Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Sydney (South) - Haymarket are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Sydney South Haymarket's population was 23,802 as of November 2025, reflecting a 19.4% increase from the 2021 Census figure of 19,935 people. This growth is inferred from ABS estimates and validated new addresses between June 2024 and the Census date. The population density reached 22,038 persons per square kilometer, placing it in the top 10% nationally. Growth since the 2021 Census exceeded state (6.7%) and metropolitan averages, driven primarily by overseas migration contributing approximately 93.7% of overall gains. AreaSearch uses ABS/Geoscience Australia projections for SA2 areas released in 2024 with a 2022 base year, and NSW State Government's projections for other areas from 2022 with a 2021 base year. Future trends forecast significant population growth by 2041, with an increase of 10,129 persons expected, reflecting a 42.4% total rise over the 17 years.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, AreaSearch is utilising the NSW State Government's SA2 level projections, as released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are also applied to all areas for years 2032 to 2041. As we examine future population trends, a significant population increase in the top quartile of Australian statistical areas is forecast, with the area expected to grow by 10,129 persons to 2041 based on the latest annual ERP population numbers, reflecting reflecting an increase of 42.4% in total over the 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Sydney (South) - Haymarket was found to be higher than 90% of real estate markets across the country

Sydney South Haymarket has seen approximately 170 new homes approved annually. Over the past five financial years, from FY21 to FY25, around 854 homes were approved, with none yet recorded in FY26. On average, 2.3 people moved to the area per new home constructed during this period, indicating strong demand which supports property values.

Developers are targeting the premium market segment, with an average construction cost of $573,000 for new homes. This financial year has seen $163.7 million in commercial development approvals, demonstrating robust commercial development activity. Compared to Greater Sydney, Sydney South Haymarket exhibits elevated construction levels, 41.0% above the regional average per person over the five-year period, offering good buyer choice while supporting existing property values.

All new construction has been townhouses or apartments, promoting higher-density living and creating more affordable entry points for downsizers, investors, and first-home buyers. By 2041, Sydney South Haymarket is projected to gain 10,083 residents. If current development rates continue, housing supply may not keep pace with population growth, potentially intensifying competition among buyers and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Sydney (South) - Haymarket has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified 72 projects likely impacting the area. Notable ones are Mariyung Fleet (New Intercity Fleet), Atlassian Central, Hyde Metropolitan, and Central Place Sydney. The following details projects likely most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

