Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Chippendale are slightly above average based on AreaSearch's ranking of recent, and medium term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch, Chippendale's population is estimated at around 9,511 as of Nov 2025. This reflects an increase of 1,708 people (21.9%) since the 2021 Census, which reported a population of 7,803 people. The change is inferred from the resident population of 9,490, estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024 and an additional 16 validated new addresses since the Census date. This level of population equates to a density ratio of 20,676 persons per square kilometer, placing Chippendale (SA2) in the top 10% of national locations assessed by AreaSearch. The area's 21.9% growth since the 2021 Census exceeded the state's growth rate of 7.6%. Population growth for the area was primarily driven by overseas migration, contributing approximately 95.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections, released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Looking ahead, Chippendale (SA2) is predicted to experience exceptional growth over the period, expanding by 4,843 persons to 2041 based on aggregated SA2-level projections, reflecting an increase of 50.7% in total over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Chippendale according to AreaSearch's national comparison of local real estate markets

AreaSearch analysis of ABS building approval numbers indicates Chippendale has around 28 residential properties granted approval per year on average over the past five financial years, totalling an estimated 143 homes. As of FY-26, no approvals have been recorded so far. Each dwelling built attracted an average of 3.1 people moving to the area annually between FY-21 and FY-25, suggesting supply is lagging demand, leading to heightened buyer competition and pricing pressures. New dwellings are developed at an average expected construction cost of $120,000, below the regional average, indicating more affordable housing options for buyers.

In FY-26, $62,000 in commercial development approvals have been recorded, reflecting a predominantly residential focus. Compared to Greater Sydney, Chippendale shows approximately 56% of the construction activity per person and ranks among the 5th percentile nationally when measured against areas assessed, resulting in relatively constrained buyer choice and supporting interest in existing dwellings.

This activity is also lower than the national average, indicating market maturity and possible development constraints. Latest AreaSearch quarterly estimate projects Chippendale will gain 4,822 residents by 2041. At current development rates, housing supply may struggle to match population growth, potentially heightening buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

Chippendale has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified 23 projects likely affecting the region. Notable initiatives include The Post House, University of Sydney Darlington Terraces Redevelopment, UTS National First Nations College, and Atlassian Central, with subsequent details focusing on those most pertinent.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

