Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Mascot lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

Mascot's population was around 23,030 as of November 2025. This reflected an increase of 1,457 people since the 2021 Census, which reported a population of 21,573. The change was inferred from the estimated resident population of 23,008 in June 2024 and an additional 36 validated new addresses since the Census date. This resulted in a density ratio of 7,550 persons per square kilometer, placing Mascot among the top 10% of locations assessed by AreaSearch. Mascot's growth of 6.8% since the 2021 census exceeded both its SA3 area (6.6%) and the state, indicating it was a growth leader in the region. Overseas migration contributed approximately 75.8% of overall population gains during recent periods.

AreaSearch adopted ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilized NSW State Government's SA2 level projections released in 2022 with a base year of 2021. Growth rates by age group from these aggregations were applied to all areas for years 2032 to 2041. Population projections indicated an above median growth, with Mascot expected to expand by 5,734 persons to 2041 based on the latest annual ERP population numbers, reflecting a total increase of 24.8% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Mascot recording a relatively average level of approval activity when compared to local markets analysed countrywide

Mascot has recorded approximately 42 residential properties granted approval annually. Over the past five financial years, from FY-21 to FY-25, around 210 homes were approved. By FY-26108 dwellings had been approved so far.

On average, over these five years, about 17.1 people moved to the area for each dwelling built. This significant demand outpaces supply, typically putting upward pressure on prices and increasing competition among buyers. The average construction cost of new homes is around $592,000. In FY-26, Mascot has registered approximately $73.4 million in commercial approvals, indicating strong commercial development momentum. Compared to Greater Sydney, Mascot records notably lower building activity, at 77.0% below the regional average per person. This constrained new construction usually reinforces demand and pricing for existing dwellings.

The mix of new building activity shows approximately 46.0% detached houses and 54.0% medium to high-density housing. This skew towards compact living offers affordable entry pathways, attracting downsizers, investors, and first-time purchasers. Interestingly, developers are building more traditional houses than the current market share suggests (21.0% at Census), indicating continued strong demand for family homes despite density pressures. Mascot reflects a highly mature market with around 1487 people per dwelling approval. Looking ahead, Mascot is projected to grow by approximately 5,712 residents through to 2041, according to the latest AreaSearch quarterly estimate. At current development rates, housing supply may struggle to match population growth, potentially heightening buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

Mascot has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

Thirty-six infrastructure projects have been identified by AreaSearch as potentially impacting the area. Key projects include: 350 King Street Business Park Development, 263-273 Coward Street Multi-Level Warehouse Development, 2 Bourke Street Mixed Use Development, and Mascot Station Precinct. The following list details those likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Mascot Station Precinct

The Mascot Station Precinct is a major urban renewal project led by Bayside Council to transform the area around Mascot Station from industrial uses into a vibrant, high-density mixed-use town centre. The masterplan supports approximately 4,300 new dwellings and significant commercial floor space by 2036, with improved public domain, new parks, and enhanced transport connections.

WestConnex M8 & St Peters Interchange

9km underground motorway tunnel from Kingsgrove to the new St Peters Interchange, with twin tunnels and capacity for a third lane. It doubles the capacity of the M5 East and improves access to Port Botany and Sydney Airport, including upgraded local roads and bridges.

Rail Service Improvement Program - T8 Airport & South Line Upgrades (Component of MTMS Stage 2)

The T8 Airport & South Line Improvements are part of the broader Rail Service Improvement Program (formerly More Trains, More Services Stage 2). The scope includes power supply and signalling upgrades along the T8 Airport Line tunnel from Central to Wolli Creek Junction, construction of a new substation at Wolli Creek, and platform canopy extension at Wolli Creek Station. These upgrades will increase peak service capacity and support the introduction of new suburban trains.

Meriton Retail Precinct Mascot Central

An award-winning open-air retail precinct featuring Woolworths, BWS, a medical centre, and 26 specialty stores and restaurants, providing essential services, dining options, and convenient shopping for the Mascot community.

