Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Bega - Tathra has seen population growth performance typically on par with national averages when looking at short and medium term trends

Bega-Tathra's population is 9,221 as of November 2025. This reflects a growth of 349 people since the 2021 Census, which recorded a population of 8,872. The increase is inferred from ABS estimates: 9,012 in June 2024 and an additional 235 validated new addresses since the Census date. This results in a density ratio of 50 persons per square kilometer. Bega-Tathra's growth rate of 3.9% since the 2021 census exceeded its SA3 area's growth rate of 2.6%. Overseas migration contributed approximately 50.0% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, NSW State Government's SA2 level projections are used, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Projected demographic shifts indicate an expected population increase just below the median of national regional areas, with Bega-Tathra expected to increase by 747 persons to 2041 based on latest annual ERP population numbers, reflecting a total increase of 5.8% over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is slightly higher than average within Bega - Tathra when compared nationally

Bega-Tathra has seen approximately 56 dwellings granted development approval annually. Over the past five financial years, from FY21 to FY25284 homes were approved, with an additional 23 approved so far in FY26. On average, each dwelling constructed over these years has accommodated around 0.9 new residents yearly.

This suggests that new construction is keeping pace with or exceeding demand, presenting more options for buyers and potentially facilitating population growth beyond current expectations. The average expected construction cost value of new homes is $376,000. In FY26 alone, commercial approvals totaling $32.6 million have been registered, indicating robust local business investment. Compared to the rest of NSW, Bega-Tathra has recorded slightly higher-than-average construction activity, with 10.0% more approvals per person over the past five years. This balance between buyer choice and support for property values is notable.

The new building activity comprises approximately 49.0% detached houses and 51.0% attached dwellings, marking a shift from the area's existing housing stock, which is currently 88.0% houses. This focus on higher-density living creates more affordable entry points, benefiting downsizers, investors, and first-home buyers. With around 197 people per dwelling approval, Bega-Tathra exhibits characteristics of a low-density area. According to the latest AreaSearch quarterly estimate, Bega-Tathra is projected to add approximately 535 residents by 2041. Given current development patterns, new housing supply should readily meet demand, offering favorable conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Bega - Tathra has limited levels of nearby infrastructure activity, ranking in the 17thth percentile nationally

Local infrastructure changes significantly influence an area's performance. AreaSearch identified three projects likely impacting the region: Bega Sewage Treatment Plant Upgrade, South Bega Urban Land Release Planning Proposal, Barrack Street Bega Redevelopment Project, and Wolumla Structure Plan. The following list details those most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