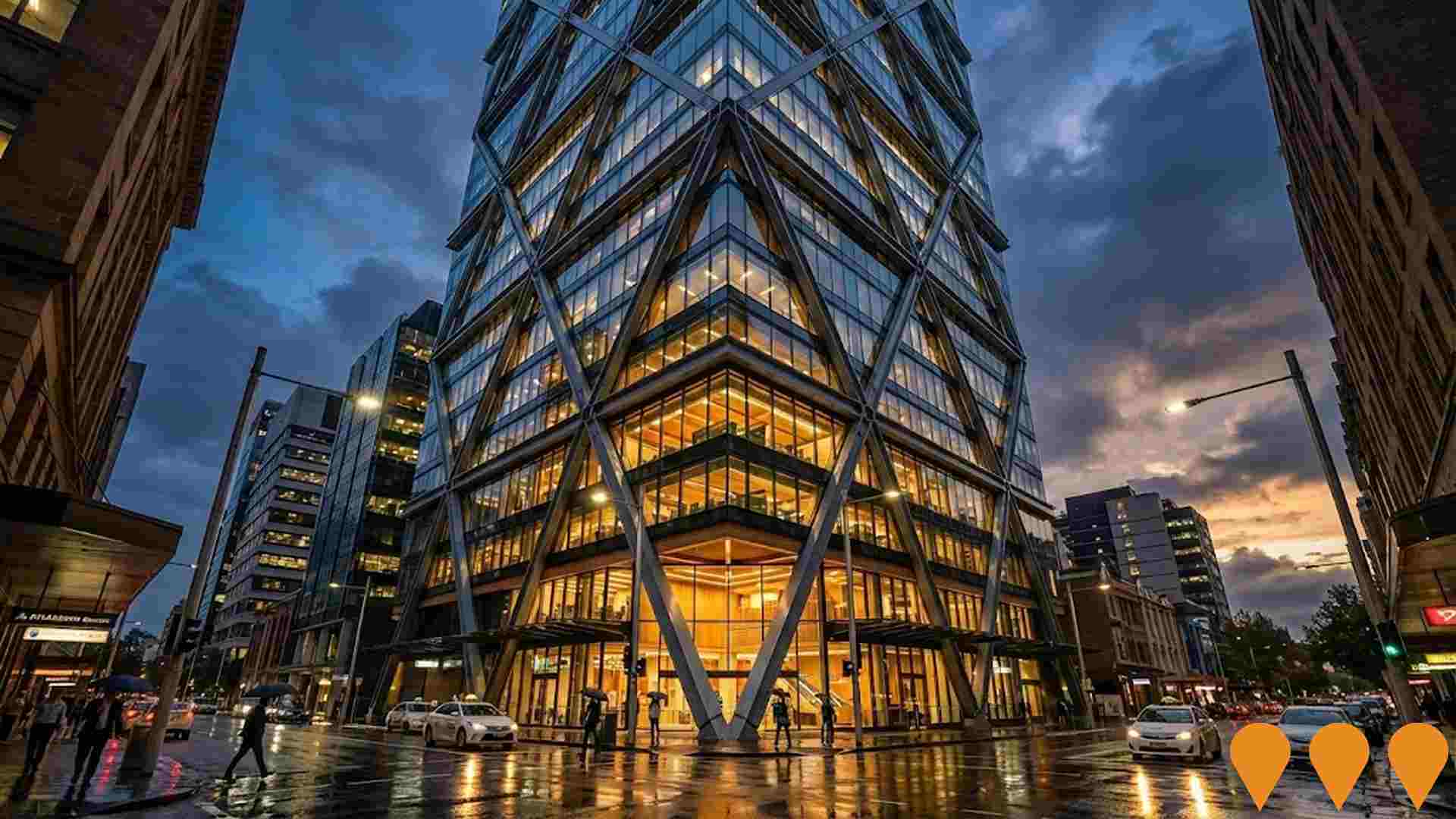

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Central Precinct Renewal Program

The Central Precinct Renewal Program is a 24-hectare urban renewal project transforming government land around Sydney's Central Station into a global innovation and technology hub. Approved for rezoning in August 2025, the program will deliver approximately 950 new homes (30 percent affordable), 2,400 new jobs, and 13,500 square metres of new public open space. Key sub-projects include the Atlassian Central hybrid timber tower, Central Place Sydney, and the Sydney Terminal Building Revitalisation. The vision integrates tech innovation, heritage conservation, and improved pedestrian connectivity between Surry Hills, Chippendale, and Redfern.

Tech Central Innovation Precinct

A 6-square-kilometre innovation district spanning Haymarket, Camperdown, and South Eveleigh. It is designed as Australia's premier deep-tech and advanced manufacturing hub, supporting a $42 billion economy. The precinct features the flagship Atlassian Central, a 39-storey hybrid timber tower, alongside the Tech Central Innovation Hub at 477 Pitt Street. While the $3 billion Central Place Sydney office project was pivoted to student housing in late 2025 due to market conditions, the broader precinct continues to expand with a refreshed 2025 Economic Development Strategy focusing on 25,000 innovation jobs and 950 new homes.

Central Place Sydney

A $3 billion flagship commercial development at the heart of Sydney's Tech Central precinct. The project features two sustainable office towers (35 and 37 storeys) and an 8-storey 'Connector' building, delivering over 130,000sqm of premium workspace. Designed by SOM, Fender Katsalidis, and Edition Office, it targets net-zero emissions with AI-powered closed cavity facades, 100% renewable energy operations, and 5,000sqm of retail and dining spaces.

The Post House

A 45-storey mixed-use tower in the Tech Central precinct, also known as TOGA Central. The development integrates the heritage-listed former Parcels Post Office and delivers 29,228sqm of premium office space, a 204-key boutique hotel, and ground-floor/podium retail. Key features include a rooftop pool, day spa, gym, and the new public Henry Deane Plaza. The project targets a 6-star Green Star and 5.5-star NABERS Energy rating.

