Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Carindale is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Carindale's population was around 17,452 as of November 2025. This reflected an increase of 948 people from the 2021 Census figure of 16,504. The growth was inferred from ABS estimated resident population data of 17,371 in June 2024 and additional validated new addresses since the Census date. Carindale's population density was 1,711 persons per square kilometer, above national averages assessed by AreaSearch. The area's 5.7% growth since the census was close to the SA3 area's 7.3%, indicating strong growth fundamentals. Overseas migration contributed approximately 85.7% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. These state projections lack age category splits, so AreaSearch applies proportional growth weightings from ABS Greater Capital Region projections (released in 2023, based on 2022 data) for each age cohort. Projected demographic shifts indicate a decline in overall population by 256 persons by 2041, but specific age cohorts are expected to grow, notably the 75 to 84 age group with an increase of 723 people.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Carindale according to AreaSearch's national comparison of local real estate markets

Carindale has seen approximately 77 new homes approved annually. Over the past five financial years, from FY21 to FY25, around 387 homes were approved, with an additional 5 approved in FY26 so far. On average, about 1.3 new residents have moved into these new homes each year over the last five financial years. However, this figure has increased to 17.8 people per dwelling over the past two financial years, indicating Carindale's growing popularity and potential supply constraints.

The average construction value of development projects in Carindale is approximately $379,000. This year alone, around $14.4 million in commercial approvals have been registered, demonstrating steady commercial investment activity in the area. Compared to Greater Brisbane, Carindale has 18.0% lower construction activity per person and ranks among the 15th percentile of areas assessed nationally, suggesting limited property choices for buyers and supporting demand for existing properties. In terms of new building activity, approximately 19.0% are detached houses, with the majority, around 81.0%, being attached dwellings. This shift towards compact living offers affordable entry pathways, attracting downsizers, investors, and first-time purchasers, marking a significant change from existing housing patterns that currently favour houses at 89.0%.

Carindale's population density, around 1171 people per approval, indicates a mature, established area. With stable or declining population forecasts, Carindale may experience less housing pressure in the future, creating favourable conditions for buyers.

