Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Darlington has seen population growth performance typically on par with national averages when looking at short and medium term trends

As of November 2025, the population of the Darlington (Sydney - NSW) statistical area (Lv2) is estimated at approximately 2,955 people. This represents an increase of 358 individuals since the 2021 Census, which recorded a population of 2,597. The latest estimate is based on AreaSearch's validation of new addresses following the examination of the ABS's ERP data release from June 2024 and includes an additional validated address since the Census date. This results in a population density ratio of 7,776 persons per square kilometer, placing Darlington (Sydney - NSW) in the top 10% of national locations assessed by AreaSearch. The growth rate of 13.8% since the 2021 Census exceeds both the state's growth rate of 7.6% and that of the metropolitan area, indicating a significant population increase in Darlington (Sydney - NSW). This growth is primarily driven by overseas migration, contributing approximately 94.0% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch employs the NSW State Government's SA2 level projections released in 2022 using a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Based on projected demographic shifts and aggregated SA2-level projections, the Darlington (Sydney - NSW) (SA2) is forecasted to experience a significant population increase, with an expected expansion of 1,153 persons by 2041. This reflects a gain of 42.8% in total over the 17-year period.

Frequently Asked Questions - Population

Development

The level of residential development activity in Darlington is very low in comparison to the average area assessed nationally by AreaSearch

Darlington has seen minimal dwelling approvals in recent years. Between FY21 and FY25, approximately 4 homes were approved, with none yet recorded for FY26.

The area's population decline suggests that new supply has been meeting demand, presenting buyers with good choices. Developers focus on the premium segment, with average construction costs of $625,000. Compared to Greater Sydney, Darlington has significantly less development activity, which typically strengthens demand and prices for existing properties. This scarcity is below the national average, indicating the area's established nature and suggesting potential planning limitations.

