Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Cannon Hill lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Cannon Hill's population is around 7,640 as of November 2025. This reflects an increase of 710 people since the 2021 Census, which reported a population of 6,930 people. The change is inferred from the estimated resident population of 7,633 from the ABS as of June 2024 and an additional 112 validated new addresses since the Census date. This level of population equates to a density ratio of 1,934 persons per square kilometer. Cannon Hill's growth rate of 10.2% since the 2021 census exceeded the SA3 area average of 7.3%. Overseas migration contributed approximately 40.4% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. These state projections do not provide age category splits; hence AreaSearch applies proportional growth weightings in line with the ABS Greater Capital Region projections for each age cohort, released in 2023 based on 2022 data. Future population dynamics anticipate an above median growth, with the area expected to increase by 1,481 persons to 2041, reflecting a total increase of 19.3% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Cannon Hill among the top 25% of areas assessed nationwide

Cannon Hill has averaged approximately 51 new dwelling approvals per year. Between FY21 and FY25258 homes were approved, with an additional 11 approved so far in FY26. This results in a substantial lag between supply and demand, leading to heightened buyer competition and pricing pressures.

The average construction value of new properties is $484,000, indicating a focus on the premium market with high-end developments. In the current financial year, commercial approvals totaling $22.5 million have been registered, suggesting balanced commercial development activity. Compared to Greater Brisbane, Cannon Hill has seen 31.0% more development per person over the past five years, maintaining good buyer choice while supporting existing property values.

Recent construction consists of 63.0% detached dwellings and 37.0% townhouses or apartments, offering choices across various price ranges. The location currently has approximately 198 people per dwelling approval, indicating an expanding market with a projected growth of 1,474 residents by 2041. Present construction rates appear balanced with future demand, fostering steady market conditions without excessive price pressure.

Frequently Asked Questions - Development

Infrastructure

Cannon Hill has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified 29 projects that may impact the area. Notable ones include East Village Cannon Hill, 60-62 Ludwick Street Residential Development, Rivermakers Masterplan, and Rivermakers Masterplan. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

