Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Alexandria lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Based on ABS population updates and AreaSearch validations, as of Nov 2025, Alexandria's estimated population is around 11,056. This reflects a growth of 1,407 people since the 2021 Census, which reported a population of 9,649. The increase is inferred from AreaSearch's estimate of 10,828 residents in Jun 2024, based on latest ERP data release by ABS, and additional 340 validated new addresses since the Census date. This results in a density ratio of 3,123 persons per square kilometer, placing Alexandria in the upper quartile nationally. Alexandria's growth rate of 14.6% since 2021 exceeded both state (7.6%) and metropolitan area averages, indicating it as a growth leader. Overseas migration contributed approximately 65.0% to overall population gains recently.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area released in 2024 with 2022 as the base year. For areas not covered by this data, NSW State Government's SA2 level projections released in 2022 with 2021 as the base year are utilised. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Future trends project above median population growth nationally, with Alexandria expected to increase by 2,277 persons to 2041, reflecting a total increase of 17.3% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Alexandria among the top 25% of areas assessed nationwide

AreaSearch analysis of ABS building approval numbers allocated from statistical area data shows Alexandria averaged around 83 new dwelling approvals annually over the past 5 financial years ending June 2021, totalling an estimated 417 homes. As of July 2026 (FY-26), 68 approvals have been recorded. Over these 5 years, each dwelling built resulted in an average of 2.5 new residents annually, reflecting robust demand that supports property values. New homes are being constructed at an average expected cost of $593,000, indicating developers target the premium market segment with higher-end properties.

This financial year has seen $93.8 million in commercial approvals, suggesting strong local business investment. Compared to Greater Sydney, Alexandria exhibits moderately higher building activity, 48.0% above the regional average per person over this period, offering good buyer choice while supporting existing property values. Recent construction comprises 2.0% detached dwellings and 98.0% townhouses or apartments, focusing on higher-density living to create more affordable entry points for downsizers, investors, and first-home buyers. Alexandria reflects a developing area with around 191 people per approval.

Future projections estimate Alexandria will add 1,912 residents by 2041 (latest AreaSearch quarterly estimate). At current development rates, new housing supply should comfortably meet demand, providing good conditions for buyers and potentially supporting growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