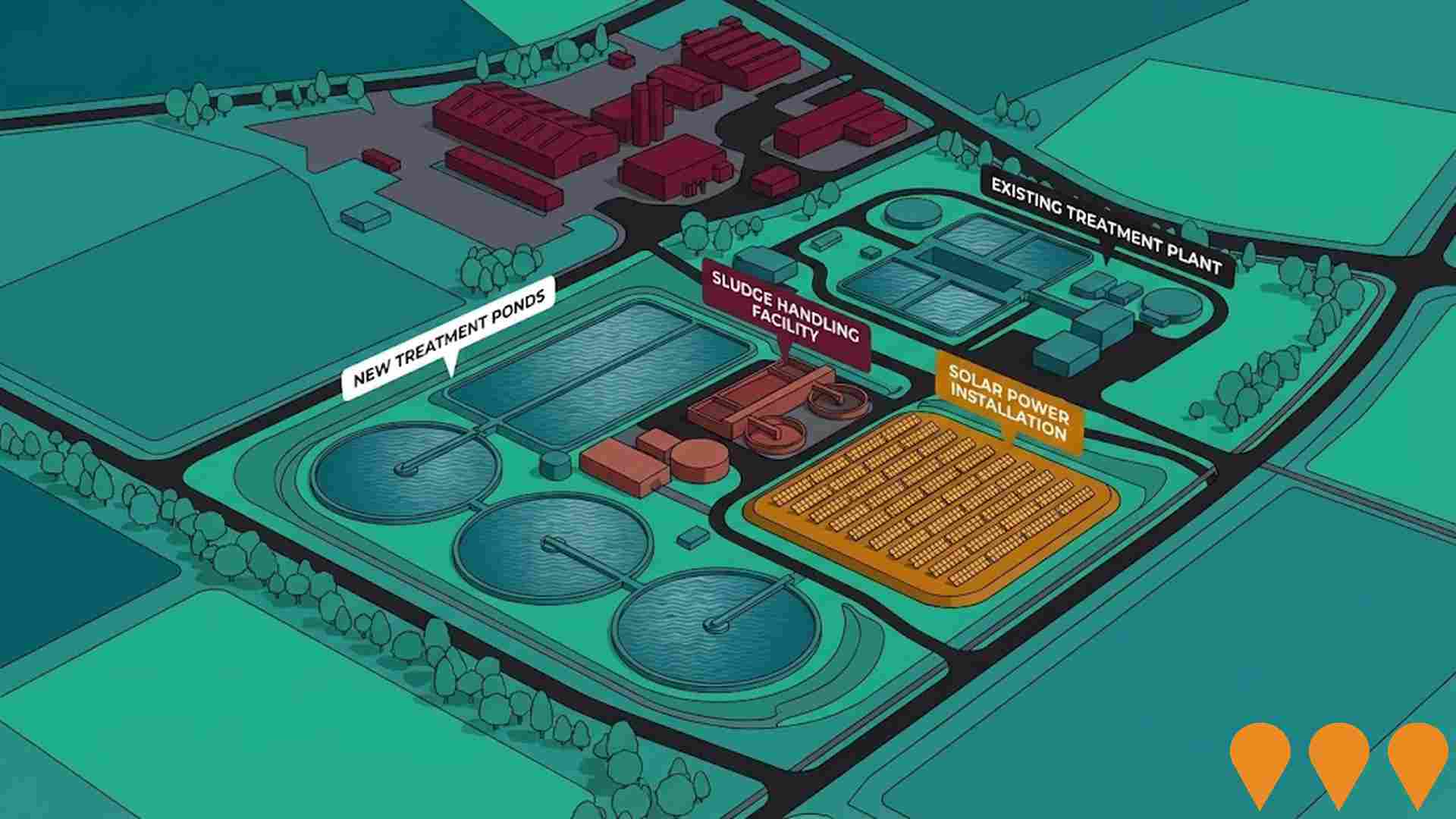

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

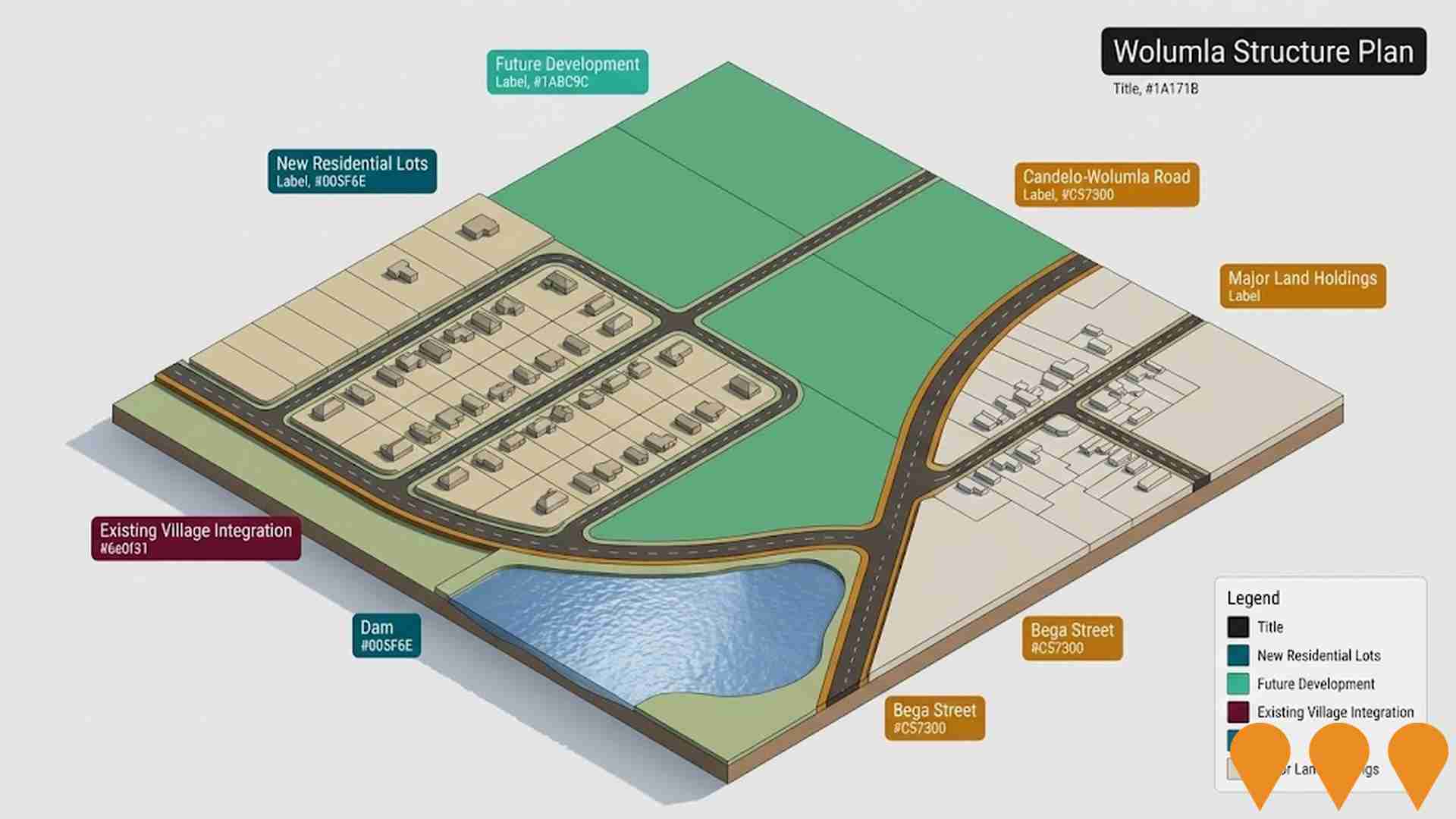

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

South Bega Urban Land Release Planning Proposal

Council-led planning proposal to rezone approximately 279 hectares of land south of Bega to facilitate around 2,200 new homes across three new neighbourhoods, with supporting retail centres, commercial areas, local shops, public spaces, and infrastructure including roads, utilities and open spaces. The proposal follows the adopted Bega Structure Plan 2024 and includes a Draft Affordable Housing Contribution Scheme proposing 2% of land value increase be reinvested into affordable housing. The development will offer a variety of densities, lot sizes and dwelling types to meet the needs of first home buyers, families, single-person households, seniors and key workers. Currently on public exhibition with feedback closing November 2, 2025, and final decision expected by July 2026.

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms via amendments to the State Environmental Planning Policy to enable more diverse low and mid-rise housing (dual occupancies, terraces, townhouses, manor houses and residential flat buildings up to 6 storeys) in well-located areas within 800 m of selected train, metro and light-rail stations and town centres. Stage 1 (dual occupancies in R2 zones statewide) commenced 1 July 2024. Stage 2 (mid-rise apartments, terraces and dual occupancies near stations) commenced 28 February 2025. Expected to facilitate up to 112,000 additional homes over the next five years.

Victorian Renewable Energy Zones

VicGrid, a Victorian Government agency, is coordinating the planning and staged declaration of six proposed onshore Renewable Energy Zones (plus a Gippsland shoreline zone to support offshore wind). The 2025 Victorian Transmission Plan identifies the indicative REZ locations, access limits and the transmission works needed to connect new wind, solar and storage while minimising impacts on communities, Traditional Owners, agriculture and the environment. Each REZ will proceed through a statutory declaration and consultation process before competitive allocation of grid access to projects.