Signia by Meriton - 200 Coward Street Mixed Use Development

Completed mixed-use development comprising five buildings of 6-8 storeys, featuring 237 residential apartments, 179 serviced apartment suites (Meriton Suites), ground floor retail space, an 80-place childcare centre, and extensive amenities including pools, gymnasium, and landscaped gardens. The development operates as Signia by Meriton and includes the Meriton Suites Sydney Airport hotel.

350 King Street Business Park Development

Mixed-use business park development on a strategic site adjacent to Sydney Airport, featuring commercial offices, logistics facilities and complementary amenities. Part of LOGOS' broader vision for a state-of-the-art logistics and business hub in the Mascot precinct.

Botany Road and Henry Kendall Crescent Affordable Housing

Approved State Significant Development (SSD-72393459) for an eight-storey residential flat building delivering 126 social and affordable dwellings managed by Homes NSW, with basement parking, communal areas and sustainable design features.

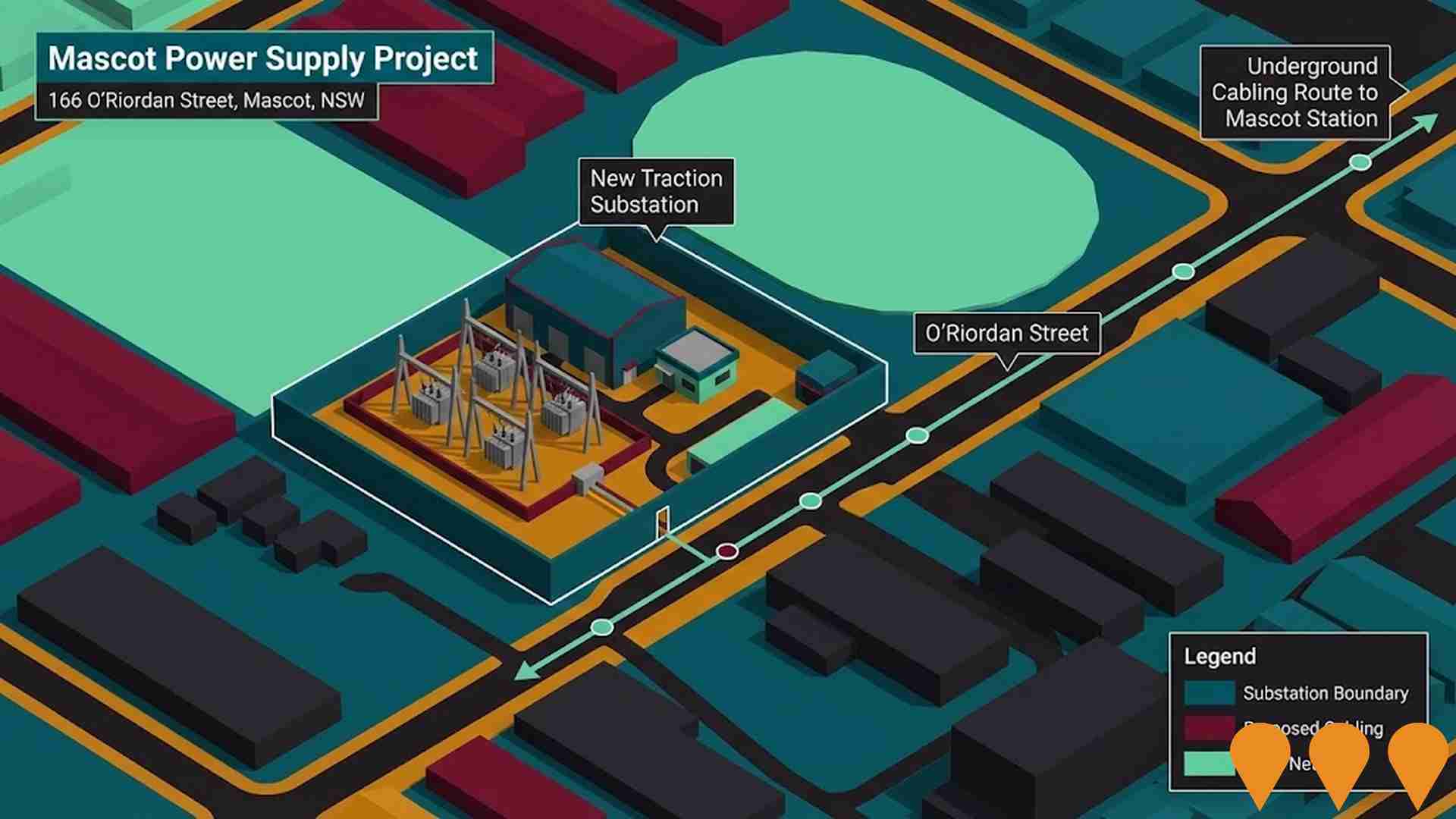

Mascot Power Supply Project

Major electrical infrastructure upgrade involving construction of a new traction substation at 166 O'Riordan Street, Mascot, with underground cabling route to Mascot Station via tunnel boring machine. Includes new lighting, CCTV, security fencing and mobile antenna. Part of the Rail Service Improvement Program to support increased T8 Airport Line services and new fleet introduction.

Employment

AreaSearch analysis places Mascot well above average for employment performance across multiple indicators

Mascot has an educated workforce with professional services well represented. Its unemployment rate is 2.8%.

Over the past year, employment stability has been relative. As of June 2025, 14,756 residents are employed while the unemployment rate is 1.4% lower than Greater Sydney's rate of 4.2%. Workforce participation in Mascot is high at 68.5%, compared to Greater Sydney's 60.0%. Leading employment industries include professional & technical, accommodation & food, and retail trade.