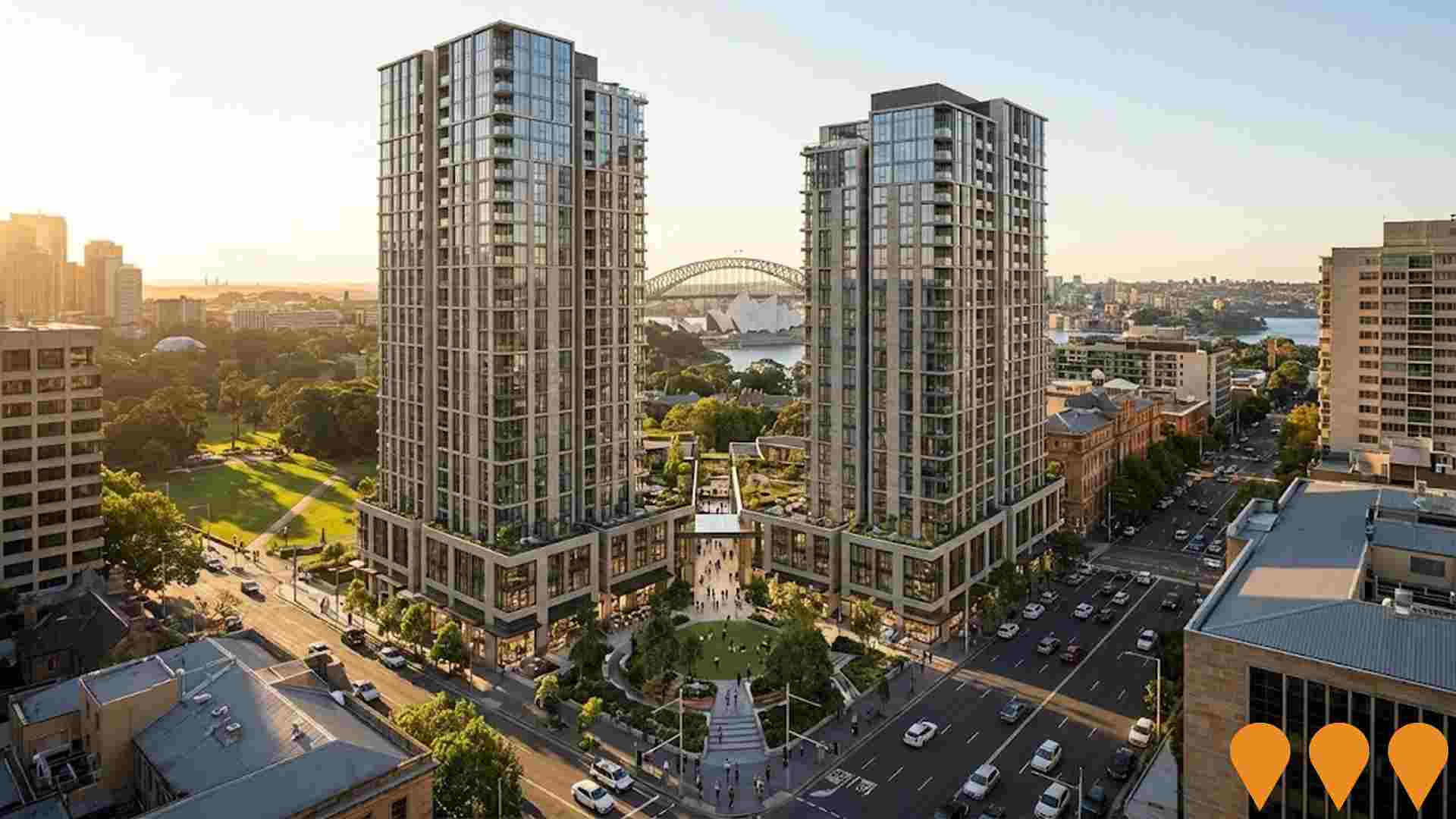

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

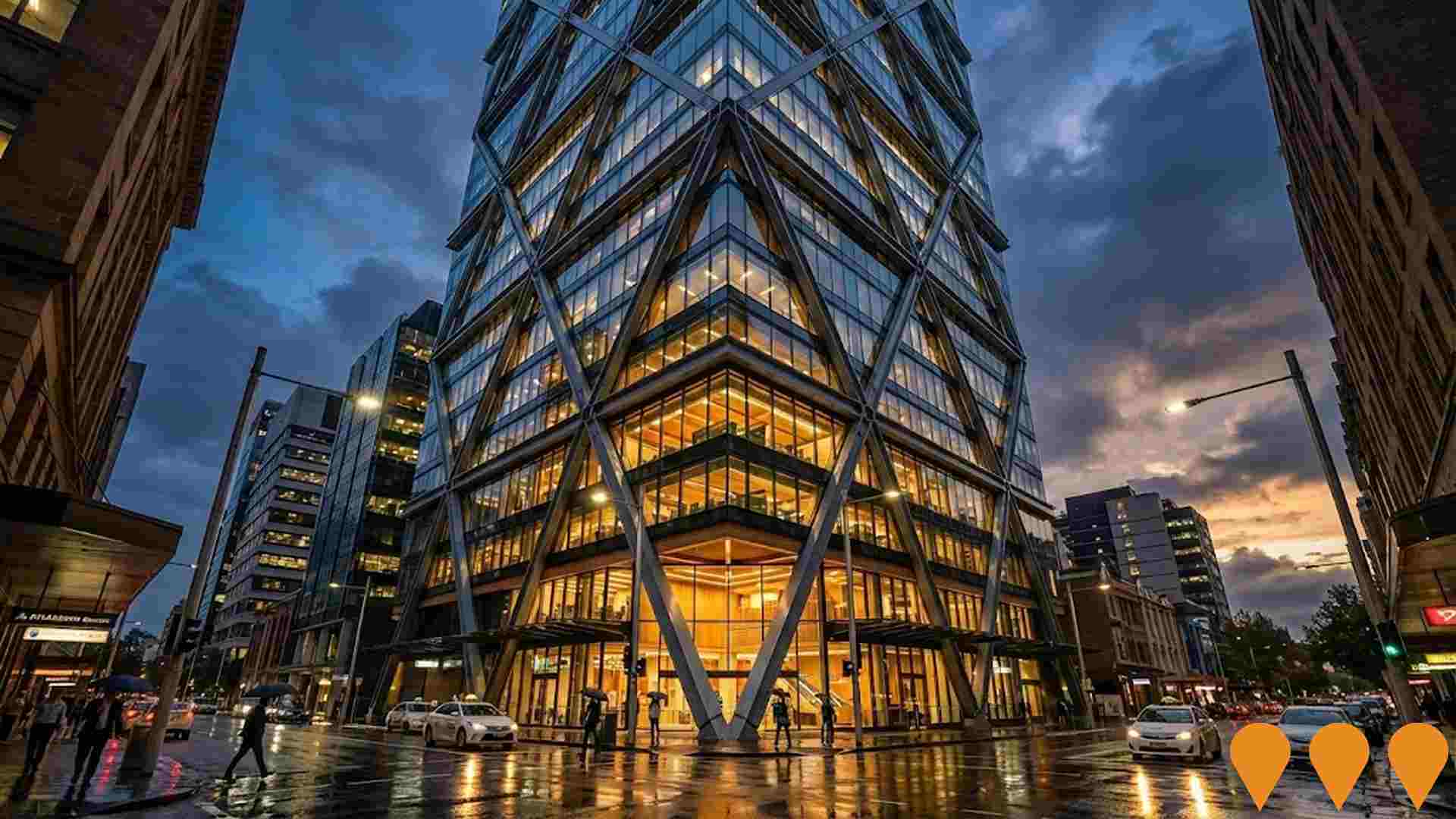

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Central Precinct Renewal Program

The Central Precinct Renewal Program (formerly Central to Eveleigh) transforms 24 hectares of government land around Sydney's Central Station into a global innovation and technology precinct known as 'Tech Central'. The project involves building a deck over the rail lines to create new public squares, parks, and mixed-use towers. Key developments include the Atlassian Central hybrid timber tower and Central Place Sydney. Rezoning was approved in August 2025, enabling approx 950 new homes, 28,700 jobs, and improved pedestrian connections between Surry Hills, Chippendale, and Redfern.

Central Place Sydney

A $3 billion flagship commercial development at the heart of Sydney's 'Tech Central' precinct. The project features two sustainable office towers (35 and 37 storeys) and a low-rise 'connector' building, delivering over 130,000sqm of premium workspace. Designed by SOM and Fender Katsalidis, it aims for 100% renewable energy operations and includes AI-powered closed cavity facades, extensive public realm upgrades, and retail amenities. It will serve as a workplace for over 15,000 employees.

Central Precinct Renewal Program

A 24-hectare State Significant Precinct renewal transforming Sydney's Central Station and surrounds. Includes over-station development delivering new commercial towers, residential apartments (up to 2,000 dwellings), revitalised heritage buildings, new public domain, improved pedestrian connections and integrated transport upgrades. The project is the largest integrated renewal of Sydney's central railway hub in over 100 years.

The Post House

45-storey mixed-use tower in the Tech Central precinct incorporating the heritage-listed former Parcels Post Office. Delivers 29,228sqm premium office space, 204-key hotel (levels 10-19), ground-floor and podium retail, co-working spaces, rooftop pool and day spa, and a new public plaza (Henry Deane Plaza). Construction is well underway with completion expected 2028.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet being delivered by RailConnect NSW (UGL, Hyundai Rotem, Mitsubishi Electric Australia) for Transport for NSW. Named after the Darug word for emu, the fleet commenced passenger services on the Central Coast & Newcastle Line on 3 December 2024, followed by the Blue Mountains Line on 13 October 2025. Services on the South Coast Line are scheduled to commence in 2026. The fleet features modern amenities including spacious 2x2 seating, charging ports, improved accessibility with wheelchair spaces and accessible toilets, CCTV emergency help points, and dedicated spaces for luggage, prams and bicycles. The trains operate in flexible 4-car, 6-car, 8-car or 10-car formations. The fleet replaces aging V-set trains that entered service in the 1970s and serves approximately 26 million passenger journeys annually across the electrified intercity network. Supporting infrastructure includes the new Kangy Angy Maintenance Facility, platform extensions, and signaling upgrades at multiple stations.