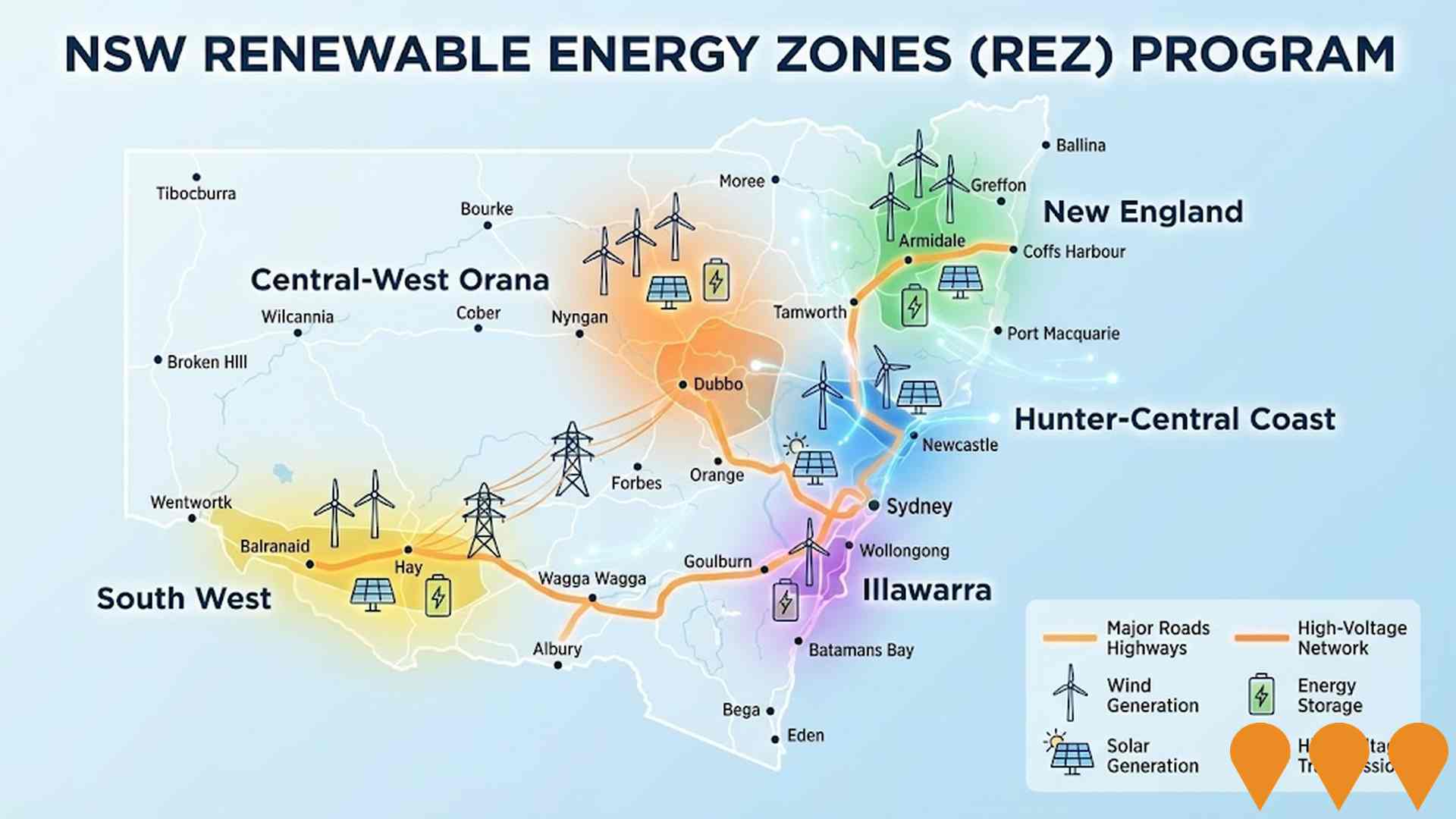

NSW Renewable Energy Zones (REZ) Program

NSW is delivering five Renewable Energy Zones (Central-West Orana, New England, South West, Hunter-Central Coast and Illawarra) to coordinate new wind and solar generation, storage and high-voltage transmission. The program is led by EnergyCo NSW under the Electricity Infrastructure Roadmap. Construction of the first REZ (Central-West Orana) transmission project commenced in June 2025, with staged energisation from 2028. Across the program, NSW targets at least 12 GW of new renewable generation and 2 GW of long-duration storage by 2030.