Frequently Asked Questions - Development

Infrastructure

Darlington has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

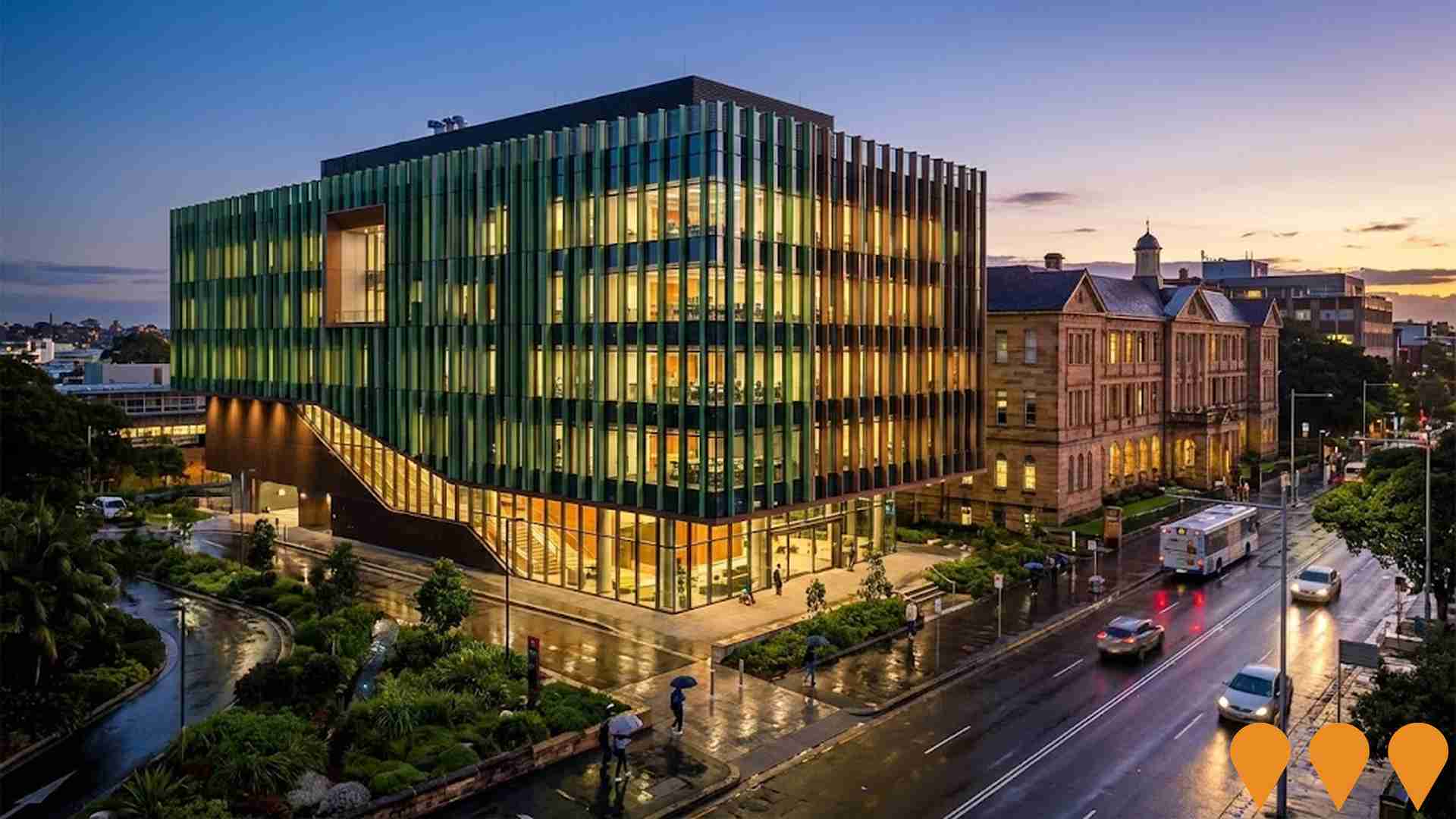

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified 12 projects that could affect the region. Notable initiatives include the University of Sydney Campus Transformation, Redfern North Eveleigh Paint Shop Sub-Precinct, University of Sydney Biomedical Accelerator (SBA), and Royal Prince Alfred Hospital Redevelopment. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Erskineville Village

$2.3 billion urban renewal masterplan transforming a 50,000sqm former industrial site into a vibrant mixed-use community. The project includes approximately 1,300 new homes, primarily Build-to-Rent (BTR) apartments operated by Nation, including 169 affordable housing dwellings managed by Evolve Housing. Key elements include the 7,500sqm McPherson Park, the Kooka Walk pedestrian boulevard, and 5,000sqm of retail and dining precincts. Construction is currently underway with early works and infrastructure upgrades progressing.

The Erskineville Project (Ashmore Precinct)

A $2.3 billion urban renewal masterplan transforming a 50,000sqm former industrial site into a vibrant mixed-use precinct. The development features approximately 1,300 residences across Build-to-Rent (operated by Nation) and Build-to-Sell (Lillian) stages, including 169 affordable housing units. Key amenities include the 7,500sqm McPherson Park, the 20m wide Kooka Walk pedestrian and cycle boulevard, and 5,000sqm of retail and dining space.

Royal Prince Alfred Hospital Redevelopment

A $940 million transformation of the Royal Prince Alfred Hospital, the most significant in its 140-year history. The project includes a new 15-storey East Tower, vertical and horizontal expansions, and major refurbishments. Key features include an expanded Emergency Department (doubling to 91 spaces), an enhanced ICU (increasing to 74 beds), new operating theatres, and expanded neonatal, maternity, and paediatric units. The project also features a new rooftop helipad and open garden courtyard.

NSW Health Infrastructure Program - Inner West

A comprehensive healthcare investment program across Sydney's Inner West, featuring the $940 million Royal Prince Alfred (RPA) Hospital Redevelopment and the $350 million Canterbury Hospital upgrade. The program delivers new clinical services buildings, expanded emergency departments, and enhanced intensive care units to meet growing community needs. Key active sites include the RPA campus in Camperdown and ongoing clinical service expansions at Canterbury Hospital.