Frequently Asked Questions - Development

Infrastructure

Carindale has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

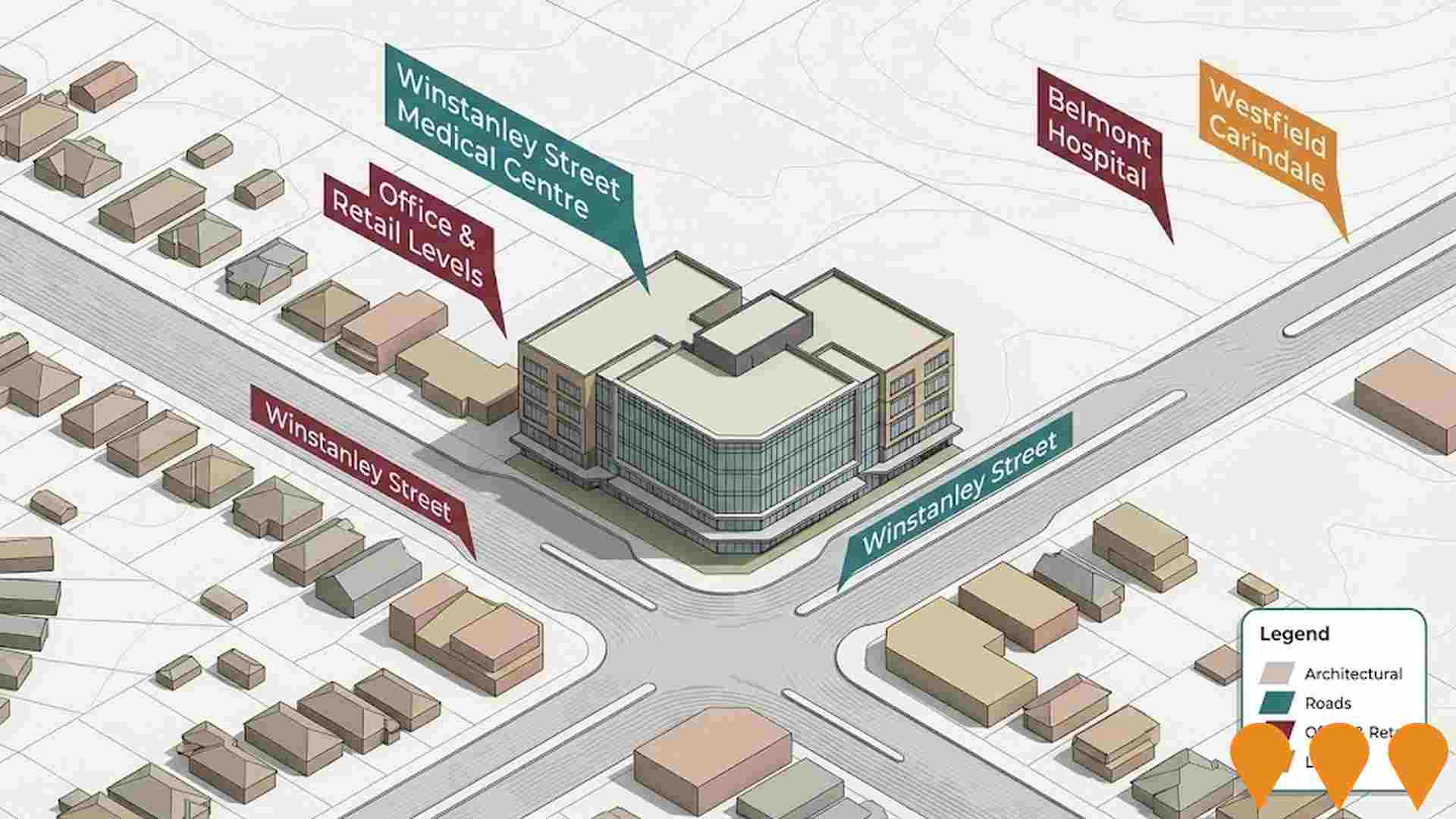

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified 16 projects that may affect the region. Notable projects include Aveo Parkside Carindale Redevelopment, Fairway Carindale Stage 2, Westfield Carindale Redevelopment & Dining Precinct, and Greendale Village Shopping Centre. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Queensland Energy and Jobs Plan

The Queensland Energy and Jobs Plan, initially a comprehensive plan for renewable energy and job creation, has been superseded by the Queensland Energy Roadmap 2025 by the new government (October 2025). The Roadmap focuses on energy affordability, reliability, and sustainability by leveraging existing coal and gas assets, increasing private sector investment in renewables and storage (targeting 6.8 GW of wind/solar and 3.8 GW of storage by 2030), and developing a new Regional Energy Hubs framework to replace Renewable Energy Zones. The initial $62 billion investment pipeline is now primarily focused on implementing the new Roadmap's priorities, including an estimated $26 billion in reduced energy system costs compared to the previous plan. The foundational legislation is the Energy Roadmap Amendment Bill 2025, which is currently before Parliament and expected to pass by December 2025, formally repealing the previous renewable energy targets. Key infrastructure projects like CopperString's Eastern Link are still progressing. The overall project is in the planning and legislative amendment phase under the new policy.

Eastern Metro Study - Coorparoo to Capalaba

Strategic study examining options for a high-capacity, high-frequency public transport corridor along Old Cleveland Road from Coorparoo to Capalaba. The study is assessing extensions of Brisbane Metro-style services or dedicated busway priority to better connect eastern Brisbane suburbs, Redlands, and major activity centres, with the aim of reducing car dependency and improving travel times. Jointly led by Queensland Department of Transport and Main Roads (TMR), Brisbane City Council and Redland City Council. A detailed business case for an eastward Brisbane Metro extension is in preparation.

Greendale Village Shopping Centre

A local retail development featuring a 3,359sqm supermarket, 2,496sqm speciality shops, food and drink outlets, health care services, and amenities, with 306 car parking spaces and landscaping on a 2.106ha site. The development application, originally approved in 2008, has been extended multiple times, most recently by court order to 31 March 2027, following delays including the insolvency of the contracted construction company in 2022.