Alexandria has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

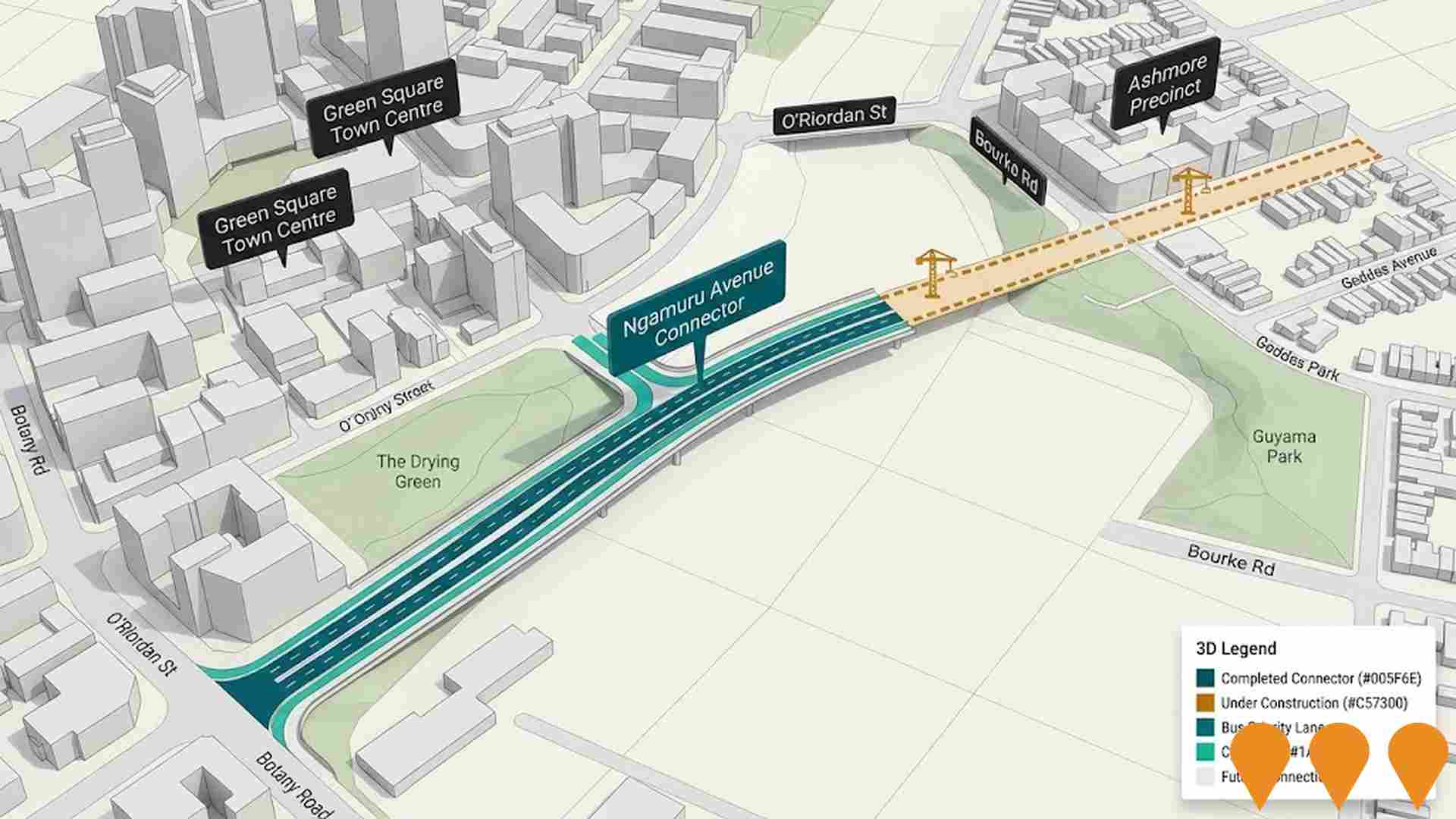

Local infrastructure changes significantly influence an area's performance. AreaSearch has identified 73 projects potentially impacting the area. Notable ones include The Erskineville Project at Ashmore Precinct, Erskineville Village, One Sydney Park, and Green Square to Ashmore Connector via Ngamuru Avenue. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Green Square Town Centre

Australia's largest urban renewal project transforming 278 hectares into a sustainable high-density precinct. By 2030, it will support 61,000 residents and 21,000 jobs. Recent milestones include the 2024 completion of The Frederick, Portman on the Park, and Portman House residential towers. Current works focus on the final stages (Stages 3, 4, and 5) which have been declared State Significant Developments, alongside the construction of the Ngamuru Avenue connector road scheduled for completion in mid-2026. The precinct features the award-winning Green Square Library, Gunyama Park Aquatic Centre, and extensive green infrastructure including a major stormwater harvesting system.

The Erskineville Project (Ashmore Precinct)

A $2.3 billion urban renewal masterplan transforming a 50,000sqm former industrial site into a vibrant mixed-use precinct. The development features approximately 1,300 residences across Build-to-Rent (operated by Nation) and Build-to-Sell (Lillian) stages, including 169 affordable housing units. Key amenities include the 7,500sqm McPherson Park, the 20m wide Kooka Walk pedestrian and cycle boulevard, and 5,000sqm of retail and dining space.

Erskineville Village

$2.3 billion urban renewal masterplan transforming a 50,000sqm former industrial site into a vibrant mixed-use community. The project includes approximately 1,300 new homes, primarily Build-to-Rent (BTR) apartments operated by Nation, including 169 affordable housing dwellings managed by Evolve Housing. Key elements include the 7,500sqm McPherson Park, the Kooka Walk pedestrian boulevard, and 5,000sqm of retail and dining precincts. Construction is currently underway with early works and infrastructure upgrades progressing.

