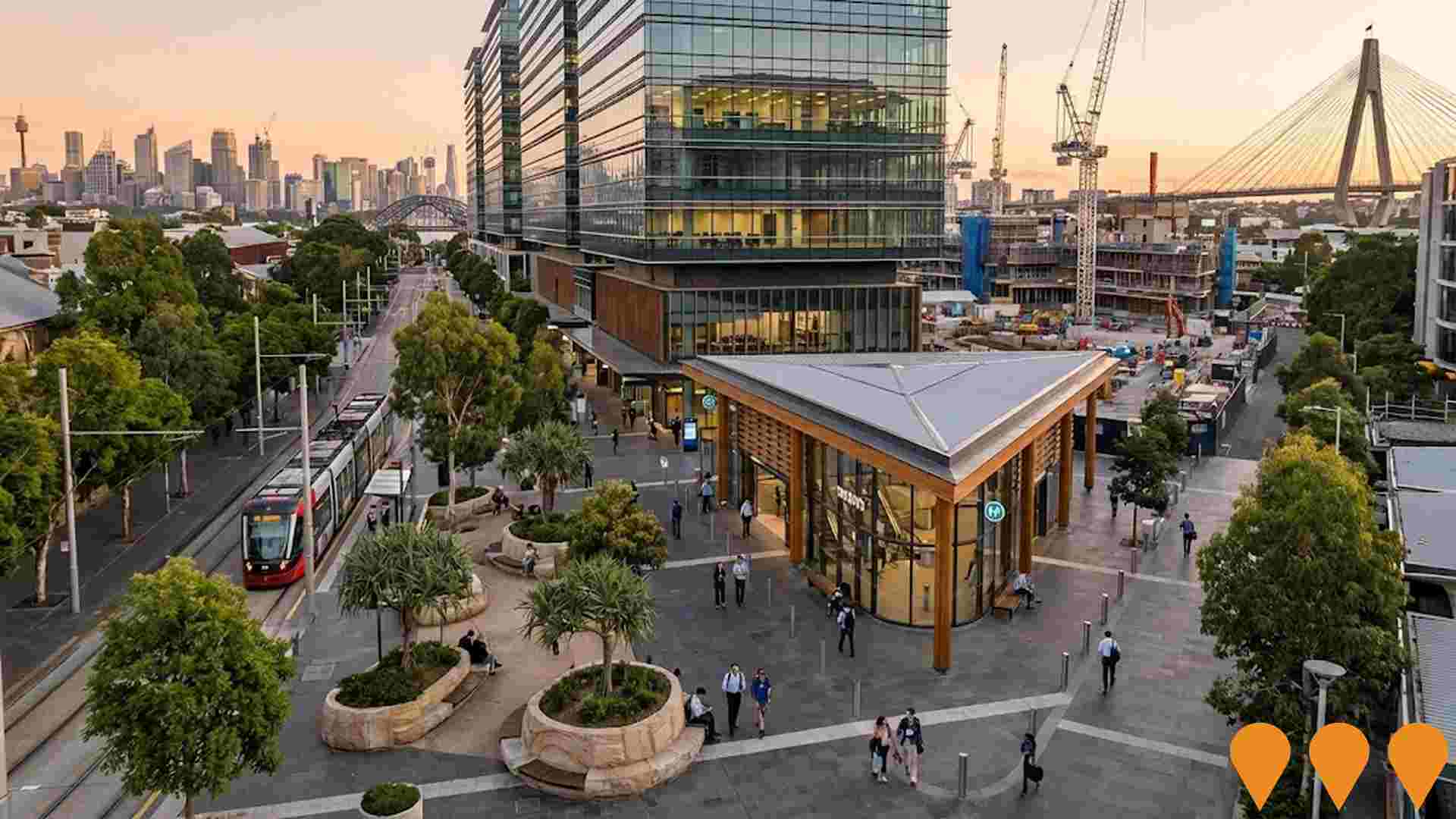

Glebe has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

The performance of a region can significantly be influenced by modifications to its local infrastructure, major projects, and planning initiatives. AreaSearch has identified 33 such projects that could potentially impact this area. Notable projects include Cowper Street Social Housing Development, Wentworth Park Rd, Glebe, Bank Street Park (Blackwattle Bay), and Bidura. The following list details those projects deemed most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

NSW Health Infrastructure Program - Inner West

A comprehensive healthcare investment program across Sydney's Inner West, featuring the $940 million Royal Prince Alfred (RPA) Hospital Redevelopment and the $350 million Canterbury Hospital upgrade. The program delivers new clinical services buildings, expanded emergency departments, and enhanced intensive care units to meet growing community needs. Key active sites include the RPA campus in Camperdown and ongoing clinical service expansions at Canterbury Hospital.