Bega Sewage Treatment Plant Upgrade

Comprehensive upgrade to the Bega Sewage Treatment Plant to expand treatment capacity for future population growth, meet NSW Environment Protection Agency operational licence requirements, protect the facility from flooding and sea level rise impacts, improve wet weather flow management, enhance sludge handling and stabilization capacity, and install solar power to reduce the carbon footprint of the site. The project includes infrastructure expansion to the west on council-owned land adjacent to the existing plant.

Barrack Street Bega Redevelopment Project

Transformation of 7.7 hectares of former Bega TAFE site into approximately 100 new homes including 68 private market homes, 8 affordable homes, and 24 social homes. The development includes a 20-unit complex of smaller accessible homes designed for the region's aging population. The project addresses critical housing shortages in Bega Valley, which has one of the lowest rental vacancy rates in NSW at 0.24%. Site demolition completed in 2024, with public exhibition planned for late 2025 and construction expected to commence in 2026.

Wolumla Structure Plan

Adopted structure plan providing a strategic framework for the development of approximately 1,096 new dwellings across three major land holdings in Wolumla. The plan guides infrastructure provision including transport networks, utilities, and community facilities to integrate new residential areas with the existing village. Council secured $50,380 in funding in July 2025 to prepare an infrastructure contributions plan. The development will effectively triple Wolumla's population over an estimated 25-year timeframe and addresses housing shortage in the Bega Valley Shire.