Botany Road Precinct

The Botany Road Precinct is a major urban renewal initiative by the City of Sydney designed to transform a 21-hectare industrial corridor into a high-density commercial and enterprise hub. The plan incentivizes over 280,000 sqm of new employment-focused floorspace, aiming to create 15,000+ jobs by 2036. Key features include building heights up to 17 storeys, mandatory new laneways for better permeability, heritage protections for local landmarks, and significant affordable housing contributions through dedicated floor space incentives. The precinct leverages its location between Redfern Station and the Waterloo Metro to support Sydney's Innovation Corridor.

Waterloo Metro Quarter

The Waterloo Metro Quarter is a $900 million mixed-use integrated station development revitalizing the inner-south Sydney precinct. The project includes four buildings: the southern precinct features 70 social housing units (now completed and managed by Link Wentworth and Birribee Housing) and student accommodation, while the northern and central precincts were recently amended to replace commercial office space with two residential towers of 24 and 21 storeys. The precinct integrates retail, a public plaza named Badumurru Place, and a new community facility, all situated directly above the Waterloo Metro Station.

Redfern Place

A $350 million mixed-tenure urban renewal precinct delivering 355 new homes, including 147 social housing units, 197 affordable housing units, and 11 specialist disability support homes. The development features a new community hub with a replacement PCYC facility, the head office for Bridge Housing, ground-floor retail and commercial spaces, and extensive public domain upgrades including a central garden and rooftop terraces. The project is a partnership between Bridge Housing and Capella Capital, designed with a focus on 'Designing with Country' principles.

Waterloo Metro Quarter

The Waterloo Metro Quarter is a 900 million dollar mixed-use integrated station development (ISD) located above and adjacent to the Waterloo Metro Station. The precinct includes four buildings: two high-rise and two mid-rise structures, delivering a mix of residential apartments, student accommodation, social and affordable housing, and commercial office space. As of February 2026, while the station is operational, the Over Station Development is undergoing assessment for significant modifications to increase residential yield and consolidate community facilities into a childcare center.

WestConnex St Peters Interchange

WestConnex St Peters Interchange is a major motorway interchange connecting the M4-M5 Link tunnels with the existing road network. The interchange includes on and off-ramps, surface roads, and connects to the broader WestConnex motorway network, improving traffic flow and connectivity in the inner west.

Employment

AreaSearch analysis places Alexandria well above average for employment performance across multiple indicators

Alexandria has an educated workforce with a technology sector prominence. Its unemployment rate is 2.8%, as per AreaSearch's statistical area data aggregation.

As of September 2025, 7,646 residents are employed at an unemployment rate of 1.4% below Greater Sydney's 4.2%. Workforce participation is high at 81.1%. Key industries include professional & technical, finance & insurance, and health care & social assistance. The area specializes in professional & technical jobs with a share 1.7 times the regional level, while construction employs just 4.4%, below Greater Sydney's 8.6%.

There are 1.9 workers per resident, indicating it functions as an employment hub attracting external workers. Between September 2024 and 2025, the labour force decreased by 1.2% with a 1.6% employment decline, raising unemployment by 0.4 percentage points. Conversely, Greater Sydney saw employment growth of 2.1%. State-level data to 25-Nov-25 shows NSW employment contracted by 0.03%, with an unemployment rate of 3.9%. National forecasts from May-25 project total employment growth of 6.6% over five years and 13.7% over ten years, but Alexandria's specific projections, based on its industry mix, suggest local employment should increase by 7.2% over five years and 14.4% over ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

AreaSearch's latest postcode level ATO data for financial year 2023 shows Alexandria's median income among taxpayers is $83,330, with an average of $108,441. This places it in the top percentile nationally, compared to Greater Sydney's median of $60,817 and average of $83,003. Based on Wage Price Index growth of 8.86% since financial year 2023, current estimates would be approximately $90,713 (median) and $118,049 (average) as of September 2025. According to the 2021 Census figures, household, family, and personal incomes in Alexandria rank highly nationally, between the 93rd and 98th percentiles. The earnings profile shows that 33.3% of individuals earn between $1,500 and $2,999, consistent with broader metropolitan trends at 30.9%. Economic strength is evident through 45.4% of households achieving high weekly earnings exceeding $3,000, supporting elevated consumer spending. High housing costs consume 19.4% of income, but strong earnings place disposable income at the 90th percentile nationally. The area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