Central Place Sydney

A $3 billion flagship commercial development at the heart of Sydney's Tech Central precinct. The project features two sustainable office towers (35 and 37 storeys) and an 8-storey 'Connector' building, delivering over 130,000sqm of premium workspace. Designed by SOM, Fender Katsalidis, and Edition Office, it targets net-zero emissions with AI-powered closed cavity facades, 100% renewable energy operations, and 5,000sqm of retail and dining spaces.

Redfern North Eveleigh Paint Shop Sub-Precinct

A State Significant Precinct renewal transforming 10 hectares of former rail yards into a mixed-use innovation, residential, and cultural hub. The Paint Shop sub-precinct features 110,000 sqm of commercial space for Tech Central, approximately 320-450 dwellings with 15% affordable and 15% diverse housing, and the adaptive reuse of the historic 1888 Paint Shop building. The masterplan includes 1.4 hectares of new public space, including a town square fronting Wilson Street and improved pedestrian links to the upgraded Redfern Station.

Redfern Place

A $350 million mixed-tenure urban renewal precinct delivering 355 new homes, including 147 social housing units, 197 affordable housing units, and 11 specialist disability support homes. The development features a new community hub with a replacement PCYC facility, the head office for Bridge Housing, ground-floor retail and commercial spaces, and extensive public domain upgrades including a central garden and rooftop terraces. The project is a partnership between Bridge Housing and Capella Capital, designed with a focus on 'Designing with Country' principles.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet (D sets) replacing the aging V-set fleet across the NSW intercity network. Delivered by the RailConnect consortium, the trains feature 2x2 seating, charging ports, dedicated luggage/bicycle spaces, and enhanced accessibility with wheelchair spaces and accessible toilets. The fleet operates in 4, 6, 8, or 10-car formations. Passenger services commenced on the Central Coast & Newcastle Line on 3 December 2024 and the Blue Mountains Line on 13 October 2025. South Coast Line services are scheduled to begin in the first half of 2026. The project includes the Kangy Angy Maintenance Facility and extensive corridor upgrades such as platform extensions and signaling modifications.

Employment

The employment landscape in Darlington shows performance that lags behind national averages across key labour market indicators

Darlington has a highly educated workforce, with the technology sector prominently represented. Its unemployment rate is 5.2%, as per AreaSearch's aggregation of statistical area data.

As of September 2025, Darlington has 1,865 residents in work, with an unemployment rate of 6.2% compared to Greater Sydney's 4.2%. Workforce participation stands at 66.5% versus Greater Sydney's 60.0%. Key industries for employment among residents are professional & technical, education & training, and health care & social assistance. Darlington specializes in professional & technical jobs, with an employment share 1.7 times the regional level.

However, construction is under-represented at 5.2% compared to Greater Sydney's 8.6%. The area hosts more jobs than residents, with a ratio of 1.6 workers per resident, attracting workers from surrounding areas. Over the year ending September 2025, labour force levels decreased by 1.5%, accompanied by a 1.5% drop in employment, keeping unemployment relatively stable. In contrast, Greater Sydney saw employment grow by 2.1% and labour force growth of 2.4%, with a slight rise in unemployment to 4.4%. State-level data as of 25-Nov shows NSW employment contracted by 0.03%, with the state unemployment rate at 3.9%. Nationally, employment is forecast to expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Darlington's employment mix suggests local employment should increase by 7.2% over five years and 14.5% over ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates above-average performance, with income metrics exceeding national benchmarks based on AreaSearch comparative assessment

The suburb of Darlington had a median taxpayer income of $50,267 and an average income of $65,974 in financial year 2023, according to postcode level ATO data aggregated by AreaSearch. This is lower than the national average, with Greater Sydney having a median income of $60,817 and an average income of $83,003 during the same period. As of September 2025, estimated incomes are approximately $54,721 (median) and $71,819 (average), based on Wage Price Index growth of 8.86%. In financial year 2021, household incomes ranked at the 87th percentile ($2,392 weekly), while personal income ranked at the 44th percentile. Income distribution shows that 30.7% of locals (907 people) fall within the $1,500 - 2,999 category. Economic strength is evident with 41.4% of households earning high weekly incomes exceeding $3,000. However, high housing costs consume 23.0% of income. Despite this, disposable income ranks at the 77th percentile, and the area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Darlington displays a diverse mix of dwelling types, with above-average rates of outright home ownership