Royal Prince Alfred Hospital Redevelopment

A $940 million transformation of the Royal Prince Alfred Hospital, the most significant in its 140-year history. The project includes a new 15-storey East Tower, vertical and horizontal expansions, and major refurbishments. Key features include an expanded Emergency Department (doubling to 91 spaces), an enhanced ICU (increasing to 74 beds), new operating theatres, and expanded neonatal, maternity, and paediatric units. The project also features a new rooftop helipad and open garden courtyard.

Sydney Metro West - The Bays Station

The Bays Station is a key underground component of the 24km Sydney Metro West line, situated between Glebe Island and the heritage White Bay Power Station. In early 2026, the project transitioned from tunnelling to the station-building phase following the award of the Stations Package West contract to Gamuda. The site serves as the nucleus for the broader Bays West Stage 1 Master Plan, an urban renewal initiative designed to transform the precinct into an employment-led innovation hub. This stage includes approximately 250 new homes, 5,400 jobs, and 4.16 hectares of new public open space, with the metro line targeting an opening in 2032.

Powerhouse Ultimo Renewal

A $300 million heritage revitalisation of the Powerhouse Museum in Ultimo. The project includes the restoration of heritage buildings, the creation of world-class exhibition spaces for applied arts and sciences, and a new 2,000 sqm public square on The Goods Line. The design, by Durbach Block Jaggers and Architectus, retains the scale of the Wran building while reorienting the entrance to improve connectivity with the Sydney CBD and local precincts.

The Star Sydney - Ritz-Carlton Hotel & Lyric Theatre

Redevelopment of The Star Sydney featuring a 66-storey tower managed by Ritz-Carlton, comprising 237 luxury hotel rooms and 153 residential apartments. The project includes a comprehensive transformation of the site's performance venues by Foundation Theatres. The new Foundry Theatre, an intimate 630-capacity venue within the existing Lyric Theatre, opened in February 2025. Major tower works by Multiplex are progressing toward ground level by late 2025, with the conversion of the former Event Centre into a new 1,550-seat proscenium-arch theatre and a 1,000-seat live room underway.

New Sydney Fish Market

The New Sydney Fish Market is a world-class waterfront destination at Blackwattle Bay, featuring a striking wave-shaped timber roof designed by 3XN with BVN and Aspect Studios. The 30,000 sqm facility serves as the largest public market hall in the Southern Hemisphere, housing over 40 retail outlets, premium restaurants, bars, and the Sydney Seafood School. Key features include a continuous public foreshore promenade, sustainable rainwater harvesting, and transparent glass facades allowing public views of the wholesale auction floors. The project is an architectural landmark integrated into a 15km foreshore walk from Rozelle Bay to Woolloomooloo.

apt.Broadway

Build-to-rent development converting heritage Grace Brothers warehouse into 160 modern apartments with creative arts allocation, wellness centre, co-working hub, and rooftop terrace.

Bank Street Park (Blackwattle Bay)

A new 1.1-hectare waterfront public park surrounding the southern pylons of the Anzac Bridge. The design includes a waterside promenade, playground, multipurpose court, outdoor fitness station, community building with amenities and cafe kiosk, dragon boat storage and kayak launch, cycle paths and enhanced water access. The State Significant Development Application was approved in July 2024, with a design modification approved in July 2025 to improve access, circulation and building layouts. Procurement for a construction contractor is underway with a shortlisted tender panel.

Employment

The labour market performance in Glebe lags significantly behind most other regions nationally

Glebe has an educated workforce with notable representation in the technology sector. Its unemployment rate is 8.5%, according to AreaSearch's aggregation of statistical area data.

As of September 2025, 6,627 residents are employed while the unemployment rate is 4.3% higher than Greater Sydney's rate of 4.2%. Workforce participation in Glebe is equal to Greater Sydney's 60.0%. Major employment industries include professional & technical, education & training, and health care & social assistance. Glebe specializes particularly in professional & technical jobs, with an employment share 1.7 times the regional level.

Conversely, construction is under-represented, comprising only 3.9% of Glebe's workforce compared to Greater Sydney's 8.6%. Many residents commute elsewhere for work, as indicated by the Census working population count. Between September 2024 and September 2025, labour force levels decreased by 1.4%, with employment decreasing by 1.7%, causing unemployment to rise by 0.3 percentage points in Glebe. In contrast, Greater Sydney saw employment growth of 2.1% and labour force growth of 2.4%, with a 0.2 percentage point increase in unemployment. State-level data from NSW to 25-Nov shows employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. National employment forecasts from Jobs and Skills Australia project national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Glebe's employment mix suggests local employment should increase by 7.3% over five years and 14.6% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income levels align closely with national averages, indicating typical economic conditions for Australian communities according to AreaSearch analysis