Atlassian Central

Atlassian's global headquarters, a 39-storey tower designed by SHoP Architects and BVN, anchoring the Tech Central precinct. It is set to be the world's tallest commercial hybrid timber building, featuring a steel exoskeleton and glass facade, providing 75,000sqm of office space. The project integrates the heritage-listed Parcels Building and includes YHA accommodation on lower levels. The design targets a 50% reduction in embodied carbon and operates on 100% renewable energy. Construction began in August 2022 and is forecast for practical completion in November 2026.

Hyde Metropolitan

55-storey premium mixed-use tower by Deicorp designed by Candalepas Associates overlooking Hyde Park. Features 168 luxury residential apartments above a 100-room boutique hotel and ground-floor retail including restaurant and Skybar. Amenities include 20-metre podium pool, gym, sauna, terrace with BBQ facilities, music room, and concierge service. Residences feature 2.9-metre ceilings, wintergardens, floor-to-ceiling glazing, marble and timber finishes, and panoramic views of Hyde Park, Sydney Harbour and city skyline. Construction underway following demolition of former Polding Centre.

Harbourside Redevelopment by Mirvac

Mixed-use redevelopment of the former Harbourside Shopping Centre at Darling Harbour. Under a Mirvac and Mitsubishi Estate joint venture, the project delivers a 42-storey residential tower with about 263 apartments, around 33,500 sqm of office, 10,000 sqm of retail and hospitality, and 10,200 sqm of public domain including a widened waterfront promenade and proposed Waterfront Gardens. State Significant Development approvals include main works (Dec 2023) and public domain works (Jun 2025). Construction is underway with staged completion from late 2026.

Employment

Sydney (South) - Haymarket ranks among the top 25% of areas assessed nationally for overall employment performance

Sydney South - Haymarket has a highly educated workforce with professional services well represented. Its unemployment rate as of September 2025 is 1.7%.

This rate is 2.5% below Greater Sydney's rate of 4.2%, while workforce participation is similar at 60.0%. Leading employment industries among residents are accommodation & food, professional & technical, and finance & insurance. The area specializes particularly in accommodation & food with an employment share 4.3 times the regional level. Conversely, health care & social assistance shows lower representation at 6.3% versus the regional average of 14.1%.

As of the Census, there are 2.6 workers for every resident, indicating the area functions as an employment hub hosting more jobs than residents and attracting workers from surrounding areas. Over the 12 months to September 2025, labour force levels decreased by 0.8% alongside a 1.2% employment decline, causing unemployment to rise by 0.3 percentage points. In contrast, Greater Sydney experienced employment growth of 2.1% and labour force growth of 2.4%, with a 0.2 percentage point rise in unemployment. State-level data to 25-Nov shows NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. National employment forecasts from May-25 project national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Sydney South - Haymarket's employment mix suggests local employment should increase by 6.7% over five years and 13.3% over ten years.

Frequently Asked Questions - Employment

Income

The area's income profile falls below national averages based on AreaSearch analysis

According to AreaSearch's aggregation of latest postcode level ATO data released on 30 June 2022 for financial year 2022, Sydney (South) - Haymarket SA2 had a median income among taxpayers of $42,927 and an average income of $107,563. These figures are exceptionally high nationally compared to the Greater Sydney levels of $56,994 for median income and $80,856 for average income. Based on Wage Price Index growth of 12.61% since financial year 2022, current estimates as of September 2025 would be approximately $48,340 (median) and $121,127 (average). According to 2021 Census figures, household income ranks at the 73rd percentile with a weekly income of $2,108, while personal income sits at the 52nd percentile. Income analysis shows that the $1,500 - 2,999 bracket dominates with 34.6% of residents (8,235 people), consistent with broader trends across regional levels showing 30.9% in the same category. Economic strength is evident through 31.0% of households achieving high weekly earnings exceeding $3,000, supporting elevated consumer spending. High housing costs consume 25.8% of income, but strong earnings still place disposable income at the 58th percentile. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Sydney (South) - Haymarket features a more urban dwelling mix with significant apartment living, with a higher proportion of rental properties than the broader region