Darlington's dwelling structure, as per the latest Census, had 3.8% houses and 96.2% other dwellings (semi-detached, apartments, 'other' dwellings), contrasting with Sydney metro's 2.3% houses and 97.7% other dwellings. Home ownership in Darlington stood at 18.2%, with mortgaged dwellings at 21.2% and rented ones at 60.5%. The median monthly mortgage repayment was $3,200, higher than Sydney metro's average of $2,705. Median weekly rent in Darlington was $650, compared to Sydney metro's $550. Nationally, Darlington's mortgage repayments were significantly higher at $3,200 versus the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Darlington features high concentrations of group households, with a higher-than-average median household size

Family households constitute 46.8% of all households, including 11.3% couples with children, 28.8% couples without children, and 5.3% single parent families. Non-family households comprise the remaining 53.2%, with lone person households at 29.3% and group households making up 23.6%. The median household size is 2.3 people, larger than the Greater Sydney average of 1.9.

Frequently Asked Questions - Households

Local Schools & Education

Darlington performs slightly above the national average for education, showing competitive qualification levels and steady academic outcomes

Darlington's educational attainment is notably higher than national and state averages. As of 2021, 57.5% of residents aged 15 years and above hold university qualifications, compared to Australia's 30.4% and New South Wales' (NSW) 32.2%. Bachelor degrees are the most common at 37.9%, followed by postgraduate qualifications at 16.5% and graduate diplomas at 3.1%. Technical qualifications make up 12.8% of educational achievements, with advanced diplomas at 6.2% and certificates at 6.6%.

Educational participation is high, with 48.6% of residents currently enrolled in formal education as of the latest data. This includes 39.6% in tertiary education, 2.4% in primary education, and 2.0% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Darlington has eight active public transport stops, all of which are bus stops. These stops are served by 14 different routes that together facilitate 4630 weekly passenger trips. The accessibility of these services is considered good, with residents on average located just 226 meters from the nearest stop.

On a daily basis, there are an average of 661 trips across all routes, which equates to approximately 578 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Darlington's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Darlington has excellent health outcomes, with a low prevalence of common conditions across all ages. Private health cover is held by approximately 53% of Darlington residents (~1,567 people), higher than the average SA2 area but lower than Greater Sydney's 68.5%.

Mental health issues affect 11.8% and asthma affects 7.7% of Darlington residents. 75.9% report no medical ailments, compared to 77.4% in Greater Sydney. Only 5.0% of residents are aged 65 and over (147 people), lower than the 9.7% in Greater Sydney. Senior health outcomes align with those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

Darlington is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Darlington's population shows high cultural diversity, with 32.4% speaking a language other than English at home and 43.8% born overseas. Christianity is the predominant religion in Darlington, comprising 19.8% of its population. Judaism is slightly overrepresented compared to Greater Sydney, making up 1.2% versus 1.1%.

The top three ancestry groups are English (20.4%), Australian (17.2%), and Chinese (13.7%). Notably, French (1.0%) and New Zealand (1.0%) ethnicities are overrepresented in Darlington compared to regional percentages of 1.1% and 0.6%, respectively. Russian ethnicity is underrepresented at 0.5%.

Frequently Asked Questions - Diversity

Age

Darlington hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Darlington's median age is 25 years, significantly below Greater Sydney's average of 37 and the national average of 38 years. Compared to Greater Sydney, Darlington has a higher proportion of 15-24 year-olds at 39.4%, but fewer 5-14 year-olds at 1.5%. This concentration of 15-24 year-olds is well above the national average of 12.5%. According to the 2021 Census, Darlington's median age has decreased by 1.8 years to 25 from its previous figure of 27. The proportion of 15-24 year-olds has grown from 34.3% to 39.4%, while the 35-44 cohort has declined from 10.9% to 8.8% and the 45-54 group has dropped from 7.9% to 6.3%. By 2041, demographic projections indicate significant shifts in Darlington's age structure, with the strongest growth projected for the 15-24 cohort at 34%, adding 390 residents to reach a total of 1,555.