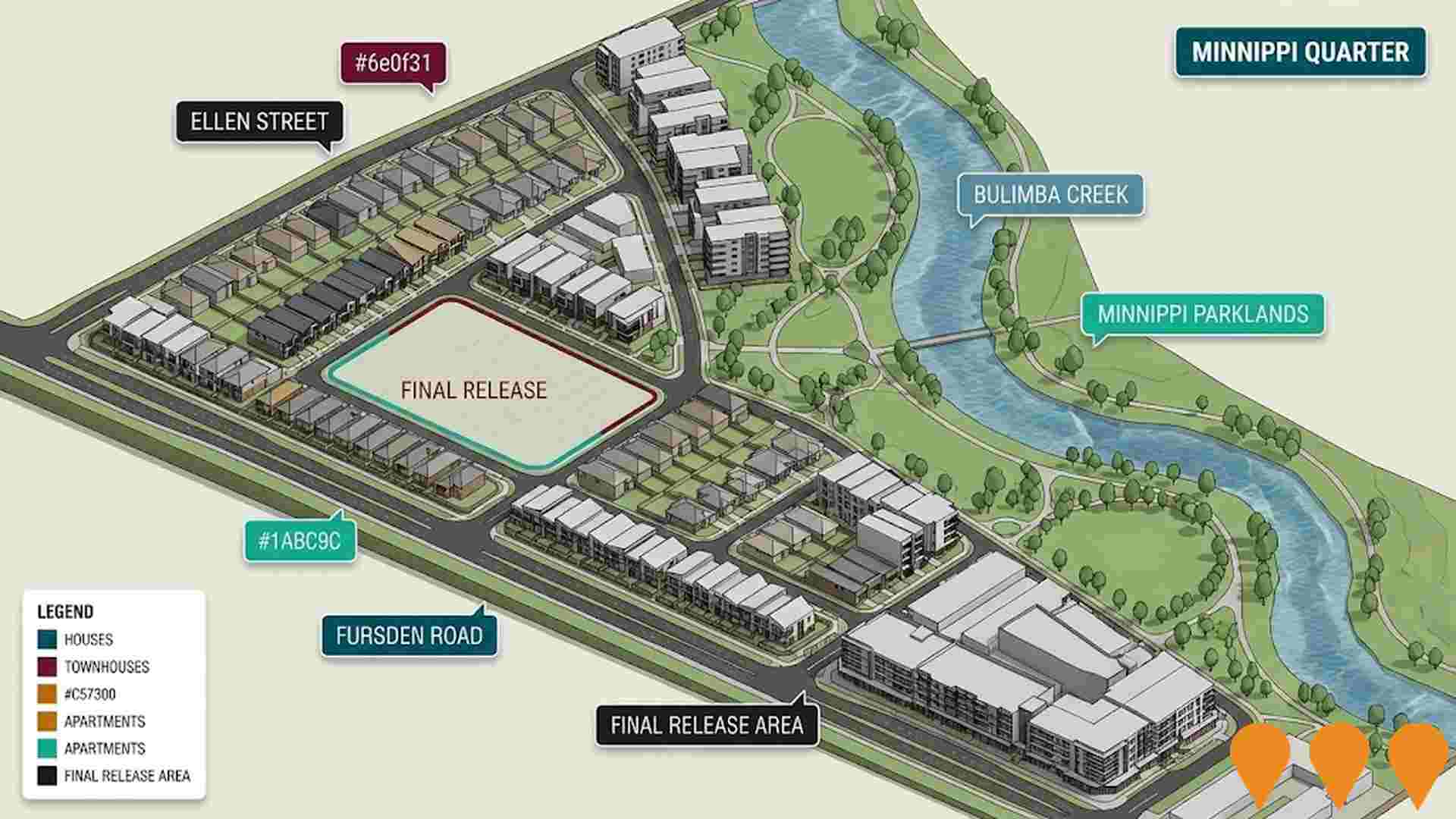

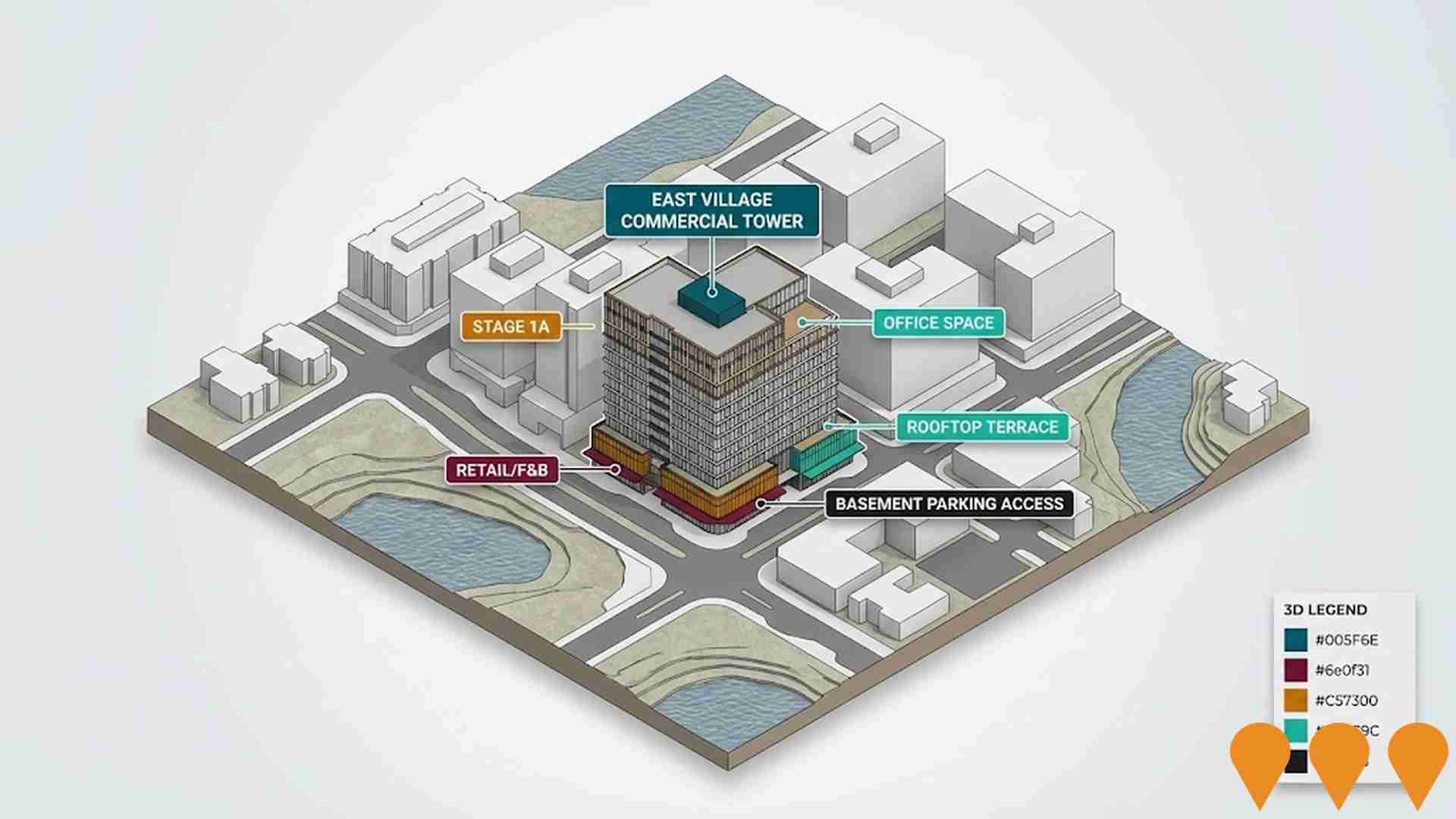

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

East Village Cannon Hill

Large-scale $1 billion+ mixed-use urban renewal precinct on the former CSIRO site in Cannon Hill. Features residential apartments (over 600 delivered/planned), commercial office space, retail, dining, cinema, hotel, and significant public realm. Developed by Anthony John Group in stages, with construction active across multiple buildings.

Rivermakers Masterplan

A 30-hectare riverside mixed-use masterplan comprising three distinct precincts: The Depot (mixed industrial and retail), Mixed Business and Industry precinct, and Heritage Quarter (food and beverage destination in restored heritage buildings). The project transforms a former industrial site into a vibrant destination combining artisan manufacturing, commercial spaces, dining, and entertainment. The Hills of Rivermakers dining and entertainment precinct opened December 2024, featuring restored heritage buildings from the 1910 Commonwealth Acetate of Lime Factory. The masterplan includes 250 meters of riverfront recreational space and promotes co-location of industrial and commercial activities without residential components.

Rivermakers Masterplan

A 30-hectare riverside mixed-use masterplan comprising three distinct precincts: The Depot (mixed industrial and retail), Mixed Business and Industry precinct, and Heritage Quarter (food and beverage destination in restored heritage buildings). The project transforms a former industrial site into a vibrant destination combining artisan manufacturing, commercial spaces, dining, and entertainment. The Hills of Rivermakers dining and entertainment precinct opened December 2024, featuring restored heritage buildings from the 1910 Commonwealth Acetate of Lime Factory. The masterplan includes 250 meters of riverfront recreational space and promotes co-location of industrial and commercial activities without residential components.

Rivermakers Masterplan

A 30-hectare riverside mixed-use masterplan comprising three distinct precincts: The Depot (mixed industrial and retail), Mixed Business and Industry precinct, and Heritage Quarter (food and beverage destination in restored heritage buildings). The project transforms a former industrial site into a vibrant destination combining artisan manufacturing, commercial spaces, dining, and entertainment. The Hills of Rivermakers dining and entertainment precinct opened December 2024, featuring restored heritage buildings from the 1910 Commonwealth Acetate of Lime Factory. The masterplan includes 250 meters of riverfront recreational space and promotes co-location of industrial and commercial activities without residential components.

Rivermakers Masterplan

A 30-hectare riverside mixed-use masterplan comprising three distinct precincts: The Depot (mixed industrial and retail), Mixed Business and Industry precinct, and Heritage Quarter (food and beverage destination in restored heritage buildings). The project transforms a former industrial site into a vibrant destination combining artisan manufacturing, commercial spaces, dining, and entertainment. The Hills of Rivermakers dining and entertainment precinct opened December 2024, featuring restored heritage buildings from the 1910 Commonwealth Acetate of Lime Factory. The masterplan includes 250 meters of riverfront recreational space and promotes co-location of industrial and commercial activities without residential components.