Accommodation & food has a strong presence with an employment share of 1.9 times the regional level. Conversely, health care & social assistance shows lower representation at 8.9% versus the regional average of 14.1%. The worker-to-resident ratio is substantial at 0.9. Over the year to June 2025, employment increased by 0.3%, labour force by 0.6%, leading to a unemployment rise of 0.4 percentage points. Greater Sydney recorded higher growth rates during this period. State-level data for NSW to Nov-25 shows employment contraction of 0.03% with an unemployment rate of 3.9%. This compares favourably to the national unemployment rate of 4.3%. National employment forecasts from May-25 indicate a projected increase of 6.6% over five years and 13.7% over ten years. Applying these projections to Mascot's employment mix suggests local employment growth of 6.7% over five years and 13.4% over ten years, though this is a simplified extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows Mascot SA2 had a median income of $52,964 and an average income of $65,968. Nationally, these figures are slightly above average. In Greater Sydney, the median was $56,994 with an average of $80,856. By September 2025, estimates suggest Mascot's median income will be approximately $59,643 and the average around $74,287, based on a 12.61% Wage Price Index growth since financial year 2022. Census 2021 data ranks Mascot's household, family, and personal incomes between the 78th and 81st percentiles nationally. Income analysis reveals that 35.4% of residents earn $1,500 - 2,999 weekly (8,152 residents), similar to the metropolitan region where 30.9% fall into this bracket. A substantial proportion, 33.5%, earn above $3,000 weekly, indicating strong economic capacity in Mascot. High housing costs consume 22.2% of income, but strong earnings place disposable income at the 71st percentile nationally. The area's SEIFA income ranking places it in the 9th decile.