Wecker Road Markets

Wecker Road Markets is an approved three stage redevelopment of the Mansfield Tavern site into a mixed use neighbourhood shopping precinct. The scheme, designed by Cottee Parker for Mansfield Investment Queensland, provides a supermarket, fresh food market, specialty retail, food and drink tenancies, offices, health care services and indoor sport and recreation facilities. Stage 1 focuses on a new and upgraded tavern and bottle shop fronting Wecker Road, while Stages 2 and 3 deliver the supermarket and additional retail and commercial buildings, landscaped public spaces and improved pedestrian links. Brisbane City Council has granted development approval, however full construction of the broader markets precinct is yet to commence.

Westfield Carindale Redevelopment & Dining Precinct

A major redevelopment of Westfield Carindale, adding 35,000m2 of retail space over two levels, new basement and rooftop parking, a relocated Target and Coles, and approximately 80 new specialty tenancies. A key component was the Level 1 'Glass House' dining precinct expansion, featuring seven new dining retailers like Claw BBQ and Betty's Burgers, with contemporary design elements. The Funhouse Entertainment area was also reopened.

Westfield Carindale Dining Precinct Expansion

Scentre Group's expansion of Westfield Carindale's dining precinct, featuring seven new dining retailers including Claw BBQ, Bettys Burgers, Sushi Jiro, Nandos, Viet House, and a relocated Yum Cha. The reimagined precinct includes integrated casual dining seating, new flooring, native plants, and a refreshed Funhouse Entertainment area with childrens bowling and family activities, enhancing the retail and entertainment destination in Brisbanes eastern suburbs.

Retail, Community Use Centre & Place of Worship - Creek Road

Mixed-use community and retail project by The Salvation Army (Qld) Property Trust at 1529 Creek Road. The development application (impact assessable) seeks a shop, community care centre, community use and place of worship delivered over four stages, with 105 parking spaces and daily operating hours 7am-10pm. The application is currently in progress with Council and with customer following an information request.

Belmont Private Hospital Expansion

A $21 million expansion of Belmont Private Hospital. The project includes a new purpose-built women's centre for perinatal mood disorders, a new adolescent mental health ward, additional patient rooms, and new operating theatres. The expansion will increase the total number of beds by 35 to 185 to serve the growing healthcare needs of the eastern Brisbane region.

Employment

Employment performance in Carindale ranks among the strongest 15% of areas evaluated nationally

Carindale has an educated workforce with professional services well represented. Its unemployment rate was 1.7% in September 2025, lower than Greater Brisbane's 4.0%.

Workforce participation is at par with Greater Brisbane's 64.5%. Key industries include health care & social assistance, professional & technical, and education & training. Carindale specializes particularly in professional & technical jobs, which make up 1.3 times the regional level. However, construction employment is lower than Greater Brisbane's, at 7.0% compared to 9.0%.

Most residents work outside the area. Between September 2024 and September 2025, Carindale's employment rose by 0.3%, labour force increased by 0.5%, leading to a 0.2 percentage point rise in unemployment. In contrast, Greater Brisbane saw employment growth of 3.8% and a drop in unemployment by 0.5 percentage points. As of 25-November-25, Queensland's employment contracted by 0.01%, with an unemployment rate of 4.2%. National employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Carindale's employment mix suggests local employment could grow by 7.0% in five years and 14.2% in ten years, though this is an illustrative extrapolation not accounting for localized population projections.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

The median income among taxpayers in Carindale SA2 was $64,110 in financial year 2022. The average income stood at $85,752 during the same period. In comparison, Greater Brisbane had median and average incomes of $55,645 and $70,520 respectively. By September 2025, estimates suggest Carindale's median income could reach approximately $73,079 and average income $97,749, accounting for a 13.99% growth since financial year 2022. According to the 2021 Census, household incomes in Carindale ranked at the 87th percentile with weekly earnings of $2,382. The largest income segment comprised 25.8% earning over $4,000 weekly (4,502 residents), contrasting with the region where the $1,500 - $2,999 bracket led at 33.3%. A substantial presence of higher earners was noted, with 40.1% exceeding $3,000 weekly. After housing costs, residents retained 87.9% of their income, reflecting strong purchasing power and the area's SEIFA income ranking which places it in the 9th decile.