Rivermakers Masterplan

A 30-hectare riverside mixed-use masterplan comprising three distinct precincts: The Depot (mixed industrial and retail), Mixed Business and Industry precinct, and Heritage Quarter (food and beverage destination in restored heritage buildings). The project transforms a former industrial site into a vibrant destination combining artisan manufacturing, commercial spaces, dining, and entertainment. The Hills of Rivermakers dining and entertainment precinct opened December 2024, featuring restored heritage buildings from the 1910 Commonwealth Acetate of Lime Factory. The masterplan includes 250 meters of riverfront recreational space and promotes co-location of industrial and commercial activities without residential components.

Colmslie Wharves

A purpose-built commercial marina providing 51 berths for vessels up to 35 metres to support Brisbane's marine tourism industry. The project addresses a critical shortage of commercial berthing following closures at Dockside Marina and Eagle Street Pier. Expected to inject over $100 million annually into the local economy, attract 109,625 additional visitors per year, and create 337 ongoing jobs across tourism, hospitality, and marine services. Backed by a $4 million Queensland Government grant from the Growing Tourism Infrastructure Fund. The marina will include on-water fuelling, wastewater pump-out facilities, car parking, and staff amenities. Construction expected to commence immediately following approval with first vessels arriving in 2026.

Colmslie Wharves

A purpose-built commercial marina providing 51 berths for vessels up to 35 metres to support Brisbane's marine tourism industry. The project addresses a critical shortage of commercial berthing following closures at Dockside Marina and Eagle Street Pier. Expected to inject over $100 million annually into the local economy, attract 109,625 additional visitors per year, and create 337 ongoing jobs across tourism, hospitality, and marine services. Backed by a $4 million Queensland Government grant from the Growing Tourism Infrastructure Fund. The marina will include on-water fuelling, wastewater pump-out facilities, car parking, and staff amenities. Construction expected to commence immediately following approval with first vessels arriving in 2026.

Employment

Employment conditions in Cannon Hill demonstrate exceptional strength compared to most Australian markets

Cannon Hill has an educated workforce with strong professional services representation. Its unemployment rate was 2.7% in September 2025, lower than Greater Brisbane's 4.0%.

Workforce participation was 76.3%, higher than Greater Brisbane's 64.5%. Dominant employment sectors were health care & social assistance, professional & technical, and education & training. Professional & technical had a high share of 1.3 times the regional level. Health care & social assistance had limited presence at 14.6% compared to 16.1% regionally.

The worker-to-resident ratio was 0.8 in September 2025, indicating above-normal local employment opportunities. Over the year to September 2025, Cannon Hill's employment increased by 0.4%, labour force by 0.5%, raising unemployment by 0.1 percentage points. In contrast, Greater Brisbane saw employment rise by 3.8% and unemployment fall by 0.5%. Statewide in Queensland on 25-Nov-25, employment contracted by 0.01%, with an unemployment rate of 4.2%. National employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Cannon Hill's employment mix suggests local employment could grow by 6.8% in five years and 13.9% in ten years, though this is an illustrative extrapolation not accounting for localized population projections.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

AreaSearch's data for financial year 2022 shows Cannon Hill SA2 had a median income of $70,015 and an average income of $95,443. This is higher than Greater Brisbane's median income of $55,645 and average income of $70,520. By September 2025, estimated incomes would be around $79,810 (median) and $108,795 (average), based on a 13.99% Wage Price Index growth since financial year 2022. Census data ranks Cannon Hill's household, family, and personal incomes between the 84th and 87th percentiles nationally. The income bracket of $1,500 - 2,999 is dominant, with 32.9% of residents (2,513 people). A significant 36.4% earn above $3,000 weekly. High housing costs consume 16.7% of income, but strong earnings place disposable income at the 82nd percentile. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Cannon Hill displays a diverse mix of dwelling types, with a higher proportion of rental properties than the broader region