Atlassian Central

Atlassian's global headquarters is a 39-storey tower anchoring the Tech Central precinct. Set to be the world's tallest commercial hybrid timber building, it features a steel exoskeleton and glass facade, providing 75,000sqm of office space. The project integrates the heritage-listed Parcels Building and includes 137-room YHA accommodation. The design targets a 50% reduction in embodied carbon and operates on 100% renewable energy. Structural works are well advanced with top-out expected in May 2026.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet (D sets) replacing the aging V-set fleet across the NSW intercity network. Delivered by the RailConnect consortium, the trains feature 2x2 seating, charging ports, dedicated luggage/bicycle spaces, and enhanced accessibility with wheelchair spaces and accessible toilets. The fleet operates in 4, 6, 8, or 10-car formations. Passenger services commenced on the Central Coast & Newcastle Line on 3 December 2024 and the Blue Mountains Line on 13 October 2025. South Coast Line services are scheduled to begin in the first half of 2026. The project includes the Kangy Angy Maintenance Facility and extensive corridor upgrades such as platform extensions and signaling modifications.

Central Park

A $2 billion mixed-use urban renewal precinct on the former Carlton & United Brewery site (5.8 ha). Delivered over 2,200 apartments, student accommodation, retail (Central Park Mall), offices, hotels, childcare and public parkland including the 6,400 mý Chippendale Green. Iconic elements include the One Central Park towers (Jean Nouvel & PTW Architects) featuring the world's tallest vertical gardens by Patrick Blanc, a cantilevered heliostat and light installation. A benchmark for sustainable inner-city regeneration in Australia.

Redfern North Eveleigh Paint Shop Sub-Precinct

A State Significant Precinct renewal transforming 10 hectares of former rail yards into a mixed-use innovation, residential, and cultural hub. The Paint Shop sub-precinct features 110,000 sqm of commercial space for Tech Central, approximately 320-450 dwellings with 15% affordable and 15% diverse housing, and the adaptive reuse of the historic 1888 Paint Shop building. The masterplan includes 1.4 hectares of new public space, including a town square fronting Wilson Street and improved pedestrian links to the upgraded Redfern Station.

Employment

The employment landscape in Chippendale shows performance that lags behind national averages across key labour market indicators

Chippendale has a highly educated workforce, particularly in the technology sector. Its unemployment rate is 4.9%, according to AreaSearch's aggregation of statistical area data.

As of September 2025, there are 5,836 employed residents, with an unemployment rate of 4.2% above Greater Sydney's rate. Workforce participation is 63.0%. Leading employment industries include professional & technical, accommodation & food, and education & training. Professional & technical jobs are particularly concentrated, at 1.8 times the regional average.

Construction employs only 3.3% of local workers, below Greater Sydney's 8.6%. The worker-to-resident ratio is 0.7, indicating above-average employment opportunities. Between September 2024 and 2025, Chippendale's labour force decreased by 1.3%, with employment down by 1.0%, leading to a unemployment rate drop of 0.3 percentage points. In contrast, Greater Sydney saw employment growth of 2.1%. State-level data from 25-Nov-25 shows NSW employment contracted by 0.03% (losing 2,260 jobs), with an unemployment rate of 3.9%, compared to the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts project overall growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Chippendale's employment mix suggests local employment could increase by 7.2% over five years and 14.3% over ten years, though this is a simplified extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

The median taxpayer income in Chippendale is $47,408, with an average of $68,064, based on the latest postcode level ATO data aggregated by AreaSearch for financial year 2023. Nationally, the median income is approximately $51,608 as of September 2025, adjusted for Wage Price Index growth of 8.86%. In Greater Sydney, the median income is $60,817 and the average is $83,003. According to the 2021 Census, Chippendale's personal income ranks at the 64th percentile ($882 weekly), with household income at the 41st percentile. The $1,500 - $2,999 earnings band captures 30.6% of Chippendale's community (2,910 individuals). Housing affordability pressures are severe, with only 70.3% of income remaining after housing costs, ranking at the 24th percentile. The area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

Chippendale features a more urban dwelling mix with significant apartment living, with a higher proportion of rental properties than the broader region