Alexandria features a more urban dwelling mix with significant apartment living, with ownership patterns similar to the broader region

Alexandria's dwellings, as per the latest Census, consisted of 4.8% houses and 95.3% other types such as semi-detached homes, apartments, and 'other' dwellings. In comparison, Sydney metro had 2.3% houses and 97.7% other dwellings. Home ownership in Alexandria was at 12.7%, with mortgaged dwellings at 34.9% and rented ones at 52.4%. The median monthly mortgage repayment in the area was $2,751, higher than Sydney metro's average of $2,705. The median weekly rent figure was recorded at $560, compared to Sydney metro's $550. Nationally, Alexandria's mortgage repayments were significantly higher than the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Alexandria features high concentrations of group households and lone person households, with a higher-than-average median household size

Family households account for 55.0% of all households, including 16.0% couples with children, 33.8% couples without children, and 4.2% single parent families. Non-family households constitute the remaining 45.0%, with lone person households at 34.9% and group households comprising 10.2%. The median household size is 2.0 people, which is larger than the Greater Sydney average of 1.9.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Alexandria exceeds national averages, with above-average qualification levels and academic performance metrics

Alexandria's educational attainment is notably higher than national averages. Among residents aged 15+, 63.0% have university qualifications, compared to 30.4% in Australia and 32.2% in NSW. Bachelor degrees are the most common at 40.8%, followed by postgraduate qualifications (18.1%) and graduate diplomas (4.1%). Vocational pathways account for 19.7%, with advanced diplomas at 10.1% and certificates at 9.6%.

A total of 23.7% of the population is actively pursuing formal education, including 8.7% in tertiary, 5.5% in primary, and 2.8% in secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Alexandria has 82 active public transport stops, offering a mix of train and bus services. These stops are served by 14 different routes, collectively facilitating 10,237 weekly passenger trips. Transport accessibility is rated excellent, with residents typically located 109 meters from the nearest stop.

Service frequency averages 1,462 trips per day across all routes, equating to approximately 124 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Alexandria's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Alexandria's health outcomes show excellent results across all age groups, with very low prevalence of common health conditions. Private health cover rate is exceptionally high at approximately 70% (7,699 people), exceeding the national average of 55.7%.

Mental health issues and asthma are the most prevalent medical conditions, affecting 9.6 and 8.1% of residents respectively. A total of 76.1% of residents report being completely clear of medical ailments, compared to 77.4% in Greater Sydney. Alexandria has 6.8% (751 people) of residents aged 65 and over, lower than the 9.7% in Greater Sydney. Senior health outcomes align with those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

Alexandria was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Alexandria's cultural diversity surpasses most local markets, with 22.0% speaking a language other than English at home and 37.1% born overseas. Christianity is the predominant religion in Alexandria at 30.6%. Notably, Judaism is slightly overrepresented at 1.2%, compared to Greater Sydney's 1.1%.

The top three ancestry groups are English (22.7%), Australian (17.5%), and Other (13.0%). Some ethnic groups show notable differences: French (1.0% vs regional 1.1%), Spanish (0.9% vs 1.0%), and Hungarian (0.5% vs 0.4%) are overrepresented in Alexandria.

Frequently Asked Questions - Diversity

Age

Alexandria hosts a young demographic, positioning it in the bottom quartile nationwide

Alexandria's median age is 34 years, which is lower than Greater Sydney's average of 37 and Australia's national average of 38 years. Compared to Greater Sydney, Alexandria has a higher proportion of residents aged 25-34 years (30.5%), but fewer residents aged 5-14 years (5.6%). This concentration of 25-34 year-olds is significantly higher than the national average of 14.5%. Between the 2021 Census and present, the proportion of Alexandria's population aged 35 to 44 has grown from 21.9% to 22.9%, while the proportion of those aged 25 to 34 has declined from 32.6% to 30.5%. By 2041, significant demographic changes are projected for Alexandria. The 45-54 age group is expected to show the strongest growth, increasing by 40% and adding 579 residents to reach a total of 2,028. Conversely, the 0-4 age group shows minimal growth, with an increase of just 3%, adding only 15 people.