Frequently Asked Questions - Income

Housing

Mascot features a more urban dwelling mix with significant apartment living, with a higher proportion of rental properties than the broader region

In Mascot, as per the latest Census evaluation, 21.1% of dwellings were houses while 79.0% were other types such as semi-detached homes, apartments, and 'other' dwellings. This compares to Sydney metropolitan area's figures of 26.0% houses and 74.0% other dwellings. Home ownership in Mascot stood at 16.6%, with mortgaged dwellings at 25.1% and rented ones at 58.3%. The median monthly mortgage repayment in the area was $2,600, matching Sydney metro's average, while the median weekly rent was $600 compared to Sydney metro's $2,600 and $550 respectively. Nationally, Mascot's mortgage repayments were significantly higher than the Australian average of $1,863, with rents substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Mascot features high concentrations of group households, with a fairly typical median household size

Family households account for 65.4% of all households, including 23.8% couples with children, 31.8% couples without children, and 6.8% single parent families. Non-family households constitute the remaining 34.6%, with lone person households at 21.7% and group households comprising 12.9%. The median household size is 2.5 people, which aligns with the Greater Sydney average.

Frequently Asked Questions - Households

Local Schools & Education

Mascot performs slightly above the national average for education, showing competitive qualification levels and steady academic outcomes

In Mascot, educational attainment is notably high. Among residents aged 15 and above, 48.7% have university qualifications, surpassing the national average of 30.4% and the NSW average of 32.2%. This indicates a significant educational advantage for the area. Bachelor degrees are the most common at 32.1%, followed by postgraduate qualifications (14.9%) and graduate diplomas (1.7%).

Vocational credentials are also prevalent, with 25.1% of residents holding such qualifications – advanced diplomas comprise 12.9% and certificates make up 12.2%. Educational participation is high, with 33.4% of residents currently enrolled in formal education. This includes 11.8% pursuing tertiary education, 5.2% in primary education, and 3.7% in secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Mascot has 46 active public transport stops, offering a mix of train and bus services. These stops are served by 24 different routes, which together facilitate 8,967 weekly passenger trips. The accessibility of these services is considered excellent, with residents on average located just 138 meters from the nearest stop.

On a daily basis, there are an average of 1,281 trips across all routes, translating to approximately 194 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Mascot's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Mascot exhibits exceptional health outcomes, with a very low prevalence of common health conditions across all age groups. The rate of private health cover in Mascot is approximately 52%, which is higher than the average SA2 area but lower than Greater Sydney's 57.5%.

The most prevalent medical conditions are asthma and mental health issues, affecting 4.7% and 4.3% of residents respectively. A total of 84.4% of Mascot residents report being completely free from medical ailments, compared to 78.7% in Greater Sydney. Mascot has a lower proportion of seniors aged 65 and over (8.1%, or 1,867 people) than Greater Sydney (12.6%). Despite this, health outcomes among seniors in Mascot are strong and align with the overall population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Mascot is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Mascot's population is diverse, with 59.7% speaking a language other than English at home and 63.0% born overseas. Christianity is the predominant religion, accounting for 44.0%. Buddhism is overrepresented, comprising 9.1%, compared to Greater Sydney's 5.4%.

The top three ancestry groups are Other (25.3%), Chinese (22.5%), and English (11.1%). Spanish (1.1%) and Greek (3.3%) are notably overrepresented, while Korean (0.9%) is slightly higher than the regional average of 0.5%.

Frequently Asked Questions - Diversity

Age

Mascot hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Mascot's median age is 30 years, which is younger than Greater Sydney's average of 37 and significantly below Australia's median of 38. Compared to Greater Sydney, Mascot has a higher proportion of residents aged 25-34 (34.3%), but fewer residents aged 5-14 (6.5%). This concentration of 25-34 year-olds is notably higher than the national average of 14.5%. According to post-2021 Census data, the proportion of Mascot's population aged 35-44 has increased from 15.1% to 16.8%, while the proportion of those aged 15-24 has decreased from 16.6% to 14.5%. Demographic projections suggest significant changes in Mascot's age profile by 2041, with the 15-24 age cohort expected to grow steadily, increasing by 1,481 people (44%) from 3,341 to 4,823. Conversely, the number of residents aged 35-44 is projected to decrease by 267.