Frequently Asked Questions - Income

Housing

Carindale is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Carindale's dwelling structures, as per the latest Census, consisted of 89.1% houses and 10.9% other dwellings (semi-detached, apartments, 'other' dwellings), contrasting with Brisbane metro's 71.2% houses and 28.8% other dwellings. Home ownership in Carindale stood at 47.4%, with mortgaged dwellings at 37.5% and rented ones at 15.1%. The median monthly mortgage repayment was $2,400, exceeding Brisbane metro's average of $2,200. Median weekly rent in Carindale was $533, higher than Brisbane metro's $450. Nationally, Carindale's mortgage repayments were significantly higher at $1,863 and rents substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Carindale features high concentrations of family households, with a higher-than-average median household size

Family households make up 80.8% of all households, including 43.4% couples with children, 28.1% couples without children, and 8.3% single parent families. Non-family households account for the remaining 19.2%, with lone person households at 17.0% and group households comprising 2.2%. The median household size is 2.8 people, larger than the Greater Brisbane average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Carindale shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Carindale's residents aged 15+ have a higher proportion with university qualifications (41.7%) compared to Queensland (25.7%) and Australia (30.4%). Bachelor degrees are the most common at 27.1%, followed by postgraduate qualifications (11.1%) and graduate diplomas (3.5%). Vocational credentials are also prevalent, with 25.1% of residents holding such qualifications, including advanced diplomas (10.9%) and certificates (14.2%). Educational participation is high, with 29.2% currently enrolled in formal education.

This includes 9.3% in primary, 8.8% in secondary, and 6.4% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Carindale has 85 active public transport stops, all of which are bus stops. These stops are served by 26 different routes that together facilitate 4,218 weekly passenger trips. The transport accessibility in Carindale is good, with residents on average being located 214 meters from the nearest stop.

On average, there are 602 trips per day across all routes, which equates to approximately 49 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Carindale is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

Carindale shows superior health outcomes for both younger and older age groups, with low prevalence of common conditions. Private health cover is exceptionally high at approximately 63% (11,047 people), compared to the national average of 55.3%.

The most prevalent medical conditions are arthritis (7.3%) and asthma (6.3%), while 72.1% of residents report no medical ailments, similar to Greater Brisbane's 72.4%. Residents aged 65 and over comprise 22.5% (3,921 people), higher than Greater Brisbane's 15.6%. Health outcomes among seniors are above average, mirroring the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Carindale was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Carindale's population has a high level of cultural diversity, with 34.7% born overseas and 29.8% speaking a language other than English at home. Christianity is the predominant religion in Carindale, accounting for 60.4%, compared to 54.6% across Greater Brisbane. The top three ancestry groups are English (22.3%), Australian (19.0%), and Other (9.7%).

Notably, Russian (0.8%) and South African (1.2%) ethnicities are overrepresented in Carindale compared to regional averages of 0.5% and 0.8%, respectively. Additionally, Korean ethnicity is also notably higher at 1.2%.

Frequently Asked Questions - Diversity

Age

Carindale's median age exceeds the national pattern

The median age in Carindale is 43 years, significantly higher than Greater Brisbane's average of 36 years and Australia's median age of 38 years. The 65-74 age group comprises 11.4% of Carindale's population compared to Greater Brisbane, while the 25-34 age group makes up 7.7%. Post-2021 Census data shows that the 75-84 age group has increased from 6.5% to 8.1%, the 55-64 cohort has decreased from 14.0% to 12.5%, and the 25-34 group has dropped from 8.8% to 7.7%. By 2041, population forecasts indicate substantial demographic changes for Carindale. The 75-84 age group is projected to grow by 46%, reaching 2,059 people from 1,413. Notably, the combined 65+ age groups will account for 92% of total population growth, reflecting Carindale's aging demographic profile. In contrast, the 15-24 and 65-74 cohorts are expected to experience population declines.