Cannon Hill's dwelling structures, as per the latest Census, consisted of 63.1% houses and 37.0% other dwellings (semi-detached, apartments, 'other' dwellings). Brisbane metro had 71.2% houses and 28.8% other dwellings. Home ownership in Cannon Hill was at 22.2%, with mortgaged dwellings at 38.1% and rented ones at 39.7%. The median monthly mortgage repayment was $2,362, above Brisbane metro's $2,200. Median weekly rent in Cannon Hill was $450, matching Brisbane metro's figure. Nationally, Cannon Hill's mortgage repayments were higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Cannon Hill features high concentrations of group households, with a lower-than-average median household size

Family households account for 67.1% of all households, including 31.4% couples with children, 25.8% couples without children, and 8.0% single parent families. Non-family households make up the remaining 32.9%, with lone person households at 25.6% and group households comprising 7.2%. The median household size is 2.5 people, which is smaller than the Greater Brisbane average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Cannon Hill shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Cannon Hill's educational attainment exceeds broader standards. Among residents aged 15+, 40.6% possess university qualifications, compared to Queensland's 25.7% and Australia's 30.4%. Bachelor degrees are the most common at 28.3%, followed by postgraduate qualifications (8.5%) and graduate diplomas (3.8%). Vocational credentials are also prevalent, with 30.1% of residents aged 15+ holding such qualifications - advanced diplomas at 10.9% and certificates at 19.2%.

Educational participation is notably high, with 29.1% of residents currently enrolled in formal education. This includes 9.9% in primary education, 6.8% in tertiary education, and 6.6% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Cannon Hill has 45 active public transport stops, consisting of both train and bus services. These stops are served by 34 unique routes that collectively facilitate 3024 weekly passenger trips. The accessibility of transportation in Cannon Hill is rated as excellent, with residents typically living within 161 meters of the nearest transport stop.

On average, there are 432 daily trips across all routes, which translates to approximately 67 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Cannon Hill's residents boast exceedingly positive health performance metrics with younger cohorts in particular seeing very low prevalence of common health conditions

Cannon Hill's health outcomes show impressive results, notably for younger populations with low prevalence rates of common conditions. Private health cover stands at approximately 69% (5,294 people), exceeding Greater Brisbane's 63.9% and the national average of 55.3%. Mental health issues affect 9.0%, asthma impacts 7.5%, while 73.9% report no medical ailments, compared to 72.4% in Greater Brisbane.

The area has 10.2% (776 people) aged 65 and over, lower than Greater Brisbane's 15.6%. Despite this, health outcomes among seniors require more attention than the broader population.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Cannon Hill was found to be slightly above average when compared nationally for a number of language and cultural background related metrics

Cannon Hill, surveyed in June 2016, exhibited higher linguistic diversity than most local areas, with 16.1% of residents speaking a language other than English at home. Birthplace diversity was also notable, with 27.2% born overseas. Christianity dominated religious affiliations, accounting for 47.8%.

Judaism, while small at 0.2%, was slightly higher than the Greater Brisbane average of 0.1%. Ancestral origins showed English (27.2%), Australian (23.3%), and Irish (9.5%) as the top three groups. Some ethnic groups had notable representation: New Zealand (1.0% vs regional 1.0%), French (0.7% vs 0.6%), and Spanish (0.6% vs 0.5%).

Frequently Asked Questions - Diversity

Age

Cannon Hill hosts a young demographic, positioning it in the bottom quartile nationwide

Cannon Hill has a median age of 34, which is slightly younger than Greater Brisbane's figure of 36 and substantially under Australia's 38 years. Compared to Greater Brisbane, Cannon Hill has a higher concentration of residents aged 25-34 (18.9%) but fewer residents aged 15-24 (11.0%). Between the 2021 Census and present, the 5-14 age group has grown from 12.2% to 12.9% of the population while the 15-24 cohort has declined from 12.4% to 11.0%. Population forecasts for 2041 indicate significant demographic changes in Cannon Hill, with the 45-54 age group projected to grow by 41%, adding 423 residents to reach 1,459. Conversely, both the 0-4 and 25-34 age groups are expected to have reduced numbers.