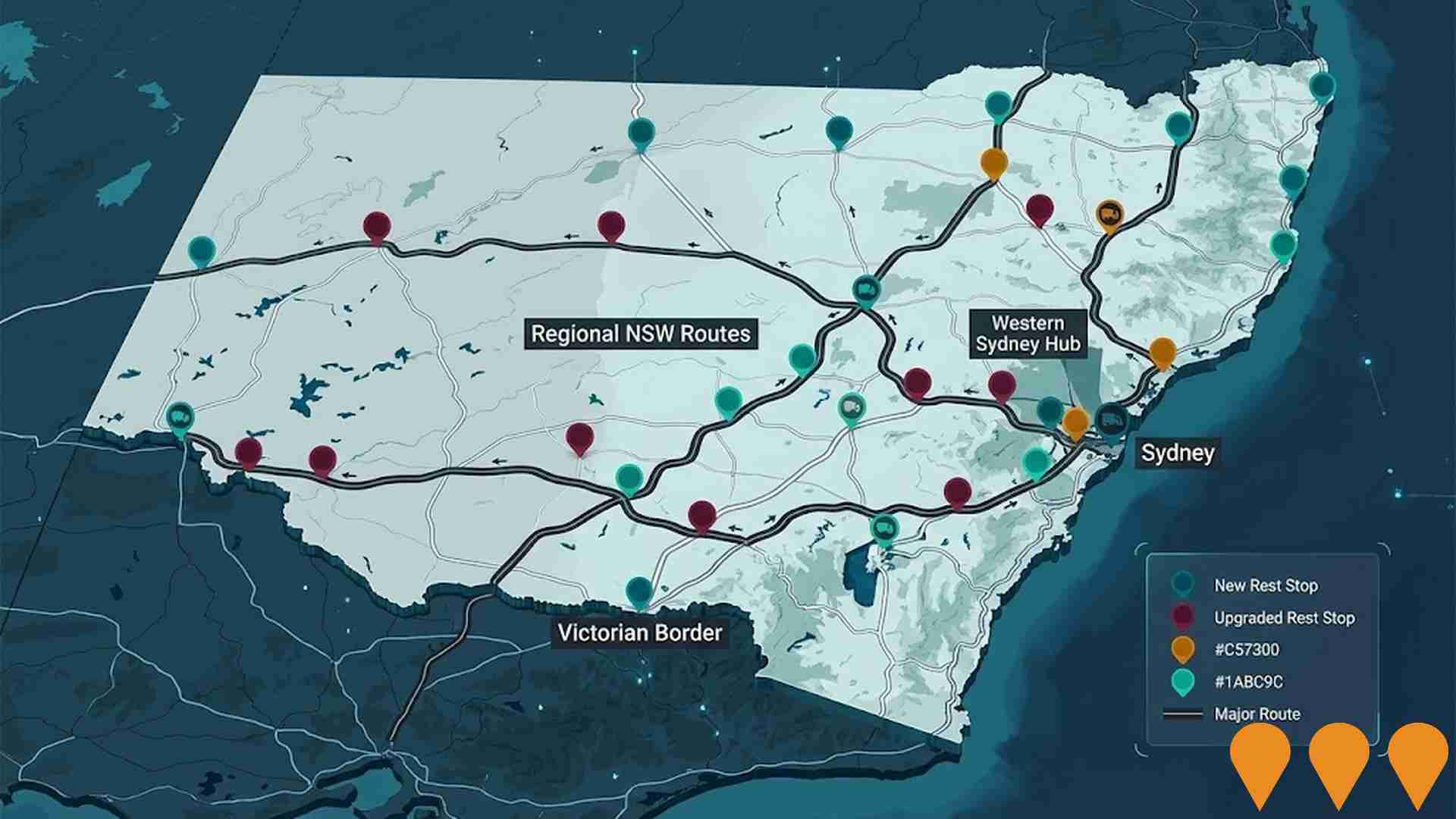

NSW Heavy Vehicle Rest Stops Program (TfNSW)

Statewide Transport for NSW program to increase and upgrade heavy vehicle rest stopping across NSW. Works include minor upgrades under the $11.9m Heavy Vehicle Rest Stop Minor Works Program (e.g. new green reflector sites and amenity/signage improvements), early works on new and upgraded formal rest areas in regional NSW, and planning and site confirmation for a major new dedicated rest area in Western Sydney. The program aims to reduce fatigue, improve safety and productivity on key freight routes, and respond to industry feedback collected since 2022.

Employment

The employment landscape in Bega - Tathra presents a mixed picture: unemployment remains low at 4.0%, yet recent job losses have affected its comparative national standing

Bega-Tathra has a skilled workforce with a low unemployment rate of 4.0% as of September 2025. It has 4,095 residents in work, which is 0.2% higher than the Rest of NSW's rate of 3.8%.

The workforce participation rate is somewhat lower at 54.2%, compared to Rest of NSW's 56.4%. Employment is concentrated in health care & social assistance, retail trade, and construction. There is strong specialization in health care & social assistance, with an employment share 1.3 times the regional level. Conversely, mining has lower representation at 0.2% versus the regional average of 2.5%.

The worker-to-resident ratio is 0.6, indicating a level of local employment opportunities above the norm. Between August 2024 and July 2025, the labour force decreased by 5.2%, while employment also declined by 5.2%, with unemployment remaining essentially unchanged. In comparison, Rest of NSW recorded an employment decline of 0.5% and a labour force decline of 0.1%, with unemployment rising by 0.4 percentage points. As of 25-November-25, NSW employment contracted by 0.03%, losing 2,260 jobs, with the state unemployment rate at 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Bega-Tathra's employment mix suggests local employment should increase by 6.5% over five years and 13.8% over ten years, though this is a simple weighting extrapolation for illustrative purposes and does not account for localised population projections.

Frequently Asked Questions - Employment

Income

The area's income levels rank in the lower 15% nationally based on AreaSearch comparative data

According to AreaSearch's aggregation of latest postcode level ATO data released for financial year 2022, Bega - Tathra SA2 had a median income among taxpayers of $43,114. The average income stood at $52,812. This is below the national average. Rest of NSW had levels of $49,459 and $62,998 respectively. Based on Wage Price Index growth of 12.61% since financial year 2022, current estimates would be approximately $48,551 (median) and $59,472 (average) as of September 2025. Census 2021 income data shows household, family and personal incomes in Bega - Tathra all fall between the 18th and 29th percentiles nationally. Income distribution reveals that the $1,500 - 2,999 earnings band captures 29.0% of the community (2,674 individuals). After housing, 85.3% of income remains, ranking at the 20th percentile nationally.