Chippendale's dwelling structure, according to the latest Census, consisted of 0.1% houses and 100.0% other dwellings (semi-detached, apartments, 'other' dwellings), contrasting with Sydney metro's 2.3% houses and 97.7% other dwellings. Home ownership in Chippendale stood at 9.1%, with mortgaged dwellings at 13.1% and rented ones at 77.8%. The median monthly mortgage repayment was $2,409, below Sydney metro's average of $2,705. The median weekly rent in Chippendale was $520, compared to Sydney metro's $550. Nationally, Chippendale's mortgage repayments were higher at $2,409 versus the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Chippendale features high concentrations of group households and lone person households, with a lower-than-average median household size

Family households constitute 37.9% of all households, including 5.1% couples with children, 27.4% couples without children, and 2.7% single parent families. Non-family households account for the remaining 62.1%, with lone person households at 46.2% and group households comprising 16.0%. The median household size is 1.8 people, which is smaller than the Greater Sydney average of 1.9.

Frequently Asked Questions - Households

Local Schools & Education

Educational achievement in Chippendale places it within the top 10% nationally, reflecting strong academic performance and high qualification levels across the community

Chippendale's educational attainment significantly exceeds broader benchmarks. Among residents aged 15+, 63.4% hold university qualifications, compared to 30.4% nationally and 32.2% in NSW. This high level of educational attainment positions the area favourably for knowledge-based opportunities. Bachelor degrees are most prevalent at 40.0%, followed by postgraduate qualifications (21.0%) and graduate diplomas (2.4%).

Vocational pathways account for 15.1% of qualifications among those aged 15+, with advanced diplomas at 9.4% and certificates at 5.7%. Educational participation is notably high, with 46.2% of residents currently enrolled in formal education. This includes 32.6% in tertiary education, 1.3% in primary education, and 1.3% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Chippendale has nine active public transport stops operating currently. These stops serve a mix of bus routes, totaling 42 different ones. Together, these routes facilitate 12,559 weekly passenger trips.

The accessibility to transport is rated excellent, with residents typically located just 143 meters from the nearest stop. On average, service frequency across all routes amounts to 1,794 trips per day, which equates to approximately 1395 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Chippendale's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Chippendale shows excellent health outcomes across all age groups, with a very low prevalence of common health conditions. Private health cover stands at approximately 54% of the total population (~5,121 people), higher than the average SA2 area but lower than Greater Sydney's 68.5%.

Mental health issues and asthma are the most prevalent medical conditions in Chippendale, affecting 7.7% and 5.4% of residents respectively. A significant majority (84.4%) report being completely free from medical ailments, compared to 77.4% across Greater Sydney. The area has a lower proportion of seniors aged 65 and over at 3.6% (342 people), compared to Greater Sydney's 9.7%. Health outcomes among Chippendale's senior residents are strong and largely align with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Chippendale is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Chippendale has a population where 57.3% speak a language other than English at home, and 67.3% were born overseas. Christianity is the predominant religion in Chippendale with 21.0%. Buddhism is notably higher here compared to Greater Sydney, comprising 10.3% versus 7.1%.

In terms of ancestry, Chinese make up 29.9%, Other 17.6%, and English 13.3%. The Chinese figure is significantly higher than the regional average of 13.0%. Spanish (1.1%), Korean (1.8%), and French (0.9%) are also notably present compared to regional averages.

Frequently Asked Questions - Diversity

Age

Chippendale hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Chippendale's median age was recorded as 28 in the census, which is lower than Greater Sydney's figure of 37 and Australia's median age of 38. The age profile indicated that those aged 25-34 were most prominent at 39.2%, while those aged 5-14 made up only 1.4% of the population, which is smaller than in Greater Sydney. This concentration of 25-34 year-olds was significantly higher than the national average of 14.5%. Post-census data showed that the 15 to 24 age group had increased from 28.9% to 30.7%, while the 55 to 64 cohort had decreased from 4.4% to 3.7%. By 2041, significant shifts in Chippendale's age composition are expected. The 45 to 54 age group is projected to grow exceptionally, increasing by 1,530 people (264%) from 580 to 2,111. Conversely, the number of those aged 25 to 34 is expected to fall by 909.