AreaSearch's latest postcode level ATO data for financial year ending June 2023 shows median income in Glebe at $54,864, with average income at $83,320. This compares to Greater Sydney's median of $60,817 and average of $83,003. Using Wage Price Index growth of 8.86% since June 2023, estimated median and average incomes as of September 2025 would be approximately $59,725 and $90,702 respectively. Census data indicates individual earnings at the 82nd percentile nationally ($1,045 weekly), with household income at the 50th percentile. Income brackets show 23.3% of Glebe locals (2,919 people) earning between $1,500 and $2,999 weekly, similar to broader trends across the area at 30.9%. A substantial proportion of high earners (31.4%) indicates strong economic capacity in Glebe. Housing affordability pressures are severe, with only 78.4% of income remaining after housing costs, ranking at the 44th percentile nationally. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Glebe features a more urban dwelling mix with significant apartment living, with above-average rates of outright home ownership

Glebe's dwelling structure, as per the latest Census, consisted of 5.0% houses and 95.0% other dwellings (semi-detached, apartments, 'other' dwellings). This contrasts with Sydney metro's figures of 2.3% houses and 97.7% other dwellings. Home ownership in Glebe stood at 20.1%, higher than Sydney metro's level. Mortgaged dwellings accounted for 16.3%, while rented dwellings made up 63.6%. The median monthly mortgage repayment in Glebe was $3,000, exceeding the Sydney metro average of $2,705. Median weekly rent in Glebe was $420, compared to Sydney metro's $550. Nationally, Glebe's mortgage repayments were significantly higher than the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Glebe features high concentrations of lone person households and group households, with a higher-than-average median household size

Family households comprise 48.7% of all households, including 13.3% couples with children, 25.7% couples without children, and 8.4% single parent families. Non-family households account for the remaining 51.3%, with lone person households at 42.5% and group households comprising 8.8%. The median household size is 2.0 people, larger than the Greater Sydney average of 1.9.

Frequently Asked Questions - Households

Local Schools & Education

Glebe shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Glebe's educational attainment exceeds national and state averages. Among residents aged 15+, 56.9% hold university qualifications, compared to Australia's 30.4% and NSW's 32.2%. Bachelor degrees are the most common at 33.4%, followed by postgraduate qualifications (19.8%) and graduate diplomas (3.7%). Vocational pathways account for 18.1% of qualifications, with advanced diplomas at 8.8% and certificates at 9.3%.

Educational participation is high, with 30.5% of residents currently enrolled in formal education. This includes 14.4% in tertiary education, 5.4% in primary education, and 4.3% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Glebe has 70 active public transport stops. These include ferry, lightrail, and bus services. There are 28 individual routes operating, serving a total of 9,838 weekly passenger trips.

Residents have excellent transport accessibility, with an average distance of 147 meters to the nearest stop. On average, there are 1,405 trips per day across all routes, which equates to approximately 140 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Glebe's residents are healthier than average in comparison to broader Australia with a fairly standard level of common health conditions seen across both young and old age cohorts

Health data shows Glebe residents have relatively positive health outcomes with common conditions seen across both young and old age groups. The rate of private health cover is exceptionally high at approximately 60% of the total population (7,496 people), compared to 68.5% across Greater Sydney.

Mental health issues and asthma are the most common medical conditions in the area, impacting 11.3 and 7.8% of residents respectively. 68.7% of Glebe residents declare themselves completely clear of medical ailments, compared to 77.4% across Greater Sydney. As of 2021, 17.5% of Glebe residents are aged 65 and over (2,192 people), which is higher than the 9.7% in Greater Sydney. Health outcomes among seniors in Glebe are particularly strong, performing even better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Glebe was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Glebe has a high level of cultural diversity, with 26.5% of its population speaking a language other than English at home and 38.5% born overseas. Christianity is the predominant religion in Glebe, comprising 33.4% of people. Judaism, however, is overrepresented compared to Greater Sydney, making up 0.7% of Glebe's population versus 1.1%.

The top three represented ancestry groups are English (22.2%), Australian (16.6%), and Other (12.5%). Notably, Spanish (0.9%) is slightly overrepresented compared to the regional average of 1.0%, while Hungarian (0.5%) and French (0.9%) also show some divergence from their respective regional percentages of 0.4% and 1.1%.

Frequently Asked Questions - Diversity

Age

Glebe's population aligns closely with national norms in age terms

The median age in Glebe is 38 years, close to Greater Sydney's average of 37 and equivalent to Australia's median of 38. Compared to Greater Sydney, Glebe has a higher proportion of residents aged 25-34 (20.7%) but fewer residents aged 5-14 (5.9%). This is significantly higher than the national average of 14.5% for the 25-34 age group. Between the 2021 Census and now, the proportion of residents aged 15 to 24 has grown from 13.4% to 16.1%, while those aged 75 to 84 have increased from 4.9% to 6.0%. Conversely, the proportion of residents aged 55 to 64 has declined from 11.9% to 10.8%. By 2041, Glebe's age composition is expected to change significantly. The number of residents aged 75-84 is projected to grow by 56%, reaching 1,175 from 751. This aging population trend is evident, with those aged 65 and above comprising 82% of the projected growth. Conversely, population declines are projected for the 0-4 and 15-24 age groups.