Frequently Asked Questions - Income

Housing

Bega - Tathra is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

In Bega-Tathra, as per the latest Census evaluation, 87.8% of dwellings were houses, with the remaining 12.1% comprising semi-detached homes, apartments and other types. This is compared to Non-Metro NSW's figures of 84.3% houses and 15.7% other dwellings. Home ownership in Bega-Tathra stood at 43.9%, with mortgaged properties at 29.0% and rented dwellings at 27.1%. The median monthly mortgage repayment was $1,517, aligning with the Non-Metro NSW average, while the median weekly rent was $320, also matching the regional figure. Nationally, Bega-Tathra's mortgage repayments were lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Bega - Tathra features high concentrations of lone person households, with a higher-than-average median household size

Family households constitute 65.9% of all households, including 22.7% couples with children, 30.5% couples without children, and 12.0% single parent families. Non-family households account for the remaining 34.1%, with lone person households at 31.3% and group households comprising 2.9% of the total. The median household size is 2.3 people, which is larger than the Rest of NSW average of 2.2.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Bega - Tathra aligns closely with national averages, showing typical qualification patterns and performance metrics

Educational qualifications in the Bega-Tathra trail region show that 23.7% of residents aged 15 and above have university degrees, compared to the NSW average of 32.2%. Bachelor degrees are the most common at 16.5%, followed by postgraduate qualifications (4.2%) and graduate diplomas (3.0%). Vocational credentials are also prevalent, with 38.3% of residents aged 15 and above holding such qualifications, including advanced diplomas (9.4%) and certificates (28.9%). Educational participation is high, with 27.7% of residents currently enrolled in formal education, which includes primary (11.2%), secondary (7.6%), and tertiary (2.7%) levels.

Educational participation is notably high, with 27.7% of residents currently enrolled in formal education. This includes 11.2% in primary education, 7.6% in secondary education, and 2.7% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis shows that there are currently 210 active public transport stops operating within the area of Bega - Tathra. These stops serve a mix of bus routes, with a total of 43 individual routes being operated. Together, these routes provide 665 weekly passenger trips in total.

The accessibility of transport is rated as good, with residents typically located approximately 203 meters away from the nearest transport stop. On average, there are 95 trips made per day across all routes, which equates to about three weekly trips being made per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Bega - Tathra is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Health data indicates significant challenges for Bega - Tathra, with high prevalence of common health conditions across both younger and older age groups. Private health cover stands at approximately 47% (around 4,306 people), lower than the national average of 55.3%.

Arthritis and mental health issues are most prevalent, affecting 11.1 and 10.0% respectively. However, 61.3% report no medical ailments, slightly higher than Rest of NSW's 59.6%. The area has 25.8% residents aged 65 and over (2,376 people), lower than the Rest of NSW average of 31.7%.

Frequently Asked Questions - Health

Cultural Diversity

Bega - Tathra is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Bega-Tathra has a cultural diversity index below the average, with 90.3% of its population being citizens and 89.6% born in Australia. The majority speaks English only at home, at 95.8%. Christianity is the predominant religion, comprising 46.7% of Bega-Tathra's population.

However, Judaism shows an overrepresentation, with 0.1% compared to the same percentage across Rest of NSW. In terms of ancestry, Australians make up 32.7%, English 31.2%, and Irish 10.0%. Notably, Germans are slightly overrepresented at 4.1%, Australian Aboriginals are at 3.3%, and Dutch are also at 1.4%.

Frequently Asked Questions - Diversity

Age

Bega - Tathra hosts an older demographic, ranking in the top quartile nationwide

Bega - Tathra has a median age of 46, which is higher than Rest of NSW's figure of 43 and significantly higher than Australia's national norm of 38. The population aged 65-74 shows strong representation at 14.0%, compared to Rest of NSW, while the 15-24 cohort is less prevalent at 9.6%. According to data from the post-2021 Census, the 0-4 age group has grown from 4.9% to 5.9% of the population. Conversely, the 55-64 cohort has declined from 15.9% to 13.9%. By 2041, Bega - Tathra is expected to experience notable shifts in its age composition. The 75-84 group is projected to grow by 38%, reaching 1,110 people from the current figure of 803. This growth will be led by the demographic shift towards an aging population, with those aged 65 and above comprising 53% of projected growth. Conversely, population declines are projected for both the 15-24 and 65-74 cohorts.