In Sydney (South) - Haymarket, as per the latest Census data, houses made up 0.1% of dwellings while 99.9% were other types such as semi-detached and apartments. This contrasts with Sydney metropolitan area's figures of 2.3% houses and 97.7% other dwellings. Home ownership in Sydney (South) - Haymarket stood at 12.0%, lower than the Sydney metro average, with mortgaged properties at 11.0% and rented dwellings at 76.9%. The median monthly mortgage repayment in the area was $2,600, below the Sydney metro average of $2,705. Weekly rent median was recorded at $620 compared to Sydney metro's $550. Nationally, Sydney (South) - Haymarket's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Sydney (South) - Haymarket features high concentrations of group households and lone person households, with a higher-than-average median household size

Family households constitute 50.3% of all households, including 9.2% couples with children, 33.5% couples without children, and 4.5% single parent families. Non-family households account for the remaining 49.7%, with lone person households at 30.4% and group households comprising 19.3%. The median household size is 2.3 people, surpassing the Greater Sydney average of 1.9.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Sydney (South) - Haymarket exceeds national averages, with above-average qualification levels and academic performance metrics

Educational attainment in Sydney (South) - Haymarket shows significant surpassing of broader benchmarks. Among residents aged 15+, 53.0% hold university qualifications, compared to Australia's 30.4% and NSW's 32.2%. This area's educational advantage is notable with bachelor degrees at 36.2%, followed by postgraduate qualifications (15.1%) and graduate diplomas (1.7%). Trade and technical skills are prominent, with vocational credentials held by 26.1% of residents aged 15+, including advanced diplomas (18.9%) and certificates (7.2%).

Educational participation is high, with 43.9% currently enrolled in formal education, comprising 12.8% in tertiary education, 2.0% in primary education, and 1.6% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Sydney (South) - Haymarket shows that there are currently 61 active transport stops operating. These stops offer a mix of ferry, train, light rail, and bus services. In total, these stops are serviced by 143 individual routes, which collectively provide 57,309 weekly passenger trips.

The report rates the transport accessibility as excellent, with residents typically located an average of 147 meters from their nearest transport stop. On a daily basis, service frequency averages 8,187 trips across all routes, equating to approximately 939 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Sydney (South) - Haymarket's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Sydney South - Haymarket shows excellent health outcomes, with very low prevalence of common health conditions across all age groups. The rate of private health cover is exceptionally high at approximately 75% of the total population (17,780 people), compared to 69.7% across Greater Sydney and a national average of 55.3%. The most prevalent medical conditions in the area are asthma and mental health issues, affecting 2.9 and 2.9% of residents respectively, while 90.9% declare themselves completely clear of medical ailments compared to 77.4% across Greater Sydney.

The area has 4.5% of residents aged 65 and over (1,082 people), lower than the 9.7% in Greater Sydney. Health outcomes among seniors are particularly strong, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Sydney (South) - Haymarket is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Sydney (South) - Haymarket has a culturally diverse population, with 76.0% speaking a language other than English at home and 82.9% born overseas. The dominant religion is Buddhism, practiced by 30.2%. This is significantly higher than the Greater Sydney average of 7.1%.

The top three ancestry groups are Chinese (33.5%), Other (33.3%), and English (9.1%). Notably, Korean (3.1%) and Vietnamese (2.2%) are overrepresented compared to regional averages of 1.1% and 1.2%, respectively. Spanish representation is slightly higher at 0.8%.

Frequently Asked Questions - Diversity

Age

Sydney (South) - Haymarket hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Sydney (South) - Haymarket's median age is 31 years, which is lower than the Greater Sydney average of 37 and the Australian median of 38. Compared to Greater Sydney, Sydney (South) - Haymarket has a higher percentage of residents aged 25-34 at 42.0%, but fewer residents aged 5-14 at 2.2%. This concentration of 25-34 year-olds is significantly higher than the national average of 14.5%. Between 2021 and present, the percentage of residents aged 35-44 has increased from 19.8% to 21.0%, while the percentage of those aged 55-64 has decreased from 5.0% to 4.0%. By 2041, demographic modeling suggests significant changes in Sydney (South) - Haymarket's age profile. The 25-34 age cohort is projected to grow by 2,315 people, increasing from 10,006 to 12,322 residents.